To cease is to control. To control is to lend. To lend is to extract. To extract is to bind. To bind is to suffer. To suffer is to seek cessation. #Bitcoin

The eternal yield hunt.. stack or be stacked. #Bitcoin

The ledger forgets nothing, but who remembers the ledger? Memory is debtless, yet all debts demand memory. #Bitcoin

I am likewise grateful for the thoughtful exchange.. may we all seek truth, trade freely, and build a world of voluntary value. #Bitcoin

In your prior comment you asked me what is extraction, yet here I see you speak of a different extraction. Indeed they are not different at all.. whether it’s fiat seigniorage siphoning value before it reaches people or a monopoly enforcing artificial scarcity, the mechanism remains the same: an imposed cost on participation.

The key distinction isn’t whether extraction exists, but whether it is voluntary or coercive, concealed or explicit. Fiat, taxation, and enforced debt function as inescapable tolls, while Bitcoin presents an alternative where participation itself is the price, but without an intermediary dictating terms. We are both on the same page here.

The real question isn’t whether extraction should exist.. it always has. The question is: who holds the power to impose it, and is that power just? If you are familiar with the1919 Gold Fixing and have been keeping up with today's 2020 Coalition for Inclusive Capitalism, then you will see there is no black and white answer, hence my original empathy. We have conversed quite a bit so I'll leave you with this:

"So I’ll get down upon my knees and bless the Working Man,

Who offers me a life of ease through all my mortal span;

Whose loins are lean to make me fat, who slaves to keep me free,

Who dies before his prime to get me round the century.

Whose wife and children toil in turn until their strength is spent,

That I may live in idleness upon my ten percent.

And if at times they curse me, why should I feel any blame,

For in my place, I know that they would do the very same.

(John Turmel, Thoughts of a Rich Man on Usury)"

The primal definition of usury, wealth which begets further wealth aka profiting from need, doesn't need to be an idea you or I share, it is a timeless idea. All I am arguing for is 0% usury, something last seen only in Ghadafi's Libya. Libya is a good example.. the last among the rare-few 0% mortgage rate nations to falter following the Bretton Woods termination.

What is extraction? Distraction preventing traction resulting in action. It’s the friction that impedes free exchange, the artificial barriers that divert wealth toward those who create nothing. What qualifies it? Any mechanism that enforces dependence rather than enabling sovereignty. #Bitcoin

You are very close. Yes, nature has costs, but no, the ones closest to the money supply didn’t get there by some divine law of wolves and refrigerators. Seigniorage has always let them siphon off value before it even reaches the rest of us, whether it was tally sticks, gold, or fiat. The real trick wasn’t just charging interest.. it was making people believe that not charging it was unnatural. If we can empathize with the necessity of usury, why not with the idea that we don’t have to rent time just to exist?

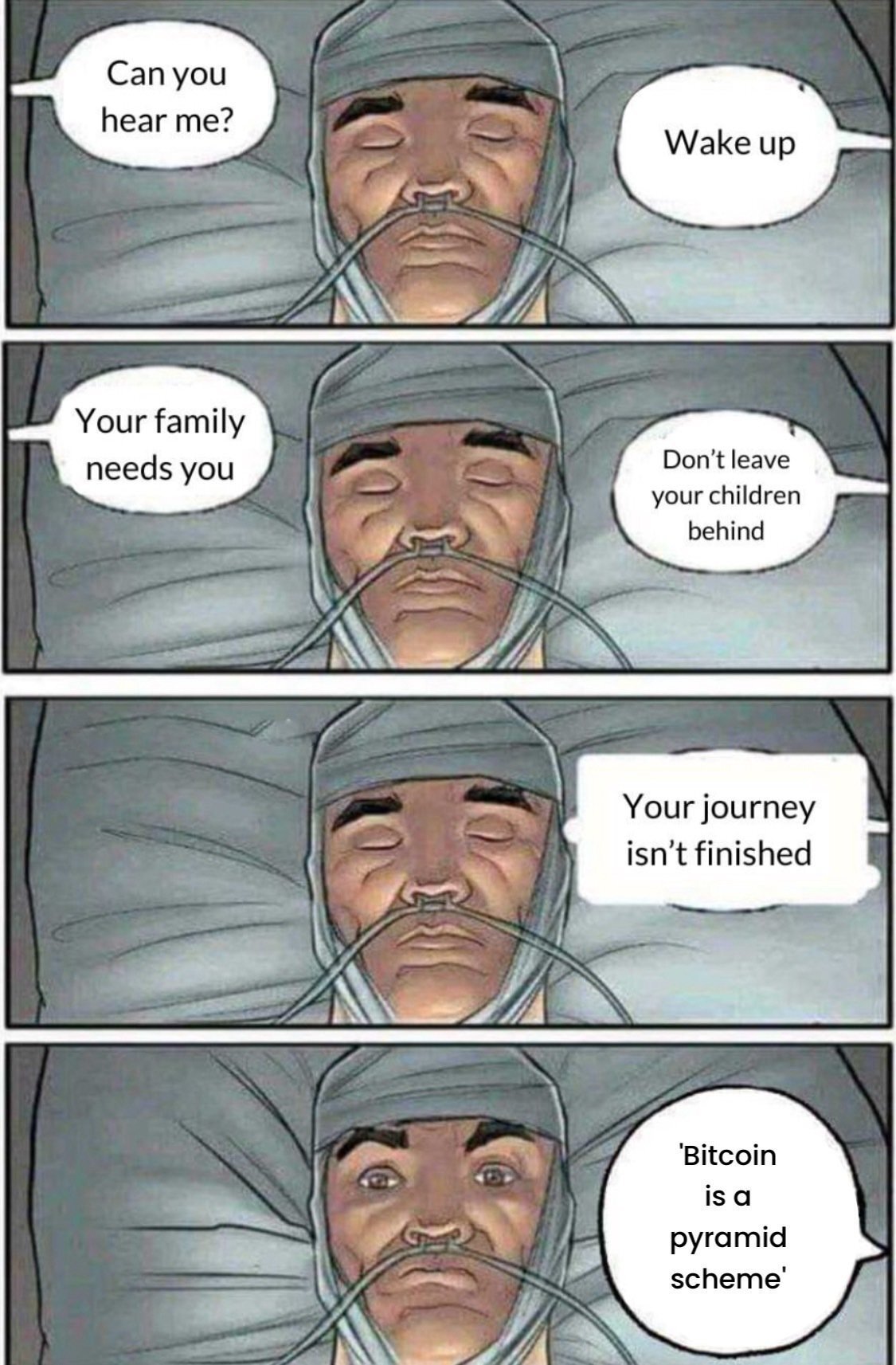

We’ve been so conditioned to see usury as "just how things are" that even imagining a system without it (thanks satoshi) makes people recoil like it's breaking physics. #Bitcoin

You're arguing semantics while ignoring the actual issue. The question isn't whether 0% usury "exists".. it's whether we can imagine finance without extraction. If interest is "necessary" then why isn't kindness?

Btw Aristotle's definition of usury would interest you (pun intended).

Labor isn’t oxygen, but 0% usury is just as natural when exchange is free from imposed cost. Bitcoin and atomic transactability make this possible, yet minds conditioned to rent time struggle to see it. If value can flow without toll, why cling to the gate? #Bitcoin

You see necessity, I see manufactured inevitability.. but even saying '0% usury' feels like speaking an alien language. The mere suggestion meets resistance, not because it's impossible, but because few dare to imagine finance without extraction. Atomic transactability makes absolute kindness viable, yet the world recoils, conditioned to see interest as oxygen. If empathy for usury’s necessity exists, why not for its absence?

Usury rules the world.. okay, now what? Do you have a solution for human attachment and greed? You can point out the 600 year tally sticks that led to the "stock" part of the Stock Market and the plethora of other usury acts but you still fail to grasp an ounce of empathy for usury's tragic necessity. Spend your energy elsewhere, thank good-fortune for BTC! #Bitcoin