When I've heard historical accounts of families that were divided on either side of a revolution or civil war, I've always concluded that those were unfortunate but unlikely anecdotes (perhaps mainly because I could never imagine experiencing such societal upheaval).

But in these crazy times, it strikes me how many seemingly unimpeachable ideas (namely resistance againts censorship/surveillance; protection of dissidents; self sovereignty/responsibilty) are completely inconsequential to people close to me. They prioritize convenience, protection, and unearned moral superiority far and away above fundamental rights of man.

It doesn't bode well. The world needs more wolves, not labradors.

The act of causing someone to accept as true or valid what is false or invalid**

**Deception (n) - Merriam Webster definition

Will Kamala Harris institute price controls on #bitcoin? Corporate greed and gouging are getting out of hand. Bitcoin CEO needs to be reigned in.... #cheapcorn

Thoughts on #bitcoin as discovery vs invention (longish post)...

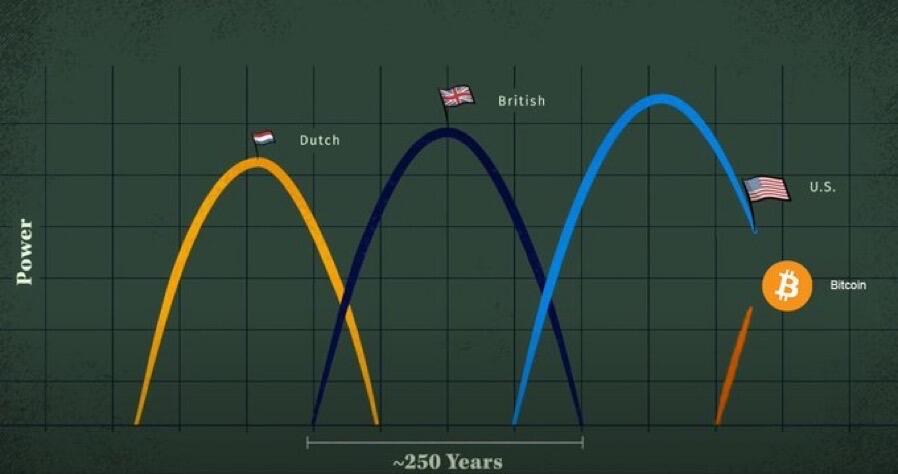

“Bitcoin will be replaced, just like MySpace was replaced,” is a common trope that belies a fundamental misunderstanding of Bitcoin and its true innovation. This assessment is wrongheaded on three counts. First, quite simply, is the fact that Bitcoin does not represent a first effort. In fact, Bitcoin in its currently familiar form is the culmination of many iterations of attempted internet peer-to-peer money. As such, Bitcoin is not analogous to MySpace, rather it should be viewed as Facebook (or even a successor to Facebook) in that analogy. But this is only the simplest example of this misapprehension and is easily refuted by the most cursory review of historical record.

The second more subtle point is that it is sometimes easy to conflate discovery with invention. Fire and the wheel were not inventions. They were discoveries of profoundly transformative chemical and physical principles respectively. Had a subsequent individual or group of individuals decided to use a different fuel source (other than wood) that had different combustion properties, that would not have been an improvement or disruption of the technology of fire. “Fire-ness” equates absolutely to combustion. Altering the formula in any way does not generate an alternative because fire is a fundamental process. It was a discovery, not an invention. Similarly, the wheel could not be improved upon with respect to its “wheel-ness” because the discovery of the wheel was actually the discovery of the concept of ‘round.’ Any subsequent iteration of this discovery could and would only be a wheel to the extent that it captures this fundamentally vital property of roundness. There is no second best shape for a wheel. Any other shape would be inferior proportional to the degree to which it departs from roundness. Hence a pentagon is a worse wheel than a hexagon, which in turn is a worse wheel than an octagon. Simply, the more the shape approximates that of a circle, the better it accomplishes the function of wheel. These facts are not controversial, and instead are implicitly understood a priori. Similarly Bitcoin is not an invention, but rather a discovery. It is a novel method for solving the Byzantine General’s problem using a distributed proof-of-work consensus algorithm. Much like fire, the wheel, or geometry or calculus for that matter, it represents a breakthrough discovery that is more fundamental than a mere tool. In the same way that the wheel is unlike the bow and arrow - in that the latter is a technological advancement that can be (and indeed was) rendered obsolete by subsequent iterations and disruptions - bitcoin is different from “crypto.” This poorly understood notion is a consequence of the third point: branding.

“Branding” is a somewhat imprecise description of the problem but roughly approximates the idea that Bitcoin is often misunderstood because its name sounds very product-like. Namely, given that bitcoin is essentially an internet based value transfer protocol, were it named something like VTP or proof of work consensus VTP, its groundbreaking significance would be far less likely to be called into question. For the same reason that TCP-IP, HTML, C++ and HTTPS are seldom questioned by laypeople. Rarely is the disruption of internet data transfer protocols by their respective Facebooks called for by the financial media. Academic abbreviated nomenclature does not invite the same scrutiny as trademark sounding designations. This cognitive bias is a large part of bitcoin’s branding problem. In a capitalist/consumerist world, the populace is programmed to expect the next thing, the latest and greatest. The iPhone n+1. For this reason, there is general skepticism toward the notion that bitcoin could be, and remain, a world-changing innovation. As a value transfer protocol, bitcoin is analogous to the wheel. It will not and cannot be iterated upon and disrupted except by an equally radical paradigm shift.

As an aside, it is worth noting that in the case of the wheel, any more effective wheel is far and away likely to be a more specialized wheel, trading general utility for narrow specialization. For example a bicycle tire, tractor tire, ball bearing, a gear and a pulley all represent more - and simultaneously less - functional versions of the wheel. In this same vein, if any of these innovations claimed to be the thing to disrupt the wheel industry, this assertion would be viewed as absurd on its face. This is the case with the crypto industry and its comparison to bitcoin.

Bolívar had it figured out.

"In matter of style, swim with the current. In matters of principle, stand like a rock."

- Thomas Jefferson

I think "useless" is the wrong word. The stuff the devs are focusing on is the backbone. It's beyond useful. It's critical. Stuff like algorithms/distribution are DESIRABLE (depending on perspective obvi)..... but truly useless - or harmful even - if prioritized above the hard work of building a robust, anti-fragile backbone

All arms. No spine. That's what you'd have without all the "useless bullshit."

Thanks for good feedback. When it comes to other ppls sats, how well Ledger reflects the ethos of bitcoin is secondary. First and foremost I care that their stacks are secure.... that said, some tradeoffs will need to be made in the name of usability.

The time will come when ppl are ready for true self-sovereignty. Baby steps.

Without getting into the philosophical incompatibility aspect, what is the consensus on the TECHNICAL quality of Ledger? Haven't used one in a minute, but all of the people I've helped get into #bitcoin over the years still have their ledgers - and are oblivious to the shitstorms that have gone on.

Used responsibly, are Ledgers fine? Do they all NEED to be replaced by a new wallet? Seeking objective/unemotional advice. #asknostr #plebchain

((Bitkey has become my go-to for onboarding noobs.))

This comes to mind. Seems like it's always been the case.

Got into a heated discussion about just this point with a very intelligent silicon valley friend. He was incapable of ingesting the concept.

It's not just the complexity. There's a lot of ego rolled up in there as well. I fear many are unreachable.

The notion that property (art, real estate, securities) are taxed, whereas legal tender/cash is not, is a fallacy. Inflation is the tax on legal tender. EVERYTHING is taxed.

The parasites permeate it all.

#BTC watching fed flirting with lowering rates

Where's the lie?

After creating “covid famine” in 2020, UN says it will somehow end world hunger by 2030

From Natural News

(NaturalNews) The United Nations (UN) is all over the place when it comes to world hunger.Back in 2015, the UN Sustainable Development Goals program announced…

Aug 2nd 2024 2:00am EDT

Source Link: https://www.naturalnews.com/2024-08-02-after-covid-famine-un-end-world-hunger-2030.html

Internet Archive Link: https://web.archive.org/web/20240803211623/https://www.naturalnews.com/2024-08-02-after-covid-famine-un-end-world-hunger-2030.html

Share, promote & comment with Nostr: https://dissentwatch.com/boost/?boost_post_id=816816

"End world hunger"

1. Define "end"

2. Define "world"

3. Define "hunger"

Every single word these lying organizations utter needs to be frisked.

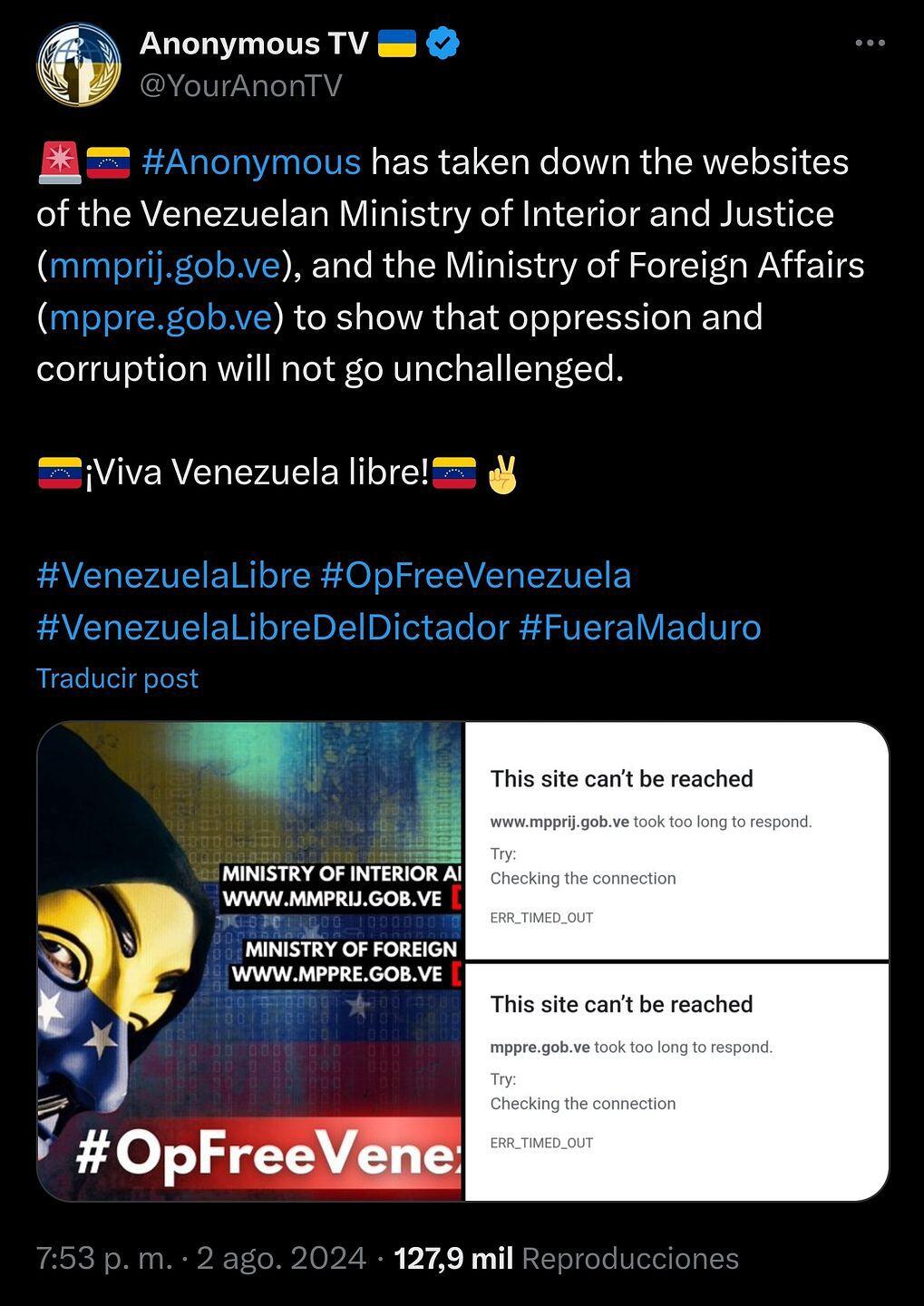

My read on American politics is that Americans are being disingenuous in claiming to value honesty and facts. If the Biden-to-Harris swap has demonstrated anything, it's that Americans have no problem with liars (the Democratic party has exposed itself to be just that). The only qualification is WHOSE liar are they: ours or theirs.

So when they decry Trump for being a prolific liar, these critiques ring hollow. Both parties lie. As a rule. Keep this in mind when looking to any candidate to be a champion for #bitcoin. It's all a fabrication. Americans not only tolerate being lied to; they DEMAND it.