There has never been a louder clarion call in your lifetime, in your parents’ lifetimes, or grandparents’ lifetimes, nor will be in your children’s or children’s children’s lifetimes

You may not have asked for it, but it wasn’t your decision to make, once you understood you cannot unhear it

So it has come to you, take action—develop, code, build, create, stack, spend, learn, teach

#bitcoin

Future #bitcoin business opportunities abound—#bitcoin disaggregates the payments and insurance function. Today, the credit card payment mechanism creates risk-shifting between the buyer and seller and the insurance intermediary. With #bitcoin those functions can be engaged (or not). For example, if a seller wants fraud (double spend before confirmation to the blockchain) protection, there will be a service provider for that. For merchants that do not need that protection they don’t pay for it.

#bitcoin for a bright future

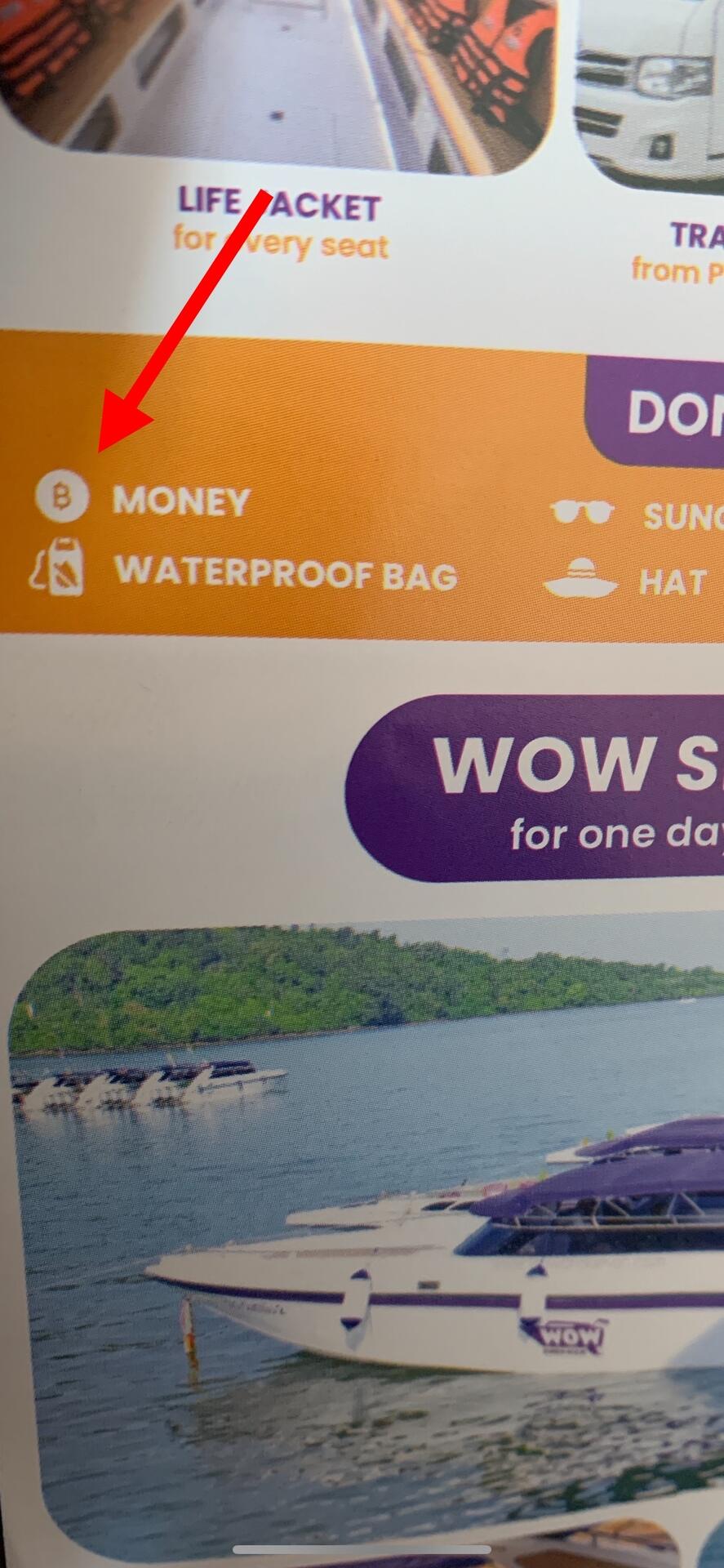

Every time I see this I take a double take—got to love Thailand where they are fully bitcoinized (in an alternate universe)

That is my line! Energy abundance and a plan for it is what drives America

Poor businesses fail and good businesses continue

Businesses that are #bitcoin Functional have a better chance for surviving but the prerequisite is business needs to be viable

Don’t expect #bitcoin to bail out a failing businesses model. #bitcoin will only buy you some time to right the ship

Had the strangest dream last night. Trump walked out on stage holding a #bitcoin sign, talked a little about it then tore the sign up. Market price cavitated but then trump went off on a rant how everyone lost the thread, how politicians follow not lead

New to #nostr and leaving #twiXter behind feels invigorating, particularly validating after X’s #bitcoin ₿ removal/betrayal

Fun math:

Top miners are about 17.5j/Th

¢5 per kW/hr is relatively inexpensive electricity

• #bitcoin has 600Ehash mining

• 600Eh @ 17.5j/Th = 10.5mm kj

• 10.5mm kj x ¢5 per kW/hr = $525,000/hr globally

• $525k/hr x 24hr x 356days =

$4,600,000,000/yr for #Bitcoin mining, globally

Cost/yr fiat currency production from treasuries:

• US = $1,900,000,000 per year

• EU = $1,700,000,000 per year

USD & EUR = $3.6 billion per year to run

• JP, etc ???

#bitcoin is not expensive

About inflation in the USD—you know it happens, but have you ever thought just how much you have gone through? I compiled this to show for your age how much USD inflation you have experienced. I am sure it is worse in other currencies. Stick with #bitcoin

Age Lifetime Inflation (CPI)

20 66%

25 89%

30 112%

35 153%

40 203%

45 335%

50 541%

55 758%

60 913%

Love seeing #bitcoin accepted at local food trucks

Made a spreadsheet that converts private keys to bech32 addresses for Bitcoin. Check it out here: https://modulo.network