It's almost like, people ignore the risk part of counterparty risk.

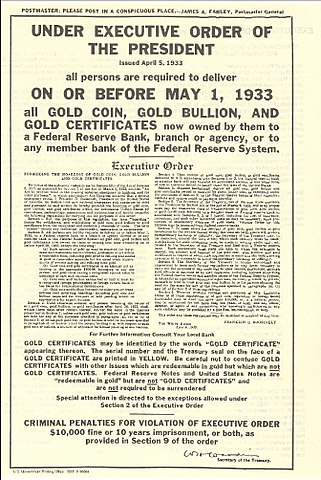

#Bitcoin having zero counterparty risk can't be overstated as a massive innovation.

Being your own bank transcends the individual. It's paramount businesses, that people rely on for their income, also understand the importance of this.

Businesses should be self banked too.

Thanks #[0]

I am reducing my exposure and risk by converting more USD into Satoshis.

One has multiple counterparty risks (banks, the Fed, US Treasury, IRS, courts, etc) and one has zero counterparty risk.

I'm a fan of cold cuts and cheese but, over beef? You absolute mad man.

Stable coins keep proving to be unstable.

#Bitcoin keeps proving, ironically, it is the stable coin.

Just a reminder: having more than $250k in a bank account is now a risk on asset.

But, #bitcoin is too risky, eh?

Good morning nostr. It's a nice day to relax and recover from all the bank running that happened this week.

I can confirm: bitcoin is immune to bank runs. Nostr is immune to tech companies failing from bank runs.

We live in a beautiful, decentralized world.

At the beach, listening to the waves, just completely relaxed knowing my sats are immune to fait banks collapsing.

Time is infinite as a resource. Your time is not.

Someone help me understand the logic of...

Banks failing = sell #Bitcoin

RIP anyone selling bitcoin during bank runs.

One day I'll tell my kids about how we'd zap people annual salaries worth of sats on nostr because we liked a people ostrich flying to the galaxy while moon walking that someone made.

The only POS I find acceptable is proof of steak that's medium rare.

Accelerates the debt spiral. Too many people's wealth is debase-able

I enjoy collecting Satoshis. They're rare collectables.

It's shaking the fiat out of my accounts to buy this dip.

Only Strike does and hourly buy, that I'm aware of.