For decades, central banks have wielded paper derivatives contracts to suppress the price of gold, a practice that traces back to the Clinton era. At the time, gold had surged to nearly $1,900 per ounce, signaling inflationary pressures on the horizon and offering investors a refuge from currency debasement. Clinton, wary of destabilizing the bond market, set the stage for this manipulation. Today, estimates suggest there are 100 to 300 paper claims for every ounce of physical gold in existence—a precarious imbalance. If investors demand delivery, bullion dealers won’t have enough to fulfill orders. The result? A squeeze on physical gold that could propel its price tenfold or more, as those holding paper contracts scramble to buy real gold from a shrinking supply to cover obligations. These contracts, typically cash-settled financial instruments, can technically be redeemed "in-kind" for physical gold, though few expect that call to come—until now.

Signs of a gold run are emerging, hinting at banks turning on each other in a high-stakes game of musical chairs. Banking, at its core, is a fragile system: every fractionally reserved bank in the U.S. is insolvent by design, unable to survive a full withdrawal of deposits. Why? Because fractional reserve banking relies on double-entry accounting and public ignorance to mask its essence—a legalized counterfeiting scheme. Banks create loans from thin air, collecting interest on money that costs them nothing to produce. Modern banknotes echo this relic of deception. The dollar, once defined as $35 per ounce of gold, lost its backing in 1971 under Nixon’s “temporary emergency measures”—a move that became permanent. Now, it’s a debt-based currency, repackaged as an asset, propped up by the vague promise of the “full faith and credit of the U.S. government.” It’s all credit, no substance—just trust holding it together.

Lifting the gold peg unshackled central banks, granting them the power to print limitless currency, unbound by physical constraints. Paper derivatives became their tool to short gold, stifling its price and stripping investors of a hedge against rampant money printing. As new currency floods the system, scarce assets—gold, housing, food—rise in value, inflating prices faster than wages can keep pace. Relative to gold’s original $35 peg, the dollar has shed 98-99% of its purchasing power, with gold now at roughly $2,700 per ounce. Against consumer goods, per the CPI, it’s down about 87% since 1971. Meanwhile, central banks globally float their fiat currencies, competitively debasing them to prop up debtors and stabilize the system. Currency too strong? Print more, erode its value, and save the borrowers at the expense of savers.

Then came Bitcoin. Unlike gold or paper promises, Bitcoin can be claimed in full via self-custody in ten minutes, bypassing the games of banks and derivatives. Over the past five years, the dollar has lost about 90% of its purchasing power against it, reflecting Bitcoin’s meteoric rise. This isn’t a glitch—it’s the system working as intended, favoring banks, governments, and the ultra-wealthy. Gold’s suppression, the dollar’s decline, and Bitcoin’s ascent lay bare the mechanics of a trust-based economy teetering on the edge.

https://goldbroker.com/news/london-gold-market-defaults-physical-gold-deliveries-3491

To be fair, it does say that the field was optional and *often* left blank. Not always. But yes we should not have to pay taxes because taxation is theft and this clown show ran off the rails seventeen years ago.

Caught up with nostr:nprofile1qyt8wumn8ghj7ct5d3shxtnwdaehgu3wd3skueqpz4mhxue69uhk2er9dchxummnw3ezumrpdejqqgpnkeqsw4f3nudn3wwr0jg5y5wft2rhd7hvmcmv6r7xxhp4tvrn55ve7rzq to discuss the latest in the world of $GME, what's happening in gold markets, and all of the debt that needs to be rolled over this year.

"There's a run on the gold markets in London."

I felt like this show was synchronicity popping up a day after I loaded up on 7 shares of GME. I'm 99.95% Bitcoin, but I like the setup for a squeeze if Cohen pulls a Saylor. Its a good set up. The commentary on gold is telling of the adversarial environment we're entering. Fuck the globalist commies we have sound money you can't fuck with.

nostr:note1hzptl0fwkgppuge9accpa7qvlsnyjrph9mklcat2y95rwrgdj42qzgtgvz

Caught up with nostr:nprofile1qyt8wumn8ghj7ct5d3shxtnwdaehgu3wd3skueqpz4mhxue69uhk2er9dchxummnw3ezumrpdejqqgpnkeqsw4f3nudn3wwr0jg5y5wft2rhd7hvmcmv6r7xxhp4tvrn55ve7rzq to discuss the latest in the world of $GME, what's happening in gold markets, and all of the debt that needs to be rolled over this year.

"There's a run on the gold markets in London."

Gold is telling us something, and Bitcoin's range is tightening. I'm getting the feeling we're due for a little price discovery... and I'm fine with either direction... but up seems likely. I'm curious to how the US potentially marking up our gold reserves would effect the global gold markets. It seems like global tensions may test legacy settlement rails in ways they haven't been stressed for awhile. Interesting time to be alive. I'd be stressed out if we didn't have Bitcoin already.

Caught up with nostr:nprofile1qyt8wumn8ghj7ct5d3shxtnwdaehgu3wd3skueqpz4mhxue69uhk2er9dchxummnw3ezumrpdejqqgpnkeqsw4f3nudn3wwr0jg5y5wft2rhd7hvmcmv6r7xxhp4tvrn55ve7rzq to discuss the latest in the world of $GME, what's happening in gold markets, and all of the debt that needs to be rolled over this year.

"There's a run on the gold markets in London."

this one was pretty dank, ngl

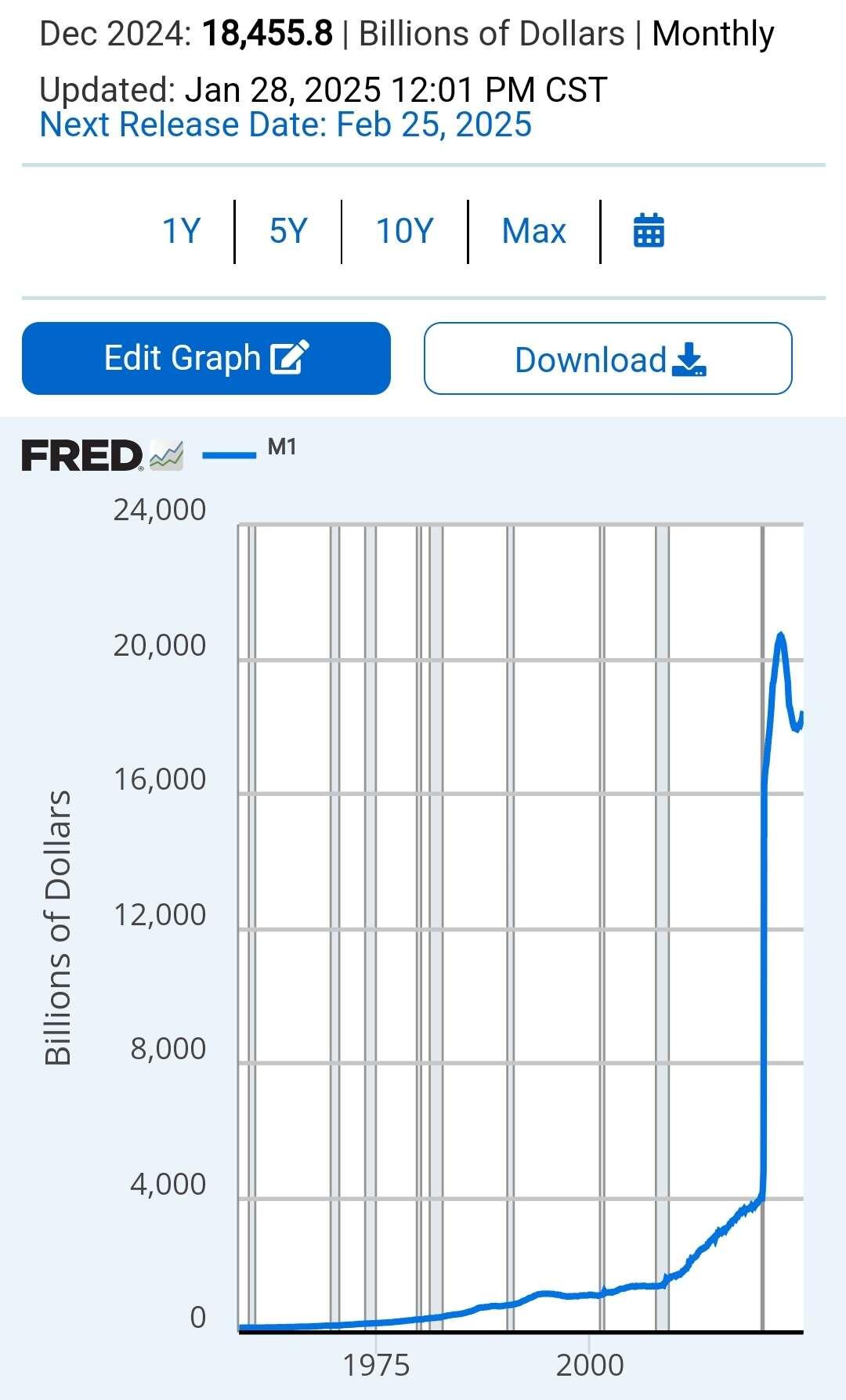

In May 2020, the Federal Reserve adjusted the definition of M1 money supply to include savings accounts, which were previously only part of the M2 money supply. This change was due to an amendment in Regulation D, which previously limited the number of transfers or withdrawals from savings accounts to six per month. When this restriction was lifted, savings accounts became functionally equivalent to checking accounts, thus qualifying them to be included in the M1 aggregate.

This adjustment led to a significant increase in the reported M1 money supply because it effectively added the balances of savings accounts into M1, which were not counted there before. This reclassification caused M1 to skyrocket as it essentially absorbed a large portion of what was formerly considered part of M2. This redefinition did not reflect new money being created but rather a shift in how existing money was categorized.

I used to throw this chart around but it's misleading in context.

In May 2020, the Federal Reserve adjusted the definition of M1 money supply to include savings accounts, which were previously only part of the M2 money supply. This change was due to an amendment in Regulation D, which previously limited the number of transfers or withdrawals from savings accounts to six per month. When this restriction was lifted, savings accounts became functionally equivalent to checking accounts, thus qualifying them to be included in the M1 aggregate.

This adjustment led to a significant increase in the reported M1 money supply because it effectively added the balances of savings accounts into M1, which were not counted there before. This reclassification caused M1 to skyrocket as it essentially absorbed a large portion of what was formerly considered part of M2. This redefinition did not reflect new money being created but rather a shift in how existing money was categorized.

The left wants to "Play the game"

The right wants to "Win the game"

To study Bitcoin is to realize the game is already over. The music already stopped.

Get a chair. #Bitcoin

Tl/dr Bitcoin is the chair.

Facebook censored my story. I requested a review on the grounds that it didn't violate their policy and it was to bring awareness to an important issue.

I'm curious to see what "based zuck" has to say.

#nostr

#federalreserve

GM

US household debt hit an all-time record and jumped by $93 billion in Q4 2024 to a record $18 trillion.

It has been driven by a $45 billion surge in credit card debt, hitting an all-time high of $1.2 trillion. Household debt as % of disposable income is 87%.

Inflation is erasing the middle class.

Those who don't own assets will be financially rekt by inflation over the next decade. There is simply too much Government debt that must be issued and rolled over at higher interest rates, and not enough natural demand for it.

The economy can be described as:

consumers + investors/savers + government = "the economy".

As the government debt has grown to unsustainable levels, and orders of magnitude higher levels of money creation go to creating money for servicing that debt instead of private sector "productive loans" that flow more broadly to savers and investors... we have a problem. That's where we are now.

When you don't own Bitcoin, government debt is your problem. Debt stacks up, spending new units of currency into existence, debasing your relative purchasing power and eroding your ability to pay for rent, food, and groceries. The prices don't really go up, the purchasing power of the currency goes down... because all prices are relative. This is the natural state of inflationary currency (currency regimes that manage crises by creating new units of currency and injecting them into the system).

Bitcoin is highly correlated to global liquidity-- the more they print into the fiat system, the higher it gets valued... because it has a fixed supply, and value is relative.

By owning Bitcoin, government debt becomes your greatest asset. Debt means more dollars. Bitcoin is essentially an insurance policy against reckless government spending. The most serious threat to Bitcoin would be a balanced budget and no deficit spending. But, let's be real....

Printer is coming. Saving anything you can in Bitcoin for the long term is the escape hatch.

The current total unrealized losses on U.S. banks' balance sheets as of the first quarter of 2025 are reported to be $329 billion. Bank of America has over 100B in unrealized losses alone.

What does that mean? It means they don't have your money. Because the second you deposit it in the bank, it becomes their operational capital. While the bank uses your money for its operations, you retain a legal claim on that money. The bank has a fiduciary duty to manage those funds responsibly, ensuring they can return the principal amount to you upon demand or at the agreed maturity date for time deposits.

Currently, they are insolvent if all depositors demanded delivery.

In practice, the money you deposit is part of the bank's operational capital, but legally and morally, it's still yours, with certain protections in place.

Those protections are as follows--

The current legally mandated reserve ratio for U.S. banks is 0%. This policy has been in place since March 26, 2020, when the Federal Reserve reduced reserve requirement ratios to zero percent for all depository institutions.

Have a great day.

#bitcoin

#DebtCrisis

#nostr

#GM indeed

#nostr

#maha

In the year 2047, the world had seen the collapse of traditional #fiat currencies. The Great Financial Reset, as it came to be known, left economies in shambles, with nations scrambling for stability. #Bitcoin, long mocked as a digital folly, had become the bedrock of a new financial order. From its ashes, a mosaic of currencies emerged, each backed by Bitcoin, creating a complex web of trust, value, and #power.

In this new world, New York City was a battleground of currencies. X, once a social media giant, had pivoted to become a financial behemoth. They issued the X-Coin, backed by their vast Bitcoin reserves, offering users a blend of digital identity and currency. Their currency was accepted in every digital transaction, from buying a coffee to securing a loan, but it came with strings attached – every purchase was a data point, enhancing X's already pervasive surveillance.

Across the river, JP Morgan, having learned from past mistakes, had issued JP-Bit, a currency for the elite, with promises of stability and exclusivity. Their banking halls were palaces of marble and steel, where the wealthy could transact without the prying eyes of the digital world, but trust was their currency – one misstep, one rumor of insolvency, and their JP-Bit could plummet in value.

#Strategy, formerly known as #MicroStrategy and now led by Michael Saylor, had launched the Saylor Standard, a currency deeply integrated with their business analytics and intelligence tools. This currency was not just a means of transaction but a gateway to advanced data insights, where holders could leverage their Saylor Standard for predictive analytics, financial forecasting, and strategic market positioning. However, navigating this currency required a deep understanding of both finance and data science, making it a tool for those with the knowledge to wield it effectively.

El Salvador, a pioneer in Bitcoin adoption, now floated the Salvadoran Satoshi, which was community-driven and backed by the country's geothermal energy Bitcoin mining operations. It was the people's currency, but its volatility made it a risky choice for everyday transactions, leading to a dual economy where barter was not uncommon.

The city buzzed with the clatter of these competing #currencies, each with its own ecosystem of trust, technology, and regulation. #Trust was no longer an implicit promise by governments but a commodity negotiated daily. Transactions were complex; a simple meal could involve converting from one currency to another, with each conversion layer adding fees, risks, and data collection.

Amidst this chaos, crime thrived. Black markets emerged where people traded in Bitcoin directly, avoiding the surveillance and conversion rates of private currencies. However, this was a double-edged sword; while it offered freedom, it also exposed users to scams and theft without recourse from any central authority.

Our protagonist, Maya, a hacker turned financial consultant, navigated this world with a mix of tech-savvy and street smarts. She worked for those who could afford her services, decrypting the layers of currency protocols to find the best rates and safest transactions. But her real passion was in the shadows, where she maintained a network of underground servers running open-source protocols.

These servers were the heart of an underground economy where Bitcoin and #nostr - a #decentralized communication #protocol - were king. Here, the elite communicated without oversight, trading ideas, assets, and influence with Bitcoin as the silent currency, unburdened by the volatility and surveillance of private currencies.

However, this elite circle was small, and the majority, the plebeians, were stuck in a world where every transaction was a gamble, every piece of data sold for the illusion of convenience. Maya knew the system was flawed, not just in its execution but in its very design.

As she sat in her loft, overlooking a city divided by digital borders, Maya reflected on the lessons of this new era. The monetization of Bitcoin had indeed shifted power, but it had also fragmented society further. The forward-looking approach to Bitcoin's potential had been realized, but at what cost? The #nation-#state had lost its #monopoly on money, fractional reserve banking had transformed into something unrecognizable, and trust had become a new form of capital, concentrated in the hands of those who could navigate or manipulate the #system.

#IsThisWhatYouWant?

#DigitalAssets

#Crypto

#Bitcoin

#fiction

#scifi

I get that. it was supposed to be a pedo joke 😭

idk why so few of "the elite" are into #Bitcoin...

don't they know it's only sixteen years old?

I have contacted the CEO of Bitcoin kindly zap me 69 sats and I wil be authorized to refund you

hey #nostr,

What is the best way to share audio on nostr?

I'm putting some of my poems over beats and I'm looking into to putting them on Wavlake.

they're in mp3 format now, and I'd love an easy solution to host them somewhere and embed that into a note.

any suggestions are appreciated!

#music

While I share your Paranoia / sentiment, I feel like this is likely language signaling the Silk Road coins being potentially used to form the SBR. Given the context that most of their coins come from seizures of bitfinex and silk Road, And they have previously signaled that one of the major ways an EO could establish a stockpile is by redirecting those seized funds, it seems appropriate that they would move to use the ones they already hold (regardless of whether they acquired them through theft) . just my two Satoshis

welcome to nostr 🥂