Announcing $1.3m pre-seed investment from nostr:npub1sg6plzptd64u62a878hep2kev88swjh3tw00gjsfl8f237lmu63q0uf63m and

Asymmetric VC in SimpleX Chat 🚀

Also SimpleX Chat v6.0 stable is now released with the new user experience and private message routing – details in the post.

wen zaps?

This is ChatGPTs version:

BREAKING: 🇺🇸 US inflation falls to 2.9%, lower than expectations.

2021 BTC at 60K , ETH 5000, Sol 250

2024 BTC at 60K, ETH 2000, Sol 100

After the market closed today, Goldman Sachs filed a 13F disclosing the following positions as of June 30:

$238.6 million iShares Bitcoin Trust (6,991,248 shares)

$79.5 million Fidelity Bitcoin ETF (1,516,302 shares)

$35.1 million Grayscale BTC (660,183 shares)

$56.1 million Invesco Galaxy Bitcoin (940,443 shares)

$8.3 million Bitwise Bitcoin ETF (253,961 shares)

$749,469 WisdomTree Bitcoin (11,773 shares)

$299,900 ARK 21Shares Bitcoin ETF (5,000 shares)

These are all new positions as of this quarter.

OP: @MacroScope17

Small outflows for the Bitcoin ETFs last week.

We're far from the strong period of inflows that pushed Bitcoin's price to a new all-time high at the start of the year.

OP: @ecoinometrics

All 3,070 Four Year HODL periods of #Bitcoin have been positive

The worst four year HODL period was:

December 16th, 2017 to December 15th, 2021

a 155% return, representing a 22.2% CAGR

99.7 percentile CAGR of 26.4%

#Bitcoin belongs on all corporate balance sheets

OP: PunterJeff

#Bitcoin miners moving to a #Bitcoin standard. GM

US Producer Inflation Data:

Core PPI

Actual: 2.4%

Estimated: 2.7%

Previous: 3.0%

Not every August/September is red for #BTC, but statistically, they are the 2 worst months on average. OP: @introcryptoverse

Go touch some sand #tennistr

Bitcoin has dipped below its historical post-halving growth trajectory range.

If it returns to this range before year-end, we're looking at a high likelihood of a six-figure value for one BTC.

OP: @ecoinometrics

It's 28 degrees right now. Perfect conditions for sitting in front of a computer screen all day and making money for a giant corporation if you ask me.

Wen possibility to schedule posts on nostr:npub12vkcxr0luzwp8e673v29eqjhrr7p9vqq8asav85swaepclllj09sylpugg? #asknostr

Looking at the #BTC market cycles as measured from the low, you can see we are at the same spot we are normally at in this phase of the cycle:

Graph by: @intocryptoverse (not on #nostr)

How 💩coins are promoted vs. how they actually work:

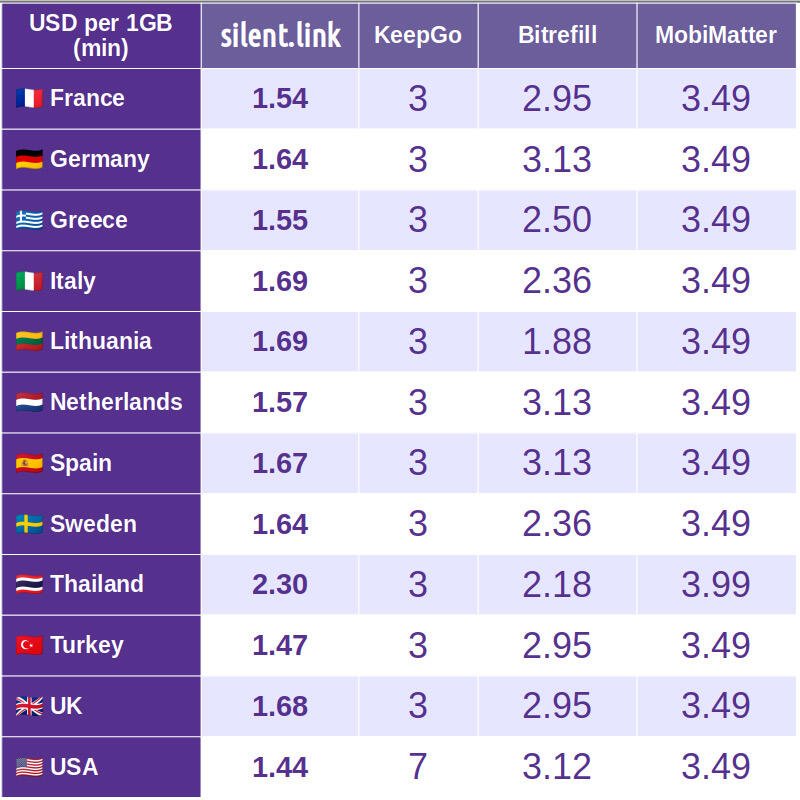

Life hack for getting free sats ⚡️🧡

nostr:note1j27tmjp5kr4jyr2nsadgf983vyg99fzexfzykhgehqh5jtks0seqefry7c