Fear & Greed Index - Aug 15, 2024:

Today: 29 (Fear)

Yesterday: 30 (Fear)

Avg. 1W: 35 😣

Avg. 2W: 33 😣

Avg. 1M: 51 😁

Avg. 2M: 48 😕

Avg. 3M: 56 😁

Avg. 6M: 65 🤑

Avg. 1Y: 62 🤑

🔸 #Bitcoin

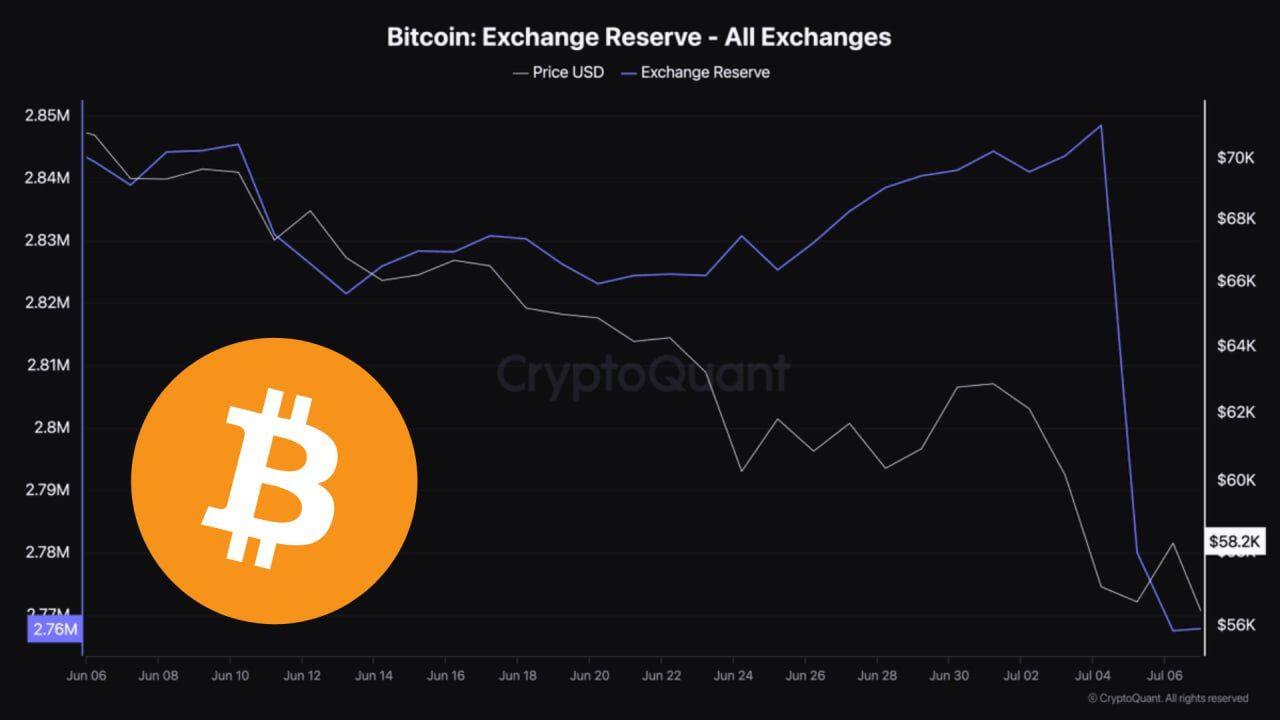

Price: $58,702

24h Low: $58,608

24h High: $61,538

MC Change: -$37.0B (-3.1%)

Dominance: 53.3%

24h: -3.1%

7d: 6.1%

14d: -9.3%

30d: -8.7%

60d: -11.3%

200d: 39.3%

1y: 99.7%

🚨🇺🇳🦠 WHO declares monkeypox (MPOX) a global public health emergency

NEW: 🟠 Bitcoin exchange reserves have hit a five-year low❗️

🏦🇺🇲July inflation report brings Fed rate cut closer to September, says WSJ's Timiraos

▶️ As Nick Timiraos of the Wall Street Journal noted, the July inflation report suggests that a rate cut by the Fed in September is all but guaranteed.

▶️ He says that this situation can also facilitate consensus among Fed members, avoiding dissent. However, there is still debate over the size of the initial cut, which could be 25 or 50 basis points, depending on upcoming labor market data.

▶️ He notes that an important question for the September meeting will be how many interest rate cuts the Fed plans for the rest of the year. If inflation remains contained, a three-cut scenario could become more likely.

Índice Fear/Greed - Crypto.

30/100 = Miedo

Global money supply is exploding up. Plus we just broke out of a massive 4 year consolidation. What do you think this means for Bitcoin?

NEW: BlackRock's #Bitcoin ETF reports its #Bitcoin holdings are worth more than $21 billion 👀

Very good day. Here's what you should know early this morning:

🔵 Today will be a Wednesday of high volatility for the price of bitcoin. Inflation data will be released in the United States, which could impact future interest rate cuts.

🔵 Goldman Sachs has invested USD 400 million in bitcoin through ETFs. The entity sees these BTC investment products as an “amazing success.”

🔵 Coinbase launches Bitcoin wrapped in Base, its own network. These are tokens that maintain parity with BTC. The move comes shortly after BitGo announced the diversification of WBTC custody to Hong Kong in a partnership with Justin Sun.

🔵 Bitcoin is also seen as a safe haven asset in Norway. The Norwegian Government's Global Pension Fund, considered the largest in the world, increased its indirect exposure to BTC by more than 400% in two years.

🚨 Fidelity Buys 370 Bitcoin

Tide is turning. Second inflow this month

🚨 Blackrock Buys 569 Bitcoin

Every F'n day 🫡

JUST IN: 🟠 Elon Musk is talking with #Bitcoin core developer Luke Dashjr on 𝕏 👀

Fear & Greed Index - Aug 14, 2024:

Today: 30 (Fear)

Yesterday: 31 (Fear)

Avg. 1W: 33 😣

Avg. 2W: 35 😣

Avg. 1M: 53 😁

Avg. 2M: 48 😕

Avg. 3M: 57 😁

Avg. 6M: 65 🤑

Avg. 1Y: 62 🤑

🔸 #Bitcoin

Price: $60,624

24h Low: $58,452

24h High: $61,540

MC Change: $24.7B (2.1%)

Dominance: 53.8%

24h: 2.2%

7d: 7.9%

14d: -8.4%

30d: -0.4%

60d: -8.2%

200d: 44.8%

1y: 107.0%

Owning 0.1 $BTC is a milestone many won't reach unless they start stacking NOW

🏅 Bitcoin occupies the sixth position in the ranking of the most valuable monetary assets in the world.

💷 The main cryptocurrency narrowly surpasses the pound sterling.

💴 However, to reach fifth place, it must surpass the Japanese yen and to achieve this it would have to almost quadruple its price.

A wallet that received $2.19 billion worth of Bitcoin from Mt. Gox has started test transactions.

This wallet is likely Bitgo, the fifth and final exchange platform working with Mt. Gox Trustee to distribute funds to Mt. Gox creditors.

The same wallet already transferred $1.97 billion worth of Bitcoin.

🔸$BTC The Bitgo company transferred 33,105 units of Bitcoin from the estate of the former Mt. Gox, approximately 2.19 billion dollars. 👀

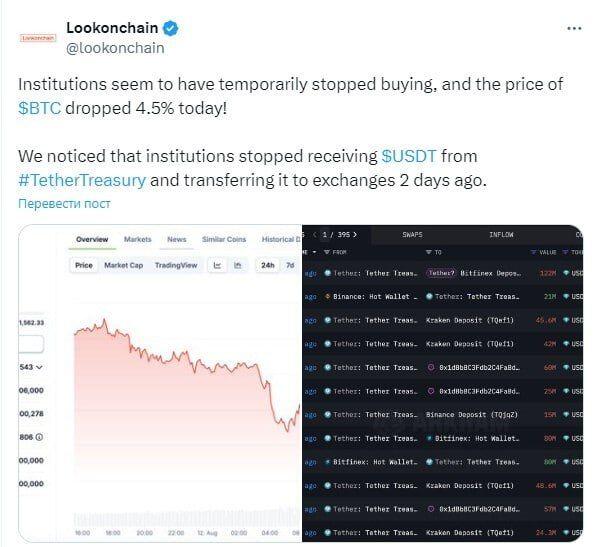

Lookonchain analysts have found the reason for bitcoin's price decline

Bitcoin has been looking to rise and consolidate above the $60,000 level lately, and crypto analyst TheMoonCarl believes that a break of this key resistance could lead to $125,000.

His more than bold prediction is based on a cup-and-handle pattern formation. TheMoonCarl cited the bitcoin price movement from 2021 to today as an example, emphasizing the formation of the cup part after BTC's decline in late 2021.

The cup part represents a period of consolidation and recovery where the bitcoin price gradually formed a rounded bottom, or a strong support level.

After the cup, the handle forms a brief period of consolidation or small correction, which bitcoin appears to be experiencing now. The analyst noted that if bitcoin successfully breaks out of this handle formation, and beyond the $70,000 level, the next price target could be $125,000. This figure is derived by adding the cup height to the breakout point.

Another analyst at TheScalpingPro opined that despite the recent volatility, bitcoin is capable of a bullish rally in the long term. In his opinion, bitcoin is forming a classic parabolic curve, often associated with strong bullish momentum.

The curve suggests that bitcoin could show rapid growth through each base with a potential peak target around $180,000. This parabolic rise could be followed by a sharp correction.

Bitcoin's current decline is partly due to a lack of interest from organizations in buying stablecoins. Analysts at the Lookonchain platform wrote on Aug. 12 that institutions stopped buying USDT two days ago.

This suggests a lack of buying pressure and a decline in investor interest in stablecoins, which are typically used as the primary way to transition from fiat currency to cryptocurrencies.

Si, ya te lo consigo

💰 84% of Bitcoin Holders Are Now Profiting