Could listen to #[0] and #[1] all day! Great rip!

https://podcasts.apple.com/au/podcast/once-bitten-a-bitcoin-podcast/id1497540130?i=1000606987718

If there’s one thing that irks me consistently it’s the proposition that tax not charged is a cost to the government.

The want to keep their boot on your throat, they don’t give a fuck about you, they want to keep you poor and they don’t want you accumulating wealth for yourself or your family!

Opt out, buy #bitcoin and self custody!

They’d really prefer it if you worked until you dropped dead, paying as much tax as possible and didn’t have any savings!

Opt out, buy #bitcoin and self custody!

TLDR - “To Lex Didn’t Read” ?

What happened with his case with Keith?

Mostly ridiculous, sometimes funny!

Buy #bitcoin and self custody in your #smsf

Now do the US dollar!

Which probably originated in Russia!

Amazing isn’t it!

#[0] do you feel like Alf agreed that #bitcoin is the answer? He kinda dodged the question?

Given bitcoin isn’t yield generating it messes with the intent of all this a bit but no doubt things will change over time.

The important thing here is to ensure there are inheritance protocols in place to ensure the bitcoin passes cleanly to your dependants without incurring tax.

So I think I got some clarity today on this. To take funds out of accumulation phase I.e. your super account they have to be moved into your pension account, you can’t just take a lump sum out of accumulation to a bank account.

Therefore anything over your transfer balance cap if withdrawn from your pension account as a lump sum will be subject to 15% tax and then prob 30% when it’s over $3m if that passes.

This doesn’t mean you can’t leave a large balance in the pension account or your super account. Does that make sense?

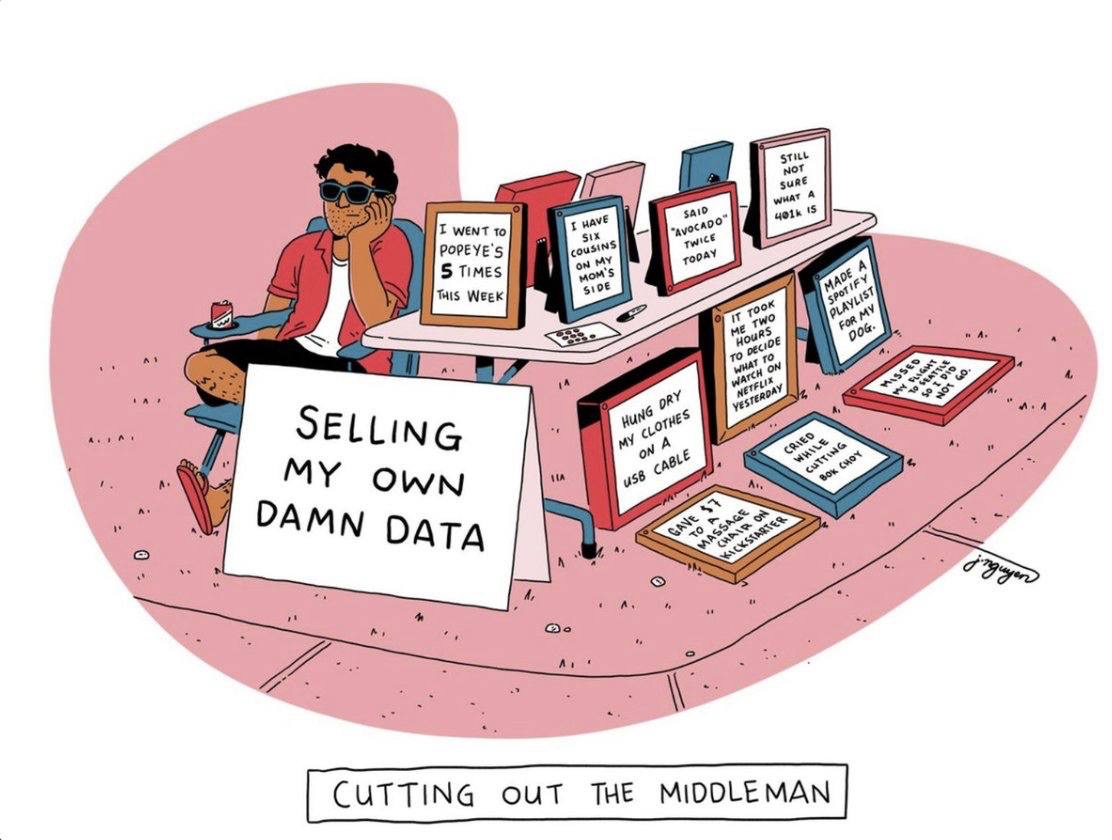

I also really like the feed containing only the content I want to follow, not some dystopian, hellscape of 🤡🌏 nonsense