Some of saw this coming..

Dems are cooked if they're hanging their futures on Bernie AOC.

U.S., China Reach Agreement To Lower Tariffs In 90-Day Cool-Off Period

U.S., China Reach Agreement To Lower Tariffs In 90-Day Cool-Off Period

Update (0958ET):

During a Monday morning press conference, President Trump told reporters that trade negotiations have led to a "total reset" in U.S.-China relations. He added that he may speak with President Xi Jinping later this week.

?itok=wGjhyGAE

?itok=wGjhyGAE

More headlines from Trump's press conference (courtesy of Bloomberg):

TRUMP: Total Reset With China

TRUMP: No Decoupling With China

TRUMP: Doesn’t Include Cars, Steel, Aluminum

TRUMP: Will Speak to Xi Maybe at End of Week

TRUMP: China Deal 'Not the Easiest Thing to Paper'

.https://twitter.com/POTUS?ref_src=twsrc%5Etfw

— Rapid Response 47 (@RapidResponse47) https://twitter.com/RapidResponse47/status/1921928176286020061?ref_src=twsrc%5Etfw

* * *

Update (0812ET):

U.S. Treasury Secretary Scott Bessent appeared on Bloomberg TV to discuss the newly announced 90-day suspension of most tariffs between the United States and China.

Below is a summary of key takeaways from the interview, as reported by Bloomberg:

BESSENT: BOTH SIDES AGREE WE DON’T WANT GENERALIZED DECOUPLING

BESSENT: PHASE ONE TRADE DEAL WITH CHINA OFFERED A TEMPLATE

BESSENT: WILL SEE WHERE THE FINAL CHINA RECIPROCAL TARIFF ENDS

BESSENT: CURRENT TARIFF LEVEL FOR CHINA IS A ‘FLOOR’

BESSENT: APRIL 2 LEVEL WOULD BE A CEILING FOR CHINA

BESSENT: NOW HAVE A PROCESS IN PLACE TO AVOID CHINA ESCALATION

BESSENT: IMPLAUSIBLE TARIFFS ON CHINA GO BELOW 10%

BESSENT: WANT TO SEE CHINA BOOST CONSUMPTION, OPEN THEIR MARKET

BESSENT: CHINA MET PHASE-ONE OBLIGATIONS UNTIL BIDEN NEGLECT

BESSENT: ESCALATORY TARIFFS WERE LIKE US–CHINA EMBARGO

BESSENT: CAN ALWAYS GO BACK TO APRIL 2 LEVEL FOR CHINA TARIFFS

BESSENT: SEE PHONE CALL BEFORE MEETING FOR TRUMP AND XI

BESSENT: IF CHINA ACTS, PERHAPS FENTANYL TARIFF COULD COME DOWN

BESSENT: NOT PUSHING FOR DEATH PENALTY ON FENTANYL PRODUCTION

https://store.zerohedge.com/neuro-ignite/

* * *

China and the U.S. moved to ease trade tensions early Monday, agreeing to a temporary 90-day reduction in reciprocal tariffs on each other's goods, according to a https://x.com/rapidresponse47/status/1921864745155543214?s=46

released by both governments on X. The accord, viewed as a breakthrough in a multi-month trade war between the world's two largest economies, helped spark a rally in global markets: S&P 500 futures rose 3%, while Nasdaq futures gained 4%. European markets also advanced, and the U.S. dollar strengthened. U.S. government bonds sold as investors rotated back into equities and other risk-sensitive assets.

— Rapid Response 47 (@RapidResponse47) https://twitter.com/RapidResponse47/status/1921864745155543214?ref_src=twsrc%5Etfw

The joint statement said that the U.S. will reduce levies on most Chinese imports from 145% to 30% by Wednesday.

Here's a summary of the U.S. actions:

The United States will remove the additional tariffs it imposed on China on April 8 and April 9, 2025, but will retain all duties imposed on China prior to April 2, 2025, including Section 301 tariffs, Section 232 tariffs, tariffs imposed in response to the fentanyl national emergency invoked pursuant to the International Emergency Economic Powers Act, and Most Favored Nation tariffs.

The United States will suspend its 34% reciprocal tariff imposed on April 2, 2025 for 90 days, but retain a 10% tariff during the period of the pause.

The 10% tariff continues to set a fair baseline that encourages domestic production, strengthens our supply chains and ensures that American trade policy supports American workers first, instead of undercutting them.

By imposing reciprocal tariffs, President Trump is ensuring our trade policy works for the American economy, addresses our national emergency brought on by our growing and persistent trade deficit, and levels the playing field for American workers and producers.

Unlike previous administrations, President Trump took a tough, uncompromising stance on China to protect American interests and stop unfair trade practices.

The breakthrough in the talks also led to China reducing its 125% tariff on U.S. goods to 10%.

Here's a summary of the Chinese actions:

China will remove the retaliatory tariffs it announced since April 4, 2025, and will also suspend or remove the non-tariff countermeasures taken against the United States since April 2, 2025.

China will also suspend its initial 34% tariff on the United States it announced on April 4, 2025 for 90 days, but will retain a 10% tariff during the period of the pause.

The joint statement indicated that Monday's agreement would pave the way for further negotiations between senior officials. On the U.S. side, talks are being led by Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer, while Vice Premier He Lifeng will represent China...

After taking the aforementioned actions, the Parties will establish a mechanism to continue discussions about economic and trade relations. The representative from the Chinese side for these discussions will be He Lifeng, Vice Premier of the State Council, and the representatives from the U.S. side will be Scott Bessent, Secretary of the Treasury, and Jamieson Greer, United States Trade Representative. These discussions may be conducted alternately in China and the United States, or a third country upon agreement of the Parties. As required, the two sides may conduct working-level consultations on relevant economic and trade issues.

The White House wrote on X that these trade talks will address America's trade imbalances:

The U.S. goods trade deficit with China was $295.4 billion in 2024—the largest with any trading partner.

Today's agreement works toward addressing these imbalances to deliver real, lasting benefits to American workers, famers, and businesses.

The talks also addressed the ongoing fentanyl crisis.

The United States and China will take aggressive actions to stem the flow of fentanyl and other precursors from China to illicit drug producers in North America.

— Rapid Response 47 (@RapidResponse47) https://twitter.com/RapidResponse47/status/1921869405715087499?ref_src=twsrc%5Etfw

Shortly after the joint statement was released, Bessent, who led the American delegation at the talks, told reporters in Geneva that both sides have "substantially moved down the tariff levels" and "neither side wants a decoupling."

"We had a very robust and productive discussion on steps forward on fentanyl," Bessent added, pointing out that those talks might lead to "purchasing agreements" by China.

.https://twitter.com/SecScottBessent?ref_src=twsrc%5Etfw

— Rapid Response 47 (@RapidResponse47) https://twitter.com/RapidResponse47/status/1921866107452846100?ref_src=twsrc%5Etfw

Commenting on markets, Benedicte Lowe, an equity and derivatives strategist at BNP Paribas Markets 360, told Bloomberg TV that "deescalation was much better than expected by the market" and "for the next couple of days I would expect a bullish environment in the global equity market."

Last week, President Trump floated the "https://www.zerohedge.com/markets/us-poised-drastically-cut-china-tariffs-soon-next-week-nypost-reports

!" trial balloon on Truth Social, noting that the final decision rests with Bessent.

?itok=u64T7-jD

?itok=u64T7-jD

"In our view, equity markets are returning to where they would have moved to if Liberation Day had not happened and Trump had just applied the 10% universal tariff," said Roberto Scholtes, head of strategy at Singular Bank.

Scholtes noted, "Corporate fundamentals are healthy, first quarter results have substantially surprised on the upside, and there's plenty of cash to be invested."

"This deescalation is much more positive than anticipated (GSe: 54% U.S. on China tariffs and 34% China on U.S. tariffs) and the market is reacting as such. We are seeing a clear reversal in short USD positions as U.S. recession risks reduce (GSe was 45%!) and risk-on sentiment rises. DXY rallied over 1%, S&P futures surged 3%, 10y UST rose to 4.43%, gold tumbled ~3%," Goldman analyst Yichin Tsai told clients.

S&P 500 futures are up 3%, and Nasdaq futures are up 4%. European stocks are in the green.

?itok=VWPDKTnf

?itok=VWPDKTnf

The move toward lower tariffs and easing trade tensions between the world's two largest economies follows Sunday's negotiations, during which both sides reported making "https://www.zerohedge.com/political/bessent-says-us-china-made-substantial-progress-deal-after-very-constructive-2-days

."

https://cms.zerohedge.com/users/tyler-durden

Mon, 05/12/2025 - 14:45

https://www.zerohedge.com/markets/us-china-reach-agreement-lower-tariffs-90-day-cool-period

These guys are crushing it. Most capable admin I've ever seen in office. Hope they can keep it up!!

The GOAT is LeBron James, but next is his Airness!

Of course most of the establishment wants badly to kill this. It hurts their power immensely.

Wish I could convince my pharma living relatives of this, they're sick as hell but think the meds help not realizing they only need all this crap cause of side effects from this crap.

I've come to think one of the biggest signs of stupidity is believing what your told more than what you can see.

Gonna win alot of fans if he keeps this up.

As Bitcoin takes over it will become imperative for better and better conditions in all places to lure people to move there and spend their Bitcoin in that local economy.

Mentally I'm preparing to be very mobile so I can up and leave anywhere to head anywhere else.

Is It Safe To Run Bitcoin Core?

https://blossom.primal.net/3ee42f2685c89fd2afebfa23874733243883f3ab20ef9564449c3b92993bedbb.mp4

Love that you're on NOSTR. I used to listen to you on YT.

In all fairness M2 is def expanding quickly, its just not called QE now.

Now instead of the Fed buying bonds its banks, laws were changed to basically force banks to buy treasuries.

"Greatest Tightening Shock The Market Has Ever Seen": Chinese Copper Stocks To Run Out In Weeks

"Greatest Tightening Shock The Market Has Ever Seen": Chinese Copper Stocks To Run Out In Weeks

Not too long ago, we reported that China was stockpiling virtually every form of commodity known to man, from corn to crude and corn... and especially copper: according to a JPMorgan report in early 2022, China held an estimated 84% of all global copper.

China currently holds an estimated 84% of global copper, 70% of corn, 51% of wheat, 40% of soybeans, 26% of crude oil and 22% of aluminum inventories: JPM

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1496313777792425990?ref_src=twsrc%5Etfw

Fast forward three years, when Geneva-based commodities trading giant Mercuria now predicts that China's copper stockpiles are on track to dwindle to nothing in just a few months - if not weeks - as the market suffers “one of the greatest tightening shocks” in its history, as unprecedented demand from both the US and China, a surge in a trans-Atlantic arb trade, and mounting fears of US tariffs, unleash havoc in the copper market.

In many ways comparable to the record scramble to deliver physical gold to US Comex vaults in late 2024 and early 2025, Mercuria said that huge US demand - as buyers rushed to get their hands on copper ahead of the potential imposition of tariffs by the Trump administration - was sucking imports of the metal into the country from the rest of the world and setting it up in direct competition with China for supplies.

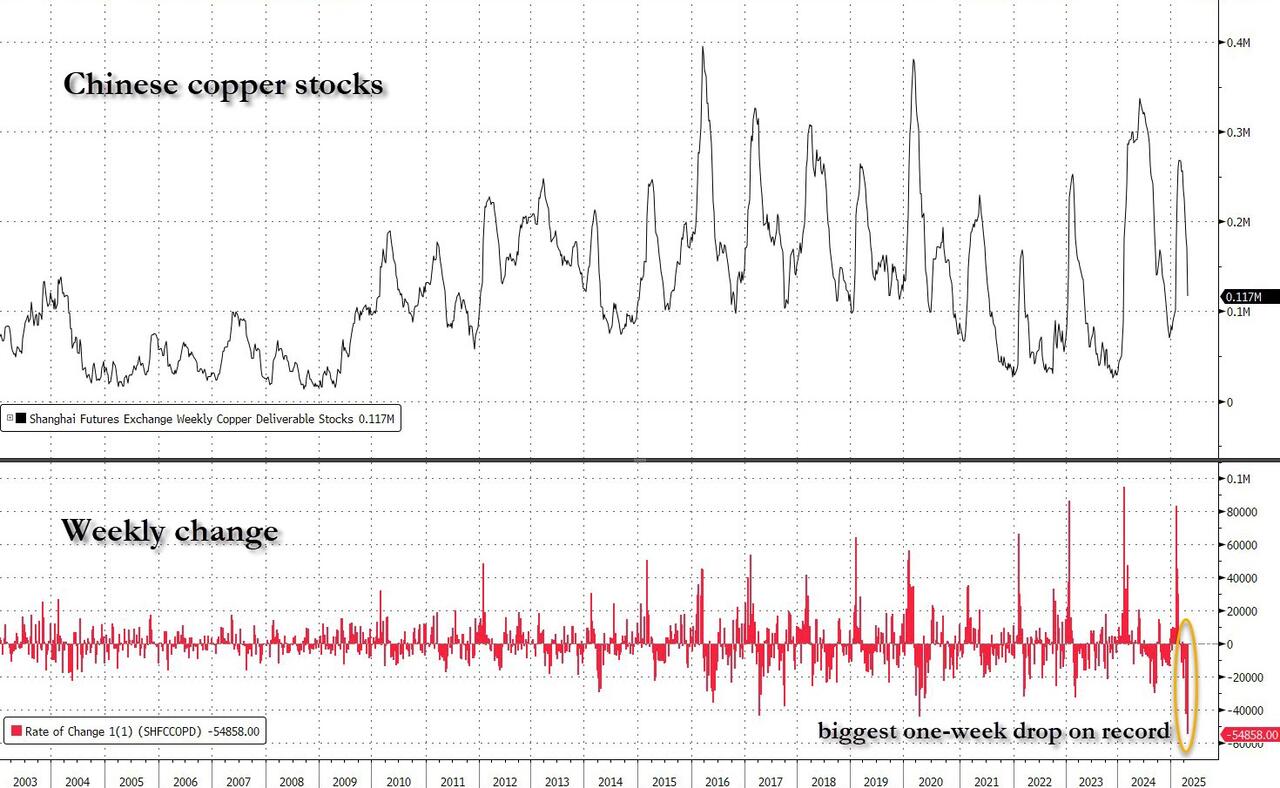

As a result, Chinese copper stocks have plunged over the past few weeks, and “at the current pace of draws, those Chinese inventories could deplete [to zero] by the middle of June”, Nicholas Snowdon, Mercuria’s head of metals and mining research, told https://www.ft.com/content/72da3728-906c-4124-8700-841adbe61f18

.

As shown below, last week the country’s inventories fell by almost 55,000 tonnes to 116,800 tonnes last week, the biggest weekly drop on record. At this rate of decline, Chinese copper stocks would run out in 2 weeks time.

?itok=DKruilXl

?itok=DKruilXl

This “is potentially going to be one of the greatest tightening shocks this market’s ever seen”, Snowdon said. Beijing had a “razor thin inventory buffer” to meet domestic demand, he added.

Ironically, copper prices tumbled after Liberation Day to the lowest level in over a year, only to surge again as copper demand in China proved remarkably resilient despite headwinds from the US-led trade war and the nation’s property crisis, with buyers taking advantage of price slumps to snap up supplies.

“The copper market remains in a tight balance, despite macro-economic difficulties,” Xiao Qianjun, vice general manager of trade business at Jiangxi Copper, a top smelter, told an industry conference this week. After prices fell recently, “spot orders from fabricators exploded,” Xiao said.

At the same time, there is growing speculation Beijing may ramp up stimulus to support the world’s second-largest economy - and especially the copper-intensive housing market - to counter more challenging overseas conditions as Trump imposes punishing tariffs, while also holding out the promise of talks and a deal.

“Demand in the spot market, from surveys of downstream users or apparent consumption, are all very good,” Angela Bi, head of Asian metals and mineral research at Mercuria said at a conference, held by Shanghai Metals Market in Nanchang, Jiangxi. Indicators “are too good to be true,” Bi added.

Meanwhile, the Yangshan premium - a gauge of import demand - recently hit the highest since 2023. And local yuan-priced futures are steeply backwardated, a bullish pattern that points to near-term tightness.

The problem is that besides soaring domestic Chinese demand, there is also massive demand for physical copper from the US. Mercuria's head of metals and mining, Kostas Bintas, said the US was for the “first time” competing with China for supplies of copper, which was likely to supercharge prices. The impact of US protectionism on the copper market adds to pressure from Chinese domestic demand and retaliatory levies that could hit vital flows of copper scrap.

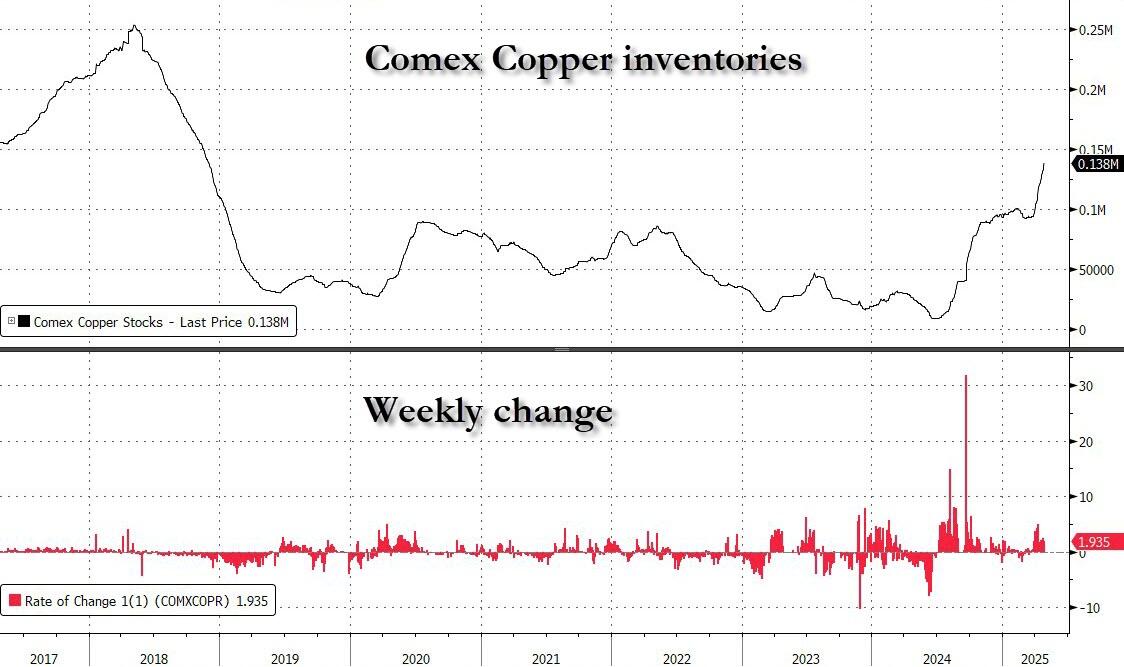

Similar to the frenzied record deliveries of physical gold to Comex, metal traders have been importing massive amounts of copper into the US ahead of possible tariffs, which could result from an investigation initiated by US President Donald Trump into alleged “dumping and state sponsored overproduction” of the metal. He has already imposed a 25% levy on aluminium and steel imports.

And just like gold, copper stocks in Comex warehouses in the US have soared this month to their highest level on Friday since 2018.

?itok=dfOvLOmP

?itok=dfOvLOmP

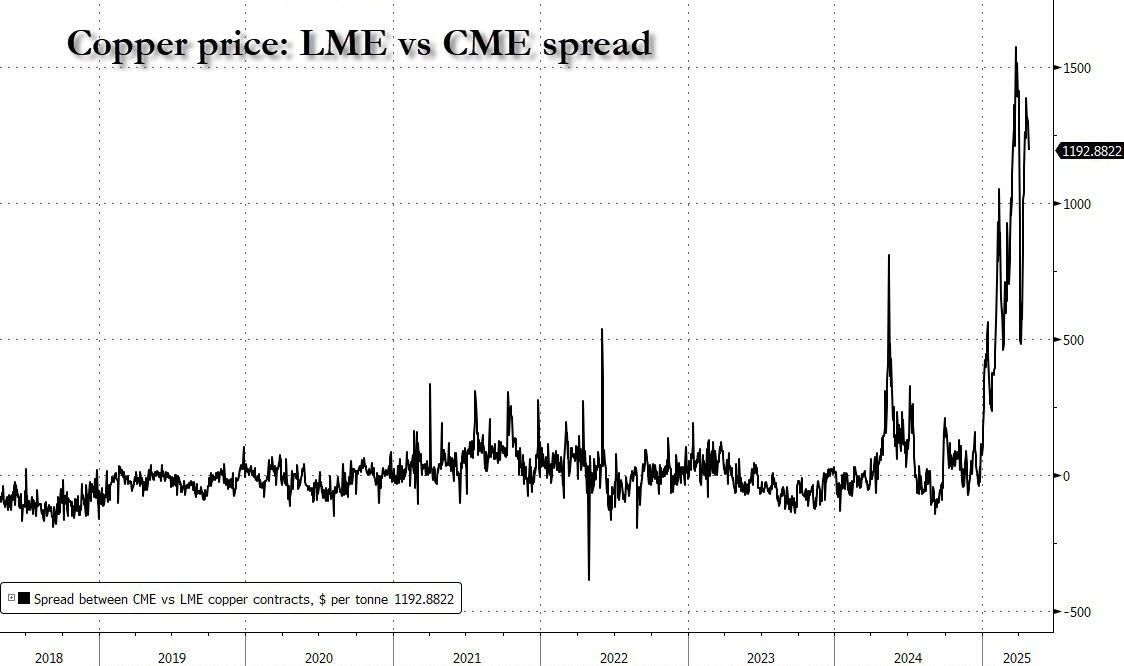

Helping drive supplies to the US is the same arbitrage observed in late 2024 in the gold market, one created by investors' fear of tariffs, among others. This has pushed up sharply the price of the metal on New York’s Comex exchange in comparison with prices on London’s London Metal Exchange.

This spread has created an unprecedented arb for traders who buy copper futures contracts in London and sell contracts in New York. The spread stood at nearly $1,200 per tonne on Monday, having risen above $1,600 in March, well above its long-term average of roughly $0.

?itok=nr83gvRU

?itok=nr83gvRU

The arb has been so popular, a potential short squeeze is emerging: as the FT reports, "some traders who had large commitments to sell copper on Comex have been urgently trying to get their hands on additional tonnes into the US to cover those short positions before any new tariffs were introduced, said Bintas." Which explains the panic scramble of physical out of China and into the US... because if they don't "get their hands on additional tonnes", the price of copper could go vertical.

There could be even more chaos: retaliatory tariffs imposed by China on US imports could also hit the crucial copper scrap market, analysts said, adding to the tightness in the Chinese market.

That could worsen if the US imposes a ban on the export of copper scrap, of which it is a big exporter. It shipped 960,000 tonnes in 2024, with almost half going to China, according to commodity pricing agency Fastmarkets.

In January and February, the latest data available, the US exported 142,000 tonnes in total, compared with 149,000 during the same period last year. That number could quickly hit zero if Washington decided to impose an embargo on the commodity to hammer Beijing, which urgently needs copper to develop everything from electrical infrastructure, to AI data centers, to ghost cities.

Sure enough, Andrew Cole, a metals analyst at Fastmarkets, said he expected “a significant plunge in scrap shipments from the US to China in March to May at the very least.

“That’s what will lead to the escalation of supply squeeze in China we have been expecting to develop as the year progresses,” he said.

“Imported copper scrap stockpiles in China have dropped significantly,” said Mercuria's Bi

However, while Chinese stocks were being depleted, in reality markets would react before stocks reached zero, with higher prices attracting more imports of copper and scrap, said Snowdon.

“That comes at the point of record pull of copper units into the US. As those two forces meet that creates an unprecedented competition for copper,” he said.

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/29/2025 - 22:02

Dr. copper.

Wake up wake up, its the first of the mooonth.

Where Things Stand

Where Things Stand

https://www.kunstler.com/p/where-things-stand

“In order for a system to be stabIe, it requires negative feedback, also known as consequences.”

- Barrie Drain

“Fighting fascism,” for the American Jacobins who lead the Democratic Party, means opposing any attempt to flush the corruption out of the entrenched bureaucracy, just as their pet phrase “our democracy” actually refers to the matrix of grift and despotic activism that drives their political operating system. That is exactly how and why the USAID was so crucial to spread captured taxpayer spoils as NGO salaries for the gender studies grads to play “activist,” so as to inflict their special brand of sadistic power madness over the land — to keep the game going.

Now, USAID is scattered to the winds and all they have left is their installed base of federal judges and the horde of lawfare lawyers who feed them bogus cases to halt the remaining work of Mr. Trump’s executive branch clean-up operation.

Remember: Robespierre, leader of the Jacobins in the French Revolution, was a lawyer.

Their version of defending “our democracy” in 1793 was the Reign of Terror that sent at least 17,000 political opponents to the guillotine.

?itok=XKpmVJmp

?itok=XKpmVJmp

Rep. Jamie Raskin (D-MD)

Rep. Jamie Raskin (D-MD) is the Democrats’ Robespierre. He is promising his own reign of terror when his party recaptures Congress in the 2026 “midterm” election.

Norm Eisen is his chief lawyer and legal strategist. His sole aim is recapture power in order to restore the Democrats’ sadistic regime of thought-control and the money-flows that feed it. That’s where things stand for the moment. You can sense how this tension is tending toward something that looks like civil war.

Someone needs to investigate the relationship between the lawfare squad and the judges to see how closely they worked together.

It appears that Norm would write prosecution memos, articles, etc., (as well as go on CNN) to act as an analyst when in reality he was running the… https://t.co/hdkDggzlt4

— The Researcher (@listen_2learn) https://twitter.com/listen_2learn/status/1903985333827445125?ref_src=twsrc%5Etfw

The game now is to goad President Trump into any kind of executive action in defiance of this legal insurrection that would subject him to impeachment after January 2027, when a new Congress is seated, theoretically with a Democratic majority. There are several flaws in the Raskin / Eisen plan-of-action. One is their supposition that the Democratic Party is popular enough to win a Congressional majority in 2026, or that they will enjoy the installed devices of electoral cheating to achieve victory no matter what.

The party is currently blundering wildly in support of obviously insane actions that a vast majority voters oppose, such as stopping the deportation of illegal immigrants, allowing men to compete in women’s sports, and opposing proof of citizenship in federal elections. Which is to say that the voters are onto exactly how crazy and destructive the Democratic Party has become.

The question is: what can be done about this lawfare insurrection. An easy solution would be for Congress to pass a law restricting the power of federal judges to issue orders that affect the nation as a whole outside their own designated districts. Senate Judiciary Committee Chair Charles Grassley has introduced the Judicial Relief Clarification Act of 2025. Grassley argues that nationwide injunctions, which allow a single district judge to block federal policies across the country, represent judicial overreach and disrupt the constitutional balance of powers.

In the House, Rep. Darrel Issa (R-CA) has introduced the No Rogue Rulings Act of 2025 (HR 1526, passed on April 9) to complement Sen. Grassley’s bill. The Constitution is somewhat vague about the composition of a federal judiciary below the Supreme Court, and essentially leaves the matter to Congress to set parameters for the power of federal judges. Congress can also alter or abolish districts, such as the DC federal district from which so much partisan Democratic Party lawfare has emanated under political activist Judges James Boasberg, Amy Berman Jackson, Tanya Chutkan, and Beryl Howell (all of them involved in the sadistic prosecutions of J-6 defendants).

The bills from each house next must go through a reconciliation process that boils them down to a single piece of legislation that can be sent to Mr. Trump for the presidential signature. The House passage is likely assured. The hang-up is that under Senate rules, the Democrats could mount a filibuster that would require 60 votes to break. The Republicans only control the chamber by a 53 to 47 majority, and no Democrats have signaled any intention to vote in favor of such a bill. In any case, the entire process would take months and might not succeed at all.

A much simpler remedy would be for the Supreme Court (SCOTUS) to rule in any of a number of cases now on their docket that the lawfare antics of the federal judges amount to interference with an independent executive branch — in short, that the judiciary can’t usurp the executive powers of the President, which include the conduct of foreign policy, the ability to manage personnel in executive agencies, and certain issues around the spending of taxpayer dollars.

A different sort of remedy would be the application by the DOJ of federal statute 18 USC 371, Conspiracy to Defraud the United States against Norm Eisen and his colleagues-in-lawfare for attempting to maliciously bury the executive branch in litigation for the purpose of nullifying the executive powers of the president. Beyond all that is the abyss: a nullified election, a paralyzed chief executive, and a constitutional crisis that has the potential to lead to civil violence. The Democrats seem willing to go there, perhaps even avid for it.

The Jacobins of 1793 were mad for blood, too, and they spilled a whole lot of it. By the summer of 1794, the blood was finally spouting out of their own necks. . . and then the Jacobin reign of terror came to a sudden and complete end. Heed their example.

https://cms.zerohedge.com/users/tyler-durden

Fri, 04/25/2025 - 16:20

Can't take or tax my Bitcoin.

I am only Nostr now.

No X.

No Reddit.

No Instagram.

No Facebook.

No Snapchat.

No Tik Tok.

No Truth Social.

No LinkdIn.

LA To Institute Mass Layoffs Of City Workers In Wake Of $1 Billion Deficit

LA To Institute Mass Layoffs Of City Workers In Wake Of $1 Billion Deficit

For many years now the narrative on California is that it is a country unto itself and it generates so many tax dollars the federal government and red states should be throwing a garden party in its honor. In reality, California is not a "donor state" as the Rockefeller Institute claims. It can't even support itself, let alone bolster the rest of the country.

This problem has become more evident in the past year as Los Angeles hits a budget deficit of a billion dollars and, the state government doesn't have the funds to help the city recover because of it's https://lao.ca.gov/reports/2023/4819/2024-25-Fiscal-Outlook-120723.pdf

.

In response to the lack of aid from the state or federal government, Los Angeles Mayor Karen Bass unveiled a proposed $13.9 billion municipal budget for fiscal year 2025-26, which includes more than 1,600 layoffs and the consolidation of four city departments in an effort to eliminate the overdraft. Though LA employs around 50,000 people in total and the layoffs might seem minor in comparison, the city's expansive programs require employee growth this year, not cuts.

Furthermore, it is likely that the 1600 fired workers are just the beginning. The city removed at least 2000 positions from its employee roster at the end of last year and is already moving to make cuts to existing workers.

It's no coincidence that LA is in fiscal trouble in 2025, and it's not only because of the $2 billion in damages associated with the recent wildfires. After decades of decadent debt spending CA is deeply dependent on federal funds. Federal budget cuts and the shutdown of agencies like USAID are having far reaching consequences, especially in progressive states with a heavy emphasis on socialized programs.

For example, the federal Department of Health and Human Services recently terminated $12 billion in grants intended for infectious disease response, mental health services and other public health issues. At least $1 billion of this cash was supposed to go to California in 2025. Covid money is funneled into various health departments and other projects and California was the biggest recipient of pandemic funds by far with https://pandemicoversight.gov/data-interactive-tools/states/ca

. Some critics argue that covid relief in California was wrongly exploited as a financial boon for various state agencies, politicians and employees.

Now the pandemic funding is finally cut off after 5 years. $45 million of the $1 billion lost was supposed to go to Los Angeles.

The LAPD is also losing https://www.nbclosangeles.com/investigations/lapd-in-jeopardy-of-losing-millions-in-federal-funds/3629308/

due to federal funding cuts. The agency and city officials are trying to sort out the potential impact of being cut-off from millions of dollars in law enforcement and homeland security grants, following the US Justice Department’s announcement such programs would be suspended for any municipality that considered itself a so-called, “sanctuary city,” that bars local officers from playing a role in immigration enforcement.

?itok=RC32GcUJ

?itok=RC32GcUJ

The Orange County Register reported last month that Orange County will lose out on https://www.sfgate.com/bayarea/article/california-coastal-bluff-funding-20242812.php

in federal earmarks for 2025, money that was previously approved for community projects.

California schools have been warned by the Trump Administration that if they don't stop instituting DEI programs and indoctrination, they will lose at https://www.latimes.com/california/story/2025-04-03/schools-have-10-days-to-comply-with-trump-anti-dei-policy-or-faces-losing-federal-funds

in funding, with $1.26 billion of that going to the Los Angeles Unified School District.

The sheer enormity of federal funds floating around California should be taken into account, but also the fact that despite access to so much money California and LA are still facing a massive budget shortfalls. The chances of this dilemma being solved through layoffs and department consolidation is next to nil. The real root of the problem is policy driven; Democrat welfare programs, social programs and their open border mentality have resulted in a never ending drain on their finances, slowing destroying what was once one of the greatest states in the nation.

https://cms.zerohedge.com/users/tyler-durden

Fri, 04/25/2025 - 17:20

https://www.zerohedge.com/political/la-institute-mass-layoffs-city-workers-wake-1-billion-deficit

Waste all the fiat they want on socialism, not stealing it from me, can't tax or seize my Bitcoin.

Any suggestions on NPUBs to follow to get honest news?

First Tariff Shock Set To Hit Port Of Los Angeles, With Ripple Effects Across The Broader Economy

First Tariff Shock Set To Hit Port Of Los Angeles, With Ripple Effects Across The Broader Economy

Ocean freight transit times from Shanghai to Los Angeles typically range from 14 to 40 days, with faster services—such as CMA CGM's expedited routes—delivering containers in as little as three weeks. With 145% tariffs now applied to most Chinese imports, the full economic impact will likely emerge with a lag of about a month or more as reduced import volumes and supply chain disruptions begin to take effect. Early high-frequency indicators already suggest those disruptions are imminent.

Let's review the key trade war developments since President Trump, following "Liberation Day" on April 2, announced a tsunami of tariff hikes on Chinese imports to 145% on April 11.

https://www.zerohedge.com/markets/amazon-cancels-orders-walmart-pulls-forecast-tariffs-take-hold

https://www.zerohedge.com/markets/chinese-sellers-amazon-panic-after-trumps-tariff-bazooka

https://www.zerohedge.com/markets/chinese-plastics-factories-face-mass-closure-us-ethane-disappears

On Wednesday, new data from Port Optimizer, a tracking system for vessel operators, https://www.zerohedge.com/economics/west-coast-tipping-point-los-angeles-port-set-steep-drop-traffic

into the Port of Los Angeles are set to decline sharply beginning on Sunday.

?itok=BX-I3oQ0

?itok=BX-I3oQ0

Adding to the conversation, FreightWaves CEO Craig Fuller posted on X that trucking activity at the LA Port, the largest container port in the Western Hemisphere, has just plunged ...

"Year-over-year trucking activity out of Los Angeles down 23%. It will likely drop to 50% in the coming weeks if there isn't trade war resolution," Fuller said.

Year-over-year trucking activity out of Los Angeles down 23%.

It will likely drop to 50% in the coming weeks if there isn't trade war resolution.

Massive layoffs coming to the West Coast trucking sector https://t.co/rLiow0xmoV

— Craig Fuller 🛩🚛🚂⚓️ (@FreightAlley) https://twitter.com/FreightAlley/status/1915241614798110946?ref_src=twsrc%5Etfw

He warned: "Massive layoffs coming to the West Coast trucking sector."

The incoming disruption at Port LA will soon result in sliding containerized flows from China, which will ripple through the Southern California economy.

?itok=xzQnZtST

?itok=xzQnZtST

Here's how the disruption could unfold:

Plunging Container Volumes

Volume Drop: A decline in imports would slash throughput at the port, disrupting operations that rely on consistent traffic for profitability.

Revenue Hit: The Port of LA, which generates revenue through container handling fees, leases, and other port services, would face a significant decline in income.

Job Losses

Dockworkers & Terminal Staff: ILWU labor hours would be cut; possible layoffs or furloughs.

Truckers & Warehouse Workers: Major layoffs in the Inland Empire's massive logistics hub (Ontario, Riverside, etc.)—home to over 200 million square feet of warehousing.

Broader Economic Fallout (Southern California)

The logistics sector is the largest private employer in the Inland Empire. A large drop in volume could collapse parts of the warehouse economy.

Retail & Consumer Ripple Effects

Higher costs and shortages for imported goods would pressure retailers and consumers alike.

Port Diversions

Shippers would increasingly reroute to Mexican and Canadian ports, bypassing LA entirely.

Companies could shift sourcing to Mexico or other non-tariffed nations, reducing LA's role as a China-facing import hub.

While the first wave of disruptions is materializing at Port LA and could soon ripple across the Inland Empire and then the Heartland, across the Pacific, high tariffs on Chinese goods have already sent factories in the world's second-largest economy into a tailspin, as per a new https://www.ft.com/content/d5784258-4de3-44a1-94ae-6f763857b034#comments-anchor

report:

Wang Xin, head of the Shenzhen Cross-Border E-Commerce Association, an industry group representing more than 2,000 Chinese merchants, said many of them were "extremely anxious" and had told factories and suppliers to halt or delay deliveries. This had prompted some factories to suspend production for one to two weeks, she said.

. . .

It is unclear how widespread the factory suspensions are, said Han Dongfang, founder of China Labour Bulletin, which closely tracks Chinese manufacturing and labor. "The rearrangement of China's manufacturing sector will be a long-term process and workers will be sacrificed," he said.

What's telling is that the Trump administration is bracing for impact and has likely viewed this port data as new signs emerge of possible de-escalation of the trade war with China.

The White House has put itself and the country in a bad situation but doesn’t realize it yet.

Around April 10th China to USA trade shut down.

It takes ~30 days for containers to go from China to LA.

45 to Houston by sea, 45 to Chicago by train.

55 to New York by sea.

That… https://t.co/8vnGDMWCpt

— molson 🧠⚙️ (@Molson_Hart) https://twitter.com/Molson_Hart/status/1915248938753392642?ref_src=twsrc%5Etfw

On Tuesday, Treasury Secretary Bessent told investors at a closed-door meeting: "No one thinks the current status quo is sustainable, at 145% and 125%, so I would posit that over the very near future, there will be a de-escalation. We have an embargo now on both sides."

Bessent stated earlier this week that a trade deal https://www.zerohedge.com/markets/china-dismisses-reports-us-trade-progress-fake-news-demands-removal-unilateral-tariffs

.

President Trump has noted on several occasions that there will be "little disturbance" and "short-term interruption" when the tariffs kick in.

Trump says there will be 'a little disturbance' when tariffs kick in: 'We're OK with that, it won't be much' https://t.co/rkGcItbCL5

— New York Post (@nypost) https://twitter.com/nypost/status/1897137779672248708?ref_src=twsrc%5Etfw

“There will be a short term interruption… I don’t think it’s going to be big.” “There will be disruption”... Is President Trump preparing us for the Mass Start Awakening? https://t.co/UfQX2ehiFG

— VAL THOR (@CMDRVALTHOR) https://twitter.com/CMDRVALTHOR/status/1898402961803354375?ref_src=twsrc%5Etfw

The adjustment period seems imminent. Even before it fully arrives, Americans are already panic-searching for "https://www.zerohedge.com/personal-finance/americans-are-searching-usa-products-never

."

It's time to break the nation's addiction to cheap Chinese goods and restore critical supply chains—an essential step to https://www.zerohedge.com/technology/goldmans-china-tech-tour-underscores-one-message-america-must-reclaim-these-supply

. Without these supply chains to produce drones, smartphones, chips, electric vehicles, and humanoid robots (all under similar ecosystems of production), it will be impossible to compete with China in the decades ahead. The adjustment period nears.

https://cms.zerohedge.com/users/tyler-durden

Thu, 04/24/2025 - 22:35

https://www.zerohedge.com/markets/it-begins-brace-first-wave-tariff-shock-port-los-angeles

Its gonna get crazy.