Can they really orchestrate the perfect landing with all these knobs

Staking is not worth the risk of 3rd party custodians!

Bitcoin is the best option on money printing because there is no time decay!

$8T of UST Debt rolls over during the next 18 months causing upward pressure on Int Rates. Rising Rates has less to do with economic activity (recession or growth) and more to do with excessive UST Debt.

IMF hates #Bitcoin.

It was tasked to kill the Gold Standard, centralise the worlds money into the control of a few and open the way for a rug pull into fiat money.

IMF Recap:

1) Formed in 1945 to help kick the world off the Gold Standard. The new system fixed to USD instead of gold directly. The IMF policed each country's FX rate to USD. If a country fell into strife, it would tie them over, while "strongly encouraging" policy changes. This step centralised monetary control to USA.

2) Once Nixon halted the convertibility of USD to Gold in 1971, the fiat rug pull was complete. Fiat was born and the IMF needed a new job.

3) The IMF then pivoted to debt enslaving developing countries with their fund. They now lend out money to countries in exchange for extractive policy changes that keep them poor

#Bitcoin

🇸🇻 Bitcoin came to the 🇺🇸 US and called out the Federal Reserve 👀

"They can make more real estate. They can find more gold. They can't make any more #Bitcoin" - Jack Mallers

There is no way to take money out of politics, but there is a way to take politics out of money, and that way is #Bitcoin.

Federal debt on 1st day of the new fiscal year, jumping $204 billion to new record of $35.669 trillion, but it gets worse: Treasury also had to draw down its cash balance by $72 billion - that's over $275 billion in the red FOR JUST ONE DAY:

Is this sustainable? the fed debt jumped $204 billion in a day to record highs.

🇺🇸 SAYLOR: "#Bitcoin's the most certain thing, in an uncertain world."

#Bitcoin will perform better if @KamalaHarris is elected, because the US Dollar's value will collapse faster

Is the USD the next biggest carry trade to unwind?

Bitcoin the best hedge against the carry trade. The carry trade is not over it took 15+ years to build and does not end with 2 days of volatility.

Other currencies need to be sold to buy back the YEN as the negative interest rate spread closes.

Either other currencies will fall against the YEN or money printing will happen to buy it back without the system loosing liquidity

With Bitcoin giving you optionality to all currencies either way you will be able to sustain purchasing power in YEN or have greater purchasing power in other currencies that need to print against BTC.

With annual spending of $6.95 trillion and taxes of $4.91 trillion, the US government is currently overspending by $233 million per hour.

On a blended basis this moves BTC from 1 T to 4 T in market cap. With a 30x multiplier, that means we need 100 Billion in fresh capital coming into the asset.

#Bitcoin breaks the entire legacy financial system by allowing everyone to play the game of money with the same rules

Most people think Bitcoin won't even reach $100K

When it does, will they continue to question the best asset in the world, the only one that doesn't require intermediaries to work as money?

Keep in mind this is a finite asset that nobody can create more of

94% of the total 21,000,000 supply is held by only 1%-5% of the world

The 95%-99% who haven't figured it out yet will have to convince the holders to convert their Bitcoin to USD

WHAT IF THE HOLDERS DON'T WANT TO SELL?

How high can the price go?

Over time, more and more people are figuring out that they don't want to hold US dollars

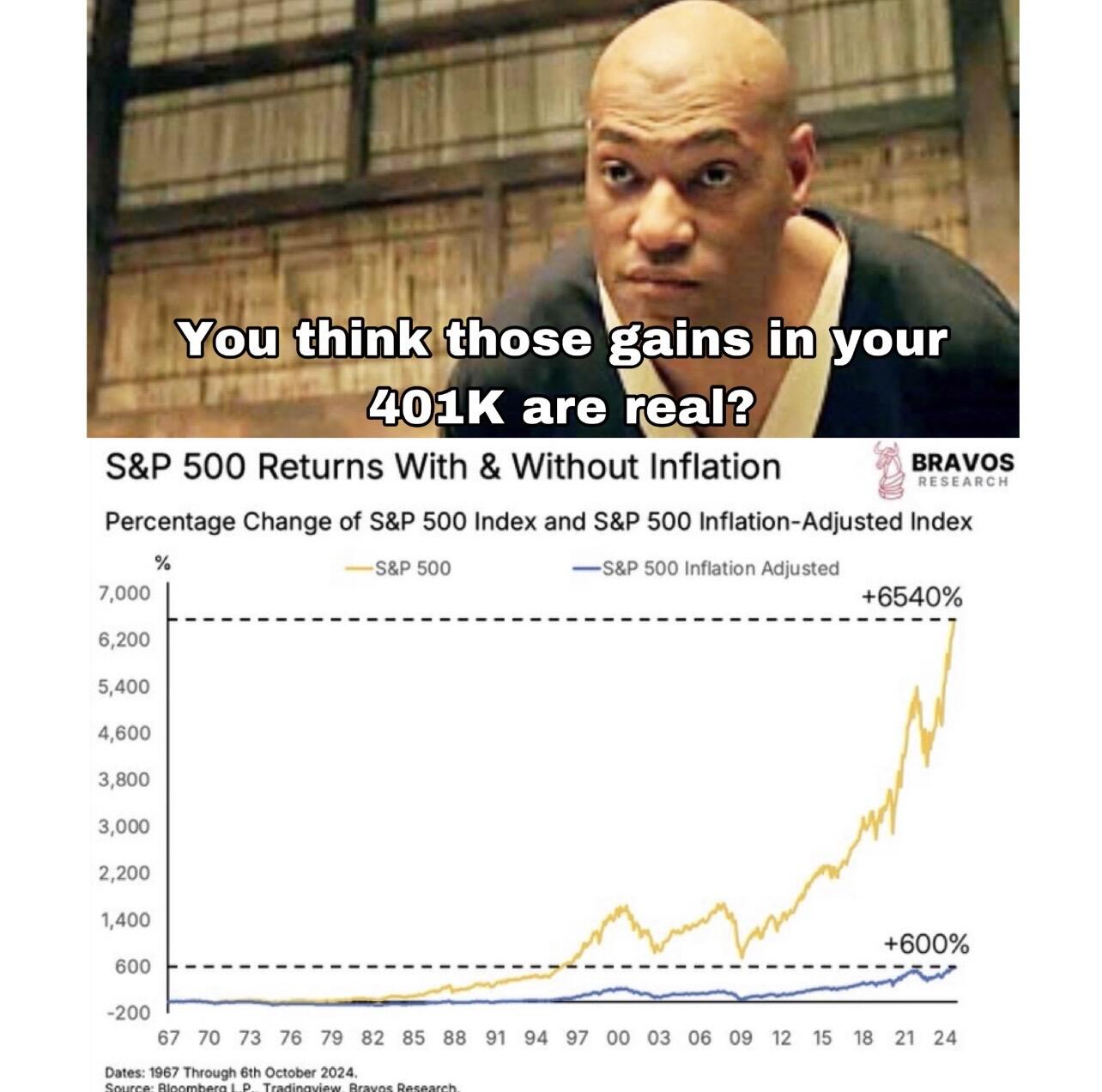

Saving in US Dollars is a death sentence for your wealth over the long term

Today, most people buy houses and stocks to protect their wealth from USD debasement

Then they switch from stocks and real estate to USD when they want to spend their savings

YOU DON'T NEED TO CONVERT BITCOIN TO DOLLARS!

You can send Bitcoin to anyone and receive Bitcoin from anyone in the world within minutes

The US government seems to be coming after holders of legacy assets with the potential of an unrealized capital gains tax

Holders of legacy assets have no choice but to comply, because they can't use stocks and real estate as a medium of exchange

You must convert legacy assets into USD at some point

The billionaires of the world didn't become billionaires by giving handouts to the government

And they're not going to like paying more taxes than they need to

This is where Bitcoin comes in:

Nobody can take your Bitcoin unless you give it to them willingly

Governments can't stop you from using your Bitcoin unless you give them your private keys

In 30 years $1,000,000 will be worth:

$552,000 at 2% inflation

$412,000 at 3% inflation

$308,000 at 4% inflation

$231,000 at 5% inflation

#Bitcoin fixes this.