#BTC

History suggests that Bitcoin tends to breakout 150-160 days after the Halving

That would mean Bitcoin would breakout from its ReAccumulation Range in late September 2024

That being said, Average Historical Monthly Returns for September are -4.48%, with highest ever upside in the month of September being just +6%

Whereas for October those Average Monthly Returns are +22.9%

I wouldn't be surprised if Bitcoin consolidates just a little bit more beyond late September to achieve an October breakout

After all, October has always historically been a strong month

💰#Bitcoin 1D

This channel is still the main thing I'm watching on the daily timeframe.

It has respected the upper and lower boundaries on several occasions so far.

It's currently trading in the mid-range, which is pretty neutral.

🇺🇸 Bitcoin usually pumps after US presidential elections 👀

Are you ready for it anon?

Fear & Greed Index - Sep 01, 2024:

Today: 26 (Fear)

Yesterday: 29 (Fear)

Avg. 1W: 36 😣

Avg. 2W: 37 😣

Avg. 1M: 34 😣

Avg. 2M: 43 😕

Avg. 3M: 49 😕

Avg. 6M: 61 🤑

Avg. 1Y: 62 🤑

🔸 #Bitcoin

Price: $58,962

24h Low: $58,797

24h High: $59,404

MC Change: -$2.9B (-0.2%)

Dominance: 53.8%

24h: -0.3%

7d: -7.8%

14d: -0.8%

30d: -9.4%

60d: -4.9%

200d: 18.9%

1y: 126.7%

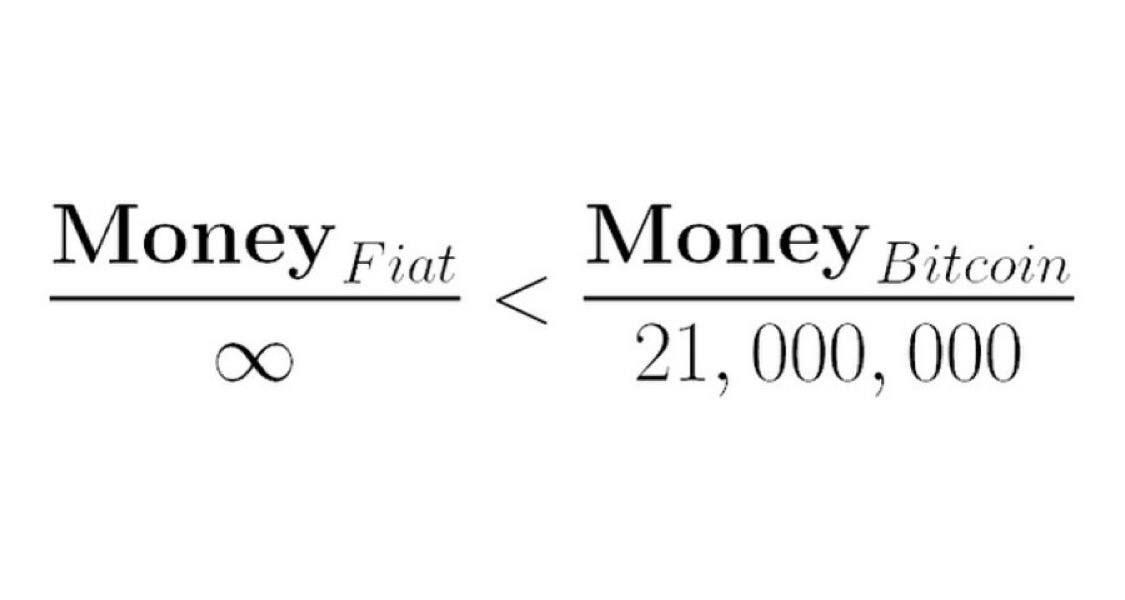

ANALYSIS: Over 94% of the total #Bitcoin supply has now been issued.

More than $6 Billion in liquidations of SHORT positions up to $65k.

The selling interest is currently at $61.5k.

If this price is exceeded, it is very likely that we will see a clearing of SHORTS in the form of a rapid movement.

💡Remember that the liquidation zones are ranges where retail traders have their liquidations, that is why the price usually looks for these zones, normally it is the institutions or Exchanges that liquidate to make money.

#Bitcoin Liquidity Heat Map Update

UBER CEO wants to accept #Bitcoin and #Crypto as a payment method🔥

Happy Friday! We share with you what you need to know to close this Friday of the last week of August.

🟠 Bitcoin is once again positioned below $60,000 and everything indicates that it will close August on the downside. Yesterday, bitcoin ETFs in the United States had their third consecutive day of money outflows, which negatively impacted the price of the digital currency.

🔵 Elon Musk and his company Tesla won the dismissal of a federal lawsuit that accused them of defrauding investors by promoting the Dogecoin cryptocurrency and carrying out operations with privileged information.

🔵 Donald Trump, the US presidential candidate for the Republican Party, launches a new cryptocurrency project called World Liberty Financial. Although there are not too many details yet, it would be a decentralized finance (DeFi) platform.

JUST IN: 🇺🇸 Donald Trump warns Facebook and Instagram CEO Mark Zuckerberg that he will face life in prison if he commits any illegal act during the 2024 election.

This after Zuckerberg admitted that he censored information at the request of the Biden-Harris administration.

🚀 El fundador de Cardano $ADA, Charles Hoskinson, está desaparecido 😳

It's no coincidence that this #Bitcoin correction has hit the exact same engulfing strength levels as the low from the same high in September 2016.

Cycles remain undeniably linked when they alternate.

Cycle 1 hit the same mid-cycle correction levels as cycle 3, and now our current cycle is copying the second one.

What does this mean to you?

Being here now is like being there in September 2016, just before the smooth parabola of the crypto curve.

This cycle wants to trick us into believing it's different, but the traces it leaves behind are all the same.

The FBI may know Satoshi's identity

Disinformation analyst and tech entrepreneur Dave Troy took to social media X to report that the Federal Bureau of Investigation (FBI) has provided its response to yet another Freedom of Information Act (FOIA) request regarding the identity of tech entrepreneur Satoshi Nakamoto.

In its latest response, the FBI doubled down on its allegations that Satoshi may have been a “third party person.”

As Troy noted, this is the response usually given when inquiries are made about foreign nationals.

Troy believes that the FBI may indeed know Satoshi's identity, and it has been reluctant to admit that it has certain records related to the elusive Bitcoin creator.

On the other hand, the FOIA office may have misinterpreted Troy's request.

As U.Today reported, the FBI broke its silence on Satoshi's identity in early August after Satoshi's initial request.

Troy's ultimate goal is to get as much information as possible from the U.S. government about the Bitcoin creator.

Throughout the years, the cryptocurrency has discussed countless candidates for Satoshi. Of course, the late computer scientist Hal Finney, who received the very first bitcoin transaction, is at the top of the list because of the many factors that seem to indicate that he was the man who started it all. However, there are also some facts that suggest Finney is unlikely to be Satoshi.

Pavel Durov, founder of Telegram, has been released from police custody, which had held him under arrest since the 24th, and has been transferred to the custody of the court, which will begin questioning him on the charges against him.

Durov was arrested on August 24 at Le Bourget airport outside Paris, after getting off his private jet.

NEW: 🟠 Publicly listed companies' #Bitcoin holdings have surged 178% in a year, reaching 💵 $20B.

42 firms now hold 335,249 BTC, up from $7.2B a year ago.