Gold without programmability and absolute scarcity trade at $10 trillion market cap compare to Bitcoin’s $500 billion market cap.

Gold is perhaps the most overvalue commodity ever?

Everything we need for a sound money is already being built on Bitcoin.

Why a Traditional VC Model Doesn't Align with the Bitcoin Standard?

A Thread:

Time Preference: In the VC world, there's a high time preference to deploy capital due to the typical deployment period. This urgency can sometimes lead to hasty decisions, not always aligning with the long-term value proposition of Bitcoin.

Illiquid Equity Risks: Investing in illiquid equity presents challenges. There's the risk of dilution, which can erode shareholder value. Additionally, liquidity events can be unpredictable, making exit strategies complex in a Bitcoin-centric ecosystem.

Fiat's Counterparty and Debasement Risk: In traditional VC, fiat often serves as the primary liquid position. However, its inherent counterparty risk (e.g., SVB) and debasement risk from central bank actions highlight its vulnerabilities in the current financial landscape.

While the VC model has its merits, adapting it to the Bitcoin Standard requires a reevaluation of strategies.

The solution is simple: prioritizing Bitcoin allocation can truly harness the potential real return for LP investors without facing the problems identified above.

The Bitcoin Standard's author, @saifedean, sums it up elegantly, “Sound money allows people to think about the long term and to save and invest more for the future. Saving and investing for the long run are the key to capital accumulation and the advance of human civilization.”

I've been pondering on the phenomenon of Bitcoin Culture for quite some time. In this brief piece, I share my insights on Bitcoin Culture and its impact on individuals, businesses, and investors.

If money can buy time, then money equates to time. You wouldn't want money to be manipulated by someone's interests. Ideally, money should be as immutable as time. However, our money is flawed, as it can be inflated by central banks. In essence, our money is stealing our time.

Hard to build a successful business without building a culture around it.

In a Bitcoin bear cycle, many people ignore the significant progress made and continue to focus on negative and false narratives until the market inevitably improves. That’s where you find a bargain in price.

Bitcoin price prediction is a sign of fiat mind.

Think long term, think Bitcoin.

To do or not to do.

#Bitcoin

Gm

Two kinds of people who go to shitcoin conferences:

Scammers and Idiots.

I’m heading to Nashville. I’ve heard a lot of great things about BitcoinPark. I’m looking forward to connecting with people excited about Bitcoin from around the world.

I will see you soon in Nashville. Flying all the way from Taiwan.

Bitcoin has made the trade off to be the best money ever.

And some people want more UtIliTy.

Shitcoin 2049

If you know what I am talking about.

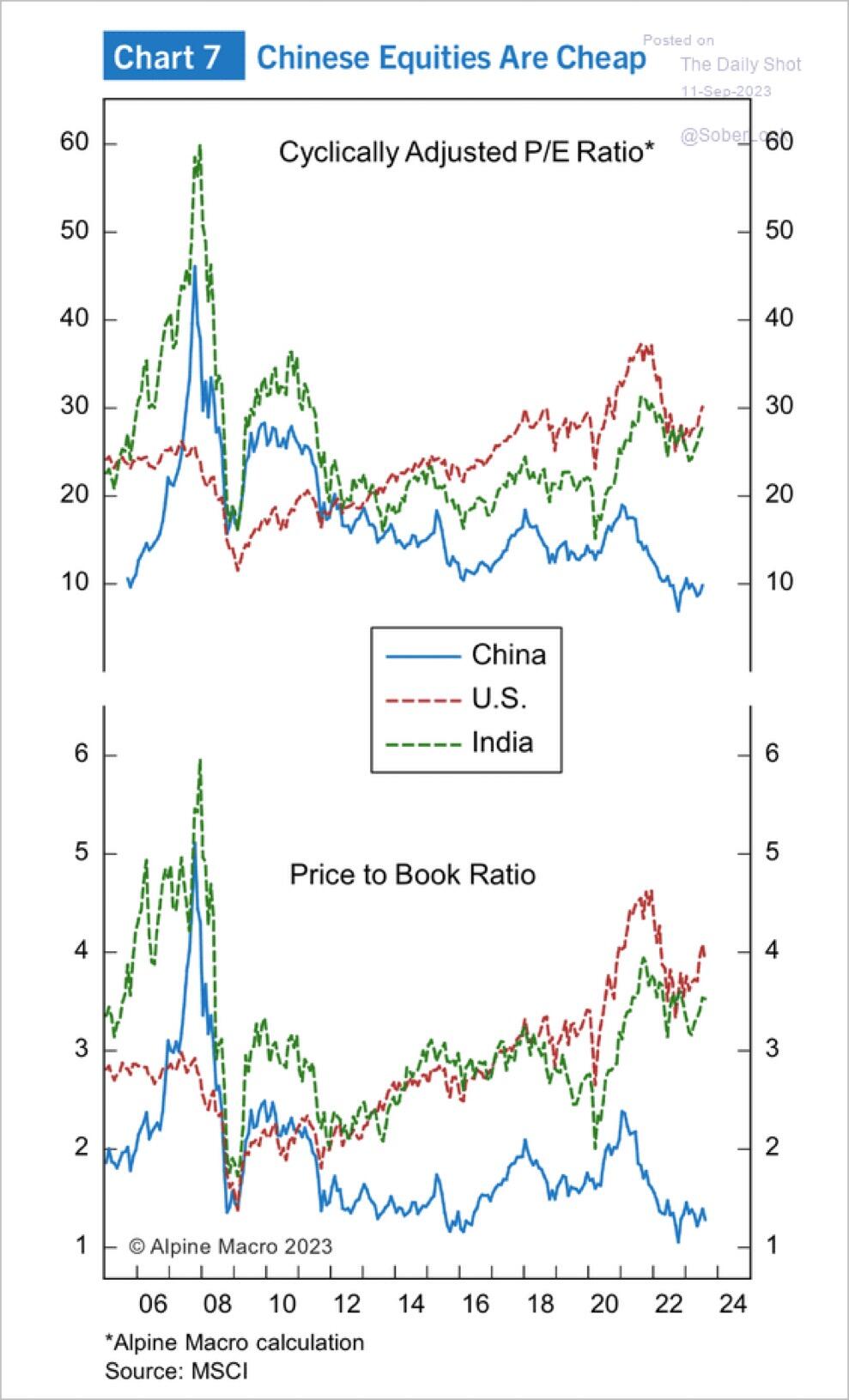

China equities are in an oversold territory.