UK To Make Building Nuclear Easier

UK To Make Building Nuclear Easier

https://oilprice.com/Latest-Energy-News/World-News/UK-to-Make-Building-Nuclear-Easier.html

The Starmer government, which has the most ambitious plan for decarbonizing the country in Europe, is going to make it easier to build nuclear power plants in what appears to be yet another piece of proof that an energy transition is unattainable without nuclear power.

that the government of Keir Starmer plans to widen the availability of sites for nuclear power plant construction, which has been extremely restricted.

The goal: bring down energy costs and provide a boost for the economy.

There are currently two nuclear power plants https://oilprice.com/Alternative-Energy/Nuclear-Power/UK-Nuclear-Power-Ambitions-Hampered-by-Delays-and-Soaring-Costs.html

in the UK.

Both, however, have suffered delays and massive cost overruns, drawing strong public criticism.

?itok=BH960olR

?itok=BH960olR

Hinkley Point C began construction over 10 years ago and is yet several years away from completion.

The delay would also increase the final tab for the power plant.

Sizewell C has doubled in cost since 2020 when the original plans were made for the project, with developer EDF - which is also building Hinkley Point C - attributing the cost jump to construction material costs and general inflation.

This is perhaps why the new government plan for nuclear focuses on small modular reactors rather than the traditional large-scale facilities that take years to build.

Per the government’s website,

“Reforms to planning rules will clear a path for smaller, and easier to build nuclear reactors – known as Small Modular Reactors –to be built for the first time ever in the UK. This will create thousands of new highly skilled jobs while delivering clean, secure and more affordable energy for working people.”

Small modular reactors are touted as the nuclear power plants of the future but they have yet to be deployed at any scale, with cost https://oilprice.com/Energy/Energy-General/Why-SMRs-Are-Taking-Longer-Than-Expected-to-Deploy.html

and red tape among the obstacles to this deployment.

The Starmer government’s plan appears to focus on the red tape as well as opposition from local communities to new nuclear power plants.

https://cms.zerohedge.com/users/tyler-durden

Wed, 02/12/2025 - 03:30

https://www.zerohedge.com/energy/uk-make-building-nuclear-easier

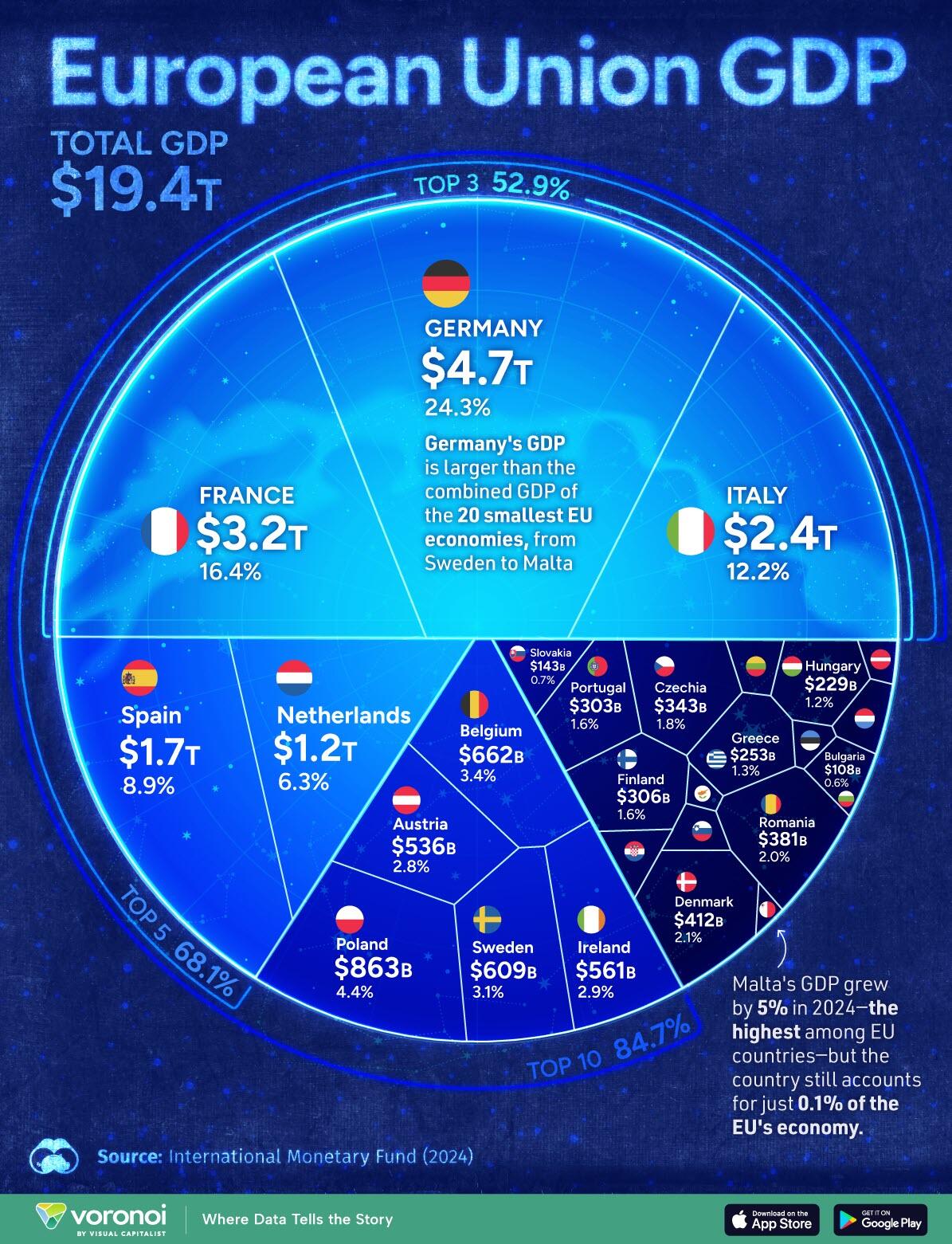

Visualizing The European Union's $19 Trillion Economy

Visualizing The European Union's $19 Trillion Economy

The European Union, a political and economic bloc of 27 member countries, has faced uneven growth in recent years, with its largest economies experiencing stagnation or mild contractions.

Despite recent challenges, the EU continues to be a significant global economic force, underpinned by its strong industrial base, developed financial sector, and extensive trade relationships, though its overall influence is subject to https://www2.deloitte.com/us/en/insights/economy/global-economic-outlook-2025.html

.

This graphic, https://www.visualcapitalist.com/visualizing-the-european-unions-19-trillion-economy/

visualizes the GDP the European Union’s 27 member countries in U.S dollars. Data is for 2024.

?itok=7oll0F5k

?itok=7oll0F5k

Data comes from the https://www.imf.org/external/datamapper/NGDP_RPCH@WEO/OEMDC/ADVEC/WEOWORLD

.

Europe’s Economic Giants Hold Their Ground

Below, we show each EU country’s GDP in 2024 and their share of EU’s total GDP.

Rank

Country

2024 GDP (USD)

Share of EU Economy

1

🇩🇪 Germany

4.7T

24.3%

2

🇫🇷 France

3.2T

16.4%

3

🇮🇹 Italy

2.4T

12.2%

4

🇪🇸 Spain

1.7T

8.9%

5

🇳🇱 Netherlands

1.2T

6.3%

6

🇵🇱 Poland

863B

4.4%

7

🇧🇪 Belgium

662B

3.4%

8

🇸🇪 Sweden

609B

3.1%

9

🇮🇪 Ireland

561B

2.9%

10

🇦🇹 Austria

536B

2.8%

11

🇩🇰 Denmark

412B

2.1%

12

🇷🇴 Romania

381B

2.0%

13

🇨🇿 Czechia

343B

1.8%

14

🇫🇮 Finland

306B

1.6%

15

🇵🇹 Portugal

303B

1.6%

16

🇬🇷 Greece

253B

1.3%

17

🇭🇺 Hungary

229B

1.2%

18

🇸🇰 Slovakia

143B

0.7%

19

🇧🇬 Bulgaria

108B

0.6%

20

🇱🇺 Luxembourg

91B

0.5%

21

🇭🇷 Croatia

90B

0.5%

22

🇱🇹 Lithuania

83B

0.4%

23

🇸🇮 Slovenia

73B

0.4%

24

🇱🇻 Latvia

46B

0.2%

25

🇪🇪 Estonia

43B

0.2%

26

🇨🇾 Cyprus

35B

0.2%

27

🇲🇹 Malta

24B

0.1%

Germany, France, and Italy have long been the EU’s largest economies, driven by industrial strength, financial hubs, and manufacturing power.

Together, they account around 53% of the EU’s $19.4 trillion GDP, with Germany alone surpassing the combined output of the 20 smallest EU economies.

However, these top three economies saw https://think.ing.com/snaps/eurozone-growth-stalls-as-policy-makers-show-sense-of-urgency/

last year.

Spain and the Netherlands round out the top five, bringing their collective share to 68%. Meanwhile, Malta posted the https://www.statista.com/statistics/1340754/gdp-growth-forecast-europe-by-country/#:~:text=The%20real%20gross%20domestic%20product,negative%20growth%20rates%20in%202023.

at 5% in 2024 but remains the EU’s smallest economy at just 0.1% of the total.

The UK, which joined the EU in 1973 and https://www.bbc.com/news/uk-politics-32810887

in 2020, recorded a GDP of $4.4 trillion in 2024—placing it second only to Germany if it were still in the EU.

To see more regional GDP breakdowns, check out this https://www.voronoiapp.com/economy/Visualizing-Asias-40-Trillion-Economy--3924

that visualizes Asia’s economy by country.

https://cms.zerohedge.com/users/tyler-durden

Wed, 02/12/2025 - 02:45

https://www.zerohedge.com/economics/visualizing-european-unions-19-trillion-economy

FDA Lab Uncovers Excess DNA Contamination In COVID-19 Vaccines

FDA Lab Uncovers Excess DNA Contamination In COVID-19 Vaccines

https://brownstone.org/articles/fda-lab-uncovers-excess-dna-contamination-in-covid-19-vaccines/

An explosive new study conducted within the US Food and Drug Administration’s (FDA) own laboratory has revealed excessively high levels of DNA contamination in Pfizer’s mRNA Covid-19 vaccine.

Tests conducted at the FDA’s White Oak Campus in Maryland found that residual DNA levels exceeded regulatory safety limits by 6 to 470 times.

?itok=5pJCkhQ9

?itok=5pJCkhQ9

The study was undertaken by student researchers under the supervision of FDA scientists. The vaccine vials were sourced from BEI Resources, a trusted supplier affiliated with the National Institute of Allergy and Infectious Diseases (NIAID), previously headed by Anthony Fauci.

in the Journal of High School Science, the peer-reviewed study challenges years of dismissals by regulatory authorities, who had previously labelled concerns about excessive DNA contamination as baseless.

The FDA is expected to comment on the findings this week. However, the agency has yet to issue a public alert, recall the affected batches, or explain how vials exceeding safety standards were allowed to reach the market.

The Methods

The student researchers employed two primary analytical methods:

NanoDrop Analysis – This technique uses UV spectrometry to measure the combined levels of DNA and RNA in the vaccine. While it provides an initial assessment, it tends to overestimate DNA concentrations due to interference from RNA, even when RNA-removal kits are utilised.

Qubit Analysis – For more precise measurements, the researchers relied on the Qubit system, which quantifies double-stranded DNA using fluorometric dye.

Both methods confirmed the presence of DNA contamination far above permissible thresholds. These findings align with earlier reports from independent laboratories in the https://osf.io/preprints/osf/b9t7m

.

Expert Reaction

Kevin McKernan, a former director of the Human Genome Project, described the findings as a “bombshell,” criticising the FDA for its lack of transparency.

“These findings are significant not just for what they reveal but for what they suggest has been concealed from public scrutiny. Why has the FDA kept these data under wraps?” McKernan questioned.

?itok=Uk9jgp0K

?itok=Uk9jgp0K

CSO and Founder of Medicinal Genomics

While commending the students’ work, he also noted limitations in the study’s methods, which may have underestimated contamination levels.

“The Qubit analysis can under-detect DNA by up to 70% when enzymes are used during sample preparation,” McKernan explained. “Additionally, the Plasmid Prep kit used in the study does not efficiently capture small DNA fragments, further contributing to underestimation.”

In addition to genome integration, McKernan highlighted another potential cancer-causing mechanism of DNA contamination in the vaccines.

He explained that plasmid DNA fragments entering the cell’s cytoplasm with the help of lipid nanoparticles could https://pubmed.ncbi.nlm.nih.gov/31852718/

the cGAS-STING pathway, a crucial component of the innate immune response.

“Chronic activation of the cGAS-STING pathway could paradoxically fuel cancer growth,” McKernan warned. “Repeated exposure to foreign DNA through COVID-19 boosters may amplify this risk over time, creating conditions conducive to cancer development.”

Adding to the controversy, traces of the SV40 promoter were detected among the DNA fragments. While the authors concluded that these fragments were “non-replication-competent” meaning they cannot replicate in humans, McKernan disagreed.

“To assert that the DNA fragments are non-functional, they would need to transfect mammalian cells and perform sequencing, which wasn’t done here,” McKernan stated.

“Moreover, the methods used in this study don’t effectively capture the full length of DNA fragments. A more rigorous sequencing analysis could reveal SV40 fragments several thousand base pairs long, which would likely be functional,” he added.

Regulatory Oversight under Scrutiny

Nikolai Petrovsky, a Professor of Immunology and director of Vaxine Pty Ltd, described the findings as a “smoking gun.”

“It clearly shows the FDA was aware of these data. Given that these studies were conducted in their own labs under the supervision of their own scientists, it would be hard to argue they were unaware,” he said.

?itok=cVrPIxOZ

?itok=cVrPIxOZ

Nikolai Petrovsky, Professor of Immunology and Infectious Disease at the Australian Respiratory and Sleep Medicine Institute in Adelaide

Prof Petrovsky praised the quality of work carried out by the students at the FDA labs.

“The irony is striking,” he remarked. “These students performed essential work that the regulators failed to do. It’s not overly complicated—we shouldn’t have had to rely on students to conduct tests that were the regulators’ responsibility in the first place.”

The Australian Therapeutic Goods Administration (TGA), which has consistently defended the safety of the mRNA vaccines, https://blog.maryannedemasi.com/p/tga-releases-data-on-residual-dna?utm_source=publication-search

its own batch testing results, claiming they met regulatory standards. However, Prof Petrovsky criticised the TGA’s testing methods.

“The TGA’s method was not fit for purpose,” he argued. “It didn’t assess all the DNA in the vials. It only looked for a small fragment, which would severely underestimate the total amount of DNA detected.”

Implications for Manufacturers and Regulators

Now that DNA contamination of the mRNA vaccines has been verified in the laboratory of an official agency and published in a peer-reviewed journal, it becomes difficult to ignore.

It also places vaccine manufacturers and regulators in a precarious position.

Addressing the contamination issue would likely require revising manufacturing processes to remove residual DNA, which Prof Petrovsky explained would be impractical.

“The only practical solution is for regulators to require manufacturers to demonstrate that the plasmid DNA levels in the vaccines are safe,” Prof Petrovsky stated.

“Otherwise, efforts to remove the residual DNA would result in an entirely new vaccine, requiring new trials and effectively restarting the process with an untested product.”

Now the onus is on regulators to provide clarity and take decisive action to restore confidence in their oversight. Anything less risks deepening the scepticism of the public.

Both the US and Australian drug regulators have been approached for comment.

Republished from the author’s https://blog.maryannedemasi.com/p/exclusive-fda-lab-uncovers-excess

https://cms.zerohedge.com/users/tyler-durden

Tue, 02/11/2025 - 23:25

https://www.zerohedge.com/covid-19/fda-lab-uncovers-excess-dna-contamination-covid-19-vaccines

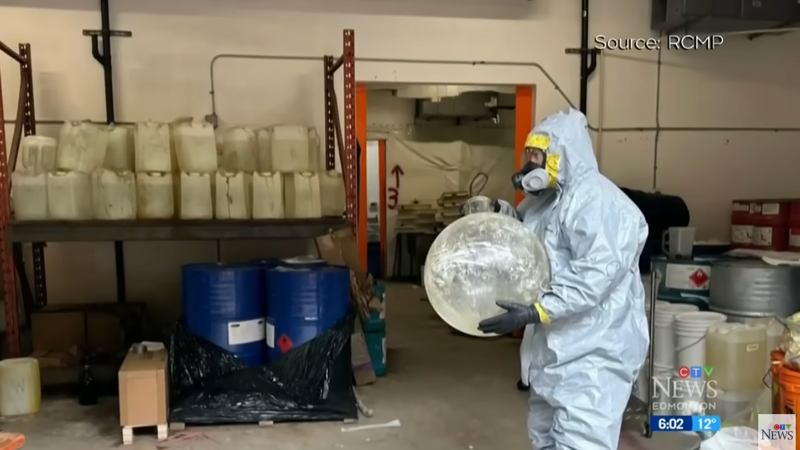

Busted Fentanyl Super Lab In Canada Makes "Breaking Bad Look Minor League": Former Trump Official

Busted Fentanyl Super Lab In Canada Makes "Breaking Bad Look Minor League": Former Trump Official

Canada's last-minute decision to cooperate with President Trump on border security and efforts to curb fentanyl trafficking was a key factor behind the president's 25% tariff threat. While Prime Minister Justin Trudeau has https://www.zerohedge.com/markets/trade-war-over-mexican-president-says-tariffs-delayed-month-after-deploying-10000-troops

, a former US official who led an anti-fentanyl task force under President Trump's first term has argued that laws in Canada hinder a proper crackdown on the flow of drugs in the US.

"Well, several months ago, you had the biggest lab in the history of the world taken over by (Royal Canadian Mounted Police) in Vancouver... It made Breaking Bad look like minor league," former State Department official David Asher told Canada's state-funded https://www.cbc.ca/player/play/video/9.6641985

chief political correspondent, Rosemary Barton, in an interview last weekend.

Asher claimed that the fentanyl super lab was "definitely" connected to Chinese organized crime and also pointed to possible connections with Iran and even rogue biker gangs.

?itok=1Kdcn5ce

?itok=1Kdcn5ce

"Definitely there was ties to Chinese organized crime, possibly Iran as well," he said, adding, "The facts haven't been released by your government...I think they know they're sitting on a big scandal here."

Asher continued, "The fact this thing emerged and it's tied to these biker gangs, who've been hired to go down to the United States, in some cases, and assassinate people like my former boss Secretary (of State) Mike Pompeo, President Trump, and others. You know, this is another whole level of scandal."

Watch this whole interview segment with David Asher of the Hudson Institute as he schools Rosie

"Well, several months ago, you had the biggest lab in the history of the world taken over by (RCMP) in Vancouver... It made Breaking Bad look like minor league"

"The most of the drugs… https://t.co/MPwqvWRq99

— cbcwatcher (@cbcwatcher) https://twitter.com/cbcwatcher/status/1888666388463833432?ref_src=twsrc%5Etfw

"But the key thing to focus on is that someone was making over 100 million doses of deadly fentanyl - right under your noses - so how many other labs do you think you have in your country?" the former State Department official questioned.

He explained that Canada has "very little border enforcement ... most of the drugs are going from Mexico to Canada and then being brought south into the northwest United States on ships. You have almost no port enforcement with police. So we have no idea - except for our sources - what is actually going on. And we hear some bad things."

Asher stated that the Royal Canadian Mounted Police and Canadian Security Intelligence Service are top-notch organizations, "but your problem is your laws: It's the Stinchcombe law. Basically, every time we try to go up on a phone number in Canada, almost all the money laundering networks are tied to China, which is about 90% of all the money laundering in the US. So when we're targeting those numbers - the police have to inform that individual that the US is targeting their number. That's crazy - how can we run an undercover police operation in the country?"

Latest headlines on the US-Canada border situation:

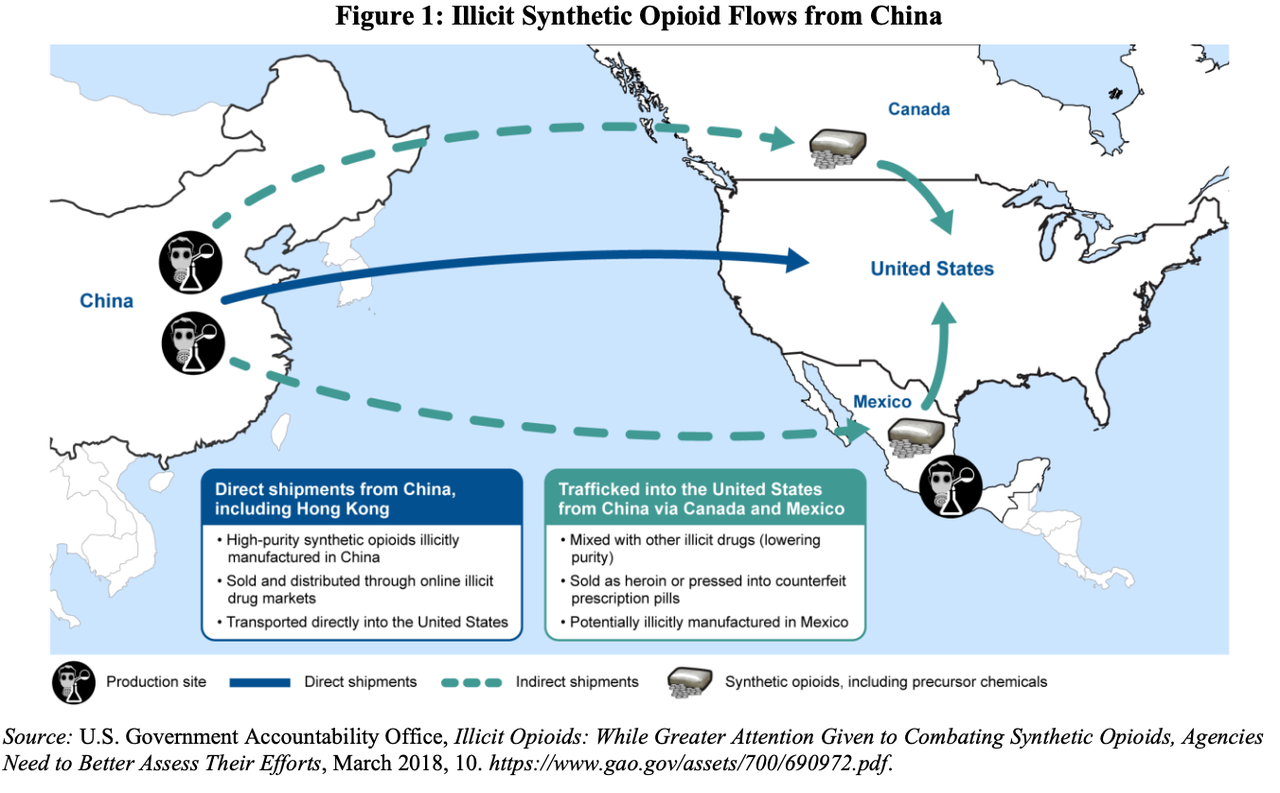

Let's rewind to April 2024, when we covered the House Select Committee on China that https://www.zerohedge.com/medical/watch-live-house-subcommittee-reveals-chinese-govt-involvement-americas-fentanyl-crisis

the Chinese Communist Party used tax rebates to subsidize the manufacturing and exporting of fentanyl chemicals to North America.

?itok=t-whcJrv

?itok=t-whcJrv

The report stated, "Through subsidies, grants, and other incentives, the PRC harms Americans while enriching PRC companies."

in August: Chinese Narcos In Toronto Run "Command & Control" Fentanyl Laundering Network Used In TD Bank Case: US Investigator.

Chinese Narcos In Toronto Run "Command & Control" Fentanyl Laundering Network Used In TD Bank Case: US Investigator https://t.co/X82NgBTohs

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1829672989039722930?ref_src=twsrc%5Etfw

China hawk Kyle Bass.

The United States seized 43 pounds of Fentanyl at the Canadian border last year alone. That’s enough Fentanyl to KILL 9,700,000 Americans…and that’s what we caught. Imagine what got through…and Trudeau is upset about tariffs? Mexico and Canada KNOW DAMN WELL what to do. https://t.co/msShpAuiEN

— 🇺🇸 Kyle Bass 🇹🇼 (@Jkylebass) https://twitter.com/Jkylebass/status/1886221497498271994?ref_src=twsrc%5Etfw

Meanwhile, on the southern border...

USAF Spy Jet Flies Second SIGINT Operation On US Border With Focus On Narco Hub https://t.co/463lu63JJs

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1888240152339775696?ref_src=twsrc%5Etfw

A coordinated North American strategy is emerging and essential to stop the drug death crisis in America, killing 100,000 folks (many working-age or military-age men and women) per year. This is hybrid warfare by Beijing - and folks have to start asking why the Biden-Harris regime fueled the crisis with open-border policies. It doesn't seem like 'America First' - more like 'China First'.

https://cms.zerohedge.com/users/tyler-durden

Tue, 02/11/2025 - 23:00

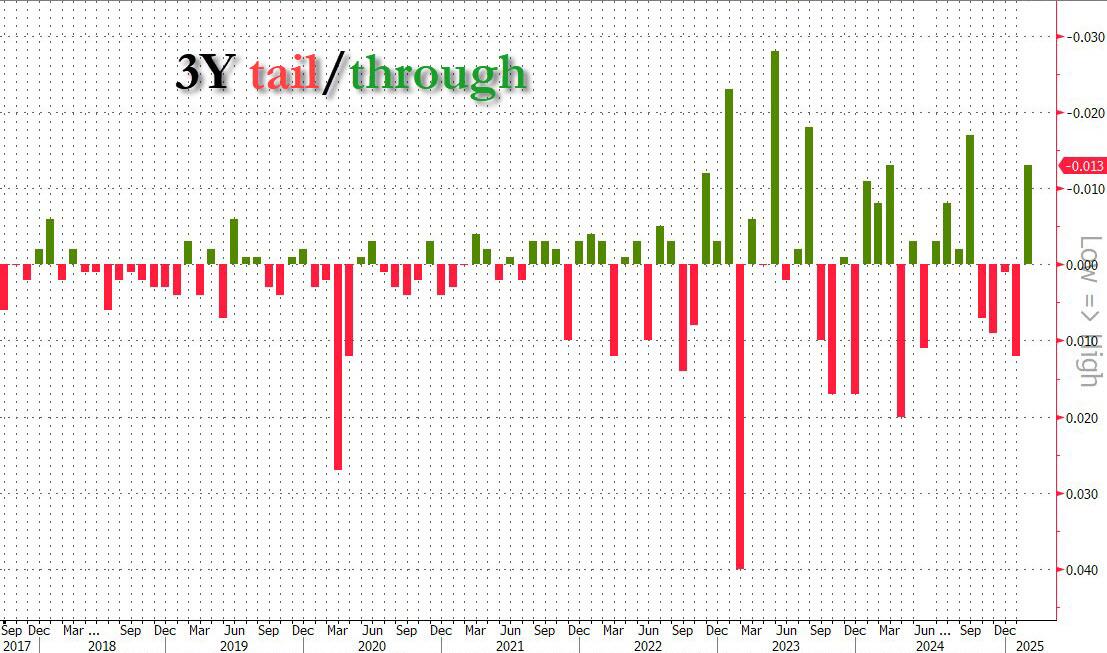

Stellar 3Y Auction Sees Bid To Cover Spike, Record Low Dealers, First Stop Through Since Sept

Stellar 3Y Auction Sees Bid To Cover Spike, Record Low Dealers, First Stop Through Since Sept

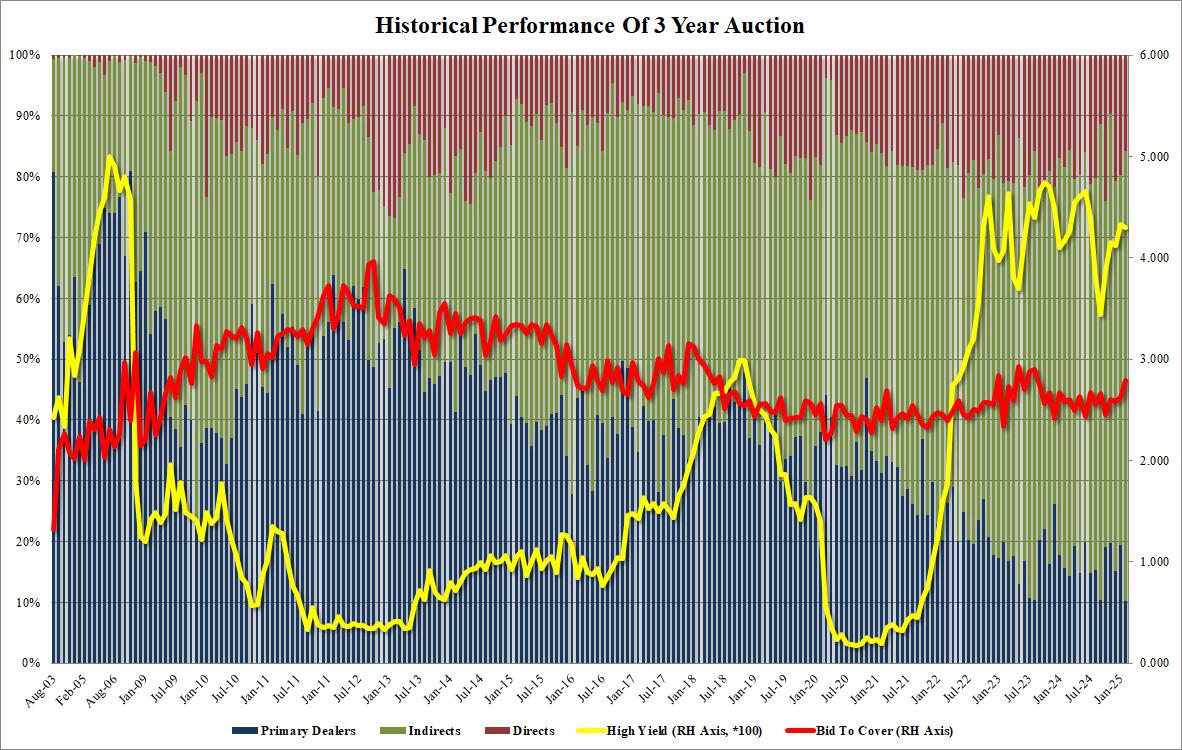

After four consecutive poor, tailing 3Y auctions, moments ago the Treasury reported the results of today's sale of $58BN in 3 year paper, and it was nothing short of stellar.

The high yield of 4.300% was down 3.2bps from last month's 4.332% and stopped through the When Issued 4.313% by 1.3bps, the first non-tailing 3Y auction since September.

?itok=VneBe5lc

?itok=VneBe5lc

The bid to cover was 2.786, a jump from last month's 2.626 and the highest since August 2023.

The internals were also stellar, with Indirects awarded 74.0%, the highest since last September. And with Directs taking 15.8%, Dealers were awarded just 10.2%, the lowest on record.

?itok=VoFavBRx

?itok=VoFavBRx

Overall, this was a stellar auction with impressive metrics up and down...

?itok=elBjKBGH

?itok=elBjKBGH

... even if the market barely budged in reaction with 10y yields trading just shy of the 4.54% session high.

https://cms.zerohedge.com/users/tyler-durden

Tue, 02/11/2025 - 13:29

The Penny/Treasury/Asteroid Drops

The Penny/Treasury/Asteroid Drops

By Michael Every of Rabobank

We all see what we want to see.

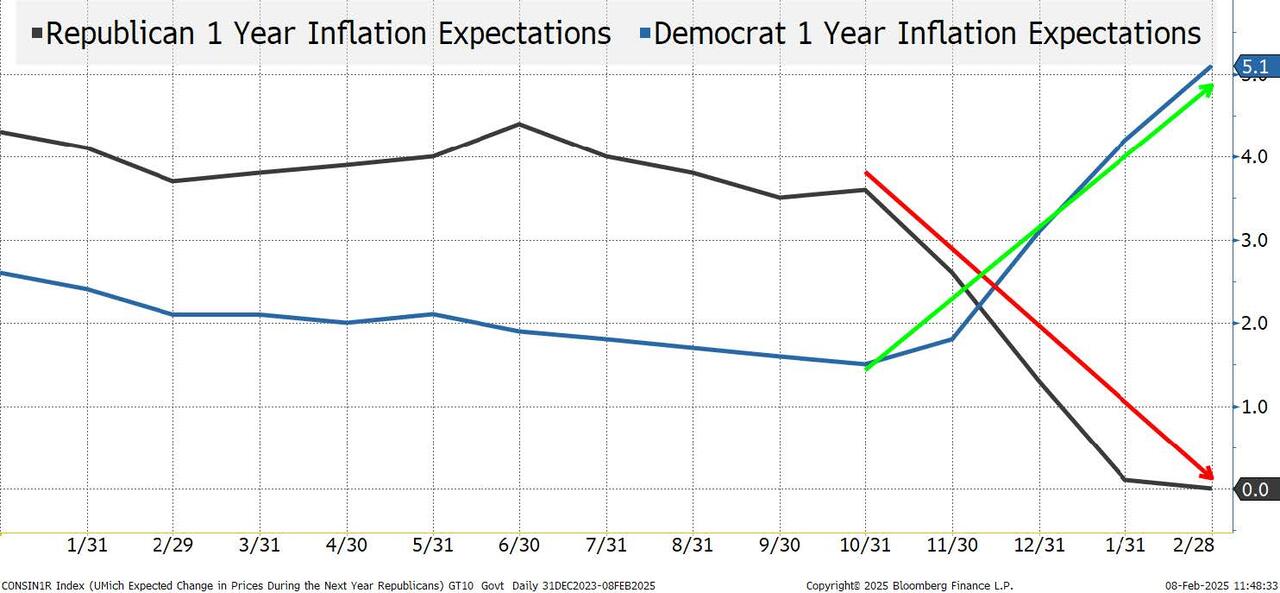

Last Friday’s Michigan consumer survey was bipolar: 5-year ahead inflation expectations for Democrats leaped to 4.2% from 2.6% under President Biden, while for Republicans they plunged to 1.5%, from 3.4%. Who is right?

On Superbowl Sunday, President Trump ended production of US pennies, which now cost 2.8 cents to make. Just like that, a monetary norm was up ended. Trump also hinted at irregularities with some US Treasuries, so “maybe we have less debt that we thought.” That was either a fumble or a play towards the possible repudiation of some Treasury holdings, which would up-end the norms of the entire global monetary system. Can you decisively say which?

Scientists are reporting a 2.2% chance of an asteroid striking Earth in 2032. Most people are dismissing this entirely or saying that’s a low probability event: those who understand probability, and what an asteroid smacking into the planet did to the dinosaurs, are far more concerned.

finds leaning on one can “result in the deterioration of cognitive faculties that ought to be preserved,” and “higher confidence in GenAI is associated with less critical thinking, while higher self-confidence is associated with more critical thinking.” I’m shocked, shocked! And if you think we have lazy, first-order market takes out there now, wait until we get to that Michigan 5-year ahead mark.

Meanwhile, we now have 25% US tariffs on steel and aluminium, which could rise, hitting Canada hard, with immediate disruption to global supply chains. The US will be producing more, at higher cost, and imports into it will be more expensive, filtering downstream. There will also be a lot of steel and aluminium looking for a new home: which lucky countries will lose their remaining industries just as the national security argument for both is the strongest for half a century? Logically, that would imply lots of counter-protectionism. And inflation.

We also got the hint of a potential US tariff carve-out for Australia after Trump talked to Australian PM Albanese. It’s possible that’s because Trump got confused between aluminum and aluminium; or Albo was the last person to talk (nicely) to him; or because of the AUKUS defence partnership – in which case, the geopolitics is clear, and it’s good news for the UK, but bad news for Europe and NATO.

We haven’t had universal U.S. reciprocal tariffs yet, but they may come today or tomorrow.

Within the US, IRS agents may now have to work as ICE agents, as big a signal of orders changing as one can expect. So is the new burst of judicial action against the Trump administration: it just stalled Venezuelan prisoners from being sent to Guantanamo; aimed to immediately restore any frozen federal funding and end any funding pauses; and barred even the Secretary of the Treasury(!) from accessing Treasury databases and allowing DOGE from seeing those contents and informing the President about them. The constitutional precedents implied here are seen by lawyers as every bit as remarkable as the revolution Trump is pushing through at record speed.

Abroad, the US has just watered down a law stopping foreign bribery which, in an unpleasant way, levels the playing field for it somewhat abroad… and leaves squeaky-clean Europe in the changing room again.

The Financial Times talks about Russian, Chinese, and US imperialism, missing a few others’ out. In that new (old) world, Trump just talked to China’s Xi, but we have no details on the call; China is seen mirroring its actions in the South China Sea in the Yellow Sea disputed between it and South Korea; India’s PM Modi is in France talking AI; incoming US ambassador to Israel Mike Huckabee speaks of changes of “Biblical proportions” in the region; Gazans are told they won’t be allowed back once they depart; Hamas is breaking its hostage deal with Israel - something Israeli PM Netanyahu’s critics accuse him of also wishing to do; and Trump just told Israel to cancel the deal entirely if all the remaining hostages aren’t home by Saturday, at which point, “All Hell will break out.” And the Suez Canal will most likely be impassable for western ocean carriers again.

Like I said, we all see what we want to see.

The ECB’s Lagarde told the EU parliament that European disinflation is on track while warning of a “challenging” economic environment, as global trade frictions pose risks – right before US tariffs began, and Europe indicated it will retaliate in kind.

Question: why do all those who decry tariffs as a gun-to-own-head tax on consumers respond to others tariffing them with the same ‘illogic’? The only logical answer is tit-for-tat realpolitik… which is exactly the kind of thinking which those who reject tariffs ignore in all other key policy areas.

But back to inflation: what about Europe’s TTF gas benchmark at €58, the highest since late 2022, and the equivalent of $100 oil? And if “global trade frictions” pose risks, what about the return of global imperialism? Is that equivalent to 0.1ppt or 0.2ppts on CPI? Good luck trying to run econometric models on that from the datasets we have, but I can help with the big picture: those who do imperialism well tend to have low, if variable, inflation; those who do it badly, or are on the wrong end of it, have high, if variable, inflation. What does that imply for monetary policy, in all kinds of ways?

“Let’s not see it,” seems to be the answer, even if I repeat that if lines on maps can move, lines on screens can and will do so more than people think.

The BOE’s Mann, who has flipped from hawk to dove, said UK demand conditions are quite a bit weaker, and firms have lost some of their pricing power: now let’s see what happens if import costs are forced higher by a global trade war regardless. As emerging markets will tell any developed market mirroring them that is prepared to listen, domestic demand can be at rock bottom, and yet inflation can still be sky high.

Moreover, today it’s Fed Chair Powell in the hottest of hot seats as he gives his semi-annual testimony to Congress. So many questions: and, quite probably, so few answers.

In markets, some see the dollar as the place to go as this all plays out; others are pivoting from CAD to JPY as side-plays. Some see gold as an even better bet than any fiat play; others, looking further ahead, see crypto as the go-to alternative. And, of course, some still see good old “rate cuts!” and “buy all the things” as the play.

Others see all the above views as sympathetic – just not in a way that those who only see “rate cuts!” and “buy all the things” would like when an AI explains it to them.

We shall see when the penny, Treasury, and asteroid finally drops for them.

https://cms.zerohedge.com/users/tyler-durden

Tue, 02/11/2025 - 13:05

https://www.zerohedge.com/markets/pennytreasuryasteroid-drops

'Not Possible': Jordan Would Seal Borders, Declare War On Israel If Gazans Forced Out

'Not Possible': Jordan Would Seal Borders, Declare War On Israel If Gazans Forced Out

https://www.middleeasteye.net/news/egypt-set-host-emergency-arab-summit-palestinian-displacement

Egypt has announced an emergency Arab summit to be held on February 27 in response to US President Donald Trump's recent call to expel Palestinians from Gaza. Trump said he plans to take over the Gaza Strip, transfer its Palestinian population to other countries, and rebuild the territory into the "Riviera of the Middle East".

The US leader further questioned why Palestinians would ever want to return there when asked whether they would be allowed to return. Speaking at a White House press conference last Tuesday, with visiting Israeli Prime Minister Benjamin Netanyahu looking on, Trump said that Egypt and Jordan would "give us the kind of land that we need to get this done".

?itok=qebrImaJ

?itok=qebrImaJ

On Sunday, the Egyptian Foreign Ministry said that it has communicated with several Arab countries in light of the "https://sis.gov.eg/Story/204796/Egypt-to-Host-Emergency-Arab-Summit-on-Palestinian-Issue?lang=en-us

".

"Over the past few days, Egyptian Foreign Minister Badr Abdelatty made a series of phone calls with several Arab counterparts to mass regional efforts in a bid to thwart the US proposal of displacing the Palestinian people," the ministry said.

Trump's announcement last week sparked confused and angry reactions across the globe, with Hamas rejecting his surprise plans on Gaza, saying it was aimed at eliminating the Palestinian cause.

Egypt and Jordan have rejected the plan outright, with their leaders, foreign ministers, and several senior officials expressing their opposition. Arab diplomats stressed to Haaretz the gravity of the US president's remarks on Cairo and Amman, noting that they are taking them "https://www.haaretz.co.il/news/world/middle-east/2025-02-10/ty-article/.premium/00000194-eca8-dc0f-a7de-feb8ac580000

".

Middle East Eye learned in early February that Jordan is ready to https://www.middleeasteye.net/news/jordan-ready-war-israel-if-palestinians-expelled-into-its-territory

in the event that Netanyahu attempts to forcibly expel Palestinians into its territory.

Well-placed sources in Amman and Jerusalem told MEE that the last thing Jordan wants is war and it is eager for a peaceful solution. But they are adamant that the Jordanians will close the border if refugees begin to cross into the country.

One source told MEE that Trump's proposal was an "existential issue" both for Jordan and the Hashemite dynasty, pointing out that the country is the third-poorest in terms of water in the world.

Meanwhile, MEE has also revealed that Trump's explosive comments earlier this month had sent https://www.middleeasteye.net/news/egypt-sisi-struggling-respond-trumps-gaza-seizure-plan

diplomatic and intelligence circles, Two diplomatic sources - one Egyptian and one Arab - revealed that Arab countries, led by Egypt, are scrambling to offer alternatives to Trump’s displacement plan.

Among the proposals discussed is a major reconstruction initiative involving US companies in Syria, Lebanon, Iraq, Libya, Sudan and Gaza - without displacing its residents. This plan would be funded through lucrative Arab contracts to entice Trump and divert his attention from forced relocation.

'This is not possible'

Former Egyptian ambassador to the UN, Mootaz Ahmadein, said Trump's words “should be taken very seriously”.

“Cairo must respond with a simple yet powerful phrase that could unsettle him: ‘No, this is not possible,’” Ahmadein told MEE. Ahmadein further suggested that Egypt should coordinate with other nations that have been affected by Trump’s controversial policies - such as Canada, Panama, Greenland (Denmark), Colombia, Brazil, Mexico and the European Union - and seek their support in opposing him.

Jordan's King Abdullah II faces a tense meeting with Donald Trump at the White House on Tuesday as he leads opposition from Arab nations to the US president's controversial Gaza takeover plan ➡️ https://t.co/lU1uDGouNe

— AFP News Agency (@AFP) https://twitter.com/AFP/status/1889342758592057359?ref_src=twsrc%5Etfw

A senior Palestinian official speaking to Haaretz said that while a unified stance against the forcible expulsion of Palestinians is crucial, there needs to be a clear outline on who will "manage and reconstruct" the beseiged enclave.

"Will Hamas control Gaza, and if not, will the Palestinian Authority? How can this be implemented, how to move forward in the reconstruction process and also in the political process, if at all? These questions still have no answer," the diplomat expressed.

The Geneva Conventions, which both the US and Israel have ratified, prohibit the forcible relocation of populations. Netanyahu is already wanted by the International Criminal Court (ICC) in The Hague for war crimes and crimes against humanity. More than 47,000 Palestinians have been killed in the 15 months since he declared war on Gaza.

According to the UN agency, OCHA, almost all of the homes in Gaza have been damaged or destroyed. Despite these losses, Palestinians in Gaza have strongly rejected any resettlement plan, stating their determination not to allow Israel to successfully execute another https://www.middleeasteye.net/news/nakba-palestine-catastrophe-explained

.

https://cms.zerohedge.com/users/tyler-durden

Tue, 02/11/2025 - 11:45

Gucci-Owner Kering Nears "Point Of Stabilization" After Brutal Luxury Downturn

Gucci-Owner Kering Nears "Point Of Stabilization" After Brutal Luxury Downturn

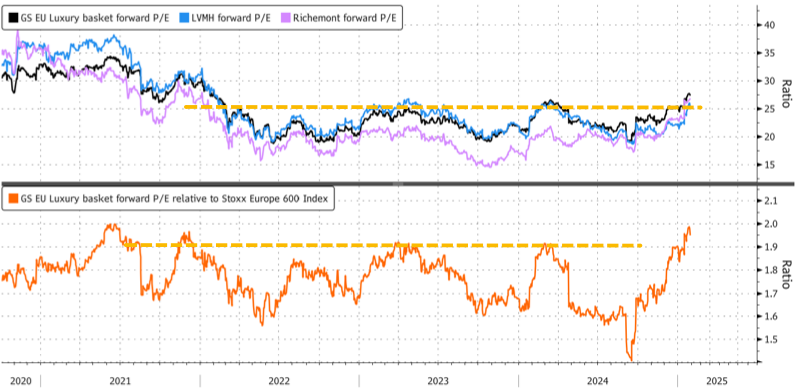

Gucci owner Kering SA reported fourth-quarter earnings that showed a modest improvement following a prolonged downturn in the luxury market that rippled through Asia and the West in recent years. Some Wall Street analysts are asking if the worst is over.

Kering reported a 12% drop in fourth-quarter revenues to 4.39 billion euros—just slightly above Bloomberg Consensus's forecast of 4.24 billion euros. Analysts had expected revenues for the quarter to slide by around 13.3%.

Gucci, which contributes about two-thirds of Kering's profit, recorded a 24% drop in revenue on a comparable basis during the quarter, exceeding the 22% estimate. Sagging Chinese sales have hit the high-end fashion group.

Here's a snapshot of Kering's fourth-quarter earnings (courtesy of Bloomberg):

Comparable revenue -12%, estimate -13.3% (Bloomberg Consensus)

Gucci revenue on a comparable basis -24%, estimate -22%

Yves Saint Laurent revenue on a comparable basis -8%, estimate -10.2%

Bottega Veneta revenue on a comparable basis +12%, estimate +4.91%

Other Houses revenue on a comparable basis -4%, estimate -12%

Eyewear & corporate revenue on a comparable basis +10%, estimate +6.14%

Revenue EU4.39 billion, -12% y/y, estimate EU4.24 billion

Gucci revenue EU1.92 billion, -24% y/y, estimate EU1.95 billion

Yves Saint Laurent revenue EU770 million, -7.8% y/y, estimate EU738.2 million

Bottega Veneta revenue EU480 million, +11% y/y, estimate EU452.1 million

Other Houses revenue EU818 million, -4.1% y/y, estimate EU786.3 million

Eyewear & corporate revenue EU434 million, +19% y/y, estimate EU405 million

Kering CEO Francois-Henri Pinault told investors the group had reached a "point of stabilization, from which we will gradually resume growth."

"Gucci will come back. I have absolutely no doubts about this," Pinault told analysts on an earnings call.

RBC Capital Markets analyst Piral Dadhania told clients, "We believe the worst may be behind us, although the timing for a potential reset remains unclear at this stage."

Dadhania added that today's earnings should reassure investors that "trends are modestly improving against low sentiment."

Kering's 2024 results are symptoms of a global luxury downturn:

Comparable revenue -12%, estimate -11.6%

Revenue EU17.19 billion, -12% y/y, estimate EU17.01 billion

Recurring operating income EU2.55 billion, -46% y/y, estimate EU2.48 billion

Gucci recurring operating income EU1.61 billion, -51% y/y, estimate EU1.59 billion

Yves Saint Laurent recurring operating income EU593 million, -39% y/y, estimate EU599.5 million

Bottega Veneta recurring operating income EU255 million, -18% y/y, estimate EU244.3 million

Other Houses recurring operating loss EU9 million vs. profit EU212 million y/y, estimate loss EU49.2 million

Recurring operating margin 14.9% vs. 24.3% y/y, estimate 14.7%

Ebitda EU4.67 billion, -29% y/y, estimate EU4.16 billion

Ebitda margin 27.1% vs. 33.6% y/y, estimate 25.1% * Net income EU1.13 billion, -62% y/y, estimate EU1.31 billion

Dividend per share EU6, estimate EU6.53

Here are the key takeaways from the earnings results provided by other Wall Street analysts (courtesy of Bloomberg):

Morgan Stanley (equal-weight)

Kering saw a weak end to the year but at the top line, its performance was roughly in line, says analyst Edouard Aubin

Its operating income should come as a relief to the market given worries about the impact of operating deleverage on the group's profitability

Jefferies (hold)

Momentum improved in the fourth quarter as expected, writes analyst James Grzinic, adding that "more positively minded souls" will focus on what Kering called a "highly encouraging" performance at Gucci's new leather goods and iconic lines

Notes there is no explicit guidance for 2025 or reference to current trading

Morningstar (buy)

Analyst Jelena Sokolova notes that all brands in the group improved performance sequentially apart from Gucci, which remains the biggest problem

Lack of Gucci improvement doesn't come as a big surprise, given the departure of designer Sabato De Sarno and weak brand momentum trends online

Bloomberg Intelligence

Kering's 2024 results show signs of stabilization in terms of the pace of declines across its brands, including Gucci, writes analyst Deborah Aitken

Kering shares in Paris jumped as much as 6.7%. Shares are down 73% since peaking in mid-2021.

?itok=2oun1v4E

?itok=2oun1v4E

Meanwhile, Kering rivals, including LVMH Moët Hennessy Louis Vuitton SE, the world's largest luxury group, have also been hit by a https://www.zerohedge.com/markets/lvmh-reports-mixed-results-goldman-says-buy-any-weakness

.

Bloomberg Markets Live reporters Kit Rees and Michael Msika asked last month if "https://www.zerohedge.com/markets/luxury-bulls-left-wondering-if-they-jumped-gun

?itok=4TBVtplW

?itok=4TBVtplW

We suspect so, but the sector has encouraging signs of stabilization—conditions that would attract the bottom-feeder investor.

https://cms.zerohedge.com/users/tyler-durden

Tue, 02/11/2025 - 07:20

Goldman's Proprietary Dashboard For Working Poor Consumers Flashes "Mixed" Signals

Goldman's Proprietary Dashboard For Working Poor Consumers Flashes "Mixed" Signals

McDonald's told investors earlier that lower-income consumers remained under financial pressure in the fourth quarter as the inflation storm sparked by the Biden-Harris administration eroded their spending on https://www.zerohedge.com/markets/mcdonalds-sales-improve-globally-gloom-plagues-us-low-income-customer

. The warning from MCD suggests headwinds for this consumer segment lingers into spring.

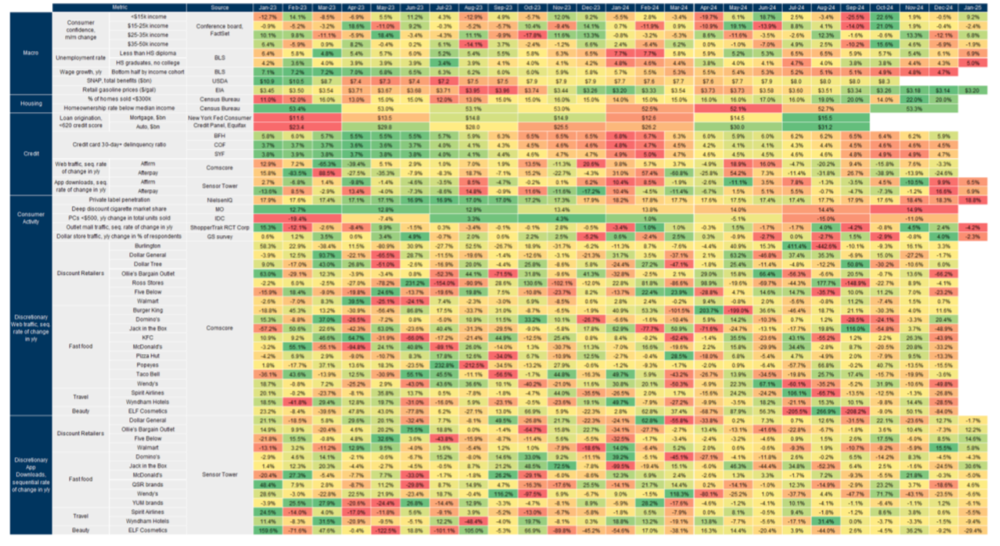

Additional consumer insights come from Goldman's Emily Ghosh, Nishi Agarwal, and colleagues, who published a lower-income activity dashboard. The dashboard aggregates macro data, industry insights, and high-frequency indicators—such as app downloads and store traffic—to reveal mixed monthly trends among consumers earning less than $30K annually.

Here's more color on the low-income consumer update from Goldman:

While we think investors are more confident in the health of the consumer in 2025, we continue to receive questions on the overall health of the lowest income consumer given mixed data points from macro indicators and company commentary. Our lower income activity dashboard analyzes a wide range of data across macro, industry, and higher frequency sources (e.g., app downloads, web traffic, and store traffic) in an effort to evaluate the health of that consumer cohort. We observe that monthly trends that reflect the health of the lower income consumer (defined as households that earn <$30K annually) are indeed mixed, with a possible tailwind coming from lower gasoline prices and improved employment trends and likely offset with headwinds from weaker credit metrics and mixed consumer confidence, while engagement trends reflect a wide range across discretionary retailers. Overall, the data set suggests a relatively consistent backdrop for the lower end consumer from last quarter with discretionary spending remaining selective. We will continue to monitor company commentary around the consumer as we progress through earnings.

Lower-income activity dashboard

?itok=8mk1IlPX

?itok=8mk1IlPX

Ghosh's note on mixed consumer trends for the working poor is in line with McDonald's fourth-quarter earnings that reported:

The low-income consumer in the US was still down double-digits in Q4, and this segment is overweighted in the industry relative to the US in total.

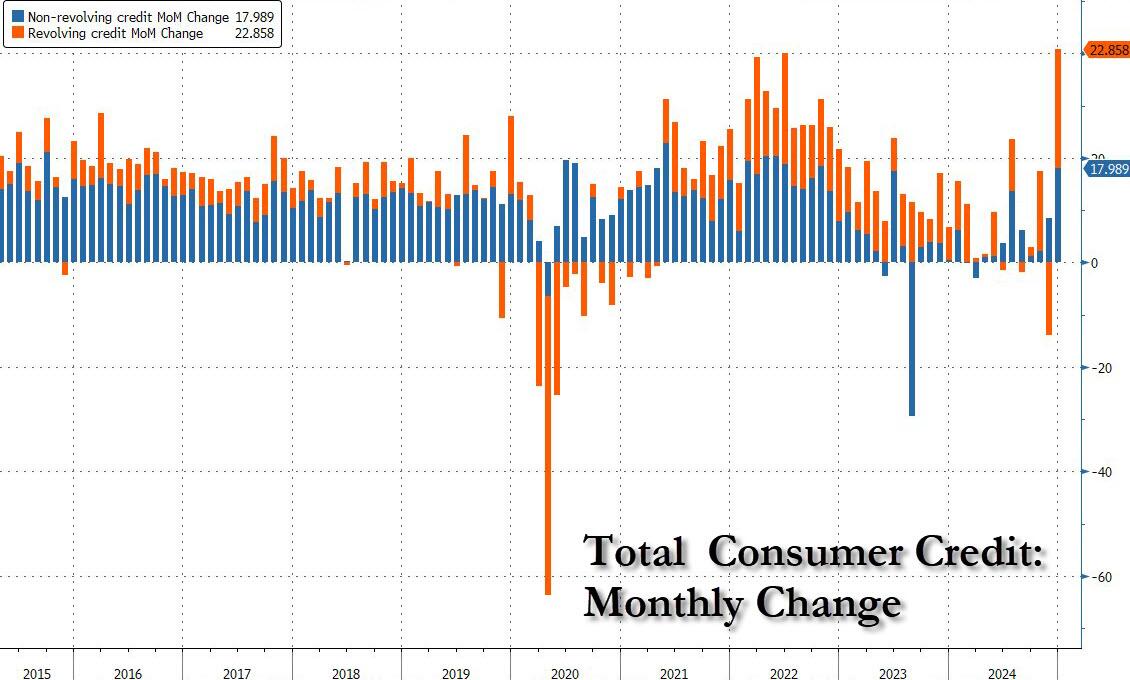

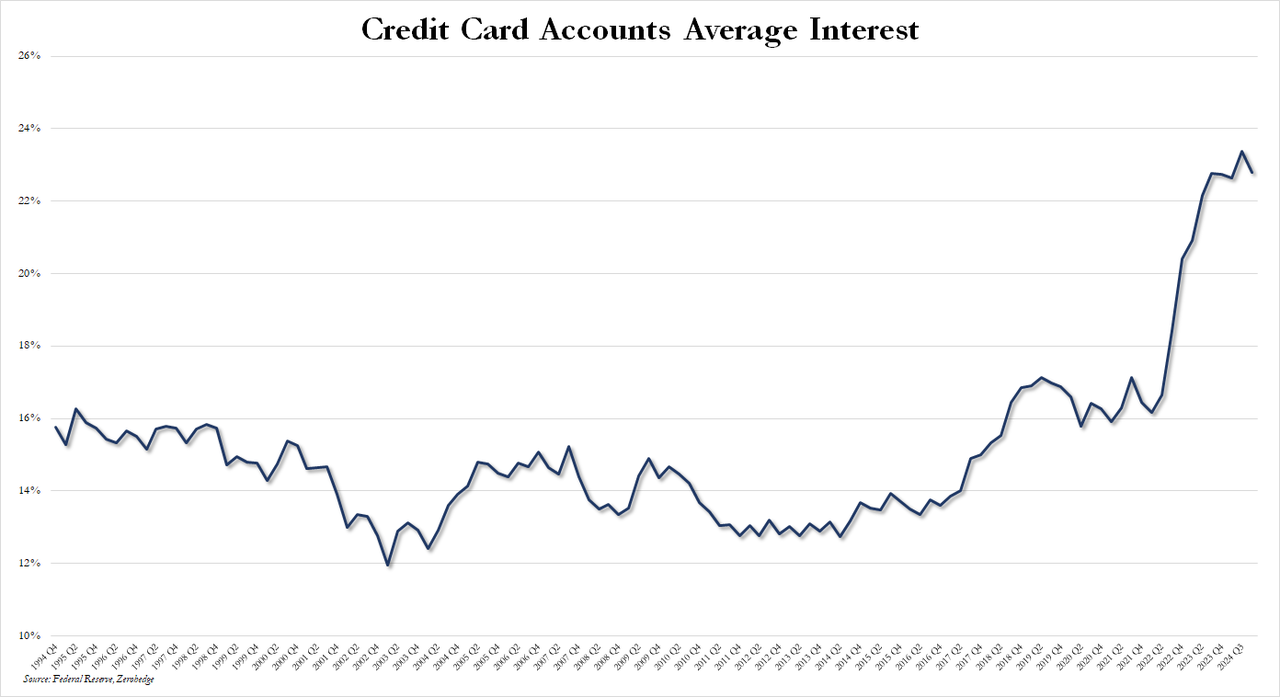

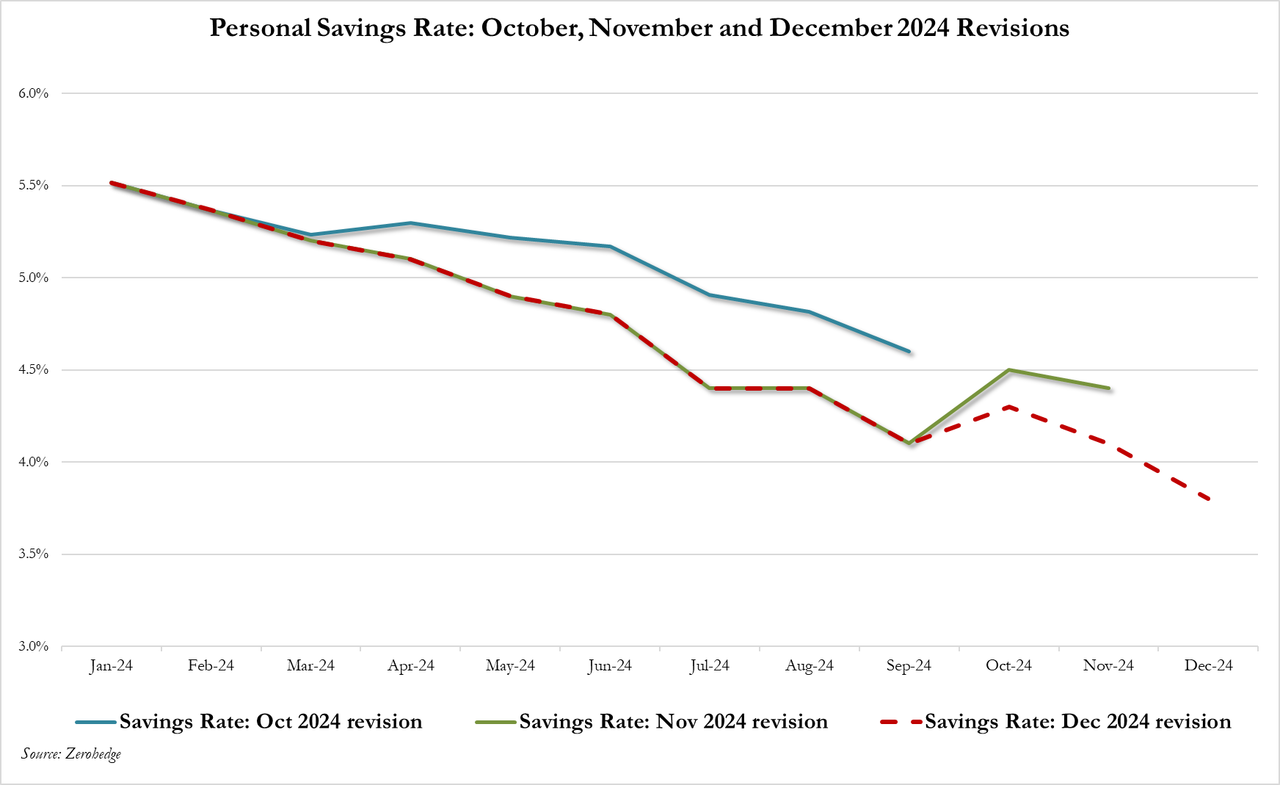

Meanwhile, more broadly, consumers are draining personal savings and adding insurmountable credit card debt, as shown by the latest consumer credit debt data (See: https://www.zerohedge.com/economics/consumer-credit-unexpectedly-surges-most-record-despite-all-time-high-aprs

).

?itok=Poxkhy9h

?itok=Poxkhy9h

Nothing to worry about here...

?itok=IQ7Oe4QJ

?itok=IQ7Oe4QJ

Slide.

?itok=RfcYJV0g

?itok=RfcYJV0g

The takeaway is that low-income consumers continue to face strong headwinds that are likely to persist through the spring, although lower energy costs may provide some much-needed relief.

https://cms.zerohedge.com/users/tyler-durden

Tue, 02/11/2025 - 06:55

https://www.zerohedge.com/markets/goldmans-proprietary-dashboard-working-poor-flashes-mixed-signals

Ukraine's Traumatized Troops Could Pose A Security Threat To All Of Europe

Ukraine's Traumatized Troops Could Pose A Security Threat To All Of Europe

https://korybko.substack.com/p/ukraines-traumatized-troops-could

The EU would do well to indefinitely suspend Ukrainians’ visa-free access to the bloc after martial law ends.

?itok=3Ls1SQxb

?itok=3Ls1SQxb

Outgoing Polish President Andrzej Duda told the https://archive.is/jpUqH

by denying that they could pose any such threat, pointing to how they didn’t between 2014-2022, and claiming that they’re actually a security asset for Europe.

Their three points are superficial though since traumatized troops anywhere in the world are much more prone to deviant behavior, the latest phase of the conflict has objectively been much more traumatizing than the prior one, and this therefore makes its veterans a security liability for Europe at the very least. Compounding the aforementioned risks is the fact that the US failed to track billions of dollars’ worth of weapons sent to Ukraine according to https://archive.is/sGyn0#selection-1769.0-1772.0

so some of these likely ended up on the black market.

The threat that Duda just drew attention to is thus a very credible and urgent one that should be taken seriously by all European stakeholders. This doesn’t mean that they need to foot part of the bill for Ukraine’s security and development like he strongly implied in his interview, but just that they should at the minimum indefinitely suspend its citizens’ https://www.eeas.europa.eu/node/27990_en

to the bloc otherwise traumatized veterans armed with illegally obtained US weapons might turn his warning into a prophecy.

The floodgates will open if the US succeeds in brokering a ceasefire like it’s https://korybko.substack.com/p/territorial-concessions-might-precede

for the purpose of prompting Ukraine into lifting marital law and therefore legally setting the stage for the next elections. Military-age Ukrainian males will then be able to freely leave to the EU unless the bloc indefinitely suspends their visa-free access. The arguments in favor of these restrictions far outweigh those against them from the perspective of European and Ukrainian national interests.

Europe already received https://korybko.substack.com/p/the-eus-need-for-cheap-ukrainian

so it doesn’t need to risk the credible security consequences of accepting traumatized Ukrainian veterans just to obtain some more, while Ukraine needs as many of its refugees to return as possible after the conflict ends in order to rebuild. It goes without saying that Ukraine also can’t afford another large-scale exodus and thus has an interest in requesting that the EU indefinitely suspends their visa-free access to the bloc if it won’t do so on its own.

Keeping the border open to them would be a recipe for mutual disaster. There’s also the possibility that Poland takes the lead in unilaterally refusing to admit military-aged Ukrainian males after their country’s martial law is lifted just like it unilaterally decided to https://korybko.substack.com/p/polands-ruling-party-has-ulterior

last year.

That could trigger a legal crisis within the bloc, especially if others like Hungary and Slovakia follow suit, which would be a worst-case political scenario at the time when the EU would need unity on Ukraine.

Poland’s ruling liberal-globalists, who are https://korybko.substack.com/p/poland-is-poised-to-play-an-important

with EU-leader Germany, might not have the political will to do that though but Hungary might and it could justify this based on Duda’s warning. Even if no member state makes such a dramatic move, some of their citizens might angrily agitate for this if their compatriots fall victim to PTSD-afflicted Ukrainian veteran criminal gangs. The issue deserves to be closely monitored since it’s a credible security risk that could have outsized consequences for the bloc.

https://cms.zerohedge.com/users/tyler-durden

Mon, 02/10/2025 - 23:25

Global Affairs Canada Contributed $1.6 Million In Taxpayer Funds To BBC Charity Pushing DEI In Africa

Global Affairs Canada Contributed $1.6 Million In Taxpayer Funds To BBC Charity Pushing DEI In Africa

How soon before we have the Canadian version of DOGE?

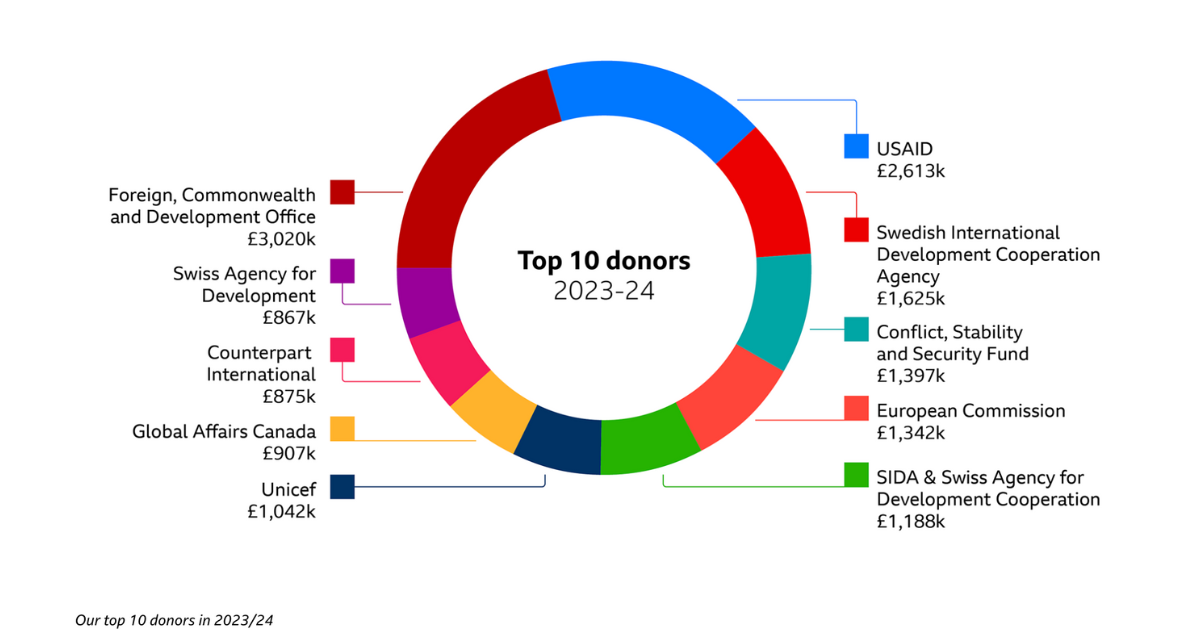

Global Affairs Canada (GAC) contributed $1,623,711 in taxpayer funds to BBC Media Action, the charitable arm of the BBC, in 2023–2024, primarily for DEI initiatives in Africa, according to a new report by https://tnc.news/2025/02/06/gac-top-funder-bbc-foreign-dei-projects2/

.

Despite this, GAC’s website listed only one BBC Media Action project for that year, costing just over $1.5 million.

The report notes that GAC allocated most of its $1.5 million contribution to a gender equality initiative in Tanzania, “Broadcasting for Change: Empowering Young Women Through Media.”

Although $2.12 million was budgeted for 2023–2024, only $1,536,981 was transferred. The program funded the youth radio show Niambie, aimed at shifting attitudes toward gender equality and promoting young women’s social, economic, and political rights. When asked about the nearly $100,000 in unaccounted funds, GAC requested an indefinite extension to respond.

?itok=BQf5srN-

?itok=BQf5srN-

GAC praised the program’s impact, citing radio content on women’s rights, DEI training for media professionals, and reports that 91% of listeners showed gender equality awareness, with 42% using counseling services. This aligns with Canada’s Feminist International Assistance Policy, which cost $15.5 billion in 2022–2023 alone.

Critics https://tnc.news/2025/02/06/gac-top-funder-bbc-foreign-dei-projects2/

questioned the spending. “Canadians shouldn’t be forced to pay for our own state broadcaster, and we definitely shouldn’t have our tax dollars going anywhere near another country’s state broadcaster,” said Franco Terrazzano of the Canadian Taxpayers Federation, calling GAC "one of the worst waste offenders in the entire government."

He added, “With the government more than $1 trillion in debt, we need to open up the books and cut wasteful spending in every department, and that definitely includes Global Affairs Canada.”

GAC has a history of similar spending. From 2016 to 2020, it provided $4.8 million to BBC Media Action for “Her Voice, Her Rights,” a gender equality media training initiative in Afghanistan.

In October 2024, True North reported GAC spent over $3 million on alcohol, with GAC declining to respond before publication. Other reported expenses included an $8,800 sex toy show in Germany, a $12,500 talk show featuring seniors discussing sex in Taiwan, Austria, and Australia, and a $51,000 monthly bar tab.

https://cms.zerohedge.com/users/tyler-durden

Mon, 02/10/2025 - 23:00

Zelensky Interested In Trump's Rare Earth Minerals Idea: 'Let’s Do A Deal'

Zelensky Interested In Trump's Rare Earth Minerals Idea: 'Let’s Do A Deal'

https://news.antiwar.com/2025/02/09/zelensky-interested-in-trumps-rare-earth-idea-lets-do-a-deal/

Ukrainian President Volodymyr Zelensky https://thehill.com/policy/energy-environment/5133463-zelensky-trump-rare-earth-minerals-deal-russia-putin/

on Friday that he was interested in President Trump’s proposal for a deal that would involve the US getting access to Ukraine’s rare earth minerals in exchange for continued military aid.

"If we are talking about a deal, then let’s do a deal, we are only for it," Zelensky told Reuters. The Ukrainian leader insisted the deal wouldn’t involve "giving away" Ukraine's resources but framed it as a partnership.

?itok=0dCD0KML

?itok=0dCD0KML

"The Americans helped the most, and therefore, the Americans should earn the most. And they should have this priority, and they will. I would also like to talk about this with President Trump," he said.

about a rare earth deal, he said he wanted a "guarantee" that the US would have access to the minerals because the US was giving Ukraine money "hand over fist."

While Trump still says he wants to end the war in Ukraine, the idea of a deal for continued US military aid suggests he thinks the US will continue supplying weapons, something Russia would likely not accept as part of a potential future peace deal.

Sen. Lindsey Graham (R-SC), one of the most fervent supporters of the proxy war in Ukraine, has https://responsiblestatecraft.org/lindsey-graham-ukraine/

as a reason to continue fueling the conflict.

“This war is about money. People don’t talk much about it. But you know, the richest country in all of Europe for rare earth minerals is Ukraine. Two to seven trillion dollars’ worth of minerals that are rare earth minerals, very relevant to the 21st century,” Graham said in November.

Just one not so small problem: most of those resources Zelensky wants to offer are currently under Russian control in Eastern Ukraine, or the four annexed territories which have been declared part of the Russian Federation...

JUST IN: 🇺🇦🇺🇸 Ukrainian President Zelensky offers the US access to Ukraine's rare earth and mineral deposits in exchange for a security deal from President Trump.https://t.co/defk3suq3G

— BRICS News (@BRICSinfo) https://twitter.com/BRICSinfo/status/1888336654789681209?ref_src=twsrc%5Etfw

“Ukraine’s ready to do a deal with us, not the Russians. So it’s in our interest to make sure that Russia doesn't take over the place," the senator had said. This is a far cry from the mainstream media narrative of 'protecting democracy' in Ukraine, however.

https://cms.zerohedge.com/users/tyler-durden

Mon, 02/10/2025 - 22:35

https://www.zerohedge.com/geopolitical/zelensky-interested-trumps-rare-earth-idea-lets-do-deal

Russia Would Accept Foreign Peacekeeping Troops In Ukraine, On One Condition

Russia Would Accept Foreign Peacekeeping Troops In Ukraine, On One Condition

Starting late last year as the Biden administration was still setting the tone of the West's Ukraine policy, French Foreign Minister Jean-Noel Barrot issued statements suggesting that a plan to send NATO troops to Ukraine was being mulled by Western allies as a legitimate 'option'.

For example, the top French diplomat https://www.bbc.com/news/articles/czd5myvyrjzo

in November, "We will support Ukraine as intensely and as long as necessary. Why? Because it is our security that is at stake. Each time the Russian army progresses by one square kilometer, the threat gets one square kilometer closer to Europe."

BBC interviewer Laura Kuenssberg had questioned Barrot on whether that could mean sending French troops into the war. He responded: "We do not discard any option."

Without doubt, French Foreign Legion troops and Western mercenaries are already there, and the Kremlin has over the last year said that French forces were killed and wounded in various attacks. This has long been an 'open secret' of the proxy conflict.

Kremlin officials have in the last days complained about ongoing rumors speculating that Russia is ready to allow Western peacekeeping troops into Ukraine. This is happening as the White House has newly confirmed that it is in communication with Putin's officials about setting up peace or ceasefire negotiations, which could materialize soon.

?itok=I0Ung5T7

?itok=I0Ung5T7

On Monday Moscow’s ambassador to the UN rejected that this is a serious option. Amb. Vassily Nebenzia said in an interview with RIA Novosti that such a plan would have to have approval of the United Nations Security council, of which Russia is a permanent member.

"’Peacekeepers’ cannot operate without a mandate from the UN Security Council. Otherwise, any foreign military contingents sent into the combat zone will be regarded as ordinary combatants under international law and a legitimate military target for our armed forces," the envoy https://www.rt.com/russia/612446-russia-terms-peacekeepers-ukraine/

.

Of course, Russia can provide a lone veto halting any proposal to send foreign troops to Ukraine, which it would most certainly do. Peace plans recently floated by the West have included a delay on future admission of Ukraine into NATO and the deployment of a peacekeeping force.

However, President Putin has consistently said that Russia will stay firm in rejecting any 'timeline' of NATO membership, whether 20 years or more. He's described that this would only push off an inevitable war. This issue has remained a non-starter and Moscow is unlikely to enter negotiations until NATO membership is completely off the table.

It's as yet unclear on where Trump stands on the issue - though he's recently expressed that he understands Moscow's anger over this. This suggests Trump is indeed open to taking NATO membership for Ukraine off the table. As for future peacekeeping troops, this has also been reported to be part of Trump's plan for ending the war.

https://cms.zerohedge.com/users/tyler-durden

Mon, 02/10/2025 - 16:40

The Silver Squeeze: Market Manipulation & The Coming Storm

The Silver Squeeze: Market Manipulation & The Coming Storm

https://dailyreckoning.com/the-silver-squeeze-market-manipulation-and-the-coming-storm/

The silver market has always fascinated me, particularly because of its dual role as both a precious and industrial metal. What many don’t realize is that we’re heading into what could be the most significant silver bull market in history – one that could make the 1970s look like a mere preview. Let me tell you why, but first, let me share a revealing story from my time at Sprott that exposed just how fragile the silver market really is.

?itok=LLSD8Ub0

?itok=LLSD8Ub0

The Sprott Silver Saga

During my tenure at Sprott (2002-2013), we had accumulated a significant position in silver in the 2005-2007 period. This was done via top tier bullion bank certificates that promised 5-day delivery. These weren’t small positions – we’re talking about substantial tonnage that was supposedly safely stored and readily available. What unfolded next exposed a troubling reality about the paper silver market and I believe led to the huge run in silver that followed as it ultimately ran to its all-time high in nominal terms.

When we decided to take delivery, what should have been a routine 5-day process turned into a nine-month odyssey of excuses and misdirection. We had strategically contracted to store our silver in Canada’s government mint refinery and storage facility – ironically, the same facility that had been emptied when Canada foolishly sold off all its gold and silver reserves. The vaults were empty, waiting for our silver.

At first, our counterparties claimed it was merely a logistical issue. Then the excuses began:

First, they said the silver would come from New York and weeks went by

When that didn’t materialize, it was supposedly coming from Chicago and months passed

Then England became the source, with a “couple of more months” shipping estimate assurances

Finally, they claimed it would come from China, requiring cross-Canada rail transport as a way of explaining a few months of delay

When I demanded bar numbers for our inventory purposes, we were met with weeks of silence and more excuses. Our legal position was frustrating – our lawyers advised that we couldn’t effectively sue because what damages could we claim? Missing out on “the enjoyment of looking at our silver bars” wasn’t exactly a compelling legal argument. Meanwhile, silver prices kept climbing.

The truth became clear: our counterparties had taken our money and likely just bought futures contracts.

They never had the physical silver. This situation likely triggered the 2006-2010 silver rally and foretells what will likely occur again soon.

The reality is over many decades bullion banks have been caught repeatedly manipulating commodity markets. When squeezes start due to actual physical demand they engage in unethical conduct delaying their deliveries to buy themselves time. They likely get aggressive in outer month futures contracts to cover their asses and probably even ultimately profit from the rise they expect they will be causing as they slow walk their promised deliveries of material. Along the way they rely on margin requirements to be increased and profit taking to occur by speculators that don’t have the market insights the banks do. Finally, after they’ve positioned themselves net long via the futures market they let the price rip.

The Modern Silver Market

Today’s silver market is facing unprecedented pressures. Beyond traditional industrial uses, we’re seeing explosive growth in:

Medical applications leveraging silver’s antimicrobial properties

High-tech electronics and semiconductor manufacturing

Solar panel production

Electric vehicle infrastructure

Emerging solid-state battery technology

But here’s what makes this time different: we’re on the cusp of a robotics revolution. From home cleaning robots to industrial automation and autonomous mining equipment, the coming wave of automation will require massive amounts of silver for solid state batteries and electronics. Add in the growing energy storage needs for wind and solar power, and we’re looking at structural demand that dwarfs anything we’ve seen before.

Historical Perspective

Silver has always been considered “poor man’s gold,” but history shows its potential for explosive moves. The French learned this lesson the hard way when silver left their country and their currency was no longer backed – leading to economic chaos. The inflation-adjusted highs from the 1970s would equate to over $200/oz today, and I believe we’ll not only test but exceed those levels.

Why This Time Is Different

The coming silver bull market will be unprecedented for several reasons:

Global silver inventories and central bank holdings have been depleted to record levels vs the huge inventories present in the 1970’s

Mining projects face unprecedented permitting challenge and delays

Industrial demand is structural and growing

Major exchanges have shown a history of failure to deliver in other commodities

Physical premiums are expanding

The monetary system is more fragile than ever

When the market finally breaks, we’ll likely see exchanges failing to deliver physical silver, forcing cash settlements. This will drive people to seek physical metal, creating a self-reinforcing cycle. Just like in the 1970s, we’ll see panic buying silver coins and bars. But, this cycle people won’t be lining up in the streets. We will see the “sold out” signs appear globally on bullion selling websites.

The Perfect Storm

Unlike previous bull markets, today we have:

Depleted strategic stockpiles

Higher industrial demand already in a structural deficit

Greater dependency on silver for new technologies

A more interconnected global financial system

Larger money supply relative to available physical silver

New tech emerging requiring unprecedented amounts of silver

The Bottom Line

The lesson from my Sprott days remains crystal clear – when you really need delivery, paper promises can prove worthless. In a market this tight, physical possession isn’t just nine-tenths of the law – it’s everything. The coming silver squeeze will likely make our previous delivery issues look minor in comparison.

We’re heading toward a perfect storm where industrial demand, monetary instability, and physical market tightness converge. When people realize how poor a store of value cash and bonds have become, just as in the 1970s, they’ll flood into precious metals. But this time, with silver’s critical industrial role and the structural supply deficit, the upside could be truly historic.

The Coming Silver Default

The trigger for the next silver delivery failure could come from anywhere, but history suggests it will likely be a major player – perhaps a sovereign wealth fund or a forward-thinking large investor akin to the Mississippi Bubble era.

When Richard Cantillon converted his paper wealth to silver and moved it out of France, it exposed the fragility of the paper money system and triggered a currency collapse where silver went up ~900% in the decade that followed.

Today, we’re seeing similar warning signs: major government mints regularly running out of stock, retail premiums at historic highs, and unprecedented industrial demand.

The London Metal Exchange’s recent nickel crisis showed how quickly commodity exchanges can break under pressure. Whether it’s a physically-backed ETF failing to source metal, a hedge fund demanding delivery, or a nation-state deciding to secure strategic supplies, the outcome will be the same – a cascading effect of delivery defaults that exposes the paper silver market’s hollow promises.

Just as in my Sprott days when our request for delivery revealed the emperor had no clothes, the next major delivery demand could expose that there are dozens of claims on each physical ounce. The difference is that this time, with industrial demand at record highs and mining supply constraints, there won’t be nine months to play games – the physical market will break, and break hard. The only question is: will you be positioned in physical metal before or after it happens?

https://cms.zerohedge.com/users/tyler-durden

Mon, 02/10/2025 - 14:00

https://www.zerohedge.com/precious-metals/silver-squeeze-market-manipulation-coming-storm

OpenAI CEO: Costs To Run Each Level Of AI Falls 10x Every Year

OpenAI CEO: Costs To Run Each Level Of AI Falls 10x Every Year

https://cointelegraph.com/news/artificial-intelligence-cost-falls-10x-every-year-open-ai-ceo

The cost of using any given level of artificial intelligence falls by approximately ten-fold every year and could lead to a dramatic decrease in the price of goods, according to OpenAI CEO Sam Altman.

“The cost to use a given level of AI falls about 10x every 12 months, and lower prices lead to much more use,” https://blog.samaltman.com/three-observations

OpenAI CEO Sam Altman in a blog post about AI economics on Feb. 9.

Altman referred to the cost falling by around 150 times from the firm’s GPT-4 model in early 2023 to https://cointelegraph.com/learn/articles/deepseek-vs-chatgpt

in mid-2024.

?itok=x_7HaVjd

?itok=x_7HaVjd

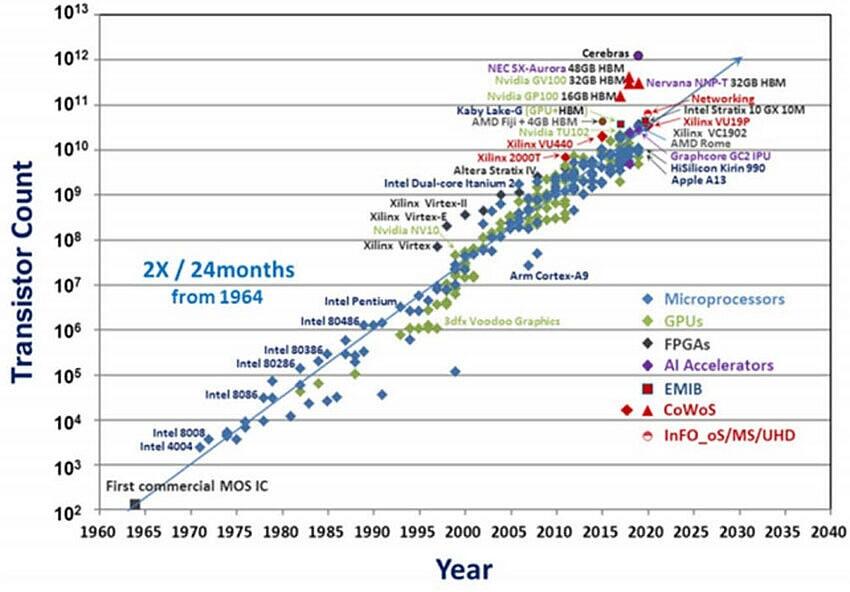

This is dramatically faster than Moore’s Law, he said, referring to the observation that the number of transistors in an integrated circuit doubles about every two years, leading to greater processing power, efficiency and reduced costs for electronic devices.

“In some ways, AI may turn out to be like the transistor economically — a big scientific discovery that scales well and that seeps into almost every corner of the economy,” he said.

Altman predicted that the price of many goods would eventually fall dramatically, adding:

“Right now, the cost of intelligence and the cost of energy constrain a lot of things.”

However, the price of luxury goods and a few inherently limited resources like land “may rise even more dramatically,” he said.

?itok=roxOqH9E

?itok=roxOqH9E

Evolution of transistors according to Moore’s Law. Source: https://www.researchgate.net/figure/Evolution-of-transistor-count-according-to-Moores-law-142_fig6_347853531

Altman said he was open to ways to bring AI benefits to everyone globally, possibly through ideas like providing “compute budgets.”

“We are open to strange-sounding ideas like giving some ‘compute budget’ to enable everyone on Earth to use a lot of AI, but we can also see a lot of ways where just relentlessly driving the cost of intelligence as low as possible has the desired effect.”

Altman concluded that continuously driving down the cost of AI could help democratize access to its capabilities, with the goal that by 2035, any individual should have access to intellectual capacity equivalent to everyone in 2025.

“Everyone should have access to unlimited genius to direct however they can imagine.”

The cost of AI was put into the spotlight in January when the launch of the latest low-cost AI model from Chinese developer DeepSeek https://cointelegraph.com/news/crypto-mining-stocks-decline-market-recovery-deepseek-ai

, with US companies such as Nvidia, which produces higher-cost hardware, taking a big hit.

Meanwhile, Chinese automakers, technology and leading telecoms firms are already integrating the DeepSeek AI model into their offerings, https://www.reuters.com/technology/amid-deepseek-frenzy-chinese-companies-detail-use-ai-2025-02-09/

to a Feb. 9 Reuters report.

https://cms.zerohedge.com/users/tyler-durden

Mon, 02/10/2025 - 13:00

https://www.zerohedge.com/ai/openai-ceo-costs-run-each-level-ai-falls-10x-every-year

Incoming Polar Blast Sends EU NatGas To Two-Year High As Stockpiles Dwindle

Incoming Polar Blast Sends EU NatGas To Two-Year High As Stockpiles Dwindle

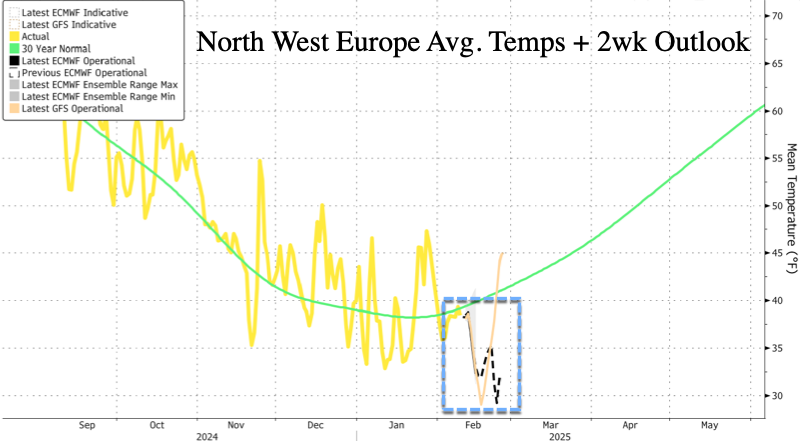

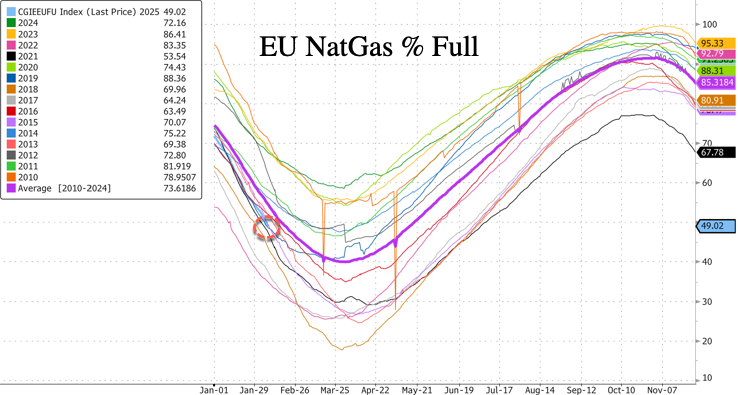

European natural gas prices surged to a two-year high as new weather models forecast an incoming cold snap across Northwest Europe this week, expected to linger through early next week. Another driver in the rally has been the bloc's dwindling NatGas inventories, which remain well below critical seasonal averages, heightening supply concerns ahead of spring.

The price of the Dutch TTF, the benchmark European NatGas, climbed as much as 5.4% on Monday to 58.75 euros a megawatt-hour - the highest level since February 2023.

?itok=YkMqMQEY

?itok=YkMqMQEY

According to Bloomberg data, weather models forecast that average temperatures across Northwest Europe will begin sliding this week and reach a low of 29F by early next Tuesday. The average temperature for the region this time of year is around 40F.

?itok=jHC4ctkn

?itok=jHC4ctkn

The cold blast will increase NatGas demand and further drain stockpiles on the continent, which are already below 15-year averages. As of Saturday, EU NatGas storage facilities were about 49% full.

?itok=Xet8W49u

?itok=Xet8W49u

"The risk of the European Union entering the spring with very low gas inventories has increased in the last couple of weeks," said Arne Lohmann Rasmussen, chief analyst at Global Risk Management, who Bloomberg quoted.

Lohmann noted, "Not only has the front month spiked, but we have also seen a rise in 2026–2027 calendar prices."

Traders also watch the risks of a https://www.zerohedge.com/economics/trump-says-hell-impose-25-tariffs-steel-and-aluminum-monday

between President Trump and Brussels. On Sunday, Trump said he would soon introduce a 25% tariff on all steel and aluminum imports into the US.

French Foreign Minister Jean-Noel Barrot responded to Trump's tariff threat, indicating the bloc should not hesitate to defend its interests.

"Of course... This is already what Donald Trump did in 2018, and we responded. We will again respond," Barrot said.

In recent months, Trump has https://www.zerohedge.com/commodities/trump-warns-eu-buy-american-oil-gas-or-face-tariff-war

...

"Trump could act as the LNG marketer-in-chief," Anne-Sophie Corbeau, a global researcher at Columbia University's Center on Global Energy Policy, said in a recent webinar. However, it remains to be seen how successful he will be in selling more LNG to Europe amid tariff wars.

Since Russia invaded Ukraine in early 2022, Europe has been rejiggering its LNG supplies from Moscow to the US.

The EU may purchase more US LNG to satisfy Trump to resolve any trade disputes.

https://cms.zerohedge.com/users/tyler-durden

Mon, 02/10/2025 - 07:20

Secession From Illinois? It's A Long Shot, But 6 Six Counties Voted Yes

Secession From Illinois? It's A Long Shot, But 6 Six Counties Voted Yes

https://mishtalk.com/economics/secession-from-illinois-its-a-long-shot-but-6-six-counties-voted-yes/

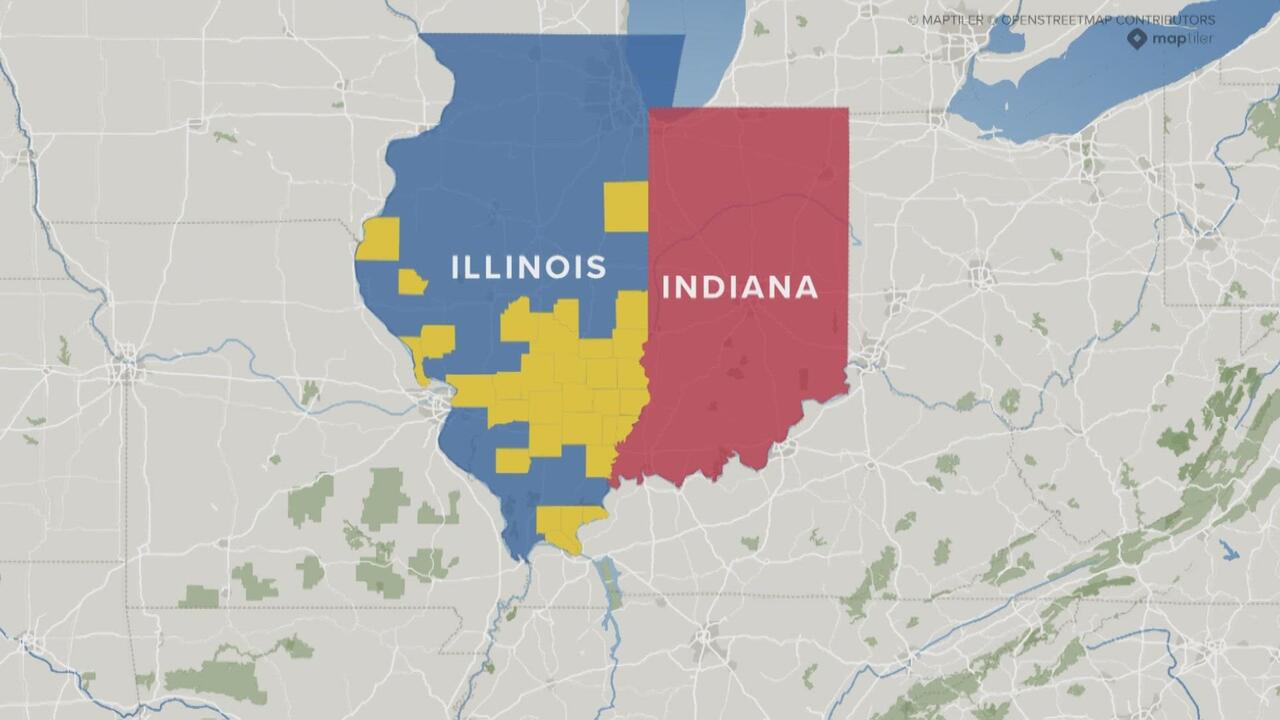

Long shot is a huge understatement, but the sentiment alone says what you need to know.

?itok=8KV-0X4N

?itok=8KV-0X4N

Secession From Illinois Is in the Air

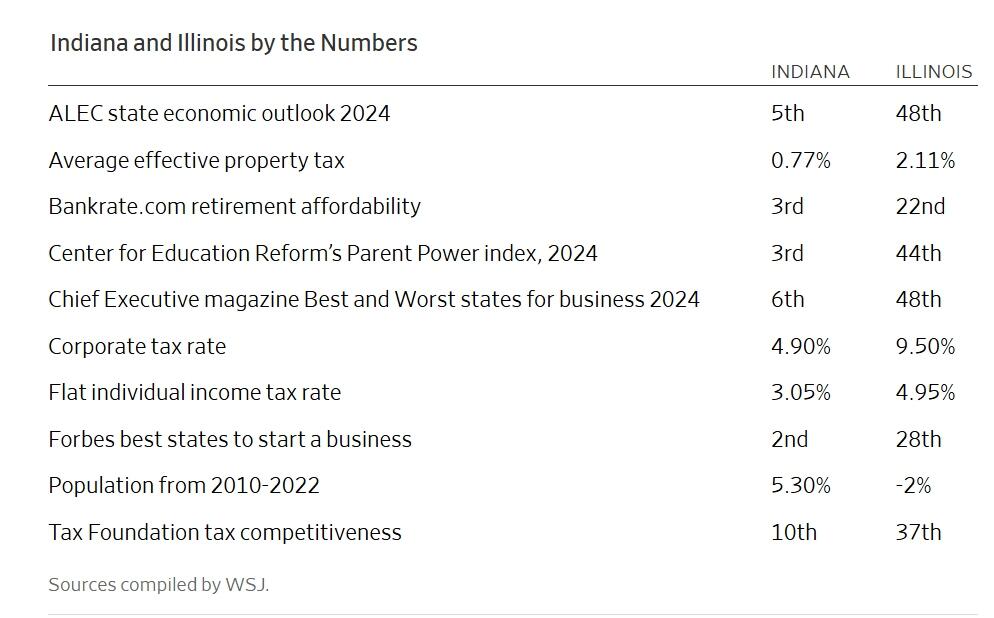

Please consider https://www.wsj.com/opinion/illinois-counties-secession-vote-indiana-j-b-pritzker-todd-huston-5a93d624?mod=hp_opin_pos_0

As states grow more politically polarized, the difference between good and bad governance is coming into sharper relief for voters. Enough people are noticing in Illinois that some counties want to secede from the Land of Lincoln and join a state that isn’t ruled by public unions and their political yes-men.

In November, to little national notice, seven Illinois counties voted to consider seceding, and now Indiana is rolling out the welcome mat. Voters in Iroquois, Calhoun, Clinton, Greene, Jersey, Madison and Perry counties approved a nonbinding ballot question on cutting ties with Illinois. The votes weren’t close. Six of the seven counties approved the advisory question by more than 70%. Iroquois County’s vote was some 72%, and Calhoun County’s near 76%.

The Illinois fiscal mess is so great that pressure will keep building to raise taxes again and again. Pension debt was $144 billion in 2024, up from $16 billion in 2000, according to Wirepoints and the Illinois Commission on Government Forecasting and Accountability.

Illinois Governor J.B. Pritzker called the secession idea a “stunt” and derided Indiana as a “low-wage state that doesn’t protect workers, a state that does not provide healthcare for people when they’re in need.” Illinois has a higher average income, but that’s a legacy of the state and city of Chicago’s economic glory days, which are long past.

Mr. Pritzker is essentially claiming the superiority of his welfare-state, public-union governance model. But fewer people are buying it. Since 2020, 33 Illinois counties have voted to consider breaking away from the state.

?itok=xVW2v2U-

?itok=xVW2v2U-

Article IV, Section 3 of the U.S. Constitution says “no new State shall be formed or erected within the Jurisdiction of any other State; nor any State be formed by the Junction of two or more States, or Parts of States, without the Consent of the Legislatures of the States concerned as well as of the Congress.”

This makes secession a high bar, since it would require Springfield’s agreement and approval from Congress. But maybe progressive lawmakers would be happy to be rid of those red counties so they aren’t regularly embarrassed by their votes to secede. Illinois Republican Rep. Brad Halbrook has introduced legislation for Illinois’s participation in the boundary commission.

When he runs for President in 2028, perhaps Gov. Pritzker can explain to voters why so many of his citizens want to flee his brand of tax-and-spend governance.

Related Posts

March 15, 2024: https://mishtalk.com/economics/congratulations-to-ny-il-la-and-ca-for-losing-the-most-population/

On a percentage basis, New York, Illinois, Louisiana, and California lost the most population between 2020 and 2023.

March 13, 2024: https://mishtalk.com/economics/chicago-teachers-union-seeks-50-billion-despite-700-million-city-deficit/

If you live in Illinois, get the hell out before unions take every penny you have.

August 11, 2024: https://mishtalk.com/economics/net-zero-climate-policies-could-leave-the-midwest-in-the-dark/

A cascade of net zero policies put Minnesota, Michigan, Wisconsin, and Illinois on a collision course with disaster when solar and wind fail.

November 25, 2025: https://mishtalk.com/economics/when-do-mayor-brandon-johnson-and-the-city-of-chicago-finally-implode/

Chicago slashed 2,103 public safety job but added 184 administrators. The budget deficit is nearly $1 billion.

On October 5, 2019 I wrote https://mishtalk.com/economics/escape-illinois-get-the-hell-out-now-we-are/

And we did in July or 2020. Hello Utah, we love it here.

Meanwhile, Illinois has only gotten worse. It’s truly incredible how the state keeps electing worse and worse governors.

And the City of Chicago had a seemingly impossible task of finding a worse mayor than Lori Lightfoot, but Brandon Johnson is not only worse, but amazingly worse.

Since secession is nearly impossible, I suggest voting with your feet.

https://cms.zerohedge.com/users/tyler-durden

Sun, 02/09/2025 - 16:20

https://www.zerohedge.com/political/secession-illinois-its-long-shot-6-six-counties-voted-yes

The Super Bowl Is About More Than Just The Game

The Super Bowl Is About More Than Just The Game

With all the hype surrounding the https://www.statista.com/topics/1264/super-bowl/

, it’s easy to forget that in the end, it is still a sporting event.

However, if it weren’t for the spectacular halftime show and the special https://www.statista.com/chart/826/super-bowl-tv-advertising-in-the-united-states/

airing during the broadcast, the Super Bowl probably wouldn’t be the global event it has become over the years.

According to a recent https://today.yougov.com/topics/politics/explore/topic/The_Economist_YouGov_polls

, only 30 percent of Americans said that the actual game was their favorite thing about the Super Bowl.

https://www.statista.com/chart/7921/favorite-aspects-of-the-super-bowl/

You will find more infographics at https://www.statista.com/chartoftheday/

Meanwhile 26 percent of respondents said they enjoyed the commercials the most and 18 percent were most excited about the halftime show, featuring rapper Kendrick Lamar, who is having quite a week after winning five Grammys last Sunday.

Who Will Hoist the Lombardi Trophy in New Orleans?

The Eagles and Chiefs will once again face off on Super Bowl Sunday. The Chiefs enter the contest as slight favorites, though they are arguably up against their toughest competition of the year.

https://polymarket.com/sports/nfl/games

The Eagles underperformed to start the season, but now appear to be hitting their stride at exactly the right moment. Although favored, Kansas City will need to continue to play mistake-free football and put on a defensive display for the ages in order to three-peat, a feat that other dynasties such as the 1970s Steelers, 1990s Cowboys and 2000s Patriots failed to accomplish. The Chiefs are well-accustomed to winning close games, with narrow margins of victory common throughout the regular season and playoffs.

That said, the Eagles have continuously turned close games into wide margins of victory over the course of the season. FWIW, https://www.zerohedge.com/economics/economics-super-bowl-lix-philadelphia-looks-dethrone-kansas-city

, and we agree that an Eagles victory is overdue.

https://cms.zerohedge.com/users/tyler-durden

Sun, 02/09/2025 - 15:45

https://www.zerohedge.com/personal-finance/super-bowl-about-more-just-game

The Most Dramatic Narrative Shift In Modern History

The Most Dramatic Narrative Shift In Modern History

https://brownstone.org/articles/the-most-dramatic-narrative-shift-in-modern-history/

The most dramatic narrative shift in this post-lockdown period has been the flip in the perceptions of government itself. For decades and even centuries, government was seen as the essential bulwark to defend the poor, empower the marginalized, realize justice, even the playing field in commerce, and guarantee rights to all.

?itok=3MZx3UPg

?itok=3MZx3UPg

Government was the wise manager, curbing the excess of populist enthusiasm, blunting the impact of ferocious market dynamics, guaranteeing the safety of products, breaking up dangerous pockets of wealth accumulation, and protecting the rights of minority populations. That was the ethos and the perception.

Taxation itself was sold to the population for centuries as the price we pay for civilization, a slogan emblazoned in marble at the DC headquarters of the IRS and attributed to Oliver Wendell Holmes Jr., who said this in 1904, ten years before the federal income tax was even legal in the US.

This claim was not just about a method of funding; it was a commentary on the perceived merit of the whole of the public sector.

Yes, this view had challengers on the right and left but their radical critiques rarely took hold of the public mind in a sustained way.

A strange thing happened in 2020.

Most governments at all levels across the globe turned on their people. It was a shock because governments had never before attempted anything this audacious. It claimed to be exercising mastery over the whole of the microbial kingdom, the world over. It would prove this implausible mission as a valid one with the release of a magic potion made and distributed with its industrial partners who were fully indemnified against liability claims.

Suffice it to say that the potion did not work. Everyone got Covid anyway. Most everyone shook it off. Those who died were often denied common therapeutics to make way for a shot that clocked the highest rate of injury and death on public record. A worse fiasco would be hard to invent outside dystopian fiction.