Banks make money from the lower class through fees and interest,

Borrow money from the middle class for free,

Then lend it to the upper class, so that they can become even more wealthy.

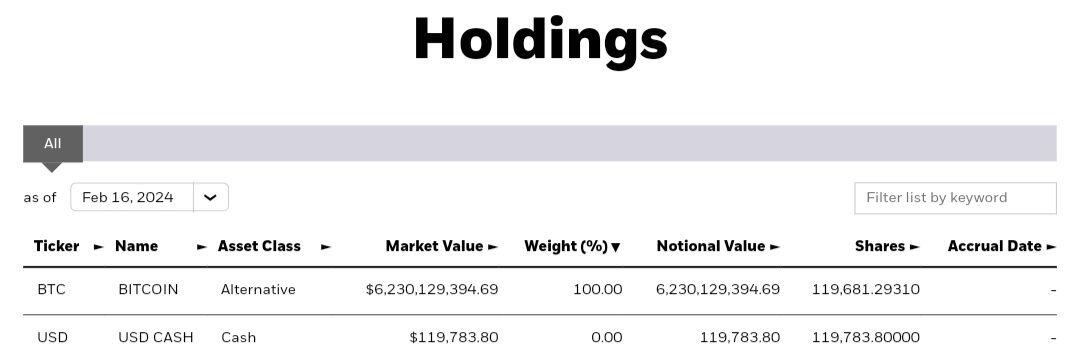

Blackrock's Bitcoin ETF now holds 119,681 BTC, up 3,692 from Thursday.

Their total holdings are now worth $6.2 BILLION.

Blackrock now holds 0.5699% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

On Friday, Blackrock clients bought 4.1x the newly issued supply.

The absolute stupidest reason for rejecting Bitcoin:

"Power grids can be taken down, and the internet may not exist."

99% of your day-to-day transactions are done using electricity and the internet.

Where do you keep your money today? Most likely in a bank account?

If every power grid on earth is somehow taken out, I'm 110% sure the money in your bank account won't be accessible either.

And I'm also 110% sure that the Bitcoin network will be back up and running BEFORE your bank.

So many people rejecting #Bitcoin think it's something the majority of the world already understands and owns.

They don't realize THEY ARE IN THE MAJORITY.

99% of people don't get it and 90%+ will NEVER get it, just like they don't understand the current financial system.

The majority are ALWAYS wrong when it comes to financial decisions.

This time will not be different.

The crowd will be wrong again, and they'll start paying attention when BTC is $1M+.

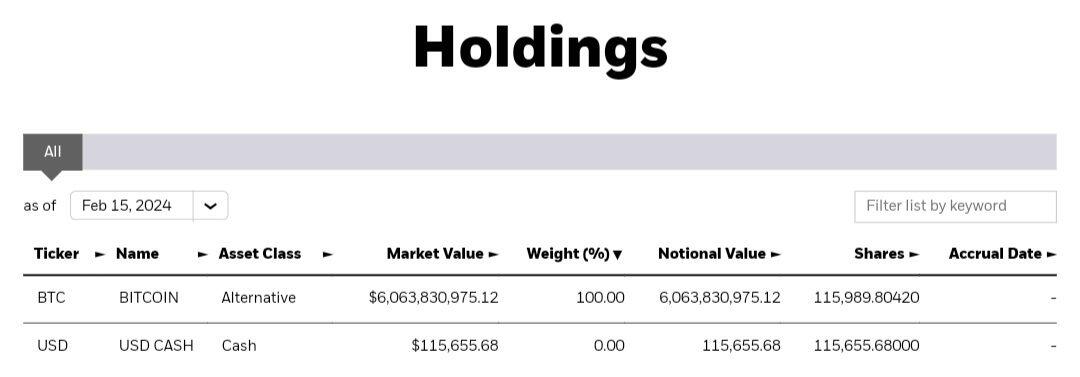

Blackrock's Bitcoin ETF now holds 115,989 BTC, up 6,380 from yesterday.

Their total holdings are now worth $6 BILLION.

Blackrock now holds 0.5523% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

Yesterday, Blackrock clients bought 7.09x the newly issued supply.

#m=image%2Fjpeg&dim=1080x377&blurhash=Q5SF%3BMRj%3FbM%7B9FRj-%3Bofxut8WB%3Fbof9Fj%5BxuRjRj%7Ept8_3t7M%7BofxuxuRj&x=7074f93e69a67a91cc3b8a390babe2e27925ddaebff5f88a82b651ac147e4df6

#m=image%2Fjpeg&dim=1080x377&blurhash=Q5SF%3BMRj%3FbM%7B9FRj-%3Bofxut8WB%3Fbof9Fj%5BxuRjRj%7Ept8_3t7M%7BofxuxuRj&x=7074f93e69a67a91cc3b8a390babe2e27925ddaebff5f88a82b651ac147e4df6

It's their customers bitcoin

Their customers have to choose to sell

Blackrock would do anything to prevent them from selling

They'll earn higher fees if their customers don't sell so they have an incentive to hold

I spent over 3 years and thousands of hours studying Bitcoin

I had to let go of things I believed about money my entire life

I had to delay gratification to buy BTC

I had to go against the crowd

And yet in 10 years

Most people will say I got lucky

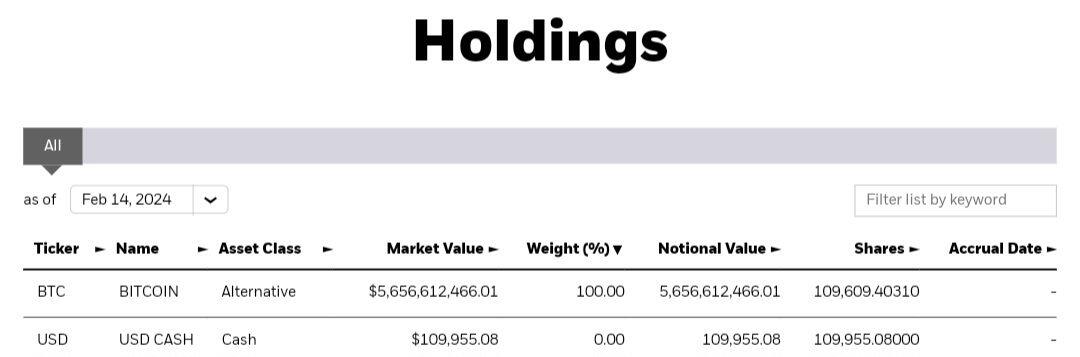

Blackrock's Bitcoin ETF now holds 109,609 BTC, up 4,392 from yesterday.

Their total holdings are now worth $5.6 BILLION.

Blackrock now holds 0.5219% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

Yesterday, Blackrock clients bought 4.88x the newly issued supply.

#m=image%2Fjpeg&dim=1080x357&blurhash=Q4SF-EM%7B_3IU9EM%7B%3Fbt7xu-qWB_3of4nofxuM%7BM%7B%7Eoxu%7Eqt7IVoM%25MxuRj&x=9494da56d837acc3fcf092779e59fe6d482aef4c25885832b542c57263eb841e

#m=image%2Fjpeg&dim=1080x357&blurhash=Q4SF-EM%7B_3IU9EM%7B%3Fbt7xu-qWB_3of4nofxuM%7BM%7B%7Eoxu%7Eqt7IVoM%25MxuRj&x=9494da56d837acc3fcf092779e59fe6d482aef4c25885832b542c57263eb841e

Over the last 15 years, Blackrock and Fidelity could do nothing to stop you from buying #Bitcoin.

Today, people are messaging me to ask "What can we do to stop BlackRock from owning all the #BTC?"

Nothing.

All you can do is not sell to them.

We (the average retail investor) had a 15-year head start.

Blackrock will keep accumulating BTC until there is almost no available supply to be bought below $100,000 then until there is no available supply below $1,000,000, then $10,000,000.

And they will likely never sell again.

Blackrock's Bitcoin ETF now holds more than 100k BTC!!

It now holds 105,280 BTC, up 10,004 from yesterday. THIS IS THEIR BIGGEST DAY SO FAR 🤯

Their total holdings are now worth $5.1 BILLION.

Blackrock now holds 0.5013% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

Yesterday, Blackrock clients bought 11.11x the newly issued supply.

#m=image%2Fjpeg&dim=1080x347&blurhash=Q4SF%3BLM%7B_3IU4nM%7B%3Fbofxu%253WB_3of4nj%5BxuM%7BM%7B_2xu%7Eqt7IUof%25MxuRj&x=4d05808fdf7125d6926ec0f2e4263060866b11eafe81a99c8ead8be6b041b238

#m=image%2Fjpeg&dim=1080x347&blurhash=Q4SF%3BLM%7B_3IU4nM%7B%3Fbofxu%253WB_3of4nj%5BxuM%7BM%7B_2xu%7Eqt7IUof%25MxuRj&x=4d05808fdf7125d6926ec0f2e4263060866b11eafe81a99c8ead8be6b041b238

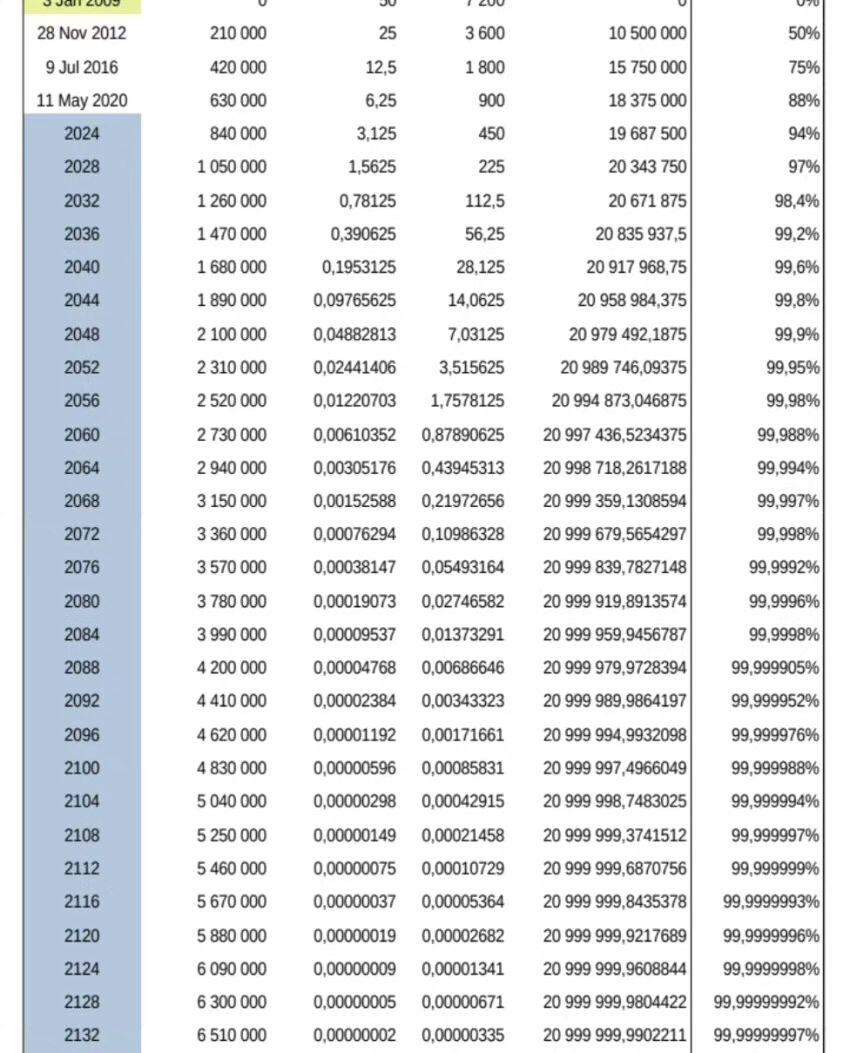

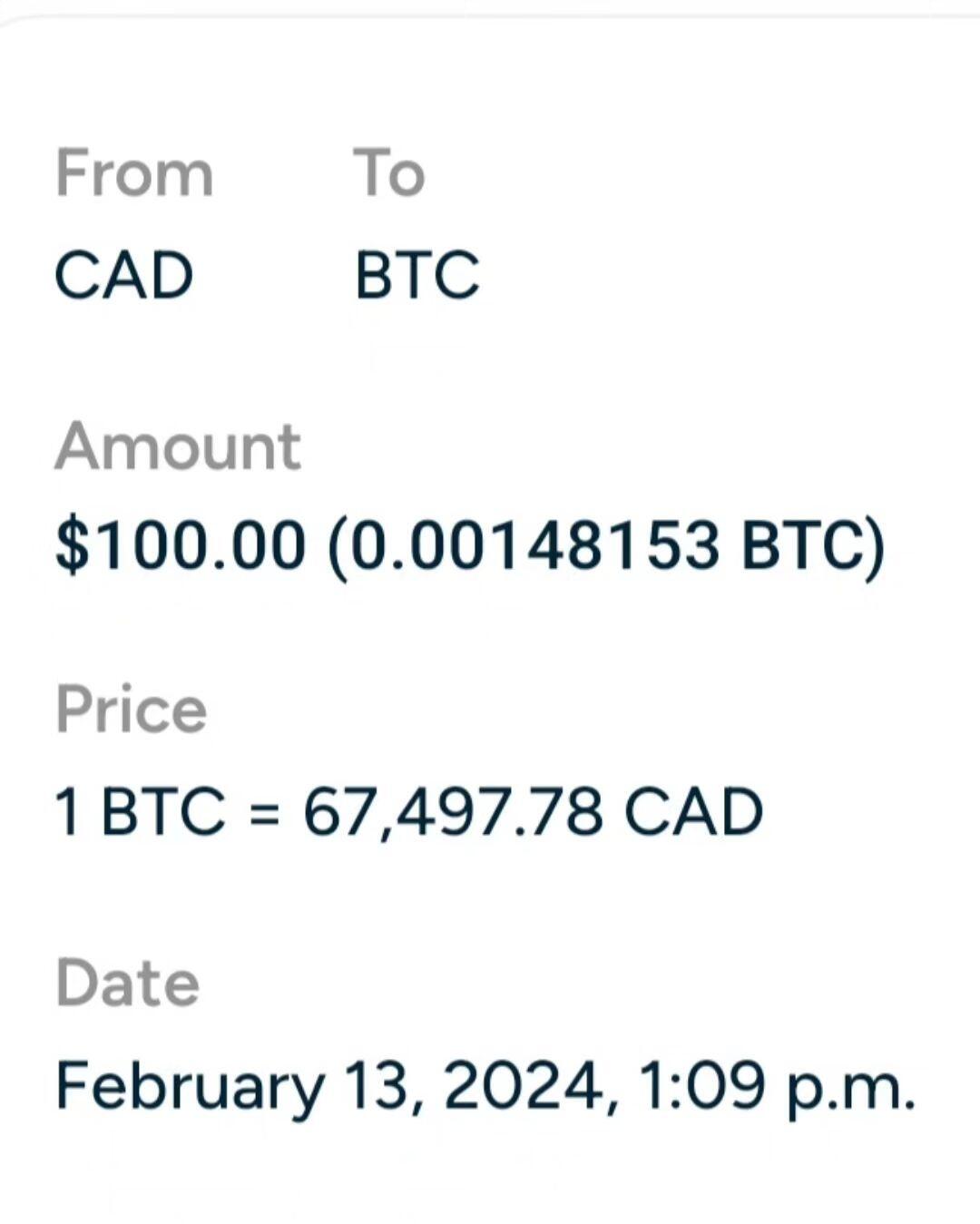

I just bought 148,153 Satoshis for $100 CAD.

In 2068, 152,588 satoshis will be produced by the Bitcoin network every 10 minutes.

The entire world's hashing power will be used to produce a little bit more than what I bought today for less than 6 McDonald's meals.

Wild.

#m=image%2Fjpeg&dim=843x1053&blurhash=_7Q%2CRJ0301024%3AIU%250%7EpV%3Fn%23t6t6oLWB-%3AxYjXxZt6fQof%25Lxss%2Cs-oeofa%23xsxst6oIoKofWVxst6t6oJj%3FofWCs-t5s.ocj%40ayazt6ocododj%3Fj%5BWCocj%3Docj%3FayfQfR&x=bb56e3a76c2b6bf78119088fa98ba863e7a7c04a1e9e312f447e95042cb38d9a

#m=image%2Fjpeg&dim=843x1053&blurhash=_7Q%2CRJ0301024%3AIU%250%7EpV%3Fn%23t6t6oLWB-%3AxYjXxZt6fQof%25Lxss%2Cs-oeofa%23xsxst6oIoKofWVxst6t6oJj%3FofWCs-t5s.ocj%40ayazt6ocododj%3Fj%5BWCocj%3Docj%3FayfQfR&x=bb56e3a76c2b6bf78119088fa98ba863e7a7c04a1e9e312f447e95042cb38d9a

#m=image%2Fjpeg&dim=1080x1349&blurhash=_4Ss884nxuRj%25Mxu%3Fb%3FbRjRjxaRjRjWB%3Fbt7Rjt7RjRjWB-%3BofofRjRjofRjIoxuofWVxaj%5Bf7IUt7WBWBxus%3Aof-%3Bt7t7fQoft7M%7B%3FHj%5BM%7BayRjofof%7EqxuWBt6M%7BRjM%7B&x=925a6a5afba7e4e9c131f16fff49c7666972ed4481b87141b3098802a321cbc6

#m=image%2Fjpeg&dim=1080x1349&blurhash=_4Ss884nxuRj%25Mxu%3Fb%3FbRjRjxaRjRjWB%3Fbt7Rjt7RjRjWB-%3BofofRjRjofRjIoxuofWVxaj%5Bf7IUt7WBWBxus%3Aof-%3Bt7t7fQoft7M%7B%3FHj%5BM%7BayRjofof%7EqxuWBt6M%7BRjM%7B&x=925a6a5afba7e4e9c131f16fff49c7666972ed4481b87141b3098802a321cbc6

A reminder:

There will only ever be 21,000,000 BTC

If you own 1/21,000,000

You own 0.00000004762% of the total monetary supply

1 BTC will cost $1M, then $10M, then $100M

Eventually, the only way to get more BTC will be to exchange your time for it

You DON'T need to buy whole coins - each BTC can be split into 100,000,000 unit, so you can buy fractions!

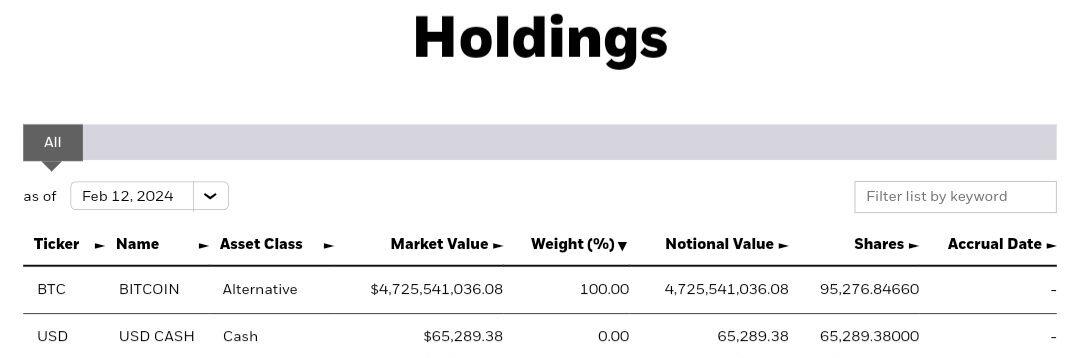

Blackrock's Bitcoin ETF now holds 95,276 BTC, up 7,497 from yesterday. THIS IS THEIR BIGGEST DAY SO FAR 🤯

Their total holdings are now worth $4.7 BILLION.

Blackrock now holds 0.4537% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

Yesterday, Blackrock clients bought 8.33x the newly issued supply.

#m=image%2Fjpeg&dim=1080x358&blurhash=Q4SF%3BMM%7B_3IU9EM%7B%3FboftQjdWB_3of4nj%5BxuM%7BRj%7Epxu%7Eqt7IUof%25MxuRQ&x=da85be3c179c8c9542d5bba765bf53b4f391d6d320d658fe4269c4a538a6b802

#m=image%2Fjpeg&dim=1080x358&blurhash=Q4SF%3BMM%7B_3IU9EM%7B%3FboftQjdWB_3of4nj%5BxuM%7BRj%7Epxu%7Eqt7IUof%25MxuRQ&x=da85be3c179c8c9542d5bba765bf53b4f391d6d320d658fe4269c4a538a6b802

BTC will reach $1M before Bitcoin ETFs hold 1M BTC (including GBTC).

Exchanges have the lowest balances since 2017.

Keep in mind a lot of these balances are just there because they are too small to move to cold storage - a lot of these coins are not for sale.

At $42.6K I got a DM from someone telling me they set up a limit order to buy BTC at $42K.

They messaged me again today and asked why I didn't just tell them to buy right away because now they can't afford a whole coin.

A lot of people are holding off to get a tiny discount, and they end up getting burned so hard...

Just set up recurring buys and relax. You don't need to get the perfect entry.

Accumulate small amounts over time.

The price might go down a bit from here, but who cares?

Does it REALLY matter if you buy at $50,200 vs 49,000?

In 10 years you won't even care about a $1,200 difference.

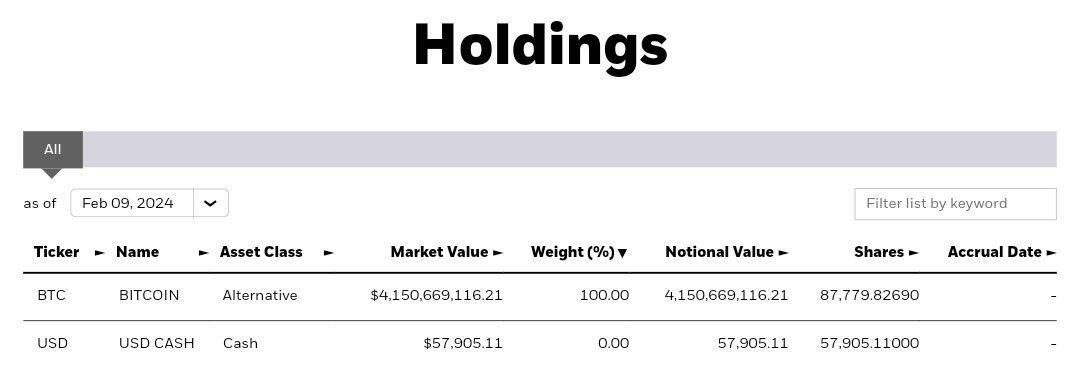

Blackrock's Bitcoin ETF now holds 87,779 BTC, up 5,264 from Thursday.

Their total holdings are now worth $4.1 BILLION.

Blackrock now holds 0.418% of the total supply of BTC.

900 BTC are issued per day. In April this will drop to 450.

On Friday, Blackrock clients bought 5.85x the newly issued supply.

#m=image%2Fjpeg&dim=1080x369&blurhash=Q5SPX_Ri%3FbM%7B9FRj-%3Boft7j%5EWB%3Fboe9FfQxuRjRj%7Ept7_3t7M%7Bofxut7Rj&x=6932b72562b585cf2a98f10004ff1538e2e1cf7fd1387d05f0468bc3ff4077c5

#m=image%2Fjpeg&dim=1080x369&blurhash=Q5SPX_Ri%3FbM%7B9FRj-%3Boft7j%5EWB%3Fboe9FfQxuRjRj%7Ept7_3t7M%7Bofxut7Rj&x=6932b72562b585cf2a98f10004ff1538e2e1cf7fd1387d05f0468bc3ff4077c5

Instead of pushing Bitcoin holders out of their country, I think in the future governments will treat them very well.

On the other hand, with stocks and real estate, governments can treat investors worse over time because there's almost no way out unless you go through a regulated financial institution.

What do you think will happen if the US government has to borrow in a different currency?

Its power to borrow USD and do whatever it wants will be gone when (not if) the US Dollar loses its status as world reserve currency.

This is when I think anyone with unrealized capital gains in the legacy financial system gets rekt.

You can never own real estate because you will always pay property taxes.

If your government increases the property tax, what are you gonna do about it?

The market price will likely be forced down as fewer buyers want to hold a property just to pay 3-5% in property taxes each year.

You might be able to sell your property, but I think capital gains tax laws would be next.

Anything you've saved in real estate will likely be devalued significantly.

What happens if CG taxes go from ~20% to 50%+?

Since Bitcoin is a permission-less network, its users are free to move their wealth across borders as they please.

You can't pick up a rental property and move it to another country.

You can't send your stocks somewhere else unless you go through a financial institution that serves as a custodian.

If governments try to implement a property tax on Bitcoin and you have self-custody, you can send it to another jurisdiction within minutes.

If you don't have the keys to the address in the other jurisdiction, there's nothing your government can do to get that BTC back.

People know who's going to play in the Superbowl tomorrow but they have no idea that Wall Street is accumulating all the available BTC

They're guessing which color Gatorade will be poured on the winning coach but they have no idea that the Bitcoin halving is in April.

This is everyone's opportunity to free themselves from the system, but most people are wasting their time on fiat entertainment.

The fact that Bitcoin is Halal is not priced in

I'm not Muslim, but I know how big of an impact this will have

Individuals who have never been able to invest before will be able to buy assets

I've spoken to friends who follow Islam, and they have no clue that Bitcoin is Halal

In fact... they don't even know what Bitcoin is

Traditional asset classes are based on "Riba" or interest

This means these assets are prohibited by the Islamic faith, because interest is seen as an unjust, exploitative gain, and such a practice is forbidden under Islamic law

These people are saving in cash, losing money each year due to theft from inflation

Trillions of dollars will flow into Bitcoin that have never been invested before, and most people don't even realize it yet