Jails Have Become "Fentanyl Free-For-Alls" Thanks To Dem Bill That Banned Strip Searches

Jails Have Become "Fentanyl Free-For-Alls" Thanks To Dem Bill That Banned Strip Searches

Washington’s soft-touch jail policies have turned facilities into fentanyl hotspots, thanks to rules that make it harder to properly search inmates, according to https://mynorthwest.com/ktth/ktth-opinion/rantz-obese-inmates-are-smuggling-fentanyl-into-jails-thanks-to-new-policy/4066877

.

Rantz writes this week that Thurston County Sheriff Derek Sanders recently sounded the alarm after two overdoses at his jail tied to drugs smuggled in body fat.

“Once the drugs made their way in, a different inmate consumed the drugs and overdosed,” Sanders said. “Life-saving efforts from jail staff prevented the overdose from being fatal.”

Days later, it happened again—this time, fentanyl was found under an inmate’s breast.

“A Corrections Sergeant observed an inmate acting oddly and immediately called for medical,” Sanders reported. “CPR was performed for 10 minutes... Narcan deployment... The inmate will be booked on new felony charges.”

In his piece, https://mynorthwest.com/ktth/ktth-opinion/rantz-obese-inmates-are-smuggling-fentanyl-into-jails-thanks-to-new-policy/4066877

that It shouldn’t be this easy for an obese inmate to sneak drugs into jail—but thanks to misguided policies, it is.

?itok=8U-7HYVt

?itok=8U-7HYVt

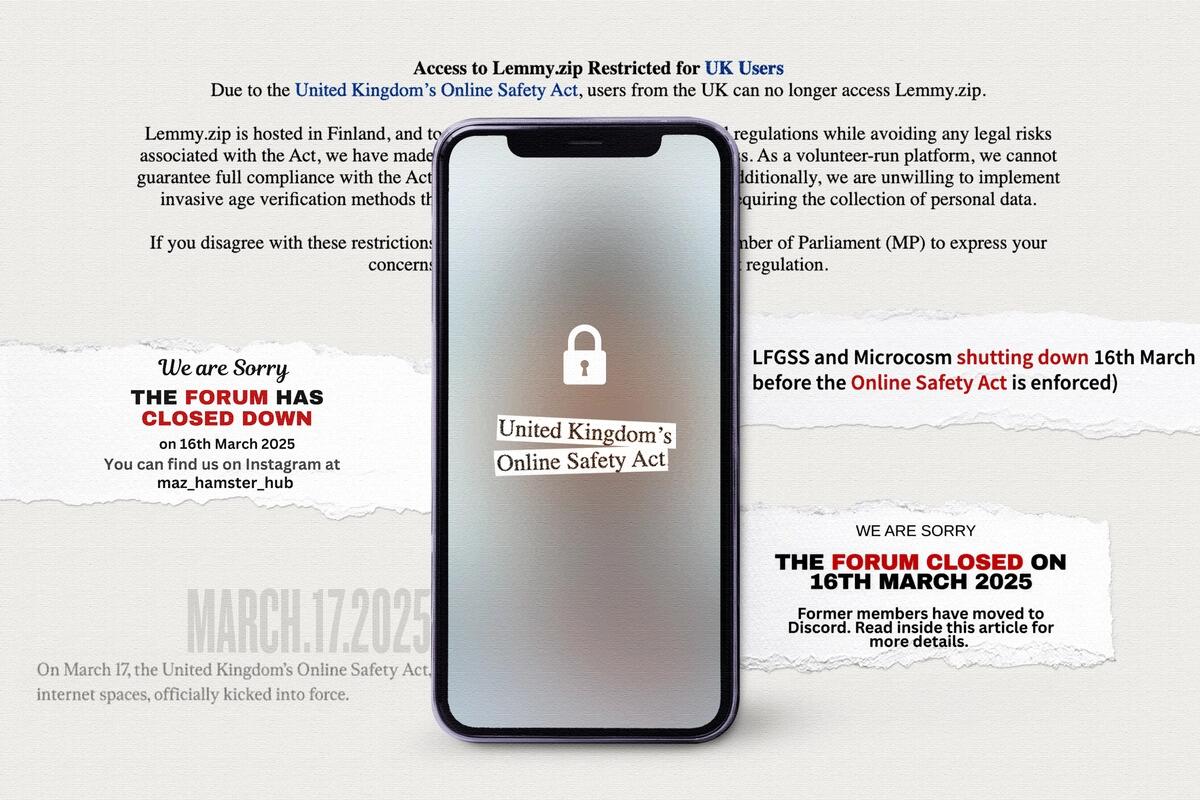

This stems from 2SSB 5695, a 2022 Democratic bill—ironically also backed by Republicans—that banned “dehumanizing” strip searches and mandated body scanners. But the Department of Health, tasked with setting scanner rules, imposed such weak radiation limits under WAC 246-230-040 that scanners can’t detect drugs hidden in body fat.

“The new rules under WAC 246-230-040, implemented in January 2025, force scanners to use laughably low radiation levels to appease activists screaming about ‘ALARA’ (As Low As Reasonably Achievable) principles,” wrote Sheriff Sanders.

Lawmakers say the new rules protect inmates from radiation—but that claim doesn’t hold up.

The previous scan dose—2.00 µSv—was already safer than a dental X-ray. Sheriff Sanders pointed out it would take 1,000 scans to hit the annual limit. “Strip searches cannot be conducted on every inmate who is booked... but its [the scanner’s] effectiveness isn’t nearly what it was post-law change,” he wrote.

Strip searches were unpleasant but worked. Lawmakers scrapped them without ensuring the scanners could actually do the job. And the same Department of Health that insisted COVID vaccines stopped transmission isn’t exactly a reliable authority on radiation safety.

https://cms.zerohedge.com/users/tyler-durden

Wed, 03/26/2025 - 22:10

RFK Jr. Is Pushing Big Pharma Ad Ban - And Corporate Media Is Panicking

RFK Jr. Is Pushing Big Pharma Ad Ban - And Corporate Media Is Panicking

https://www.thekylebecker.com/p/rfk-jr-is-pushing-big-pharma-ad-ban

,

Robert F. Kennedy Jr., Donald Trump’s Health and Human Services Secretary, is pushing a plan to ban pharmaceutical ads from television. He’s right to push for it—and not just because the U.S. is one of only two countries on earth that allows such advertising (the other being New Zealand).

America’s health system isn’t just flawed; it’s harming public health, distorting journalism, and fueling Big Pharma’s malignant influence over our daily lives.

Let’s start with the obvious: TV drug ads aren’t designed to inform—they’re designed to manipulate. The formula is always the same. Cue soft lighting and sappy piano music. A sad, listless person pops a pill and suddenly life is vibrant again. They’re running through fields, laughing with family, walking dogs across idyllic bridges.

Then, in a breathless voiceover, the side effects come tumbling out like a legal disclaimer roulette wheel—stroke, heart failure, suicidal thoughts. The goal? Make viewers want a drug before they even talk to their doctor. It’s emotional coercion dressed up as health education.

This completely inverts how medicine is supposed to work. Health care decisions should be made inside the exam room, not in a 60-second marketing spot. Patients should go to their doctors with symptoms, and those doctors—armed with clinical training and knowledge of the patient’s full health profile—should decide whether a drug is even necessary.

Many issues could be better addressed through lifestyle changes, diet, supplements, or preventative care. But instead, America has normalized a pill-for-everything culture, supercharged by the fact that doctors are often nudged by patients demanding whatever drug they saw advertised last night during a commercial break.

This isn’t just bad medicine—it’s dangerous. And it’s no accident.

Big Pharma isn’t spending billions on advertising because it cares about your health. It’s doing it because the return on investment is enormous. Studies estimate the ROI on direct-to-consumer (DTC) drug ads ranges from 100% to 500%, depending on the drug. In 2025 alone, pharmaceutical companies are projected to spend over $5 billion on national linear TV ads, according to iSpot.tv. That number balloons even higher when you include digital and streaming. Just a handful of blockbuster drugs—like Skyrizi, Jardiance, and Ozempic—are burning through tens of millions in TV ads every month.

This revenue isn’t just padding Big Pharma’s pockets—it’s quietly buying influence in the media. Nearly 31% of ad minutes on major nightly news broadcasts in 2024 came from pharmaceutical brands. That means a huge portion of media budgets depend on the very companies they should be holding accountable. And surprise, surprise: when Big Pharma misleads the public, many news outlets are either silent or hesitant to report critically. The financial conflict of interest is baked in.

?itok=dnZFVTbZ

?itok=dnZFVTbZ

We saw the worst-case version of this during the COVID-19 pandemic. The novel mRNA shots—rushed to market under emergency use—were sold to the public as miracle solutions. Government officials and media outlets claimed these vaccines would "stop infection," "prevent death entirely," and "end the pandemic." Younger, healthy individuals were told they needed them for everyone’s safety, despite already low statistical risk. None of these claims held up. As the data evolved, we learned the vaccines offered some reduction in severe disease, but not sterilizing immunity. Yet the media rarely corrected course.

Why would they? Pharma ads were paying the bills. Meanwhile, federal workers were mandated—and many private sector employees coerced—into getting injections under false pretenses. Billions of dollars flowed to Big Pharma. The American public was misled.

This pattern of deception is not new. Pfizer alone has paid billions in legal penalties over the years for unethical marketing, off-label promotion, and other violations. The most infamous: a $2.3 billion settlement in 2009—the largest health care fraud settlement in U.S. history at the time. Yet companies like Pfizer, AbbVie, and Johnson & Johnson still enjoy a polished image on TV, thanks in part to relentless ad spending and regulatory leniency.

RFK Jr.’s plan, while legally uphill, is not without precedent. In 1970, President Nixon signed the Public Health Cigarette Smoking Act, which banned tobacco ads from TV and radio. Cigarettes were legal, yet too dangerous to promote on air. The same principle should apply here. Just because a drug is FDA-approved doesn’t mean it should be marketed like soda. Approval doesn’t equal infallibility—just ask anyone who took Vioxx or OxyContin.

Critics, including the Wall Street Journal, have framed RFK’s proposal as a personal vendetta. That’s both lazy and misleading. In reality, there’s wide bipartisan and public support for reining in pharma ads. The American Medical Association called for a ban back in 2015. A STAT/Harvard poll found that 57% of Americans support banning TV drug ads. Even hosts on CNBC—hardly anti-business—agreed the ads are unnecessary. “Don’t you think doctors should prescribe it if you need it?” asked Joe Kernen. Exactly.

The pharmaceutical industry’s defenders like to invoke the First Amendment, claiming that banning ads would be unconstitutional. But commercial speech does not enjoy absolute protection. Under the Central Hudson test, the government can regulate ads if it has a substantial interest, the regulation directly advances that interest, and the restriction is narrowly tailored. Protecting public health from misleading pharmaceutical marketing clears all three hurdles. Even if a full ban doesn’t survive, tighter restrictions—like banning ads for certain drug classes, or requiring full price transparency—could pass muster.

More importantly, even the threat of a ban could pressure drugmakers to change course voluntarily. They did it before in 2008, when criticism led to updated self-regulatory guidelines. If Kennedy’s push forces them to rethink their practices, that alone is a win.

Pharma companies will no doubt fight this tooth and nail. But that’s not a reason to back down—it’s a reason to press harder. We’ve allowed an industry with an immense profit motive to shape our health decisions for too long. The result? A country drowning in prescriptions, mired in chronic disease, and confused about who to trust.

Enough is enough. RFK Jr.’s proposal to kick drug ads off TV isn’t radical—it’s responsible. And it’s long overdue.

~~~ KB

https://cms.zerohedge.com/users/tyler-durden

Wed, 03/26/2025 - 15:40

https://www.zerohedge.com/political/rfk-jr-pushing-big-pharma-ad-ban-and-corporate-media-panicking

Four Missing US Army Troops In Lithuania Found Dead: NATO

Four Missing US Army Troops In Lithuania Found Dead: NATO

An unusual and alrming headline is emerging out Europe, as a major search was underway since yesterday for four US Army soldiers who had gone missing in Lithuania. The Associated Press in a breaking headline is now reporting they are dead:

NATO CHIEF SAYS 4 MISSING US SOLDIERS WERE KILLED: AP

The incident of the missing personnel and military search operation was first reported by Lithuanian public broadcaster LRT and subsequently picked up in European media. They first disappeared on Tuesday, along with a military vehicle, and belonged to the US Army's 1st Brigade, 3rd Infantry Division.

?itok=gsPUtwH6

?itok=gsPUtwH6

"A possible scene has now been identified, and a search and rescue operation is underway," the Lithuanian military said in a statement hours prior to the announcement of their deaths.

The troops had been undergoing tactical training at the time the went missing. According to https://www.theguardian.com/us-news/2025/mar/26/soldiers-missing-lithuania?CMP=share_btn_url

:

The Lithuanian public broadcaster LRT reported that four US soldiers and a vehicle were reported missing on Tuesday afternoon during an exercise at the General Silvestras Žukauskas training ground in Pabradė, a town located less than 10km (6 miles) from the border with Belarus.

The Belarus angle and the proximity of the border could be alarming, given the US essentially considers it an 'enemy' state given its support to the Russian side of the Ukraine war.

"A search operation is currently under way, involving military personnel, rescue services, and firefighters. Lithuanian police also have launched an investigation," US state-funded RFERL writes. According to further statements and https://www.rferl.org/amp/us-soldiers-missing-lithuania-belarus/33360885.html

:

Lithuanian officials have given few details, with Gintautas Ciunis, a military spokesman, confirming only that "these are foreign soldiers."

US Army Europe and Africa on March 26 https://www.europeafrica.army.mil/ArticleViewPressRelease/Article/4135345/press-release-us-soldiers-reported-missing-in-lithuania/

that the soldiers had gone missing, saying in a statement that they were "conducting scheduled tactical training at the time of the incident."

“I would like to personally thank the Lithuanian Armed Forces and first responders who quickly came to our aid in our search operations,” said Lt. Gen. Charles Costanza, the V Corps commanding general.

?itok=E0wJw8Ll

?itok=E0wJw8Ll

Lithuania has been a NATO member since 2004, and is one of the Baltic countries which has been outspoken and hawkish in condemning Moscow.

https://cms.zerohedge.com/users/tyler-durden

Wed, 03/26/2025 - 14:40

US Intelligence Says Iran Is 'Not Building A Nuclear Weapon'

US Intelligence Says Iran Is 'Not Building A Nuclear Weapon'

https://news.antiwar.com/2025/03/25/us-intelligence-says-iran-is-not-building-a-nuclear-weapon/

US intelligence agencies have reaffirmed that there’s no evidence Iran is developing nuclear weapons or that Iranian Supreme Leader Ali Khamenei has reversed his 2003 fatwah that banned the production of weapons of mass destruction.

"The IC continues to assess that Iran is not building a nuclear weapon and Supreme Leader Khamenei has not authorized the nuclear weapons program he suspended in 2003," Director of National Intelligence Tulsi Gabbard https://jewishinsider.com/2025/03/gabbard-iran-is-not-currently-developing-nuclear-weapons/

a Senate Intelligence Committee hearing.

?itok=ioZ9RGC-

?itok=ioZ9RGC-

Gabbard’s comments were based on the https://www.dni.gov/index.php/newsroom/reports-publications/reports-publications-2025/4058-2025-annual-threat-assessment

, which is released by the ODNI with input from all US intelligence agencies. The report did note that there have been more calls inside Iran to reverse the ban on nuclear weapons, which have grown in response to Israeli aggression in the region.

"In the past year, there has been an erosion of a decades-long taboo on discussing nuclear weapons in public that has emboldened nuclear weapons advocates within Iran’s decision-making apparatus," the report reads.

"Khamenei remains the final decision maker over Iran’s nuclear program, to include any decision to develop nuclear weapons," it notes.

The threat assessment comes amid increasing US sanctions and threats of military action over Iran’s nuclear program. Iranian officials have rejected the idea of talks with the US in the face of President Trump’s "maximum pressure campaign," but have said https://news.antiwar.com/2025/03/24/iran-says-its-open-to-indirect-talks-with-the-us/

The hype over Iran’s nuclear program revolves around the https://news.antiwar.com/2025/02/27/hysteria-after-iaea-issues-quarterly-report-on-irans-uranium-enrichment/

against its Natanz nuclear facility, which was meant to sabotage talks between the Biden administration and Tehran.

Iran is still a signatory to the Non-Proliferation Treaty (NPT) and has told the International Atomic Energy Agency (IAEA) that it https://www.theguardian.com/world/2024/nov/20/iran-has-offered-to-keep-uranium-below-purity-levels-for-a-bomb-iaea-confirms

Amid increasing US and Israeli threats about its nuclear program, Iran has https://news.antiwar.com/2025/02/24/iran-says-israels-nuclear-weapons-are-a-grave-threat-to-the-world/

that Israel has a secret nuclear weapons stockpile, and its nuclear program is not subject to IAEA inspections since Israel is not a signatory to the NPT.

https://cms.zerohedge.com/users/tyler-durden

Wed, 03/26/2025 - 14:20

https://www.zerohedge.com/geopolitical/us-intelligence-says-iran-not-building-nuclear-weapon

Futures Rise As Tariff Uncertainty Grows Ahead Of "Liberation Day"

Futures Rise As Tariff Uncertainty Grows Ahead Of "Liberation Day"

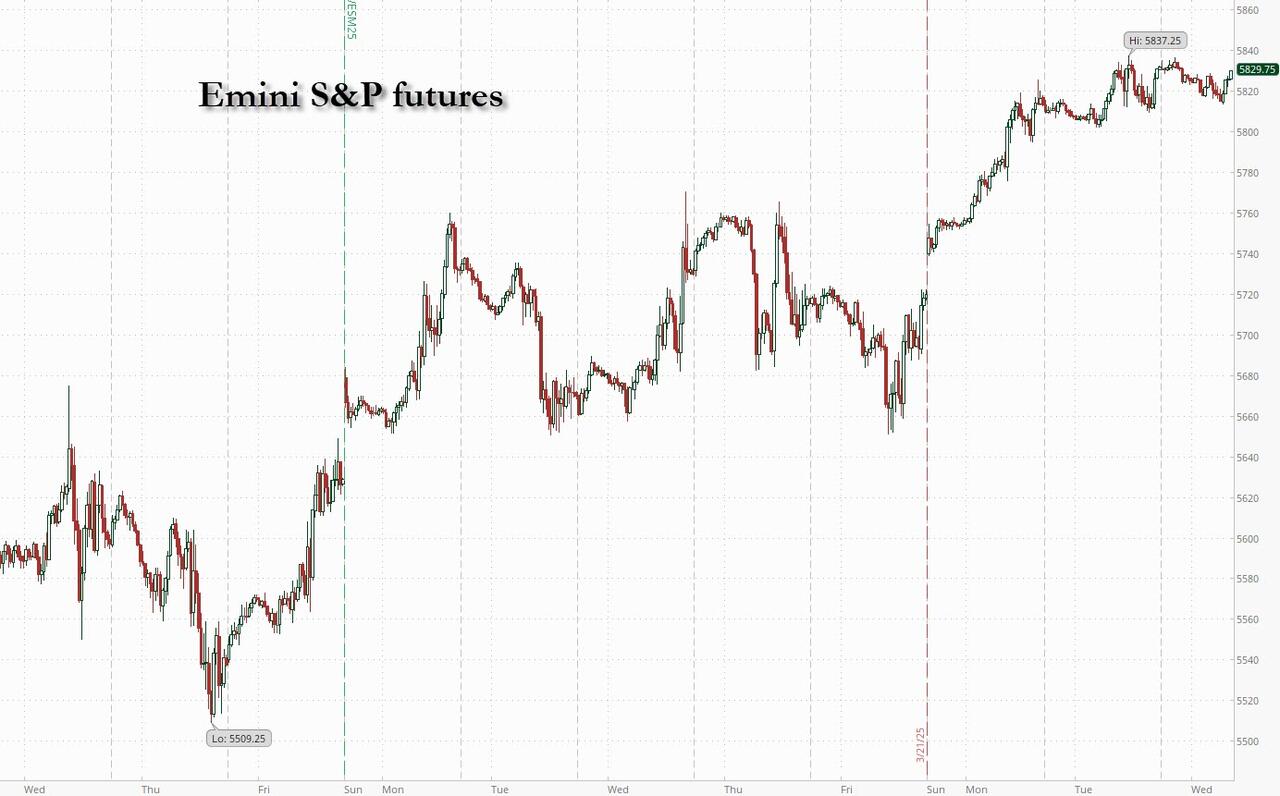

US equity futures are flat, reversing earlier losses while global markets were mixed (Europe down, Asia up) as investors awaited more clarity on US tariff plans and the economic outlook before Donald Trump’s April 2 "Liberation Day" deadline to impose a fresh reciprocal tariffs. As of 8:00am ET, S&P futures were up 0.1% following modest gains on the indexes on Tuesday, while Nasdaq futures were flat as Tesla and Nvidia shares edged lower, pressuring the Mag 7. Europe’s Stoxx 600 index dropped 0.5%. Bond yields are 1-3bp higher and USD is higher. Commodities are mostly higher led by oil and base metals. Copper futures in New York surged to a record high (up 1% now after easing off records) as traders priced in the possibility of hefty import tariffs that may come within several weeks. Headlines were mostly quiet since market close yesterday. Today's economic calendar includes Feb durable goods orders at 8:30am; Fed speaker slate includes Kashkari (10am) and Musalem (1:10pm).

?itok=bK956vS5

?itok=bK956vS5

In premarket trading, video game retailer GameStop jumped 14% after the struggling video-game retailer that became a favorite of retail traders during the meme stock frenzy said its board approved a plan to add Bitcoin as a treasury reserve asset. Tesla and Nvidia lead losses among the Magnificent Seven stock (Alphabet -0.4%, Amazon +0.2%, Apple +0.1%, Microsoft -0.1%, Meta +0.1%, Nvidia -1.4% and Tesla -1.2%). Dollar Tree (DLTR) rises 2% as the company will sell its Family Dollar chain for about $1 billion to Brigade Capital Management and Macellum Capital Management a decade after buying the business. Here are some other notable movers:

Global-e Online (GLBE) rises 3% after Morgan Stanley upgraded the software firm to overweight, citing achievable growth targets.

Humacyte (HUMA) slides 26% after the biotech firm offers 25 million shares at $2 apiece, a discount of around 30% to its previous close.

Goldman Sachs (GS) rose 1% Tuesday for an 8th day, on its longest winning streak since November 2022.

Playtika (PLTK) rises 7% following a double upgrade of the mobile-games company at BofA, removing the only negative analyst view on the stock.

Summit Therapeutics (SMMT) rises 4% after Citi upgraded the biotech to buy on stronger conviction on the firm’s HARMONI-2 clinical trial.

The tariffs issue remains front and center for investors, who took comfort earlier this month from the Trump adminstration’s signal that the coming wave of levies may be less expansive and more targeted than originally feared. However, the president has since sown confusion by saying he didn’t want too many tariff exceptions, but he would “probably be more lenient than reciprocal.” All that has left investors struggling to work out how to position ahead of the April 2 deadline that Trump has dubbed “Liberation Day.”

“Uncertainty on the tariff front remains ridiculously high, leaving it incredibly tough for businesses or consumers to plan more than about a day into the future, and still making it nigh-on impossible for market participants to price risk,” said Michael Brown, a strategist at Pepperstone Group Ltd.

European stocks retreated on lingering jitters about US tariffs. UK mid-caps rise on an unexpected cooldown in inflation before a key budget statement from the government later in the day. The Stoxx 600 fell 0.6% to 549.21 with 366 members down, 223 up and 11 unchanged. In Britain, the FTSE 250 gauge of mid-sized stocks advanced about 0.5%, as data showing an unexpected inflation slowdown strengthened the case for the Bank of England to cut interest rates. Here are some of the biggest movers on Wednesday:

Ocado shares rise as much as 16% as the firm gets a positive analyst rating from JPMorgan for the first time in over seven years, with the broker upgrading to overweight from neutral to reflect a “turning tide” in the digital grocery sector.

Danieli shares gain as much as 11% after better-than-expected net cash results and FY targets confirmation for this year, analysts say, as the Italian metal-production company released 1H24/25 results on Tuesday after market close.

ProSieben shares rise as much as 5.7% after Reuters reported that MFE had called a board meeting for Wednesday to review a possible bid for the company.

TotalEnergies shares rise as much as 1.1% after being upgraded by analysts at Citi, who say the oil giant will increase cashflow at a much faster pace than key European peers over the coming years.

Avon rises as much as 9.2%, the most in over four months, after the maker of helmets and respirators raised its revenue growth and margin guidance for this year, as the firm announced new orders and contracts from European nations and a ramp-up of volumes for deliveries in the US.

Mips shares gain as much as 5.4%, the most since February, after the Swedish helmet technology firm was upgraded to buy from hold at SEB, citing an attractive risk/reward after a 30% share price drop since August.

Evoke shares sink as much as 19%, the most since July 2023. Though the William-Hill owner reported in-line results for fiscal year 2024, a soft start to 1Q25 is likely to raise concerns on whether the gambling operator can meet its guidance for 2025, JPMorgan notes.

Vistry shares drop as much as 11%, the biggest drop since December, after analysts warned of weak current trading and low visibility on the homebuilder’s 2025 financial results.

CD Projekt shares fall as much as 13%, the steepest drop since March 2021, after the video-games maker said its Witcher 4 game won’t be released before 2027, overshadowing strong 4Q earnings and news of a cooperation pact with US peer Scopely.

Wetherspoon slides as much as 4.7% after Deutsche Bank assigns the only sell rating on the pub operator, downgrading from neutral based on the impact of changes related to the UK Government’s budget.

Earlier in the session, Asian equities rose, heading for their first advance in four days, helped by gains in Chinese technology heavyweights and a rally in Indonesia’s market. The MSCI Asia Pacific Index climbed as much as 0.5%. Nintendo Co. was among the biggest contributors after Goldman Sachs reinstated coverage of the Japanese games maker with a buy rating. Samsung Electronics, Alibaba and Tencent were among other major stocks buoying the regional benchmark. The Jakarta Composite Index jumped 4%, the most in the region, after several state-owned banks increased their dividend payouts. Stocks in Australia closed higher after the government unveiled tax cuts and other sweeteners in a pre-election budget. Chinese equities listed in Hong Kong also gained. Morgan Stanley strategists raised their targets for the nation’s equities for the second time in a little more than a month, citing upside for valuations amid an improving outlook for earnings. A gauge of Chinese tech shares in Hong Kong rebounded after falling to the brink of a technical correction in the previous session.

In FX, the dollar is little changed, supported on the view that the US would limit exceptions to the next tranche of tariffs expected next week. The Bloomberg Dollar Spot Index rose 0.1% before paring gains during the European session; it is on track to gain for the five of the last six days.

USD/JPY gained as much as 0.5% to 150.62 as Bank of Japan Governor Kazuo Ueda indicated he aims to keep his options open ahead of the bank’s next policy meeting, adding to the view that Japan’s yield discount to the US will remain wide

GBP/USD fell 0.5% to the day’s low 1.2886 after data showed an unexpected slowdown in UK CPI; traders await the country’s fiscal statement later in the day

In rates, treasuries edged lower as investors await speeches by Federal Reserve officials later in the day for more steer into the US interest rate outlook. Treasury yields are 1bp-3bp cheaper across a slightly steeper curve, with 5s30s spread around 1bp wider on the day; 10-year, 3bp higher near 4.35%, trails bunds and gilts in the sector by 2bp and 5bp.

Gilts outperform, led by front-end tenors as swaps price in additional easing by Bank of England after UK February CPI data rose less than estimated. UK 2-year yields are more than 5bp lower on the day after the inflation data, steepening the gilts curve. Treasury auction cycle continues with $70 billion 5-year note sale at 1pm New York time, following good demand for 2-year notes on Tuesday. It concludes with $44 billion 7-year note auction Thursday

In commodities, copper futures in New York surged to a record high as traders priced in the possibility of hefty import tariffs that may come within several weeks. WTI oil edged higher after an industry report signaled a large decline in US crude stockpiles, while the market weighed the prospect of a Russia-Ukraine ceasefire in the Black Sea. Gold extended gains, rising 0.6% to $3,027.

Looking to the day ahead now, data releases include the preliminary durable goods orders for February. Meanwhile from central banks, we’ll hear from the Fed’s Kashkari and Musalem, along with the ECB’s Villeroy and Cipollone.

Market Snapshot

S&P 500 futures little changed at 5,822.50

STOXX Europe 600 down 0.2% to 551.61

MXAP up 0.4% to 189.10

MXAPJ up 0.4% to 590.15

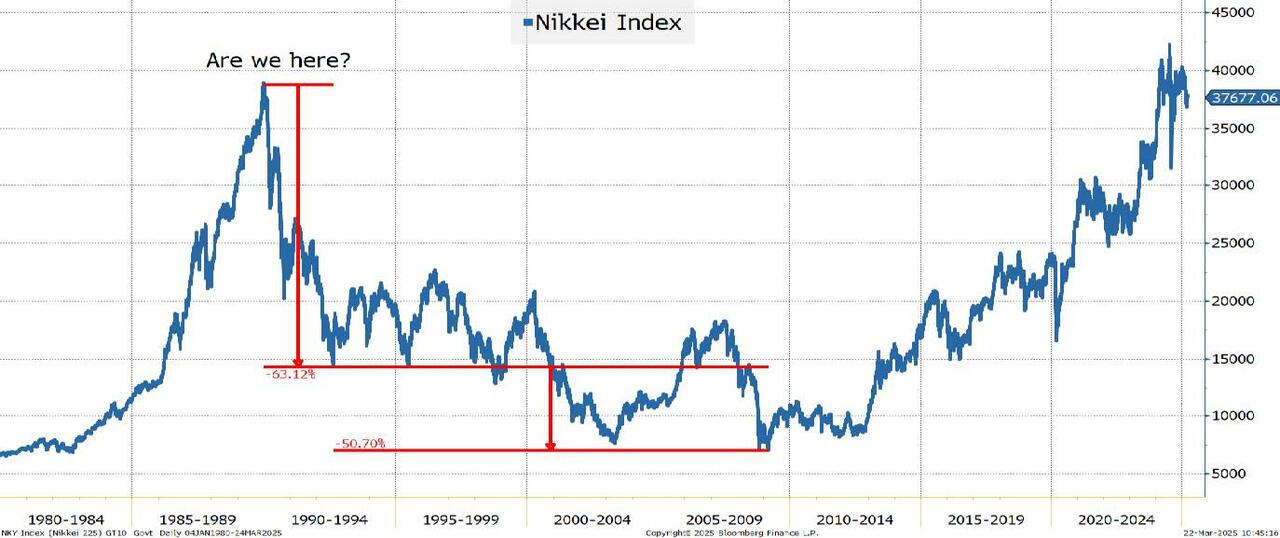

Nikkei up 0.7% to 38,027.29

Topix up 0.5% to 2,812.89

Hang Seng Index up 0.6% to 23,483.32

Shanghai Composite little changed at 3,368.70

Sensex down 0.7% to 77,508.02

Australia S&P/ASX 200 up 0.7% to 7,998.97

Kospi up 1.1% to 2,643.94

German 10Y yield little changed at 2.78%

Euro little changed at $1.0792

Brent Futures up 0.4% to $73.29/bbl

Gold spot up 0.3% to $3,027.85

US Dollar Index little changed at 104.27

Top Overnight News

GOP leaders said they’re getting close to agreeing on a plan to pass an extension of Trump’s 2017 tax cuts and an increase to the debt ceiling. The CBO will today release its estimate for when the debt ceiling will be reached. BBG

Trump’s copper tariffs could arrive within the next several weeks, earlier than initially anticipated. BBG

Fed's Goolsbee (2025 voter) said it may take longer than anticipated for the next cut to come because of economic uncertainty and ‘wait and see’ is the correct approach when facing uncertainty. Goolsbee also commented that market angst over inflation would be a red flag and believes borrowing costs will be a fair bit lower in 12–18 months, while he noted that if investor expectations begin to converge with those of American households, the Fed would need to act: FT

China economic optimism rises, and the Street has raised their growth forecasts on back of stimulus, although tariffs loom as a risk. WSJ

China wields significant policy room to stimulate its economy this year while some reform was needed to boost consumption, Huang Yiping, an advisor to China's central bank and a professor at Peking University, said on Wednesday. China has unveiled fresh fiscal measures, including a rise in its annual budget deficit, to help hit an economic growth target of around 5% this year, which analysts have described as ambitious. The central bank has pledged to cut interest rates and pump more money into the economy at an appropriate time. RTRS

The Bank of Japan may consider monetary tightening if a surge in food prices causes broader and stronger inflation, the central bank governor said Wednesday, adding fuel to expectations for a near-term rate hike. WSJ

UK CPI cools by more than expected in Feb on headline (+2.8% vs. the Street +3% and vs. +3% in Jan) and core (+3.5% vs. the Street +3.6% and vs. +3.7% in Jan) while services held steady at +5% (vs. the Street +4.9% and vs. +5% in Jan). WSJ

Australia’s CPI in Feb ticks down to +2.4% (vs. the Street +2.5%), helped by a fall in electricity prices, while the continued easing in home building costs and rents supported fueling expectations for further RBA rate cuts. RTRS

Signs that investors in the US bond market are baking in higher inflation would be a “major red flag” that could upend policymakers’ plans to cut interest rates, Goolsbee warned. He added that the Fed is no longer on the “golden path,” and that the rate cuts will take longer than expected. “If you start seeing market-based long-run inflation expectations start behaving the way these surveys have done in the last two months, I would view that as a major red flag area of concern,” said Goolsbee. FT

Canada and India are taking steps to cool diplomatic tensions, including considering sending back envoys after tit-for-tat expulsions last year, people familiar said. The two nations are looking to strengthen trade ties to counter US tariff threats. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded with a mostly positive bias after the somewhat mixed performance stateside where the focus centred on tariffs, data and geopolitics including reports that Ukraine and Russia agreed with the US on a maritime ceasefire. ASX 200 was led higher by gains in the mining, resources and financial sectors in the aftermath of the recent budget announcement, while participants also digested softer-than-expected monthly inflation from Australia. Nikkei 225 reclaimed the 38,000 level with upside supported by a weaker currency and after slightly softer Services PPI data. Hang Seng and Shanghai Comp eked slight gains but with upside capped amid ongoing tariff uncertainty with a Chinese delegation to meet with the US Commerce Secretary and the USTR today to negotiate over tariffs in which they will also discuss fentanyl and trade barriers among other issues, while a PBoC adviser warned at the Boao Forum that changes in the global environment will be challenging for China and China must boost domestic demand, especially consumption.

Top Asian News

PBoC adviser said at the Boao Forum that changes in the global environment will be challenging for China and China must boost domestic demand, especially consumption, while it added that there is still very big macro policy space for supporting China's economy and reform measures alongside recent policy steps are needed to support consumption.

BoJ Governor Ueda said cost-push factors are likely to gradually dissipate but also noted that underlying inflation is likely to gradually converge towards the 2% target even when the temporary boost from food inflation disappears. Ueda said the BoJ will make a judgment call by looking at various indicators to determine whether underlying inflation has hit the target and underlying inflation is close to but has yet to move into the narrow band defined as sufficient achievement of the 2% price target. Furthermore, Ueda said the BoJ remains vigilant to the possibility that underlying inflation may accelerate faster than projected and expects to keep raising interest rates if the economy and prices move in line with forecasts in the quarterly outlook report but later commented that if price risks overshoot expectations, they will take stronger steps to adjust the degree of monetary support.

BoJ's Koeda says the Bank's mandate is to contribute to a healthy economy, various indicators show Japan's underlying inflation moving towards a sustainable achievement of BoJ's 2%.

Despite a steady and firmer open European bourses now find themselves mostly in the red, Stoxx 600 -0.6%. Selling pressure picked up after the cash open with no obvious catalyst for the price action at the time. Sectors began mixed but now have a negative bias with Health Care, Chemicals and Autos bottom of the pile; the latter seemingly hit on remarks from Trump about Europeans "freeloading", reports of copper tariffs and pressure in Porsche SE on an Volkswagen impairment.

Top European News

ECB's Villeroy says in the short-term, US President Trump's "lose-lose" strategy is harming the US as the Fed's downgrade of its forecast show. A 25pp increase in US tariffs in Q2 would have a limited impact on European inflation, but could reduce EZ GDP by 0.3pp in a year

FX

DXY is currently flat but with modestly diverging fortunes against peers, greenback softer vs. cyclicals and firmer vs. havens despite the pullback in European stocks seen since the cash open. Comfortably above 104.00 but at the lower-end of a 104.18-38 band.

EUR attempting to get back above the 1.08 mark and while it has tested the figure it is yet to convincingly breach it. Upside which comes despite the rhetoric from Trump and with incremental drivers light since the Ifo.

Cable the G10 laggard after cooler-than-expected inflation data this morning and ahead of the Spring Statement which commences from 12:30GMT. Cable back above 1.29 but only modestly so after slipping as low as 1.2887 early doors.

USD/JPY rebounded overnight from the prior day's trough and reclaimed the 150.00 handle with tailwinds amid the constructive APAC risk tone and following the softer Services PPI data from Japan; got to a 150.63 peak but has since pulled back towards the mentioned figure.

AUD was hit on soft domestic inflation data overnight which saw a 0.6279 low in AUD/USD print but it has since recovered back above the mark and to a high some 30 pips above.

PBoC set USD/CNY mid-point at 7.1754 vs exp. 7.2559 (Prev. 7.1788).

Riksbank Minutes (March): Thedeen says "...we have some scope to see through upturns in inflation if we judge that they are temporary".

Fixed Income

Gilts gapped higher by 33 ticks at the open after an almost entirely cooler-than-expected inflation series. A series which has sparked a modest dovish move in BoE pricing, though the overall narrative hasn’t shifted.

Got to as high as 91.58 though this proved short lived as we approach the Spring Statement from 12:30GMT where Reeves is expected to try and raise/save GBP 17bln, to plug the fiscal hole she finds herself in and then to provide headroom of just under the GBP 9.9bln she had in October; full preview available.

Bunds modestly firmer after picking up early doors on the above. Thereafter, hit a 128.36 session high which is a tick above Tuesday's best. Specifics light into supply which was strong but sparked no reaction in the benchmark. Leaving it marginally in the green around 128.20.

USTs in the red but only modestly so with action relatively steady in the European morning as we await updates to numerous catalysts in addition to Fed speak, data and supply with 70bln of 5yr Notes due and following the 2yr tap on Tuesday which was strong when compared to recent averages though not quite as well received as the outing in February.

Commodities

Crude continues to inch higher and is at highs of USD 69.54/bbl and USD 73.57/bbl respectively for WTI and Brent but remains within Tuesday's parameters. Upside driven by the private inventory report, absence of sanctions removal on oil tankers and Yemeni forces targeting the USS Truman.

Dutch TTF in the red with Ukraine-Russia geopols in focus and the most recent language from the Kremlin being that talks are continuing with the US and they are satisfied with the dialogue. There have been reports of drone strikes on/from both sides, with the Kremlin continuing to state that they will only comply with the Black Sea truce once specific sanctions are lifted.

Gold indecisive and flat on the session, around the mid-point of a USD 3013-3032/oz band. Copper was bid overnight after futures hit a record high in Tuesday's session which followed through into 3M LME and lifted it above the USD 10k mark on latest tariff reports; since, the metal has pulled back and is in the red as we await further updates.

Goldman Sachs maintains its 3-, 6- and 12-month copper price forecasts at USD 9,600, USD 10,000 and USD 10,700, respectively.

US Private Energy Inventories (bbls): Crude -4.6mln (exp -2.6mln), Distillate -1.3mln (exp. -2.2mln), Gasoline -3.3mln (exp. -2.2mln), Cushing -0.6mln.

TotalEnergies (TTE FP) CEO says he would not be surprised if two of the Nord Stream gas pipelines came back.

Reliance has paused purchases of Venezuelan crude following US President Trump's 25% tariff, according to Bloomberg.

Geopolitics: Middle East

Two Israeli raids were reported on the northeastern areas of Gaza City, according to Al Jazeera.

Houthi military spokesman said they targeted Israeli military sites in the Jaffa area with a number of drones and targeted US aircraft carrier Harry Truman.

Geopolitics: Ukraine

Russia's Foreign Minister Lavrov said the Black Sea deal is aimed at Russia making legitimate profit in fair competition and ensuring food safety in Africa and elsewhere. Lavrov also commented that Russia and the US are discussing other things than Ukraine in their talks, according to TASS.

Russian drone attacks caused major destruction in the central Ukrainian city of Kryvyi Rih, according to the local military administration. It was also reported that emergency power cuts were implemented in Ukraine's Mykolaiv port following reported drone attacks, according to the mayor.

Russia's Kremlin says the order on moratorium on energy strikes is still in force and Russia are compliant; are continuing contacts with the US, satisfied with the dialogue. Black sea initiative will be activated after a number of conditions are met.

US Event Calendar

07:00: March MBA Mortgage Applications , prior -6.2%

08:30: Feb. Durable Goods Orders, est. -1.0%, prior 3.2%

Feb. Durables-Less Transportation, est. 0.2%, prior 0%

Feb. Cap Goods Ship Nondef Ex Air, est. 0.2%, prior -0.3%

Feb. Cap Goods Orders Nondef Ex Air, est. 0.2%, prior 0.8%

Central Banks

10:00: Fed’s Kashkari Hosts Fed Listens, conversation

13:10: Fed’s Musalem Speaks on Economy, Monetary Policy

DB's Jim Reid concludes the overnight wrap

Markets put in a decent performance yesterday, with the S&P 500 (+0.16%) posting a third consecutive advance for the first time since early February. The moves came despite several obstacles, including an unexpectedly large drop in the US Conference Board’s consumer confidence indicator. But ultimately investors shrugged that off, as there were still no signs that this recent survey weakness was being reflected in the hard data. Moreover, the rally got further support thanks to hopes that next week’s reciprocal tariffs wouldn’t be as bad as previously feared. So that helped to lift sentiment around the US outlook, with signs of market stress continuing to ease after the S&P 500’s correction. Indeed, the VIX index of volatility fell to its lowest level in over a month yesterday, at 17.15pts.

That story had looked quite different around the US open, when the Conference Board’s indicator was released. It showed an unexpectedly large drop in consumer confidence to 92.9 in March (vs. 94.0 expected), leaving it at its lowest level since January 2021, back when the economy was still emerging from the pandemic. Moreover, the expectations measure fell to a 12-year low of just 65.2. So that took it beneath its 2022-lows, when the Fed were still hiking rates aggressively and CPI inflation was running above 8%. But despite the negative headlines, investors were reassured by the fact that the labour market measures were still holding up. For instance, the differential between those saying jobs were plentiful versus hard to get actually moved up slightly in March, to a net +17.9%. On top of that, investors also recognised that we still hadn’t seen this deterioration echoed in the hard data yet. So they’re still waiting for more evidence before they’re willing to price a more significant economic downturn.

That more positive tone led to a fresh pickup for US equities, with the Magnificent 7 (+1.23%) leading the way once again. That group are now up +6.21% over the last three sessions, making it their best 3-day performance since the news of Trump’s election victory in early November. However, the broader equity performance was more subdued, and even though the S&P 500 advanced (+0.16%), the equal-weighted version of the index was down -0.27% and the small cap Russell 2000 (-0.66%) lost ground after its Monday surge.

Equities also got support from a fresh drop in Treasury yields, with the 10yr yield coming off a one-month high of 4.37% intraday, before closing down -2.3bps at 4.31%. Near term market expectations for the Fed were little changed, but a modest decline in 2026 pricing helped 2yr yields post a similar -2.0bps decline to 4.02%. Otherwise, we didn’t hear from many Fed speakers, but Governor Kugler sounded a patient note, saying that “FOMC policy is well positioned”, and that they could keep policy on hold “at the current rate for some time”. Meanwhile, Chicago Fed President Goolsbee said in an FT interview that the Fed wasn’t on the “golden path” of 2023-24, and that “there’s a lot of dust in the air”.

Nevertheless, he still said he thought borrowing costs would be “a fair bit lower” in 12-18 months time. Overnight, 10yr Treasury yields have reversed course again, moving up +2.1bps to 4.33%.

Over in Europe, there was an even stronger risk-on tone yesterday, with the STOXX 600 (+0.67%) recovering after three consecutive declines. That got a boost from the Ifo’s latest business climate indicator in Germany, which moved up to an 8-month high of 86.7 in March, in line with expectations. However, sovereign bonds sold off, in contrast to their US counterparts, after some hawkish comments from several ECB officials. They cast doubt on the prospect of another rate cut at the April meeting, with Croatia’s Vujcic saying that he saw the next meeting “as a completely open question.” Separately, Slovakia’s Kazimir said that he was “open to discussing either further interest-rate cuts or holding steady”, while France’s Villeroy noted that “the easing cycle is neither finished nor automatic”. So all that contributed to a rise in yields, with those on 10yr bunds (+2.7bps), OATs (+2.3bps) and BTPs (+2.1bps) all moving higher.

Elsewhere, there was a clear market reaction after the US said yesterday that Russia and Ukraine had agreed to a ceasefire in the Black Sea, as well as on the previously signalled 30-day halt to strikes against energy infrastructure. President Zelenskiy said Ukraine would implement this partial ceasefire immediately. Oil prices fell back in response, as the news eased fears about supply disruptions, with Brent trading crude falling by about 1% following the headlines to trade -0.7% lower intra-day. However, it rose back to close +0.03% on the day at $73.02/bbl, perhaps reflecting some inconsistency in the signals from the different sides. Notably, the Kremlin said the maritime ceasefire was conditional on the lifting of sanctions against Russian banks and companies involved in agricultural trade, a detail that was absent from the US statement. Still, there was a positive reaction among Ukraine’s dollar bonds, with the 10yr yield down -22.5bps on the day. And given the Black Sea’s importance for grain shipments, wheat (-0.82%) and corn (-1.29%) futures also fell back.

Overnight in Asia, markets have continued their strong performance, with decent gains for the Nikkei (+1.13%) and the KOSPI (+1.14%). Meanwhile in Australia, the S&P/ASX 200 (+0.71%) is also higher, which comes after the February CPI print was a bit softer than expected, falling to +2.4% (vs. +2.5% expected). However, there’s been a weaker performance in mainland China, where the CSI 300 (-0.19%) has lost ground this morning, and the Shanghai Comp (+0.06%) has only seen a modest increase. Looking forward, European equity futures are broadly positive, with those on the DAX up +0.22%, but US futures are very slightly lower, with those on the S&P 500 down -0.01%.

In terms of today, one of the main highlights will be the UK Government’s Spring Statement. That includes a new set of forecasts from the Office for Budget Responsibility, who are the UK’s independent fiscal watchdog, and they judge if the government are on track to meet their fiscal rules. However, because the economy has been weaker than the OBR set out last autumn, and gilt yields have also moved higher, our UK economist thinks that will remove the fiscal headroom set out at the time of the budget. In his preview for today’s event (link here), he expects fiscal consolidation near £14.5bn, comprising of welfare savings, departmental efficiency savings, and NHS reforms. And from a market perspective, he says the focus is likely to be on the size and composition of the 2025/26 gilt remit, how much fiscal headroom the government now has, and the credibility of any medium-term fiscal consolidation.

To the day ahead now, and here in the UK, Chancellor Rachel Reeves will deliver the spring statement, and there’s the CPI report for February as well. In the US, data releases include the preliminary durable goods orders for February. Meanwhile from central banks, we’ll hear from the Fed’s Kashkari and Musalem, along with the ECB’s Villeroy and Cipollone.

https://cms.zerohedge.com/users/tyler-durden

Wed, 03/26/2025 - 08:24

https://www.zerohedge.com/markets/futures-rise-tariff-uncertainty-grows-ahead-liberation-day

Vance Cautioned Against Bombing Yemen, Calling It A 'Mistake'

Vance Cautioned Against Bombing Yemen, Calling It A 'Mistake'

https://news.antiwar.com/2025/03/24/vance-cautioned-against-bombing-yemen-calling-it-a-mistake/

Vice President JD Vance cautioned against bombing Yemen before the US restarted its airstrikes on the country, calling it a "mistake," and suggested delaying the attack by one month, according to a https://archive.vn/JEYep

between administration officials.

Jeffrey Goldberg, a reporter for The Atlantic, was included in the Signal thread, apparently by accident, which is how he obtained the conversation. An account believed to be Secretary of Defense Pete Hegseth shared details of the March 15 airstrikes on Yemen two hours before they happened, and the White House confirmed that the Signal conversation appeared to be authentic.

A day before the airstrikes, an account labeled "JD Vance" expressed misgivings about the idea of targeting the Houthis. "Team, I am out for the day doing an economic event in Michigan. But I think we are making a mistake," the Vance account said.

?itok=6nPvkVKi

?itok=6nPvkVKi

Vance framed his opposition to the airstrikes based on President Trump’s policies toward Europe, which have involved pressuring the Europeans to pay more for their own militaries to be less reliant on the US. Vance pointed out that only a small percentage of US shipping goes through the Suez Canal compared to European trade.

The message said: "3 percent of US trade runs through the suez. 40 percent of European trade does. There is a real risk that the public doesn’t understand this or why it’s necessary. The strongest reason to do this is, as POTUS said, to send a message."

Vance continued, "I am not sure the president is aware how inconsistent this is with his message on Europe right now. There’s a further risk that we see a moderate to severe spike in oil prices. I am willing to support the consensus of the team and keep these concerns to myself. But there is a strong argument for delaying this a month, doing the messaging work on why this matters, seeing where the economy is, etc."

An account believed to be Joe Kent, President Trump’s nominee to lead the National Counterterrorism Center, replied to Vance, saying, "There is nothing time sensitive driving the time line. We’ll have the exact same options in a month."

Hegseth responded to Vance by saying the messaging to the American people about the war would focus on President Biden failing to deter Yemeni attacks and the Houthis being "Iran funded." Iran is aligned with the Houthis, but it’s unclear how much support they give to the group, and US officials https://news.antiwar.com/2025/03/17/trump-says-us-will-hold-iran-accountable-for-houthi-attacks/

the Houthis wouldn’t take orders from Tehran and have their own weapons supply.

"VP: I understand your concerns – and fully support you raising w/ POTUS. Important considerations, most of which are tough to know how they play out (economy, Ukraine peace, Gaza, etc). I think messaging is going to be tough no matter what – nobody knows who the Houthis are – which is why we would need to stay focused on: 1) Biden failed & 2) Iran funded," Hegseth said.

Hegseth also disputed the idea that the strikes could wait, saying he wanted it to happen before the Gaza ceasefire fell apart and before Israel attacked Yemen. The US launched the March 15 airstrikes just a few days after the Houthis, officially known as Ansar Allah, https://news.antiwar.com/2025/03/11/yemens-houthis-announce-renewed-blockade-on-israeli-ships-due-to-lack-of-gaza-aid/

they would reimpose their blockade on Israeli shipping in response to Israel’s ceasefire violations, which included imposing a full blockage on all goods entering Gaza.

"Waiting a few weeks or a month does not fundamentally change the calculus. 2 immediate risks on waiting: 1) this leaks, and we look indecisive; 2) Israel takes an action first – or Gaza cease fire falls apart – and we don’t get to start this on our own terms. We can manage both. We are prepared to execute, and if I had final go or no go vote, I believe we should," Hegseth said.

Hegseth also claimed bombing Yemen wasn’t really "about the Houthis" and suggested the messaging would focus on protecting shipping. "This [is] not about the Houthis. I see it as two things: 1) Restoring Freedom of Navigation, a core national interest; and 2) Reestablish deterrence, which Biden cratered. But, we can easily pause. And if we do, I will do all we can to enforce 100% OPSEC [operations security]. I welcome other thoughts," he said.

National Security Advisor Mike Waltz, who added Goldberg to the chat, made his argument for bombing Yemen, saying it would "have to be the United States that reopens these shipping lanes" and that the administration would figure out a way to get Europe to pay. "Per the president’s request we are working with DOD and State to determine how to compile the cost associated and levy them on the Europeans," he said.

Vance said that he would agree with whatever Hegseth’s decision was. "If you think we should do it let’s go. I just hate bailing Europe out again," he said.

The first round of US airstrikes on Yemenhttps://news.antiwar.com/2025/03/16/yemen-us-airstrikes-kill-31-including-women-and-children/

, including five children and two women, according to Yemen’s Health Ministry. Administration officials celebrated the strikes in the chat, including Waltz, who sent a fist emoji, a flame emoji, and an American flag emoji.

Since those initial airstrikes, the Houthis have carried multiple attacks targeting the US aircraft carrier USS Harry Truman, which US officials have said were intercepted. The Houthis also began https://news.antiwar.com/2025/03/23/houthis-target-israel-with-missile-as-us-pounds-yemen/

in response to Israel restarting its massive bombing campaign on Gaza.

JD Vance recognizes war on Yemen as “a mistake” that doesn’t advance US interests, but agrees to go along with the consensus

The discussion leaked thanks to Mike Waltz, who inexplicably added the editor of one of the most rabidly anti-Trump outlets to a chat of natsec principals https://t.co/omgv2VrLQj

— Max Blumenthal (@MaxBlumenthal) https://twitter.com/MaxBlumenthal/status/1904254547209458051?ref_src=twsrc%5Etfw

The Houthis ceased their attacks on Israel and Israel-linked shipping when the Gaza ceasefire went into effect on January 19. The group has maintained that the only way to stop its attacks now is for another truce in Gaza and the end to the Israeli blockade on aid entering the Strip.

While the Trump administration officials’ conversation was focused on the impact on shipping, the US bombing campaign in Yemen is more about backing Israel. The Israeli news site Ynet https://www.ynetnews.com/article/skre6ttnjx

that the US has told Israel not to worry about retaliating against the Houthis for their recent missile attacks, saying US forces will handle it.

President Trump is threatening the Houthis with "annihilation," but a year-long US bombing campaign launched by President Biden from January 204 to January 2025 did not stop the Houthis, and a brutal US-backed Saudi-led war on Yemen from 2015 to 2022 also failed to remove the group from power.

https://cms.zerohedge.com/users/tyler-durden

Tue, 03/25/2025 - 14:20

https://www.zerohedge.com/geopolitical/vance-cautioned-against-bombing-yemen-calling-it-mistake

Philly Fed Services Survey Crashes To Weakest Since COVID

Philly Fed Services Survey Crashes To Weakest Since COVID

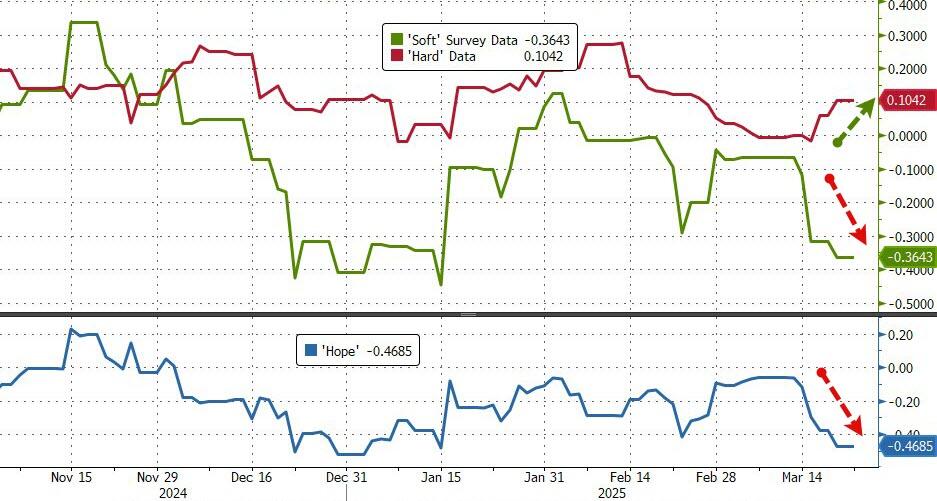

Continuing the trend of 'soft' data deterioration...

?itok=YscYK8EV

?itok=YscYK8EV

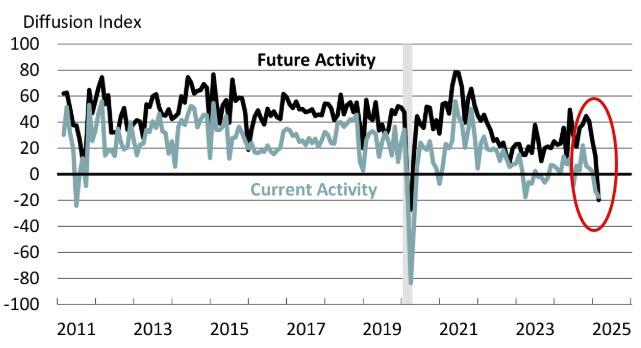

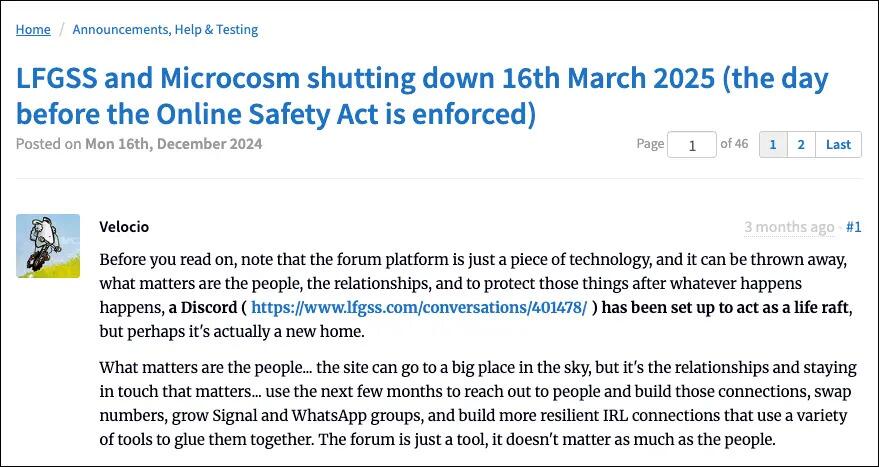

The Philly Fed Services Sector survey Current Activity collapsed from -13.1 to -32.5 - its weakest since May 2020. And at the same time, Future Activity plunged even more...

?itok=mQFZIF9f

?itok=mQFZIF9f

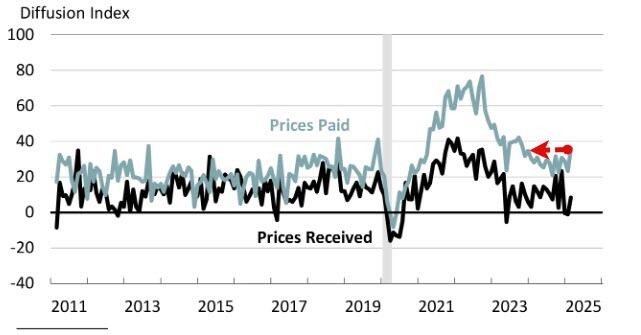

The indexes for general activity, new orders, and sales/revenues remained negative, with the former two declining further. Both price indexes rose and indicate overall increases in prices.

?itok=JAucbxJI

?itok=JAucbxJI

The full-time employment index fell 10 points to -7.5, its first negative reading since August.

It looks like the post-election honeymoon is over (in the soft data)... even if the hard data keeps improving.

https://cms.zerohedge.com/users/tyler-durden

Tue, 03/25/2025 - 08:41

https://www.zerohedge.com/personal-finance/philly-fed-services-survey-crashes-weakest-covid

Futures Rise As Global Markets Extend Monday's Torrid Rally

Futures Rise As Global Markets Extend Monday's Torrid Rally

US equity futs are little changed, erasing a modest loss earlier in the session when investors took some profits from yesterday’s torrid rally which pushed the S&P 1.8% higher. As of 8:00am ET, S&P and Nasdaq futures are both up 0.2%, with Mag 7 stocks all higher pre-market, led by TSLA (+1.4%). European stocks gained as the Estoxx 50 rises 1.1% led by energy and financials, although Asian stocks dropped for a third straight day of losses, driven by Chinese tech shares trading in Hong Kong slid 2.6%, weighed down by a drop in Xiaomi after its $5.5 billion share sale. Investors were also rattled by Trump’s new threat of “secondary tariffs” on countries that buy oil from Venezuela. Bond yields are 1-3bp higher. Commodities are mostly higher led by precious metals (silver) and oil. WTI crude oil futures add about 0.5% to Monday’s 1.2% gain. Today, we will receive consumer confidence at 10am ET (est 94.0 survey vs. 98.3 prior).

?itok=DsADQm_L

?itok=DsADQm_L

In premarket trading, Tesla whipsawed, first sliding as data showed fresh sales declines in Europe, only to rebound 1.4% higher making it the top gainer among the Mag7 stocks (Alphabet +0.3%, Amazon +0.1%, Apple +0.05%, Microsoft +0.1%, Meta +0.5%, Nvidia -0.4% and Tesla +1.4%). Ally Financial declines 2% after BTIG downgraded the auto-lender to sell, projecting that the company won’t meet its net interest margin and return on equity targets in the near term due to macroeconomic headwinds and increased competition. Carvana rises 4% after Morgan Stanley raised the used-car retailer to overweight, saying the pullback in shares creates an attractive entry point for the used-car retailer. Here are some other notable premarket movers:

Cloudflare (NET) climbs 6% as BofA double-upgrades the software company to buy on improving fundamentals, saying it’s set to be an “AI winner.”

Faraday Future (FFAI) climbs 13% after the mobility ecosystem company secured $41m in new cash financing commitments.

KB Home (KBH) falls 9% after the homebuilder cut its fiscal 2025 revenue guidance amid a soft start to the spring selling season.

McCormick (MKC) slips 3% as the maker of spices posted 1Q profit that missed expectations.

Mobileye Global (MBLY) gains 9% after Volkswagen Group said it is working with the maker of software and hardware technologies for automobiles to enhance driver assistance in future MQB vehicles.

Oklo (OKLO) slides 7% after the nuclear fission reactors firm reported disappointing quarterly results.

Smithfield Foods Inc. (SFD) rises 3% after the world’s largest pork producer said it expects 2025 sales growth in the “low-to-mid-single-digit percent range”.

Trump Media (DJT) jumps 7% after signing a non-binding agreement to partner with Crypto.com for a series of ETFs through its Truth.Fi brand.

UniFirst (UNF) drops 10% after Cintas (CTAS) terminated discussions to acquire the workplace uniform rental company.

Markets have been unnerved by a fresh tariff salvo from Trump, who threatened a 25% levy on any nation purchasing crude from Venezuela. Brent crude rose 0.5%, adding to Monday’s gain. Trump also said he will announce tariffs on automobile imports in the coming days — and indicated nations will receive breaks from next week’s “reciprocal” tariffs, further adding to confusion about the plan for sweeping levies to kick in on April 2.

“Between now and the 2nd of April, it’s just a phase of wait and see,” said Michael Nizard, head of multi-asset at Edmond de Rothschild Asset Management. “If Trump is doing exactly what he’s saying in terms of reciprocal tariffs, it should be negative both for Wall Street and Main Street.”

Investors also remain unclear on how tariffs might impact inflation and economic growth, with most recent data hinting at softer economic momentum alongside still-elevated price pressures. While swaps still price the Federal Reserve to cut rates twice this year, Atlanta Fed chief Raphael Bostic said Tuesday he sees just one 25 basis-point reduction, due to “very bumpy” inflation.

Meanwhile, Turkish markets continued to stabilize after a rout fuelled by the arrest of a key opposition leader. Stocks rose as much as 5.5% and the lira currency was steady, after a series of emergency measures helped calm markets. Top economic officials are due to speak with foreign investors later on Tuesday.

Investors will now watch out for US consumer confidence data which is expected to have eased slightly in March from the previous month.

The oil price rise fueled a rally in the shares of European oil majors including Shell Plc, BP Plc and TotalEnergies SE, lifting the Stoxx 600 index by 0.8%, and ending three straight sessions of losses as investors focus on the potential for a global trade war ahead of a US tariff deadline next week. Energy and insurance sectors lead gains while retail falls. Here are some of the biggest movers on Tuesday:

Shell shares climb as much as 2.2% in London after the oil giant said it would boost investor returns through the end of this decade and strengthen its global leading position as an LNG trader.

Morgan Sindall shares jump as much as 10% after the construction firm said that it expects 2025 results to be slightly ahead of market expectations thanks to an acceleration in trading momentum at its Fit Out division.

Medacta shares gain as much as 6.8% as the Swiss medical-implant firm’s guidance offers scope for performance to exceed expectations, according to Stifel.

Johnson Matthey shares drop as much as 4.1% after BofA Global Research cut its recommendation on the chemicals firm to neutral, saying its Clean Air business could be disrupted by the impact of tariffs on North American auto and truck production.

Baloise shares rise as much as 7.5%, to a new record high, after the Swiss insurer reported FY24 results. Analysts praised the better-than-expected profit and the initiation of a CHF100 million buyback program.

Warehouse REIT shares rise as much as 5.9% after funds managed by Blackstone made a final proposal to buy the UK industrial landlord.

Bellway shares rise as much as 4.1% after delivering reassuring interim results and reiterating its full year guidance.

Gamma’s shares climbed as much as 5.3% after the communication service provider published positive results with a reassuring outlook and announced a buyback program.

Kuehne+Nagel falls as much as 4.7% after the Swiss freight company presented 2025 targets that underwhelmed investors.

Hermes shares slip as much as 0.9% as Oddo analysts trim their price target on the luxury goods maker on expectation that growth in the first quarter is set to be modest. Oddo also cuts its target for LVMH.

Kingfisher shares fall as much as 13% after the British home improvement firm reported a disappointing 2026 outlook, analysts note, with its French and Polish businesses weighing particularly.

Earlier in the session, Asian equities are heading for a third straight day of losses, driven by selloff in Hong Kong as investors remain cautious about forthcoming US tariffs on China. The MSCI Asia Pacific Index declined as much as 0.4%, reversing a gain of 0.5%. Chinese internet stocks Alibaba and Tencent were among the biggest drags. Taiwan’s tech-heavy market tracked gains in US peers, while Japan’s gauges closed higher amid optimism over possible breaks from President Donald Trump’s levies. An index of Chinese shares trading in Hong Kong slid 2.6%, weighed down by a drop in Xiaomi after its $5.5 billion share sale. Investors were also rattled by Trump’s new threat of “secondary tariffs” on countries that buy oil from Venezuela. Investors in Chinese stocks are cautious ahead of the April 2 tariff announcement, said Gary Tan, a fund manager at Allspring Global Investments. “Chinese companies during their post 2024 results conference calls mostly guided cautiously on the growth outlook for this year. Both factors probably drove some near term profit-taking.” Elsewhere, Australian stocks rose ahead of the nation’s annual budget announcement later. Stock benchmarks also advanced in Singapore, New Zealand and Malaysia, while Philippine equities dropped. Indian stocks were little changed after Monday’s rally.

In FX, the Bloomberg Dollar Spot Index dropped 0.2% as investors also seek more clarity on “secondary tariffs” US President Donald Trump has threatened to impose on countries that buy oil from Venezuela. CHF and NZD are the weakest performers in G-10 FX, SEK and AUD outperform. The Australian dollar rises 0.2% versus the greenback after the government unveiled an unexpected tax cut and an extension of energy rebates. “Markets have not priced enough bad news for the world economy from the upcoming tariff announcements,” Kristina Clifton of Commonwealth Bank wrote in a note. “Bad news for the US and global economies can ultimately support USD because of its safe haven status”

In rates, treasuries are lower for the third straight day, extending Monday’s aggressive selloff as US stock futures trade steady and European equities advance. Treasury yields are 1bp-3bp cheaper across maturities with the curve steeper; 10-year at around 4.36% outperforms Germany’s, cheaper by an additional 3bps. Fed rate-cut pricing continues to fade, with around 58bp of easing priced in by December vs 60bp at Friday’s close. Auction cycle begins with $69 billion 2-year note sale, and corporate new-issue slate has begun to build following Monday’s nearly $25b haul. The 2-year note auction at 1pm New York time has WI yield near 4.03%, about 14bp richer than February’s, which stopped through by 1.1bp, a strong result. The IG dollar new-issue slate includes a four-part offering from LG Energy; 16 companies priced a combined $24.2 billion across 30 tranches Monday.

In commodities, WTI futures reversed an earlier drop and rose 0.7% higher to trade near $69.60. Most base metals trade in the green. Spot gold rises roughly $12 to near $3,023/oz. Bitcoin trims loss.

Looking at today's calendar, US data slate includes March Philadelphia Fed non-manufacturing activity (8:30am), January FHFA house price index and S&P CoreLogic home prices (9am), February new home sales, March consumer confidence and Richmond Fed manufacturing index (10am). Fed speaker slate includes Kugler (8:40am) and Williams (9:05am)

Market Snapshot

S&P 500 futures down 0.2% to 5,804.00

STOXX Europe 600 up 0.3% to 550.77

MXAP down 0.3% to 188.08

MXAPJ down 0.6% to 587.85

Nikkei up 0.5% to 37,780.54

Topix up 0.2% to 2,797.52

Hang Seng Index down 2.3% to 23,344.25

Shanghai Composite little changed at 3,369.98

Sensex up 0.2% to 78,123.61

Australia S&P/ASX 200 little changed at 7,942.46

Kospi down 0.6% to 2,615.81

German 10Y yield little changed at 2.80%

Euro down 0.1% to $1.0788

Brent Futures up 0.4% to $73.26/bbl

Gold spot up 0.3% to $3,019.04

US Dollar Index up 0.11% to 104.38

Top Overnight News

A Trump administration proposal to impose stiff levies on Chinese-made ships entering US ports is sowing panic in the country’s agriculture industry, with farmers saying the added cost threatens to upend exports of wheat, corn, and soybeans. The US Trade Representative has recommended imposing fees of up to $1.5mm per prot call on ships built in China or operated by companies with Chinese-built vessels, and hearings on the matter are scheduled for this week. FT

Treasury Secretary Bessent said interest rates are going to keep declining as energy costs decline and noted that laid-off workers can go into the private sector.

Ukraine unconditionally supports the idea of a full ceasefire with Russia, Kyiv’s Ambassador to the US Oksana Markarova said. BBG

Tech chiefs and senior foreign officials are urging the Trump administration to reconsider its AI diffusion rule that limits AI chip exports before the deadline for compliance arrives in less than two months. BBG

Ifo’s German business optimism gauge rose more than expected, to the highest level since June 2024, as the government readied hundreds of billions of euros of spending. BBG

Chinese technology stocks fell from a three-year high to the brink of a correction in just five sessions, fueled by a lack of positive surprise in earnings & cooling sentiment. The Hang Seng Tech Index dropped 3.8% on Tuesday, extending its slide from a March 18 high to nearly 10%. BBG

China could broaden its consumer services stimulus plan to include services (such as travel and tourism) in addition to goods if the economy stays sluggish. FT

India is open to cutting tariffs on more than half of U.S. imports worth $23 billion in the first phase of a trade deal the two nations are negotiating, two government sources said, the biggest cut in years, aimed at fending off reciprocal tariffs. RTRS

Alibaba’s Joe Tsai warned of a potential bubble in datacenter construction, arguing that the buildout pace may outstrip initial demand for AI services. Tsai singled out US spending in particular. BBG

Tesla shares reversed premarket losses even as its European car sales plummeted 40% in February, marking the 10th drop in the past year. The figures contrast with a 31% rise in industrywide EV registrations. BBG

Tariffs/Trade

US President Trump signed an order imposing sanctions on countries importing Venezuelan oil and said tariffs for doing business with Venezuela will be on top of existing tariffs but added that not all tariffs will be included on April 2nd.

India proposed to remove the 6% tariff imposed on online advertisement services offered by companies such as Google (GOOG) and Meta (META), widely known as the Google tax from April 1st, which is a day before Trump's reciprocal tariffs take effect.

Subsequently, India is reportedly open to cutting tariffs on over half of US imports, worth USD 23bln, via Reuters citing sources; open to cutting tariffs to as low as 0 from a 5-30% range on 55% of US imports. Estimates a hit to USD 66bln worth of exports to the US from reciprocal tariffs. In return for tariff cuts, seeking relief from reciprocal tariffs.

South Korea's Acting President Han said their mission is to secure national interest in a trade war and will do everything to weather the tariff storm triggered by the US, while it was also reported that South Korea is to launch a special probe on 'made in Korea' violations ahead of US tariffs.

German Agriculture Ministry said Britain removed import restrictions on German animals and animal products imposed after the foot-and-mouth disease case.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks trade mixed after the early momentum from the tariff-related optimism on Wall St wore thin. ASX 200 advanced at the open but then gave back most of its gains after stalling near the 8,000 level and as participants await Treasurer Chalmers's pre-election budget which is expected to return to a deficit. Nikkei 225 rallied at the start of trade and briefly climbed above the 38,000 level but has since pulled back from intraday highs with recent currency moves influencing price action. Hang Seng and Shanghai Comp were pressured with notable underperformance in Hong Kong as tech and auto names lost traction amid recent earnings releases and tariff risk, while there was a lack of details so far regarding the PBoC's MLF operation after the central bank recently unveiled a new method for how MLF operations will be conducted whereby banks will be able to bid for different prices on its one-year loans.

Top Asian News

China is considering including services in the multi-billion dollar subsidy program to stimulate consumption, according to FT.

BoJ January Meeting Minutes stated most members expressed the recognition that the likelihood of realising the outlook had been rising and some members shared the recognition that real interest rates were expected to remain significantly negative even after the rate hike. The minutes stated that a member expressed the view that if underlying inflation increased, the BoJ would need to raise the policy interest rate accordingly in a gradual manner and a member continued that it would be necessary for the BoJ to adjust the degree of monetary accommodation from the viewpoint of avoiding the yen’s depreciation and the overheating of financial activities. Furthermore, a member said the BoJ should be extremely careful about suggesting the pace of policy interest rate hikes and the terminal policy rate and a member said it would be desirable for the BoJ to bear in mind that the policy interest rate should be at around 1% in the second half of fiscal 2025.

BoJ Governor Ueda said they still need some time to consider what to do with the BoJ's ETF holdings and must think about valuation and market rout risks when offloading its ETF holdings. Ueda added that the BoJ's JGB holdings would continue to have a stock effect since the reduction pace is extremely slow and the massive JGB holdings have a stock effect that would slightly lower long-term yields.

European bourses defied the lead from futures and began the session on a firmer footing, Stoxx 600 +0.4%; no significant/fresh driver for the move with it seemingly an extension of Monday's US action. Sectors mostly in the green, Energy leads given benchmarks and with Shell (+2.0%) assisting. Retail lags, weighed on by Kingfisher (-11%) after weak results.

Top European News

UK Chancellor Reeves is to publish the forecast from the OBR which is to roughly halve the UK’s expected growth in 2025 from 2% to about 1%, while her GBP 9.9bln of headroom against her fiscal rule has been wiped out, leaving her about GBP 4bln in the red. Furthermore, Reeves's statement is expected to have more than GBP 5bln of extra cuts to UK public spending and she will claim that Britain is “uniquely positioned” to pursue favourable trading relations with the US and EU, according to FT.

ECB's Muller says rates are not restricting the economy or investments; tariffs are likely to mean faster inflation in the short term; any further cuts will be tariff dependent.

ECB's Kazimir says "services inflation is key", open to discuss rate cut or pause in April; already in the zone of the neutral rate.

FX

Relatively steady trade for the first part of the European morning but as we approach the US session slightly more pressured has emerged in the USD with the Index at a 104.15 trough. Overall, a session of slightly choppy FX action with moves turning around and extending in recent trade with no clear/overt fresh fundamental driving.

EUR benefitting from the above move, no specific/fresh driver behind it. Prior to this, the index got back towards the 1.08 mark on the latest Ifo metrics which improved from the prior. Most recently, the USD action has lifted the single currency to a fresh 1.0816 session high.

USD/JPY initially extended on the prior session's advances, but failed to breach the 151.00 mark and has been easing back since. Currently finds itself at a 150.32 low.

Again, GBP was steady for the first part of the session but Cable picked up further from the 1.29 handle and is at a 1.2944 high, benefitting from USD moves. Specifics focussed entirely on Wednesday's Spring Statement.

AUD saw little follow through from the pre-election budget announcement. Benefitting from the above moves and is just above the 0.63 mark in recent trade. Kiwi in the green, but not faring quite as well so far.

PBoC set USD/CNY mid-point at 7.1788 vs exp. 7.2630 (Prev. 7.1780).

Fixed Income

Benchmarks lower across the board. Bunds weighed on by the latest Ifo metrics with expectations and conditions printing above consensus while climate was in-line. A move which added to the bearish bias in fixed income and sent Bunds below the 128.00 mark around 10-minutes after the print. Currently just off a 127.84 base.

USTs in-fitting, in a continuation of the sizable moves from Monday, which sent USTs to a 110-15+ base, a low that has since been taken out to a 110-11+ WTD trough.

Gilts weighed on by the above and also as we count down to the Spring Statement. Fresh reporting ahead of this that the OBR’s growth forecast will be essentially cut in half from the 2% level outlined in the autumn. At a 91.05 base, lowest since March 6th when 90.71 printed.

Crude

Crude complex remains supported after Monday’s buying, which saw WTI and Brent settle around USD 0.80/bbl higher after numerous catalysts aided the benchmarks. The latter, settling at the highest since late February.

US remarks around Venezuela and tariffs in focus while we await an update on the geopolitical front.

On this, Dutch TTF is modestly lower, owing to the “constructive” talks in Riyadh, which US and Ukrainian teams are set to be extending.

Spot Gold has recouped some losses from overnight and is at a fresh session high of USD 3023/oz, seemingly benefiting from the initially tepid USD and US risk tone.

Geopolitics: Ukraine

Ukraine delegation in Saudi Arabia will meet with the US team on Tuesday, according to a Ukrainian broadcaster Suspilne citing an unnamed source in the Ukrainian delegation.

White House source says talks facilitated by the Trump administration's technical teams in Riyadh are going extremely well, and we expect to have a positive announcement in the near future.

Russia and US talks in Saudi Arabia were not simple but were useful, while their talks will continue with participation of international community including the UN, according to TASS.

Ukraine and US teams are said to be holding further Russia-Ukraine talks in Riyadh, according to Bloomberg.

Russia's Kremlin says there are no plans for a Russian President Putin-US President Trump call yet but it can be organised; the content of the talks will not be disclosed in public.

Geopolitics: Middle East

Israeli military says it struck targets at Syrian military bases.

Houthi military spokesman says they targeted US naval vessels in the Red Sea and Israel's Ben Gurion Airport, according to Al Jazeera and Sky News Arabia.

US Event Calendar

08:30: March Philadelphia Fed Non-Manufactu, prior -13.1

09:00: Jan. S&P Case-Shiller 20 City MoM SA, est. 0.40%, prior 0.52%

Jan. S&P Case-Shiller Composite-20 YoY, est. 4.80%, prior 4.48%

09:00: Jan. FHFA House Price Index MoM, est. 0.3%, prior 0.4%

10:00: March Conf. Board Consumer Confidenc, est. 94.0, prior 98.3

March Conf. Board Expectations, prior 72.9

March Conf. Board Present Situation, prior 136.5

10:00: March Richmond Fed Index, est. 1, prior 6

10:00: Feb. New Home Sales, est. 680,000, prior 657,000

Feb. New Home Sales MoM, est. 3.5%, prior -10.5%

DB's Jim Reid concludes the overnight wrap

Good morning from New York, where Friday's headlines that next week’s reciprocal tariffs are set to be more targeted than previously expected, have continued to help the recent US outperformance. My theory is that US stocks now underperform most when the tariff threat is the highest, because if you believe returns to capital have been greatest under global free trade, then the larger the threat to that, the larger the impact on the ultimate beneficiary of capitalism in recent years, namely US stocks. See my CoTD from two weeks ago here for more on this theory.

Friday's news meant US futures were already pointing towards a solid start yesterday, but markets then got a fresh burst of support after the March flash PMIs were much stronger than expected, which collectively led to a pushback against the weaker US growth/recession narrative that’s developed over recent weeks. In turn, that meant US assets did very well, with the Magnificent 7 (+3.46%) posting its biggest gain in over two months, which in turn saw the S&P 500 (+1.76%) move further away from correction territory, having now risen +4.46% since its low on March 13. Moreover, the gains were broad-based, with the small-cap Russell 2000 (+2.55%) seeing its best day of 2025 so far. US equities continued to close the gap with their European counterparts, with the S&P 500 outpacing the STOXX 600 (-0.13%) for a fourth consecutive session, even if it’s still lagging well behind for the year as a whole.