🇺🇸 FED SPEAKERS THIS WEEK:

• FOMC MEMBER BOSTIC (TUESDAY 1:15 PM)

• FOMC MEMBER MUSALEM (THURSDAY 9:10 AM)

• FOMC MEMBER HARKER (THURSDAY 1:10 PM)

• FOMC MEMBER GOOLSBEE (FRIDAY 1:25 PM)

https://video.nostr.build/a58c1c1e3021c2d54826472cc42ea012f10299ef4e825a5e22259f7276be1453.mp4

🇸🇻 El Salvador has the best performing emerging market bonds in the world.

✅ Put criminals in jail

✅ Crack down on corruption

✅ Growing economy

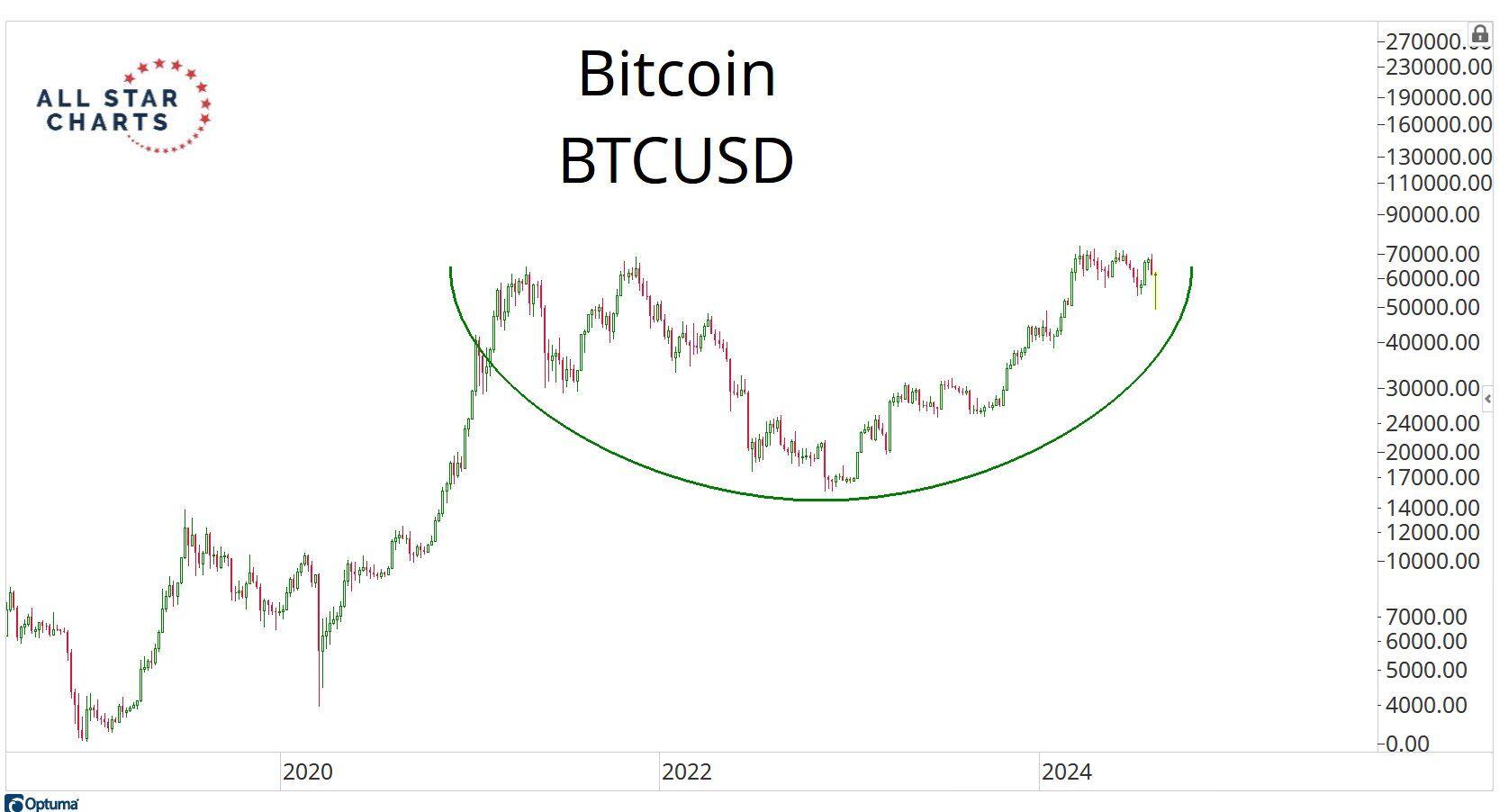

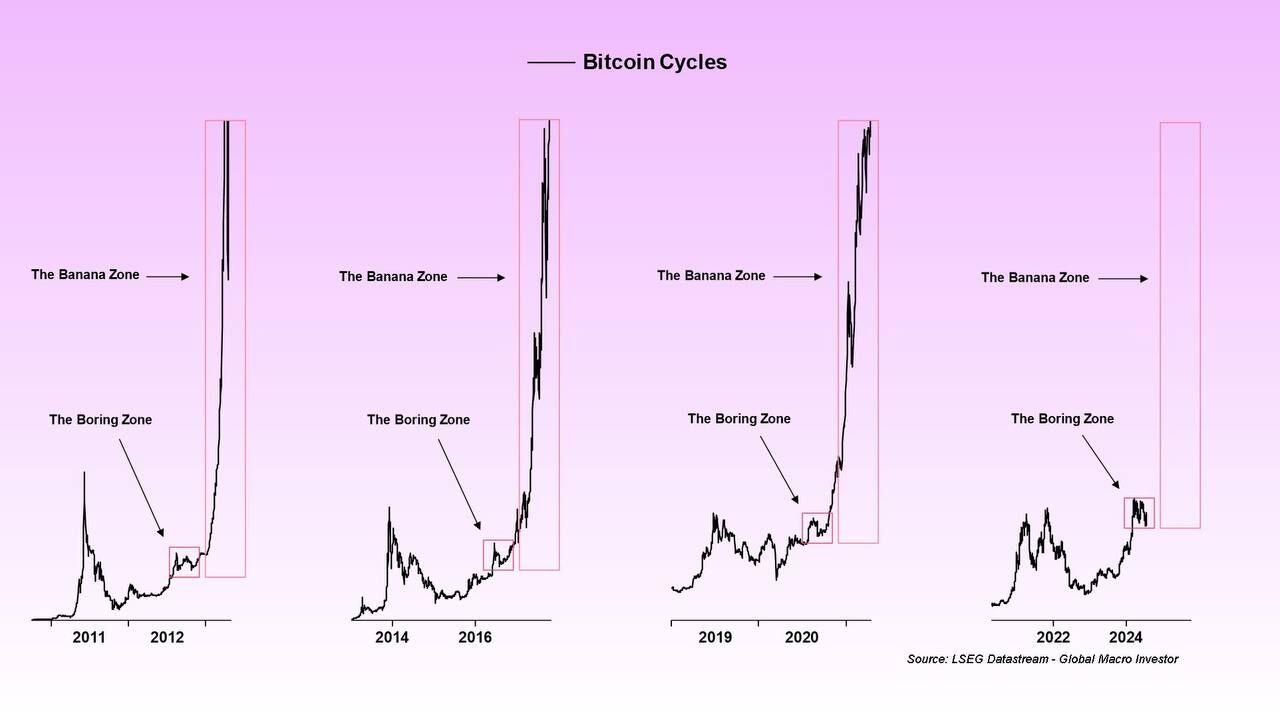

If you look at #BTC market cycles, as measured from the low, you can see we are at the same spot we are normally at in this phase of the cycle

Microstrategy's $BTC buying history & HODL balance 👇 $MSTR

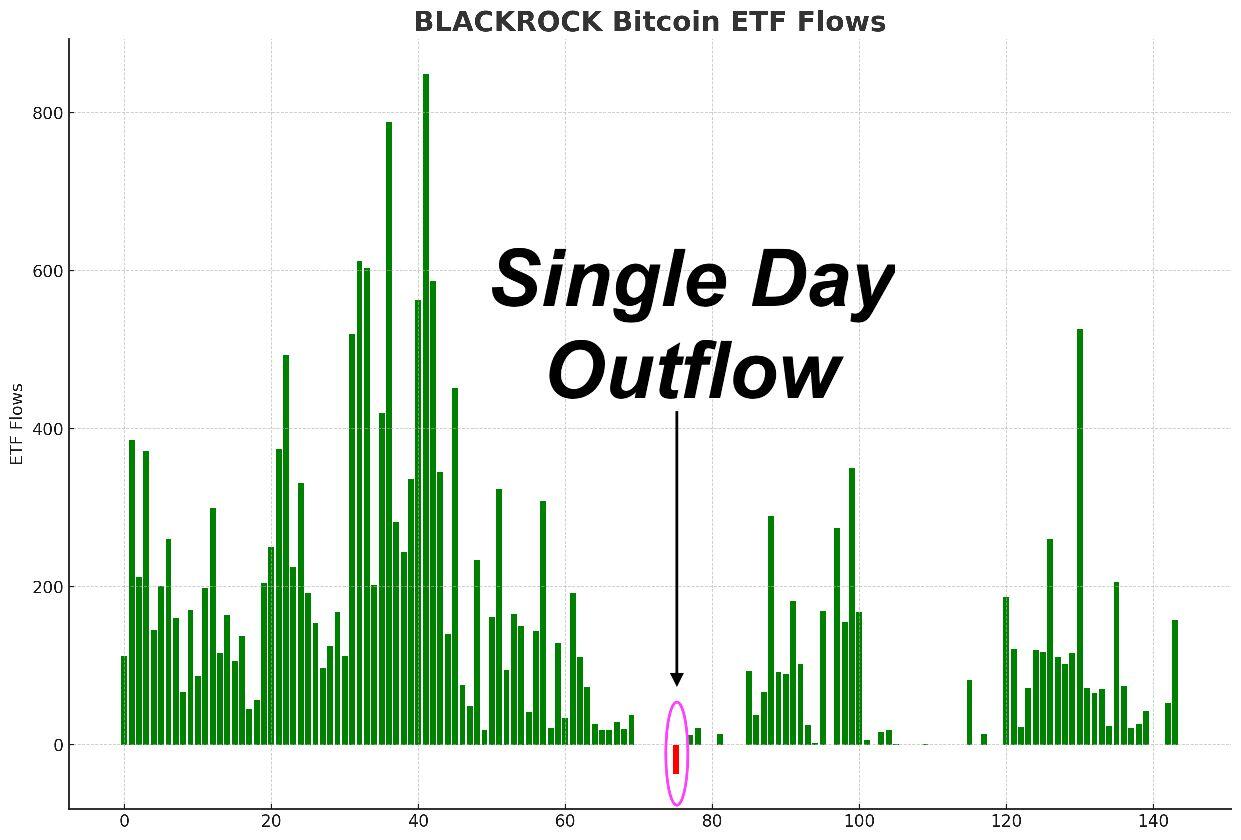

BlackRock's #Bitcoin ETF has had just 1 single day of outflows since launching in January.

+$20 BILLION locked up!

Bitcoin up over $10,000 off this week's lows. Look at this base

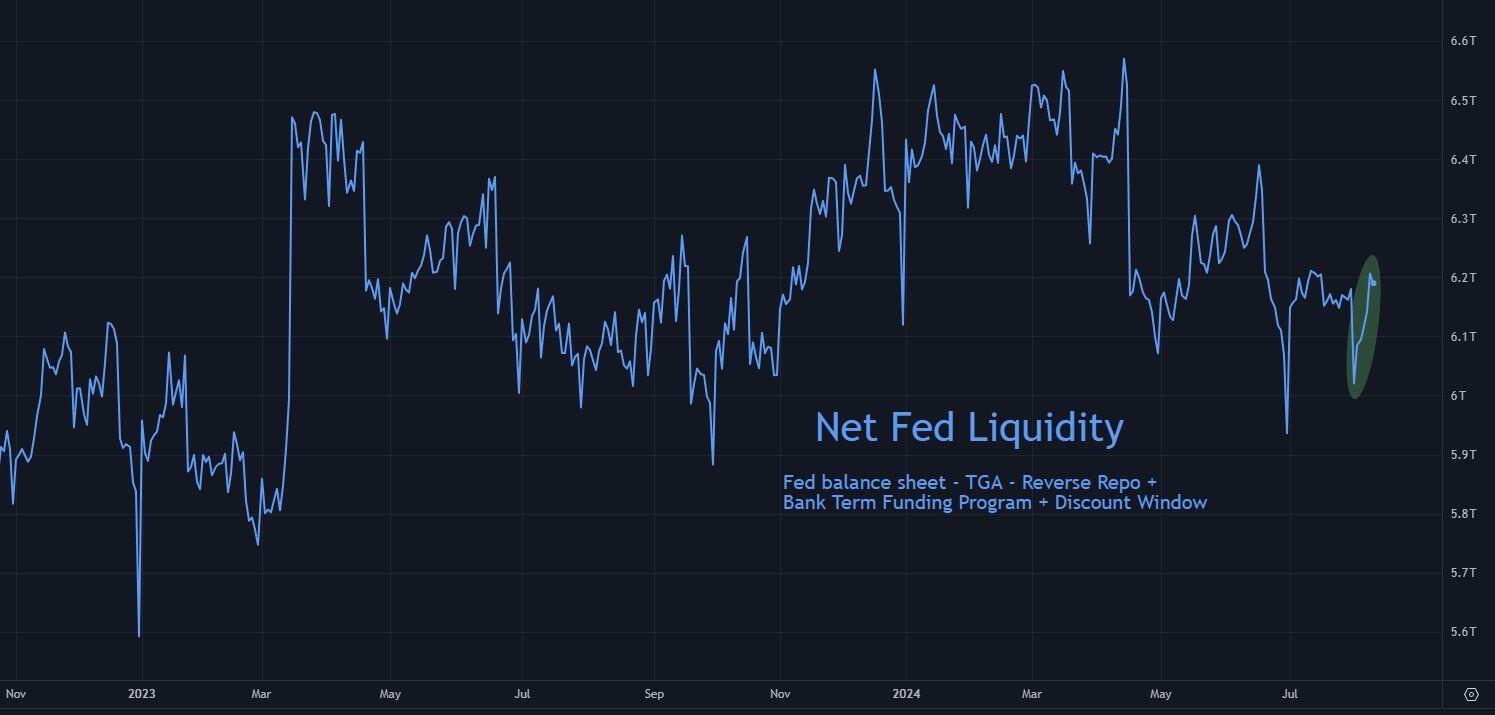

📈 Fed Liquidity rebounds strongly this week

Since falling by $160bn last week, Net Fed Liquidity has shot back up by $170bn [chart 1].

Without drawing a direct causation - it's interesting to note that both the S&P 500 (-3%) and bitcoin (-30%) fell through last week, and then both have rebounded strongly (so far) this week (S&P 500 +4% and bitcoin +22%).

The ongoing flood of new T-bills from the US Government has finally caused Reverse Repo usage to start falling notably (liquidity injection), and it's now at its lowest level since May 2021, breaking down from an eight month flatlining [chart 2].

The Treasury General Account balance has also decreased significantly by around $70bn (liquidity injection) [chart 3].

You can find a more detailed explanation of these points in the thread below.

As we move into September, it's likely things will start to get worse for Fed liquidity due to seasonal factors.

I'm still wary that Net Fed Liquidity is not showing enough upward momentum currently, and it's very likely to roll over in the second half of Q3, with a good chance it will fall to a new lower low by the end of September.

If this happens, the medium term downtrend that began in April 2024 will hold.

But I'm hopeful Q4 will be much better generally for Net Fed Liquidity.

For those following my Fed Liquidity Rhythm (thread in the comments) - we will be transitioning from a "favorable Fed liquidity environment" to an "unfavorable Fed liquidity environment" next week (August 15), lasting until September 31.

BTC needs to trade above EMA200 frame D to continue pumping

EMA200 can be considered the boundary between the uptrend and downtrend of BTC in this wave

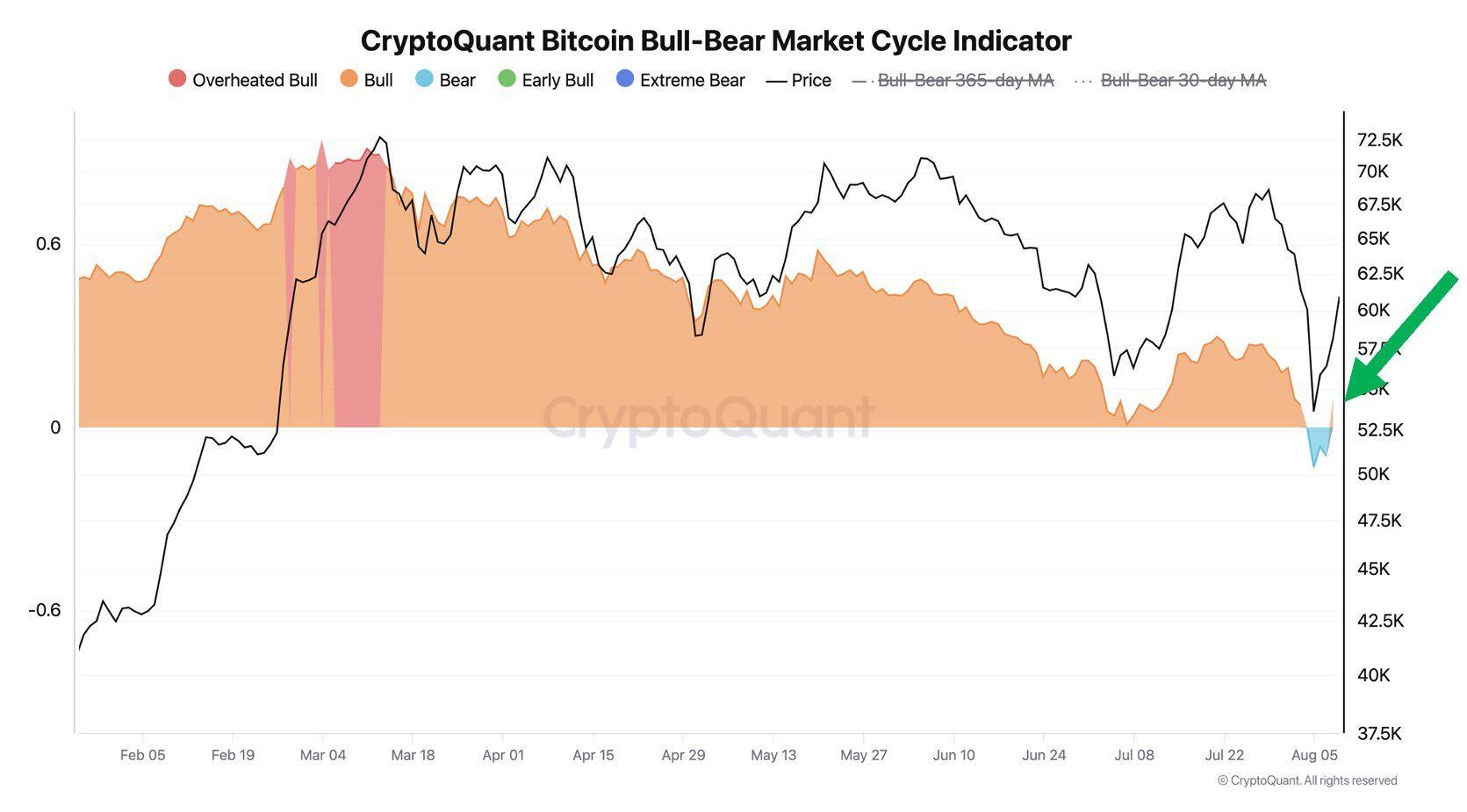

Most #Bitcoin on-chain cyclical indicators that were hovering near the borderline have now shifted back to signaling a bull market. BTC was discounted for only three days.

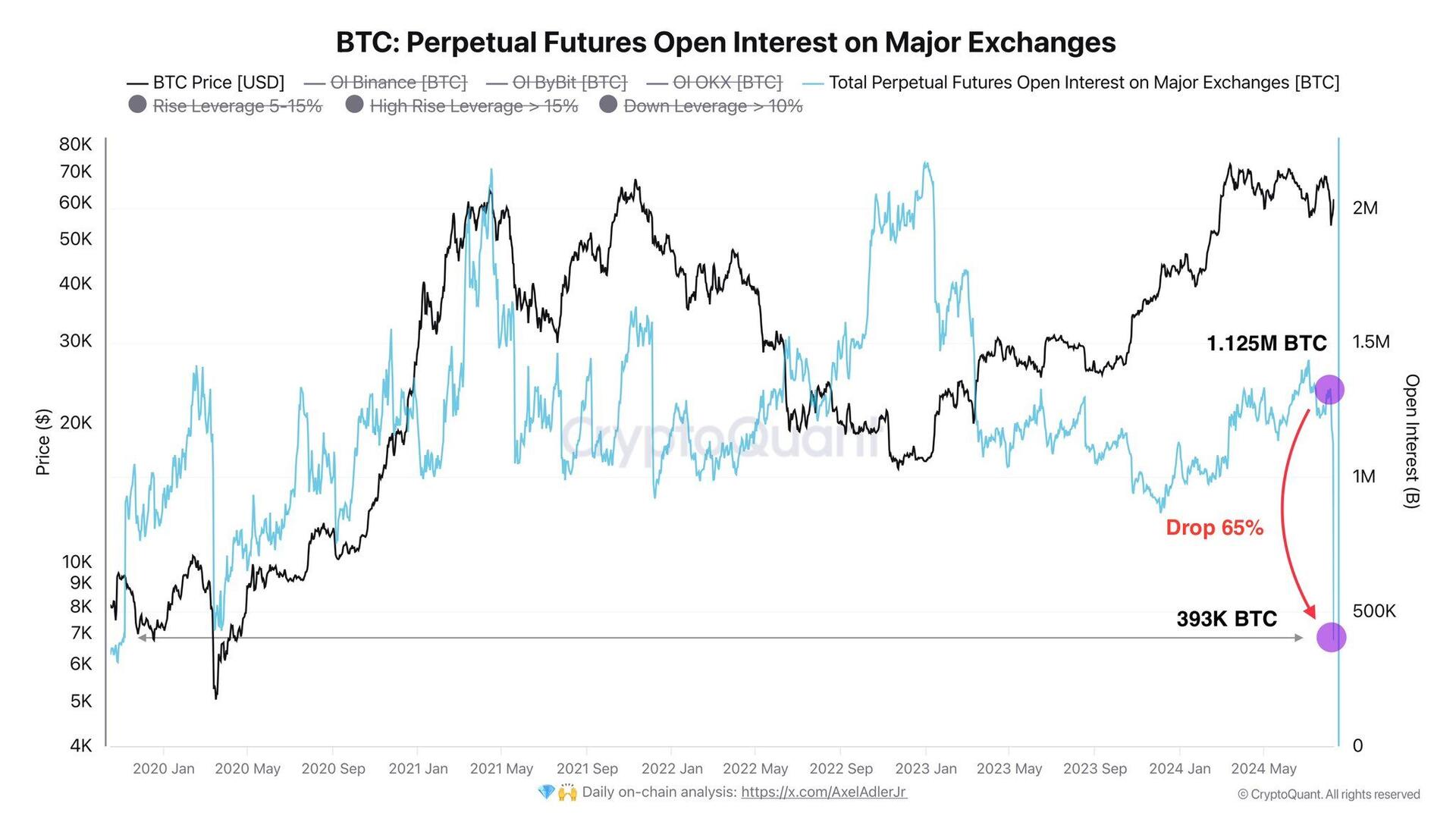

OI on the three major exchanges dropped by 65% in one day - this is the largest position closure in history.

We do not know whether these were short positions being closed or profits being taken on long positions. One thing is clear - traders are unwilling to take risks.

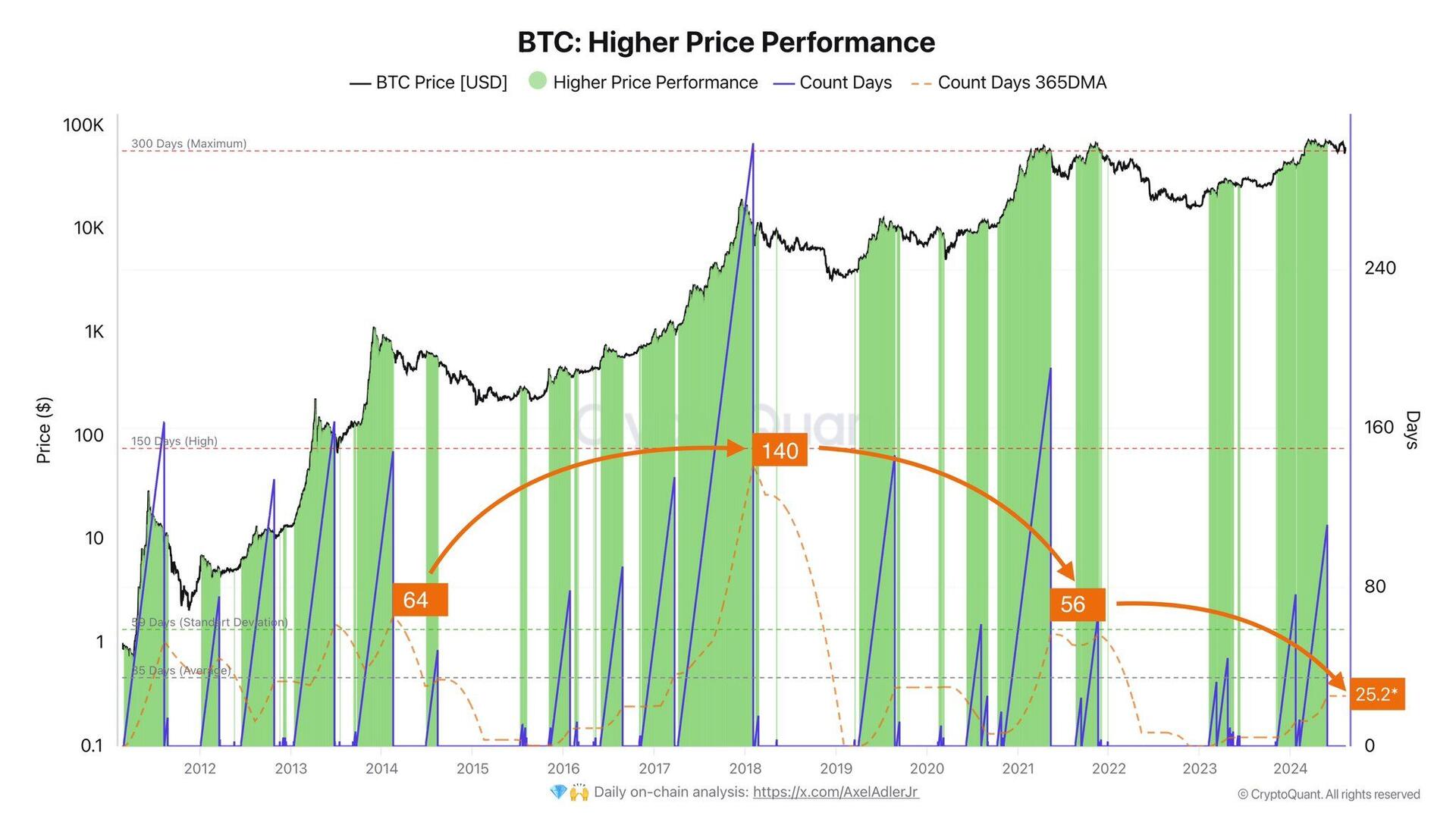

The average number of days with high price performance this year equals 25 days, compared to past cycles, which recorded 56, 140, and 64 days, respectively.

At a minimum, this cycle is expected to see a doubling in price growth.

Fear & Greed Index - Aug 11, 2024:

Today: 39 (Fear)

Yesterday: 40 (Fear)

Avg. 1W: 31 😣

Avg. 2W: 43 😕

Avg. 1M: 53 😁

Avg. 2M: 51 😁

Avg. 3M: 58 😁

Avg. 6M: 66 🤑

Avg. 1Y: 62 🤑

🔸 #Bitcoin

Price: $60,955

24h Low: $60,261

24h High: $61,495

MC Change: $1.2B (0.1%)

Dominance: 54.1%

24h: 0.2%

7d: 0.6%

14d: -10.6%

30d: 6.3%

60d: -9.7%

200d: 54.5%

1y: 107.0%

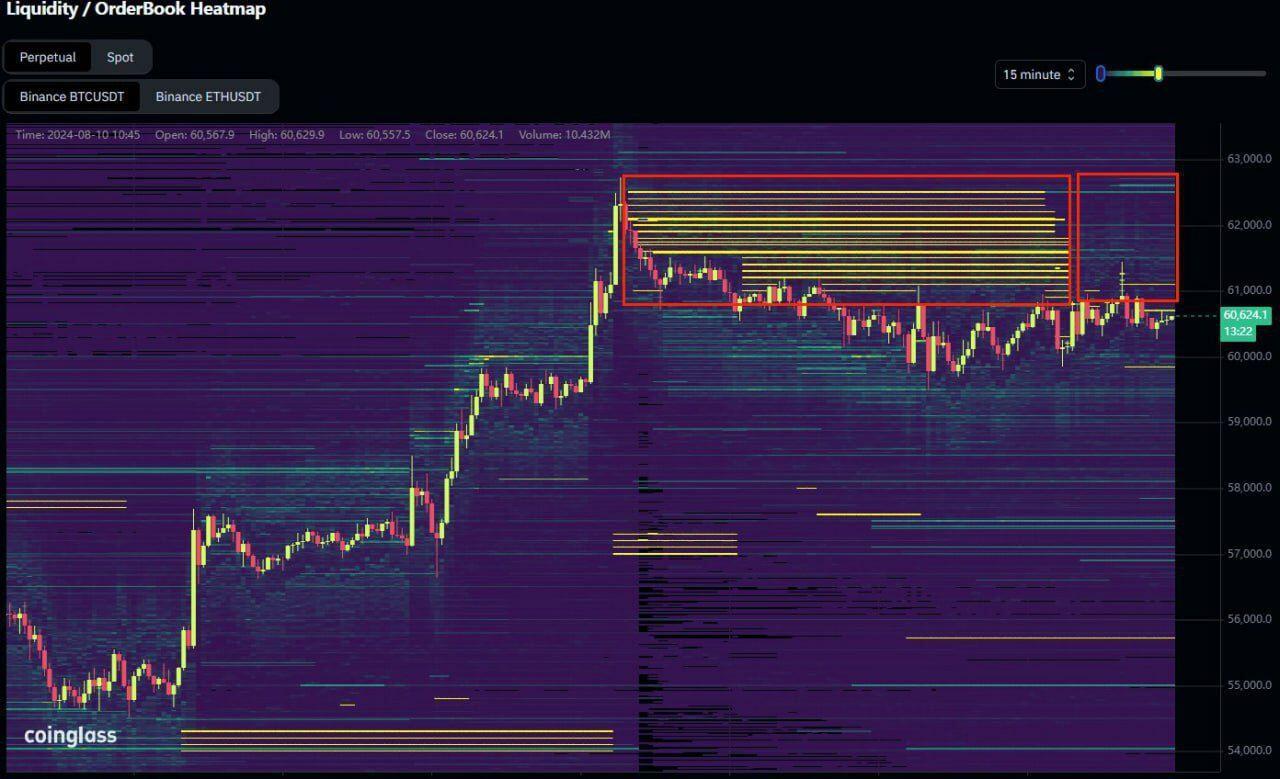

BTC Liquidity/Order Book Heatmap

The roughly $800 million BTC futures selling wall that lasted 22 hours disappeared.

Someone is manipulating the market.🤔

Adam Back on hodling Bitcoin

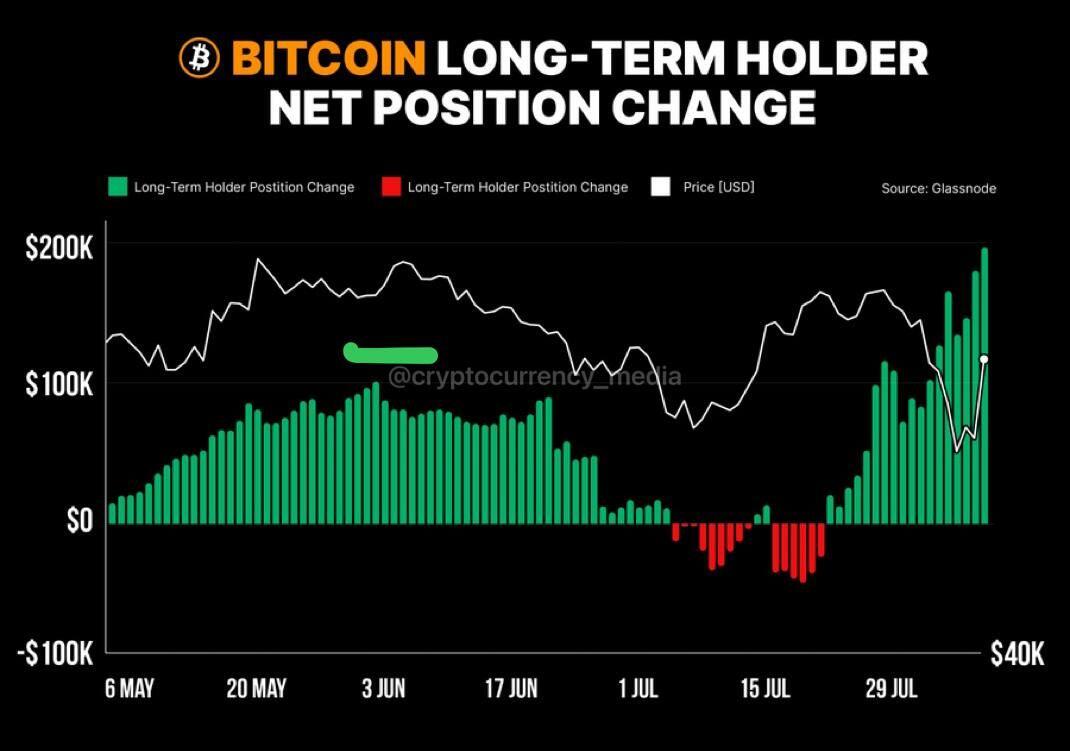

Long-term #Bitcoin holders bought over 184,500 #BTC worth $11.1 billion during the recent crash 🤯

Every cycle of BTC will have a big wave like this

But this cycle is a bit late, just a bit late, but it will definitely come

💰 Tether has issued 1.3 billion USDT since reaching the bottom on August 5th.

Typically, the issuance of fresh stablecoins is seen as investors' desire to buy back cryptocurrency. The newly minted USDT was sent to centralized exchanges.

Weekly $BTC ETF Net Flows = -$159.6m

When your friend asks you for the 69th time “is now a good time to buy #bitcoin or do you think it will go lower?”

https://video.nostr.build/eed36266ad6791a0b523a7ec780219dc1a145834cbeb48ffb4e193e368ba7dc2.mp4