Over time, inflation erodes the purchasing power of fiat currencies like the US dollar. With a 7% annual inflation rate, $1,000 today would only be worth about $510 in 10 years, meaning you’d need more money to buy the same goods. This is due to the increasing supply of money (M2) and the decline in value of fiat currency. As a result, the dollar buys less over time, losing its value steadily.

On the other hand, assets like Bitcoin and gold tend to preserve or even increase their purchasing power. Bitcoin, with its fixed supply and increasing demand, could see significant price growth, potentially reaching $5.77 million for 1 BTC in 10 years, assuming a 50% annual growth rate. Similarly, gold, which traditionally hedges against inflation, could rise by about 79% over the same period, reaching $3,580 per ounce. While both Bitcoin and gold outperform fiat currencies in the long run, Bitcoin offers the most dramatic potential for increasing purchasing power.

#btc #bitcoin #nostr #siamstr

Michael Saylor’s Bitcoin treasury strategy focuses on converting company treasuries into Bitcoin, viewing it as a long-term store of value and a hedge against inflation. His approach involves varying levels of Bitcoin allocation, from a highly aggressive “Triple Maxi” strategy, where Bitcoin is the sole reserve asset, to a more conservative “BTC Min” approach, where Bitcoin is part of a diversified portfolio. By prioritizing Bitcoin over fiat, Saylor aims to preserve purchasing power and ensure future growth through its potential appreciation.

Saylor also emphasizes using cash flows, dividends, buybacks, and debt strategically to maximize shareholder value. MicroStrategy, for example, has used debt to acquire more Bitcoin, betting on its value increasing over time. This bold approach positions Bitcoin as the primary asset, with the belief that it will significantly outperform traditional reserve assets in the future, ultimately reshaping corporate treasury management.

#nostr #btc #bitcoin #siamstr

The Relative Strength Index (RSI) is a technical indicator used to measure the speed and strength of price movements in assets like Bitcoin. It helps identify whether an asset is overbought or oversold, which could signal potential price reversals. RSI is calculated on a scale from 0 to 100, with values above 70 indicating overbought conditions (potential price pullback) and below 30 suggesting oversold conditions (potential price rise).

To calculate RSI, first, calculate the daily price changes by subtracting the previous day’s closing price from the current day’s. Separate the positive changes (gains) and negative changes (losses). Then, calculate the average gain and average loss over a 14-day period. The Relative Strength (RS) is the ratio of average gain to average loss, and the RSI is computed using the formula:

This formula gives the RSI value, helping traders identify market conditions. For example, an RSI of 70 suggests Bitcoin may be overbought, while an RSI of 30 indicates it may be oversold. Many trading platforms automatically calculate RSI, making it easier for traders to monitor price trends.

#Siamstr #btc #bitcoin #nostr

Michael Saylor recently presented a compelling vision of global wealth distribution and Bitcoin’s future potential. Currently, Bitcoin’s market capitalization stands at $2 trillion, compared to traditional asset classes like real estate ($330T), bonds ($300T), and equities ($115T). However, Bitcoin’s unique properties, such as scarcity and decentralization, position it as a superior store of value for the future. Saylor projects that by 2045, Bitcoin’s value could skyrocket from $2T to an estimated $200T+, driven by growing adoption and its role as “digital gold.”

Saylor also highlighted the risks facing traditional assets, which lose over $10 trillion annually due to factors like regulation, taxation, economic instability, and competition. Bitcoin, in contrast, offers a hedge against these risks and is poised to capture a larger share of global wealth in the coming decades. If his predictions hold true, Bitcoin could reach an estimated price of $10 million per Bitcoin by 2045, representing a monumental increase in value.

#Siamstr #btc #bitcoin #nostr

First they ignore you, then they fight you and then they join you ! 🥳

#Siamstr #btc #bitcoin #nostr

Mathematics Behind Bitcoin

Bitcoin’s security and functionality rely on cryptography, algorithms, and game theory:

1. Cryptographic Hash Functions (SHA-256):

• Creates unique, irreversible hashes for data security.

• Used in mining and verifying transactions.

2. Public-Key Cryptography (Elliptic Curve Cryptography):

• Private keys generate public keys and Bitcoin addresses.

• Ensures ownership and secures transactions without revealing private keys.

3. Proof of Work (PoW):

• Miners solve complex puzzles to validate transactions and add blocks.

• Prevents manipulation by making attacks computationally expensive.

4. Game Theory:

• Incentivizes honesty with rewards (block rewards/fees).

• Makes attacking the network cost-prohibitive.

5. Finite Supply & Halving:

• Bitcoin’s supply is capped at 21 million.

• Mining rewards halve every 4 years to control issuance and mimic scarcity.

6. Merkle Trees:

• Efficiently verify transactions using a hierarchical structure of hashes.

These principles ensure Bitcoin’s decentralization, security, and trustworthiness.

#Siamstr #btc #bitcoin #nostr

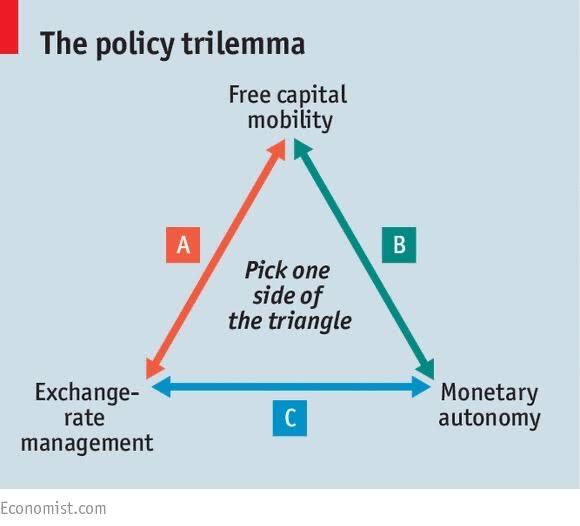

The Impossible Trinity (Trilemma) in economics states that a country cannot achieve all three of the following goals at the same time:

1. Free Capital Flow – Unrestricted movement of capital across borders.

2. Fixed Exchange Rate – A stable currency value relative to others.

3. Independent Monetary Policy – Control over interest rates and money supply.

A country can only achieve two of these three goals simultaneously. For example:

• If a country wants free capital flow and an independent monetary policy, its exchange rate must float.

• If it wants free capital flow and a fixed exchange rate, it must give up an independent monetary policy.

• If it wants independent monetary policy and a fixed exchange rate, it must impose capital controls.

This highlights the trade-offs in managing economic policies in a globalized economy.

#Siamstr #btc #bitcoin #nostr

•Bitcoin supports both free capital flow and independent monetary policy:

1. Free Capital Flow: Bitcoin operates on a decentralized network, enabling global transactions without intermediaries like banks, allowing unrestricted movement of capital across borders.

2. Independent Monetary Policy: Bitcoin’s supply is fixed at 21 million BTC, with no central authority controlling its monetary policy, unlike traditional currencies subject to inflationary policies and interest rate changes.

This makes Bitcoin unique, as it allows both free capital flow and independent monetary policy to coexist, which traditional fiat currencies cannot achieve due to the Impossible Trinity.

•The strengths of Bitcoin lie in its ability to provide global accessibility (enabling cross-border transactions without intermediaries), inflation resistance (with a fixed supply that is immune to central bank policies), decentralization and security (protecting against manipulation and ensuring transparency), and economic sovereignty (allowing users to control their own wealth without reliance on central authorities). These features make Bitcoin a powerful alternative to traditional financial systems, offering greater freedom and stability.

#Siamstr #bitcoin #btc #nostr

With Bitcoin’s current supply of 19.79 million BTC and a $96,000 price(estimation) ($1.899 trillion market cap), its potential to capture value from gold’s $18.048 trillion market cap results in the following scenarios: (if)

• 10% Capture: Bitcoin price rises to $187,150.

• 50% Capture: Bitcoin price rises to $551,600.

• 100% Capture: Bitcoin price rises to $1,007,810.

Key Drivers

• Bitcoin is portable, divisible, and easier to store than gold, appealing to modern investors.

• Growing recognition as “digital gold” positions Bitcoin as an alternative store of value.

Challenges

• Gold’s long history as a store of value and its industrial uses could limit Bitcoin’s market share.

• Bitcoin’s volatility and regulatory risks remain concerns for some investors.

Bitcoin has significant upside potential but would require broader adoption and trust to fully rival or replace gold.

#Siamstr #nostr #btc #Bitcoin

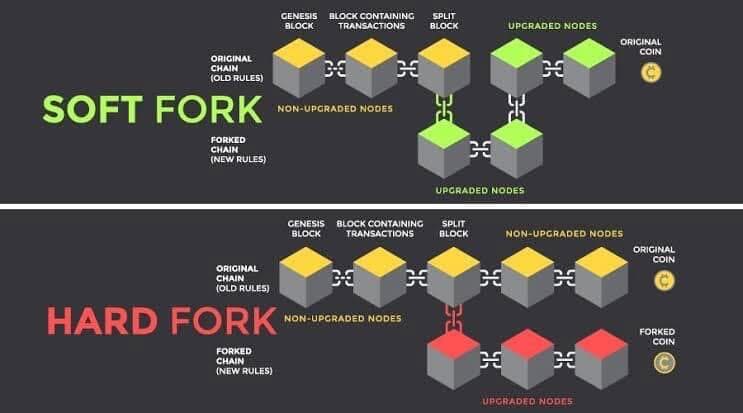

If large holders, like ETFs and companies, store 9.53% of Bitcoin’s supply under centralized custody and face theft or loss, they might push for a hard fork to reverse transactions. However, this would conflict with Bitcoin’s principles of decentralization and immutability.

A hard fork is unlikely to succeed due to challenges in achieving consensus, risks of splitting the network, and the precedent it would set for future manipulation. Instead, improving custodial practices, such as using multi-signature wallets, cold storage, and decentralizing holdings, is crucial to prevent such risks and preserve Bitcoin’s trust and decentralized nature.

But If a hard fork to reverse Bitcoin transactions were to happen, it would require a proposal from influential stakeholders, consensus among developers, miners, and the community, and the implementation of a new version of Bitcoin’s software. This would result in a network split, with two competing chains. However, achieving consensus is highly challenging due to Bitcoin’s decentralized nature, and the market may reject the fork, undermining trust in Bitcoin’s immutability. Such a scenario is unlikely due to the strong resistance against changes that compromise Bitcoin’s core principles.

#Siamstr #nostr #btc #Bitcoin

Bitcoin’s decentralized equilibrium relies on three key parameters:

1. Block Time (10 Minutes): Maintains a predictable and fair mining process by adjusting difficulty, ensuring widespread participation and preventing miner centralization.

2. Block Size (~1-4 MB): Limits resource requirements for running full nodes, enabling decentralized validation by a diverse set of participants.

3. Transaction Velocity: Balanced by fee markets and scalability solutions (e.g., Lightning Network) to avoid congestion while maintaining accessibility.

Together with Proof-of-Work, these mechanisms distribute control, ensure fairness, and preserve Bitcoin’s decentralization by balancing usability, security, and inclusivity.

#Siamstr #btc #bitcoin #nostr

Bitcoin stands out from “shitcoins” primarily due to its strong network effect and proof of work (PoW) mechanism:

1. Network Effect: Bitcoin has the largest, most adopted user base, providing liquidity, trust, and security. “Shitcoins” typically lack widespread adoption and real-world utility.

2. Proof of Work (PoW): Bitcoin uses PoW, a secure and energy-intensive mechanism that ensures decentralization and makes it resistant to attacks. Many altcoins use alternative mechanisms like Proof of Stake (PoS), which can be less secure and more centralized.

3. Security and Decentralization: Bitcoin is highly decentralized, making it resistant to manipulation. “Shitcoins” may have fewer nodes and central control, making them more vulnerable.

4. Store of Value vs. Speculation: Bitcoin is seen as a reliable store of value (“digital gold”), while many “shitcoins” are speculative and highly volatile without inherent value.

In summary, Bitcoin’s network effect, security, and decentralization make it distinct from many altcoins, which often lack these qualities.