ICYMI: 🇸🇻 While the world bleeds El Salvador bought more #Bitcoin yesterday 🙌

The Bitcoin Miner Balance reached the lowest level since April 2019.

At 1.8M BTC, miners now hold around 6k more coins than the all-time low in Bitcoin's modern history.

After 9 straight months of miner selling, this sell pressure has started to ease up.

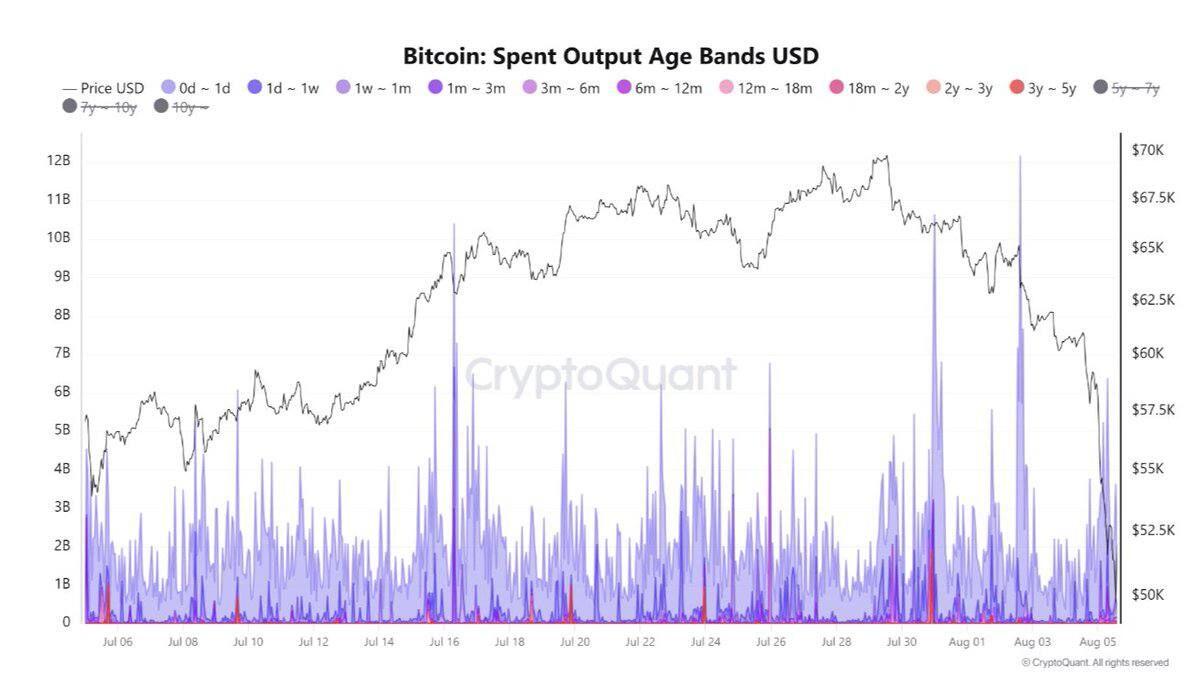

Short-term holders moved more than 💵$5. 2B of #Bitcoin in a week.

In contrast, long-term holders largely held on to their BTC.

Of the $850 million in realized losses, only $600,000 came from long-term holders.

⚫ Stock market turmoil

— The US capital market lost more than $3 trillion in a single day, driven by the bursting of the AI bubble.

—$500 billion were lost overnight alone.

⚫ The Federal Reserve maintains current interest rates

— The Federal Reserve kept interest rates between 5.25% and 5.50%, which influenced market sentiment and liquidity.

— Without lowering rates, the market could take this as a bearish signal.

⚫ Mining reserves plummet amid ATH difficulty

– Bitcoin mining difficulty hit an all-time high, prompting miners to sell their reserves to offset costs.

– Bitcoin mining reserves are now extremely low since plummeting on July 15.

⚫ Kamala Harris' odds increase

— Crypto betting site Polymarket saw Harris' odds increase to 43% compared to Trump's 53%.

GAP around 58k already filed

BTC recently collapsed strongly, leaving a GAP around 62k5

The possibility of increasing fil GAP is 70-80%

Yesterday saw a record number of coins sold at a loss, comparable to the ban on mining in China and the collapse of the FTX exchange.

✊HODL

Global Liquidity breaking out now $106.47 trillion.

#Bitcoin clearly flushed my the manipulators to the Double Top target at $48000.

- They gave it their best but couldnt get past $49300

- Expect Bitcoin to chase the liquidity upward now.

The Bitcoin Fear & Greed Index reached the lowest level since July 2022, which was a few months away from the bear market bottom.

BTC 2020 vs BTC 2024

This is very reminiscent of the covid crash of March 2020 🧐

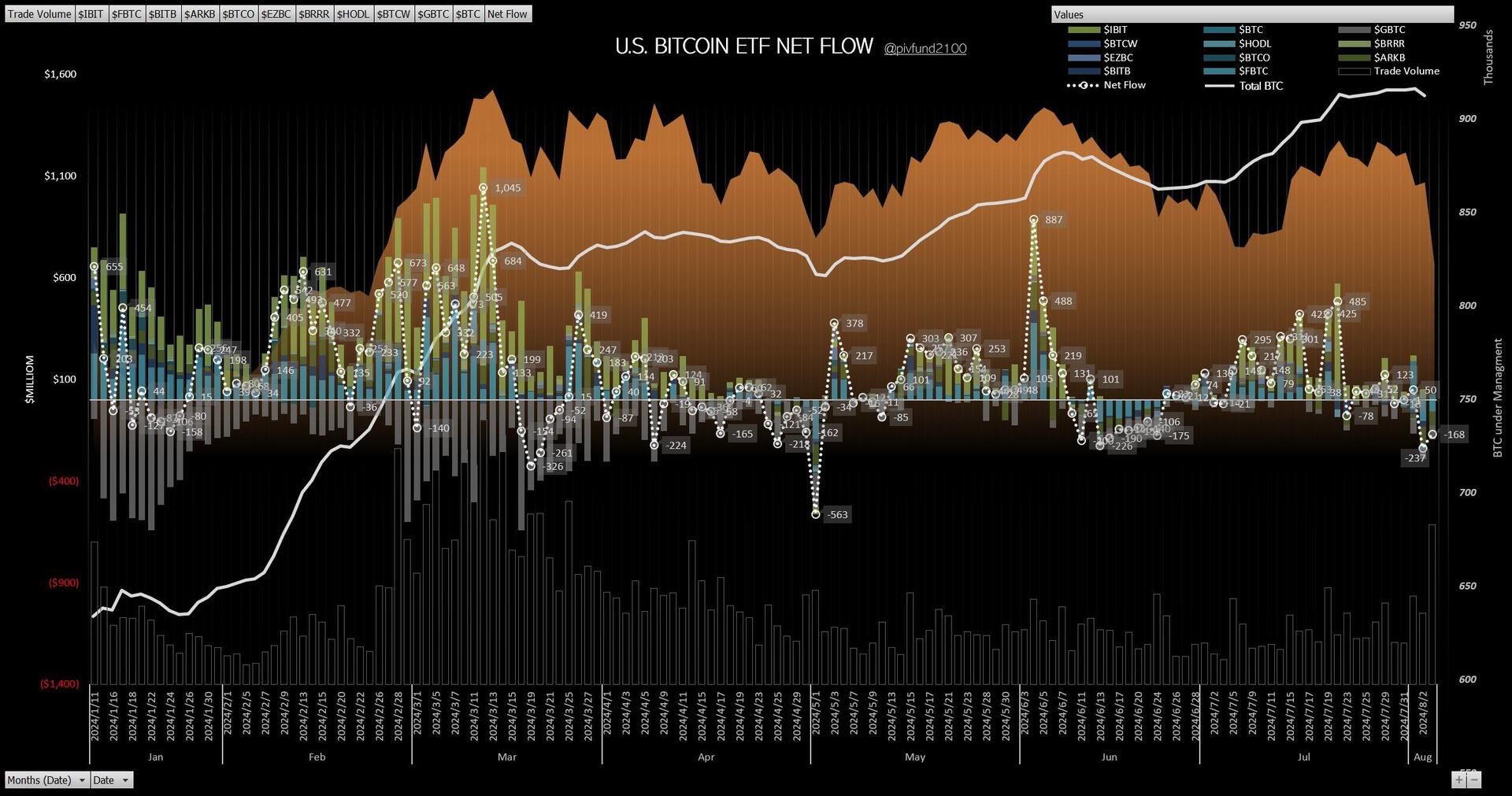

8/5 Bitcoin ETF Net Flow:$ -168.4 million

BlackRock $IBIT: $ 0 m

Grayscale $GBTC: $ -69.1 m

Grayscale mini $BTC: $ 21.8 m

Fidelity $FBTC: $ -58 m

Bitwise $BITB: $ 2.9 m

Ark $ARKB: $ -69 m

Invesco $BTCO: $ 0 m

Franklin $EZBC: $ 0 m

Valkyrie $BRRR: $ n/a

VanEck $HODL: $ 3 m

WisdomTree $BTCW: $ 0 m

🚨Fidelity Sells 1085 Bitcoin

Weak hands shaken out

Fear & Greed Index - Aug 06, 2024:

Today: 17 (Extreme Fear)

Yesterday: 26 (Fear)

Avg. 1W: 41 😕

Avg. 2W: 55 😁

Avg. 1M: 52 😁

Avg. 2M: 54 😁

Avg. 3M: 59 😁

Avg. 6M: 67 🤑

Avg. 1Y: 63 🤑

🔸 #Bitcoin

Price: $53,993

24h Low: $49,221

24h High: $58,164

MC Change: -$81.1B (-7.1%)

Dominance: 53.5%

24h: -7.2%

7d: -19.4%

14d: -20.0%

30d: -7.1%

60d: -23.8%

200d: 30.7%

1y: 85.8%

JUST IN: 🟠 BlackRock explains how Ethereum is no competition for #Bitcoin 👀

“Bitcoin is trying to be a global monetary alternative as a potential global payments system, ETH really isn’t trying to be that.”

- Robert Mitchnick, BlackRock Head of Digital Assets

https://video.nostr.build/0cd1a15e23da3d69fd4770aeba77088a07a71e6b2386dd80d5820e7c38ad264b.mp4

BREAKING: The #Bitcoin fear and greed index is now almost at "extreme fear" 👀

Buy and HODL #BTC ✊

🇺🇸Donald Trump: “Israel is going to be attacked by Iran tonight”

➡️During a live broadcast from Mar-a-Lago, the former president made this statement but assured that he had no secret information about the possible attack

MOST IMPORTANT BITCOIN UPDATE.

KEY BITCOIN LEVELS

I remember that in February #Bitcoin skyrocketed from 50k to 60k in days, unsustainable.

We completed it today.

NEW: #Bitcoin Implied Volatility Index Hit 3-Month High 👀