$MSTR melting faces while #Bitcoin pumps to start off the week 🚀

Do you take privacy into account when consolidating UTXOs?

21 million #bitcoin

60 million millionaires

Believing in #bitcoin makes me happy!

There are many draconial provisions in the upcoming #EU #AML Regulation both for cash and to p2p #bitcoin transactions (self-hosted wallets and use of mixers).

Some examples:

(33b) The introduction of a Union-wide limit to large cash payment mitigates the risks associated with the use of large cash payments. However, obliged entities that carry out transactions in cash below this amount remain vulnerable to risks of money laundering and terrorist financing as they provide a point of entry into the Union’s financial system. Therefore, it is necessary to require the application of customer due diligence measures to mitigate the risks of misuse of cash. To ensure that the measures are proportionate with the risks posed by transactions of a value lower than EUR 10 000, such measures should be limited to the identification and verification of the customer and the beneficial owner when carrying out occasional transactions in cash of at least EUR 3 000. This provision does not relieve the obliged entity from conducting all customer due diligence measures whenever there is a suspicion of money laundering or terrorist financing, or from reporting suspicious transactions to the FIU.

(93) The anonymity of crypto-assets exposes them to risks of misuse for criminal purposes. Anonymous crypto-asset ▌accounts as well as other anonymising instruments, do not allow the traceability of crypto-asset transfers, whilst also making it difficult to identify linked transactions that may raise suspicion or to apply to adequate level of customer due diligence. In order to ensure effective application of AML/CFT requirements to crypto-assets, it is necessary to prohibit the provision and the custody of anonymous crypto-asset ▌accounts or accounts allowing for the anonymisation or the increased obfuscation of transactions by crypto-asset service providers, including through anonymity-enhancing coins. The prohibition does not apply to providers of hardware and software or providers of self-hosted wallets insofar as they do not possess access to or control over those crypto-assets wallets.

As we were said by the EU Commission, “the ban on crypto-asset payments not intermediated by a crypto-asset service provider has not been retained given the absence of technical means of enforcing such a requirement at present”. But that exactly shows the direction of the regulatory approach.

This is a huge deterioration of financial and privacy rights after EU Commission and Council put pressure on the EU Parliament and removed all provisions in favor for individual rights, privacy and financial inclusion.

We need your support guys, before it is too late. Final vote on April 22nd.

Full text you can find here:

https://data.consilium.europa.eu/doc/document/ST-6220-2024-REV-1/en/pdf

Not to mention, the €3,000 figure will not be adjusted for inflation overtime.

How much will €3,000 be in 10 years? 20 years? Purchases of that size will eventually become more common, and governments will be able to automatically increase their scope of surveillance without having to introduce new laws.

#bitcoin

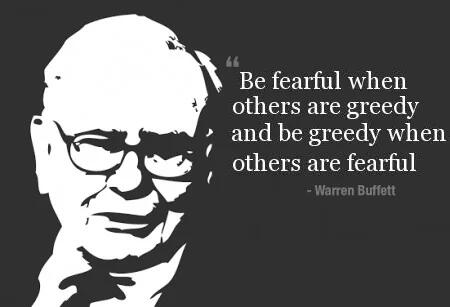

Buffet hates #bitcoin but these words could not be more prescient.

As a pleb, when you see red candles and everyone is freaking out… it’s time to double down.

If you panic sell, you may never get those sats back.

♾️/21M

Free Palestine!

The multi-decade #bitcoin TWAP by institutions is not priced in by normies

Bears are fucked

Do financial advisors have a fiduciary responsibility to offer #bitcoin to their clients?

“In some cases, advisers are still not allowed to provide recommendations for these ETFs unless specifically asked about them, so they don't have a fiduciary duty to offer them. However, they may soon lose business to their competition if they aren't allowed to inform their clients about all of the options they have.”

https://www.investopedia.com/tech/do-advisors-have-fiduciary-responsibility-offer-bitcoin/

The Cantillon Effect:

Those closer to the source of money creation benefit significantly more than those to whom it trickles down.

This is why we #bitcoin

Awesome! ⚡️

Kraken has become my preferred exchange because of the relatively low fees and nice UX.

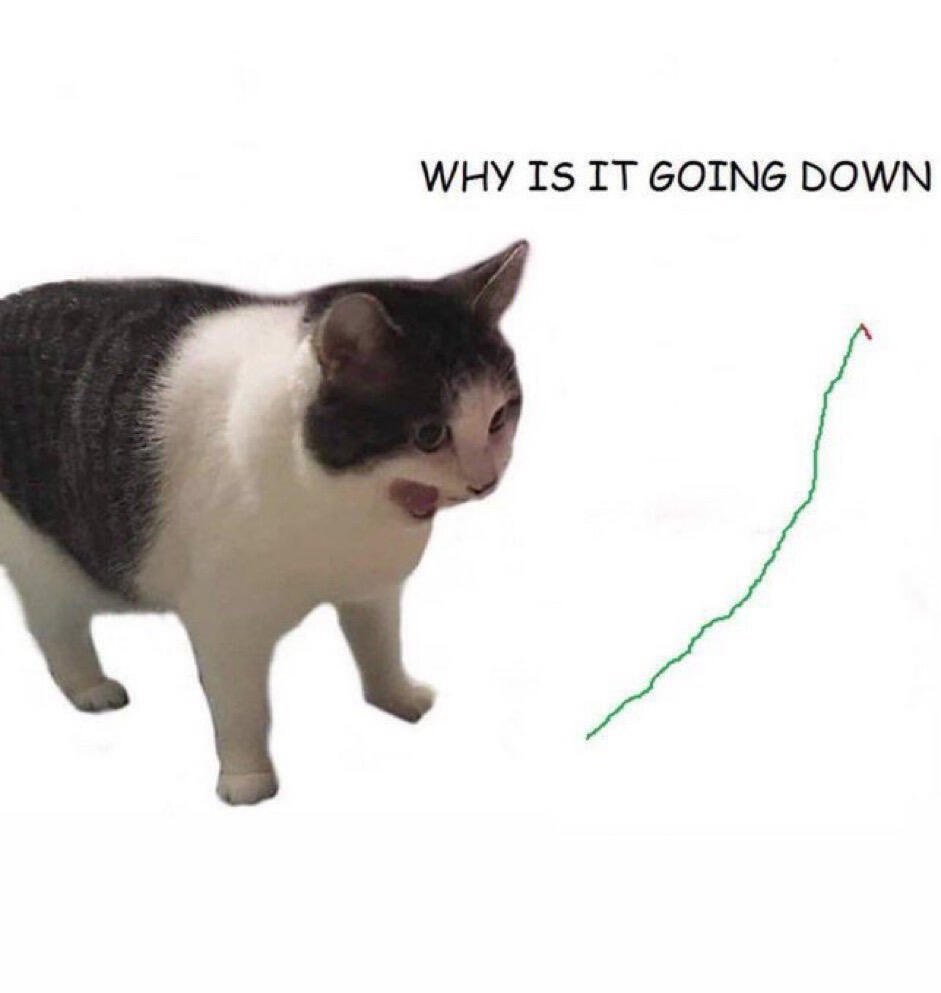

Never fails

#bitcoin

This is when you SMASH BUY the dip!

🤜🏼 ⚡️ 🤛🏼

#bitcoin

No. Open source is fundamental to decentralization, which is fundamental to what Bitcoin is.

Some argue that #bitcoin can’t be considered money because it’s too volatile, but most haven’t taken the time to understand what money actually is.

Money has 3 key functions:

1. Medium of exchange

2. Unit of account

3. Store of value

Volatility matters for 1 & 2 but not so much for 3.

Medium of exchange (MoE) - money acts as a universally accepted intermediary for transactions.

Unit of account (UoA) - money provides a common unit to measure the relative value of different goods.

Store of value (SoV) - money saves the purchasing power of earnings for future use.

Not all money that we use today is good at all 3. The dollar, for example, is a great unit of account and medium of exchange, but it’s a terrible store of value. Due to systematic inflation, people have to invest (gamble) their earnings to preserve their purchasing power, or watch as the value erodes away. One reason #bitcoin is a big deal is because, while it’s not currently a MoE or UoA, it’s an excellent store of value. It allows people to become savers, not gamblers.

Most monies go through stages of development, and if adopted organically, they are always accepted as a store of value before they can function as a medium of exchange. One of the biggest differences between a SoV and a MoE is their functions in the context of time, and it’s why volatility matters for one but not the other.

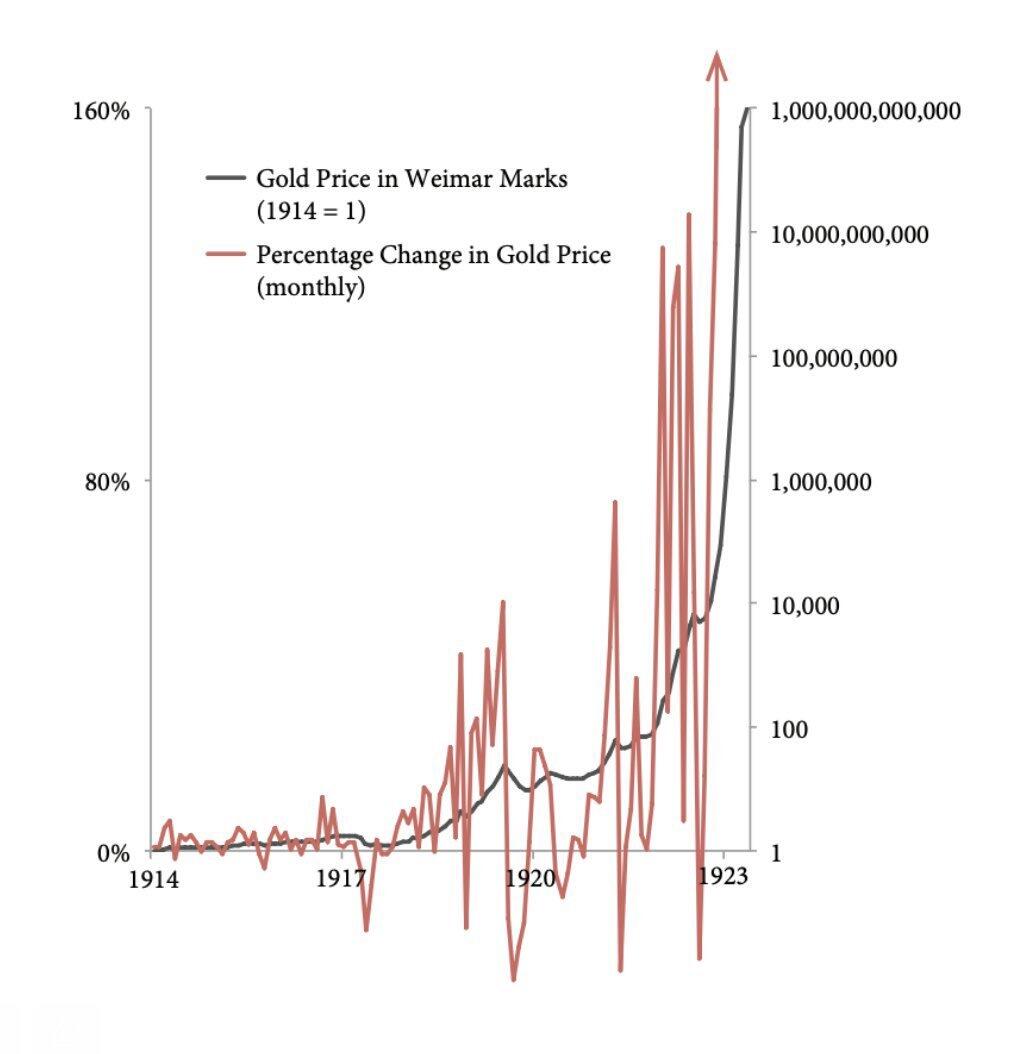

As a MoE it’s important that the value of money stays relatively stable day to day so you can predict future prices. As a SoV, money functions over a longer time period, so the daily price fluctuation is less important than the overall long term trend. As shown in the attached chart, the exchange rate of hard assets like gold can fluctuate violently day-to-day when denominated in failing fiat currencies, but they tend to trend up over the long term. This is what #bitcoin does with fiat currencies AND all other assets.

As #bitcoin gains global adoption, you should expect that its price will be volatile. It’s no easy feat to repair/replace the massively broken financial system that is currently used, and there’s naturally a lot of friction involved when adopting a new form of money. But if you zoom out, you can see clearly that #bitcoin is winning, thanks to its disinflationary supply and an increasing demand for assets that can’t be debased. As the dollar continues to inflate, the demand will only grow stronger.

Ultimately, it’s my opinion that everyone should own a non-zero amount of #bitcoin in their overall portfolio. It’s more risky to NOT own some, and if volatility is a major concern for you, there are two main solutions:

1. Increase your time horizon

or

2. Decrease your allocation

I spend every waking hour of my day thinking about bitcoin

Imagine thinking #bitcoin can’t get to $1M after it went from $1 to $73k… you’re right, it’s just gonna stop going up here and never go higher again 🤣

Happy Saturday!

What was it that made #Bitcoin *click* for you?