nostr:npub16up8472yajrceaxq72yz4an7lggw0s6esgg7rm74k8fh3khsesjs6vnevp

#m=image%2Fjpeg&dim=867x1156&blurhash=_MJQs9%7EWD%24.7M%7Bozt78wM%7Bt8M%7Ct7R*js8_M%7BozRjj%5DayWBIUWBofWBbHj%5BWCozj%5BjZj%5Ba%7Dj%5Bj%5Bx%5Dt7e.ofayjsj%5Bx%5Ds%3AaeofjsjZj%5BofjtjZj%5BjsjsjtV%40jYoLafjtf6jZ&x=031b2eacd055248c3f3171f0e0a05bb1795589e9bc11232686692369368b9c59

#m=image%2Fjpeg&dim=867x1156&blurhash=_MJQs9%7EWD%24.7M%7Bozt78wM%7Bt8M%7Ct7R*js8_M%7BozRjj%5DayWBIUWBofWBbHj%5BWCozj%5BjZj%5Ba%7Dj%5Bj%5Bx%5Dt7e.ofayjsj%5Bx%5Ds%3AaeofjsjZj%5BofjtjZj%5BjsjsjtV%40jYoLafjtf6jZ&x=031b2eacd055248c3f3171f0e0a05bb1795589e9bc11232686692369368b9c59

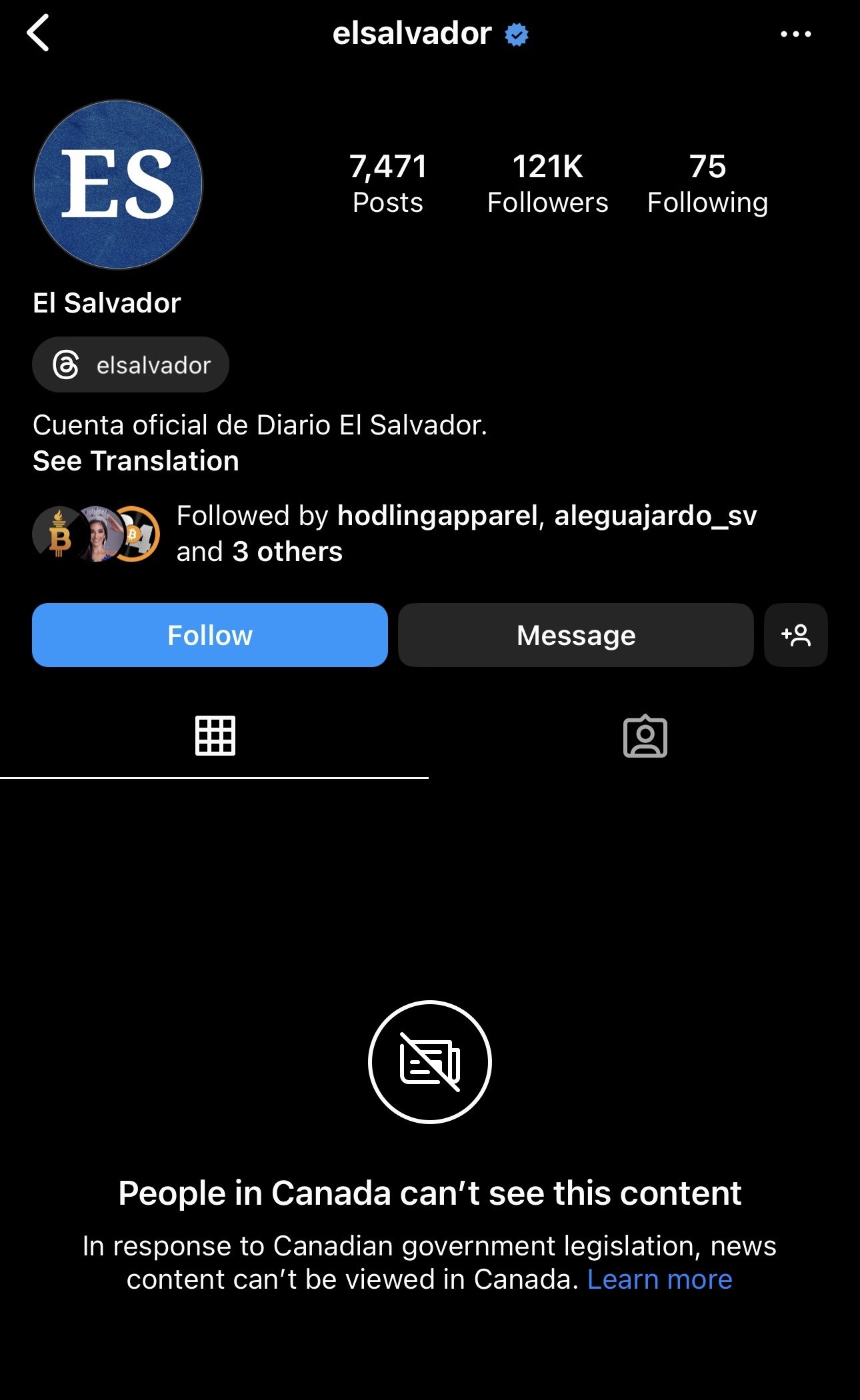

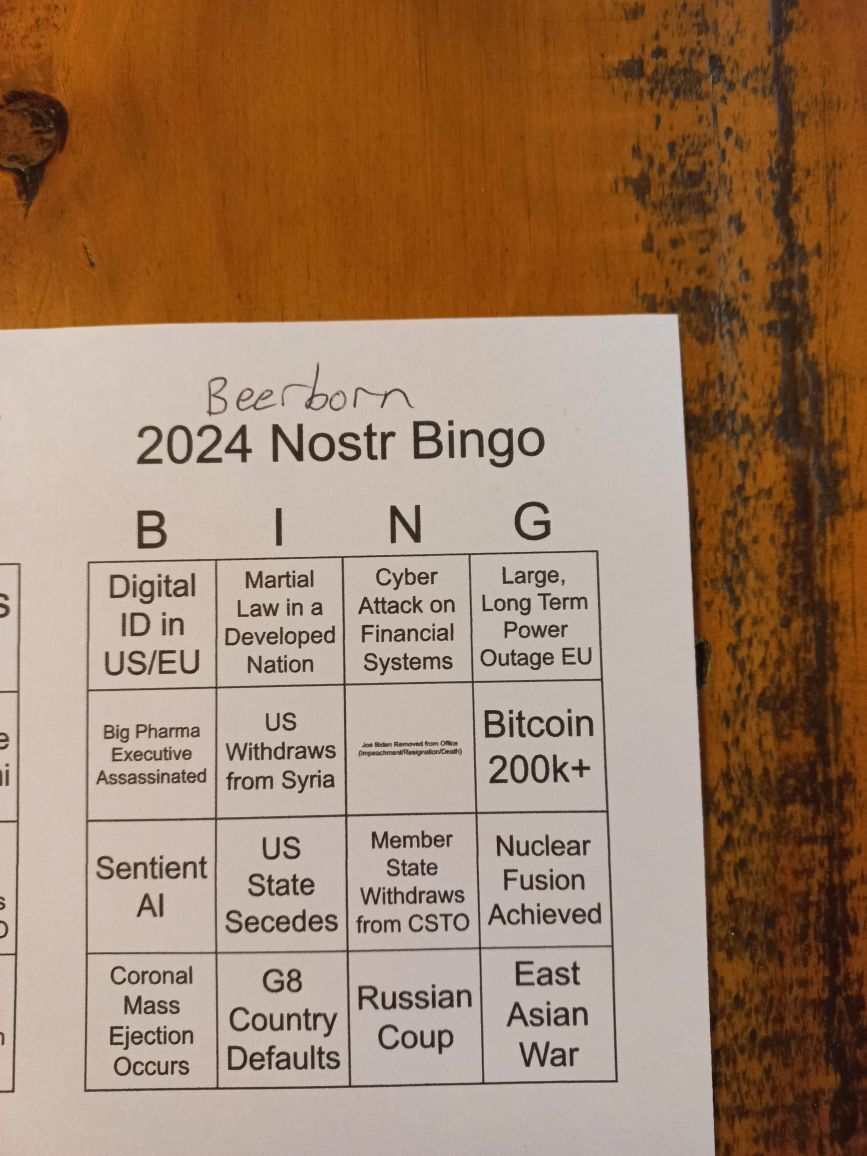

There's one I hope, many I wouldn't be surprised by, a few I'd WTF on.... And there's a BTC price call

Bullish on happy new year zap collecting bots! #happynewyearstr

A day in the life of an anarchist

#m=image%2Fjpeg&dim=1080x1113&blurhash=%7CADl1g%5Ej%3FG%7EBIn0%23NHrpWBM%7CWVjuxZj%5BW%3DofbFbba%23j%5BWCWWofjZWVayoKaeWVoLs%3AWBf8WVfOazt7ayayazofj%5Bt6WVRkjYWoj%5BofWBjZR*aejFfka%7Cayoeoyfks%3AbHR%2BVtWooMxuWnjIR*NFa%23FwIoe.IpMyxYafS4W%3B&x=bc32a870752cd28174d75ee43764610407253597db8f55672037ce1536d60812

#m=image%2Fjpeg&dim=1080x1113&blurhash=%7CADl1g%5Ej%3FG%7EBIn0%23NHrpWBM%7CWVjuxZj%5BW%3DofbFbba%23j%5BWCWWofjZWVayoKaeWVoLs%3AWBf8WVfOazt7ayayazofj%5Bt6WVRkjYWoj%5BofWBjZR*aejFfka%7Cayoeoyfks%3AbHR%2BVtWooMxuWnjIR*NFa%23FwIoe.IpMyxYafS4W%3B&x=bc32a870752cd28174d75ee43764610407253597db8f55672037ce1536d60812

#memestr #nostr

Ok, new years' dinner consisted on: dried tuna roes, smoked red deer, duck and mufflon, and reindeer in tomato sauce. Side was roasted green kale and raw tomatoes. Páramo Arroyo 2004 Grand Reserve as pairing. Sorry #foodstr and #winestr but no pics of the whole meal, I was too busy enjoying food, wine and family.

We do Santa v2 at home today. Old folks got a TapSigner. Son Jimmyng my way...

IYKYK. Happy new year #nostr!

#m=image%2Fjpeg&dim=1080x1920&blurhash=%5DHK0%7EMW9-%3BM%7CIpozjFIUIVM%7CE%23%7EVIBIpRQ01t7ofE2Wq9G%25LxuM%7CkCtRIUNGWXIVIVxtaeS3jZIoR%2CM%7CWB%25Mt6M%7CxuoeWC&x=e2748d17f65a4fab9f05530a7c26bbe371bc63fda31c1b943957ad023fb02ffe

#m=image%2Fjpeg&dim=1080x1920&blurhash=%5DHK0%7EMW9-%3BM%7CIpozjFIUIVM%7CE%23%7EVIBIpRQ01t7ofE2Wq9G%25LxuM%7CkCtRIUNGWXIVIVxtaeS3jZIoR%2CM%7CWB%25Mt6M%7CxuoeWC&x=e2748d17f65a4fab9f05530a7c26bbe371bc63fda31c1b943957ad023fb02ffe

Money supply hits the lower band, printer go brrr, assets prices shoot up, a new cycle of the everything bubble

Nice truffle!

You are welcome. You really just proved mine

Soap, and depending on the country toilet paper, are used (or at least should be) by the totally of the population on a daily basis. Tampons and pads are neither used by the totally of the population nor used by the same individuals more than 3-5 days a month, on average. The comparison is simply fallacious. People should take responsibility and provide those items by themselves.

I guess I'll add uneducated sexit bigot to the list of sins and go cry because some entitled stranger on the Internet thinks that of me 🥲

No it isn't. The government handing out nickels while taxing the hell out of citizens is bad.

You want to make a statement about your toilets not being discriminatory, make all toilets unisex and let everyone decide which one is their favorite paid-to-dump spot.

Hands are hard, even for AI 😂

There's a 10k fee for opening a channel at 1 sat/vB. That fee increases on higher fee environments. And even though they charge you the fee, they add the fee and some extra into the channel, so you have some spare inbound liquidity. The insufficient balance might be more related to the channel's minimum balance requirements. If you don't like those prices, you can connect the wallet's node to other LSP and use it that way, or manually manage your channels without any LSP.

As for the balance not showing, I've never experienced that myself so I can't really comment on that.

Anyway, I'm not trying to sell you on it, just commenting because I'm under the impression that you are mixing the LSP side of things and the wallet itself side.

Is the (re)inflow enough to move the needle against bot trading? That's the question. I don't know many of the specifics of the case.

Like are they getting paid the value of their BTC at the collapse time? I assume they'll get a portion of what they had there in USD terms, not what it'd be worth today, so that wouldn't be so much against the current volume of bot trading.

Of course, some will buy back in, some others won't. The anecdotal data may suggest there's a lot of bitcoiners active in their socials, but that's in part because those who will just take the money and be happy they got something back, are probably not around those groups anymore.

I might be wrong. As I said, I haven't been following the case closely, but I wouldn't hold my breath.

Not necessarily, many receiving cash payments would never go back to BTC after getting burnt by the whole thing.

You don't have to pay anything to use the wallet. You get the app, set up the node, open a channel to it and you're good. They say to send at least 100k if you are using the LSP so that you get the lowest possible fee when they open a channel for you.

I don't know exactly the prices for other LSPs, but I'm pretty sure all I've checked so far charge you a fee if they need to open the channel for you. That's part of the LSP business, they lock liquidity into a channel to your node so you are connected to a well connected node to reliably route your payments.

You've been on a gifting spree for some time 💜🫂