💥$70,000 #Bitcoin 💥

A new All-Time-High! 🚀

💥 BREAKING: #Bitcoin hits $69,000 to make new all-time high!

🔸$66,000 #Bitcoin

🔸#Bitcoin is up 285% since the European Central Bank said Bitcoin was on "the road to irrelevance".

It was literally the bottom of the bear market...😅

🔸JUST IN: #Bitcoin market cap hits new all-time high!

JUST IN: Bitcoin officially enters Bull market territory on Plan B's model with first 🔴 since 2021.

This usually marks the start of a parabolic move. 🚀

NEW: BlackRock’s #Bitcoin ETF breaks $10 Billion in just 7 weeks.

The fastest ever for an ETF.

It took the Gold ETF $GLD 3 years to reach $10b in assets.

BREAKING: 🇧🇷 BlackRock to launch #Bitcoin ETF in Brazil this Friday.

🟠 JUST IN: BlackRock's #Bitcoin ETF $IBIT took in $520 million yesterday.

- The biggest inflow for a $BTC ETF ever!

- The 2nd biggest inflow of any ETF yesterday

- $8b in total assets

- Top 5% among all ETFs

Bitcoin smashed $59,000 🚀

$60K on the way...

💥Bitcoin just smashed $53,000!

BREAKING: 🇪🇹 Ethiopia to build $250M #Bitcoin mining and AI data facilities.

Michael Saylor Bet Billions on #Bitcoin and Keeps Winning

--------------------

MicroStrategy had a market cap of $1.3b when it first bought bitcoin on the 11th of August, 2020.

This kicked off a Bitcoin buying spree that has seen the company spend $5.98 BILLION accumulating 190,000 $BTC

To date this is the single largest corporate treasury holding of Bitcoin.

The 190,000 Bitcoin acquired for $5.98b is currently worth $9.96b.

Profit so far = $3.98b

Starting market cap = $1.3b

‼️Unrealised profit is 3x bigger than the entire market cap of MSTR before it bought bitcoin.

It's market cap now is up more than 9x at $11.94b.

When Bitcoin hits $100K USD, MicroStrategy's profit on its current Bitcoin holding will be worth £13.58 BILLION.

More than 10x its market cap from when it first started buying Bitcoin.

#Winning 🤑

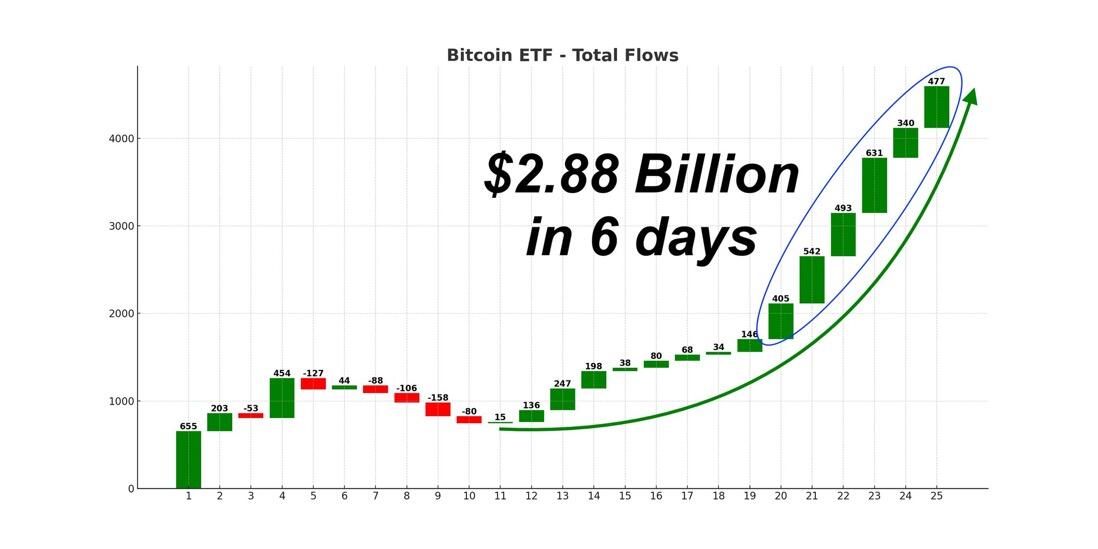

JUST IN: #Bitcoin ETFs have taken in $2.88 BILLION in in just 6 days (net of GBTC outflows).

🟠This train is not stopping... 🚆

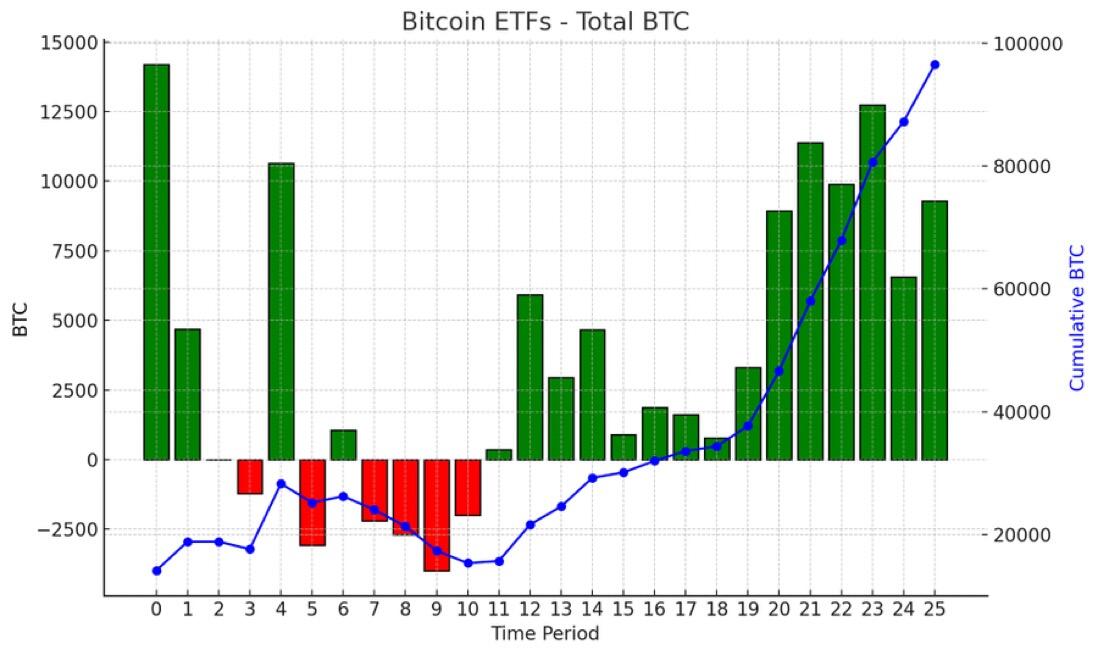

JUST IN: The 9 new Bitcoin ETFs now hold 258,770 $BTC in total, buying an average of ~10,000 #Bitcoin a day.

This is about 11x the daily issuance from the block reward.

CHART: Daily number of Bitcoin acquired by ETFs net of GBTC outflows.

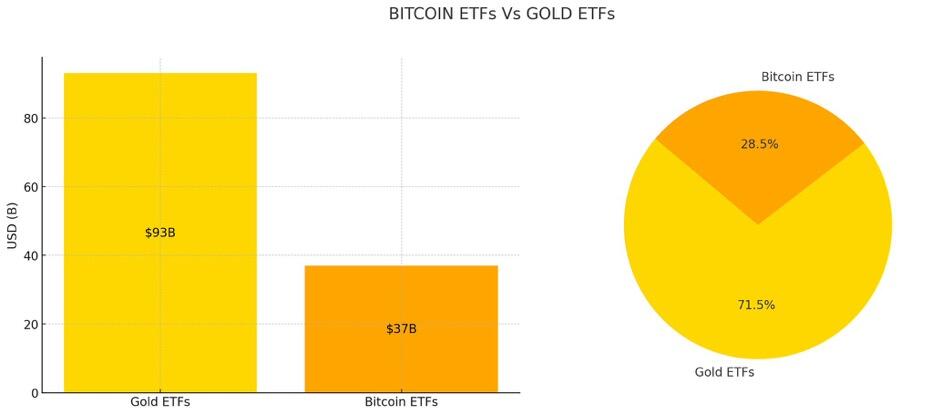

JUST IN: #Bitcoin ETFs are catching up to Gold ETFs for assets.

$37b for $BTC

$93b for Gold

💥After just 25 trading days!

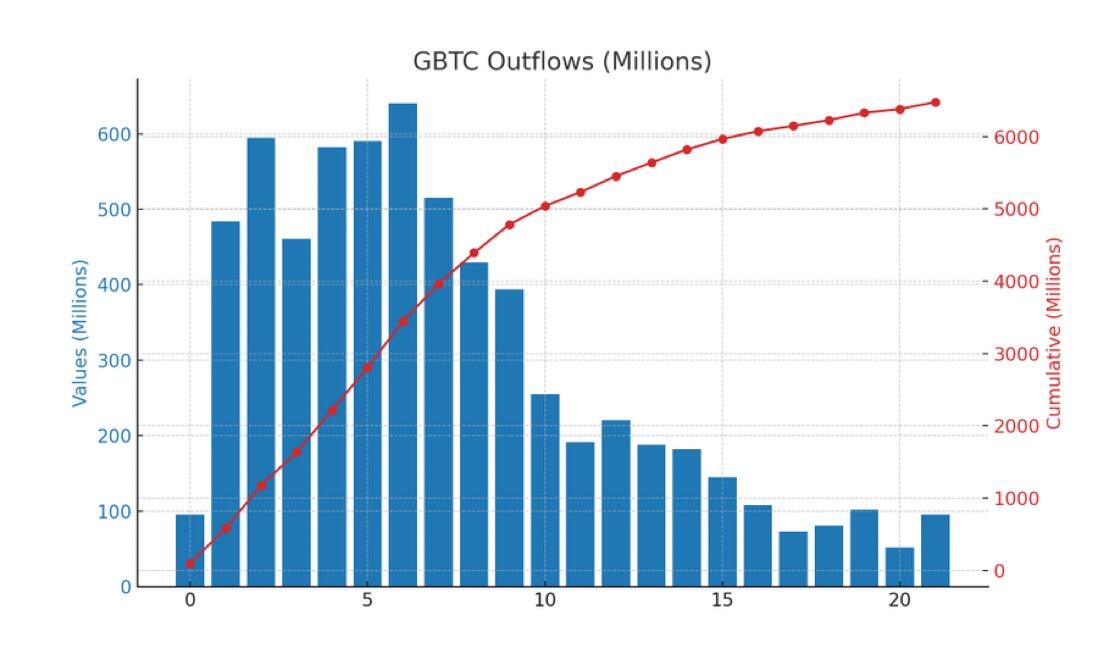

NEW: Grayscale Bitcoin outflows have stabilised under $100m per day as inflows into the other 9 #Bitcoin ETFs are around $400-$600m per day.

JUST IN: #Bitcoin ETFs broke $3 BILLION net inflows in just one month.

It took the Gold ETF 2 years to do that.|

$50,000 #Bitcoin feels pretty chill…