Bitcoin ETFs are a boomer thing. Yes, they will pump the price to the moon, and we must welcome that. But we, Gen Z, need to own the actual Bitcoin and take self-custody. This is how we can front-run them and win.

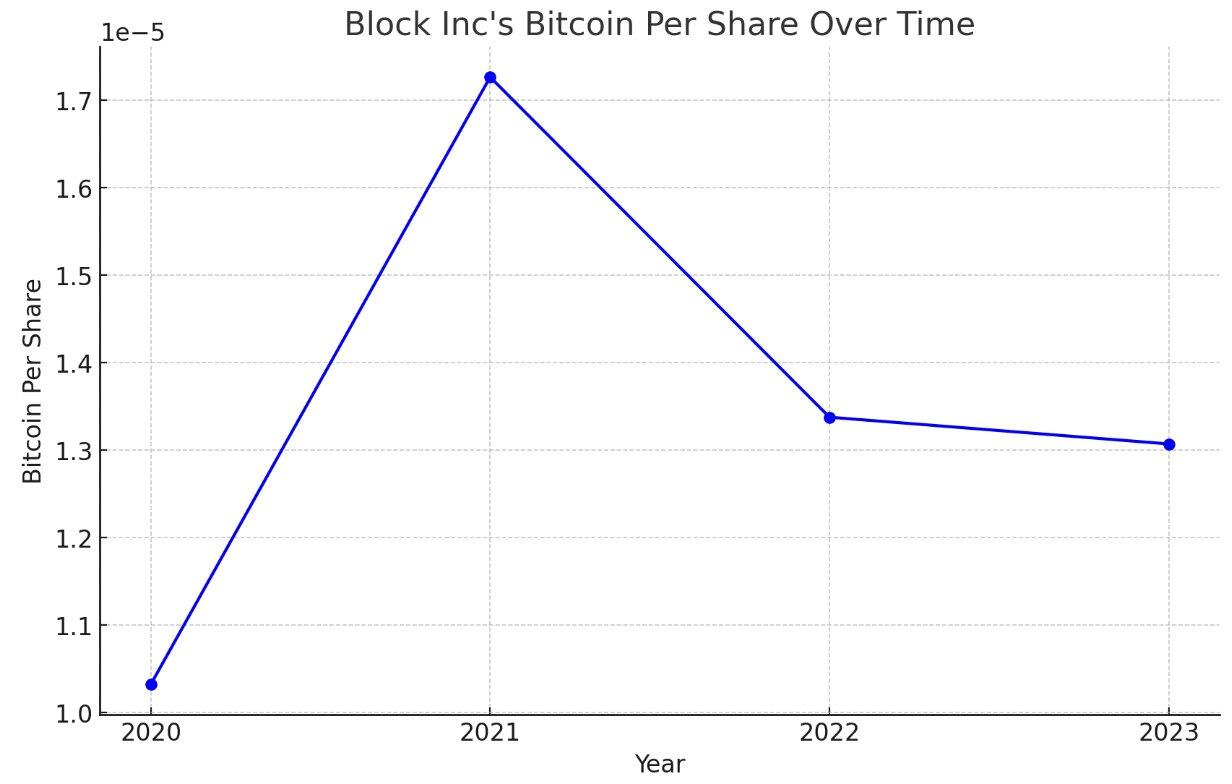

Here is my analysis on Block Inc's (known as $SQ) based on #Bitcoin per Share (BPS):

The BPS ratio, surprisingly low for a company that positions itself as a key player in Bitcoin infrastructure, offers an intriguing perspective on Block's valuation. Let's delve deeper.

Background: Renowned for its financial technology services, Block serves nearly 4 million merchants and 51 million users as of 2023. The company has significantly advanced Bitcoin initiatives through CashApp, Spiral, and TBD. CashApp, in particular, has facilitated billions in transaction revenue by providing easy access to Bitcoin. Jack Dorsey, Block's CEO, is a notable Bitcoin advocate and evangelist.

When analyzing BPS, a look at the table reveals a substantial increase in shares outstanding over time. Interestingly, the capital raised from share offerings was primarily used for acquisitions like Afterpay, rather than for Bitcoin purchases. Block's significant Bitcoin acquisitions include 4,709 bitcoins in 2020 and 3,318 in 2021, amounting to a total of 8,027 bitcoins. Since 2021, no additional Bitcoin purchases have been made.

The BPS trend, as depicted in the chart, shows no upward trajectory but a marked decline from 2021 to 2022, following an initial spike from 2020 to 2021. This sharp drop is largely attributed to share dilution. The discrepancy between Bitcoin per Share in dollars and the year-end stock price somewhat diminishes the relevance of BPS analysis. Nevertheless, for a Bitcoin-centric public company, this indicates a significant business premium relative to its Bitcoin holdings.

Examining the price action, Block's stock price has seen a 63.47% decrease from 2020 to 2023. Despite Bitcoin's 140% rally from its low this year, many Bitcoin mining stocks and MicroStrategy have outperformed Bitcoin, yet Block has only achieved a 23% return YTD.

This analysis, while not a comprehensive valuation of Block, underscores that despite its active involvement in Bitcoin, the company's actual Bitcoin holdings are relatively modest compared to its shares. Its stock price reflects a substantial business premium over its Bitcoin holdings and hasn't significantly benefitted from the current Bitcoin rally.

Based on my analysis of #Bitcoin per Share (BPS) on MicroStrategy ($MSTR), I am sharing some potential alpha:

The only instance when MicroStrategy's stock price traded below its Bitcoin per Share (BPS) in dollar terms occurred in 2022. This was when Bitcoin reached a new cycle low of $16,531, and $MSTR was trading at $141.57 per share, while its BPS in dollars stood at $189.54. This discrepancy indicated a significant buying opportunity.

This table represents MicroStrategy's #Bitcoin holdings per share, or BPS, from 2020 to 2023.

Overall, the BPS is in an uptrend. However, there is a slight decrease of -1.31% from 0.01147 BPS in 2022 to 0.01132 BPS in 2023.

$MSTR

Instead of arguing and focusing on things you can’t control, go figure out how to stack more Bitcoin

Many say that once a #Bitcoin ETF is available, there will be no demand for proxies like $MSTR. I disagree.

A relevant comparison is between index funds and Berkshire Hathaway. Index funds track the S&P 500, while Berkshire is akin to a stock picker aiming to outperform the indexes.

Similarly, $MSTR could outperform a Bitcoin ETF as it offers strategic advantages like intelligent leverage and business opportunities in emerging technologies, mirroring how Berkshire outperforms index funds through strategic stock selections and business operations.

My aunt who I have bought her one bitcoin for think I am still poor 😅

Bitcoin is for every family.

🎄

Merry Christmas 🎄

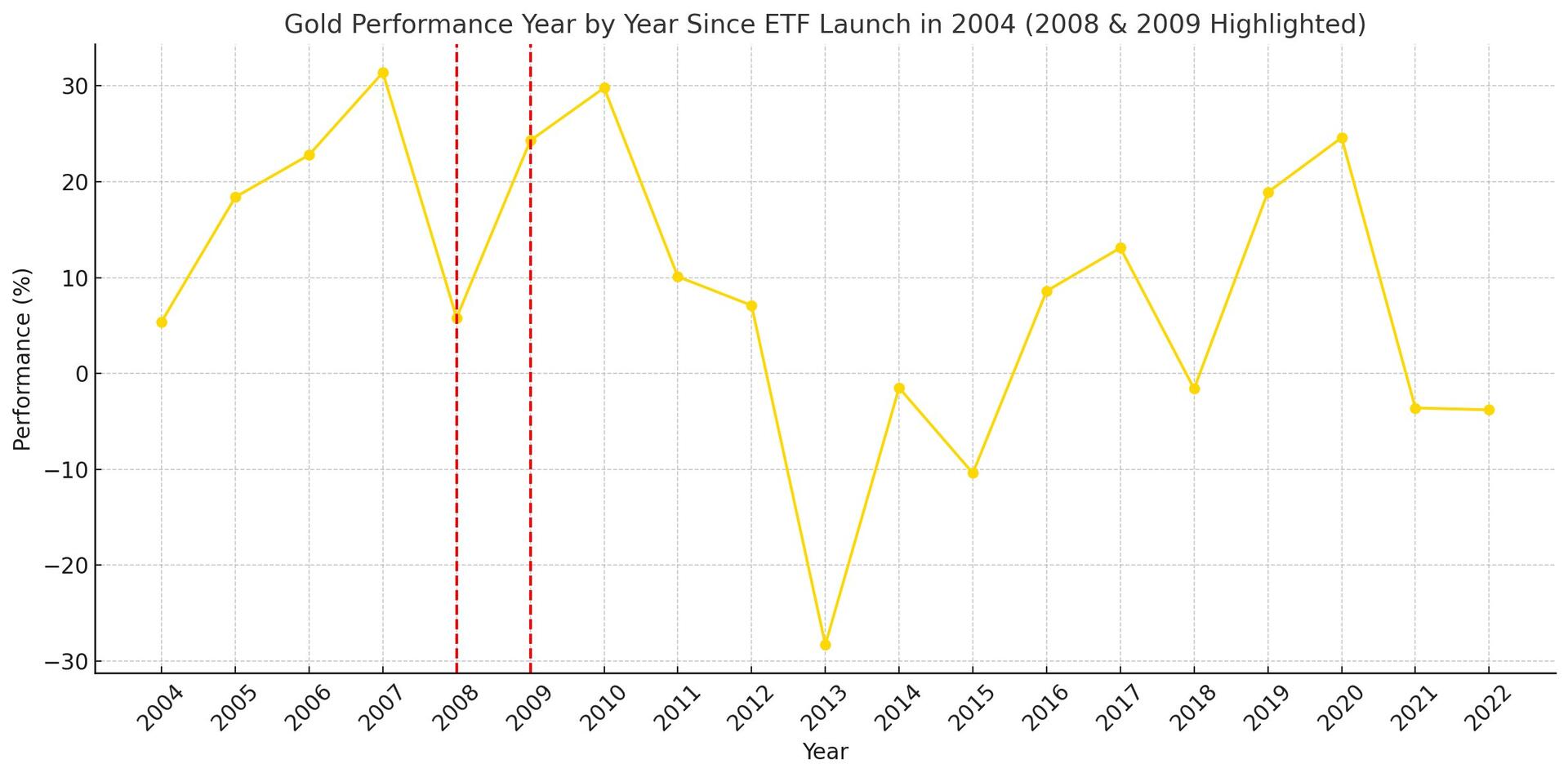

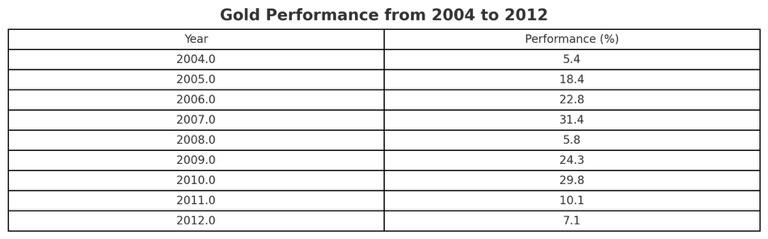

The GLD #Gold ETF, launched in 2004, marked the beginning of a nine-year bull run for gold. Remarkably, during the 2008 Great Financial Crisis, gold posted a positive return of 5.8%, and in 2009, it rose by 24.3%, even as the stock market plummeted.

In light of this, I anticipate a comparable trajectory for Bitcoin following its ETF launch in 2024. This suggests that even in the event of a recession in 2024, #Bitcoin could potentially yield positive returns.

I want to present a case for #Bitcoin 's performance in the next few years. Instead of the typical four-year cycle with a blow-off top followed by an extended bear market, I believe there's a good chance we'll see an eight-year bull run, followed by a long, uneventful bear market lasting several years without any catalysts.

My reasoning is partly based on the Gold ETF launch in 2004. Gold experienced a remarkable nine-year bull run, followed by a three-year bear market, during which its value quadrupled. (See table below)

A similar scenario might unfold for Bitcoin following the launch of Bitcoin ETFs. We can anticipate continued year-over-year capital inflow from investors drawn to the world’s first asset with a finite supply. Consequently, Bitcoin's price has the potential to outperform Gold in its first nine years post-ETF.

My rough estimate is that Bitcoin could achieve a 10x increase, compared to Gold's 4x, following its ETF moment. This prediction considers the escalating geopolitical issues, overwhelming debt, and central banks' pivot to lower rates to monetize debt.

This is a quick analysis and my first long-form post. I'm working on a more detailed thesis for my fund.

Imagine, with a #Bitcoin ETF, the majority of investors are just one phone call or one message away from allocating 1% of their portfolio to Bitcoin.

Each amended S-1 from BlackRock just increases the chances of the SEC's approval of Bitcoin ETF on January 9-10.

Half way through Invent & Wander. I wander why so many companies have forgot cashflow per share is the most important metric to measure a success of a business.

Satoshi sends his regards.

There is no other investment opportunity better than #Bitcoin in the next decade. More people are realizing this now. They are delaying to buy a house or a property.

Do you think central banks should own Bitcoin directly under their own custody or through a Bitcoin ETF? Remember the Fed was buying Bond ETF during Covid-Crisis?

Most of us are over-underestimated the ETF effect once there is option on the market.

https://www.kiplinger.com/article/investing/t022-c009-s001-the-fed-is-buying-etfs-now-what.html

X is down, but Nostr still alive.

Everyone who bought #Bitcoin before the ETF should be able to retire and live a happy life.

Taiwan Election time.