Trump Retaliates Against Ontario's "Electricity" Tariff, Threatens To "Permanently Shutdown" Canadian Carmakers, Pushes 51st State Idea

Trump Retaliates Against Ontario's "Electricity" Tariff, Threatens To "Permanently Shutdown" Canadian Carmakers, Pushes 51st State Idea

Just when you thought it was safe to dip your toe back in the growth-challenged markets, President Trump took to https://truthsocial.com/@realDonaldTrump/posts/114144180393726960

and unleashed a retaliatory strike against Canada (more specifcally Ontario) for its ongoing tariffs (and electricity price hike)... (emphasis ours)

Based on Ontario, Canada, placing a 25% Tariff on “Electricity” coming into the United States, I have instructed my Secretary of Commerce to add an ADDITIONAL 25% Tariff, to 50%, on all STEEL and ALUMINUM COMING INTO THE UNITED STATES FROM CANADA, ONE OF THE HIGHEST TARIFFING NATIONS ANYWHERE IN THE WORLD.

This will go into effect TOMORROW MORNING, March 12th.

Also, Canada must immediately drop their Anti-American Farmer Tariff of 250% to 390% on various U.S. dairy products, which has long been considered outrageous. I will shortly be declaring a National Emergency on Electricity within the threatened area. This will allow the U.S to quickly do what has to be done to alleviate this abusive threat from Canada.

If other egregious, long time Tariffs are not likewise dropped by Canada, I will substantially increase, on April 2nd, the Tariffs on Cars coming into the U.S. which will, essentially, permanently shut down the automobile manufacturing business in Canada.

Those cars can easily be made in the USA!

The result is that the Canadian dollar dumped...

?itok=OEh_wdnz

?itok=OEh_wdnz

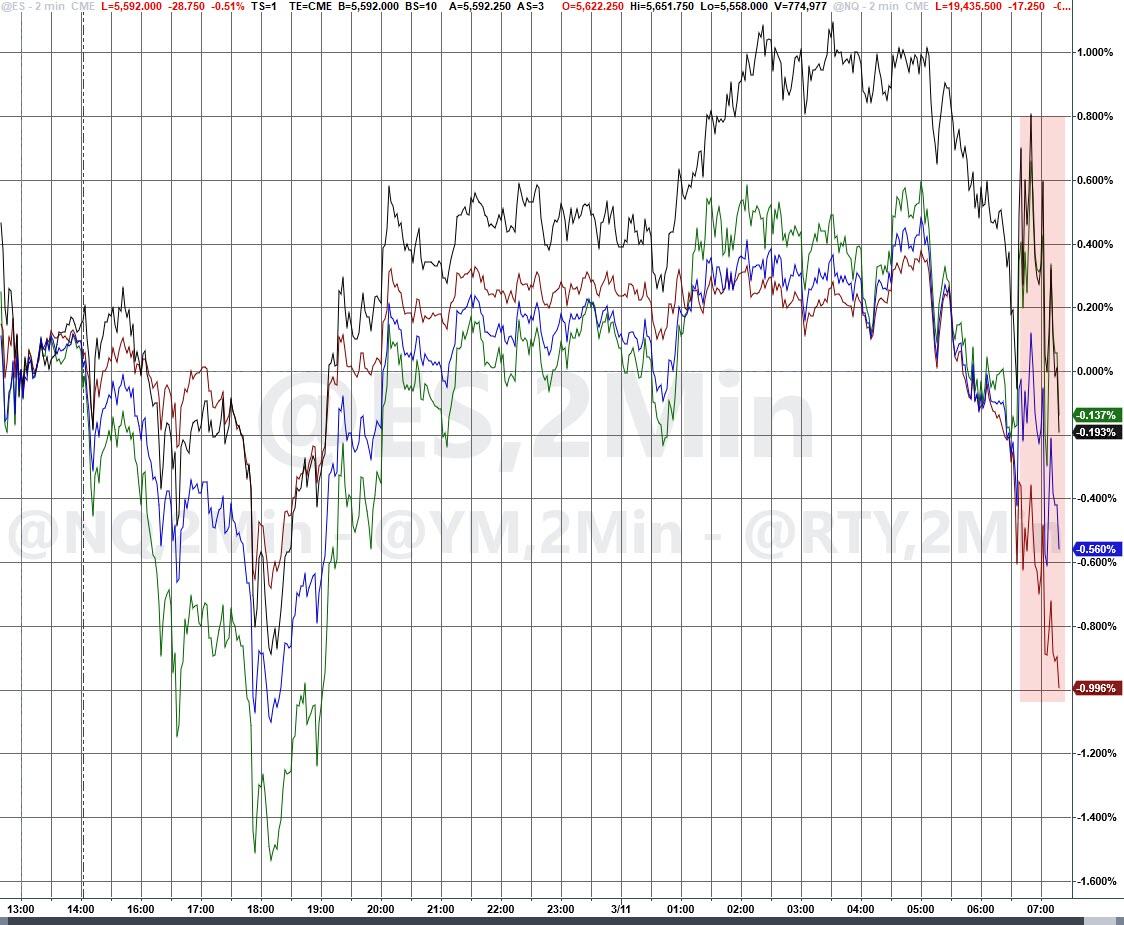

And US stocks gave up some their early gains.

?itok=9BDZYZw5

?itok=9BDZYZw5

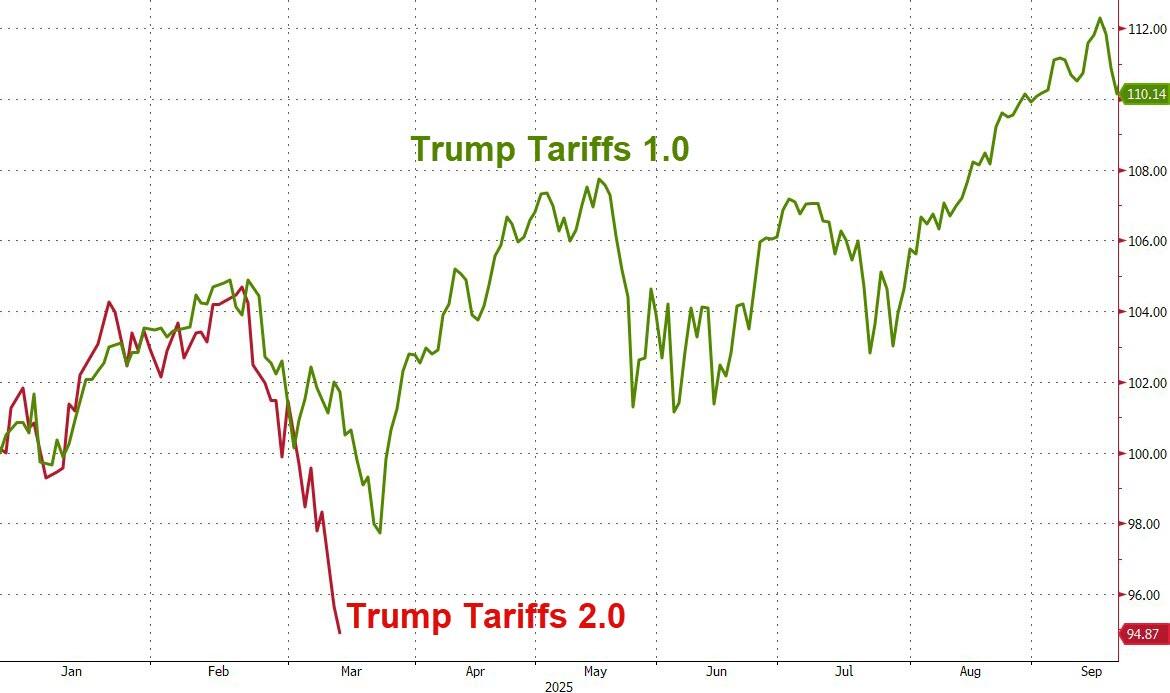

It's different this time.. for now...

?itok=igg9cYEg

?itok=igg9cYEg

Trump then diverted back to his previous comments on making Canada America's 51st State:

Also, Canada pays very little for National Security, relying on the United States for military protection.

We are subsidizing Canada to the tune of more than 200 Billion Dollars a year. WHY??? This cannot continue.

The only thing that makes sense is for Canada to become our cherished Fifty First State.

This would make all Tariffs, and everything else, totally disappear.

Canadians taxes will be very substantially reduced, they will be more secure, militarily and otherwise, than ever before, there would no longer be a Northern Border problem, and the greatest and most powerful nation in the World will be bigger, better and stronger than ever — And Canada will be a big part of that.

The artificial line of separation drawn many years ago will finally disappear, and we will have the safest and most beautiful Nation anywhere in the World — And your brilliant anthem, “O Canada,” will continue to play, but now representing a GREAT and POWERFUL STATE within the greatest Nation that the World has ever seen!

We are sure Mr Carney will bristle with Trump's hurtful words.

?itok=D3DhK47e

?itok=D3DhK47e

* * *

Top sellers from last week at https://store.zerohedge.com

:

https://store.zerohedge.com/zerohedge-multitool

https://store.zerohedge.com/swat-micarta-blued

(1 left until resupply)

https://store.zerohedge.com/wise-food-storage-heirloom-seed-vault-39-varieties-4-500-seeds

https://store.zerohedge.com/iq-colostrum

https://store.zerohedge.com/coffee/

(buy 2 bags, get free tumbler)

https://store.zerohedge.com/anza-tanto-black-micarta

https://cms.zerohedge.com/users/tyler-durden

Tue, 03/11/2025 - 14:15

US 'Immediately Lifts' Pause On Intel & Military Aid To Ukraine As 30-Day Truce Plan Agreed Upon

US 'Immediately Lifts' Pause On Intel & Military Aid To Ukraine As 30-Day Truce Plan Agreed Upon

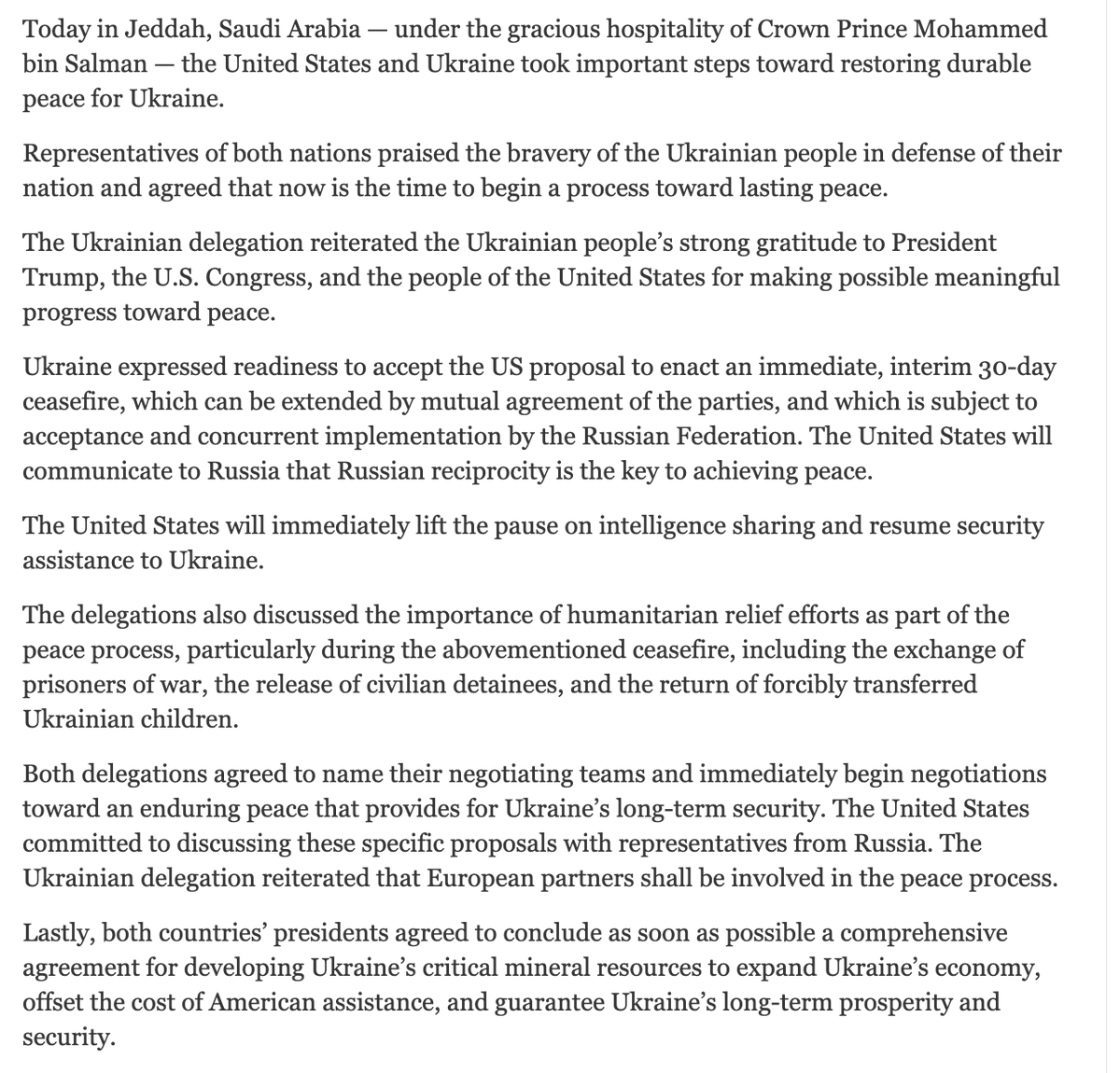

An apparent breakthrough in Jedda talks between the US and Ukraine, as the United States has announced it "will immediately lift the pause on intelligence sharing and resume security assistance to Ukraine."

The Zelensky government has also "expressed readiness to accept the U.S. proposal to enact an immediate, interim 30-day ceasefire, which can be extended by mutual agreement of the parties, and which is subject to acceptance and concurrent implementation by the Russian Federation," the statement said.

?itok=gP3G11-C

?itok=gP3G11-C

"The United States will communicate to Russia that Russian reciprocity is the key to achieving peace," it added. This comes after a reported over eight hour-long meeting between the US and Ukrainian delegations in the Saudi port city on Tuesday. No doubt, the Ukrainians came hat in hand, ready to please Trump after relations had fallen off a cliff with the Zelensky Oval Office confrontation earlier this month.

Shortly before the announced US-Ukraine agreement for a 30-day ceasefire, a TASS headline said that the Kremlin has no information on any details coming out of the Jeddah meeting.

But will Putin agree? There's as yet little incentive for him to enact a temporary ceasefire, given as Trump recently admitted... he has all the cards (and Zelensky doesn't).

By all accounts the Russians are fast taking back territory in Kursk and advancing along front lines in the Donbas. Likely Russia fears that Kiev could simply use this ceasefire as an opportunity to rearm, rest, resupply and regroup - especially given Washington just said the US arms and intel pipeline is back on.

Moscow is likely to see this is simply a matter between Washington and Kiev, and it appears to be a version of Zelensky's 'partial ceasefire' which demands a halt to all air assaults. Or in essence it sounds like Zelensky just wants his satellite images turned back on.

Ukraine's presidential office presenting this as the joint statement following the talks led by Rubio, Waltz, and Witkoff:

"The United States will immediately lift the pause on intelligence sharing and resume security assistance to Ukraine."

"Both countries’ presidents agreed to conclude as soon as possible a comprehensive agreement for developing Ukraine’s critical mineral resources to expand Ukraine’s economy, offset the cost of American assistance, and guarantee Ukraine’s long-term prosperity and security."

The full statement:

?itok=rFJOYsGI

?itok=rFJOYsGI

From Russia's point of view, there's nothing about turning back on the weapons and intel assistance which will help anything, given also just last night Ukraine launched its https://www.zerohedge.com/geopolitical/largest-ever-ukrainian-drone-attack-moscow-kills-three-civilians-injures-9

in Russian territory to date, targeting the capital of Moscow.

developing...

https://cms.zerohedge.com/users/tcitizen

Tue, 03/11/2025 - 14:15

Futures Rebound From Worst Plunge Of 2025 As Trump Meet CEOs

Futures Rebound From Worst Plunge Of 2025 As Trump Meet CEOs

US equity futures are higher, rebounding from the biggest selloff since last September (and since 2022 for the Nasdaq) with both tech and small caps outperforming as Trump is set to meet with top business executives later in the day, and many speculate that he will address the recent stock market plunge (the mere confirmation should sends stocks higher according to Goldman's Delta One team). As of 8:00am ET, S&P futures are up 0.4%, while Nasdaq futures gain 0.6% after plunging 4% on Monday, with all Mag7 names (ex AAPL) higher premarket with Semis, Financials, and Int’l Equity ADRs also poised to outperform. The JPM Trading Desk says it likes participating in this bounce higher but warns that it may be short-lived unless trade policy is crystallized (well, duh). Delta’s earnings (and now American's this morning) calling out uncertainty for hitting guidance may increase expectations for Trump to establish the "Trump Put" in Equity markets. Trump may also visit China in April, according to https://www.scmp.com/news/china/diplomacy/article/3301827/despite-escalating-trade-war-trump-may-meet-xi-china-soon-april-insiders-say

, potentially to do a trade deal as a second summit in the US in June is also in discussion. Bond yields are higher as the yield curve twists flatter and the USE slides again, helping US stock futures in their attempt to rebound after Monday’s slump. Commodity prices are strong across all 3 complexes with precious metals the standout, as gold storms back over $2900. Today’s macro data focus is on JOLTS data and Small Business Optimism which slumped to 100.7 from 102.8, the lowest since Trump won the election (future hiring plans are a leading indicator for NFP).

?itok=oqaaERa5

?itok=oqaaERa5

In premarket trading, Delta Air Lines shares tumbled 11% after the airline cut its adjusted earnings per share guidance for the first quarter, sending shock waves across the sector (United Airlines -8.0%, American Airlines -6.5%). Tesla is leading premarket gains among the Magnificent Seven stocks, with the EV maker set to rebound after a 15% rout on Monday. The slide came as investors dumped last year’s biggest winners amid growing fears that the economy is headed for a recession (Tesla +3.2%, Nvidia +0.84%, Meta +0.8%, Amazon +0.5%, Alphabet +0.3%, Microsoft -0.1%, Apple -0.3%). Here are some other notable premarket movers:

Asana shares slump 27% after the work management platform provider announced Dustin Moskovitz would retire as chief executive officer. Additionally, the company issued first-quarter revenue guidance that failed to meet consensus expectations.

Oracle shares fall 2.9% after the software company reported third-quarter results that missed the average analyst estimates. Morgan Stanley says there are questions surrounding the durability of its training business and rising margin impacts.

2Seventy Bio shares surge 76% after Bristol Myers Squibb agreed to buy the biotech company for $5.00 per share in cash.

Net Power shares extended losses, falling 36% to new record lows as investors continued to sell the clean energy technology company after it announced higher than anticipated costs for its Project Permian project.

Redwire shares plunge 17% after the space infrastructure company reported revenue for the fourth quarter that trailed Wall Street’s expectations.

The latest company results hinted at slowing profits earnings. Delta Air Lines shares tumbled as much as 11% in US premarket trading after a a deep cut to profit expectations. The news hit peers United Airlines Holdings Inc. and American Airlines Group Inc., and also weighed on European airlines. Sofware firm Oracle Corp. slipped after its results missed estimates.

The selloff in US stocks, particularly in the tech sector, has been accompanied by shift in investor perception on Europe and China, especially after Germany’s pledge to embark on large-scale defense spending. “The news flow from the US economy is likely to undershoot the rest of the world in coming months,” Citigroup strategists wrote. They downgraded their view on US stocks to neutral from overweight, ditching a position they had held since October 2023. Earlier, HSBC strategists also cut their view on US stocks, raising their European equity rating instead.

Meanwhile, Trump’s meeting with the Washington-based Business Roundtable will include CEOs from around the country, including the bosses of Wall Street lenders, Bloomberg reported. Given the increasingly uncertain outlook for the US economy and trade war concerns, investors will watch for any signals from Trump on the likelihood of tariff-policy shifts or support for equity markets.

“What is being questioned in the market is US exceptionalism,” said Aneeka Gupta, head of macroeconomic research at Wisdom Tree UK Ltd. “When Trump came back into the White House, the focus on was on the positive impact of his policies, but now the market is really drilling down into the negatives.”

European stocks retreated for a fourth straight session as worries about a faltering US economy fueled a global selloff, with the region’s travel and airline stocks sliding after US airline Delta cut its 1Q profit expectations. Travel and health care underperformed, pulling the Stoxx 600 down by about 0.2%. The DAX outperformed regional peers, adding 0.6%, after Bloomberg reported that Germany’s Greens are ready to negotiate and are hoping for an agreement by the end of this week in a dispute over defense spending. Here are the biggest movers Tuesday:

Redcare Pharmacy shares surge as much as 18%, the most since May 2022, after the online pharmacy provided a 2025 outlook that pleased analysts, with peer DocMorris rising as much as 8.4%

Volkswagen shares rise as much as 3.7% to their highest intraday value in nine months. The German carmaker’s full-year results are called strong by JPMorgan, highlighting working capital

Rotork shares rise as much as 6.9% after reporting 2024 results that beat expectations, with signs of improved momentum in the latter-half of the period leaving the actuators manufacturer in good shape

Sensirion shares advance as much as 13% as the sensor maker delivers results which analysts say represent a significant beat. JPMorgan says estimates for FY25 may increase by almost 30%

Prysmian shares rise as much as 4.2% after UBS upgrades its recommendation to buy, saying that recent declines related to a broader unwind of the AI trade has created an attractive entry point

Burberry shares rise as much as 3.9% after BNP Paribas Exane upgraded the luxury goods stock to outperform from neutral, citing the firm’s refocus on heritage products under CEO Joshua Schulman

Henkel shares fall as much as 7.6%, the most in almost three years, after the company reported 4Q results that fell short of expectations and issued a warning for negative consumer volumes in 1Q

Partners Group shares gain as much as 2.4% after the Swiss private equity company reported better-than-expected results due to higher fees. Analysts will focus on Partners Group first CMD

European travel stocks slide, tracking declines in US peers after Delta Air Lines cut its profit expectations for the first quarter on weakening travel demand

Galderma shares drop as much as 6.7% to a three-month low after shareholders sold a stake of roughly 6.3% in the Swiss skincare group at a discount to Monday’s close

PolyPeptide shares drop as much as 11%, the most since June, after the Swiss biotech reported 2024 revenue that missed estimates and gave a wide guidance range for 2025 that RBC said implies cuts

Traton falls as much as 5% as Kepler Cheuvreux cuts its recommendation on the truckmaker to reduce from hold a day after results; Kepler notes Traton the US market is recovering slower than anticipated

Earlier in the session, Asian stocks also slumped, taking cues from the tech-led sell-off stateside. Nikkei 225 retreated following disappointing Household Spending and revised Q4 GDP data from Japan. Hang Seng and Shanghai Comp conformed to the negativity amid light catalysts and as the NPC concludes today. ASX 200 was dragged lower by underperformance in tech and with most sectors in the red aside from energy and some defensives, while improved consumer confidence and mixed business surveys did little to inspire a rebound.

In FX, the Bloomberg Dollar Spot index fell 0.3%. The haven FX rally falters, as JPY and CHF flip to be the weakest performers in G-10 FX. NOK and SEK outperform. The euro was the biggest gainer, strengthening 0.6% as German lawmakers are expected to reach an agreement over additional spending.

In rates, Treasuries drop with the 10-year yield rising 4bps to 4.24% ahead of US job openings and layoffs data. German bond yields rise across the curve, led by the 10-year. Comparable gilts are little changed. Peripheral spreads tighten to Germany with the 10y BTP/Bund narrowing 2.7bps to 110.4bps.

In commodites, crude futures advance. WTI drifts 1% higher to near $67. Most base metals trade in the green. Spot gold rises roughly $25 to trade near $2,914/oz. Spot silver gains 1.4% near $33. Bitcoin rebounds, climbing above $81,000.

Market Snapshot

S&P 500 futures up 0.4% to 5,641.25

STOXX Europe 600 little changed at 546.15

MXAP down 0.7% to 185.10

MXAPJ down 0.5% to 580.83

Nikkei down 0.6% to 36,793.11

Topix down 1.1% to 2,670.72

Hang Seng Index little changed at 23,782.14

Shanghai Composite up 0.4% to 3,379.83

Sensex little changed at 74,134.83

Australia S&P/ASX 200 down 0.9% to 7,890.10

Kospi down 1.3% to 2,537.60

German 10Y yield little changed at 2.86%

Euro up 0.6% to $1.0897

Brent Futures up 0.4% to $69.55/bbl

Gold spot up 0.7% to $2,907.92

US Dollar Index down 0.41% to 103.48

Top Overnight news

The Trump administration is prepared to enforce sanctions on Iranian oil production, Energy Secretary Chris Wright said. Treasury Secretary Scott Bessent also discussed pressure on Iran with his Saudi counterpart. BBG

Washington and Beijing have begun discussions about a potential “birthday summit” in June in the U.S. between President Trump and Chinese leader Xi Jinping. The latest talks on a potential summit in the month when both leaders celebrate birthdays signal a willingness from both sides to inject some goodwill in the relationship amid trade tensions that have unsettled markets and businesses. WSJ

Talks between the US and China on trade and other issues are stuck at lower levels, people familiar with the matter said, with both sides talking past each other and failing to agree on the best way to proceed. While representatives from the two countries have had contact, officials in Beijing say the US hasn’t outlined detailed steps they expect from China on fentanyl in order to have the tariffs lifted. Trump’s team rejects the assertion that it hasn’t given clear demands on fentanyl. BBG

The ultra-conservative House Freedom Caucus backed a stopgap funding package, bolstering Speaker Mike Johnson’s attempt to pass the bill without the help of House Democrats and avert a government shutdown on March 15. BBG

Musk says DOGE is embedded in nearly every gov’t agency, and he wants to double headcount at the group as he ramps cost cutting initiatives throughout the federal government. NBC

Oracle shares fell premarket after reporting lackluster results and a profit forecast that missed. BBG

Airlines cutting guides… DAL -11% in pre-market.. Lowered 1Q guidance last night .. Guided EPS to $0.30-$0.50 vs. $0.70-$1.00 prior. Worse than expected, driven by domestic -- consumer and corporate. LUV -2.75% in pre-market on light volume: Lowers Q1 RASM guide to +2-4% on capacity down ~2% vs. Prior RASM guide of +5-7%. Roughly 1 pt of decrease is due to higher-than-expected completion factor, less government travel and a greater impact from the California fires. The remainder of the decrease is primarily attributable to softness in bookings and demand trends as the macro environment has weakened.

The BOJ probably won’t raise rates until June as it looks to maintain a pace of one hike every six months, despite recent speculation of an earlier move, former official Kazuo Momma said. BBG

Ukraine launched its biggest drone attack on Moscow, targeting the Russian capital and other regions, hours before a Tuesday meeting between senior U.S. and Ukrainian officials to discuss ways to bring an end to the war after more than three years of fighting. WSJ

Tariffs/Trade

US President Trump said on Truth Social that "Despite the fact that Canada is charging the USA from 250% to 390% Tariffs on many of our farm products, Ontario just announced a 25% surcharge on “electricity,” of all things, and your not even allowed to do that. Because our Tariffs are reciprocal, we’ll just get it all back on April 2. Canada is a Tariff abuser, and always has been, but the United States is not going to be subsidizing Canada any longer. We don’t need your Cars, we don’t need your Lumber, we don’t your Energy, and very soon, you will find that out".

Japanese Trade Minister Muto said he asked that Japan be exempt from tariffs in talks with US officials and did not get any assurance from the US that Japan will be exempted from US tariffs due to come into force on Wednesday.

South Korean acting President Choi said the time for negotiating with the US has begun ahead of reciprocal tariffs taking effect, while he added that President Trump's America First moves are targeting South Korea and the government will respond calmly and flexibly, considering only national interests.

Taiwan is said to launch an anti-dumping probe related to certain Chinese steel products and an anti-dumping probe related to beer from China.

A more detailed look at global markets courtesy of Newqsuawk

APAC stocks took their cues from the tech-led sell-off stateside after the Nasdaq suffered its worst day since 2022 amid recession fears and tariff-related concerns. ASX 200 was dragged lower by underperformance in tech and with most sectors in the red aside from energy and some defensives, while improved consumer confidence and mixed business surveys did little to inspire a rebound. Nikkei 225 retreated following disappointing Household Spending and revised Q4 GDP data from Japan. Hang Seng and Shanghai Comp conformed to the negativity amid light catalysts and as the NPC concludes today.

Top Asian News

Nissan Motor (7201 JT) CEO Uchida is set to step down.

European bourses are mixed, with price action fairly rangebound thus far. The DAX 40 (+0.7%) outperforms, as the region reacts to optimism surrounding German defence spending plans, whilst the FTSE 100 (-0.1%) is a little lower. European sectors are mixed; Real Estate is propped up by post-earning strength in Persimmon (+4.2%); Autos benefits from post-earning strength in Volkswagen (+2.5%) which reported robust FY results, but its guidance was not so optimistic. Travel & Leisure is the clear underperformer, as the sector reacts to Delta Airlines (-10% pre-market) cutting guidance, amid weak demand.

Top European News

Barclays UK February Consumer Spending rose 1.0% Y/Y (prev. +1.9%) and UK Consumers' Confidence in household finance was the highest since the series began in 2015 at 75% (prev. 70%).

Germany's Greens reportedly made their own proposal to loosen defence spending, according to Bloomberg. Thereafter, the Green party co-leader says they are hopeful of a defence deal occurring this week.

ECB's Rehn says Europe needs common solutions to boost defence, Eurosystem's forecast and indicators of core inflation suggest that it will align with the 2% target. Bank of Finland estimates US tariffs on the EU and China could reduce global output by over 0.5% this year and next. Defence investments must be increased at a time when EU countries already hold large public deficits.

Riksbank's Thedeen says there are signs of a business cycle rebound, with GDP growth exceeding expectations in the second half of last year; early-year indicators remain mixed.

FX

DXY is on the backfoot and trades towards the bottom end of a 103.40-92 range, with the trough for the session marking a fresh YTD low. The downside today stems from a slight unwinding of its haven appeal seen on Monday, but more pertinently, the resurgence in the EUR (discussed below). Ahead, markets will await US JOLTS Job Openings data.

EUR is the best performing G10 currency today, with commentary via a German Green party co-leader the main driver for the upside; the politician said that they are hopeful of a defence deal occurring this week. This follows on from reporting overnight via Bloomberg, which suggested that the Greens had made their own proposal to loosen defence spending. The Single Currency topped 1.09 earlier in the session and now looks to test the 5 Nov 2024 high at 1.0936. On the policy front, ECB's Rehn said if the data indicates, the Bank would hold rates in April. Ahead, today sees a busy ECB speaker slate, including the likes of President Lagarde, VP de Guindos, Lane, Villeroy & Escriva

JPY is the marginal underperformer today, alongside its haven peers CHF amid the modest improvement in sentiment. Overnight, USD/JPY was choppy owing to relatively disappointing Japanese GDP/Household spending metrics. The pair has been fairly unfazed by the Dollar weakness, currently trading in a 146.55-147.40 range.

GBP is on a firmer footing, with upside largely a factor of the broader Dollar weakness rather than UK-specific newsflow. Overnight saw a downtick in Y/Y BRC retail sales and a Y/Y slowdown in the Barclays UK February Consumer Spending report. However, these prints had no follow-through into the pound. As it stands Cable sits at the top end of a 1.2873-1.2941 range.

Antipodeans are both a little firmer, but to a lesser extent than the EUR and GBP, after marginal underperformance overnight.

PBoC set USD/CNY mid-point at 7.1741 vs exp. 7.2597 (Prev. 7.1733).

Fixed Income

USTs are essentially flat, but do hold a downward bias, as sentiment continues to incrementally improve in today's session, and in tandem with the pressure seen in Bunds (see below). Focus for traders today will be on US JOLTS Job Openings, remarks from US White House Press Secretary Leavitt and then President Trump thereafter. But before those remarks, a 3yr auction; as a reminder, the prior outing was strong, which stopped through the when issued by 1.3bps. USTs currently trading towards the lower end of a 111-11 to 111-25 range. If the pullback continues then USTs have a little bit of clean air until the 111-00 mark.

Bunds are pressured today and the underperformer amongst peers. Downside stems from comments via Germany's Green party co-leader who said they are hopeful of a defence deal occurring this week. This followed on from reporting overnight which that the Greens had made their own proposal to loosen defence spending. Bunds have been holding a bearish bias throughout the European session thus far, and currently at the day's trough at 127.04, just ahead of the 127.00 mark. Ahead, a 2027 Schatz tap and a slew of ECB speakers.

Gilts are modestly lower, but to a much lesser extent than Bunds. UK-specific newsflow remains light, and will likely to remain-so up until the region's GDP figures on Friday; more broadly however, PM Starmer held a cabinet meeting early doors which Politico reports is set to be focussed on the domestic agenda. This aside, European defence officials are due to meet in France today. Gilts currently in a 92.07-92.46 range, which marks a marginal new WTD low.

Guidance for the UK's 1.875% 2049 I/L Gilt benchmark reportedly +1.0 to +1.5bps, via Bloomberg citing sources. Orders for the UK 2049 I/L syndication are in excess of GBP 56bln, via Reuters citing a bookrunner; guidance +1.0 to +1.5bps.

Commodities

Crude is on a firmer footing, after clambering off overnight lows which saw the complex modestly subdued. Upside today may stem from the a) weaker Dollar b) improvement in risk-tone (US indices look to open higher). Energy specific newsflow has been light this morning; more focus will be on Monday's remarks from US Energy Secretary Wright who said he is looking at working with Congress on cancelling mandated sales from oil reserve. Brent'May currently trades at the top end of a USD 68.63-69.72/bbl range. Energy traders will await the EIA STEO and then Private Inventory data thereafter.

Spot gold is back on a firmer footing, continuing the upward bias seen in APAC trade and amidst the broader Dollar weakness. XAU tested USD 2.9k overnight, and firmly topped the figure as the European session commenced; currently trading at the upper end of a USD 2,880.40-2,910.95/oz range.

Base metals hold a positive bias, given the slight improvement in risk sentiment seen in today's session, following a mostly subdued session overnight. 3M LME Copper is currently higher by just under USD 50/t, in a USD 9,460.95-9,602/t confine.

BofA expects platinum to outperform Palladium going forward, expect a Platinum deficit and Palladium surplus for 2025. Lingering concerns over trade disputes may mean that PGMs get stranded in the US for a bit longer, potentially limiting liquidity in other markets.

US Event Calendar

06:00: Feb. SMALL BUSINESS OPTIMISM 100.7, est. 101.0, prior 102.8

10:00: Jan. JOLTS Layoffs Rate, prior 1.1%

10:00: Jan. JOLTS Layoffs Level, est. 1.81m, prior 1.77m

10:00: Jan. JOLTS Quits Rate, prior 2.0%

10:00: Jan. JOLTS Quits Level, est. 3.18m, prior 3.2m

10:00: Jan. JOLTS Job Openings Rate, est. 4.5%, prior 4.5%

10:00: Jan. JOLTs Job Openings, est. 7.6m, prior 7.6m

DB's Jim Reid concludes the overnight wrap

https://cms.zerohedge.com/users/tyler-durden

Tue, 03/11/2025 - 08:21

https://www.zerohedge.com/market-recaps/futures-rebound-worst-plunge-2025-trump-meet-ceos

Watch: Someone Thought It Was A Good Idea To Ask Kamala Harris To Speak At A Major AI Conference

Watch: Someone Thought It Was A Good Idea To Ask Kamala Harris To Speak At A Major AI Conference

Someone thought it was a good idea to invite Kamala Harris to speak at AI conference HumanX at Fontainebleau in Las Vegas over the weekend, and it was obviously a disaster.

?itok=x47DnwWA

?itok=x47DnwWA

Harris delivered a word salad complete with Doritos on the side.

“Former Vice President Harris will share her vision for the future of AI, emphasizing the responsibility to shape this technology in a way that promotes human rights, privacy, and equal opportunity,” Business Wire suggested when Harris was announced as a speaker.

Instead she blathered on about how she is obsessed with nacho cheese Doritos.

“We did DoorDash ’cause I wanted Doritos. And the red carpet part was about to start and nobody wanted to leave to go to the grocery store,” Harris was filmed saying.

“So it was DoorDash … So I was willing to give up whatever might be the tracking of Kamala Harris’ particular fondness for nacho cheese Doritos for the sake of getting a big bag of Doritos as I watched the Oscars,” she furthered blathered, sounding completely drunk and breaking into inane cackling.

She continued, “And you can debate with me if it should be a right – I think it should. To expect that the innovation would also be weighted in terms of solving their everyday problems, which are beyond my craving for Doritos… but about whatever – and I know the work is happening – the scientific discoveries, for example to cure longstanding diseases I would love it if there was an investment in resources and solving the affordable housing issue in America.”

Kamala just tried to explain innovation and it is the dumbest thing I have ever heard: https://t.co/GPqNu60FQm

— End Wokeness (@EndWokeness) https://twitter.com/EndWokeness/status/1899172363813466615?ref_src=twsrc%5Etfw

Ok, what?

I'm so glad she's still out there talking and reminding everyone daily how good we have it with President Trump

— Whale Psychiatrist ™️ (@k_ovfefe2) https://twitter.com/k_ovfefe2/status/1899172770392494331?ref_src=twsrc%5Etfw

Who the hell thought she would make a good speaker on the subject of AI and innovation?

https://twitter.com/grok?ref_src=twsrc%5Etfw

what is she talking about? Please make it make sense

— TheMatrixUnplgd (@LiberalTears101) https://twitter.com/LiberalTears101/status/1899292390764224828?ref_src=twsrc%5Etfw

The country really dodged a bullet here.

It doesn't get worse than this.

Actually it could've been worse. She could've been president. We dodged a bullet.

— Shawn Farash (@Shawn_Farash) https://twitter.com/Shawn_Farash/status/1899190519642599733?ref_src=twsrc%5Etfw

Every time you hear Kamala Harris talk, you think it's not real.

Yet somehow, it's real and it is exactly has bad as it actually is.

We dodged a massive bullet in 2024.

— Matt Van Swol (@matt_vanswol) https://twitter.com/matt_vanswol/status/1899180725645054120?ref_src=twsrc%5Etfw

* * *

Your support is crucial in helping us defeat mass censorship. Please consider donating via https://pauljosephwatson.locals.com/support

.

https://cms.zerohedge.com/users/tyler-durden

Tue, 03/11/2025 - 08:15

https://www.zerohedge.com/markets/watch-someone-invited-kamala-harris-speak-major-ai-conference

US Regulator Rescinds Biden's Blocks, Says Banks Can Engage In Some Crypto Activities

US Regulator Rescinds Biden's Blocks, Says Banks Can Engage In Some Crypto Activities

A U.S. regulator said on March 7 that banks can engage in some activities related to cryptocurrencies.

?itok=RvuFyGyy

?itok=RvuFyGyy

The Office of the Comptroller of the Currency (OCC) https://www.occ.treas.gov/news-issuances/news-releases/2025/nr-occ-2025-16.html

in a statement that the permitted activities include keeping hold of crypto assets and maintaining reserves for stablecoins, a class of crypto that features prices tied to other assets.

The OCC https://www.occ.treas.gov/topics/charters-and-licensing/interpretations-and-actions/2025/int1183.pdf

it was rescinding a 2021 policy that set limits on when banks could hold crypto, including the requirement that banks must show they have controls in place to ensure they conduct the activity in a “safe and sound manner.”

“The OCC expects banks to have the same strong risk management controls in place to support novel bank activities as they do for traditional ones,” Acting Comptroller of the Currency Rodney E. Hood said in a statement.

“Today’s action will reduce the burden on banks to engage in crypto-related activities and ensure that these bank activities are treated consistently by the OCC, regardless of the underlying technology. I will continue to work diligently to ensure regulations are effective and not excessive, while maintaining a strong federal banking system.”

The OCC previously issued a series of letters outlining its stance on crypto-related services.

In July 2020, the office https://www.occ.treas.gov/topics/charters-and-licensing/interpretations-and-actions/2020/int1170.pdf

that banks could utilize technologies such as stablecoins to perform permitted functions, such as payment activities.

Later in 2021, though, the OCC https://www.occ.gov/topics/charters-and-licensing/interpretations-and-actions/2021/int1179.pdf

that banks could not engage in crypto-related activities until they notified its supervisory office that it intended to engage in the activities and had received approval from supervisors. The OCC also said that supervisors, before issuing approval, had to evaluate the bank’s systems and make sure the bank could safely engage in such activities.

That’s the position that the OCC has now reversed.

The OCC also said it was withdrawing from joint statements issued on crypto risks to banks, including a 2023 https://www.occ.gov/news-issuances/news-releases/2023/nr-ia-2023-1a.pdf

with the Federal Reserve and the Federal Deposit Insurance Corporation that said volatility in the crypto space meant there were key risks associated with the sector.

Crypto, including bitcoin, can serve as digital investments and payment methods. Bitcoin, with a limited supply of 21 million coins, also functions as a store of value similar to gold.

President Donald Trump has championed crypto and recently https://www.theepochtimes.com/us/trump-signs-order-creating-strategic-bitcoin-reserve-digital-asset-stockpile-5821547

reporters that the foundation of the reserve will be the bitcoin seized from criminals.

https://cms.zerohedge.com/users/tyler-durden

Mon, 03/10/2025 - 15:00

New York Advertises State Jobs To Laid-Off Federal Workers In DC

New York Advertises State Jobs To Laid-Off Federal Workers In DC

(emphasis ours),

The state of New York is looking to recruit federal employees in Washington who were recently laid off amid the Trump administration’s efforts to trim the federal workforce.

?itok=UEDTmgPh

?itok=UEDTmgPh

The advertisement for New York’s recruitment drive on March 3 https://www.governor.ny.gov/sites/default/files/2025-03/NYS_We_Want_You_Signage.pdf

on digital signboards inside Union Station, the busy train hub in the nation’s capital. It features the Statue of Liberty striking Uncle Sam’s iconic “I Want You” pose with the caption: “DOGE said you’re fired? We say you’re hired! New York wants you!”

The message refers to the Department of Government Efficiency (DOGE), a team led by entrepreneur Elon Musk and tasked by President Donald Trump with finding ways to reduce government spending and cut excessive regulations.

Advised by DOGE, Trump in the first five weeks of his second term has shut down the U.S. Agency for International Development and taken steps toward https://www.theepochtimes.com/us/vought-halts-funding-to-consumer-protection-agency-says-not-needed-5806917

the Consumer Financial Protection Bureau. Trump has also floated the idea of abolishing the Department of Education altogether.

As part of the administration’s restructuring, federal employees have been offered “deferred resignations,” which provide paid leave to those who voluntarily quit government service. At least 75,000 federal workers accepted the buyouts after a federal court https://www.theepochtimes.com/us/government-buyout-program-is-proceeding-after-new-ruling-things-to-know-5809419

the initiative to continue.

The U.S. Office of Personnel Management (OPM) has https://storage.courtlistener.com/recap/gov.uscourts.cand.444883/gov.uscourts.cand.444883.37.1.pdf

maintained by OPM, as of March 2024, some 220,000 workers with less than a year of job experience fell into this category.

New York Gov. Kathy Hochul is hoping to attract these displaced federal workers to fill the vacancies in her government.

The Empire State employs about 180,000 workers but has more than 7,000 positions https://www.governor.ny.gov/news/governor-hochul-holds-roundtable-workers-impacted-federal-layoffs-and-announces-expansion-new

, according to Hochul’s office. Some of the most in-demand positions currently open include roles for attorneys, engineers, nurses, and IT specialists.

“[The] federal government might say, ‘You’re fired’—but here in New York, we say, ‘You’re hired,’” the Democratic governor said last week in a https://www.youtube.com/watch?v=ra6Kxy1OG_I

promoting the recruitment drive.

The Trump administration has dismissed New York state’s recruitment campaign as an attempt to expand an already bloated bureaucracy.

“Leave it to the failed New York state bureaucracy to stack their payrolls with more bureaucrats at the expense of the abused taxpayers of New York,” White House spokesperson Harrison Fields told The Epoch Times. “Growing the public sector is not President Trump’s definition of job creation.”

New York is the latest state to reach out to Washington’s displaced federal workers. Maryland and Virginia, home to many of the affected individuals, have also put out their own recruitment and support campaigns.

Maryland Gov. Wes Moore, a Democrat, https://governor.maryland.gov/news/press/pages/factsheet-in-support-of-md-federal-public-servants.aspx

on Feb. 28 that his administration is streamlining the hiring process to help displaced federal workers secure new government jobs. This initiative builds on an online job portal launched two weeks ago, designed to match former federal employees with available positions.

In Virginia, Gov. Glenn Youngkin, a Republican, has https://www.governor.virginia.gov/newsroom/news-releases/2025/february/name-1041600-en.html

a new job website connecting job seekers to 250,000 available positions, including opportunities at companies such as LEGO, Micron, Amazon, Capital One, Liebherr Mining Equipment, and Electro-Mechanical.

The Virginia Employment Commission is also offering job placement support. The commission’s maximum unemployment benefit is $387 per week.

Youngkin announced the initiative while expressing support for the Trump administration’s federal agency overhaul.

“I actually have extraordinary empathy for the fact that there are many workers in Virginia today—from our federal workforce—who are experiencing real concerns,” he said at a Feb. 24 https://www.youtube.com/watch?v=hME_JAfRZH4

.

“We have a federal government that is inefficient, and we have an administration that is taking on that challenge of rooting out waste, fraud, and abuse and driving efficiency in our federal government. It needs to happen.”

https://cms.zerohedge.com/users/tyler-durden

Mon, 03/10/2025 - 14:20

https://www.zerohedge.com/political/new-york-advertises-state-jobs-laid-federal-workers-dc

Turkey Offers Peacekeeping Troops As US-Zelensky Meeting Unfolds In Saudi Arabia

Turkey Offers Peacekeeping Troops As US-Zelensky Meeting Unfolds In Saudi Arabia

At a moment that American and Ukrainian delegations are meeting in Saudi Arabia, which includes President Zelensky's presence, Turkey has offered that it is willing to send troops to Ukraine if necessary, according to https://www.reuters.com/world/turkey-ready-send-troops-ukraine-if-necessary-source-says-2025-03-06/

.

"Turkiye remains committed to supporting Ukraine’s sovereignty while advocating for a peaceful resolution," a statement said. The offer is unusual given that Turkey under Erdogan has long maintained a delicate balancing act between NATO and Russian interests.

?itok=mV2E9chJ

?itok=mV2E9chJ

Turkey is of course NATO's lone alliance member which straddles two continents - Europe and Asia - and extends across the entire southern shore of the Black Sea.

The report notes that any potential Turkish deployment would be contingent on international agreements and whether it meets Turkey's national interests.

While the Kremlin has welcomed Turkey's diplomatic engagement on the Ukraine war, which included for example hosting talks in the opening months of the conflict, Russia has already condemned the possibility of any NATO troops being positioned in Ukraine, even if they are dubbed 'peacekeepers'.

Turkey's troop offer has been made in the context of European officials trying to figure out how to stay the course in supporting Ukraine as the Trump administration withdraws the United States.

There is also the ultimate question of how Europe and NATO would 'defend' Europe without the US. One recent defense policy paper offers the following https://www.bruegel.org/analysis/defending-europe-without-us-first-estimates-what-needed

:

The current assumption of NATO military planners (RAND, 2024) is that in case of a Russian attack on a European NATO country, 100,000 US troops stationed in Europe would be rapidly augmented by up to 200,000 additional US troops, concentrated in US armoured units best suited for the East European battlefield.

A realistic estimate may therefore be that an increase in European capacities equivalent to the fighting capacity of 300,000 US troops is needed, with a focus on mechanized and armored forces to replace US army heavy units. This translates to roughly 50 new European brigades.

But this is precisely why President Trump is pushing a quick peace plan - the 'alternative' could be a European-wide WW3 scenario. Trump officials have said the president wants to avoid this at all costs.

Zelensky is meanwhile expected to present a ground and air ceasefire in the context of Saudi talks, but is unlikely to offer any territorial concessions at this point. Media headlines are describing that Zelensky is pushing for a partial truce with Russia. The White House is at the same time urging that new elections be held in war-ravaged Ukraine.

https://cms.zerohedge.com/users/tyler-durden

Mon, 03/10/2025 - 14:00

Michael Saylor's 'Strategy' To Raise Up To $21B To Buy More Bitcoin

Michael Saylor's 'Strategy' To Raise Up To $21B To Buy More Bitcoin

https://cointelegraph.com/news/michael-saylor-strategy-raise-21-billion-purchase-bitcoin

Michael Saylor’s Strategy, the world’s largest public corporate Bitcoin holder, is looking to raise up to $21 billion in fresh capital to purchase more BTC.

?itok=U5ay6Atd

?itok=U5ay6Atd

On March 10, Strategy officially https://www.strategy.com/press/strategy-announces-21-billio

) acquisitions.

As part of the agreement deal, dubbed the “ATM Program,” Strategy expects to make sales “in a disciplined manner over an extended period,” taking into account the trading price and volumes of the perpetual strike preferred stock at the time of sale.

“Strategy intends to use the net proceeds from the ATM Program for general corporate purposes, including the acquisition of Bitcoin and for working capital,” the firm said in the filing with the Securities and Exchange Commission (SEC).

The announcement comes amid https://cointelegraph.com/news/strategy-bitcoin-stash-up-7-billion-500k-btc-holdings

($41.2 billion), which it acquired for an aggregate amount of $33.1 billion at an average price of $66,423 per BTC.

The company previously disclosed plans to issue and sell shares of its class A common stock tohttps://cointelegraph.com/news/microstrategy-42b-capital-bitcoin-purchase-michael-saylor

and $21 billion in fixed-income securities over the next three years in order to accumulate more Bitcoin under its “21/21 plan.”

Despite suffering its lhttps://cointelegraph.com/news/biggest-red-weekly-candle-ever-5-things-bitcoin-this-week

, Strategy remained ahead on its BTC purchases.

In total, Strategy has spent $33.1 billion on Bitcoin purchases, while its holdings are now valued at $41.2 billion - a 24% unrealized gain even amid the correction.

Strategy founder Michael Saylor has proposed that the United States government acquire up to 25% of Bitcoin’s total supply over the next decade for its Strategic Bitcoin Reserve.

“Acquire 5-25% of the Bitcoin network in trust for the nation through consistent, programmatic daily purchases between 2025 and 2035, when 99% of all BTC will have been issued,” Saylor https://www.michael.com/a-digital-assets-strategy

in a document titled “A Digital Assets Strategy to Dominate the 21st Century Global Economy.”

Saylor reiterates to the US government, “Never sell your Bitcoin”

Saylor presented the document to US President Donald Trump, government executives, and global crypto leaders at the https://cointelegraph.com/news/bitcoin-investors-mixed-reactions-white-house-crypto-summit

.

He explained that the government should stick to a “Never sell your Bitcoin” policy, predicting that by 2045, the Strategic Bitcoin Reserve could generate over $10 trillion annually and serve as a “perpetual source of prosperity” for Americans.

Up until 2045, Saylor said the Reserve could generate between $16 trillion and $81 trillion for the US Treasury, potentially easing the national debt.

?itok=gf3KLCE1

?itok=gf3KLCE1

Source: https://x.com/saylor/status/1898136271131758895

Earlier that day, Trump https://cointelegraph.com/news/donald-trump-signs-executive-order-strategic-bitcoin-reserve

a “Strategic Bitcoin Reserve” and a “Digital Asset Stockpile,” initially funded with cryptocurrency seized in criminal cases.

While it didn’t include an immediate plan to buy more Bitcoin, the order stated that the Treasury and Commerce secretaries would develop “budget-neutral strategies” for acquiring more Bitcoin, ensuring no added costs for taxpayers.

https://cms.zerohedge.com/users/tyler-durden

Mon, 03/10/2025 - 09:01

https://www.zerohedge.com/crypto/michael-saylors-strategy-raise-21b-buy-more-bitcoin

DOGE Says It Found $312 Million In Loans That Were Given To Kids During Pandemic

DOGE Says It Found $312 Million In Loans That Were Given To Kids During Pandemic

(emphasis ours),

The Department of Government Efficiency (DOGE) said over the weekend that it found that the Small Business Administration (SBA) allegedly granted thousands of loans worth hundreds of millions of dollars to individuals who had an age listed as 11 years old or younger.

?itok=6HDX3eHf

?itok=6HDX3eHf

In a https://x.com/elonmusk/status/1898594551297700031

n social media platform X on March 8 that was reposted by Elon Musk, who leads the department, DOGE wrote that in the COVID-19 pandemic years of 2020 and 2021, the SBA granted 5,593 loans worth $312 million “to borrowers whose only listed owner was 11 years old or younger at the time of the loan.”

“While it is possible to have business arrangements where this is legal, that is highly unlikely for these 5,593 loans, as they all also used an SSN with the incorrect name,” the post added, referring to a Social Security number.

It said that DOGE and the SBA are now working to investigate the matter. The Epoch Times contacted the SBA for comment Sunday.

At around the same time on Saturday, DOGE wrote in a post that it found that the SBA issued 3,095 loans for $333 million to borrowers whose age was listed at over 115 years old. Those borrowers, it https://x.com/DOGE/status/1897039724822315489

, were listed as alive in the Social Security database, and in one instance, a 157-year-old individual received loans worth $36,000, including Paycheck Protection Program and Economic Injury Disaster Loan loans.

Also Saturday, DOGE said a U.S. Department of Agriculture contract worth $10.3 million that was started for “identifying unnecessary contracts” had been canceled, noting that it was one of 162 nonessential contracts that had been terminated.

Since the start of the second Trump administration, DOGE has been combing through federal agency data to find waste that it can slash in a bid to save money. However, the organization isn’t without its critics and has faced a bevy of lawsuits, including ones questioning DOGE’s legality and the role Musk is playing.

Late on March 7, a group of labor unions asked a federal court for an emergency order to stop DOGE from accessing the Social Security data of millions of Americans.

The motion for emergency relief was was in federal court in Maryland by the legal services group Democracy Forward against the Social Security Administration and its acting commissioner, Leland Dudek. The unions want the court to block DOGE’s access to the vast troves of personal data held by the agency.

Judges have raised questions in several cases about DOGE’s sweeping cost-cutting efforts, conducted with little public information about its staffing and operations. But judges have not always agreed that the risks are imminent enough to block DOGE from government systems.

DOGE has accessed government databases, including at the Treasury and Internal Revenue Service (IRS). The Trump administration has said generally that the efforts are aimed at eliminating waste and fraud in government.

The Associated Press contributed to this report.

https://cms.zerohedge.com/users/tyler-durden

Mon, 03/10/2025 - 08:40

Futures Slide As Recession Fears Mount, Trump Warns Of Looming "Disruption"

Futures Slide As Recession Fears Mount, Trump Warns Of Looming "Disruption"

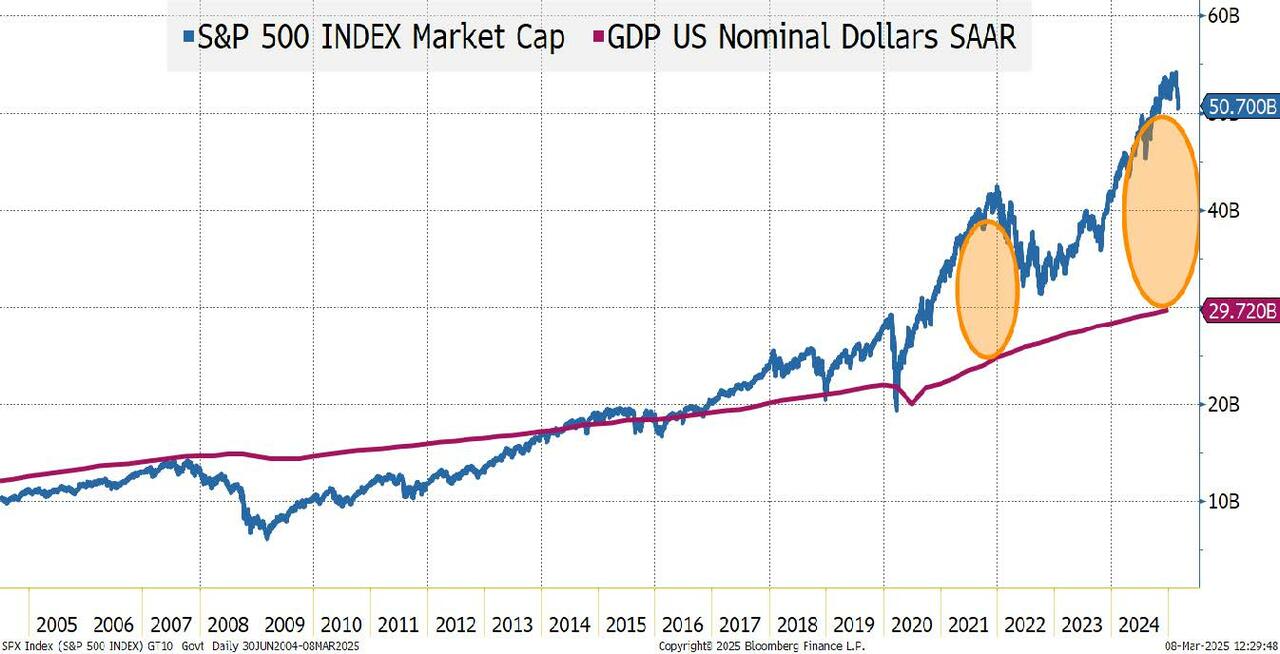

US equity futures continue their relentless grind lower, as they trade just off session lows, down more than 1% as the "Trump Dump" selloff continues amid growing concerns about the health of the US economy. As JPM notes this morning "today there is a global de-risking but let’s see if Int’l Eqys outperform on the move lower or if the US can see a relief rally"; so far the answer is a resounding no with both European and Asian stocks tumbling, after Trump declined to rule out a recession due to his policies, pointing to a transition period for the economy. As of 8:00am, S&P futures are down 1.2% to 5,705 following the worst week for the benchmark index since September, while Nasdaq 100 futures slide 1.1% with all Mag7 stocks sharply lower to start the week: Tesla shares fell about 3% in premarket trading inching toward erasing their post-election gains, and most other Big Tech names also dropped, including AI bellwether Nvidia. European stocks slipped 0.4%. Treasuries are down 4-6bps amid rising recession fears, while the USD continues its post-Trump slump. In commodities, Ags and Energy are higher green while precious and base metals slide after China’s recent data confirmed deflation has returned to the second largest economy. Today’s macro data focus is on NY Fed’s 1-Year Inflation Expectations.

In premarket trading, Tesla leads losses among the Magnificent Seven stocks as the broader market selloff intensifies amid concerns of slowing economic growth (GOOGL -1%, AMZN -1.2%, AAPL -1.4%, MSFT -1%, META -1.4%, NVDA -1.8% and TSLA -2.6%). Cryptocurrency-exposed stocks fall as Bitcoin extends losses for a fifth consecutive session after President Donald Trump’s long-awaited order to create a strategic Bitcoin reserve disappointed the market and weighed on digital currencies (MicroStrategy (MSTR) -5%, Riot Platforms (RIOT) -4%). Here are some other notable premarket movers:

Beam Therapeutics (BEAM) rises 12% after the drug developer gave initial data from an early trial of its investigative therapy for a genetic disease that can cause lung and liver damage.

Checkpoint Therapeutics (CKPT) soars 67% after the immunotherapy and targeted oncology company agreed to be acquired by Sun Pharmaceutical Industries.

Coinbase (COIN) drops 6% after the cryptocurrency exchange operator was left out of a reshuffling of the S&P 500 Index on Friday.

DoorDash (DASH) climbs 3% as the S&P Dow Jones Indices is adding the the food-delivery company to the S&P 500 index.

Other S&P 500 inductees gain: Williams-Sonoma (WSM) +0.8%, Expand Energy (EXE) +2%

Intuitive Machines (LUNR) slumps 8%, extending last week’s selloff after it ended a lunar mission early following a flawed landing, the second setback for the company following a similar problem last year.

Mineralys (MLYS) soars 45% after the drug developer said two trials of its experimental hypertension medicine, lorundrostat, met their main goals.

Redfin Corp. (RDFN) soars 85% after Rocket Cos. agreed to buy the company in a deal that values the real estate listing site at $1.75 billion. Rocket (RKT) slips 9%.

Robinhood (HOOD) falls 5% after agreeing to pay $26 million to settle allegations by the Financial Industry Regulatory Authority that it failed to respond to red flags about potential misconduct and didn’t verify the identities of thousands of customers.

Samsara (IOT) gains 2% after Piper Sandler and BMO upgraded the software company to buy-equivalent ratings in the wake of a stock selloff driven by a lackluster fourth-quarter earnings report.

Mounting unease over the potential fallout from trade tariffs and sweeping government job cuts sent 10-year Treasury yields five basis points lower. The key borrowing rate has dropped more than 20 basis points in the past month, signaling risks that the world’s biggest economy will stall. Bloomberg’s dollar index held just shy of four-month lows. Tariffs and Trump’s policies have started having their “fair share of pressures on the equity markets, plus we have now started seeing a lot of concerns around US growth,” Sanford C. Bernstein strategist Rupal Agarwal said on Bloomberg TV.

Trump said at the weekend the US economy faces “a period of transition,” and there could be disruption in the near-term, suggesting that stocks could extend their slide in the near-term. “There could be a little disruption. You can't really watch the stock market. If you look at China, they have a 100-year perspective… we go by quarters. What we’re doing is building a foundation for the future” Trump told Maria Bartiromo on Sunday. At the same time, Treasury Secretary Scott Bessent earlier warned of disruption to growth. Bessent also ruled out policy shifts to prop up the stock market, the so-called “Trump Put.”

Meanwhile, more analysts are warning of a hit to corporate earnings from tariffs and fiscal spending cuts. Morgan Stanley strategist Michael Wilson said the S&P 500 could slide 5% in the first half of the year, though he expects a recovery by year-end. JPMorgan analysts also said they are turning cautious on risk assets.

A higher open for European stocks didn’t last for long as shares quickly turned negative and the Stoxx 600 is now down 0.6%, with banks, construction and technology shares underperforming. Verallia, Ryanair and energy stocks were among the biggest outperformers, while Traton, Norma and Air France-KLM fall. Here are the biggest movers Monday:

Verallia shares rise as much as 4.5% after Brazil’s billionaire Moreira Salles family said it will make a voluntary tender offer for shares it doesn’t already own in the French glass-bottle maker

Ryanair shares jump as much as 6.7%, the most since November 2023, after the airline group said non-EU nationals are allowed to purchase ordinary shares

European energy stocks outperform Monday after US natural gas futures advanced to the highest level since 2022 on signs the nation could face storage levels below the five-year average this summer

Watches of Switzerland rises as much as 7.8%, rebounding after ending last week at its lowest level since November, as the luxury watch retailer said it has started a £25 million share buyback

Assura shares rise as much as 14% to 46.64p after a group comprising KKR and Stonepeak Partners made an indicative, non-binding cash proposal of 49.4p per share for the UK health-care landlord

Traton shares drop as much as 7.9% after the German truckmaker’s margin guidance for 2025 missed expectations and after the company said it is too early to declare a European turnaround

Norma shares drop as much as 7%, to the lowest since December, after analysts said the component maker’s guidance, released on Friday, was well below expectations

Air France-KLM shares slip as much as 3.1% after Bernstein cuts its rating on the airline group to market-perform. Analysts note that the carrier’s unit costs are set to keep rising in 2025

Clarkson shares slide as much as 20%, their worst one-day loss in seven months, after the shipbroker gave a cautious outlook for 2025 citing uncertainty due to regional conflicts and trade tensions

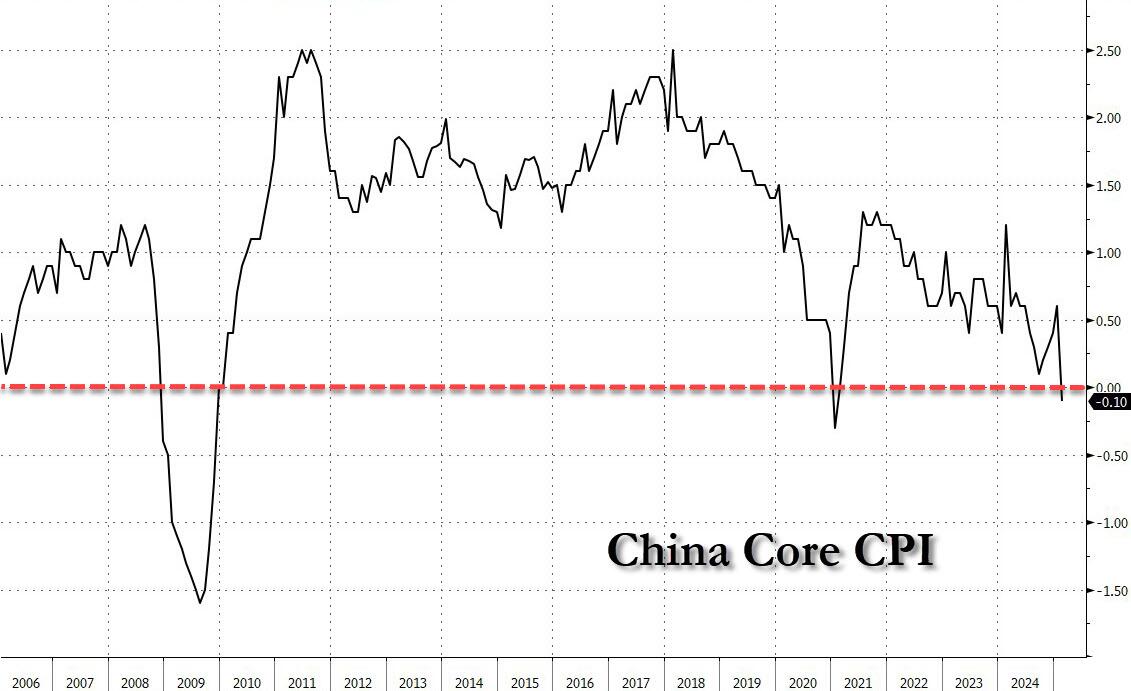

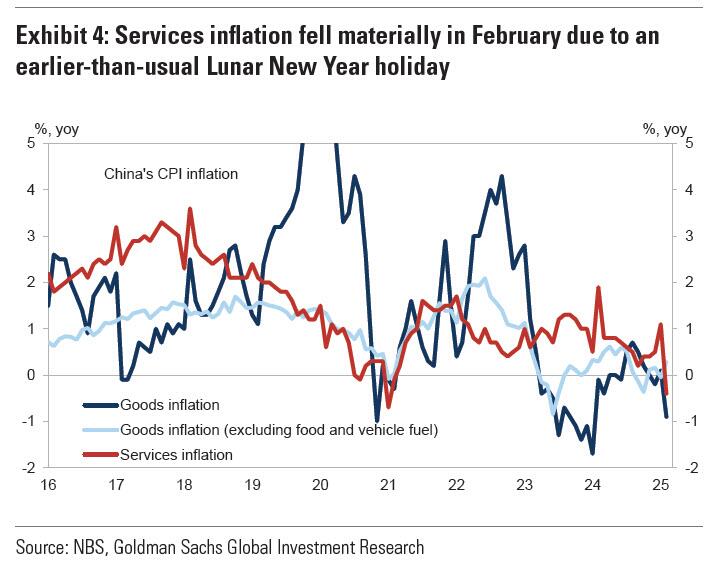

Earlier, Asian equities fell, led by declines in Hong Kong, as consumer inflation fell below zero for the first time in 13 months, compounding the dour outlook for the world’s second-biggest economy. The MSCI AC Asia Pacific Index fell as much as 0.9%, extending Friday’s losses, which pared the gauge’s best week since September. Tencent, Alibaba and Meituan were among the biggest drags Monday. Hong Kong-listed Chinese stocks dropped more than 2%, while shares gained in South Korea and Australia. China’s consumer inflation dropped below zero for the first time in 13 months and missed expectations. While the data were skewed by an earlier-than-usual Lunar New Year holiday, the reading unsettled the market after last week’s optimism over Beijing’s efforts to support domestic consumption.

“The market is still concerned over the dis-inflation pressure of China, which may be one of the excuses for equity indexes to see near-term corrections,” said Jason Chan, a senior investment strategist at Bank of East Asia. “In the medium run, I think inflation data will improve amid fiscal stimulus and recovery in the property market.”

The risk-averse mood can be seen elsewhere as havens outperform. In FX, the Bloomberg Dollar Spot Index hovered near to a four-month low, while Treasury yields slipped 5-7bps across the curve, as concerns around the US growth outlook mounted. Noway’s krone led Group-of-10 gains climbing over 1% against the dollar; Norwegian inflation accelerated more than expected last month, throwing in doubt Norges Bank’s long-awaited first interest-rate cut

USD/JPY fell as much as 0.7% to 146.99, after Japanese workers saw their base pay rise at the fastest clip in 32 years

USD/CAD steadied around 1.4375, after Mark Carney won the race to become Canada’s next prime minister

In rates, Treasuries lead gains in the bond market, with US 10-year yields dropping ~8 bps to 4.23% as spreading concern about a US growth slowdown fuels a flight-to-quality bid, weighing on equity index futures. A heavy corporate bond slate has been predicted for this week, with as many as 15 offerings viewed as possible for Monday. This week’s Treasury supply kicks off Tuesday and includes 3-, 10- and 30-year notes and bonds. US yields are 5bp-7bp richer across maturities led by intermediates, steepening 5s30s curve by around 2bp; 10-year near 4.24%, richer by 6bp, outperforms bunds and gilts in the sector by 3bp and 5bp. In Japan, 40Y JGB yields rose to the highest on record.

In commodities, oil prices edge higher, with WTI rising 0.3% to $67.20 a barrel. Spot gold falls $5 to around $2,905/oz. Bitcoin falls 1% to near $82,000, having pared an earlier drop to near $80,000.

Looking at today's calendar, US economic data calendar includes February New York Fed 1-year inflations expectations at 11am New York time. Ahead this week are JOLTS job openings, CPI, PPI and University of Michigan sentiment. Fed officials are inn external communications blackout ahead of March 19 policy announcement.

Market Snapshot

S&P 500 futures down 0.9% to 5,724.50

STOXX Europe 600 little changed at 552.92

MXAP down 0.7% to 186.71

MXAPJ down 0.9% to 585.22

Nikkei up 0.4% to 37,028.27

Topix down 0.3% to 2,700.76

Hang Seng Index down 1.8% to 23,783.49

Shanghai Composite down 0.2% to 3,366.16

Sensex little changed at 74,387.84

Australia S&P/ASX 200 up 0.2% to 7,962.30

Kospi up 0.3% to 2,570.39

German 10Y yield down 2.7 bps at 2.82%

Euro down 0.1% to $1.0821

Brent Futures little changed at $70.34/bbl

Gold spot down 0.2% to $2,902.71

US Dollar Index little changed at 103.92

Top Overnight News

Ahead of the Friday deadline for a funding bill to pass to avoid a US shutdown, "It doesn’t feel like a shutdown is going to happen, although there’s still a chance because, well, this is Congress" - Punchbowl

House Republicans announced a spending bill to avert a government shutdown, daring Democrats to vote against it. Trump called on Republicans to pass the bill, warning them to allow “no dissent” in their ranks. BBG

Fed’s Daly (2027 voter) suggested that economic research shows uncertainty is a source of demand restraint and noted there are plenty of signs that the economy is solid but the market is giving mixed signals which is the reason monetary policy should be careful and deliberate, while she added that the Fed has rates in a good place.

Trump said he will pick the Federal Reserve Vice Chairman for Bank Supervision fairly soon It was also reported that Trump declined to predict whether the US could face a recession amid stock market concerns about his tariff actions on Mexico, Canada and China over fentanyl, while he said tariffs on Mexico and Canada could go up, according to Reuters citing an interview with Fox News.

Mark Carney will lead Canada’s Liberal Party and become the country’s next PM as Donald Trump’s trade policies fuel uncertainty. The former central bank chief vowed to maintain retaliatory tariffs until “Americans show us respect” and to make the nation an energy superpower. BBG

AAPL (Apple) suffered another AI setback when the company confirmed it wouldn’t be releasing an enhanced version of Siri for the foreseeable future. BBG

A new ceasefire deal between Israel and Hamas is possible within weeks, a US envoy told CNN. Israel halted its supply of electricity to Gaza. BBG

China’s CPI turned negative for the first time in 13 months, falling 0.7% in February from a year earlier. The core measure, which also slid, highlights the need for policymakers to deliver stimulus quickly. BBG

China has introduced retaliatory tariffs on about $22bn of US goods, including agricultural exports, targeting President Donald Trump’s rural base in the latest escalation in the trade war between the world’s two largest economies. Beijing’s measures, which were announced last week in response to Trump slapping an additional 10% levy on all Chinese products, are aimed primarily at US farm goods. FT

Japan's real wages fell in January after two months of slight gains, data showed on Monday, days before the annual rounds of pay negotiations held each spring culminate at the country's major firms. Japan real cash earnings for Jan come in a bit below expectations at -1.8% (vs. the Street -1.6%). RTRS

German industrial production comes in a bit better than anticipated in Jan (+2% M/M vs. the Street +1.5%) while exports fall short (-2.5% vs. the Street +0.5%). RTRS

Ukraine will try to convince Washington to resume arms/intelligence assistance during negotiations this Tues in Saudi Arabia, w/Kyiv advocating for a partial ceasefire in the war with Russia. FT

Trade/Tariffs

US Commerce Secretary Lutnick said President Trump will not ease up on fentanyl-related tariffs and that tariffs will come off if fentanyl ends, while he noted steel and aluminium tariffs take effect on Wednesday and they will revisit fentanyl and reciprocal trade issues on April 2nd.

Incoming Canadian PM Carney vowed to discover new trade partners and ensure borders, while they will keep tariffs on the US until Americans show them respect. Carney said they cannot let Trump succeed and will ensure that all proceeds from tariffs will be used to protect their workers.

Canadian Finance Minister LeBlanc said Canada is ready for an immediate review of the USMCA trade agreement and there is still room for talks on steel and aluminium tariffs.

China’s MOFCOM said it will impose tariffs on some imports from Canada in retaliation for Canadian tariffs on Chinese goods effective March 20th in which it will impose 100% tariffs on Canadian rapeseed oil imports and 25% on port and seafood imports, while it will impose additional tariffs on some other Canadian goods.

South Korean Acting President Choi ordered to communicate actively with the US about tariff rates and will consult with the US about cooperation in shipbuilding and energy sectors, while they are to review non-tariff measures related to US reciprocal tariffs.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the week mixed amid tariff-related concerns and as participants digested the softer-than-expected Chinese inflation data from over the weekend. ASX 200 eked mild gains with outperformance seen in energy, resources and materials but with the upside capped by weakness in defensives and the economic concerns related to Australia's largest trading partner. Nikkei 225 gradually shrugged off the initial indecisiveness and clawed back early losses to reclaim the 37,000 status as participants digested data releases including the slower-than-forecast growth in Labour Cash Earnings. Hang Seng and Shanghai Comp retreated amid deflationary headwinds after CPI data slipped into negative territory for the first time in over a year, while tariff concerns lingered as China's retaliatory tariffs against the US's March 4th additional tariffs took effect today.

Top Asian News

Deputy to China's National People's Congress (NPC) says China's "around 5%" GDP target for 2025 is certainly challenging and by no means an easy feat, via Global Times. Tian said one of China's biggest challenges is insufficient domestic demand but believes the government's plans, such as increasing the budget deficit to support higher government spending, issuing ultra-long special treasury bonds, and improving investment efficiency will help address the issues.

China’s Housing Minister said market confidence has been enhanced and the property market shows positive changes, while they will step up lending for ‘White list’ property projects and promote the purchase of existing housing stocks. China will give more autonomy to local governments in purchasing housing stocks for affordable housing and part of China’s local government special bonds will be used for purchasing land and housing stocks.

China’s Human Resources Minister said they face an arduous task to stabilise and expand employment in 2025 and the external environment for employment could become more complex and severe but added that the employment situation is generally stable. Furthermore, China will step up resources and funding to support employment and will prepare to roll out new policies to support employment.

South Korean prosecutors decided not to appeal President Yoon’s release.

Acer (2353 TW) Feb Revenue TWD 17.07bln.

Key Japanese government panel members called for vigilance to risks of rising inflation hurting the economy.

European bourses (STOXX 600 -0.5%) opened modestly in the green, but quickly succumbed to selling pressure soon after, to display a negative picture in Europe. As it stands, indices currently reside at the bottom end of the day's ranges. European sectors are mixed vs initially opening with a slight positive bias; Real Estate takes the top spot, as yields move lower, whilst Tech is swept away by the risk tone. Novo Nordisk (NOVOB DC) says Cagrisema demonstrates superior weight loss in adults with obesity or overweight and type 2 diabetes in the Redefine 2 trial; People treated with Cagrisema achieved a superior weight loss of 15.7% after 68 weeks. Shares dip -5% on this news. Analysts at HSBC downgrade US equities to Neutral.

Top European News

Germany's Green party insider says approval of financial package becomes less likely every day, according to Handelsblatt. "Willingness to help the black-red debt package for defence and infrastructure to gain a two-thirds majority in the Bundestag is apparently declining."

Leaders of Germany’s CDU/CSU and SPD said they have completed preliminary talks on forming a coalition government.

Germany's AfD has filed an urgent appeal with the Constitutional Court against the session of the outgoing Bundestag on Thursday, via Reuters citing a court spokesperson.

S&P affirmed Norway at 'AAA'; Outlook Stable.

ECB's Kazimir says inflation risks remain tilted to the upside; must remain open minded on whether we cut rates or pause. Geopolitical and trade tensions add another layer of unpredictability. Looking for undeniable confirmation that disinflation will stay; tariffs historically slow growth and boost inflation.

Germany's VDMA says Jan orders -2% Y/Y (domestic -6%, foreign unchanged); Nov-Jan orders -2% Y/Y (domestic 10%, foreign +1%).

FX

DXY has been choppy thus far, initially topping the 104.00 mark as risk sentiment waned, but is now a little lower thus far; currently trading within a 103.55-104.03 range. The Fed is now in blackout, so focus this week will be on trade developments. Most recently, US President Trump said on Friday regarding Canada that he may do reciprocal tariffs as early as Friday or Monday, while he added the EU has been a terrible abuser on tariffs and India has agreed to cut tariffs way down. Focus ahead will be on US NY Fed SCE.

EUR price action has been at the whim of a choppy Dollar; currently firmer and trading around 1.0870, in a 1.0806-1.0874 range. As mentioned above, commentary from President Trump who said the EU has been a terrible abuser on tariffs, will garner some attention. On the domestic front, Germany’s CDU/CSU and SPD said they have completed preliminary talks on forming a coalition government. The EU Sentix Index printed above expectations, but had limited impact on the Single-Currency. ECB's Nagel is set to speak this afternoon.

JPY is one of the better performing G10 currencies today, largely a factor of narrowing yield differentials and as risk sentiment continues to deteriorate in European trade. Overnight, USD/JPY was relatively choppy given the uncertain risk sentiment in Tokyo in APAC trade. USD/JPY currently trading at the bottom end of the day's ranges (146.98-147.96), dipping below 147.00, with Friday's 146.93 thereafter.

GBP is softer vs. the USD and at the bottom of the G10 leaderboard after a solid showing for Cable last week which saw the pair rally from a 1.2577 opening level last Monday to a YTD peak at 1.2944. UK-specific newsflow has been light and does not pick-up until Friday.

Antipodeans are firmer today, with modest outperformance in the Kiwi but with upside capped amid downbeat sentiment and with Chinese inflation over the weekend printing below expectations.

The NOK is stronger today, after the region printed hotter-than-expected inflation data; EUR/NOK fell from 11.7463 to 11.7150 before then paring around half of the move. Following the data, Nordea bank wrote that "Norges Bank need to think twice about cutting rates at all this year. The March cut is definitely off."

PBoC set USD/CNY mid-point at 7.1733 vs exp. 7.2355 (Prev. 7.1705).

Former Central Banker Mark Carney won the Liberal Party race to become the next Canadian PM, according to official results cited by Reuters.

Fixed Income

USTs picked up at the reopening of trade, given the pressure in US equity futures and as the benchmark acknowledged the soft Chinese inflation data on the weekend. The risk-off tone has intensified further with USTs outperforming and at a 111-03 peak, resistance at 111-11+ and 111-15 from last week. Market focus is firmly on tariffs/trade with new measures set to come into play on metals on Wednesday and the prospect of reciprocal tariffs being implemented imminently. Furthermore, President Trump’s sights seem to have turned back to the EU, with him labelling the bloc as a terrible abuser. Finally, focus is also on fiscal matters as the Friday deadline to pass a funding bill to avoid a federal shutdown fast approaches. The House Republicans released their CR on the weekend and following this Punchbowl writes that it does not feel as if a shutdown will occur.

Bunds opened lower following German political updates; reports indicate that coalition talks for the new Bundestag are progressing well. Elsewhere, for the bloc more broadly, EU Commission President von der Leyen said that “nothing” is off the table for security, including defence eurobonds. All of the above weighed on Bunds to a 127.21 low overnight, just above Friday’s 127.18 base and the contract low from last week at 126.64 below. However, fixed benchmarks generally have been lifting off worst through the European morning as the risk tone deteriorates. On incoming Chancellor Merz's spending plans, recent reporting via Handelsblatt has suggested that the approval of financial package becomes less likely every day, citing a Green party inside. Furthermore, Germany's AfD has filed an urgent appeal with the Constitutional Court against the session of the outgoing Bundestag on Thursday.

Gilts are trading in tandem with the above as the risk tone soured throughout the European morning. Gapped higher by 22 ticks at the open and has since risen almost the same amount again to a 92.49 peak. A high which surpasses the 92.41 top from last Wednesday but has stopped just shy of Friday’s 92.63 best

Commodities

Crude is incrementally firmer, in what has been a choppy but fairly lacklustre European morning for the complex thus far, but also in a continuation of the price action seen overnight. In early European trade, oil prices picked up a touch, but gains were soon capped as sentiment waned in Europe. Brent'May sits in a USD 69.84-70.57/bbl range. On the geopolitical front, new Russia/US talks are reportedly not scheduled for this week, according to TASS. And in the Middle East, Al Jazeera reported that Smotrich said that "in light of the lack of progress in negotiations, we will return to fighting in Gaza".

Spot gold is a little firmer, with a slight bounce in recent trade as the Dollar comes off best levels. Currently trading in a USD 2,896.83-2,918.32/oz range.

Base metals are mostly lower, given the weak Chinese inflation data and flimsy risk tone. 3M LME Copper currently trading in USD 9,510.35-9,640.6/t range vs the prior close at USD 9,584.63.

Iraq set the April Basrah medium crude official selling price to Asia at plus USD 2.15/bbl vs Oman/Dubai and the OSP to Europe at minus USD 1.50/bbl vs Dated Brent, while it set the OSP to North and South America at minus USD 0.65/bbl vs ASCI, according to SOMO.

US is in exploratory talks with Congo about a potential minerals deal, according to FT.

Geopolitics: Middle East

Hamas says it dealt with mediator efforts with flexibility, now awaiting the result of talks with Israel. Talks focussed on ending the war, Israel's withdrawal from Gaza and reconstruction.

"Israel Broadcasting Corporation on Smotrich: In light of the lack of progress in negotiations, we will return to fighting in Gaza and the new chief of staff has a more effective combat plan than his predecessor", according to Al Jazeera

Israel’s Energy Minister ordered the stoppage of electricity transmission to Gaza, according to Israeli broadcaster Kan.

Hamas said there are positive indicators over negotiations for the second phase of the Gaza ceasefire deal, while it noted its delegation met Egypt’s spy chief in Cairo to discuss the Gaza ceasefire and it urged commitment to all the Gaza ceasefire deal’s articles and the immediate start of talks for the second phase. It was separately reported that a Hamas official said the group is open to releasing American-Israeli hostage Edan Alexander as part of talks to end the Gaza war, according to Al-Aqsa TV.

US hostage envoy Boehler said meetings with Hamas leaders in recent days were very helpful and that something could come together within weeks on Gaza and hostages, while he thinks all prisoners could get out not just Americans.

France, Germany, Italy and Britain said they welcome the Arab plan for Gaza reconstruction which they said shows a realistic path to reconstruction of Gaza and are committed to working with the Arab initiative.