https://youtu.be/NgYV0p7Mf6s?si=wU8deIJl4PQ02pxh

#siamstr #nostr #btc #bitcoin

Damn 🤣

#siamstr #btc #bitcoin #nostr #meme

The modern banking system, originating in 1644, shifted financial risks to the public while reserving profits for private shareholders. The first central bank, the Bank of Amsterdam, was followed by the Swedish Riksbank in 1668. By 1694, England established the Bank of England under King William III to finance its navy and the East India Company. The system relied on government-issued bonds backed by tax revenue, which the Bank of England used as collateral to print money. This money supplied private banks, enabling them to lend further and fueling economic growth.

This system created a credit supply chain where governments produced money, central banks distributed it, and private banks profited. The financial framework, designed by bankers, ensured their interests were prioritized, leading to a public loss-private gain dynamic: taxpayers shouldered the risks, while private institutions reaped rewards. This innovation transformed England into a global power within a century but entrenched inequalities in financial systems worldwide.

#nostr #btc #bitcoin #siamstr #bank #history

Elon Musk’s preference for fiction, especially science fiction, stems from its ability to inspire innovation and expand his imagination. Books like The Foundation and The Hitchhiker’s Guide to the Galaxy provide Musk with bold visions of the future, exploring themes like space exploration, advanced technology, and societal evolution. These genres allow him to think beyond current limitations and imagine new possibilities, often influencing his work with SpaceX, Tesla, and other ventures. Fiction serves as a creative outlet that helps Musk tackle real-world challenges by offering complex scenarios and problem-solving frameworks.

Additionally, science fiction aligns with Musk’s personal interests in space, technology, and existential questions. Novels like The Foundation and The Hitchhiker’s Guide delve into the long-term consequences of technological advancement and humanity’s place in the universe, which resonates with Musk’s goals of space colonization and pushing the boundaries of human progress. By reading these works, Musk not only entertains himself but also finds philosophical insights and inspiration for tackling the most ambitious challenges of the future.

#elonmusk #tesla #btc #bitcoin #nostr #siamstr

Global tensions are shaped by economic competition, technological disruption, and shifting alliances. The U.S.-China rivalry over trade, technology, and influence will likely intensify, while regional conflicts like Ukraine and Taiwan could destabilize markets. Resource control, such as energy and rare earth metals, is becoming a focal point, driving protectionist policies. Meanwhile, the rise of de-dollarization and digital currencies challenges traditional financial systems. Conspiracy theories about the Rothschild family’s manipulation often oversimplify these complexities, as modern economic conflicts are primarily driven by governments, corporations, and institutions, not individual families.

Emerging markets like India and Southeast Asia are gaining prominence as older powers face internal divisions and slower growth. Economic fragmentation, debt crises in developing nations, and the push for self-reliance could lead to regional trade blocs and further polarization. While unfounded claims about Rothschild influence persist, the real drivers of change are systemic—shaped by power struggles between nations, technological innovation, and global financial shifts. How these challenges are managed will determine whether cooperation or conflict defines the future.

#siamstr #btc #bitcoin #nostr

Let’s go 🔥

Merry X mas 🎅

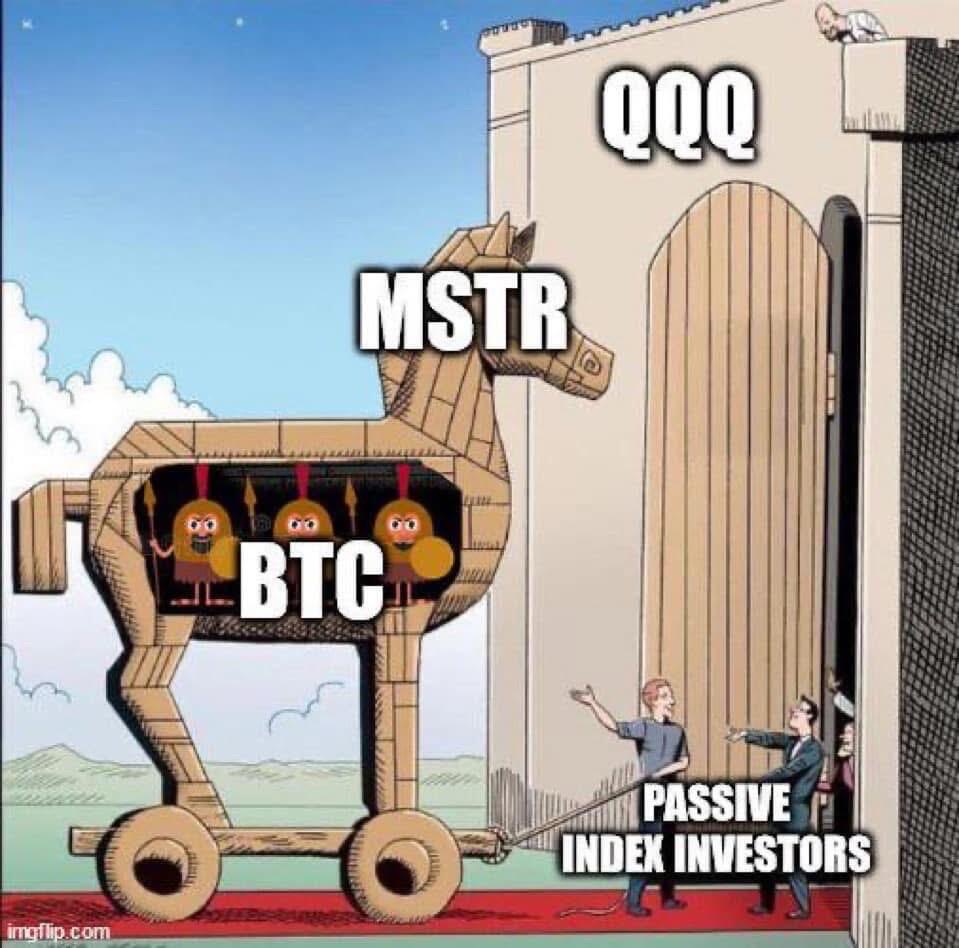

If MicroStrategy is included in the Nasdaq-100, it would bring indirect Bitcoin exposure to a broader range of investors through index funds and ETFs tracking the index, such as the Invesco QQQ ETF.

This inclusion could legitimize Bitcoin’s role in mainstream finance, as passive investors and institutions would gain exposure to Bitcoin via MicroStrategy’s balance sheet. It may also inspire other companies to adopt similar strategies, potentially increasing demand for Bitcoin and driving its price.

However, Bitcoin’s inherent volatility could introduce new risks to the Nasdaq-100, potentially impacting funds and investors who did not intend to invest in cryptocurrency.

Additionally, MicroStrategy’s funding approach, particularly its use of convertible bonds to purchase Bitcoin, could draw more attention, encouraging further corporate adoption of Bitcoin as a treasury asset.

At the same time, inclusion in the Nasdaq-100 would boost MicroStrategy’s stock liquidity and trading volume but also expose the company to greater scrutiny from regulators and investors.

Overall, this move could deepen Bitcoin’s integration into traditional markets while sparking debates over the risks and benefits of cryptocurrency exposure for institutional and passive investors.

#nostr #bitcoin #btc #siamstr #microstrategy #michaelsaylor #nasdaq

• Education and Policy Integration

• Thaksin emphasizes that Thai people must educate themselves about Bitcoin and integrate its adoption into national policies to stay competitive globally.

• Pilot Bitcoin Adoption

• He suggests starting with a study and implementation of Bitcoin in specific sectors, like tourism, to test its feasibility in real-world payments.

• Issuing a Thai Stablecoin

• Thaksin proposes creating a stablecoin backed by government bonds, which could stabilize and enhance the Thai economy significantly.

He concludes that these steps, if executed well, could lead to massive economic benefits, increased liquidity, and a smoother transition to a tech-driven economy.

#siamstr #bitcoin #btc #nostr

https://www.youtube.com/live/ztjhdE18iuA?si=SPkF6mOwyWW7ounT

#siamstr #btc #bitcoin #nostr

#siamstr #btc #bitcoin #nostr

Thaksin Shinawatra highlighted Bitcoin’s potential to reach $850k due to its limited supply, even more than gold. He mentioned that many countries are considering Bitcoin as a reserve asset. Additionally, he noted that Thailand’s Prime Minister Ung Ing has asked the Finance Ministry to explore using Bitcoin for payments in tourist areas and to issue Stablecoins backed by government bonds to boost money circulation.

#btc #bitcoin #siamstr #nostr

Accept that uncertainty is part of life and that wealth is built through small wins that drive overall success, not by avoiding every failure.

Focus on your portfolio as a whole rather than individual investments, and use money to gain control of your time—the ultimate financial reward. Save not only for specific goals but also for unexpected events, as life is full of surprises, and unscheduled savings act as a crucial safety net.

Recognize that success has costs, such as uncertainty and regret, but these are often worth enduring. Build a margin of safety to protect yourself from setbacks, stay in the game long enough to benefit from compounding, and avoid extreme decisions that may lead to future regret. Flexibility and balance are key to navigating life’s inevitable changes.

———The Psychology of Money pg.232-234

#money #btc #bitcoin #siamstr #nostr

Stay humble when things go well and empathetic when they don’t, recognizing the roles of luck and risk while focusing on what you can control.

Wealth is the gap between ego and income, built by saving today for greater options in the future. Manage your finances in a way that lets you sleep peacefully, prioritizing peace of mind over maximum returns.

The most powerful tool in investing is time, which magnifies growth and diminishes mistakes the longer your horizon.

———The Psychology of Money pg.231-232

#bitcoin #btc #siamstr #nostr #money

#btc #bitcoin #siamstr #nostr

#georgeharrison

What is Bitcoin Dominance?

Bitcoin dominance refers to the percentage of the total cryptocurrency market cap that is held by Bitcoin. It’s a measure of Bitcoin’s market share compared to all other cryptocurrencies combined. The formula to calculate it is:

For example, if Bitcoin’s market cap is $600 billion and the total market cap is $1 trillion, the dominance would be 60%. This means Bitcoin represents 60% of the total crypto market.

Why is Bitcoin Dominance Important?

1. Market Sentiment: High dominance indicates Bitcoin’s dominance, while low dominance suggests increased interest in altcoins.

2. Market Trends: A drop in Bitcoin dominance often signals an “altcoin season,” where alternative cryptocurrencies outperform Bitcoin.

3. Investor Behavior: During uncertain times, Bitcoin’s dominance tends to rise as investors seek stability, while altcoins may rise in bull markets.

Tracking Bitcoin Dominance

Bitcoin dominance can be easily tracked on platforms like CoinMarketCap or CoinGecko. Understanding it helps investors gauge market trends and make informed decisions in the ever-evolving world of crypto.

#BitcoinDominance #CryptoMarket #Bitcoin #Altcoins #Cryptocurrency #btc #siamstr

https://www.facebook.com/share/v/YKWomqpHY25GfTdx/?mibextid=WC7FNe

#siamstr #bitcast #rightshift #btc #bitcoin #nostr