Canada keeps debasing its currency.

At a M2 Money Supply CAGR of 8.08% since 1973 (when I was born) the cost of groceries, rent, real estate ... aka "life" ... doubles every 9 years or so.

The majority doesn't understand this and gets frustrated at how difficult it is to save and "get ahead".

Some try to out pace this debasement by "investing" and/or earning "yield".

Beating 8% debasement a year without leverage is tough. But if you don't beat it your purchasing power falls behind every-single-year-without-fail.

Most have forgotten what real money is ... so when Bitcoin is staring at them as a solution to this debasement they call it a "fraud" or "lacking yield" or "not physical so it can't be trusted".

Real money has characteristics that make it so. It's durable, divisible, portable, scarce, verifiable, secure etc. It doesn't have "yield".

You earn yield with risk. Earning and then saving good money shouldn't earn yield ... but it should increase your purchasing power over time.

Because we haven't had real money in generations (we currently use credit/debt as our currency) most people don't see Bitcoin for what it is: the best savings technology we've ever seen.

If you're one of the few that do ... pleasure to meet you.

The next few years are going to be fun.

We don't know how much Canada will debase in 2025 but we know the direction ... HIGHER! CAD is in dumpster fire mode.

🇺🇸 INCOMING WHITE HOUSE AI & CRYPTO CZAR DAVID SACKS: "Bitcoin has the potential to be the next Internet - the Internet of money. I'm buying." 🚀

FED: unknown issuance month to month

BTC: known issuance until 2140

Only 0.27% of the global population can own 1 #Bitcoin each 🤯

🇪🇺 European MP: "Donald Trump is going to create a #Bitcoin Strategic Reserve. Bitcoin is skyrocketing. The EU is squandering our money!"

EU MP @knafo_sarah tells the European Parliament to set up a "Strategic Bitcoin Reserve".

NEW: As of today Dec 15th 2024 the U.S. Financial Accounting Standards Board (FASB) now allows companies to value Bitcoin at current market prices.

The rule, fully effective in 2025, aims to improve transparency and could drive more businesses to adopt Bitcoin as a reserve asset.

World Government leaders receiving their updates from the treasury:

"Errrm, it seems 95% of all bitcoin have been mined and there is only 5% left to be released to the network!! There can be no more created EVER... and worse still... it is on a fixed release schedule... and will take 116 years to get to it... We need to buy as much as we can now.

$300 trillion in global bonds are being demonetized by Bitcoin.

And Saylor $MSTR figured out how to accelerate the demonetization.

#Bitcoin is a much better savings vehicle than real estate

I don't know why this is so hard for people to wrap their heads around

A house that cost 12 Bitcoin in NOVEMBER 2023 (1 YEAR AGO)

Now costs 4.5 Bitcoin...

If you had sold your rental properties last year, you would now be able to buy 2.5x the houses you would have sold (net of fees)

Eg. If you owned two rental properties and you sold them for bitcoin in November 2023, you can now buy ~5 rental properties!

Why?

Real estate prices will always rise in terms of US Dollars because US Dollars are easier to produce than houses

Real state prices will always fall in terms of Bitcoin because Bitcoin is harder to produce than houses

Be the person with one #Bitcoin in your own wallet and a 5k car. Not the person with a $100k car on lease and no #Bitcoin.

ETFs have been buying 4,500 BTC per day the last weeks, and Microstrategy have been buying around 3,000 BTC per day.. There are only 450 new BTC being mined per day.

Take out a $100k student loan or a $80k car loan at 6% interest, and you’ll get a pat on the back. DCA $1k into #Bitcoin each month, and they’ll call you reckless.

The hard truth is that most people celebrate debt slavery over financial freedom. Don’t be most people.

BlackRock has put out an OFFICIAL recommendation of 2% into #Bitcoin.

Based on their AUM, this accounts for an injection of $220 Billion.

That is 4x more than is currently in IBIT.

Gold and Silver worked because it was hard to dig out of the ground.

That's no longer true. The future of money can only be a ledger secured by energy.

BTC is having its 0 to 1 moment to fill these shoes, there's no second best to challenge it.

This is why it went from 0.08 cents to $100k in 15.2 years.

Maybe 10-20yrs more to get to saturation.

Real estate is going to severely underperform Bitcoin over the next two decades. It won't even be close.

You will save your money in Bitcoin. Not real estate.

Real estate used to be the best inflation hedge. Now we have something infinitely better.

No real estate taxes. No tenants. No maintenance. Can be sold in seconds.

People will rent their entire lives. The idea of buying a house with a financial inflation premium will be lost, there will be no need for it.

This is a pivotal tech movement that is going to define the class structure of this country.

Imagine working 9-5 for 50 years then The Fed prints 40% of the total money supply and inflates away 20 years of your work.

Bitcoin does not require backing, it has inherent monetary properties superior to any other form of money that has ever existed.

It's important bc when people think money needs to be backed by something, they assume money requires backing from a government

Louis kc:

So what’s the plan to make people “want” to have children again?

4k a month mortgage to get a starter home, with both parents working full time, to afford two cars and bills, while daycare costs $1500 + a month per child, neighbors no longer help each other, and families live far apart… and even if they were close, everyone is working full time

Schools get out at 2:30 and corporations want everyone back in the office until 5 every day

One day at an amusement park for 4 costs 500 bucks

Call me crazy but it just doesn’t sound that appealing if I was young again

You think you’re late to Bitcoin because it’s $95,000

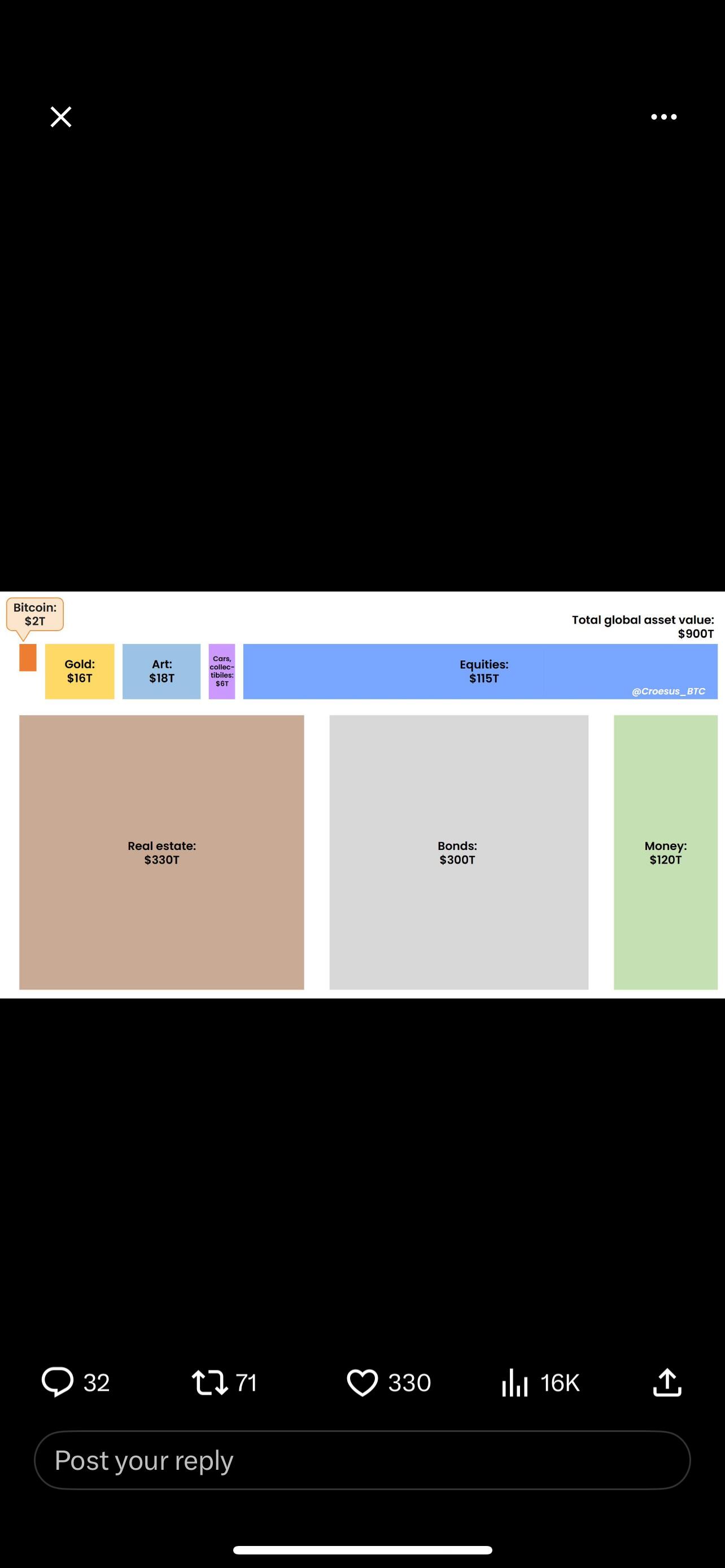

I think I’m early to Bitcoin because it’s $1.7T market cap of $900t in global assets

Is a $10M Bitcoin a possibility?