nostr:note1ts3vwufwkrxjhnwxgjacynus4pfyumjyrlwpz2v4xqy05rx35resxdcnqq

nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z and nostr:npub1w69ya7xs697hk3hky3gllryz8rwverfa0ylz89chf9qnhfcskc2s64zltw explain why the halving is not priced in … logic which still holds true even with the recent ETF inflows:

From a thermodynamic point of view, I agree. However, from a capital allocation angle, hydrocarbons are much better because they are more abundant, safer, and can be monetized at smaller scale with smaller supply chains.

No. Hydrogen is thermodynamically the equivalent of burning water. Hydrogen is the ultimate energy shitcoin.

This is a shocking chart that makes a lot of sense when you stop to think about it. nostr:note1298e0xz2esqalkkqlmtrjv8aqhy3k0dhu2e7fp58asuyt8v0djrs94xjnd

“Buying US Treasuries!”

Atlas Shrugged but with planes instead of trains:

Good plan. I enjoy Damus, what you’re building, and how you’re building it … keep it up!

Wildly effective marketing right here. nostr:note1mm4gx2657mc9qskkxurq9p7aj5p9u40ydzphm3urqj3467m0g9hst2g0mj

We need a matured lending product using bitcoin AND other assets as collateral.

Current products are short-term and “high” interest rate…meaning they introduce too much liquidation risk given bitcoin’s volaitlity.

We need wholecoiners going out into the world and buying companies / assets and running their business through a bitcoin frame.

With the current financing mechanisms, this is too risky (even though on a 5-year time frame it isn’t).

Equity is a residual claims on cashflows.

And debt is getting more expensive…

Printing Press: Freedom of Speech

Internal Combustion Engine: Freedom of Transportation

Bitcoin: Freedom to Transact

An integrated oil and gas company

They also use Fidelity.

Any financial advisor who suggests holding positions for 4+ years and does not advise bitcoin has failed as a fiduciary.

Bitcoin’s four-year Sharpe Ratio has outperformed every asset class for Bitcoin’s entire existence as an asset. nostr:note1n5mk6pg2tx268j0lnqdnk92ctlpy5ydq9q4ctd4xqqy8sfkwauusyqt6cs

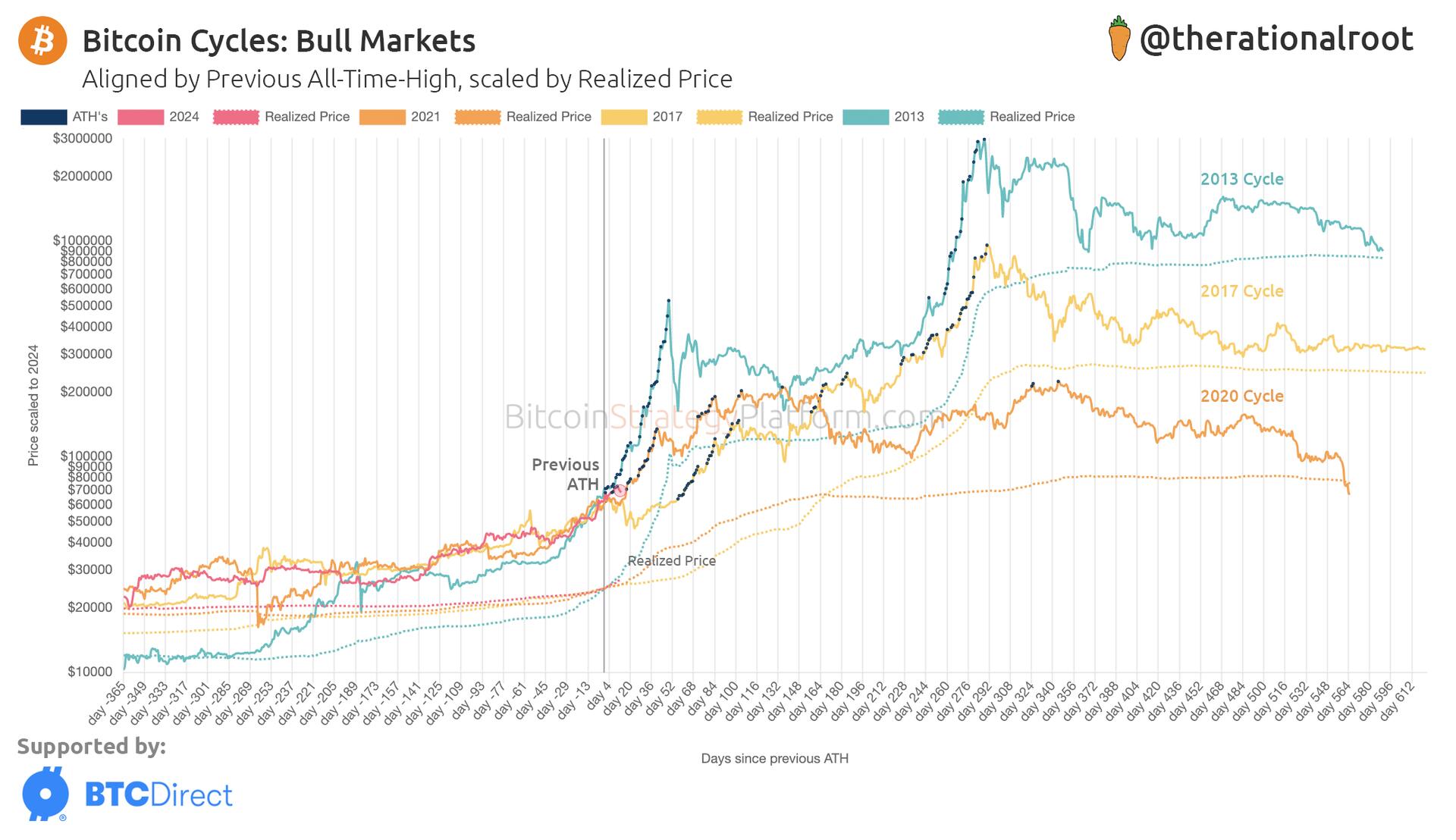

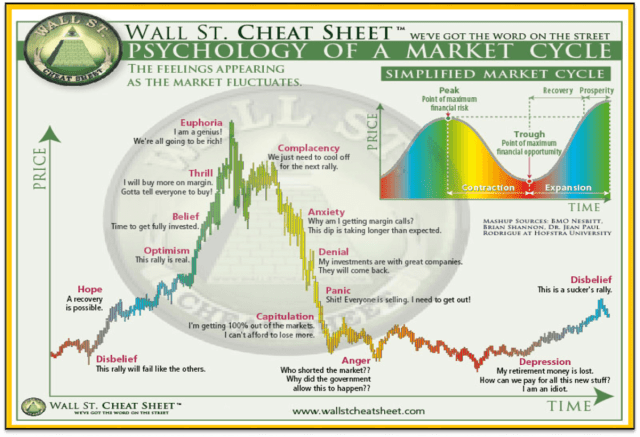

Far right side of the market cycle chart … things don’t get started until the halving.

The whole financial market assessing bitcoin in March ‘24?

Disbelief.