Jewish Miami Man Randomly Shoots Two Israelis He Hoped Were Palestinians

Jewish Miami Man Randomly Shoots Two Israelis He Hoped Were Palestinians

A wacky story of anti-Palestinian and anti-Arab animus played out in Miami Beach on Saturday night, as a Jewish American mag-dumped a pistol at two visiting Israeli nationals, telling police he attacked them because they were Palestinians. It gets nuttier: After the shooting, one of the Israeli victims reportedly posted "Death to the Arabs" on his social media account, declaring the attack was an act of antisemitism.

Police https://www.miamiherald.com/news/local/crime/article300433159.html

was driving south on Pine Tree Drive before executing a U-turn at 48th Street and then stopping. His victims were in a Hyundai behind him and in the next lane. “[Brafman] then exited his vehicle and remained on the driver’s side,” the police report says. “As the victims were driving past him, he shot at the victim’s vehicle 17 times, unprovoked, striking both victims.”

?itok=Gzgkl-wl

?itok=Gzgkl-wl

Brafman, 27, has been booked into Miami-Dade's Turner Guilford Knight Correctional Center on two counts of attempted murder. When he was interviewed by police, Brafman was quick to admit to his intent and motive, as he https://www.miamiherald.com/news/local/crime/article300433159.html

and shot and killed both," police say.

He was wildly wrong about the ethnicity of his victims -- and the efficacy of his pistol work. Despite firing 17 shots, he only managed to hit one of the Israelis, Ari Rabi, in the shoulder, while grazing Rabey's father in the forearm. Rabi made his own false conclusions about what transpired. According to a https://x.com/KashifMD/status/1891299268423479742

n, Rabi posted pictures of himself and his shot-up vehicle, along with this narrative, which is Facebook's imperfect translation of the original Hebrew:

"My father and I went through a murder attempt against anti-Semitic background. They tried to murder us in the heart of Miami but the creator of the world is with us so he didn't go. I want to say thank you to everyone for their support it is not taken granted with Israel Live. . Death to the Arabs ."

?itok=I28BK0TZ

?itok=I28BK0TZ

“It is deeply ironic and telling that both the alleged pro-Israel perpetrator and the pro-Israel victim in the Miami Beach shooting reportedly hold racist anti-Palestinian views,” https://www.cair.com/press_releases/cair-condemns-israeli-tourist-for-death-to-the-arabs-post-after-pro-israel-miami-man-shoots-him/

Nihad Awad, National Executive Director of the Council on American-Islamic Relations (CAIR). "Policymakers in our nation should stop fomenting the anti-Palestinian hate that led to the genocide in Gaza and to hate crimes in America.”

Rabi struck a different tone when talking to https://www.cbsnews.com/miami/news/israeli-man-speaks-out-after-surviving-miami-beach-shooting/

about the incident: "A life shouldn't just be taken away from anyone. It doesn't matter who you are, what religion you are, or where you're from. People should just live in peace." Speaking of different tones, Brafman in 2023 told a local TV station that "I'd love to see some unity and people come together," as he commented on incidents in which Israeli flags and pro-Israeli banners were yanked from the eaves of a bagel shop he frequented:

I think this is the guy who shot two israelis in miami thinking they were palestinians https://t.co/fxGrTGN8pc

— max 🇵🇸 (@langezahl) https://twitter.com/langezahl/status/1891293380706967909?ref_src=twsrc%5Etfw

Brafman's lawyer quickly attributed his client's attempted murder of two randomly-selected "Palestinians" to mental health problems. “It is believed that his ability to make sound judgments was significantly compromised," https://www.miamiherald.com/news/local/community/miami-dade/miami-gardens/article253098548.html

. “We are...committed to working with healthcare professionals to ensure Mr. Brafman receives the appropriate and necessary treatment.

The bizarre episode has drawn light media attention. It's safe to say that, if a Palestinian-American shot two vacationing Arabs in Miami because he thought they were Israelis, the story would have a very high media profile, with the incident decried as terrorism and exploited by US and Israeli politicians to advance pro-Israel policies.

American Jew shooting Israelis in Miami because they looked Palestinian is really the ne plus ultra of deranged Zionist culture

— Jeff Melnick (@melnickjeffrey1) https://twitter.com/melnickjeffrey1/status/1891356342138351702?ref_src=twsrc%5Etfw

https://cms.zerohedge.com/users/tyler-durden

Tue, 02/18/2025 - 22:10

ESG And DEI Are Down But Not Out, Analysts Say

ESG And DEI Are Down But Not Out, Analysts Say

(emphasis ours),

Despite recent eulogies for the environmental, social and governance (ESG) movement, as well as diversity, equity, and inclusion (DEI) policies, many insiders say the funeral is premature.

?itok=D1_Avg3g

“Their demise is inevitable, and it has been accelerated,” David Bahnsen, chief investment officer of the Bahnsen Group and formerly an asset manager at Morgan Stanley, told The Epoch Times.

However, “they are not over,” he said.

The ESG movement began two decades ago with a U.N. initiative, sketched out in a 2004 position https://documents1.worldbank.org/curated/en/444801491483640669/pdf/113850-BRI-IFC-Breif-whocares-PUBLIC.pdf

called Who Cares Wins, to get private companies in line with the U.N.’s Sustainable Development Goals.

Those https://sdgs.un.org/goals

included, among other things, climate action and gender and racial equity, and they aligned with corporate trends such as “conscious capitalism” and “stakeholder capitalism,” which redirected companies from merely serving owners to serving employees, the community, and the environment.

Institutional asset managers gave the ESG movement critical leverage over companies because they collectively own about 80 percent of the shares in S&P 500 companies. Immediately upon its introduction, ESG was endorsed by 23 financial institutions collectively representing more than $6 trillion in assets at the time.

Most major banks, asset managers, and insurance companies quickly joined U.N.-sponsored climate clubs, including the Net Zero Banking Alliance, the Net Zero Asset Managers initiative, and the Net Zero Insurance Alliance. This was followed by a proliferation of ESG rating agencies, consultants, accountants, and others dedicated to measuring companies’ compliance with ESG criteria.

Twenty years later, the winds appear to have shifted. In 2024, half of the Net Zero Insurance Alliance members quit, while the Net Zero Asset Managers initiative https://www.netzeroassetmanagers.org/update-from-the-net-zero-asset-managers-initiative/

its activities in January after several of its largest members, including BlackRock, left the group.

A 2024 Securities and Exchange Commission (SEC) https://www.sec.gov/newsroom/press-releases/2024-31

that required listed companies to produce audited reports of their CO2 emissions and their plans to reduce them, faced numerous court challenges and was recently shelved. And on the social justice front, a parade of companies recently announced that they are downsizing their diversity programs.

“ESG is on death watch,” Daniel Cameron, CEO of the 1792 Exchange, an analytics nonprofit, told The Epoch Times. “You saw a lot of iconic brands last year walk away from DEI in particular.”

Companies stepping back from diversity programs include Amazon, Google, Target, Meta, Walmart, Boeing, Molson Coors, Lowe’s, Ford, Toyota, Harley-Davidson, Jack Daniels, Caterpillar, John Deere, McDonald’s, Nissan, Stanley Black & Decker, and Tractor Supply.

?itok=dQCZ7eOL

?itok=dQCZ7eOL

Rethinking or Rebranding

Some experts say this trend may be little more than rebranding.

“Boeing, who just got rid of its [DEI] department, noted in the press release that none of them were laid off; they were distributed across the company in other roles,” Will Hild, executive director of Consumers’ Research and a longstanding critic of ESG, told The Epoch Times.

And many companies, including Apple, Cisco, Costco, Microsoft, Delta Airlines, and JPMorgan Chase have defended their DEI programs and insist they will keep them in some form.

Tim Schwarzenberger, portfolio manager at Inspire Investing, says the notion that “DEI is dead or it’s on life support” is wrong.

“I was talking to a major energy company, talking to their chief diversity officer—they have their livelihood on the line,” Schwarzenberger told The Epoch Times.

Defenders say that the ideas behind ESG have been wrongly maligned.

BlackRock CEO Larry Fink, formerly an outspoken advocate for ESG, https://www.pionline.com/esg/blackrock-ceo-larry-fink-says-he-no-longer-uses-term-esg

in 2023 that he no longer uses the term because it has been “politicized and weaponized.”

“DEI is not a synonym for the ’S’ in ESG,” Julie Anderson, a professor of management at American University’s Kogod School of Business, told The Epoch Times. “When I refer to the ‘S,’ it’s usually labor, health, and human rights.

“Politics has intentionally conflated and stolen the ‘S’ category and turned it into a gender and racial issue, which is a fraction of what it really is.”

Whether it goes by ESG or another name, its underlying principles appear to be alive and well.

According to a November 2024 https://corpgov.law.harvard.edu/2024/11/18/u-s-shareholder-proposals-a-decade-in-motion/#:~:text=Proposals%20related%20to%20environmental%20and,12%20months%20through%20June%202024.

on ESG-related shareholder proposals by Harvard Law School, over the past decade, “the number of proposals on environmental and social topics exploded, surpassing the governance and compensation topics that had dominated the discourse in mid-2010s.”

The study found that environmental and social proposals accounted for 62 percent of the total in 2024, up from 44 percent in 2014. More recently, environmental and social proposals increased by 57 percent between 2020 and 2022 and hit a record of 610 proposals for the year ending in June 2024.

https://cms.zerohedge.com/users/tyler-durden

Tue, 02/18/2025 - 21:45

https://www.zerohedge.com/political/esg-and-dei-are-down-not-out-analysts-say

Watch: Trump Calls Out Massive Social Security Fraud After DOGE Exposes Ancient 'Vampires'

Watch: Trump Calls Out Massive Social Security Fraud After DOGE Exposes Ancient 'Vampires'

Update (1800ET): During a Tuesday press conference, President Trump rattled off some of the massive waste, fraud and abuse found by Elon Musk's team at DOGE - including thousands of Social Security recipients listed as being more than 200 years old, to which Musk joked "Maybe Twilight is real and there are a lot of vampires collecting Social Security."

🚨BREAKING: President Trump lists MASSIVE fraud in Social Security:

200 to 209 years old, 879 people.

210 to 219 years old, 866 people.

220 to 229 years old, 1,039 people.

240 to 249 years old, 2 people.

1 person that is 360 years old. https://t.co/WM8XSaZyd0

— Benny Johnson (@bennyjohnson) https://twitter.com/bennyjohnson/status/1891969151024914478?ref_src=twsrc%5Etfw

Listen to Trump go into detail on other terrible things DOGE has found:

Trump highlights a list of projects funded by U.S. taxpayers, including $10 million for circumcision programs in Mozambique.https://t.co/mlzHTAlVSN

— Josh Caplan (@joshdcaplan) https://twitter.com/joshdcaplan/status/1891969556064666007?ref_src=twsrc%5Etfw

Insane!

The https://twitter.com/DOGE?ref_src=twsrc%5Etfw

revelations are exposing the dystopian US Hunger Games system where the districts (taxpayers) confer tribute on their labor to the capital city (DC) which lives in grifter opulence.

To make matters worse some of the tribute is used to silence and persecute those who…

— Edward Dowd (@DowdEdward) https://twitter.com/DowdEdward/status/1891952829784359035?ref_src=twsrc%5Etfw

* * *

Great news! Our most popular supplement https://store.zerohedge.com/iq-astaxanthin-ultimate-antioxidant

. Grab some today!

https://store.zerohedge.com/iq-astaxanthin-ultimate-antioxidant/

* * *

Acting commissioner of the Social Security Administration, Michelle King, resigned on Sunday after a standoff with Elon Musk's Department of Government Efficiency (DOGE) over access to sensitive government records.

?itok=iX04wVpV

?itok=iX04wVpV

The same day, Musk posted what he says could be the 'https://www.zerohedge.com/political/might-be-biggest-fraud-history

' in which millions of 'people' over the age of 100 are collecting payments.

According to the Social Security database, these are the numbers of people in each age bucket with the death field set to FALSE!

Maybe Twilight is real and there are a lot of vampires collecting Social Security 🤣🤣 https://t.co/ltb06VX98Z

— Elon Musk (@elonmusk) https://twitter.com/elonmusk/status/1891350795452654076?ref_src=twsrc%5Etfw

King - who worked at the agency for over 30 years, left her position this weekend after refusing to give DOGE staffers access to sensitive information, such as the fraudulent payments to 'vampires' - with at least one recipient being older than the United States itself.

?itok=pZv-PIEX

?itok=pZv-PIEX

Which of course is the exact reason career employees shouldn't be holding the keys to the castle with the new sheriff in town.

According to the https://www.washingtonpost.com/politics/2025/02/17/doge-social-security-musk/

, "Administration officials have also been skeptical of career employees' efforts to guard federal data, maintaining that political appointees should also be able to access it, particularly if necessary to root out wasteful or erroneous spending."

In the wake of King's departure, President Donald Trump appointed Leland Dudek - a manager in charge of Social Security's anti-fraud office, as acting commissioner, while the Senate vets Trump nominee Frank Bisignano. Dudek had previously posted positive remarks on social media over DOGE's efforts to cut waste, fraud and abuse throughout the US government.

Yes, there are FAR more “eligible” social security numbers than there are citizens in the USA.

This might be the biggest fraud in history.

— Elon Musk (@elonmusk) https://twitter.com/elonmusk/status/1891357918605332965?ref_src=twsrc%5Etfw

Trump picking Dudek to take over for King bypassed 'dozens of other senior executives who sat higher in the agency's leadership heirarchy, touching off alarm in and around the agency,' according to WaPo.

"At this rate, they will break it. And they will break it fast, and there will be an interruption of benefits," said former Social Security commissioner under Biden, Martin O'Malley - a former Maryland governor.

"It’s a shame the chilling effect it has to disregard 120 senior executive service people," O'Malley continued. "To pick an acting commissioner that is not in the senior executive service sends a message that professional people should leave that beleaguered public agency."

Yes jackass, that's the point.

On Monday evening, White House press secretary Karoline Leavitt said she had been fighting "fake news reporters" trying to "fearmonger" about Social Security payments.

DOGE's access to records across the federal government have prompted disputes with senior officials at various agencies. Perhaps most prominently, the highest-ranking civil servant at the US Treasury Department quit after similarly refusing to grant Musk's team access to the Bureau of Fiscal Service, which manages over $5 trillion in annual payments.

On Sunday, the Post reported that DOGE is looking to access a heavily guarded IRS system that contains detailed information about every taxpayer, business and nonprofit in the country. For some reason, Democrats seem to be the https://www.zerohedge.com/political/bruh-musk-shuts-down-fetterman-over-deep-state-doge-disinfo

freaking out about this.

And again, that's the point.

* * *

Our most popular supplement https://store.zerohedge.com/iq-astaxanthin-ultimate-antioxidant

today.

https://cms.zerohedge.com/users/tyler-durden

Tue, 02/18/2025 - 17:59

A Million Things To Parse

A Million Things To Parse

By Peter Tchir of https://academysecurities.com/

A Million Things to Parse?

Given the nonstop barrage of headlines, it might seem like there are a million things to parse? But maybe there is a subset of things that we can focus on to try to determine the direction of the market? It won’t make the task of coming up with answers easier, but it might make it manageable. Messy, but manageable remains a theme.

Academy was on Bloomberg TV on Friday, and I don’t think we could have scripted a set of issues this important to markets that are in Academy’s wheelhouse any better. The Full Clip starts at the 1:39:45 mark, but they also produced this smaller segment https://www.bloomberg.com/news/videos/2025-02-14/tchir-is-bullish-on-china-us-chipmakers-europe-video

.

Getting out of DOGE

Not a day goes by without a slew of DOGE-related headlines. I’m not sure if this is true, but it was so interesting that I figured I’d pass it along. Apparently, internet searches for “criminal lawyers” is “off the charts” in the D.C. area and a massive inventory of homes for sale has come on the market in recent weeks. Honestly, I’m not sure if those rumors are true, but the fact that the stories are circulating so widely is telling. I did find one “source” but the “source” for that “source” was GROK, which somehow seems fitting with everything going on.

On DOGE:

Headline after headline of waste that is being reduced. Even if a fraction of the headlines are accurate, the ability to cut spending seems high. That is without focusing their attention, yet, on some of the big-ticket items in the budget. DOGE alone seems able to help with the goal of reducing the deficit.

Accountability and Transparency. Or, simply, audits. There seems to be overwhelming support for accountability and transparency. As deficits have skyrocketed, in good and bad economic times, more people are left wondering where their tax dollars are going. Initial indications are that they are not being treated as carefully as we, the taxpayer, might like.

Mistakes as well. The “other side” of the story is also emerging. What if certain things being cut as “fat and waste” are actually useful and important? What happened to the cryptic tweet about “discrepancies in Treasuries?” That one seemed unlikely to be true and has quickly disappeared from the ether. Chatter about paying lots of people who are 150 years old seems to be getting debunked as it may be an issue with COBOL dates. Not sure whether the root of the issue has been figured out, but it seems insane to me that systems run on COBOL, which was already falling out of favor when I was programming, last century.

So far, I think DOGE has been helping support Treasuries. DOGE provides some element of hope that bigger chunks of the deficit can be trimmed, without major repercussions to the economy or markets, than previously thought. The excitement about what DOGE can do to the bigger line items is real. The risk that the approach is too simplistic (with too many mistakes) is there as well, but so far, there seems to be enough low hanging fruit to feed an army.

The fact that Secretary Bessent and others seem focused on longer term yields (and not just the front end of the yield curve) is also encouraging. Their task of slowing the steepening may be Herculean, but it is helping, and something, as a Treasury bear, that I’m watching closely.

Enemies Close, Friends Less So

The adage of “keep your friends close and your enemies closer” seems to be getting turned upside down.

China got hit with “only” a 10% “fentanyl” round of tariffs. TikTok remains under Chinese ownership. The administration seems to be reaching out to Xi, as much, or more, than Xi seems to be reaching out to us.

Tossing out the idea of China, the U.S., and Russia cutting their defense spending in half seems a bit dubious. We mentioned transparency earlier, and that is never a word I would use to describe China’s official data. Of all the things that have been “tossed out there” as ideas, this one seems, uhm, not so great? If I’m China, I sign on the dotted line instantly and then spend more than ever. Probably the same for Russia, though not sure what they have to spend, though that could change on the back of any agreement to end the fighting in Ukraine.

Russia back in the G-7? Not sure Europe wants that at all (see the title of this section). Not sure if calling it the G-7 was a slip, as it should be the G-8 if Russia is back, or it is a veiled threat that one member might get kicked out? This could be like quantum physics – with both answers being true at the same time!

“Friends” sometimes need to be reminded that they too need to act in certain ways to remain friends. From trade practices to defense issues, relationships need to benefit both sides. Friends that are only “take, take, take” don’t make for good friends for the longer term. Having said that, most relationships are rarely that one sided.

Canada and Mexico are dealing with the “third round” of tariffs. See Reciprocal Tariffs from Thursday for more thoughts on the subject as a whole. Two countries, which could be a big part of shifting supply chains back to one heavily dominated by the U.S., seem to be absorbing the brunt of the president’s ire so far. Not sure if that is the best strategy. So far, so good, but it does seem to go against the adage of what to do with friends.

Hegseth and Europe. The Munich speech was aggressive and presumably designed to motivate Europe to do more, so the U.S. can step its spending and efforts back. Reasonable, to some degree, but not without longer term risks.

My simplistic world view, which has served us well, has been:

On one side you have China. China is “circled” by their “bad actor” relations – Russia, Iran, and North Korea. Beyond that, China has wrapped their tentacles around many autocratic, resource-rich nations. China is a large importer of raw resources from certain nations, and in many cases, their Belt and Road Initiative is very involved in the infrastructure of those nations. I’m less worried about the BRICS as any sort of organization, than I am about their ability to act as an effective barter system for Chinese brands. There are openings into parts of Europe where current weak economic conditions, coupled with more reliance on China, make them susceptible to growing trade with China, potentially at the expense of the U.S.

On the other side you have Europe, Canada, Mexico, Central America, and South America as opportunities. Africa could be a bonanza for the U.S., as China’s behavior has not endeared it to some of the countries that they are involved with. Plenty of opportunities, but an interesting start on this front.

An interesting start to relationship building. So far, it seems to be working, but these things take time to play out. There may yet come a time when the U.S., in its efforts to “nudge” countries to do more, pushes too far. Not even close to being there yet, but I expect some pushback rather than “ring kissing” in the coming weeks, which should upset markets.

What Did You Think the End of Russian Hostilities Would Look Like?

The level of global confusion, if not outrage, about a possible deal to stop the fighting between Russia and Ukraine is surprising. It is, for better or worse, following the path that Academy has been laying out. Our assessment wasn’t based on what people would “like” to happen, but what their experiences with the individuals involved and the current state of the battlefield led them to conclude would happen.

Two things that finally seem to be getting the attention they deserve with respect to the talks:

Russia’s frozen dollar reserves are a big bargaining chip. The U.S. is trying to determine how much can be legally kept. The more the better. But the reality is that any agreement will likely include Russia getting some back, with some being used to pay off Ukraine’s debts and to fund the rebuilding.

Zelensky isn’t that popular within Ukraine any longer. Now, it appears, out of nowhere, we are seeing articles about his inability to win an election and that is why he is choosing not to hold one. That has been part of our take on the situation for months, which is why he is likely going to take a deal that goes against a lot of what he publicly claimed he needed to do a deal.

There is one twist, which I’m still trying to make sense of:

Getting access to Ukraine’s resources as payment for services already rendered. While fully on board with the idea that the U.S. will benefit from supporting the rebuilding efforts, “re-trading” something always rubs me the wrong way. The U.S. and U.S. companies should do well in the rebuilding. But do we change the terms of what was already done? Maybe, I guess, framing it as the way we want them to repay their debt makes it ok, but I cannot help but wonder if other nations will view it quite that cleanly? If they don’t, probably not a big deal in the here and now, but in the future?

Simple and Transactional

When asked about the president’s two greatest strengths, I pounce on the phrase:

Simple and Transactional. He is quick to cut to the chase. To see through a lot of the messiness and get to the point. Deals are good. They don’t need to be all-encompassing deals. Each deal can be struck on its own merit, and we can move along by keeping things simple and transactional.

Wow, I feel like we are back to quantum physics, but when thinking about the president’s two greatest weaknesses, I get right back to:

Simple and Transactional. As great as KISS is, there are things that are complex. The devil can be in the details. While everyone likes a good deal, there is a tendency to do more deals with those you trust over time (where you build a rapport). The need to “win” every deal may not lead to optimal outcomes down the road.

As we examine everything this administration is trying to accomplish, and think about how it will affect businesses, the economy, and markets, it is the balance of the simple and transactional that we will be forced to weigh. What are we getting today? What are we getting set up for down the road?

Mar-a-Lago Accord

Is all of this setting up for some push towards a “Mar-a-Lago Accord?” There has been an increasing amount of chatter about a so-called Mar-a-Lago Accord.

Most of what we’ve written about today, and in the past, fits well.

Talk of an External Revenue Service, which would focus on generating income from “foreign” sources, primarily trade. We haven’t discussed this specifically, but it fits well within our view (and concern) that the administration could decide that they like the revenue from tariffs so much that it becomes an increasingly important part of our budget process. My concern is that the benefits are felt immediately (more income), but the shifts in supply chains and relationships might be damaging longer term.

Discussions about moving more assets to the Sovereign Wealth Fund and valuing them at market prices. Our expectation is that we would look to move gold, some land, and other assets into a sovereign wealth fund.

For gold and some other assets, it might be a way to mark them to market. We’ve always tried to point out that for every corporation, people discuss the asset and liability side of the balance sheet, but for the government, we are only fixated on the liability side. I’m not a proponent for selling off national parks to the highest bidder, but trying to better account for U.S. assets would be good.

It may open the way for the government to strike deals with the private sector that ensure that the rights and privileges granted are not overturned by the next administration, or the one after that. My biggest concern about “refine baby refine” or now “National Security = National Production” has been whether corporations will be convinced that a favorable regulatory environment will remain in place for the duration of their project. I could see the sovereign wealth fund being a vehicle that could be used to structure deals with more regulatory certainty which would be good for my National Security = National Production view.

Paying for U.S. “trade protection” (the Navy in particular, but all branches of the armed forces) by “forcing” countries to buy Treasuries at off-market prices. Chatter of paying par for 100-year bonds with a 0% coupon. Lots of chatter on this, but this seems like it could hit a number of roadblocks, especially as it seems like the view is that countries may have to pay for protection that was already afforded to them. I assume this would have the “benefit” of reducing our spending (others now are paying for it) and lowering the cost of funding the debt (off-market prices would do that). Both might backfire, especially on the off-market pricing. We already “broke” one “covenant” when we froze Russia’s dollar reserves. It sent a clear signal that if you are a bad actor, your dollars are not necessarily yours. This would breach another covenant along the same lines. The debt we owe you is subject to our needs at some point in time. It won’t overwhelm markets on day one if something like this is implemented, but I’d bet against it helping yields in the longer run and it would likely hasten deglobalization.

Things do seem to be funneling in this direction, but I don’t think we’ve missed much by addressing the various topics individually rather than under the banner of the Mar-a-Lago Accord.

How Much More Good News Can Bitcoin Handle?

I’m not sure I’ve ever been this confused about Bitcoin. I’ve lost count of how many states, countries, and companies are “discussing” Bitcoin or crypto reserves (I really wanted to write “spouting off” but restrained myself). Yet, here we are still below $100k on Bitcoin.

Maybe the average investor has figured out that crypto enthusiasts can pay people to pump crypto and some of the most vocal pundits are paid and heavily conflicted (I really wanted to use “shills,” but restrained myself, again). Maybe it was that in Argentina, which has been in the headlines, in a good way, of late, there was a “rug pull” of a meme coin that seemed to have President Milei’s endorsement. At least during the few moments when the meme coin (LIBRA) did well, though social media seems to have been scrubbed of those endorsements. Or maybe, and this seems weird, so many big institutions are showing up with Bitcoin ETFs rather than “physical” (an oxymoron for a bunch of 1s and 0s), then having to explain how it is easier to own in ETF form rather than in their own wallets. That does seem a bit strange.

With all the headlines, I’d expect crypto to be soaring. It isn’t.

Crypto seems much more correlated with the market of late. Partly because of real world links (the ETFs and crypto-focused firms in major indices) and partly because it’s all part of the same sentiment/trade. I’m keeping an eye on this closely, as crypto can lead the way, particularly to the downside, for U.S. risk assets.

The Gold Arbitrage

Arbitrage is a term thrown around loosely. It should only be used when you can buy and/or sell things where the up-front cost/fee of putting the trades on converges to a point where you are guaranteed a profit. I warn you not to Google “Bitcoin arbitrage” / ”Bitcoin yield” as they are currently being used because it might make your head explode.

There is a “real” arbitrage between the price of gold in New York and London. Gold is fungible. There are storage and delivery costs that need to be accounted for, but the potential for arbitrage exists.

The relationship between New York and London gold prices has generally been stable. Of late, the price of gold in the U.S. is now significantly more than the price in London, relative to history.

Presumably, it is largely because of concerns about tariffs. When going through my notes on tariffs, thoughts and concerns on gold were, ummm, nowhere on my list. Or at least far enough down, that I hadn’t thought about it.

Yet, here it is, being influenced by tariffs.

There is only one reason why I bring this up – it is the first sign of tariffs affecting liquidity.

When we gets shifts in relationships (arbitrage conditions, volatility, cross-asset correlation) there is increased risk that one or more dealers get caught “offsides.”

That can tend to reduce the liquidity, obviously in the market in question, but it can also reduce liquidity more broadly.

If liquidity in precious metals breaks down, could it hit other commodities? As it hits other commodities, it leaks into the stocks (and bonds) of those companies that are related.

So on and so forth.

At the moment, what is going on in gold is registering as “mildly intriguing,” but given my view of market structure (the faux liquidity of algo-driven market making), it is yet another thing to keep an eye on.

National Security = National Production

I’ve given up on getting “Refine Baby Refine” to resonate. But, I have not given up on my belief that everything that is considered necessary for national security will generate a lot of attention from this administration. With the goal of being as independent as possible (and certainly independent of China, Russia, etc.) for those items.

Those items include commodities, the processed (or refined) versions of the commodities, chips, and some medical/pharma/biopharma items as well. Energy production certainly falls into this camp as well, since if we want to dominate AI and chips, we will need energy and power to do that.

If you position your portfolio around National Security = National Production, you should fare well under this administration. Maybe that will resonate better than “Refine Baby Refine.” In any case, “Drill Baby Drill” barely scratches the surface of what national security is pushing for and what seems to be getting a very positive reception from this administration.

Over time, this will keep a lid on inflation, but I don’t see how we get to extracting, processing, or producing anything in scale, without first experiencing some inflation.

Bottom Line

Millions of things are going on, but using terms like “simple” and “transactional” can help us focus on what is most important. However, we need to be aware of the failings of simple and transactional, at the same time, to avoid getting blindsided.

Credit still seems boring.

Yields are lower than my targets, but I do understand why. I’m not buying into the bullish arguments as much as the market is, but I am considering them, and wondering if I’ve underestimated the positives for bond yields? I don’t think so, but I have to keep it in mind.

Equities have plenty of opportunities, but I’m focused on the most shorted, least loved assets right now. We haven’t had a really good (meaning vicious) rotation lately, and I’m betting that we see that coming soon. Look for foreign markets to outperform. Look to own companies that will benefit from the National Security = National Production view of this administration.

Bitcoin has so many positives, but it keeps muddling along, so I’d be very tempted to dump it or short it here. This probably means that by Tuesday morning we will be at new all-time highs, but something is rotten in the state of Denmark (separate from Greenland – yeah, I had to go there!).

Good luck, and I am hoping for a Canada/U.S. rematch in the 4 nations series, as Saturday night’s game embodied the old joke, “I went to a fight and a hockey game broke out” with 3 fights in the first 9 seconds! Old school hockey! Both sides will be putting on the foil if we get to that rematch!

This is the same kind of preparation we need for dealing with these markets and the slew of headlines (for those who think we have a few weeks of no tariff-related headlines after last week’s vague announcements, I wouldn’t bet on that!).

https://cms.zerohedge.com/users/tyler-durden

Tue, 02/18/2025 - 13:45

Orban Issues 'WARNING!' Over 'Soros NGO Network Fleeing To Brussels' After USAID Funding Freeze

Orban Issues 'WARNING!' Over 'Soros NGO Network Fleeing To Brussels' After USAID Funding Freeze

With the Trump administration https://www.zerohedge.com/political/how-usaid-and-its-50-billion-budget-became-target-reform

of US taxpayer funding for the USAID international slush fund, formerly flush NGOs are now begging woke EU nations for money to continue operations, according to Hungarian Prime Minister Viktor Orbán.

?itok=kqtA3p2L

?itok=kqtA3p2L

"WARNING! Our fears have come true: the globalist-liberal-Soros NGO network is fleeing to Brussels, after President Trump dealt a huge blow to their activities in the US," Orbán wrote in a Tuesday post to X. "Now 63 of them are asking Brussels for money, under the guise of various human rights projects. Not going to happen! We will not let them find safe haven in Europe!"

"The USAID-files exposed the dark practices of the globalist network. We will not take the bait again!"

WARNING! Our fears have come true: the globalist-liberal-Soros NGO network is fleeing to Brussels, after President Trump dealt a huge blow to their activities in the US. Now 63 of them are asking Brussels for money, under the guise of various human rights projects. Not going to…

— Orbán Viktor (@PM_ViktorOrban) https://twitter.com/PM_ViktorOrban/status/1891788592730476821?ref_src=twsrc%5Etfw

Orbán then https://x.com/PM_ViktorOrban/status/1891788595377156390

a plea from the International Commission of Jurists begging the EU for money.

The International Commission of Jurists (ICJ), together with over 60 civil society organizations, has joined an urgent appeal calling on EU leaders to take immediate action to address the global development aid crisis triggered by recent decisions by the U.S. administration.

On 20 January 2025, U.S. President Donald Trump signed an Executive Order imposing a 90-day freeze on all U.S. foreign aid. This decision has already led to immediate and devastating consequences, including the closure of clinics, the suspension of life-saving disease treatment programmes, the disruption of human rights and rule of law initiatives, and a funding crisis for NGOs worldwide. -ICJ

And what are their priorities that demand this urgent intervention?

Provide emergency funding to mitigate the financial shortfalls created by the U.S. aid freeze and Global Gag Rule;

Prioritize funding for sectors most affected, including reproductive rights, gender equality, and LGBTIQ rights;

Reduce administrative barriers to ensure accessibility of funding for civil society organizations;

Take diplomatic action to urge the U.S. administration to reverse course.

Good luck getting the EU to pay for it. Surely such wealthy and virtuous nations can foot the bill?

Expel them from every corner of your nation.

We are doing the same.

Save your country!

— Gunther Eagleman™ (@GuntherEagleman) https://twitter.com/GuntherEagleman/status/1891864234956320948?ref_src=twsrc%5Etfw

The corrupt NGO's that were refunded by DOGE are going to the WEF and UN for money. Who would've guessed.

— individual1st (@individual1st) https://twitter.com/individual1st/status/1891819863368245480?ref_src=twsrc%5Etfw

In January, Orbán predicted a "new golden age" for Hungary after Donald Trump's November win, six years after https://www.zerohedge.com/news/2018-05-15/george-soros-open-society-foundation-closes-hungary-operations

out of Hungary.

“Everything will change, a different day will dawn over the Western world on Tuesday morning. The failed democratic governance in America will come to an end,” https://magyarnemzet.hu/belfold/2025/01/hazatert-orban-viktor-indiabol-hamarosan-a-kossuth-radioban-ad-politikai-helyzetjelentest-kovesse-nalunk-eloben

reported Viktor Orbán as saying in his first interview this year with Kossuth Radio’s Good Morning Hungary! program.

Calling the Democratic Party and George Soros “a bunch of idiots,” Orbán claimed the Democrats want to force what they think is right on the world, including regarding migration and gender.

He further added that his top priority for 2025 is to send George Soros back to the United States, with the “expulsion of the Soros network from Hungary” starting this spring. Orbán also expressed his hope that “patriots elsewhere” will also do the same.

“It must be shown that the Soros network’s presence in Europe is contrary to the interests of the people,” he stated.

Stating that Brussels is in the pocket of George Soros, he said, “If there is corruption, this is it.”

Noting the start of a “new era in Brussels,” the prime minister said Brussels needs to “sober up” and “adapt.”

https://cms.zerohedge.com/users/tyler-durden

Tue, 02/18/2025 - 13:25

Mysterious Explosions Rock Russian Shadow Fleet Tanker Off Italian Coast

Mysterious Explosions Rock Russian Shadow Fleet Tanker Off Italian Coast

Two explosions rocked the hull of a Maltese-flagged oil tanker hauling Russian crude oil from Algeria while it was docked at the port of Savona in northwestern Italy late last week. Investigators have not ruled out the possibility that the "two loud bangs" were caused by explosive devices, as a section of the hull appeared to be "retracted inwards."

Italian daily newspaper https://www.ilfattoquotidiano.it/2025/02/17/falla-con-lamiere-ripiegate-verso-linterno-indagini-sulla-petroliera-seajewel-ormeggiata-a-savona-capitaneria-verifiche-in-corso/7881845/

to circumvent Western sanctions, was hit by "two loud bangs" on Friday. The crew found a section of the hull "bent inwards."

Another Russian Tanker suffered an explosion whilst exporting illegal oil to Europe 🚨 🔥

Two explosions occurred on an oil tanker SEAJEWEL in Savona, Italy, with damage below the waterline. The vessel was reported to have repeatedly transported Russian oil to Europe despite… https://t.co/3ff2BPXUxP

— Martin Kelly (@_MartinKelly_) https://twitter.com/_MartinKelly_/status/1891709521145241962?ref_src=twsrc%5Etfw

The local outlet continued:

The Savona Public Prosecutor's Office has already reported the matter to the Genoa DDA and does not rule out any hypothesis, from a breakdown to a collision with an explosive device.

The Seajewel incident comes just days after the Antigua-flagged oil tanker Koala experienced "three explosions" in the engine room on Sunday while docked in Ust-Luga, a port in northwest Russia. Koala is also part of Russia's shadow fleet. The incident also comes nearly two months after the Russian cargo ship Ursa Major https://www.zerohedge.com/military/cargo-ship-hauling-russian-weapons-paralyzed-engine-failure-near-portugal-ukraines-intel

in the Mediterranean Sea between Spain and Algeria following reports of an engine room explosion.

It raises the question of whether Western intelligence agencies or Special Forces—perhaps even private contractors—are engaged in covert operations against Russia’s shadow fleet, extending the conflict far beyond Ukraine’s borders.

https://cms.zerohedge.com/users/tyler-durden

Tue, 02/18/2025 - 07:20

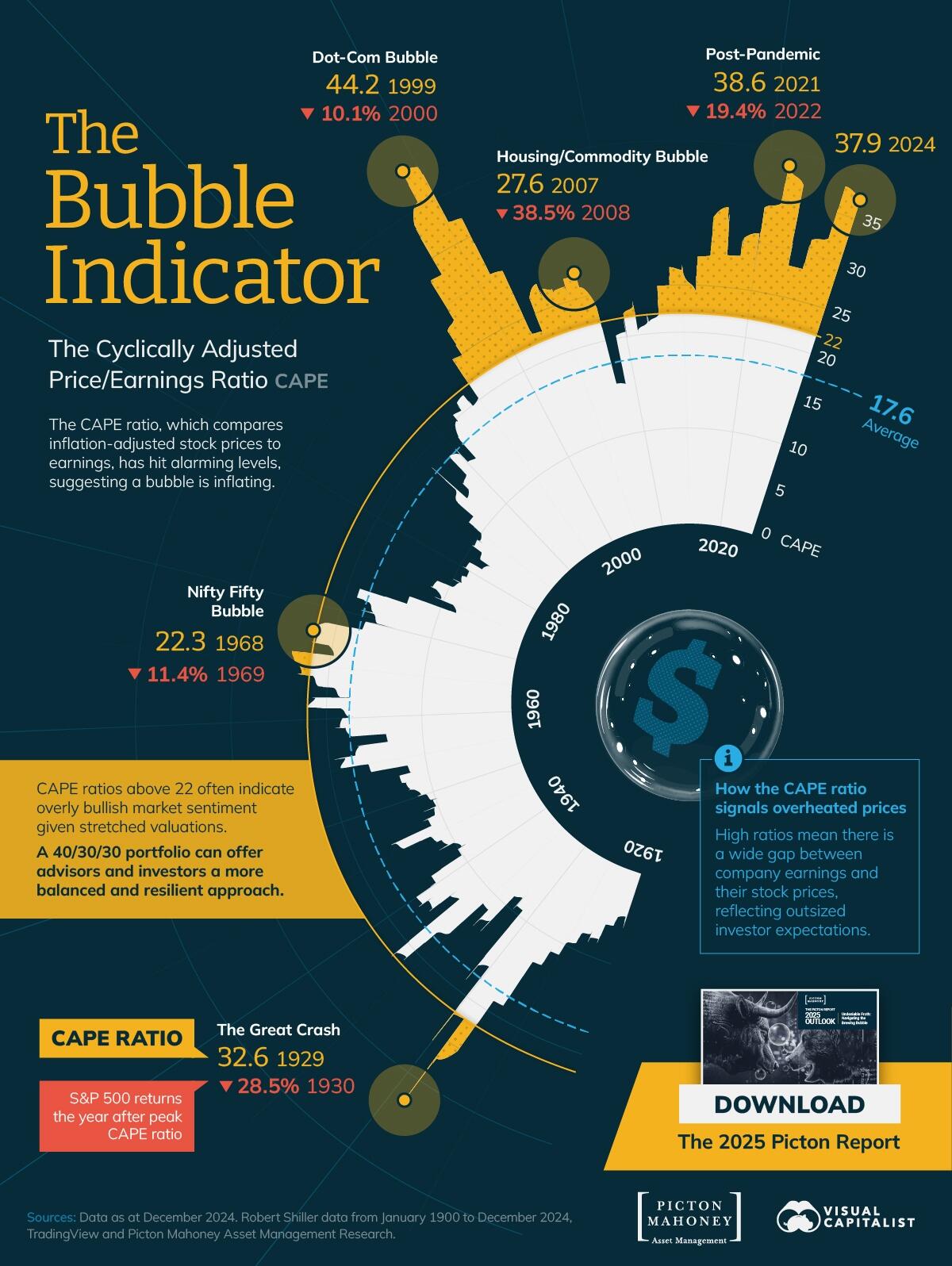

The Bubble Indicator: Is The Stock Market Overheating?

The Bubble Indicator: Is The Stock Market Overheating?

Today, the S&P 500’s cyclically adjusted price-to-earnings ratio (CAPE) is nearing historic highs, signaling market valuations may be in overheated territory.

In December 2024, the S&P 500 CAPE ratio stood at 37.9 - well above its long-term average of 17.6. Notably, it has only exceeded this level during the Dot-Com bubble and in 2021.

As https://www.visualcapitalist.com/sp/the-bubble-indicator-is-the-stock-market-overheating/

shows the S&P 500 CAPE ratio since 1920.

?itok=bya20PqE

?itok=bya20PqE

The S&P 500 CAPE Ratio Across Major Bubbles

The CAPE ratio is a widely used metric for assessing stock market valuations, comparing equity prices to their 10-year average earnings.

By smoothing out short-term fluctuations, it accounts for economic cycles and offers a more stable view of long-term value. Higher CAPE levels often signal stretched valuations, with historical trends showing that ratios above 22 typically indicate heightened market optimism.

Here are the peak CAPE ratios during major market bubbles over the past century:

?itok=CLiiO6-9

?itok=CLiiO6-9

Sources: Data as at December 2024. Robert Shiller data from January 1920 to December 2024. TradingView and Picton Mahoney Asset Management Research.

The CAPE ratio hit an all-time high during the Dot-Com bubble in 1999, which was followed by a 40% decline in the S&P 500 from 2000 to 2002.

More recently, the ratio climbed to 38.6 in 2021, its second-highest reading ever, fueled by massive pandemic stimulus and a big tech rally. The following year, the S&P 500 sank 19.4% as the Federal Reserve kicked off its monetary tightening cycle.

Similarly, the CAPE ratio has risen sharply as AI enthusiasm—particularly for https://www.visualcapitalist.com/cp/charted-the-surging-value-of-magnificent-seven-2000-2024/

stocks—has led stock prices to soar, making stock prices expensive by historical standards.

Diversification Strategies for Market Bubbles

At a time of outsized investor expectations, a more balanced portfolio allocation may reduce exposure to market bubble risk.

Investors and advisors can implement Picton Mahoney Asset Management’s Innovative Portfolio, which offers a strategic 40/30/30 mix of equities, bonds, and alternatives to hedge against a potential asset bubble.

https://cms.zerohedge.com/users/tyler-durden

Tue, 02/18/2025 - 06:55

https://www.zerohedge.com/markets/bubble-indicator-stock-market-overheating

EU Needs A Permanent CBDC, Deutsche Börse CEO

EU Needs A Permanent CBDC, Deutsche Börse CEO

https://cointelegraph.com/news/deutsche-borse-ceo-digital-euro-eu-finance

The CEO of German securities marketplace Deutsche Börse, Stephan Leithner, is calling for financial reforms in the European Union, including establishing a permanent digital euro to strengthen the region’s financial autonomy.

?itok=wvsj_DuS

?itok=wvsj_DuS

In a policy paper published on Feb. 15, Leithner outlined a 10-step strategy to transform the EU’s Capital Markets Union (CMU) into a Savings and Investments Union (SIU), with a central bank digital currency (CBDC) at its core.

Leithner sees the launch of a permanent CBDC as a key element of the EU’s digital agenda and as a crucial component of its financial strategy.

Using the digital euro as a strategic asset

Speaking about the EU’s policy framework and broader approach toward digital thought leadership, the Deutsche Börse CEO said that the European Central Bank (ECB) and national central banks must work together to ensure that the digital euro enriches the region’s capital markets ecosystem.

“The ECB’s joint approach with national central banks around a central bank digital currency will facilitate exploration of the most suitable solutions and truly enrich the EU’s capital markets ecosystem,” he said.

He also highlighted the need for technological developments around “cash on ledger” or “programmable payments” systems to ensure seamless interconnection between the EU’s permanent CBDC and existing payment systems and services.

Leithner said that a CBDC would improve efficiency in financial transactions and strengthen the EU’s economic autonomy.

Minimizing the influence of US dollar on Europe

Leithner added that combining various key regulatory frameworks in the EU, such as Markets in Crypto-Assets Regulation (MiCA), the AI Act and the Digital Operational Resilience Act (DORA), “would enable the euro to gain competitive edge at global level.”

While Leithner sees a permanent digital euro as a critical tool for enhancing the EU’s financial stability, competitiveness and innovation, the policy paper did not elaborate on the technical implementation or regulatory framework.

In January, banking giant Standard Chartered announced plans to establish a https://cointelegraph.com/news/standard-chartered-crypto-custody-luxembourg-license

and digital asset custody services.

Standard Chartered’s crypto offering in the EU will be limited to Bitcoin and Ether, with more assets coming later in 2025, the bank’s head of digital assets, Waqar Chaudry, told Cointelegraph.

https://cms.zerohedge.com/users/tyler-durden

Tue, 02/18/2025 - 03:30

https://www.zerohedge.com/crypto/eu-needs-permanent-cbdc-deutsche-borse-ceo

European Officials Say 'Nyet' To Nobel For Trump If He Secures Ukraine Peace

European Officials Say 'Nyet' To Nobel For Trump If He Secures Ukraine Peace

At the Munich Security Conference this weekend Polish Foreign Minister and Anne Applebaum's husband - Radosław Sikorski - rejected Trump's peace plan for Ukraine, mocking what he said is an unfair deal, before it has even gotten off the ground.

Sikorski declared during a panel discuss, "I would tell him [Trump] that we Europeans control the Nobel Peace Prize. If you want to earn it, the peace has to be fair."

BREAKING: Polish globalist Sikorski now threatens they will deny Trump the Nobel Peace Prize even if he ends the Ukraine War https://t.co/9b90KRMTNz

— Jack Poso 🇺🇸 (@JackPosobiec) https://twitter.com/JackPosobiec/status/1891501758486085841?ref_src=twsrc%5Etfw

The top Polish diplomat was commenting on President Trump's last Wednesday 90-minute phone call with Putin, and said: "I think the call was a mistake."

Apparently world leaders are not supposed to conduct diplomacy to stop the killing in Ukraine, which is of course how peace after a three-year long war could be achieved. "I argued against an early summit," Sikorski continued, in an apparent reference to efforts to get Trump and Putin face-to-face in a peace summit. "It vindicates Putin and lowers morale in Ukraine."

"Therefore, the credibility of the United States depends on how this war ends – not just the Trump administration, but the United States."

Sikorski then began talking Western 'grand strategy' (so much for Ukrainians suffering needlessly as the war is furthered?), saying next that "I would tell him that if you allow Putin to vassalise Ukraine, that will send a message to China that you can recover what you regard as a renegade province, and that would have direct consequences for US grand strategy, for the US system of alliances, and possibly for the future of Taiwan."

He then drew laughter and applause by the audience by mentioning the Nobel Peace Prize. "I would tell him that we Europeans control the Nobel Peace Prize [so] if you want to earn it the peace has to be fair," he asserted.

European officials are seething over what they see as Trump bypassing Zelensky in talks. After all, last Wednesday Trump held his Putin call first, after which a shorter call with the Ukrainian leader was held. Zelensky has reiterated that Ukraine won't acknowledge any dealmaking without its direct input and agreement.

As for the Nobel, the 2009 Nobel Peace Prize was awarded to President Barack Obama which the committee said was for his "extraordinary efforts to strengthen international diplomacy and cooperation between peoples." He had not actually done anything, but was merely the first Black American president.

Later in his presidency, Obama led the US-NATO intervention in Libya, which was widely understood to be at its heart a regime change operation, leading to the brutal murder of the longtime Libyan leader in a ditch outside of Sirte. Obama had also khttps://inthesetimes.com/article/yemen-war-saudi-arabia-uae-trump-obama-famine-power-khanna-sanders

of assisting the Saudis and UAE in a ruthless bombing campaign over Yemen using heavy American weaponry. It led to a half-decade long war in Yemen, targeting the Houthis, a conflict which set up the current Red Sea conflict.

Obama had also at one point ordered the drone assassination of 16-year old US citizen from Colorado, Abdulrahman Al-Awlaki (and without any due process whatsoever) - son of Al Qaeda linked cleric Anwar al Awlaki...

This is how Obama's Press Secretary Robert Gibbs responded to questioning on the murder of the 16 year old US citizen Abdulrahman al-Awlaki in a drone strike ordered by Obama: "I 'd suggest that you should have had a far more responsible father". https://t.co/Hp408VX08P

— Louis Allday (@Louis_Allday) https://twitter.com/Louis_Allday/status/1009784604008550405?ref_src=twsrc%5Etfw

We don't actually know what concrete 'peace' Obama ever brought to the world, and yet already the Europeans are saying nyet to even the possibility of a Nobel for Trump should he oversee the end a tragic war which has killed hundreds of thousand, and has threatened the security of Europe.

https://cms.zerohedge.com/users/tyler-durden

Tue, 02/18/2025 - 02:45

Our Birth Dearth Is Becoming Our Death Knell

Our Birth Dearth Is Becoming Our Death Knell

One of our current cultural mantras is “you do you” - putting your personal desires over the greater good of others and society. In other words, living selfishly instead of selflessly.

?itok=z6aZgnCW

?itok=z6aZgnCW

The manifestation of such a philosophy and its implications for our society is particularly acute when it comes to the institutions of marriage and family.

As the late James Q. Wilson, former professor of government at Harvard University, wrote in his book, “The Marriage Problem”: “It is not money, but the family that is the foundation of public life. As it has become weaker, every structure built upon that foundation has become weaker.”

I pondered this after I read last month about the Congressional Budget Office (CBO) https://www.cbo.gov/publication/59899

troubling new numbers regarding current fertility rates in the United States.

While numerous articles have been written about the “birth dearth” over the past few years and its implications for our future, this report clearly illustrates that what was once a matter of concern is rapidly becoming a full-blown crisis as the CBO forecasts significantly lower population growth over the next three decades.

Writing in the Wall Street Journal, Paul Kiernan https://www.msn.com/en-us/politics/government/u-s-deaths-expected-to-outpace-births-within-the-decade/ar-BB1rqnUf

:

“As a result of these changes, deaths are expected to exceed births in 2033, seven years earlier than the nonpartisan agency projected a year ago.”

The https://www.cbo.gov/publication/59899

shows the population receiving Social Security will grow from its current total of 342 million to 383 million by 2054. The current ratio of people aged 25–64 compared to those over 65 is 2.9-1. By 2054, it will be 2.2-1.

While better health care has resulted in longer life expectancies, thus increasing this ratio, the nation’s current population growth rate is 0.2 percent, with much of that driven by immigration rather than births. In fact, the CBO projects that the fertility rate will be approximately 1.70 percent, below the replacement level of 2.1.

So, while people living longer is one contributing factor, it is just that: one factor. There are more and greater factors in play. Perhaps the most important one is this: Americans are not getting married or forming families, or if they are, it happens later in a woman’s prime childbearing years.

For instance, in 1970, married couples made up 71 percent of all American households. By 2022, that percentage had decreased to just 47 percent. In 1962, 90 percent of all 30-year-olds were married, with that percentage dropping to 51 percent in 2019.

Dr. Peter H. Schuck, professor emeritus at Yale Law School, perhaps put it best when he wrote in his book, “One Nation Undecided: Clear Thinking About Five Hard Issues That Divide Us”:

“The family is the essential core of any society, and the steady decline of two-parent households is probably the single most consequential social trend of the half-century.”

Decisions not to get married or have children are often driven by choices to pursue so-called “personal fulfillment,” such as money, travel, and a career.

Last year, the Pew Research Center https://www.pewresearch.org/social-trends/2024/07/25/the-experiences-of-u-s-adults-who-dont-have-children/

that 57 percent of adults under 50 who say they’re unlikely to ever have kids say a major reason is they just don’t want to; 31 percent of those ages 50 and older without kids cite this as a reason they never had them.

The implications are ominous—the rapidly growing aging population that becomes dependent upon younger generations for their care will be like old Mother Hubbard, who goes to the cupboard and finds nothing more than a bone.

According to Pew, even those who have chosen not to marry or have children worry about what their lives will be like as they age, without children or younger generations to provide the financial and familial support they will need. In addition, this will only increase government dependence for the elderly.

But there are also other societal considerations beyond caring for an aging population. Across the nation, we are already seeing schools beginning to close because of decreased enrollment (https://nces.ed.gov/programs/digest/d23/tables/dt23_203.20.asp?current=yes

finding young, skilled, able-bodied workers, and when there are less children it will likely mean a continued drop in fertility rates as there will be even fewer young adults getting married and having children in the future.

It is a death spiral as the lack of marriages and children continues to weaken our nation’s foundation. You can only remove so many bricks, in this case families and children, before the entire building comes tumbling down.

What is the solution? We need to become a society that once again emphasizes the importance of marriage and children, putting sacrifice over personal ambition and family over autonomy. Without such a reversal from our current societal philosophy of “you do you” and a return to these values, our birth dearth will become our societal death.

* * *

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

https://cms.zerohedge.com/users/tyler-durden

Mon, 02/17/2025 - 23:35

https://www.zerohedge.com/political/our-birth-dearth-becoming-our-death-knell

US Special Forces Deploy To Mexico For "Training" Mission Following Spy Plane SIGINT Operations

US Special Forces Deploy To Mexico For "Training" Mission Following Spy Plane SIGINT Operations

After two weeks of US Air Force RC-135V/W Rivet Joint reconnaissance aircraft conducting multiple signals intelligence (SIGINT) operations along the US-Mexico border and in international waters off southern Baja California—areas controlled by heavily armed drug cartels—the Mexican Senate Commission has approved the deployment of US Special Forces operators to the country for "training missions."

reports that the Mexican Senate Commission has already approved the US Army's 7th Special Forces Group (Airborne) Green Berets to conduct training exercises at a naval facility in Campeche, a Mexican port city on the Gulf of Mexico.

![]() ?itok=iIk3RVfJ

?itok=iIk3RVfJ

As of Monday, the exercise is underway and will last through the end of March in conjunction with the Mexican Navy's Infantería de Marina.

The training will take place at the Luis Carpizo naval facility in Campeche from February 17 to March 30, 2025. It has been officially approved by the Mexican Senate's Naval Ministry Commission and will be conducted under the supervision of the Mexican Defense Ministry (SEDENA). This ensures that while the training benefits from US military expertise, it remains aligned with Mexico's national defense priorities. -SOFREP

"It's important to say the Green Berets' role is going to be just that: Training," Scott Stewart, vice president of intelligence for international security consultant TorchStone Global, told https://www.newsnationnow.com/us-news/immigration/border-coverage/us-special-forces-mexico-training/?email=b225caf80d2ba695aef90160aa724c7d985421e2&emaila=db4be34bd6094598e01be51f5d7d9f74&emailb=638182035d5ebfd2f3429af764fa4995d193ffcfbd5d2034df127e002fa73295&utm_source=Sailthru&utm_medium=email&utm_campaign=Your%20Morning%20-%20WEEKDAYS%202025%202025-02-17

, adding, "It's not like they're sending in the SEALs, the Delta (Force) or the (Army) Rangers. It's not like we are seeing the deployment of combat troops or combat aircraft."

LFG 🔥🔥🇺🇸🇺🇸 https://t.co/2WvCeOCau9

— Elon Musk (@elonmusk) https://twitter.com/elonmusk/status/1891582468529983682?ref_src=twsrc%5Etfw

Stewart suggested that the Mexican government likely permitted the USAF spy planes near cartel-controlled areas to collect SIGINT for law enforcement agencies.

"That may be an attempt to increase signals intelligence – that plane is a vacuum, it sucks up all communications – but I think it would be intelligence to pass to the Mexican marines and not necessarily in preparation for a US airstrike or something," he noted.

As we previously reported:

Beyond training, this partnership comes as President Trump recently designated Mexican cartels as "foreign terrorist organizations."

When reporters asked Trump earlier this month whether he would consider deploying Special Forces operators to Mexico, he responded, "Could happen" and added, "Stranger things have happened."

ABC News asked Trump administration Border Czar Tom Homan a few weeks ago whether the US military could get involved if cartels strike. Homan https://www.zerohedge.com/military/border-czar-expects-kinetic-warfare-between-us-troops-mexican-drug-cartels?ref=redicate.com

, "Yes, and we expect them to," adding that US troops "need to protect themselves."

Pres. Trump's "border czar" Tom Homan says the U.S. military could get involved in a conflict with the Mexican cartels.

"I think the cartels would be foolish to take on the military," Homan said.https://t.co/2MHah30Ivj

— ABC News (@ABC) https://twitter.com/ABC/status/1887603440559239511?ref_src=twsrc%5Etfw

At the start of the month, in what appeared to be the https://www.zerohedge.com/markets/trade-war-over-mexican-president-says-tariffs-delayed-month-after-deploying-10000-troops

, Mexico and Canada each committed 10,000 troops to their respective borders, while the US reinforced its southern border with thousands of soldiers in the last three weeks.

Last month, US https://www.zerohedge.com/political/military-strikes-cartels-inside-mexico-table-hegseth

had some strong words for drug cartels.

BREAKING: Secretary of Defense Pete Hegseth just confirmed that the United States could now conduct special operations against Mexican cartels now that President Trump has declared them foreign terrorist organizations.

"All options will be on the table." https://t.co/UhCvRaGRvJ

— George (@BehizyTweets) https://twitter.com/BehizyTweets/status/1885368484571603076?ref_src=twsrc%5Etfw

As we've previously noted:

Dismantling Mexican drug cartels could be a very messy operation, which is why the Trump administration fortified the border with the military. The challenge, however, is that if US Special Forces operators kill cartel leaders, retaliatory attacks by cartel members could occur at Mexican beach resorts or, worse, on the streets of US cities.

This move could mark the beginning of a broader deployment of US Special Forces in Mexico, aimed at dismantling drug cartels responsible for the drug death catastrophe of 100,000 Americans per year. Beyond military action, there is also the possibility that the Trump administration could launch financial hybrid warfare—applying pressure on Mexican banks to disrupt cartel operations. Additionally, Beijing may soon face more pressure from Trump in its role in https://www.zerohedge.com/medical/watch-live-house-subcommittee-reveals-chinese-govt-involvement-americas-fentanyl-crisis

.

This is what 'America First' looks like.

https://cms.zerohedge.com/users/tyler-durden

Mon, 02/17/2025 - 23:00

Watch: Whinging Karen Tries To Interfere With ICE Arresting Illegal Aliens

Watch: Whinging Karen Tries To Interfere With ICE Arresting Illegal Aliens

Footage out of North Carolina shows ICE agents being interrupted by an interfering Karen while they were conducting a raid and detaining three illegal aliens for deportation.

?itok=h2xyz4_e

?itok=h2xyz4_e

She got all up in their faces with a camera phone and demanded they show her their warrant.

Of course they completely ignored her because it had absolutely nothing to do with her.

Three men from India arrested by law enforcement for deportation, in Durham, North Carolina, on Thursday around 7:30 a.m.

This apparent ICE raid was met by a woman named Alisa Cullison who demanded to see a signed warrant from a judge.

The agents appropriately ignored her. https://t.co/v2aewTKHof

— Paul A. Szypula 🇺🇸 (@Bubblebathgirl) https://twitter.com/Bubblebathgirl/status/1890562728395153672?ref_src=twsrc%5Etfw

She wants to speak to the ICE manager right away.

Just another stupid woman that doesn't care that they are here illegally and that's why they are getting deported, but wants to see a signed warrant from a judge to deport them.

What did we do to live in such a backward ass country?

— SheepDog Society LLC (@SDSLLC_USA) https://twitter.com/SDSLLC_USA/status/1890828563923771663?ref_src=twsrc%5Etfw

Later she got all over local news with another neighbourhood Karen complaining about the agents trying to do their job.

Exactly what you would expect her to look like. https://t.co/9rnPCokPZ7

— DVinny84🇺🇸 (@DVinny84) https://twitter.com/DVinny84/status/1890824233640509754?ref_src=twsrc%5Etfw

The incredible CBS affiliate News report painted up the illegals as the victims and noted that the Karens had called a pro-illegals group called “Siembra NC,” which is known for trying to warn illegal aliens how to avoid raids and deportation.

CBS reported on this deportation and tried to make the illegals seem like the victims, even though they were the ones who broke the law.

A pro-illegals group called “Siembra NC” said they got involved to dispel rumors.

What they’re really doing is trying to warn other illegals. https://t.co/3qRA41ZudG

— Paul A. Szypula 🇺🇸 (@Bubblebathgirl) https://twitter.com/Bubblebathgirl/status/1890567284357288216?ref_src=twsrc%5Etfw

The group https://twitter.com/SiembraNC?ref_src=twsrc%5Etfw

is basically an organization trying to thwart the efforts of ICE.

Siembra NC should be investigated by https://twitter.com/ICEgov?ref_src=twsrc%5Etfw

.

Are illegals working there? https://t.co/Owj44AsWXY

— Paul A. Szypula 🇺🇸 (@Bubblebathgirl) https://twitter.com/Bubblebathgirl/status/1890569830345986269?ref_src=twsrc%5Etfw

I wrote a detailed report about this organization https://t.co/PKdXnXXEak

— Amy Mek (@AmyMek) https://twitter.com/AmyMek/status/1891074029714276820?ref_src=twsrc%5Etfw

When you love foreign criminals more than your own neighbors... is that a disordered love, no love at all, or a blatant hatred of America?

Clueless Karens who make themselves enemies of the people are playing a dangerous game. https://t.co/9umFaFdMLL

— CHARITY 🇺🇸 (@heycharity) https://twitter.com/heycharity/status/1891142439190053219?ref_src=twsrc%5Etfw

It is illegal to interfere with the duties and operations of ICE officers. Expect to see this reflected with arrests if this continues.

Can’t wait for the first retard arrested for interfering with them. https://t.co/8YMNu1RjUi

— T (@Trav_inMissouri) https://twitter.com/Trav_inMissouri/status/1890924628303810943?ref_src=twsrc%5Etfw

* * *

Your support is crucial in helping us defeat mass censorship. Please consider donating via https://pauljosephwatson.locals.com/support

.

https://cms.zerohedge.com/users/tyler-durden

Mon, 02/17/2025 - 13:30

Oops: Trump Administration Un-Fires Hundreds Of Nuclear Weapon Workers

Oops: Trump Administration Un-Fires Hundreds Of Nuclear Weapon Workers

The new Trump administration has worked to reduce the federal employee headcount with jaw-dropping speed, but the well-intended haste has started to produce some unintended consequences -- starting with Uncle Sam's nuclear arsenal.

First, a quick review of that broader campaign: After offering nearly everyone in the federal workforce the option to https://www.zerohedge.com/political/least-70000-federal-workers-have-accepted-buyout-offer-white-house-official

that targeted some 200,000 "probationary" federal employees across several departments.

?itok=X8X6neRh

?itok=X8X6neRh

While that status may sound like it's associated with employees who did something wrong, it generally applies to any federal "worker" who's in the first one or two years of their current position, regardless of whether they've been a federal employee for years before taking the current role. The bottom line of "probationary" status is that, during the time period, these employees generally can be fired without any privilege of appealing their terminations.

Among those on the receiving end of the probationary-employee bazooka shot were hundreds employed by the National Nuclear Security Administration (NNSA). On Thursday, they found themselves suddenly out of work. For some, ominous indicators preceded receipt of official termination -- unable to access email or https://apnews.com/article/nuclear-doge-firings-trump-federal-916e6819104f04f44c345b7dde4904d5

, upwards of 350 probationary NNSA employees were fired.

?itok=YwwY-s2a

?itok=YwwY-s2a

Though the agency supervises production of new nuclear warheads and maintains existing ones, the NNSA isn't part of the Department of Defense, but rather the Department of Energy, where a total of about 2,000 probationary employees were targeted. About https://apnews.com/article/nuclear-doge-firings-trump-federal-916e6819104f04f44c345b7dde4904d5

.

Apparently realizing its ax had slashed through an unintended target, the Trump administration raced to negate the terminations. On Friday night, acting NNSA director Teresa Robbins fired off a memo rescinding the terminations for hundreds of fired probationary employees -- minus 28 who were excluded from the reprieve. The memo obtained by AP read:

“This letter serves as formal notification that the termination decision issued to you on Feb. 13, 2025 has been rescinded, effective immediately."

At least initially, the NNSA was https://www.nbcnews.com/politics/national-security/trump-administration-wants-un-fire-nuclear-safety-workers-cant-figure-rcna192345?taid=67b0cdf1e6d2760001470968&utm_campaign=trueanthem&utm_medium=social

some fired-and-unfired employees. "We do not have a good way to get in touch with those personnel,” NNSA officials wrote in an email sent to other employees, seeking their help in getting the word out via their "personal contact emails."

Critics leapt on the debacle. “The DOGE people are coming in with absolutely no knowledge of what these departments are responsible for,” Daryl Kimball, executive director of the Arms Control Association, told AP. "They don’t seem to realize that it’s actually the department of nuclear weapons more than it is the Department of Energy.”

?itok=tOqLPCme

?itok=tOqLPCme

At least one of the probationary NNSA employees caught up in the fiasco plans to return -- but to look for a new job anyway. "I will be honest, I intend to keep looking for work,” the employee told https://www.nbcnews.com/politics/national-security/trump-administration-wants-un-fire-nuclear-safety-workers-cant-figure-rcna192345?taid=67b0cdf1e6d2760001470968&utm_campaign=trueanthem&utm_medium=social

. “I will go back, but as soon as I find another role, I’ll be leaving.”

That may be a smart move. While the blunt "probationary employee" weapon seemingly did some unintended damage at NNSA, we suspect the organization is ripe for a more deliberate effort to slash overhead, as it has more than https://www.nytimes.com/2025/02/16/us/politics/trump-national-nuclear-security-administration-employees-firings.html

employees.

https://cms.zerohedge.com/users/tyler-durden

Mon, 02/17/2025 - 13:00

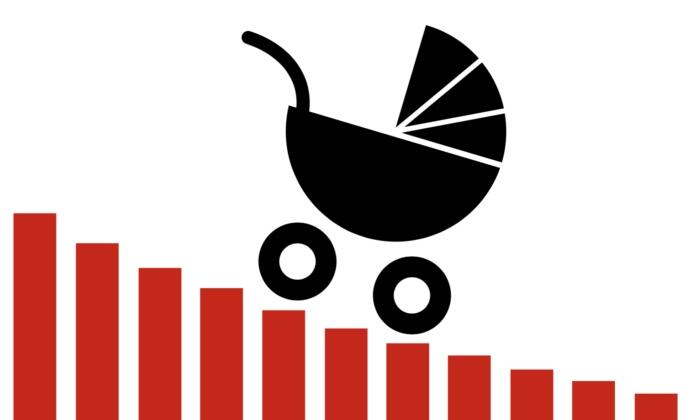

Defense Stocks Soar As EU Leaders Plan To "Substantially Increase" Weapon Spending

Defense Stocks Soar As EU Leaders Plan To "Substantially Increase" Weapon Spending

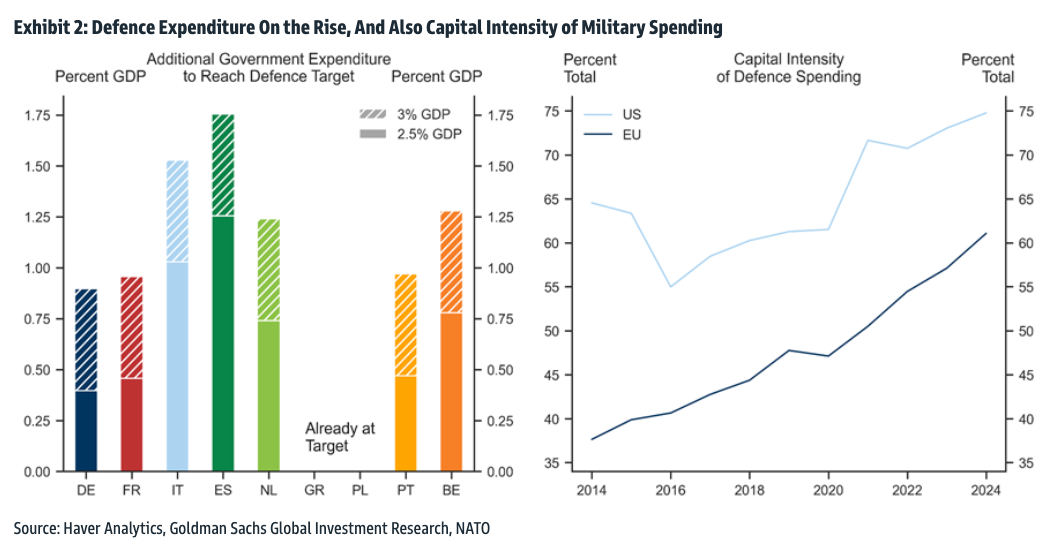

European defense stocks surged on Monday following last week's Munich Security Conference, where global leaders, ministers, and top policymakers discussed the urgent need to increase defense spending across the continent as a deterrent against an increasingly emboldened Russia.

On Friday, European Commission President Ursula von der Leyen told the audience at the annual three-day meeting, "I can announce that I will propose to activate the escape clause for defense investments. This will allow member states to substantially increase their defense expenditure."

The North Atlantic Treaty Organization (NATO) mandates that European countries allocate about 2% of their GDP to defense spending. However, many member states have failed to meet this target. New commitments over the weekend signaled that military expenditures will rise, fueling EU defense stocks on Monday.

Goldman's Lindsay Matcham told clients earlier that the GS EU Defense basket was the "chart of the day" after surging nearly 8% to a record high, driven by the notion that defense spending will rise and continued support for Ukraine.

?itok=nxI81l8J

?itok=nxI81l8J

In a separate note, Goldman's Matt Atherton explained to clients that bullish comments from the Munich Security Conference about defense spending would act as a "tailwind" for defense stocks:

Additional Defence Spending an Extra Potential Tailwind: Despite little change regarding a Ukraine/Russia peace deal over the weekend amid growing positioning for such an event, the market has not retraced much of last week's price action this morning. We think there was just enough positive soundbites, especially with regards to increased defence spending, to keep the market trading this theme. Notably, EU Commission President von der Leyen stated in a speech at the Munich Security Conference that she "will propose to activate the escape clause for defence investments [similar to a measure used during COVID]. This will allow member states to substantially increase their defence expenditure". While GS Economics have highlighted that wider fiscal deficits across Europe via national debt are not sustainable over the long-term, they are certainly possible for a few years and would be much easier to pass than additional defence spending funded via European issued debt.

Individual names rocketed higher, including Rheinmetall +7.2%, Saab +7.7%, Hensoldt +7.7%, RENK +10%, Leonardo +4.5%, BAE Systems +4.7%.

Bloomberg noted, "Shares of steel and engineering conglomerate Thyssenkrupp soar as much as 11%, hitting the highest level since April 2024; the group is pursuing an IPO of its naval unit, a maker of military ships and submarines."

European leaders have been deeply concerned that President Trump could retreat from NATO, leaving much of the continent unable to defend itself because of its deindustrialized state. The latest data from Goldman's Sven Jari Stehn, Filippo Taddei, and others show that most of the bloc does not meet the NATO defense spending target.

?itok=eJyxthjf

?itok=eJyxthjf

The move towards higher defense spending will occur over several years...

?itok=Ah-pv0t_

?itok=Ah-pv0t_

The Goldman analyst outlined three funding options for the bloc to increase defense spending:

national debts,

EU debt through existing institutions/programs,

and a borrowing facility established through a new European program.

They noted, "All these options are unlikely to become operational before 25H2 at the earliest, so we turn to them now."

https://cms.zerohedge.com/users/tyler-durden

Mon, 02/17/2025 - 08:00

The Stability-Instability Paradox

The Stability-Instability Paradox

https://realinvestmentadvice.com/resources/blog/the-stability-instability-paradox/

Market Shakes Off Inflation Data

I am back from traveling, and we have a good bit to catch up on since https://realinvestmentadvice.com/resources/blog/the-clock-has-no-hands/

, updating all the weekly technical and statistical data we produce. Most noteworthy in that report was the sharp increase in money flows into the market despite the tariff announcement by the Trump administration and the latest inflation reports.

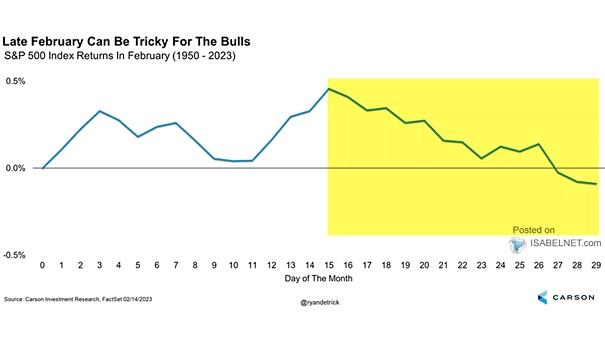

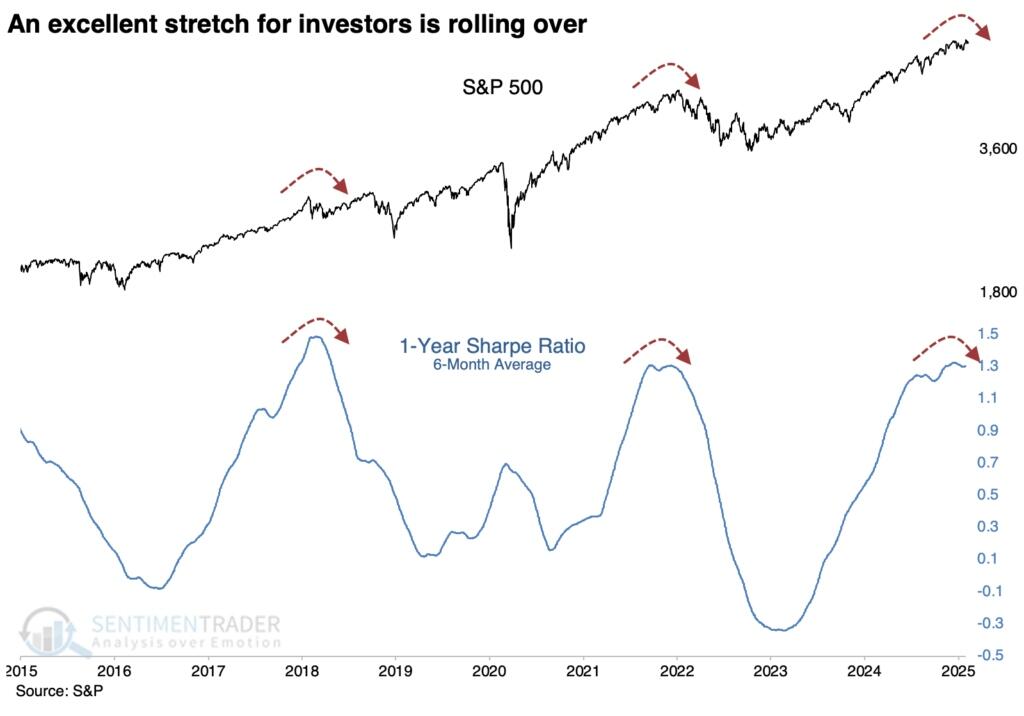

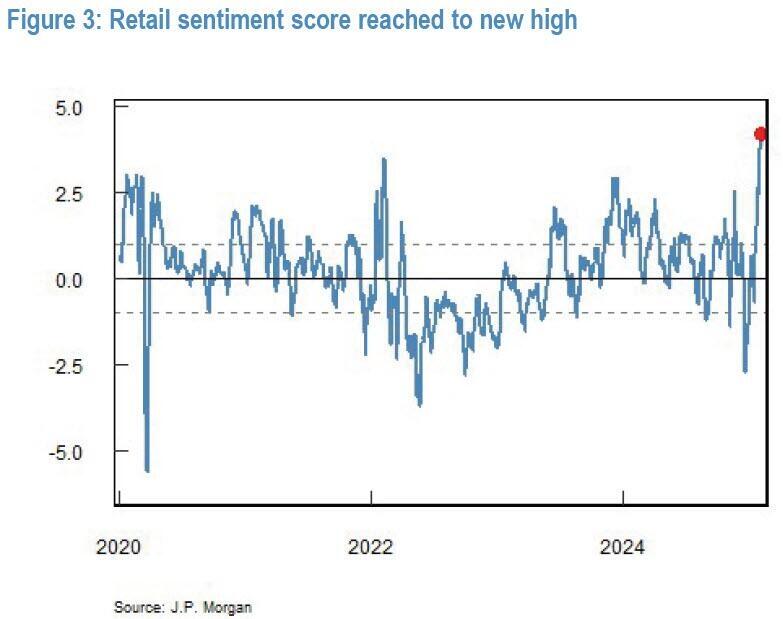

On Thursday, the market broke out of the bullish consolidation over the last few weeks, successfully retesting and holding support at the 50-DMA. Notably, the bullish trend remains intact, and retail investors continue to pour money into the market, with money flows reaching typical peak levels. With the market elevated, downside risk over the next few weeks will likely be contained to recent January lows. What would cause such a correction is unknown, but if money flows begin to reverse, such will likely provide the evidence needed to rebalance risks accordingly.

?itok=DmTuZgla

?itok=DmTuZgla