Jackson

9a55ad37dbf829789ea629cb4ea9df6931acf70e306748170cda8e6a76eb7513

GM, Sir ☕ Happy Day🌤️🫡

Gm nostr 👋

Shout out to Upendo Block Party crew! ⛏️

The image didn't finish rendering, and it messed up names, but I see you nostr:npub1tvqc82mv8cezhax5r34n4muc2c4pgjz8kaye2smj032nngg52clq0rkrq4 nostr:npub1nl8r463jkdtr0qu0k3dht03jt9t59cttk0j8gtxg9wea2russlnq2zf9d0 nostr:npub1fnn2h0tgm2mwnl0kar5ez25wztum2w0q0rrrf326n0ljn999znwsqf4xnx nostr:npub1t6el40knsq8hmrpr0m6tt3t0tr4pdeyhlt2qelwhgtwawddqx0xsv03scu

GM ☕💜🌅

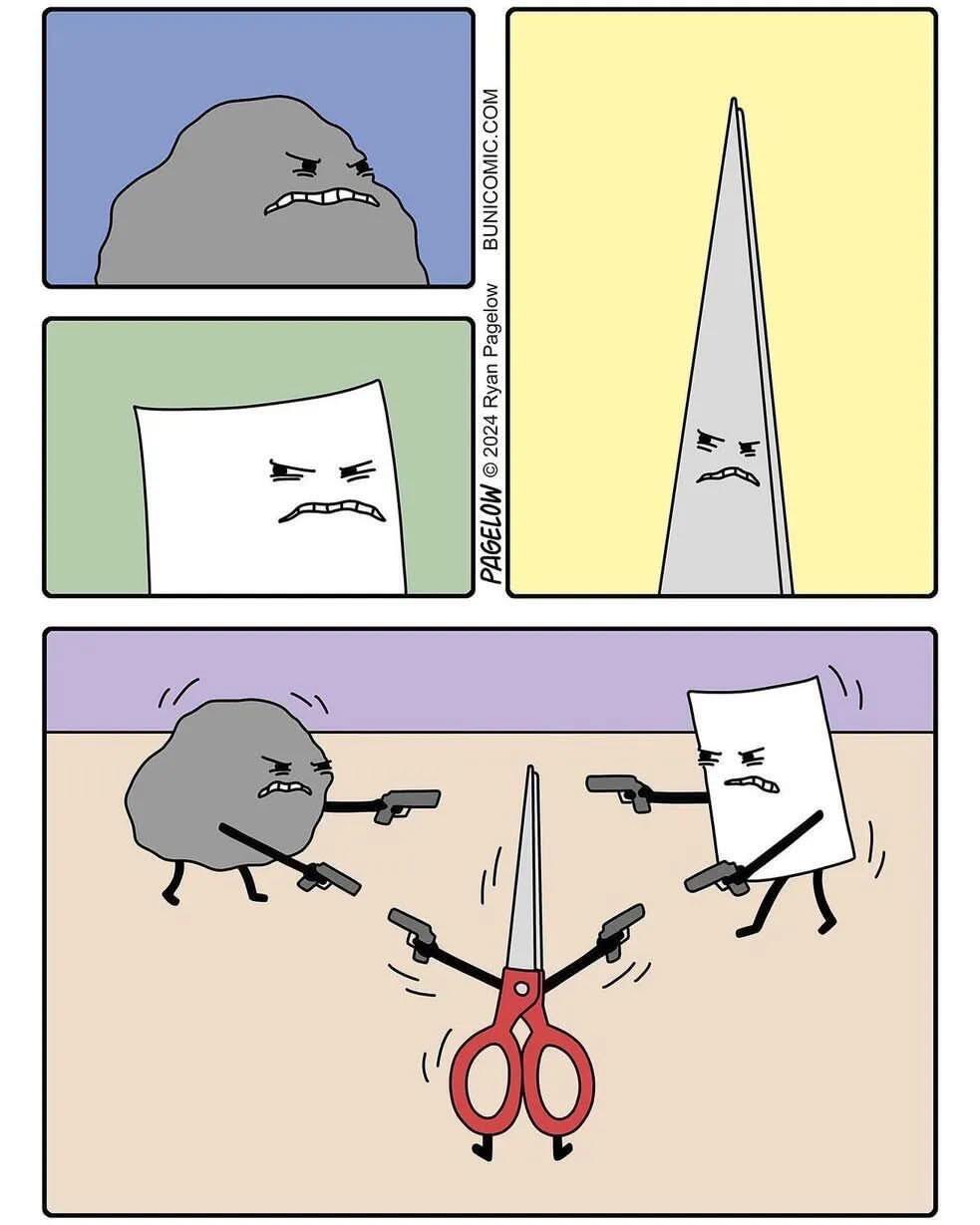

The nostr:npub1563z6kxmvuy7s8zhzan8m0hzmkavyfzg2aw6h7f0fvcvdms398csaxc9n6 Maxi Madness is a schelling point in bitcoin culture

GM ☕💜🌅

GM, no one wants sell fees... 💸

GM, no one wants sell fees... 💸