Wat bedoel je met aanvallen?

2 device is enough but I agree it is not easy. At this moment I wouldn´t try to explain it to a noob, it is not user friendly enough. I think it is possible to make it a lot more simple and maybe integrate the software in other wallets directly.

The moment of opportunity to buy #bitcoin !!! When you don´t have any or buy more. The moment to go ALL IN!!!

I agree, if it would be true the eth/btc ratio would move more. Definitely in such little time frame.

On long time frame 10-20 years time frame I think most people in bitcoin are not bullish.

People will less engage when your view on social media is nuanced. Some people look at this statement of Adam Back on the long term other on the short term. People who want to gamble on the short term of bitcoin because Adam Back said something must do more research or experience a big loss.

If you trust the big banks read this👇

nostr:naddr1qqgxzc3nxg6rjv3hxscrjwtzx5ensqghwaehxw309aex2mrp0yh8qunfd4skctnwv46z7q3qhzz35pkl67w53lpj2g62zh56g63j5zvz4q3m2nxlsfg5hxcjpwssxpqqqp65w2fj7qu

🔥 nostr:nprofile1qqswmnfq2k830kvnylvyrezc97dsqce343qppqrwlgpqaux5qpuwdkshfwsm2: Bitcoin is American at its core. It is for everyone regardless of political party.

I would not frame it as American, everyone can use bitcoin regardless their nationality.

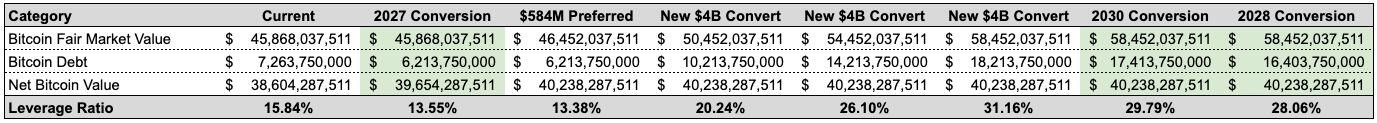

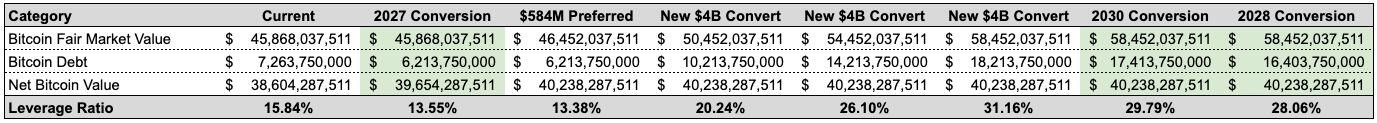

#Strategy #MSTR Leverage Ratios & Q1 2025 Potential

Now that MSTR has officially confirmed a target leverage range of 20-30% (which I interpret as the range they will actively leverage the balance sheets to), let's take a look at what might be in store for this quarter.

First the knowns.

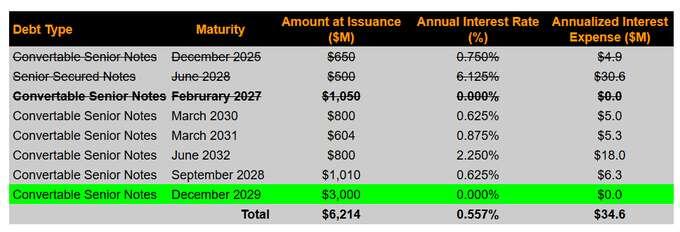

MSTR confirmed in their presentation that they view their leverage ratio as Bitcoin related Debt divided by Bitcoin Fair Market Value, simple. Now keep in mind that debt is not equal to fixed income. The reason this distinction is important is that while Preferred Stock may be classified as a fixed income offering in their 21/21 plan, it does not actually add a liability to their balance sheet as it is structure as equity.

So what do we know. We know that the 2027 Convertible Bonds will be fully converted in February. This removes $1.05B from the Bitcoin related liabilities.

We also know that they have closed the Preferred Stock offering for $584M which they will be using to buy more Bitcoin soon, if not already.

As things currently stand with Bitcoin's price, this would mean that their leverage ratio is effectively 13.38%. This is far below the target, and they will work to correct this quickly (likely starting as soon as next week).

The question on everyone's mind is how much can they lever up through fixed income instruments in the near term.

Based on what I see, it looks like they could potentially go up to $12B in new convertible offerings as things stand today.

However, if they go up to $12B with Bitcoin prices as they are today then this would actually bring them up to a 31.16% leverage ratio. So in order to make that palatable, they would need confidence in the conversion of at least 1 of the other bonds. The most obvious candidate would be the 2030 bonds for $800M which carry a conversion price of $149.77 making them equity at this stage, but the other is the 2028 at $1.01B and a $183.19 conversion price.

If just the 2030 bonds convert, this will put their leverage ratio at 29.79% which gets them back into range. If the 2028 also converts, this would bring it down even further to 28.06% and comfortably in the range.

Both bonds are eligible for early conversion, but at the bond holders discretion. MSTR has no ability to soft call these right now in the same way they just did with the 2027 bonds.

So this is where the relationships come in. You can be sure MSTR is talking to the major holders of these bonds, and likely would be pitching new allocations (likely upsized allocations) in the new offerings if they convert early.

I think that MSTR will be pushing hard for as much capacity as possible in Q1, and there is a very tactical reason for this. Early conversion triggers.

Typically, there is a quarter lag from issuance to when the 130% early conversion trigger kicks in for the bond holders. So if we think strategically, why might this matter?

The short answer is cycle theory. If MSTR believes there is a high probability that the 4 year cycles continue, then the timing for this cycle's top would typically fall in Q4. So what this does is it makes sure that they are planning ahead where there is a potential event that can trigger massive deleveraging leading into the historic "top" of the cycle if the bond holders trigger the early conversion mechanisms.

Why this may be important is that it could set MSTR up to be largely unencumbered by debt with massive flexibility to operate and continue to execute their strategy during a potential bear market.

It is yet to be seen whether the cycles will fully continue, or if it gets muted by institutional/nation state capital allocations, but it is never bad as a management team to plan strategically for future events and outcomes.

So will we see urgency in MSTR's fixed income activity through the end of Q1? I think so, but we will have to wait and see. Sitting on the sidelines has not been this teams approach, so I don't see them waiting for very. long now.

nostr:nprofile1qqspf2k9a5dcxfttkceh5k09s6cw2qdlads50g4qhrmnl78w072p2tqacwekg

#MicroStrategy sold 584 million of perpetual preferred stocks with a dividend of 10% with a strike price of 1000 dollars.

As long term investor in the common stock, the perpetual preferred stocks is accretive in value as long as the value of bitcoin grows on average more than 10% yearly.

#MicroStrategy to Redeem $1.05B of 2027 Convertible Notes and Settle All Conversion Requests in Shares $MSTR on February 24, 2025

If you are thinking about altcoins this video from Joe Nakamoto is a must watch!!!

Greed and stupidity is taking over

SHITCOIN/ALTCOIN TRUMP COIN IS NUMBER 11 ON THE ALTCOIN MARKETCAP

LEVERAGED PRODUCTS GETTING AGAIN VERY POPULAR:

- LOANS AGAINST BITCOIN AND CRYPTO

- PERPETUAL SWAPS

NEVER FORGET WHAT HAPPEND WITH MT GOX, BITCONNECT, CELSIUS, BLOCKFI, LUNA, HAWKTUAH,...

THE SHIT THAT IS HAPPING WITH ALTCOINS AND LEVERAGED PRODUCTS WILL BLOW UP IN A BIG WAY.

HOW CAN YOU PREVENT THAT THE SHIT THAT IS HAPPENING WILL NOT HARM YOU:

- HOLD ONLY BITCOIN

- DON´T HAVE ANY ALTCOINS

- DO HOLD YOUR BITCOIN ON HARDWARE DEVICE NOT A EXCHANGE

- HAVE A TIME FRAME OF AT LEAST 4 YEARS

- DON´T LOAN AGAINST YOUR BITCOIN

- SPEND BITCOIN WHEN YOU NEED IT

Reminder me in december 2026

STAY AWAY FROM ALTCOINS, JUST HOLD BITCOIN OTHERWISE HAVE FUN GETTING POOR!!!

Bitcoin Safe has lots of languages. Any important missing?

Check out

www.bitcoin-safe.org

I'm about to release the version 1.0.0 stable and would love for feedback: https://github.com/andreasgriffin/bitcoin-safe/releases/tag/1.0.0rc2

With a Quick view it is a good wallet for developers by developers. For mainstream users the interface must be a lot less complex. With this advanced wallet I think it has enough language options.

Personally I think our onboarding with new people to bitcoin. Could be better with exchanging cash directly to bitcoin or using dex´s like bisq.network . Maybe we could think about how to make this markets better and more liquid. We must not give up because government takes excessive control on central exchanges it was expected.

I agree to a certain level, a lot more people could help with thinking how to solve problems in the bitcoin p2p market also if you are not a developer.

Bull Bitcoin becomes the first mobile Bitcoin wallet that allows users to send and receive asynchronous Payjoin transactions without needing to run their own server, using BIP77!

I am very excited about this new and bleeding-edge feature, because it has been a long-standing ambition of Bull Bitcoin to become the first Bitcoin exchange to process Bitcoin withdrawals via Payjoin (Pay-to-Endpoint) transactions.

However, it was hard to justify Bull Bitcoin investing time into building this feature since there were no commercially available end-user Bitcoin wallets that were able to receive Payjoin payments.

Indeed, in order to receive Payjoin payments (BIP78), a Bitcoin wallet needed to be connected to a full node server and be online at the moment the payment is made. This means in practice that only merchants, professional service providers and advanced full node users had the capacity to receive Payjoin payments. This is, we believe, one of the major reasons why Payjoin had failed to gain significant traction among Bitcoin users.

For this reason, the Payjoin V2 protocol (BIP77) was conceived and developed by Dan Gould, as part of the Payjoin Dev Kit project, to outsource the receiver's requirement to run his own server to an untrusted third-party server called the Payjoin Directory. In order to prevent the server from spying on users, the information is encrypted and relayed to the Payjoin Directory via an Oblivious HTTP server.

Bull Bitcoin’s Payjoin ambitions had been put on hold since 2020, until there was more adoption of Payjoin receiving capabilities among end-user Bitcoin wallets…

But it turns out that in the meanwhile, Bull Bitcoin developed its own mobile Bitcoin wallet. And it also turns out that the open-source Bitcoin development firm Let There Be Lightning, which we had collaborated with in the past, had itself collaborated with Dan to build a software library for Payjoin that was compatible with and relatively straightforward to integrate into our own wallet software. All that was missing was to put the pieces together into a finished product.

Thanks to the collaborative open source effort of the Payjoin Dev Kit team, Let There Be Lightning team and the Bull Bitcoin team, the Bull Bitcoin wallet has now become the first commercially available end-user mobile wallet on the Google Play store to implement the BIP 77 Payjoin V2 protocol.

Moreover, the Bull Bitcoin wallet has also implemented asynchronous Payjoin payments, which means that a Payjoin transaction can be “paused” until the receiver or the sender come back online. This way, the receiver's mobile phone can be “turned off” when the sender makes the payment. As soon as the recipient’s phone is turned back on, the Payjoin session will resume and the recipient will receive the payment. This is a major breakthrough in the mobile Payjoin user experience.

We would like to thank the Human Rights Foundation for allocating a generous bounty for the development of a Serverless Payjoin protocol and its implementation in a mobile Bitcoin wallet, as well as OpenSats and Spiral for supporting the work of Payjoin Dev Kit, which made this all possible.

Why does this matter?

Payjoin, also known as Pay-to-endpoint, is a protocol which allows the Bitcoin wallet of a payments receiver and the Bitcoin wallet a payments sender to communicate with each other for the purpose of collaborating on creating a Bitcoin transaction.

I first heard about Payjoin (then called Pay-to-endpoint) in 2018 and it completely blew my mind. What I liked most about it was that it was not a protocol change to Bitcoin, but rather it was an application-layer protocol that allows wallets to communicate in order to create smarter and more efficient Bitcoin transactions.

Whereas in a normal Bitcoin payment the transaction is created by the sender, and all the inputs of that transaction belong to the sender, in a Payjoin payment both the sender and the receiver contribute coins as inputs.

In the Bitcoin whitepaper, Satoshi wrote:

"some linking is still unavoidable with multi-input transactions, which necessarily reveal that their inputs were owned by the same owner"

With Payjoin, this assumption is no longer true. With Payjoin, we have fixed one of Bitcoin’s most fundamental privacy problems... without changing the Bitcoin protocol!

In a Payjoin transaction, the output amounts visible on the blockchain does not necessarily reflect the value of the payment that was actually exchanged. In other words, you can’t easily tell how much money one wallet sent to the other. This is great for users that are concerned a malicious third party may be attempting to obtain sensitive information about their finances without their consent. This does not however pose an accounting problem for the Bitcoin wallets involved in that transaction: since both wallets are aware of which coins they used as inputs and outputs, they are independently able to calculate the "actual" value of the payment that was sent even if the payment on the blockchain appears to be a of a different amount.

Payjoin breaks the common input ownership heuristic, an assumption used by hackers and fraudsters to track ownership of addresses on the blockchain. The neat thing about this property of Payjoin is that it benefits everyone on the network, not just the Payjoin users themselves.

It allows the receiver of a payment to opportunistically consolidate his utxos when he is receiving funds, in a way which does not necessarily appear to be a consolidation transaction on the blockchain. Depending on the configuration of a payment transaction, it can also make a regular payment look like a consolidation.

In addition to these benefits, the introduction of collaborative peer-to-peer transaction protocols opens up exciting opportunities for the creation of Lightning Network channels, as well as efficiencies for transaction batching.

How to use Payjoin in the Bull Bitcoin wallet:

It’s so seamless, you may not even realize you are using it!

To receive via Payjoin, simply navigate to the “Receive tab” using the network “Bitcoin” and you will see a Payjoin invoice. When you want to get paid, send this invoice to the payer, or show them the QR code. If the sender’s wallet is compatible with Payjoin, it will be up to the sender to decide whether or not they want to use Payjoin.

To send via Payjoin, simply paste the receiver's Payjoin invoice, or scan the associated QR code, in the Bull Bitcoin wallet. If you decide that you don’t want to pay with Payjoin, simply turn off the Payjoin toggle.

Original post: https://www.bullbitcoin.com/blog/bull-bitcoin-wallet-payjoin

Download the wallet: https://play.google.com/store/apps/details?id=com.bullbitcoin.mobile&hl=en-IN

I like the Payjoin transactions in Bull Bitcoin, one functionality I would like to see is the optionality to use STANDING ORDERS in mobile wallet.

:max_bytes(150000):strip_icc()/hodl678x381-5bfc2e10c9e77c002630d42d.png)