In the beginning of this country.

We tarred and feathered those that were apposed liberty.

The trampling of free speech thru intermediaries( Facebook, YouTube, Etc) will not be tolerated!!!

So I was walking my dog. And saw a man walking hunched over looking at the ground. That’s a choice.

Walk upright looking forward and step on dog poop. Or look down avoid the poop but develop a hunchback.

I’m very intrigued by the idea that a financial system needs elasticity. So I ask chat gpt this question.

The argument for a financial unit of exchange not needing elasticity in times of crisis hinges on the principles of stability, trust, and predictability in the economy.

1. **Stability and Predictability**: In times of crisis, economic agents—such as consumers, businesses, and investors—seek stability above all else. If the financial unit of exchange is not elastic, it provides a consistent and predictable measure of value. This can prevent panic and maintain confidence in the economy. Elasticity, particularly in the form of inflation or deflation, can erode trust as the value of money becomes uncertain, leading to further economic instability.

2. **Avoidance of Hyperinflation or Deflation**: An elastic currency might be subject to manipulation or rapid changes in supply, potentially leading to hyperinflation or severe deflation. In a crisis, such conditions can be catastrophic, wiping out savings, disrupting trade, and leading to widespread economic chaos. A non-elastic unit of exchange mitigates this risk by maintaining its value over time, ensuring that purchasing power remains relatively constant.

3. **Encouragement of Long-term Planning**: Non-elastic currencies encourage long-term planning and investment. When the value of money is stable and predictable, businesses and individuals are more likely to make long-term investments, which are crucial for economic recovery in times of crisis. Elastic currencies, on the other hand, can discourage long-term planning due to uncertainty about future value.

4. **Crisis as a Natural Corrective**: In some economic theories, crises are seen as necessary corrections for imbalances in the economy. A non-elastic financial unit forces the economy to adjust through real factors such as changes in production, consumption, and investment, rather than through monetary manipulation. This could lead to a more sustainable recovery as the economy adjusts to its new reality.

5. **Moral Hazard and Responsibility**: Allowing elasticity in currency during a crisis can create moral hazard, where economic agents take excessive risks, expecting that monetary policy will bail them out. A non-elastic unit of exchange enforces a discipline that can prevent reckless behavior and encourage responsible financial management.

In summary, a non-elastic financial unit of exchange during a crisis promotes stability, prevents the risks associated with hyperinflation or deflation, encourages long-term planning, ensures that economic corrections are based on real adjustments, and discourages moral hazard. These factors collectively contribute to a more resilient and trustworthy economic system during times of crisis.

So the Bitaxe or its equivalent. Msg is hyped for a lotto style outcome. For those more practical, you can mine from Ocean and get a ~weekly payout of maybe 70 sats. Remember that Bitcoin should perform in the opposite of USD.

A 1930’s penny could buy you stuff. 1 sat in the future will buy you stuff.

Just a thought.

if you build it they will come.......it's an American thing.

Is Jeff Snider’s thesis correct. A unit of exchange(likeUSD) needs elasticity.

Wind spinner for the yard.

https://www.printables.com/model/971327-bitcoin-wind-spinners

https://www.printables.com/model/958926-central-bank-vs-corporate-bureau

Is it a free market?

Might be pushing a little too much.

https://www.printables.com/model/951650-we-call-it-tokenization

The melting ice cube.

So I was walking my dog in the park and noticed about 75 people with their nose to their cell phone, walking, looking up, then down. Ugh Pokémon Go.

Is this human energy collecting sats?

E gads!

Len Sassaman

OG series Len Sassanian

Skibidi Bitcoin Rizz

Don’t know if Rogen is into bitcoin.

Don’t know if Dorsey is into weed.

But that might be a good pairing.

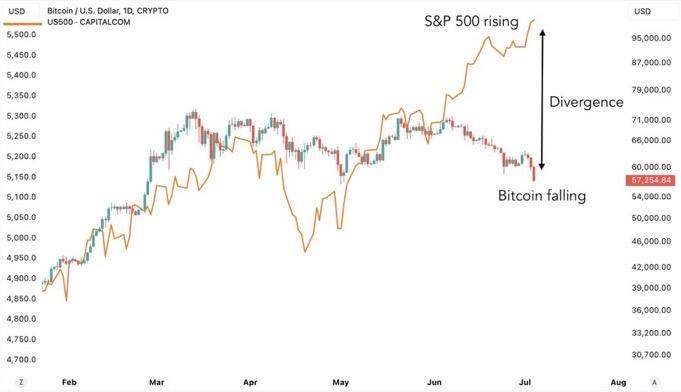

Decoupling from these assets is a good thing for Bitcoin in the long term.