Long term Bitcoin holders are aggressively buying!

Over the past 2 months, long term holders have accumulated more BTC than in any other period in the past 3 years.

Someone knows something...

Bulls need to push $BTC up above 65.1k to cancel the hidden bearish divergence on the daily and print a higher high, else we're still going to print that E wave back towards 58k #Bitcoin

Bitcoin Weekly RSI Marks an “Intermediate” BTC Price Target of $85,000

Bitcoin Market Forecasts Increasingly Bullish, But One Trader Says More Evidence of a BTC Price Reversal Is Needed

💰#Bitcoin in the daily is still in this narrow channel range

For the first time in months, $BTC has formed a higher low

The fourth quarter will be important 👀

💰$BTC on 3 month chart looks good here 👀

Something big is coming in the next few months.

Fasten your seatbelts 🤝

#Bitcoin Bottom to Top vs. 4 & 8 Years Ago

Current Price: $63,069

Price 4 Years Ago: $10,411 (Scaled: $51,509)

Price 8 Years Ago: $595 (Scaled: $53,273)

as of 09/21/2024 $BTC #BottomToTop #BitcoinChartBot

Bitcoin needs to rise above $64K - formally, we will transition from a macro Bear market to a Bull market.

The 200-day SMA needs to become support rather than resistance.

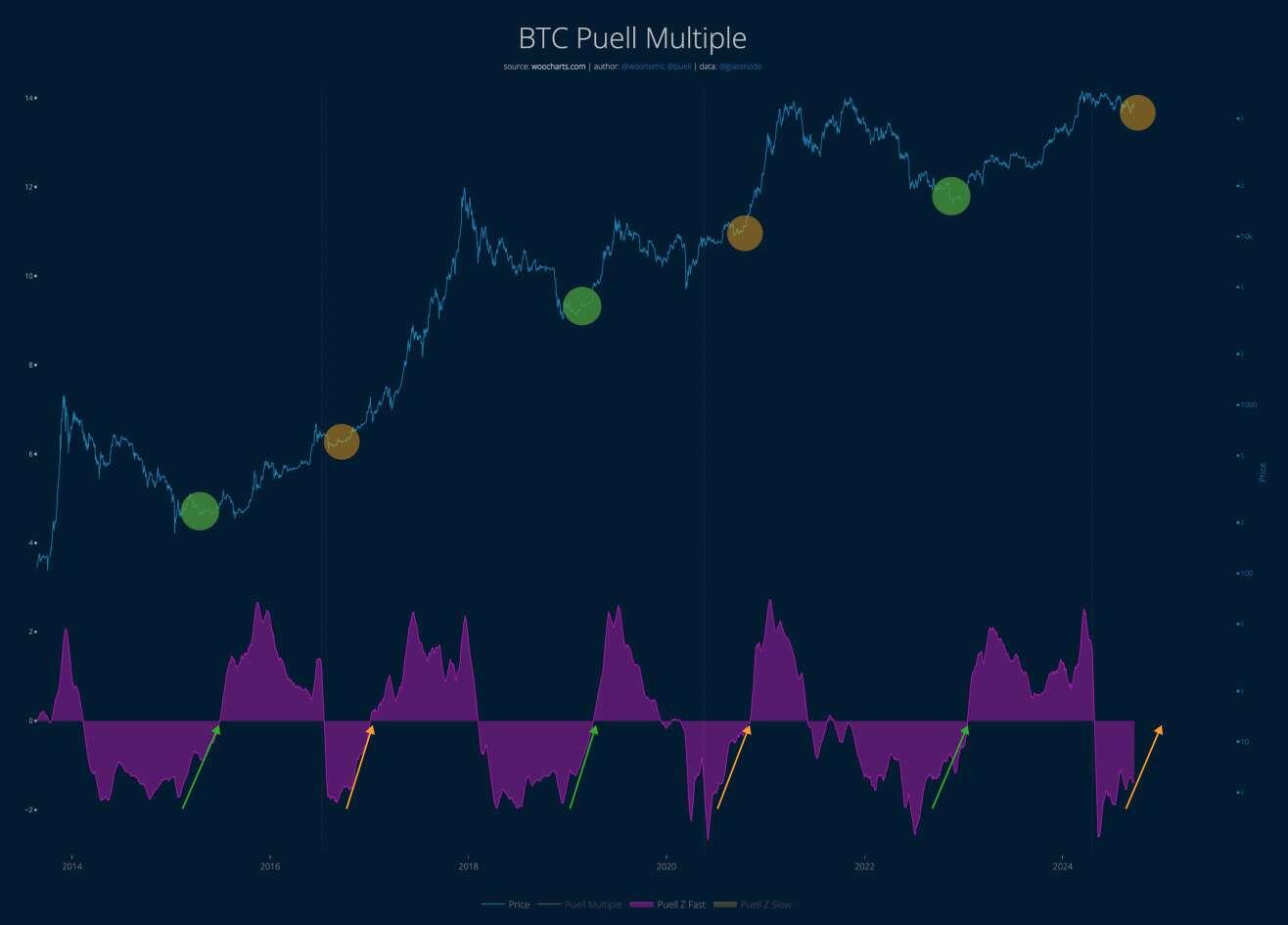

Famous quote from Dr Puell.

"The best time to buy #Bitcoin is at the bottom, the second best time to buy is at the post halving re-accumulation"

He didn't say it in words, he said it in numbers.

I've cleaned his model up to say it a bit clearer.

MicroStrategy bought 7,420 BTC after selling $1 billion in bonds

MicroStrategy reported the purchase of an additional 7,420 BTC for $458.2 million at a price of ~$61,750 following the sale of $1.01 billion in convertible senior notes due 2028 at 0.625% APR.

The net proceeds from the sale of the securities totaled approximately $997.4 million. $500 million will be used to redeem the remaining principal amount of the senior secured notes due 2028 with a coupon rate of 6.125%.

Upon redemption, the securities' collateral, which is approximately 69,080 BTC, will be unlocked.

The rest of the money was used for bitcoin purchases and corporate purposes. The firm already holds 252,220 BTC on its balance sheet, purchased for $9.9 billion at an average rate of ~$39,266 per coin. Their value at the current first cryptocurrency price of $62,900 is ~$15.86 billion.

On September 16, MicroStrategy announced a $700 million securities offering to “acquire additional bitcoins and fund general corporate purposes.” The target threshold was later raised to $875 million.

The notes will mature on September 15, 2028, unless redeemed or converted early. Subject to certain conditions, on or after December 20, 2027, the company may redeem all or any portion of the issue for cash.

Holders will have the right to require MicroStrategy to redeem all or any portion of their securities on September 15, 2027.

At maturity, holders may convert the notes into cash, MicroStrategy's Class A common stock or a combination thereof at the issuer's option.

As a reminder, on September 13, MicroStrategy reported the purchase of an additional 18,300 BTC for $1.1 billion.

For BlackRock, bitcoin (BTC) has the potential to become a unique hedge against economic and geopolitical risks.

🔍 In its latest report, the firm highlights how Bitcoin outperformed gold and the S&P 500 in times of crisis such as the COVID-19 pandemic or the war between Russia and Ukraine.

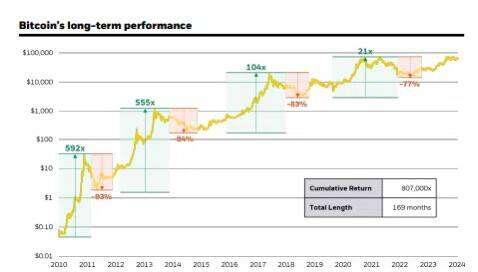

📈 Despite its volatility, BTC has been the highest-performing asset in 7 of the last 10 years, with annualized growth of more than 100%.

Bitcoin has officially broken through the STHCB and is now over $63K.

Next step, the 200DMA at $64K.

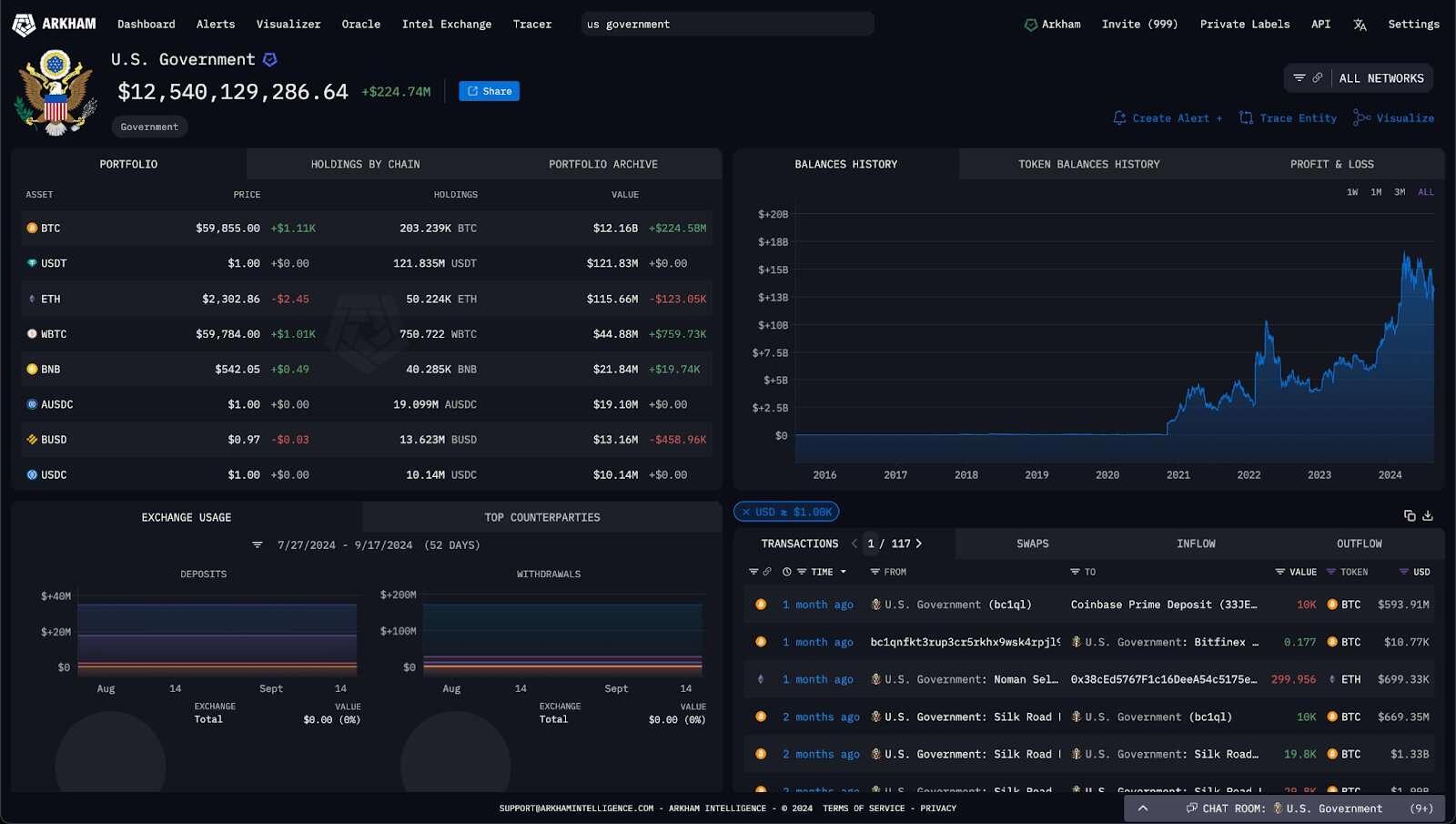

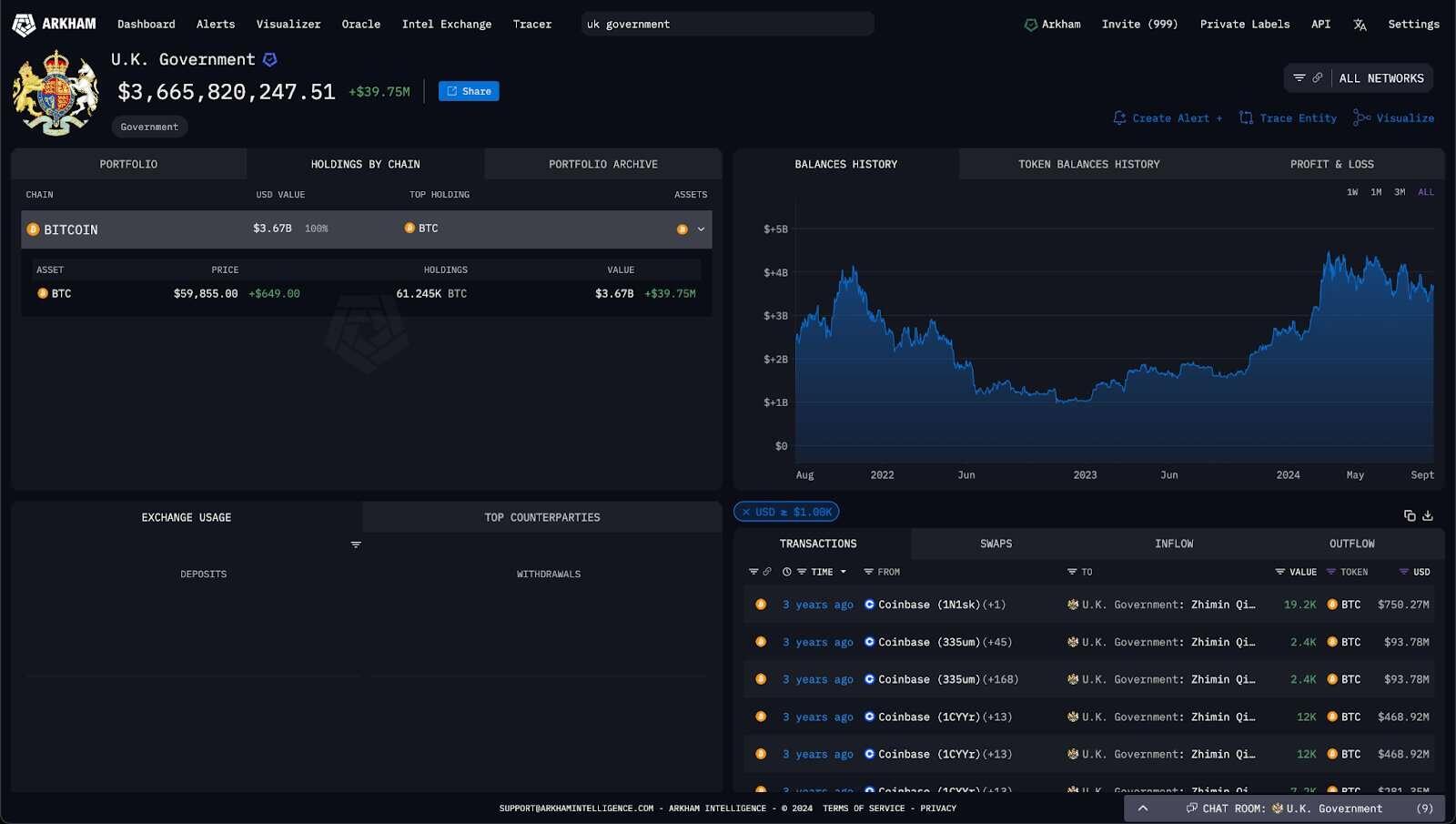

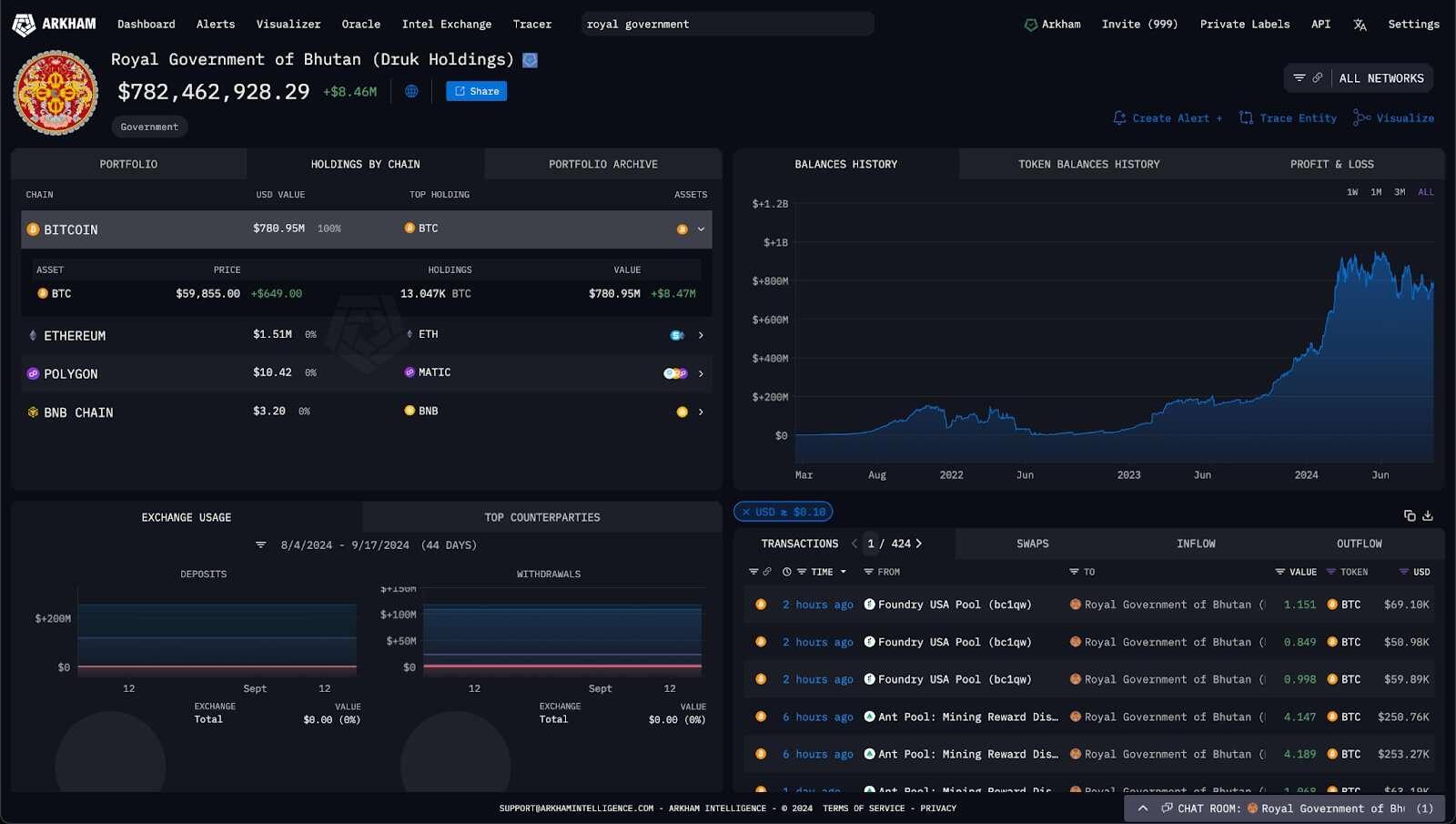

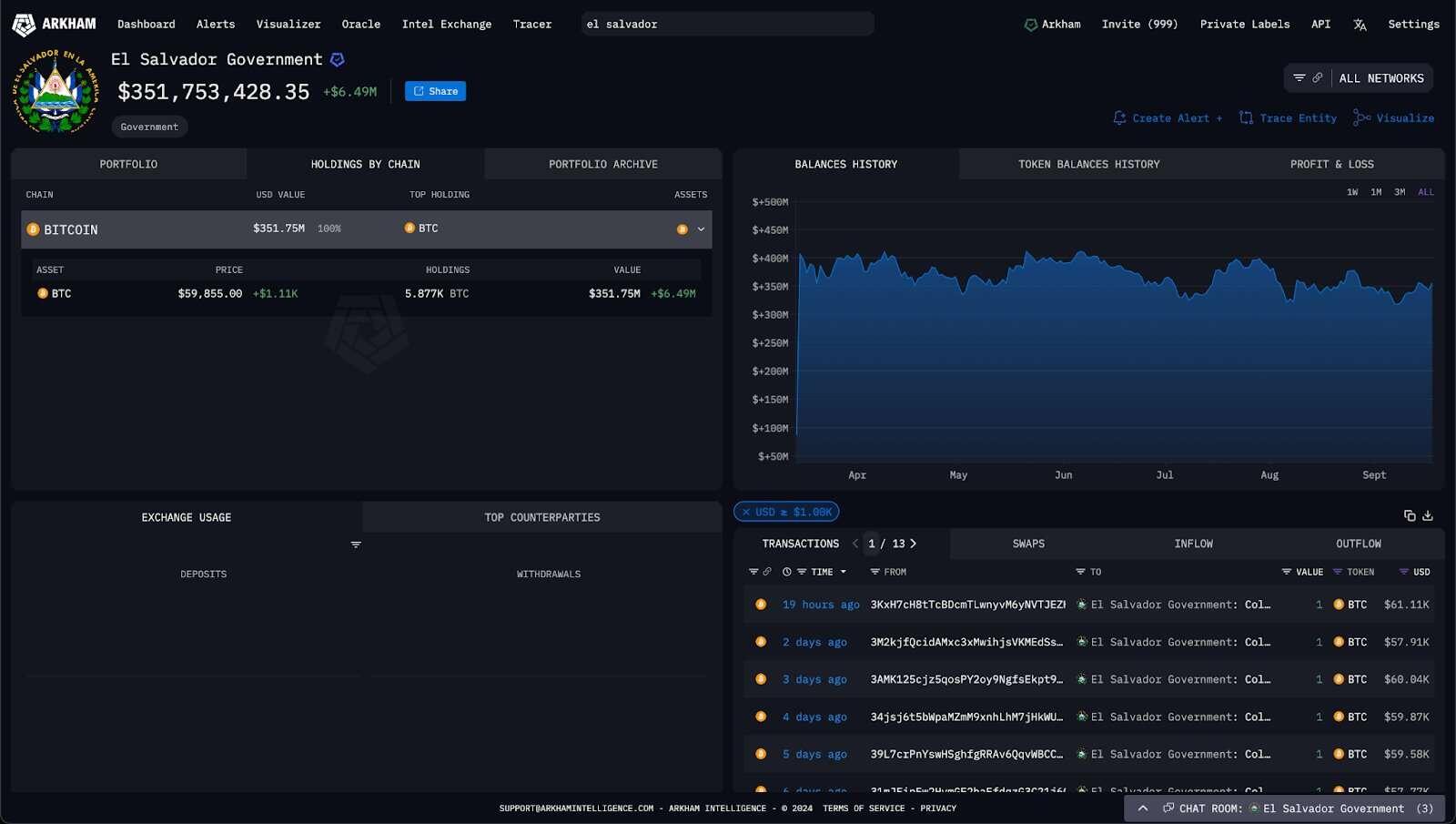

ARKHAM GOVERNMENT BITCOIN HOLDINGS LEADERBOARD

1. United States - $12.16B

2. United Kingdom - $3.67B

3. Bhutan - $782.46M

4. El Salvador - $351.75M

Honorable Mention - Germany - ZERO (down from $3.56B)

Breaking out of re-accumulation.

Like clockwork. #Bitcoin

#Bitcoin is still playing out similarly to the summer of 2023.

Months of chop, finding a bottom in early September, and slowly grinding up now.

Should accelerate towards the end of the month, leading to new highs in October if this plays out the same.

I'm pretty sure it will.

#Bitcoin Bottom to Top vs. 4 & 8 Years Ago

Current Price: $62,337

Price 4 Years Ago: $11,077 (Scaled: $54,804)

Price 8 Years Ago: $609 (Scaled: $54,526)

as of 09/19/2024 $BTC #BottomToTop

GM✌️

Resistance

- STH 3M-6M Realized Price: $67.1K

- 200D SMA: $64K

- STH Realized Price: $62.8K

Support

- STH 1M-3M Realized Price: $61.8K

- STH 1W-1M Realized Price: $58.8K

- 365D SMA: $53.3K

Breaking above $67.1K opens the path to a new ATH.

Happy Thursday. We wish you a good start to the day, while keeping you informed with what you need to know this morning:

🔵 With more than 4% up in the last 24 hours, the price of #Bitcoin is above $62,300.

🔵 The rally in #BTC occurred after the announcement of the Fed's interest rate cut. Expectations have become more bullish in the medium term as a result of this decision.

🔵 #Litecoin and #Dogecoin mining is currently more profitable than Bitcoin. These are less demanding networks that allow older and less powerful equipment to be profitable.

Fed cuts interest rates by 50 basis points, Bitcoin briefly hit $61k

The U.S. Federal Reserve cut the benchmark federal funds rate by 50 basis points to 4.75% -5%, the first rate cut in four years after the central bank's most aggressive interest rate hike cycle.

Fed members expect median benchmark rates to fall to 4.4% by year-end, reflecting about 50 more basis points of cuts at the next two Federal Open Market Committee (FOMC) meetings, according to the Fed's quarterly economic forecast. This is higher than just ONE more cut projected in June.

Within minutes of the FOMC decision, the price of Bitcoin (BTC) jumped 1.2% to $61,000 before resetting gains. The largest Cryptocurrency fell 0.5% in the last 24 hours. U.S. stocks also jumped higher, with the tech-heavy Nasdaq up 0.8% and the S&P 500 rising 0.6%. Gold mostly stayed below $2,600.

Markets were widely expecting a looser monetary policy from September, as Chairman Jerome Powell said at a symposium in Jackson Hole last month that “it is time for a policy adjustment” in light of lower inflation and rising unemployment. However, traders were divided on whether the Fed would cut rates by 25 basis points or opt for a larger 50 basis point cut. Before Wednesday's decision, the market was pricing in a 40% chance of a smaller cut and a 60% chance of a larger cut, the CME FedWatch Tool showed .

The uncertainty set the stage for a volatile session. Crypto Maker Wintermute predicted Bitcoin price swings of 2%-3% in either direction after today's decision.

Arthur Hayes, co-founder of BitMEX and IT director at Maelstrom, said in an interview with CoinDesk that a Fed rate cut could crash the Markets due to the narrowing borrowing rate differential between the US dollar and the Japanese yen. This would cause investors to unwind their yen-based trades en masse. Notably, the same dynamic triggered the collapse of stocks and digital assets on August 5 , which briefly pushed BTC below $50,000.

Further clues as to policymakers' thinking will come soon when Chairman Powell holds his post-meeting press conference, which begins at 2:30 p.m. ET.

🚨ARK Sells 718 #Bitcoin

Looks like they sold the bottom 🤷♂️

💰#Bitcoin 1D

Finally a breakup

Next resistance area of $63,500 – $64,000