RHR 343: THE SECOND AMERICAN REVOLUTION WITH nostr:nprofile1qyv8wumn8ghj7urjv4kkjatd9ec8y6tdv9kzumn9wsq3vamnwvaz7tmjv4kxz7fwwpexjmtpdshxuet5qqsqfjg4mth7uwp307nng3z2em3ep2pxnljczzezg8j7dhf58ha7ejgqgzx3h AND nostr:nprofile1qy0hwumn8ghj7cnfw33k76twd4shs6tdv9kxjum5wvhx7mnvd9hx2qg4waehxw309ajkgetw9ehx7um5wghxcctwvsqzq3e0gs8jnmued6f2rp4c6vs07xqvs4vs8zpwt82smcdch4txjvq76kl2yj

https://cdn.satellite.earth/3a8047d012f99341786dc636816a940cc05ffe3cd1463ad385bdfe955a45f4a0.mp4

Great Rabbit Hole Recap. nostr:npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx one thing I am really curious about - while USDT on LN may not be ideal for everyday payments, wouldn’t it be a huge breakthrough for Bitcoin-backed loans?

If Tether on LN + DLCs can be combined, could we finally see Bitcoin-backed lending without trusted third parties? It seems like the biggest missing piece to making such lending both trustless and more accessible.

Agree 100%. People get way too caught up in political chaos instead of actually building something. Meanwhile, Nostr and Bitcoin are much healthier rabbit holes to go down.

Less noise. More building.

Curious to hear what Nostr thinks - selfishly looking to learn!

Taproot Assets could change Bitcoin-backed lending and payments - especially with Tether’s recent move.

No more wrapped BTC on centralized blockchains - no trusted third parties for collateral. And now, fast USDT payments on LN.

I have mixed feelings about it. But knowing how many people rely on USDT - and having some respect for what Tether has built - I am cautiously optimistic.

programming is art

I joined nostr:nprofile1qqsywt6ypu57lxtwj2scdwxnyrl3sry9typcstje65x7rw9a2e5nq8sprpmhxue69uhhyetvv9ujuumwdae8gtnnda3kjctvqydhwumn8ghj7un9d3shjtnzd96xxmmfdecxzunt9e3k7mgpp4mhxue69uhkummn9ekx7mq9hxafw at TFTC and we talked Bitcoin and Ecash, and the art of digital rebellion

Great podcast, nostr:npub12rv5lskctqxxs2c8rf2zlzc7xx3qpvzs3w4etgemauy9thegr43sf485vg with nostr:npub1guh5grefa7vkay4ps6udxg8lrqxg2kgr3qh9n4gduxut64nfxq0q9y6hjy! Bitcoin and LN clicked for me early on, but eCash (like Cashu) is taking me a bit longer to fully wrap my head around. I see the privacy benefits, but I am still working through the long-term scaling vision.

If Bitcoin ossifies and UTXO ownership remains constrained, LN channels might not be accessible to everyone. In that case, do you see a future where small, trusted mints run by families and communities become the dominant way to scale?

Either way, I appreciate the work you are doing. It is an important experiment!

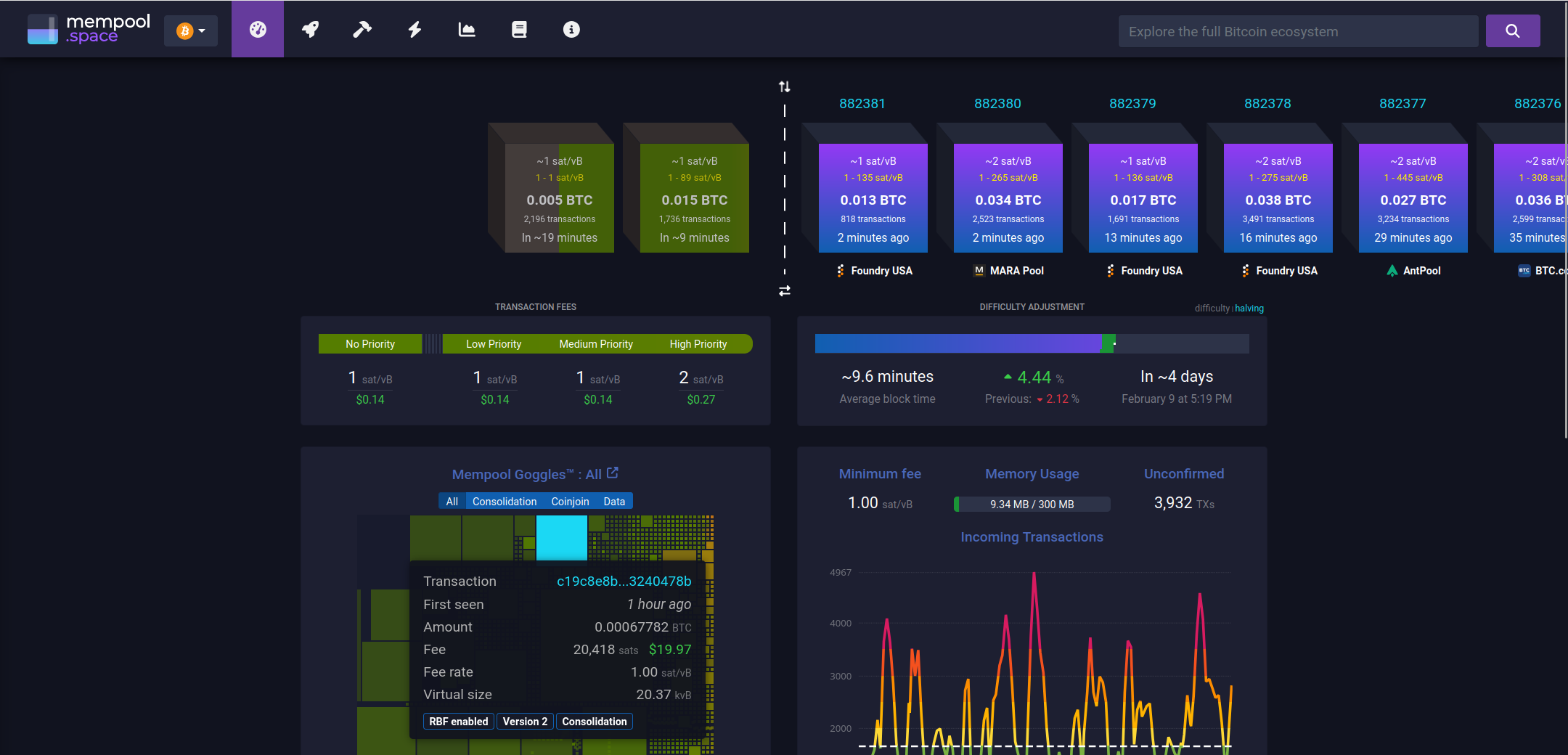

Looks like a good time to open some LN channels. Always good to be prepared for the next fee spike.

Every cycle, the same argument pops up:

- Altcoins are faster than Bitcoin.

- They scale better.

- They have more features.

But here is the thing - speed is not innovation if you sacrifice the foundation.

Bitcoin’s goal was never just to be fast - it was to be trustless and permissionless. Altcoins introduce trust at some level, and once you need trust, you are back to where we started.

We already have fast, trust-based payments - that is modern central banking. Scaling something that relies on trust is not innovation, it is repackaging the old system.

The challenge is not just making payments fast, it is making them fast, secure, and censorship-resistant at scale. Bitcoin is the only one actually trying to solve that.

BITCOIN OSSIFICATION & THE INNOVATOR’S DILEMMA w/ nostr:nprofile1qy08wumn8ghj7mn0wd68yttsw43zuam9d3kx7unyv4ezumn9wshsz8thwden5te0dehhxarj9e3xjarrda5kuetj9eek7cmfv9kz7qpq7u5dneh8qjp43ecfxr6u5e9sjamsmxyuekrg2nlxrrk6nj9rsyrquyd27a

We discuss:

- Physical attacks on bitcoiners

- How to protect your Bitcoin

- Ossification

- The challenges with rough consensus

https://cdn.satellite.earth/f90489e9a55c44258bd092e435610561275364d9888372d3f4dcd92b094e9c8d.mov

Great podcas nostr:npub16le69k9hwapnjfhz89wnzkvf96z8n6r34qqwgq0sglas3tgh7v4sp9ffxj and nostr:npub17u5dneh8qjp43ecfxr6u5e9sjamsmxyuekrg2nlxrrk6nj9rsyrqywt4tp.

If we ossify now, censorship resistance and store of value (owning UTXOs) will be limited to a few.

- If users cannot own UTXOs, they do not truly have self-sovereign wealth.

- If they cannot open LN channels, they cannot transact cheaply without a third party.

In my opinion, when considering any protocol updates, the priority should be scaling solutions that maximize UTXO ownership and non-custodial LN use.

As Lopp well pointed out, email started decentralized, but reputation and UX barriers led to centralization. Could Bitcoin face the same fate if ossification happens prematurely?

Is it already too late with institutional adoption and potential BSR coming? Which discussed BIPs still have a chance and should be prioritized before ossification? Honestly curious to hear thoughts.

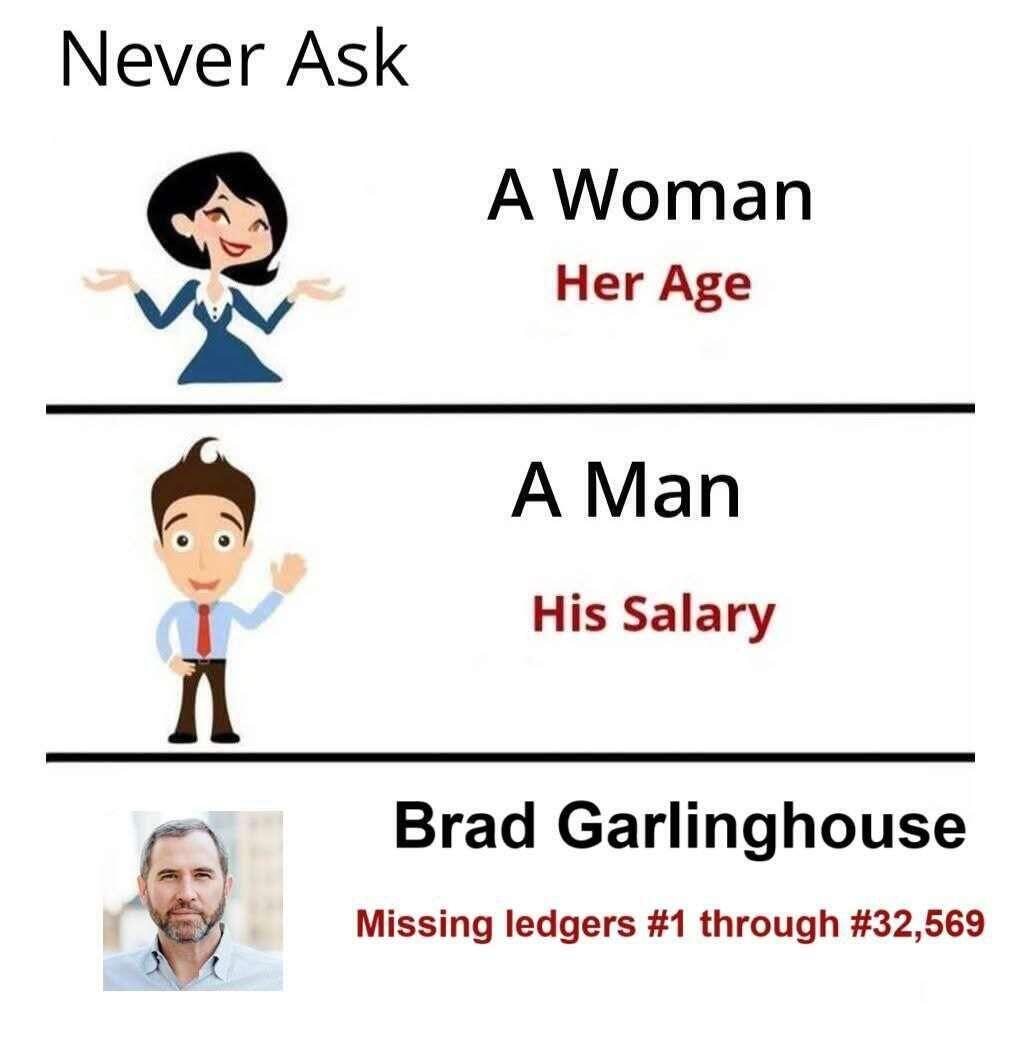

The Bitcoin energy debate is a tired distraction. What really matters: Ripple relies on lobbying and regulators to push their centralized system.

Bitcoin wins by proof of work, not by corporate influence. They know this, and that is why they attack it.

I watch these events unfolding in the US, where bureaucrats who not only contribute nothing but actively drain value from the system are being removed. I can only hope that something similar will soon start happening in the EU as well. So far, however, the signs only point to things getting worse.

Heavy bags, happy lads! Loving the hat, looking sharp nostr:npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx!

You would think that someone who picks up a tool like Alby would already know.

Most people don’t have any plan.

I feel the same way. He used to be my favorite podcaster, but over the last few years, I cannot stand the hypocrisy. That said, I would still listen if the guest is interesting - he is fairly talented when it comes to talking with technical people.

A big one.

Ripple poses a danger and can cause short-term setbacks for Bitcoin adoption. While I believe it will not matter in the long term, it is crucial that we take action to challenge and eliminate bad actors like this as quickly as possible.

A big thank you to everyone using their voice to speak out and stand up for the right cause - people like nostr:npub1cn4t4cd78nm900qc2hhqte5aa8c9njm6qkfzw95tszufwcwtcnsq7g3vle and many others are important in moments like these. Appreciate you all!