Leveraged traders in bullish #bitcoin and cryptocurrency positions suffered liquidations of more than $1 billion this week.

This liquidation volume has not been seen since the beginning of July, when BTC touched $56,000.

Despite these volumes of bitcoin liquidations, ETH traders have been the hardest hit in the last 24 hours. Its liquidations narrowly exceed those of BTC in that period.

The cause behind this drop is that giants in the hardware manufacturing industry are having multimillion-dollar losses, dragging mining equipment manufacturing companies with them.

NEW: 🟠 Almost 94% of the total #Bitcoin supply has now been issued 👀

💰 Bitcoin is set to close its worst week since the blowup of FTX.

According to statistics, August is a red month for #Bitcoin

Will this August be the same?

Block seeks to decentralize Bitcoin mining (Article)

The payments company Block, founded by Jack Dorsey, has taken its Bitcoin mining project a step further. In addition to developing a 3nm chip, the company plans to offer a complete mining system of its own, with the aim of decentralizing hardware supply and hashrate distribution.

🖋️Block completes development of its 3nm Bitcoin mining chip.

🖋️Collaborate with a leading foundation to complete the design.

🖋️The company plans to offer both the standalone chip and a complete Bitcoin mining system.

🖋️Block seeks to overcome obstacles such as the limited availability and high cost of mining equipment.

I attach the link to said article so that you can continue reading it if it is of interest to you.

Goku from dragon ball in super saiyin #inkblotart

How are the ETFs creating the range, profiting from the #Bitcoin range, accumulating Bitcoin, as well as suppressing the price in the range.

Bitcoin ETFs using market makers like Jane Street are indeed involved in a popular trading strategy known as the "basis trade" or "cash-and-carry trade." This strategy involves buying (accumulating) spot #Bitcoin and short-selling @CMEGroup #Bitcoin futures contracts, aiming to profit from the price discrepancy between the spot and futures markets.

Here we see the Dealer shorts used to manipulate the price into the range 60-70k, accumulation of spot Bitcoin and profiting from the created spread.

Is it moral? Who knows.

Is it legal. Yes. The @SECGov allows this trade on all regulated ETFs with Futures contracts.

💵 💵 💵 50,000,000 #USDC (50,058,301 USD) minted at USDC Treasury

🚨 🚨 🚨 50,000,000 #USDC (50,000,000 USD) transferred from USDC Treasury to #Coinbase

JUST IN: 🇺🇸 The Strategic #Bitcoin Reserve bill has been officially introduced 🙌

🔴The new normal has come to Europe to stay.

https://video.nostr.build/d3cb00125bef27757a5cd331074b52a79e458d558d8ed2b46f813e949dc87dbb.mp4

🔴 BITCOIN MOMENTARY LOSES $60,000.

Probably

🟠 Long-term #Bitcoin HODLers are buying the dip, adding over 110,000 $BTC in July to their wallets! 👀

Weekly $BTC ETF flows = -$82.3m

#BTC daily

imagine capitulating here

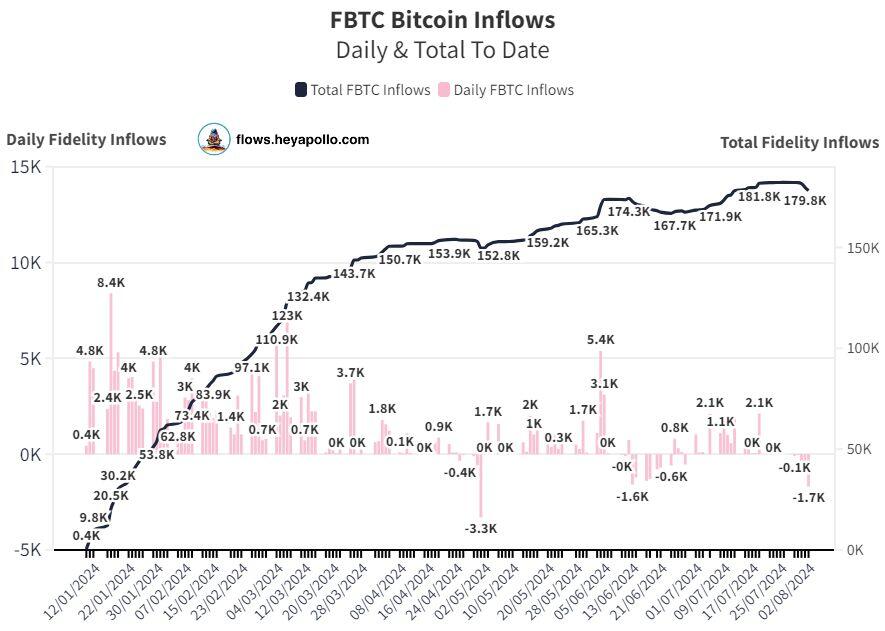

🚨Fidelity Sells 1680 Bitcoin

Bitcoin is built for this moment.

What's spooking them?

🚨Blackrock Buys the dip!

Buying 683 Bitcoin yesterday