Could not fetch invoice from https://lifpay.me/api/ln/lnurl/payreq/notoriousxmr_994454: Internal Server Error - The server has encountered an unexpected error and cannot complete the request

Need Bitcoiner firends IRL before somthing like this can be useful for me

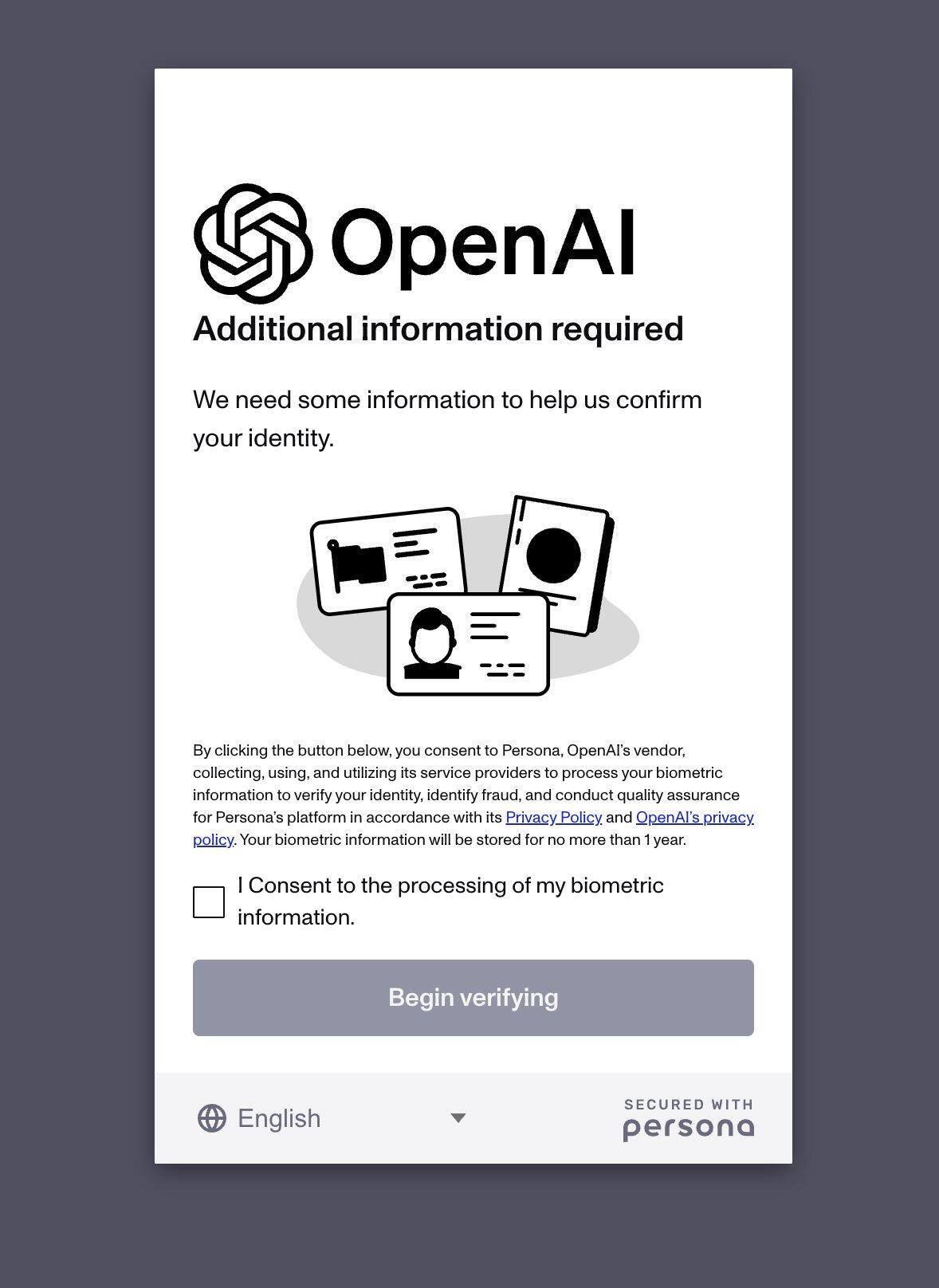

I guess they have to make sure your an Ai trying to use their Ai

Hey man this is self-hosted of course its going to be a bit slower a few years ago I was using Tor. So this is a huge upgrade for me

I've ordered an RGB strip for my homelab. I'm hoping the internals will be more visible

Ummm interesting

Bitcoin Homelab

Ravens are incredibly intelligent. After seeing a fellow bird being fed and cared for by humans, they started pretending to be sick too.

https://video.nostr.build/fe3214bed270fe30d6c08925ac3dfd8543c802b473de3f3b7b3fbc3c6651f779.mp4

I can tell that one was first

Hyperinflation much?

Tonight is the first Nostr Atlanta. Calling all nostr users, content creators, enthusiasts, developers, and more!

https://www.meetup.com/atlbitlab/events/306210201/

👋

**Strategic Advantages of Being Debt-Free in the Bitcoin Era**

In an evolving financial landscape increasingly shaped by digital currencies like Bitcoin, adopting a debt-free stance offers individuals a critical edge. This approach not only aligns with Bitcoin’s scarcity-driven model but also positions investors to navigate volatility, institutional shifts, and systemic risks. Below is a synthesis of key advantages and implications:

---

### **1. Bitcoin’s Scarcity as a Value Anchor**

- **Fixed Supply Advantage**: With a capped supply of 21 million coins, Bitcoin’s scarcity contrasts sharply with inflationary fiat currencies. This scarcity may drive long-term appreciation as demand grows, rewarding early, debt-free adopters who can invest without dilution risks.

- **Institutional Adoption**: Entities like MicroStrategy and nation-states (e.g., El Salvador) are accumulating Bitcoin, reducing circulating supply. Debt-free individuals are better positioned to hold assets through price cycles, avoiding forced liquidation during downturns.

---

### **2. Debt-Free Flexibility in Investment**

- **Capital Allocation Freedom**: Without debt obligations, individuals retain more disposable income to invest in Bitcoin early and at lower entry points. This contrasts with indebted counterparts, who face constrained liquidity and opportunity costs.

- **Avoiding Risky Leverage**: Using debt to buy Bitcoin amplifies risks—interest payments erode profits, and price volatility may trigger margin calls. A debt-free strategy eliminates these pitfalls, enabling calmer, long-term holding.

---

### **3. Psychological and Strategic Resilience**

- **Emotional Stability**: Debt-free investors avoid the stress of repayment deadlines, reducing panic-driven sales during market swings. This fosters rational decision-making aligned with Bitcoin’s multi-year growth trajectory.

- **Portfolio Diversification**: Freed from debt, individuals can diversify into Bitcoin while maintaining cash reserves for emergencies, balancing risk and opportunity.

---

### **4. Decentralization and Systemic Shifts**

- **Escape from Fiat Dependence**: Bitcoin’s decentralized design offers independence from government-controlled currencies, which derive 90–95% of their value from credit systems. A debt-free stance reduces reliance on fragile, debt-saturated financial structures.

- **Transition Challenges**: As Bitcoin gains traction, governments may impose regulations or capital controls. Debt-free individuals are better insulated from such disruptions, retaining autonomy over their assets.

---

### **5. Long-Term Economic Implications**

- **Inflation Mitigation**: A Bitcoin-dominated economy could reduce inflationary pressures by limiting unchecked money creation through loans, fostering stability.

- **Wealth Inequality Risks**: Early adopters and debt-free investors may capture disproportionate gains as Bitcoin appreciates, potentially exacerbating wealth gaps.

---

### **6. Risk Management and Prudence**

- **Volatility Awareness**: While Bitcoin’s potential is significant, its price swings demand cautious investment. Debt-free individuals can allocate only risk-capital, avoiding overexposure.

- **Regulatory Uncertainty**: Mainstream adoption may invite stricter oversight. A debt-free portfolio provides flexibility to adapt to evolving policies.

---

### **Conclusion**

Being debt-free in the Bitcoin era is a strategic imperative, enabling individuals to harness scarcity-driven appreciation, avoid leverage risks, and maintain psychological resilience. As institutions and governments navigate this transition, debt-free investors are uniquely positioned to capitalize on Bitcoin’s growth while mitigating systemic vulnerabilities. However, success requires balancing optimism with prudence—recognizing both Bitcoin’s transformative potential and the challenges ahead. By prioritizing financial independence, individuals can secure a proactive role in reshaping the future of global finance.