I strongly agree with that. I think #Teather is positioning #USDT to replace #SWIFT. Especially after Howard Lutnick's #Bitcoin2024 speech.

West Palm Beach?

Mine does the same. Not sure why. I would also like to know though.

#Zap #Zapping #Zaps #Zapped

#Nostr #AskNostr #Zapstr

My wife, nostr:nprofile1qqs98t84lhp68wcjlag0hr3ct8gxtw4u0lapfpnrkjhjl4mxw00cwlcpr4mhxue69uhkummnw3ezucnfw33k76twv4ezuum0vd5kzmp0xscdx7, found this rad mantis while we were watering the #garden.

#gardening #bugs #bug

I’m curious what year you started to buy #Bitcoin and what year you went maximal #AskNostr #Nostr #PlebChain

I custodied my first UTXO in 2019 and realized Bitcoin only in early 2020 thanks to nostr:npub1gdu7w6l6w65qhrdeaf6eyywepwe7v7ezqtugsrxy7hl7ypjsvxksd76nak and Andreas Antonopoulos (ps does Andreas have a Nostr key pair?)

Found #Bitcoin in mid 2023, after our Son was born. I always thought it (and all #crypto) was a ponsy scheme and/or scam. However, I gave it a second chance because of British_Hodl's videos while looking to provide a future for our kids. Went full blown #Bitcoiner within 30 days (about 120 hours of listening to #BTC content, reading the White Paper, and listening to nostr:nprofile1qqsyx708d0a8d2qt3ku75avjz8vshvlx0v3q97ygpnz0tllzqegxrtgppemhxue69uhkummn9ekx7mp0appv40's #BitcoinStandard), and started liquidating any long term savings from "safe" investments like CDs immediately. We left short term emergency reserves in USD to reduce tax liability. Skipped 99.99% of shitcoin degeneracy by hearing other people's stories.

My #crypto #confession is that I bought Shib in 2017, and some XRP. Insignificant amounts at the time, since I viewed it as gambling. That's my 0.01%, there to remind me that shitcoins are not the way.

You find #Bitcoin when you need it. #Hodl for your last name. #Bitcoin is the great financial equalizer.

I'm simple, I see nostr:nprofile1qqsp4lsvwn3aw7zwh2f6tcl6249xa6cpj2x3yuu6azaysvncdqywxmgpr9mhxue69uhhqatjv9mxjerp9ehx7um5wghxcctwvsqs6amnwvaz7tmwdaejumr0dsq32amnwvaz7tm9v3jkutnwdaehgu3wd3skueqkshq8e on a podcast, I listen to it. He's always based, and never ceases to make me laugh and smile. Was a pleasure to see Erik Cason, really enjoyed his takes as well. Thanks to nostr:nprofile1qqs2auxkkgfgylem580xrztp8ek5sf83s86k0vfq2feuz6y4lkhskgcprpmhxue69uhkummnw3ezuendwsh8w6t69e3xj7308pdmr2 for the podcast this morning.

Your Bitaxe would require only a local ip address but still needs a connection to a pool.

If you want to learn a bit more general stuff about Bitaxe checkout the Bitaxe101 series

Bitaxe 101

https://www.youtube.com/playlist?list=PL8e2e0X27IU_Qo9AT0BxGnEgxbtnV18qu

Thank you for the resource!

Thank you, I'm trying to track my Zaps on other's posts. :)

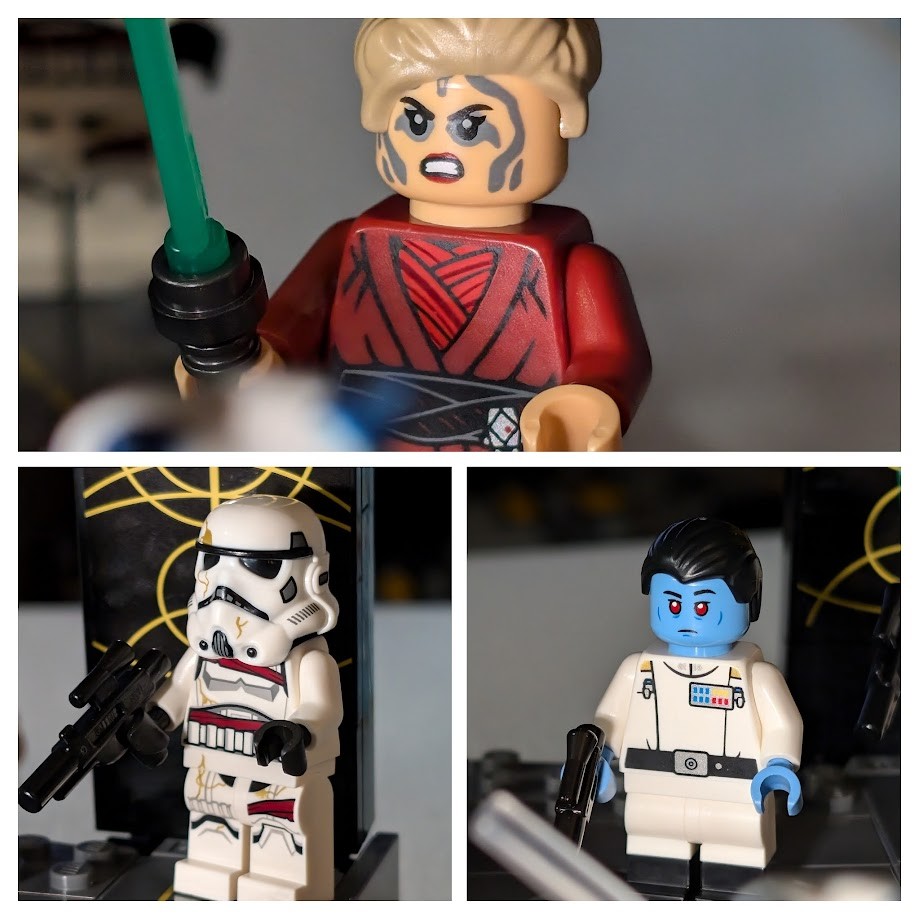

I mostly buy #Lego #StarWars. She does a lot of the botanical sets. I am hoping they do more #LotR sets.

This may be an alternative method if you live well below your means.

At the next bear market take out a personal loan for whatever you're comfortable with.

Make a lump sum purchase of #Bitcoin using the loan. You don't have to worry about trading then, just make the monthly loan payments instead of worrying about buying in and out of #Bitcoin. So long as #Bitcoin is above the initial loan amount, you're net positive.

I seem to find local sellers with suspiciously, dare I say "criminally," low prices on Facebook marketplace. I don't ask questions. Plausible deniability? <.<

Building #Lego with my wife nostr:nprofile1qqs98t84lhp68wcjlag0hr3ct8gxtw4u0lapfpnrkjhjl4mxw00cwlcpr4mhxue69uhkummnw3ezucnfw33k76twv4ezuum0vd5kzmp0xscdx7. It was her idea, she's perfect. <3

#Boom #Booming #Boomed

#Lego #Legos

My #Npub doesn't seem to be tracking my #Zaps. Have I linked my lightning payment method incorrectly?

#Zap #Zaps #Zapping

#Boom #Boomed #Booming

I very much agree, it's what we do with our time and money. My goal is to create value for people in my life. Ultimately the more value we create, the more we can give back to the world. :)

Was planning on nabbing this just for the minifigs. I'll wait for a discount though. I do my best to never buy #Lego at full price. Too expensive for me. Your post has great photo quality of the minifigs and layout!

Speed doesn't require KYC, just an email.

I appreciate your view on wanting to own the land you live on. Here are a few things to consider.

Everyone needs a place to live. Apartments should offer affordable housing to allow people to get up on their feet. Not everyone is fortunate enough to be able to live with their parents or family until they can buy a place.

Additionally, there are some people who aren't interested in the responsibility of owning a home. They don't want to worry about property taxes, insurance, and most importantly - maintenance. Sometimes people need a place to rent because they are only in town for a few months for work. Not everyone wants to be a homeowner.

I think that single family homes will become more affordable as #Bitcoin is adopted more as a store of value. The only property I'd be interested in owning as an investment for rental income is multifamily housing, or commercial buildings.

I also believe owning and managing rental property is a service industry. Where you should work to provide the best quality of service to your tenants. This opinion is not shared by all in my industry, but at least I can sleep easy knowing I'm providing the best quality of service to my tenants.

I will personally not trade Sats. Stay humble, stack Sats. I do keep some with lightning to spend on extremely rare occasions.

Are these doxing relays?

I suspect that you are correct. For most people I think it'll be harder to sell the closer it gets to paying off their home, credit cards, cars, kids' college, etc. I don't expect the same for most hardcore hodlers. We do all we can to save in Sats, and keep living below our means as to not have to touch them.

However, in the next 5-20 years I think you'll be able to play your cards in a manner that you won't have to sell. If you have something like major medical, or other unexpected life expense come up, you'll likely be able to get a collateralized loan against some of your Sats. I'd like to believe most people will be wise enough to do something along those lines, as opposed to dumping their Sats.

I plan to get a loan like that when they mature to buy an income generating asset like a duplex, triplex, fourplex, or small apartment complex. Use the rental income to pay the loan off. As Bitcoin keeps growing in strength against the US Dollar you'll be able to keep reducing your collateral until the loan is paid off. No loss of your own Sats.

If you default or have to forfeit your Sats to pay off the loan, then the original plan was to sell them for whatever you needed taken care of in the first place. Meaning you're not really out anything more than you would have been otherwise.