💸 The month of July has seen an average of $1.75B in Bitcoin ETF volume per day among the 7 largest ETF's. However, things have picked up after a slow start:

😒 Average volume, July 1st through 3th: $1.24B

🥳 Average volume, July 4th through 10th: $2.13B (+72% Rise)

🐳📈 Bitcoin whale and shark wallets are increasing in number while small traders sell off their bags during this dip period. July has seen a net increase of +261 wallets that now hold at least 10 BTC, which should give traders comfort in a long-term bullish future.

In the United States they copy Bukele and his “Bitcoin Model”

Following in the footsteps of El Salvador, the Santa Monica City Council voted unanimously in favor of creating a Bitcoin Office.

I love it when people attribute smart money to whales.

The 16th largest address containing #Bitcoin bought 50k BTC, a few days before June 7, the start of the correction.

They now have an unrealized loss of $520 million.

Whale watching is pointless, I would even go so far as to say retail is smarter.

🇺🇲 ANNUAL CPI ESTIMATES FOR TOMORROW:

TD Securities: 3.0%

JP Morgan: 3.1%

Factset Consensus: 3.1%

Wells Fargo: 3.1%

Citadel: 3.1%

Barclays: 3.1%

UBS: 3.1%

CitiGroup: 3.1%

Goldman Sachs: 3.2%

Bank of America: 3.2%

Morgan Stanley: 3.5%

Previous: 3.3%

Average: 3.1%

Expected monthly CPI: 0.2%

NEW: 🟠 Bitcoin address with 149 $BTC (💵 $8.5M) reactivates after 10 years 🤯

Back in 2013, those bitcoins were worth $81,667.

The power of HODLING.

Jack Dorsey's Block to Provide 3nm ASIC Miners to Core Scientific

Block has secured its first sale of newly developed mining chips, co-designed in collaboration with ePIC Blockchain Technologies and Core Scientific

Don't worry about the German government.

US #Bitcoin spot ETFs are buying it back.

BTC price struggles to reach USD 60,000

BTC price bullish momentum is increasing, but liquidity is concentrating at $60,000 in an attempt to prevent the market from regaining lost ground.

#Bitcoin knocking on the range low's door... 🚪

#BTC

$58,222.86

Ξ: 18.17007800

H|L: 59,322.00|57,047.00

1h -0.25% 😕

24h 1.64% 😄

7d -3.14% 😥

Cap: 1st | $1.1T

Vol: $28.8B

🙈

We have another interesting day ahead of us in the equity markets, as today Jerome Powell compares, again, but before the Congressional Control Commission. Although the same speech is expected, we will be attentive to questions from politicians, which may generate new comments from the President of the FED.

Additionally, we will look at updated crude oil inventories, the Atlanta Fed GDPNow and another appearance from Bowman (FOMC).

Finally, we remain attentive to the development of the price of Bitcoin, at this time it manages to bounce up to 59 thousand dollars.

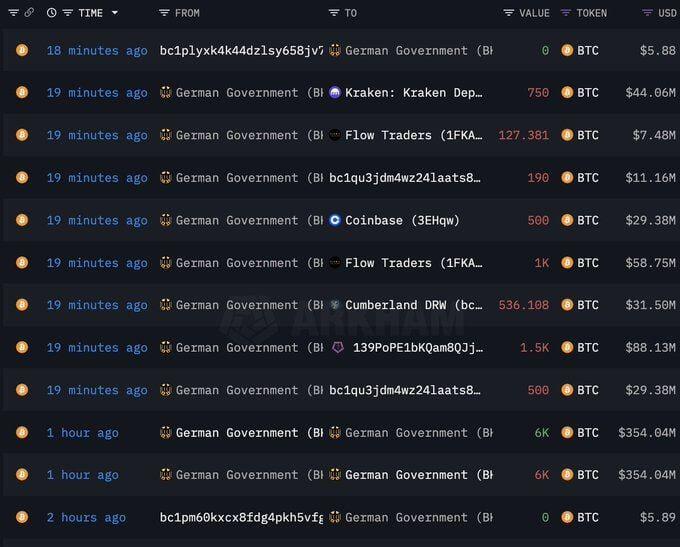

The German government sent 5,100 more Bitcoin worth $300 million to exchanges.

Now they have 18,860 BTC left

📈7/9 Total Net Flow:$ 217 million

BlackRock $IBIT: $ 121.1m

Grayscale $GBTC: $ -37.5 m

Fidelity $FBTC: $ 91 m

Bitwise $BITB: $ -4.7 m

Ark $ARKB: $ 43.3 m

Invesco $BTCO: $ 0

Franklin $EZBC: $ 0

Valkyrie $BRRR: $ 0

VanEck $HODL: $ 3.3 m

WisdomTree $BTCW: $ 0

Hashprice revisited its all-time low last week, falling to $44.31/PH/Day, despite a 5% downward difficulty adjustment on the 4th of July.