Don't wing your finances! Get financial advice or hit the books - either way, take control of your future! #FinancialLiteracy #MoneyManagement

Is inflation chipping away at your savings? #GoldStandard could be the answer! A return to gold-backed currencies would limit reckless printing & stabilize prices. #SoundMoney #MakeMoneyMatter Let's get the conversation going!

Congress passed a HUGE $1.2 trillion spending bill to fund the government, but lawmakers only had a short time to review it! This raises concerns about accountability & whether this will cause further inflation (which the US export to US....). What's in the bill & is it the best use of our money? #BudgetBill #Accountability

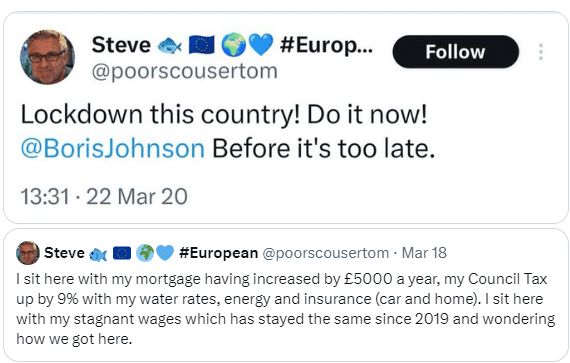

Genius alert #lockdown #inflation

Advancewealth.co.uk is celebrating 15 years of making financial dreams a reality! Here's to 15 more years of helping people ditch the piggy bank and level up their finances. #FinancialFitness #AdvanceWealth #InvestingMadeEasy

#Drawdown vs #Annuity for #idiots

Drawdown:

Imagine: You keep your retirement pot invested, like a big piggy bank. You take out money ("draw it down") whenever you need it.

Pros: Flexibility: You control your income. Need more cash? Take it out. Want to leave some for your heirs? It's yours! Growth potential: Your investments might grow, giving you more money over time.

Cons: Risk: Investments can go down too, meaning your pot could shrink. You could run out of money if you live longer than expected. Responsibility: You need to manage your investments and withdrawals carefully.

Annuities:

Imagine: You hand over your retirement pot to an insurance company in exchange for a guaranteed income for life. It's like buying a retirement paycheck.

Pros: Security: You get a fixed income no matter how long you live. Peace of mind! Less responsibility: The insurance company manages the money, not you.

Cons: Less flexibility: Your income is fixed. Can't adjust it easily if your needs change. No inheritance: Once you die, any remaining money in the annuity is gone. No passing it on.

Choosing: Like security and guaranteed income? Annuity might be for you. Want flexibility and control? Drawdown could be better.

Important note: This is a simplified overview. There are different types of annuities and drawdown options with their own details.

Remember: Don't rely solely on this guide. Talk to a financial advisor to understand your options and make the best choice for your specific situation.

Ever wondered why things seem to get more difficult financially for you each year while you work harder and harder? It's by design. Recommended reading....: https://www.youtube.com/c/ThePriceofTomorrow

Have you heard of the "Fourth Turning"? ⏳ It's a theory about 80-year historical cycles, each ending in a ~20-year crisis of transformation. Think revolutions, wars, major change! Are we in one now? What do you think the future holds? #FourthTurning #Generations #History

Disruptive stocks can disrupt your portfolio too... in a good way. Think Netflix vs. Blockbuster . While established players resist change, these innovators challenge the status quo, often leading to BIG returns. Example: Tesla defied auto giants, soaring from $17 to 187$ since 2010! Do your research & remember, disruption breeds opportunity! #investing #innovation #stocks Can you wok out what the next disruptive asset or company will be? Tesla still? Bitcoin?

Please note:

This is just an example, and you should always do your own research before investing in any stock.

Disruptive stocks & assets can also be very volatile, so be prepared for the possibility of significant losses.

It is important to consider your own investment goals and risk tolerance before investing in any stock.

Evergrande, the world's most indebted property developer, just collapsed in Hong Kong! 😳

👉 Keep an eye on this, it's not clear yet what the knock on effects are for the likes of Blackrock who has financial connections.

#Evergrande #China #debtcrisis #globalfinance

Where are YOU most influenced by your #investments & #lifeoutlook? TV hype, radio pundits, social media frenzy, or your own gut? Let's hear it! #DecisionDrivers #FinancialWisdom #MindsetMatters

Weighing London vs. Wall Street: 🇬🇧 #FTSE100 vs. 🇺🇸 #S&P500

Similarities: Both offer access to global giants, liquidity, & diversification.

Differences: #UK stocks lean towards consumer staples & financials, while #US leans towards tech & healthcare.

Volatility: #US markets tend to be more volatile, but also offer higher potential returns.

Tax: UK dividends taxed at 20%, 🇺🇸 US at 15%. Both have capital gains taxes.

Ultimately, the choice depends on your risk appetite & investment goals. Do your research! #investing #stocks #finance

Bonus: #AIM for exciting growth potential in the UK, or #Nasdaq for tech-heavy exposure in the US.

Let me know in the replies which market you prefer and why!

pic.twitter.com/bqxUSnCowi

This is the world’s most important central banker trying to explain inflation - why can’t he do it? #inflation

January: the market's crystal ball? Some say its performance sets the year's tone. Stats say it's 50/50:

Strong Januaries precede strong years 55% of the time.

But a weak Jan doesn't doom the year: markets recover 68% of the time after a down Jan. #MarketMythDebunked #JanuaryBarometer #InvestingTips

#BRICS expansion is official! Saudi Arabia, Iran, Ethiopia, Egypt, & UAE join the club. What does this mean for the future? More economic & political clout for the Global South? Shifting alliances & a multipolar world? Will it challenge Western dominance? Only time will tell! #NewWorldOrder #GlobalShift #WatchThisSpace

Any help out there for a UK based financial adviser wanting to help my clients understand Bitcoin? And no idea where to start….especially as it would have to involve no advice for regulatory reasons.

Hi, first post from UK financial adviser here interested in Bitcoin