16 years ago, an idea was born. A global constitution for an open, fair, transparent system for communicating and exchanging value. The paper is shorter than the U.S. Constitution, but is bound to be more important than that seminal document. Like the constitution, it’s bound to transform speech, expression, freedom, self-defense, right against searches and seizures, taxation, property, etc. It’s destined to alter governments and the fate of nations; the way people think and behave; the social production and consumption of information; and finally, and perhaps most important, the meaning of meaning and the notion of a good life.

“Fix the money, fix the world.”

Bitcoin = ISO for transmitting and storing value.

crowdsource the truth.

decentralize institutions.

remove intermediaries.

as much as possible.

he’s probably playing a different game. he knows the value of self-custody.

yes. it’s crucial for Bitcoin’s success to have a wide open space for experimenting with the technology (Saylor’s crude oil analogy is great), but the right to self-custody must remain foundational across jurisdictions—a global standard.

re-read.

those who live in competing paradigms see the other as irrational.

societies that understand the value of energy thrive and flourish. those that are able to connect energy with money are able to sustain themselves.

for value, nodes.

for ideas, relays.

Another day, another case for Bitcoin and nostr.

the ground is moving.

rights exist at the level of persons.

freedom exists at the level of protocols.

Fiat is a digitized monetary system: it’s a political system converted into digital form. Bitcoin is a digital native monetary system: it’s a non-political system that only exists in digital form.

these attacks on centralized platforms are highlighting the importance of nostr.

X is a public forum, a marketplace of ideas, w a single point of failure: Elon.

Nostr is a public forum for ideas and value w/out such disadvantage.

BANKING THE UNBANKED. This is “N”, an 8-year old boy, near the top of his class, and a disciplined saver in the only money he and his family know: fiat. Today, I taught him about Bitcoin: internet money that cannot be debased. I also taught him how fiat money works, why currencies lose value, and why prices are designed to rise over time. Both he and his uncle don’t have bank accounts. Through his uncle, he will be saving in Bitcoin over (hopefully) a long time through a project called Bitcoin Savings Program. I intend to train him to become a Bitcoin lecturer so he can teach fellow Filipinos about Bitcoin and how to use it. By the time he becomes a teenager, he will be training fellow students and Filipino professionals about sound money.

This is him writing down his private keys and, with 12 words in his head, is on his way to becoming a sovereign individual.

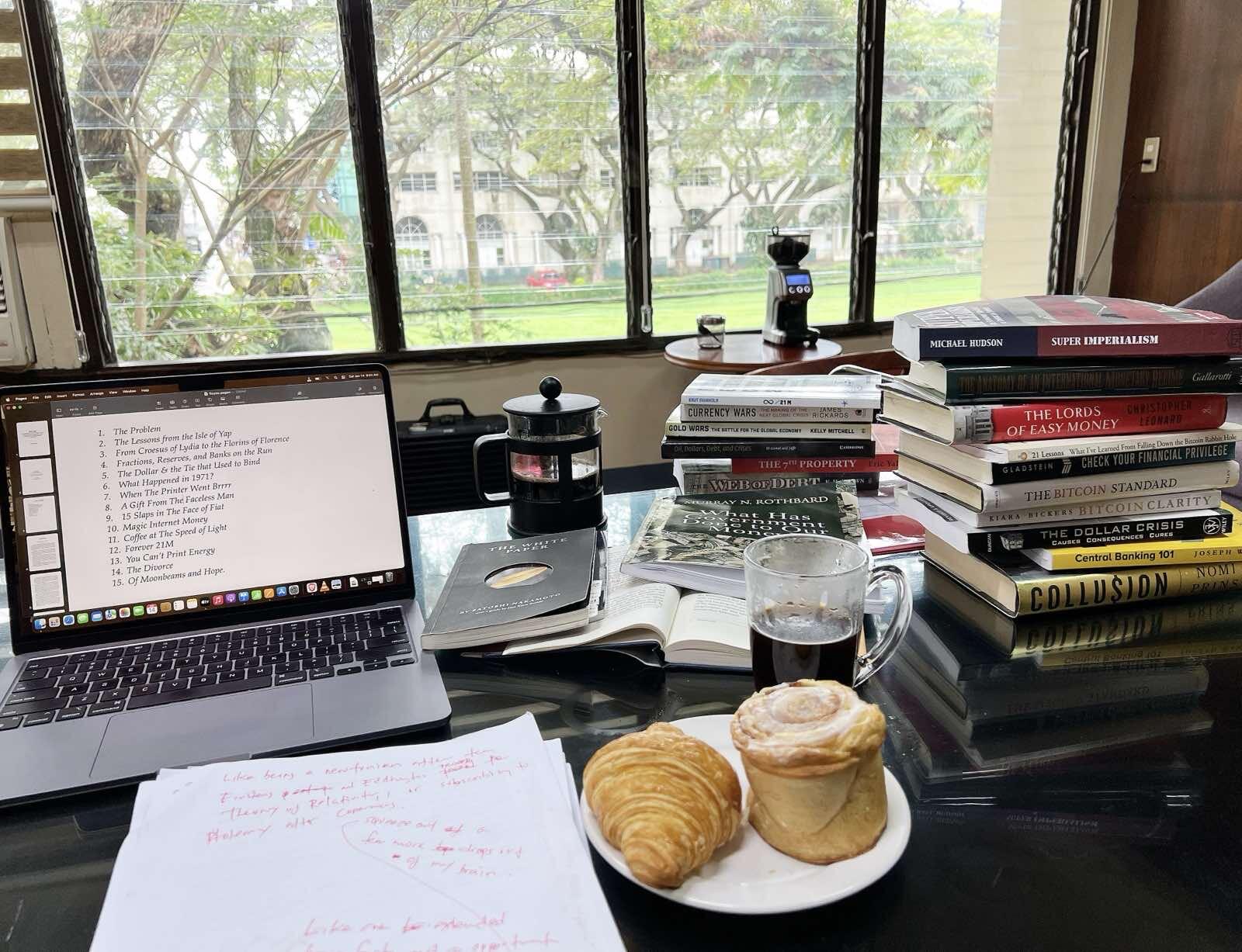

About a year ago, I accepted the position of dean of a law school to teach and build on Bitcoin. Dropped the formal attire for shirts, taught a course on Money and State, wrote a book, spoke to anyone who listened, attended conferences, and learned from fellow bitcoiners. The exchange rate of bitcoin then was around $16K. It’s been an interesting year.

The next few years will be even more interesting. These days, I see working on Bitcoin both as advocacy and professional work, and the larger goal is to make as many people as possible understand Bitcoin as a real store of value and medium of exchange that is immune to manipulation. Those willing to learn will see the world differently, find hope, and see optimism in these challenging times. They will find like minded people who share a vision of a future that is more fair, where people are more empowered and self-reliant.

Happy to ride this wave. Excited and thankful to be part of this peaceful global movement for fairness.

Onwards.

Low time preference is a function of experience, not mere knowledge. People w/out access to a good store of value will find it impossible to develop such discipline/mindset, especially when the money is a melting ice cube. Bitcoin fixed the money; now let’s help it fix the world.

Monetary systems today are considered “public” in the sense that they are owned/controlled by governments. #Bitcoin as a monetary system is also public but in a different, empowering sense: its stewards are the people themselves, the global Bitcoin community, its various publics.