Tick tock, next block. nostr:note18q9w0kmdqp35fra2fs2fkzag2hlk8kdd5c63hf2cgvvdq6s4263sun4u2q

When does max pain hit those who have ridiculed and ignored bitcoin?

Been looking forward to this. Need it this week. 🙌🏼 nostr:note1rmyhhvjfj2j0dpmur3tfg7vkpyncl2gwhz6eduhuet40luylauvseuf7z9

In that last segment with Peter Todd and Adam Back did they dub Adam Back? Looks like his lips aren’t moving but maybe his voice?

Not gonna watch so mostly just interested in the exchange that’s getting so much play today.

$58k

So $100M+ purchasing power?

Do we have proof MSTR has the coins on their disclosures custodied?

The interview with Saife made no sense…lacked intellectual consistency and was irrational & emotional.

Something has to give. Feels like something has to give. And soon. Either we’re heading lower or we’re gonna pop.

This sideways crab is no longer “natural market dynamics.”

“…bUt He WeNt On WiTh TuCkEr!” nostr:note19p2tkla8aelh9y5dxg4x90cgys67utkk2yp9jqm7jhc2xxe0nk4qnnvmn9

I listened to this. Leaves more questions then answers given.

“Show me the incentive and I’ll show you the outcome.”

The political world understands it needs to get their arms around this industry before the next hyperbolic move upward excites the public and makes it harder for them to act.

The powerful of the fiat world now understand (enough) and are working diligently to “regulate” the bitcoin market and/or integrate bitcoin into the legacy financial systems.

Can their actions suppress the price for months? Can they blunt the halving impacts indefinitely? If they can’t suppress price indefinitely, what disruptions will be caused by the eventual price rip?

I just don’t believe that the retail / OG sell-side pressure is enough to offset MicroStrategy, ETF, halving-reduction impact.

Bitcoin absorbed 50k Bitcoin incremental sell side pressure from Germany over two weeks. There is no way this is a steady state supply / demand balance in the spot markets.

No one will be able to convince me otherwise without specific, data driven insights.

Have a listen to some of nostr:npub1qh5sal68c8swet6ut0w5evjmj6vnw29x3k967h7atn45unzjyeyq6ceh9r recent interviews

I think it is an important question as to WHO are the long term hodlers who are selling.

Perhaps some of the buyers in 2013(ish) who are now selling were not interested in price appreciation. Perhaps they were accumulating a reserve to try to manage future volatility.

Say whatever you want, I absolutely don’t believe that long-term, authentic bitcoin hodlers are selling here because it goes against the obvious halving market cycle timing. I believe anyone selling in bulk here is trying to suppress price.

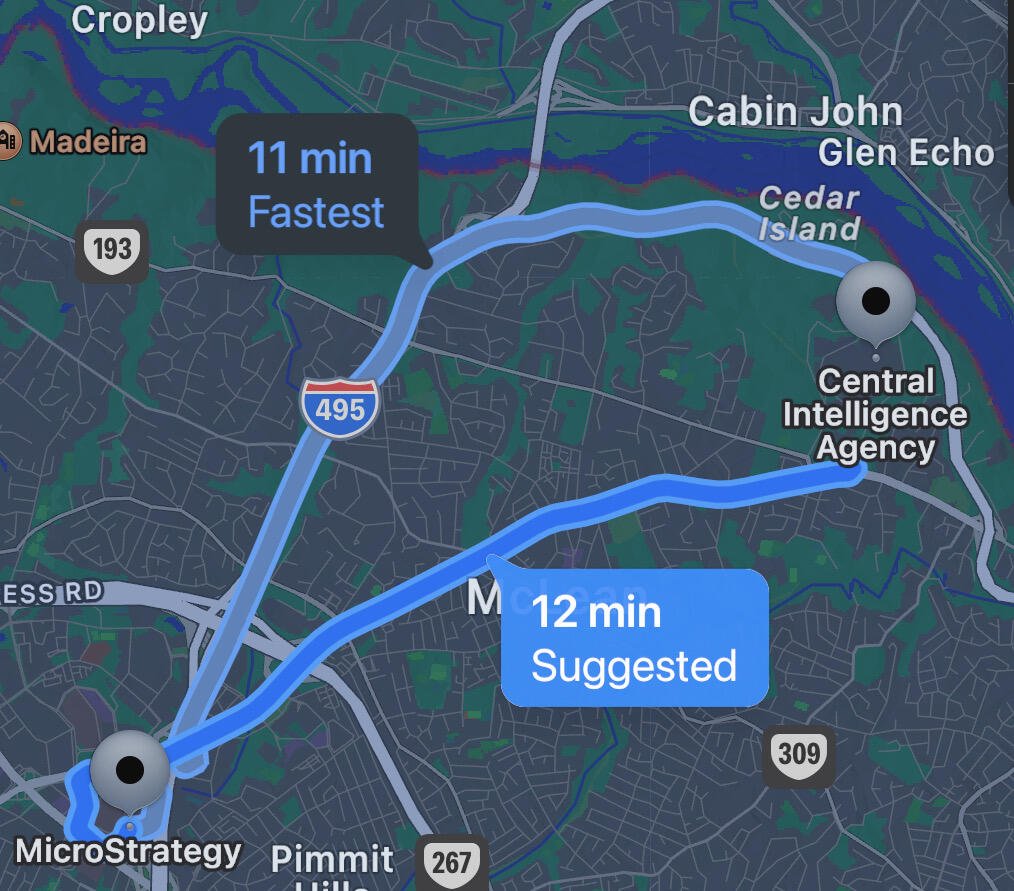

MicroStrategy claims to be buying 30% of bitcoins produced at today’s conversion rate. ETFs are buying multiple days’ production regularly. Plebs continue to stack.

Where is the supply shock? Something isn’t adding up.

GM!

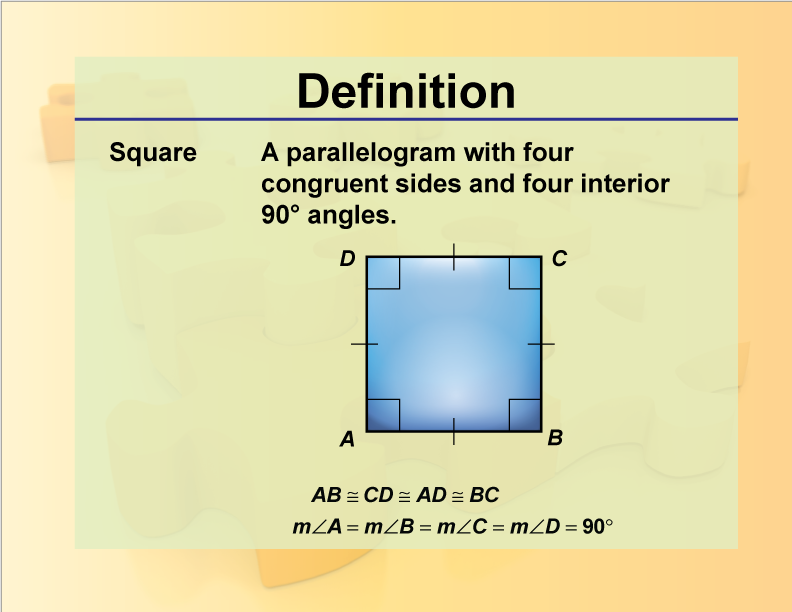

The mathematical definition should be used over google’s definition.

Truth. nostr:note1mnmtjxr2f9qmw6ansky0qe4kvmf7ge4g9zrq0e4d9tdm4fzgr2nq0qfmej