White House Official Says More Than 15 Countries Have Made Trade Deal Offers

White House Official Says More Than 15 Countries Have Made Trade Deal Offers

A senior White House trade official said that more than 15 countries made trade deal offers to the Trump administration after reciprocal tariffs were announced last week, and before President Donald Trump paused the duties on Wednesday.

?itok=GvKmq8HZ

?itok=GvKmq8HZ

National Economic Council Director Kevin Hassett told reporters at the White House on Thursday that the Office of the U.S. Trade Representative “has informed us that there are maybe 15 countries now that have made explicit offers that we’re studying and considering and deciding whether they’re good enough to present [to] the president.”

In an interview with CNBC, Hassett on Thursday https://www.cnbc.com/video/2025/04/10/necs-hassett-on-tariffs-almost-had-two-deals-close-last-week.html

, “We’ve got a few deals that we’ve been working on ahead of this that are really, really well advanced.”

In https://www.youtube.com/watch?v=wNvAdyTSowg

to Fox News, he said that the 90-day pause announced by Trump was part of the president’s plan all along.

Trump said on Wednesday that he paused the reciprocal tariffs for 90 days on every country except China—which now faces a total tariff rate of https://www.theepochtimes.com/business/tariffs-on-china-reach-145-percent-after-latest-increase-white-house-clarifies-5839809?ea_src=frontpage&ea_cnt=a&ea_med=latest-news-posts-1

on all goods—to give U.S. trading partners, who contacted the White House to negotiate, space to reach agreements.

A baseline 10 percent tariff on all countries remains in effect, White House officials later said.

Hassett https://www.cnbc.com/2025/04/10/china-trump-tariffs-live-updates.html

on Thursday that the 10 percent tariff will remain in effect as part of trade talks.

“It is going to take some kind of extraordinary deal for the president to go below” the baseline, he said.

Elaborating on why Trump acted when he did, Hassett told Fox News that the president may have been influenced by a recent increase in U.S. government bond yields.

“Everything was moving, but then when the bond market started to say, ‘Hey, we don’t believe these guys,’ I think the president decided on his own really, that, well, we’re gonna announce this anyway, we might as well do it today,” he said.

“There’s a little bit of an extra push for the bond market.”

Trump on Wednesday indicated that investor concerns played a role in his decision to announce the pause earlier that day.

“I thought that people were jumping a little bit out of line,” the president said during remarks at the White House. “They were getting a little bit yippy, a little bit afraid.”

Trump’s tariffs pause on Wednesday, which came hours after the new tariffs kicked in for many trading partners, followed an intense episode of financial market volatility not seen in years.

After the decision, the Dow Jones Industrial Average shot up by 2,900 points, while both the Nasdaq and S&P 500 posted similarly high gains. As of Thursday morning, all three major U.S. stock indexes saw declines.

The European Union’s executive commission said on Thursday that it will put its retaliatory measures against new U.S. tariffs on hold for 90 days to match Trump’s pause and to leave room for a negotiated solution.

New tariffs on 20.9 billion euros ($23 billion) of U.S. goods entering the EU will be put on hold for 90 days because “we want to give negotiations a chance,” European Commission President Ursula von der Leyen said in a statement.

https://cms.zerohedge.com/users/tyler-durden

Thu, 04/10/2025 - 13:40

Stellar 30Y Auction: 2nd Highest Direct Award, 3rd Biggest Stop-Through On Record

Stellar 30Y Auction: 2nd Highest Direct Award, 3rd Biggest Stop-Through On Record

After this week started with a dismal 3Y auction and a solid 10Y auction yesterday, both of which however saw a collapse in the Direct bid, many - certainly we...

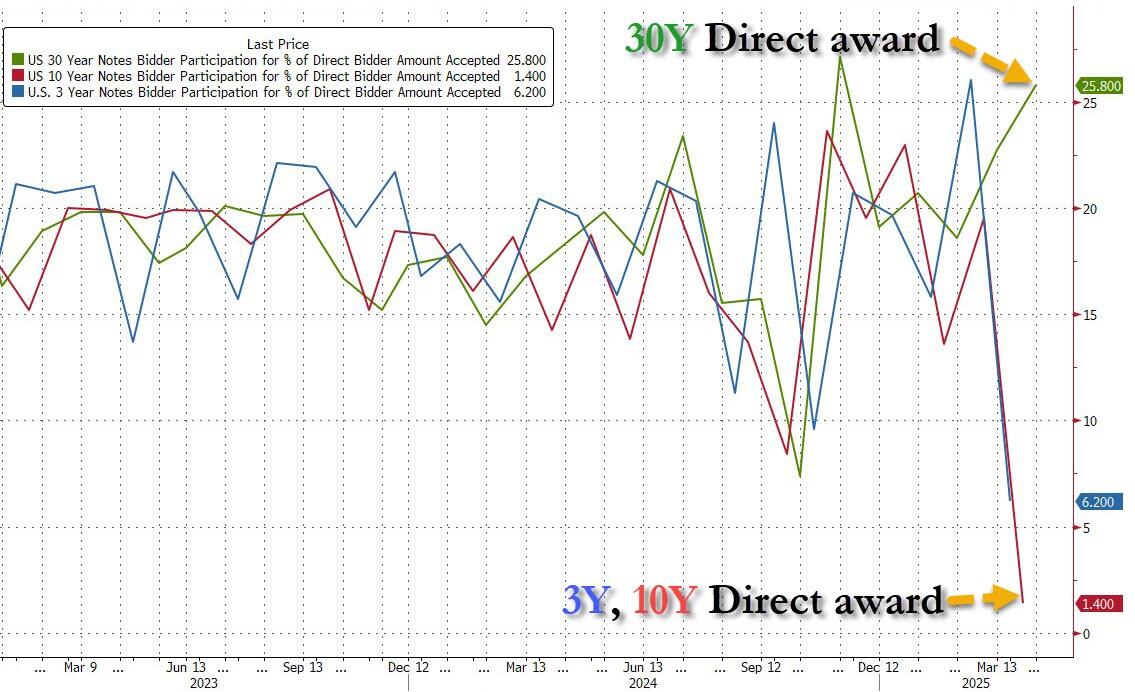

30Y auction in an hour: Directs were 22.7% in March. How low will they drop today? (over/under 3%)

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1910362432024772949?ref_src=twsrc%5Etfw

... were dreading to see what the Direct award would be in today's auction. We get the result moments ago when the Treasury sold a $22 billion reopening of the February 30Y in the form of a 29 Year, 10 Month reopening.

The results were stellar across the board!

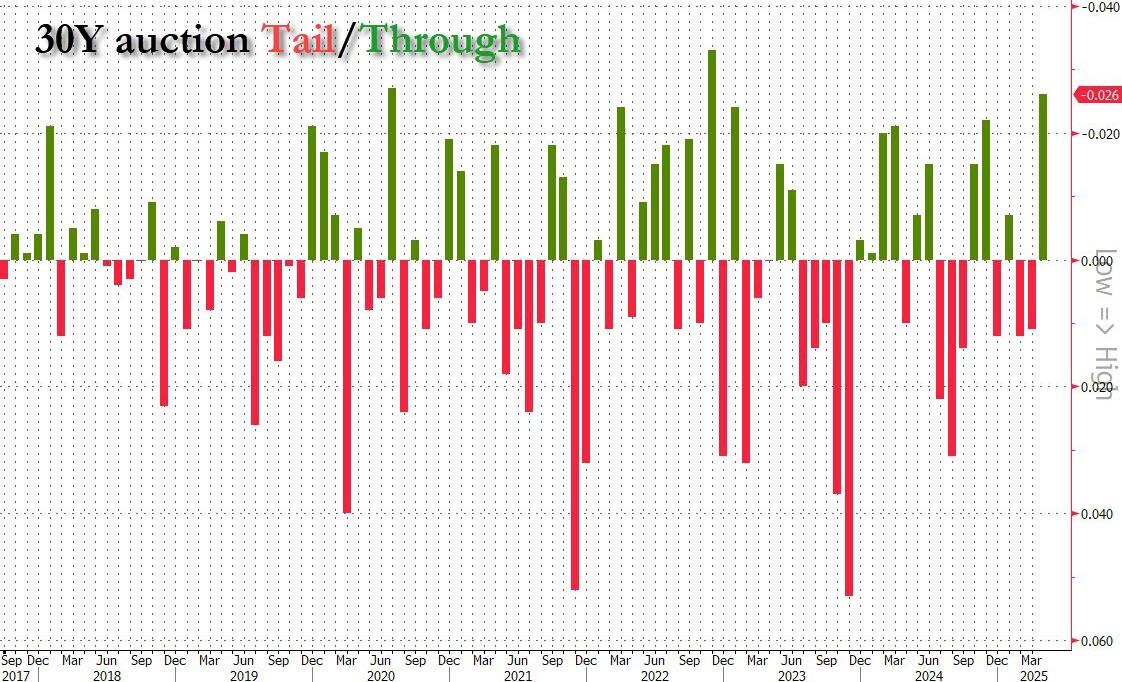

The high yield was 4.813%, up sharply from 4.623% last month and the highest since January. But more importantly, while many were expecting the auction to tail, instead we got a massive 2.6bps stop through the When Issued 4.839. This, as shown below, was the highest stop through since Nov 2022 and the third highest on record!

?itok=4mANrStP

?itok=4mANrStP

Looking at the bid to cover, no big surprises there: at 2.435, it was above last month's 2.366 but just below the recent average 2.47%.

But it was the internals that were the big story again: while Indirects were awarded 61.88%, or roughly the same as last month's 60.45%, below the recent average 67.0%, and hardly an upside outlier like yesterday's record Indirect award to the 10Y auction, it was the Directs that everyone was looking at again because as we noted earlier today, the Basis Trade is blowing out again.

Basis trade resumes rapid unwind https://t.co/Jkbi76Otw9

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1910333310854651919?ref_src=twsrc%5Etfw

Only this time, this did not manifest itself in a collapse in the Direct award, on the contrary. As shown in the chart below after plunging Direct takedowns in the 3Y and 10Y auctions, today's 30Y auction saw a surge in the Direct award to 25.8%, up from 22.7% and the 2nd highest on record!

?itok=5yW_YOME

?itok=5yW_YOME

The market reaction was curious: while yields dropped modestly amid relief there was not major challenges to digesting the sale of long-dated paper, stocks plunged, with spoos tumbling from 5300 to below 5200 in minutes, in what appears to have been disappointment that yields arent going to blow out and force the Fed to step in and bailout the market sooner!

Then again, since the Fed continues to allow the unwind of the basis trade (just look at the ongoing collapse in the swap spreads) we are confident that stocks will have more than enough opportunities to blow up the bond market and force Powell to finally panic.

https://cms.zerohedge.com/users/tyler-durden

Thu, 04/10/2025 - 13:37

Novavax Shares Crash After RFK Jr. Comments

Novavax Shares Crash After RFK Jr. Comments

Robert F. Kennedy Jr., in his first national TV appearance as Health and Human Services Secretary under the Trump administration, questioned the effectiveness of Novavax's Covid vaccine during an interview with CBS News' chief medical correspondent, Dr. Jon LaPook. The interview, which cast doubt on the shot, sent shares of the Maryland-based biotech firm crashing on Thursday.

?itok=o_PD9dXd

?itok=o_PD9dXd

RFK Jr. told LaPook that Novavax's shot targets just one piece of the virus, an approach he said has "never worked" for respiratory illnesses:

We're looking at that vaccine, and it is a single-antigen vaccine. And, for respiratory illnesses, the single-antigen vaccines have never worked and we're actually shifting our priorities to multiple-antigen vaccines. And NIH is already working on a number of those.

RFK Jr.'s comments sent Novavax shares into a tailspin, plunging 24% during late-morning trading in New York. The stock has already suffered steep losses in recent years, falling back to pre-pandemic lows after the pandemic ended.

?itok=AO40KTz2

?itok=AO40KTz2

"Novavax's shot is already on the market under a conditional approval. It's awaiting from the Food and Drug Administration a full approval that was expected April 1," https://www.bloomberg.com/news/articles/2025-04-10/novavax-shares-plunge-after-rfk-jr-questions-its-covid-vaccine

noted.

In recent weeks, Wall Street analysts have raised concerns about Peter Marks' abrupt resignation. Marks was a top FDA regulator and pro-vaxxer.

Analysts—including BMO Capital Markets' Evan David Seigerman—viewed Marks' departure as a "significant negative" for the biotech and biopharma sectors.

The share of SPDR S&P Biotech ETF (XBI) is down about 34% since Trump won the presidential election and Wall Street's fear that RFK Jr. would push through major reforms at HHS that would hurt the vaccine industrial industry

?itok=GR69M5xM

?itok=GR69M5xM

. . .

https://cms.zerohedge.com/users/tyler-durden

Thu, 04/10/2025 - 13:20

https://www.zerohedge.com/markets/novavax-shares-crash-after-rfk-jr-comments-cbs

Here's What Democrats Stand For, In Their Own Words

Here's What Democrats Stand For, In Their Own Words

https://modernity.news/2025/04/10/heres-what-democrats-stand-for-in-their-own-words

Democrats have become the pro war party of domestic terrorism and lawlessness. Their brand is toxic and their leaders are totally lost.

?itok=E0wdXlmw

?itok=E0wdXlmw

All you have to look to for confirmation of this is their own words and those of their supporters.

This video could have been hours in length.

You could throw a rock at YouTube and hit a video of a Democrat saying this stuff.

🚨WATCH: The best way to define to define the Democrat brand is to let Democrats define it — themselves. https://t.co/rluDgGk8Rs

— Western Lensman (@WesternLensman) https://twitter.com/WesternLensman/status/1910115200562569510?ref_src=twsrc%5Etfw

I guess there isn’t anything you could say or do that would be as degrading to the democrats as their own words and behavior?

— Timothy Huntington (@TimothyDuckDuck) https://twitter.com/TimothyDuckDuck/status/1910118341944950915?ref_src=twsrc%5Etfw

This video could have been hours in length.

Could have gone on for hours

— Stallion Pt. 3 (@Stallion_Pt3) https://twitter.com/Stallion_Pt3/status/1910122778604241345?ref_src=twsrc%5Etfw

You could throw a rock at YouTube and hit a video of a Democrat saying this stuff.

So much material, so little time.

— Western Lensman (@WesternLensman) https://twitter.com/WesternLensman/status/1910130034721116179?ref_src=twsrc%5Etfw

What are they?

TOXIC. domestic terrorists. weak and woke. violent. the party of mayhem. that about sums it up.

add criminals. corrupt. anti-American. mentally ill, racist, and we sealed the definition.

— pebbles (@jbamban) https://twitter.com/jbamban/status/1910116813620265135?ref_src=twsrc%5Etfw

How is that a REdefinition?

— Bob James (@rockyfort) https://twitter.com/rockyfort/status/1910310932758090159?ref_src=twsrc%5Etfw

Oh yeah, that’s it.

Democrats are the party of violence and hate.

— Spitfire (@DogRightGirl) https://twitter.com/DogRightGirl/status/1910116575669112869?ref_src=twsrc%5Etfw

The dems I know are all eating up every negative thing claimed about Trump and his actions. All panic all the time about whatever the latest "Trump is evil" lies may be. I'm sure they're already convinced that he's guilty of inside trading in this stock market tariff goofiness.

— Matthew Siekierski (@mattsiekierski) https://twitter.com/mattsiekierski/status/1910288418124210649?ref_src=twsrc%5Etfw

Their base now consists of blue haired crazies who have a penchant for assassination.

* * *

Your support is crucial in helping us defeat mass censorship. Please consider donating via https://pauljosephwatson.locals.com/support

.

https://cms.zerohedge.com/users/tyler-durden

Thu, 04/10/2025 - 13:00

https://www.zerohedge.com/political/heres-what-democrats-stand-their-own-words

Six Jumbo Jets Of iPhones From India Part Of Apple's Scramble To Beat Tariff Blitz

Six Jumbo Jets Of iPhones From India Part Of Apple's Scramble To Beat Tariff Blitz

provided more details on a strategic airlift operation that allowed Apple to sidestep tariffs that could have pushed iPhone retail prices above $2,300 per unit. By ramping up chartered air freighter flights, Apple transported approximately 600 tons of iPhones—equivalent to an estimated 1.5 million units—from India to the United States to beat President Trump's "Liberation Day" tariff blitz.

Sources said Apple chartered six jumbo jets, each with a capacity of 100 tons of iPhones, in recent weeks. There was no confirmation from sources on whether the aircraft used were Boeing 747-8Fs (maximum payload 140 tons) or Boeing 777Fs (maximum payload 102 tons). The planes reportedly departed from Chennai Airport in the southern state of Tamil Nadu. Inspection times were reduced from 30 to just six hours, underscoring the urgency by CEO Tim Cook to transport iPhones to the US before tariff deadlines.

We first reported the emergency iPhone airlift operation on Monday...

Apple Scrambles: Five Air Freighters Full Of iPhones Rush To US Amid Trump's Tariff Blitz https://t.co/4F61VifCF0

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1909378192634175690?ref_src=twsrc%5Etfw

Sources also said that Apple's iPhone plants in India increased production above 20% of normal levels to fulfill six jumbo jet loads of iPhones at the company's request:

In India, Apple stepped up air shipments to meet its goal of a 20% increase in usual production at iPhone plants, attained by adding workers, and temporarily extending operations at the biggest Foxconn India factory to Sundays, the source added.

Two other direct sources confirmed the Foxconn plant in Chennai now runs on Sundays, which is typically a holiday. The plant turned out 20 million iPhones last year, including the latest iPhone 15 and 16 models.

'Operation iPhone Lift to America' comes as some Wall Street analysts warned Trump's tariffs could've increased iphone costs by 30-40%. Most iPhones are made in China, where levies are in excess of 120%. The good news is that a 26% tariff on imports from India has been https://www.zerohedge.com/markets/china-holds-back-retaliation-opts-strategic-messaging-through-white-paper-trade

.

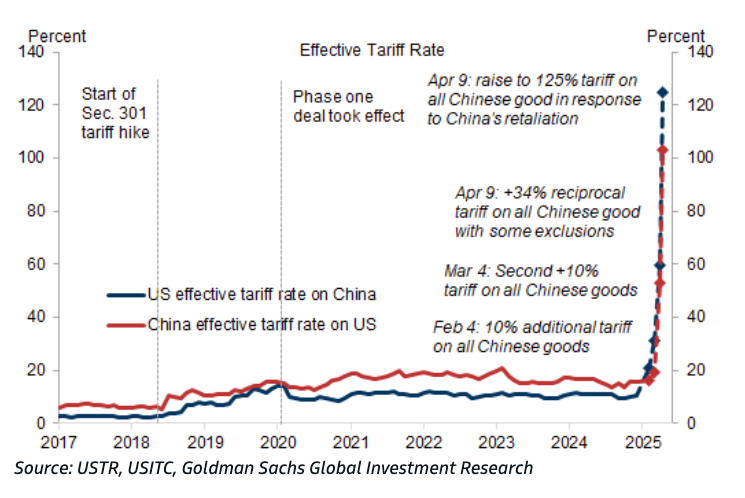

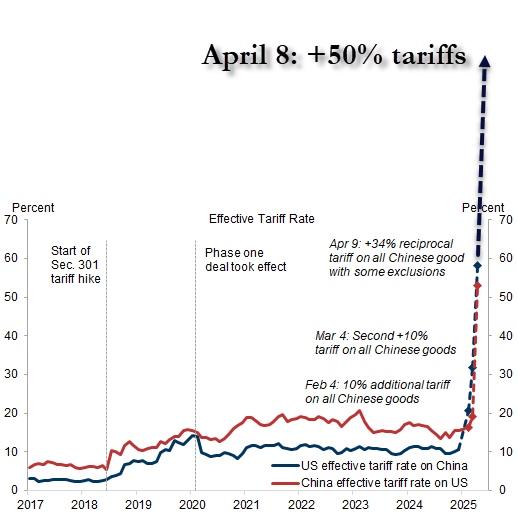

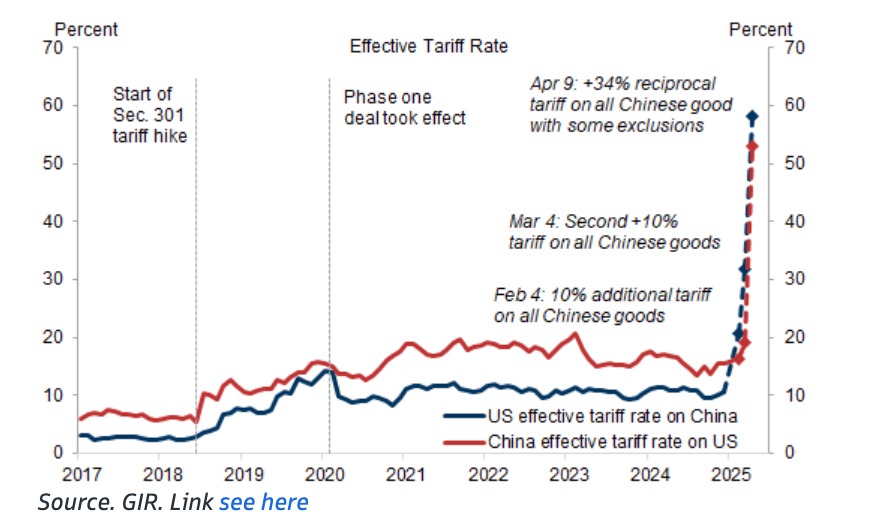

Goldman: President Trump increased the US effective tariff rate on Chinese goods to 125%

?itok=bZVQB-To

?itok=bZVQB-To

Before the 90-day pause for countries excluding China, Rosenblatt Securities analysts forecasted that the most affordable iPhone 16 model with a retail price of $799 would cost as much as $1,142 - or about a 43% rise.

"This whole China tariff thing is playing out right now completely contrary to our expectation that American icon Apple would be kid-gloved, like last time," Rosenblatt analyst Barton Crockett wrote in a note to clients.

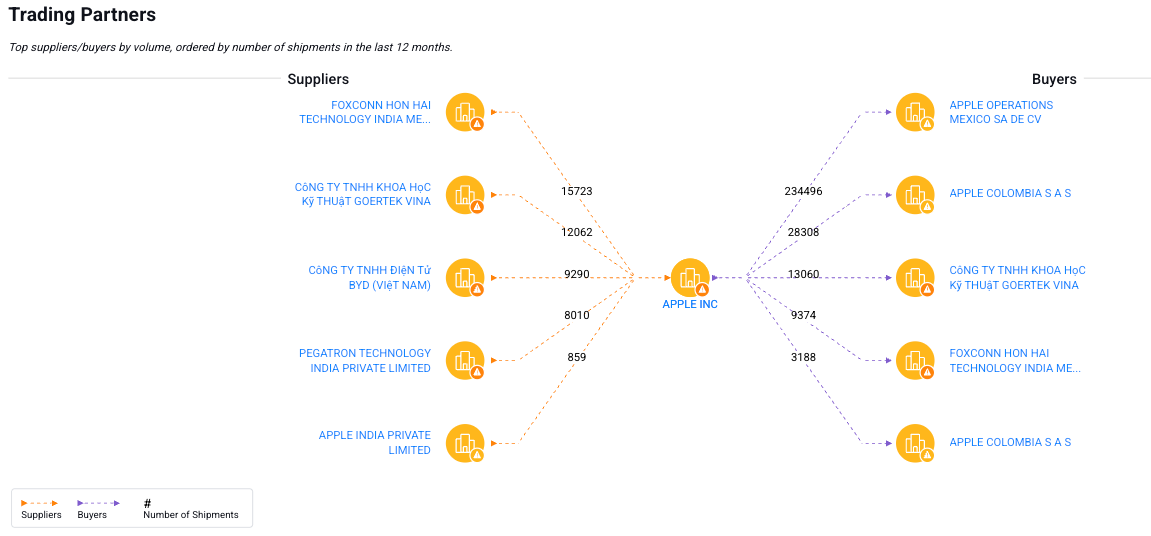

Trade data via the supply chain platform Sayari shows that Foxconn India is a major Apple supplier.

?itok=ljPWbACj

?itok=ljPWbACj

Counterpoint Research estimates that Apple sells 220 million iPhones per year worldwide, and about a fifth of total iPhone imports to the United States now come from India, and the rest from China.

https://cms.zerohedge.com/users/tyler-durden

Thu, 04/10/2025 - 07:20

One Of The Largest Malls In The U.S. Just Defaulted On Its $300 Million Mortgage

One Of The Largest Malls In The U.S. Just Defaulted On Its $300 Million Mortgage

Destiny USA, New York’s largest mall and one of the biggest in the U.S., has defaulted on a $300 million mortgage, https://www.syracuse.com/news/2025/04/destiny-usa-new-yorks-largest-mall-defaults-on-300-million-mortgage.html

.

Its owner, Carousel Center Co., failed to secure an extension when the loan matured on June 6 of last year, according to recent financial filings.

says that after failing to extend its loan maturity, Destiny USA’s $300 million mortgage is now in default, with the full balance of $325.2 million—including $25.2 million in deferred interest—immediately due, according to an independent audit.

The lender terminated its forbearance agreement, raising the threat of foreclosure, as seen with two other Pyramid-owned malls last year.

Pyramid is negotiating a deal to extend the loan to Dec. 6, 2025, in exchange for a $1.1 million “consent fee,” but auditors warn there’s no guarantee of success. As they put it: “These conditions raise substantial doubt about the company’s ability to continue as a going concern.”

?itok=IToNdZlR

?itok=IToNdZlR

Pyramid took out the loan from JPMorgan Chase in 2014 to finance Destiny USA’s expansion. It has only made interest payments and failed to refinance or repay the principal as required, due in part to the mall’s declining value amid retail closures and e-commerce growth.

Recall about a month and a half ago https://www.zerohedge.com/markets/subprime-redux-commercial-real-estate-bond-distress-hits-another-record-high

that at the end of Q4 2024, commercial real estate continued to exhibit severe weakness, with commercial real estate bonds hitting record distress levels, surpassing the previous records reached in Q3 2024.

Commercial real estate bonds are just commercial real estate loans packaged into securities and sold to investors. One category of bonds, commercial mortgage-backed securities (“CMBS”), saw their https://cred-iq.com/blog/2025/01/09/office-distress-rate-eclipses-17/

, a fourth consecutive monthly record.

Most notably, in the CMBS category—which comprises approximately $625 billion in outstanding commercial real estate debt—loans on office properties now exhibit a distress rate above 17 percent while apartment loan distress accelerated to 12.5 percent.

While loans underlying CMBS bonds—which are generally longer-term and fixed-rate—appear woefully insolvent, another group of bonds comprising short-term floating-rate commercial real estate loans are even worse.

https://cms.zerohedge.com/users/tyler-durden

Thu, 04/10/2025 - 06:55

https://www.zerohedge.com/markets/one-largest-malls-us-just-defaulted-its-300-million-mortgage

US Equities Explode Higher As Trump "Pauses" Reciprocal Tariffs For 90 Days (Except For China)

US Equities Explode Higher As Trump "Pauses" Reciprocal Tariffs For 90 Days (Except For China)

Update (1320ET): And Trump finds an off-ramp...

Based on the lack of respect that China has shown to the World's Markets, I am hereby raising the Tariff charged to China by the United States of America to 125%, effective immediately.

At some point, hopefully in the near future, China will realize that the days of ripping off the U.S.A., and other Countries, is no longer sustainable or acceptable.

Conversely, and based on the fact that more than 75 Countries have called Representatives of the United States, including the Departments of Commerce, Treasury, and the USTR, to negotiate a solution to the subjects being discussed relative to Trade, Trade Barriers, Tariffs, Currency Manipulation, and Non Monetary Tariffs, and that these Countries have not, at my strong suggestion, retaliated in any way, shape, or form against the United States,

I have authorized a 90 day PAUSE, and a substantially lowered Reciprocal Tariff during this period, of 10%, also effective immediately.

Thank you for your attention to this matter!

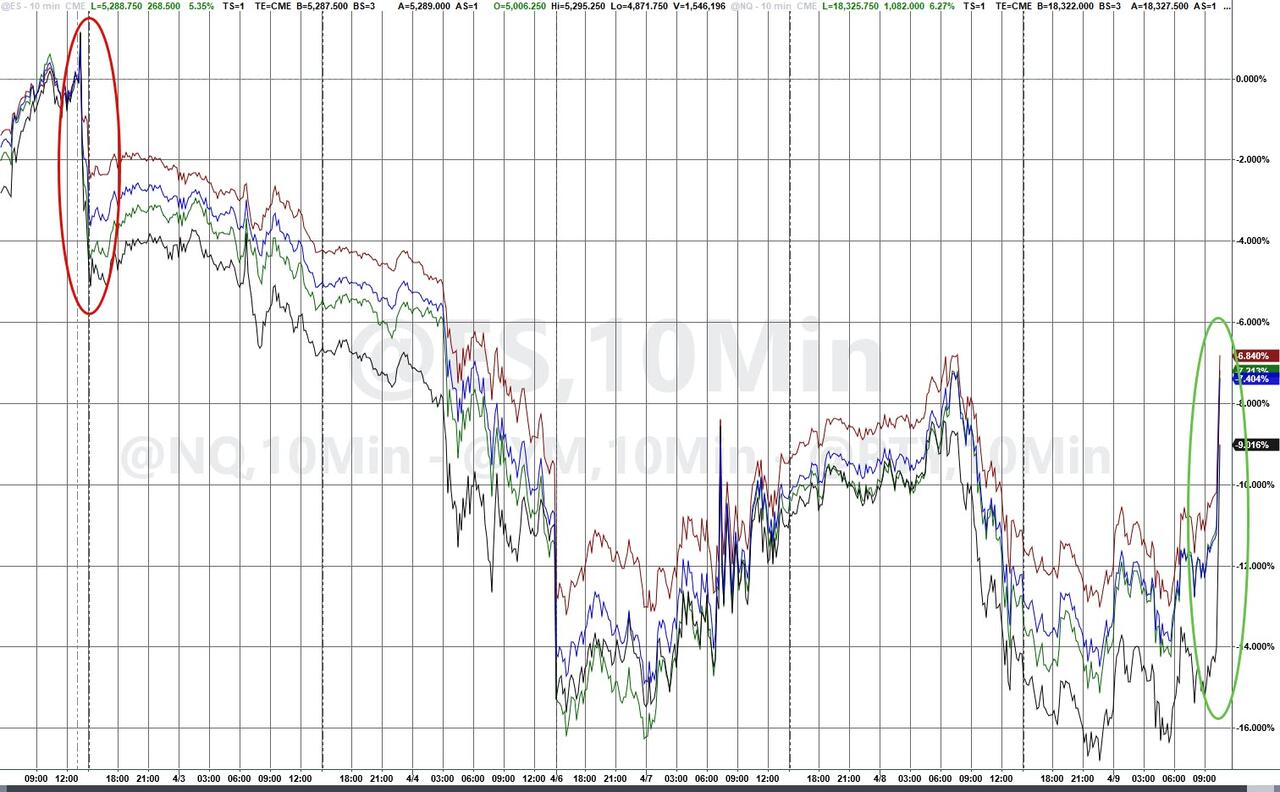

The result is a massive surge in US equity markets (up 7-9%)...

?itok=KpBf2MH5

?itok=KpBf2MH5

...cutting losses post-Liberation Day in half...

?itok=BNgduScJ

?itok=BNgduScJ

* * *

Update: After Beijing’s overnight inaction in response to President Trump’s new 104% effective-rate tariff on Chinese goods—and the release of a white paper on trade between the two superpowers—there now appears to be a response from the Chinese side.

*CHINA RAISES TARIFFS ON US GOOD TO 84%

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1909931225441001816?ref_src=twsrc%5Etfw

Bloomberg reports that China plans to counter Trump's tariffs with an effective tariff rate of around 84%, escalating the trade war. These countermeasures go into effect on Thursday.

More from Bloomberg:

A day earlier, China vowed to "fight to the end" if the US insists on new tariffs. Chinese exports were already facing blanket levies imposed this year and punitive taxes from Trump's first term and the following Biden administration. China also added six firms to its unreliable entity list, and 12 US entities to its export control list. Initially, Trump justified the 34% tariff hike on China as a fair way to match the barriers that Beijing has in place against US firms and goods, and then added to them after Beijing retaliated with its own levies.

In markets, European equity futures are down more than 3%. Equity futures in the US are down over 1% for the S&P500 and Nasdaq.

?itok=52Tn-62r

?itok=52Tn-62r

Rollercoaster of headlines for S&P500 futs...

?itok=KyG2LrDm

?itok=KyG2LrDm

And what a mess. The PboC has been propping up Chinese markets, while the Federal Reserve has been stuck in wait-and-see mode as the basis trade unravels (read: https://www.zerohedge.com/markets/absolutely-spectacular-meltdown-basis-trade-blowing-sparking-multi-trillion-liquidation

).

* * *

President Donald Trump's reciprocal tariffs took effect at 12:01 a.m. Wednesday in Washington, sending shockwaves through global markets as he advances the 'America First' agenda to reshape the international economic order. In a notable shift from the previous tariff rounds, Beijing refrained from immediately firing back with countermeasures to the new 104% effective-rate tariffs. Instead, Beijing https://english.news.cn/20250409/99fee2caf56643b590aab19d2dc9b239/c.html

a 28,000-character white paper detailing its economic relationship with the US as foundational to global stability.

China's State Council Information Office released the white paper on Wednesday titled "China's Position on Some Issues Concerning China-U.S. Economic and Trade Relations." The paper provides statistics about China-U.S. economic and trade relations.

?itok=4PhsndHw

?itok=4PhsndHw

"China does not deliberately pursue a trade surplus," the white paper said, adding, "The trade imbalance in goods between China and the U.S. is both an inevitable result of structural issues in the U.S. economy and a consequence of the comparative advantages and international division of labour between the two countries."

?itok=qeilLX7q

?itok=qeilLX7q

Chinese state media https://english.news.cn/20250409/7458b316f22944fe9059d229d4d22ed3/c.html

provided more details about the white paper:

The white paper came as rising unilateralism and protectionism in the United States have significantly impeded normal economic and trade cooperation between the two countries.

. . .

These measures -- revealing the isolationist and coercive nature of US conduct -- run counter to the principles of the market economy and multilateralism, and will have serious repercussions for China-U.S. economic and trade relations, the white paper said.

In response to the US moves, China has taken forceful countermeasures to defend its national interests, and has remained committed to resolving disputes through dialogue and consultation, with multiple rounds of consultations with the US side to stabilize bilateral economic and trade relations, according to the document.

The Chinese side has always maintained that China-U.S. economic and trade relations are mutually beneficial and win-win in nature, the white paper said.

The White Paper concluded that cooperation—not confrontation—between both sides is essential for global economic growth, technological governance, and security, urging the US for a winnable solution through dialogue:

Trade wars produce no winners, and protectionism leads up a blind alley. The economic success of both China and the US presents shared opportunities rather than mutual threats

The reason for the Chinese restraint remains unclear, though https://www.bloomberg.com/news/articles/2025-04-09/china-holds-fire-on-immediate-retaliation-against-new-us-tariffs

noted that President Xi Jinping "could still hit back later today as U.S. markets open, or in the coming week."

On Tuesday, two Chinese bloggers leaked https://www.zerohedge.com/geopolitical/tariff-war-just-begun-beijings-new-tariff-target-list-leaked-bloggers

Beijing could unleash on the US, such as banning imports of US poultry and Hollywood films.

Commenting on markets, Goldman analysts told clients:

Surprise move from HK/China markets where we saw incremental recovery, in a tape where trade war headlines had turned worse. Beijing's lack of an immediate response to new incremental US tariffs (104%), was a departure from last two episodes of President Trump hiking duties (Last two instances, Beijing hit back within minutes).

Around 3 p.m. local time, Beijing released a 28,000-character white paper on trade with the US Accompanying it was a question-and-answer document in which the Ministry of Commerce reiterated China is willing to talk with the US

HSI saw a reversal of ~4% over the day, from being more than 3% weaker at the open to ending 70bps above water. Southbound net buying a record $4.6Bn was the most notable metric for the day, as support from retail and foreign investors accelerated. Turnover remained upbeat and above the HK$400Bn mark.

Earlier, Xinhua reported that Beijing would fight until the end if the US deepens the trade war. The Ministry of Commerce said it has "abundant means" to take countermeasures. It noted that Beijing and Washington could resolve trade differences through dialogue.

In a separate report, Reuters said top officials in Beijing plan to meet and discuss measures to boost the economy and stabilize capital markets amid the tariff turmoil with the US.

Both sides—Beijing and the US—will likely need stabilizing policies for markets and the economy to fight the trade war.

As we noted on Tuesday, a basis trade blow-up might force the Federal Reserve into https://www.zerohedge.com/markets/absolutely-spectacular-meltdown-basis-trade-blowing-sparking-multi-trillion-liquidation

. Deutsche Bank followed our lead on Wednesday.

https://cms.zerohedge.com/users/tyler-durden

Wed, 04/09/2025 - 13:25

Could Trump Cut China Out Of The Dollar System

Could Trump Cut China Out Of The Dollar System

By Benjamin Picton, senior strategist at Rabobank

To whom much is given...

US stocks were a rollercoaster yesterday. Having closed at 5062 on Monday evening, the S&P500 opened Tuesday trade 130 points higher and spent the next 45 minutes rallying up to the 5267 daily high as markets reacted enthusiastically to comments from Trump and Bessent suggesting that there might be room for some countries to cut deals for lower tariffs. Stocks were then sold steadily for the remainder of the trading day as markets reacted to President Trump’s promise to hit China with an extra 50% tariff (104% total) from midnight.

The additional tariffs comes in retaliation to the retaliation for the reciprocal tariffs that were apparently imposed in retaliation for long-term cheating on trade. The absurdity of this sequence should make it abundantly clear that the world’s two largest economies are engaged in a tit-for-tat that could conceivably halt bilateral trade altogether. Neither side appears ready to blink; Chinese officials had earlier said that they were prepared to “fight to the end”.

Australian economist Warwick McKibbin (a former RBA Board member) recently commented that “the whole world is not having a trade war here. It’s just 20 per cent of the world (the USA) attacking the other 80 per cent.” That characterisation might be (somewhat) true for now, but the situation is likely to metastasize as Europe and others beef up anti-dumping measures on Chinese goods to protect their own industry. The trade war will really go global if the United States tells other countries that the price for providing global public goods like the US security umbrella and the US Dollar as the global reserve asset is a common tariff against China. That would effectively cut China out of the Dollar system, and make it exceedingly difficult for China to raise Dollars to pay for its food and energy imports.

China is taking policy measures of its own. CNH weakened to 7.43 yesterday – the highest reading since the establishment of the offshore market in 2009 – and the PBOC fixed the onshore Yuan at its weakest level since September 2023. If the onshore Yuan fixes above 7.2258 in coming days it will be the weakest since before the crisis of 2008. Chinese authorities are clearly allowing the currency to depreciate to offset some of the pain inflicted by US tariffs. This will only further inflame tensions with the White House, given that currency manipulation is one of the US’s major grievances with countries running large trade surpluses. China-adjacent AUD and NZD are trading close to 5-year lows this morning as the tariff deadline approaches.

The yuan is absolutely disintegrating. Expect 8 handle if tariffs go live at midnight. https://t.co/nLdahVRJAW

— zerohedge (@zerohedge) https://twitter.com/zerohedge/status/1909705129193775546?ref_src=twsrc%5Etfw

10-year Treasury yields rose 11bps on Tuesday to close the day at 4.29% and yields are up another 4.5bps in Asian trade to 4.335%. That’s a 48 basis point lift in yields since the lows last Friday. Up until yesterday the rise in yields had occurred in tandem with a rally in the DXY index, suggesting investors were actually repatriating funds into the USA and a great deal of the Treasury selling pressure may have been domestic. That dynamic flipped yesterday as the DXY closed lower and yields continued to soar, which perhaps supports views that China (and/or others) is dumping its Treasury holdings to pressure US yields higher and make like difficult for Trump and Bessent.

Brent crude active futures were down 2.16% yesterday and are down a further 2.58% to $61.18/bbl today. It’s a perfect storm for crude prices as tariff-induced recession fears collide with much higher supply from OPEC+ producers. Also lurking in the background is Donald Trump’s ‘Big Beautiful Bill’ which contains provisions to slash red tape for US producers to encourage more supply into the market and lower oil prices further. We’re a little sceptical on the efficacy of those ‘Drill, Baby, Drill!’ measures due to the high production breakevens of US producers, but given that Trump recently signed executive orders to boost domestic coal production under powers granted by the Defence Production Act it would be foolish to argue strongly that a similar thing won’t happen with oil.

As the Dollar weakens, Gold appears to have found support around the $2,980/oz level and may be poised for gains down the track as US inflation breakevens lift and the probability of a ‘Mar-a-Lago Accord’ to devalue the US Dollar rises. US officials are saying that more than 70 countries have contacted the White House desperate to make a deal on trade. Could a ‘grand bargain’ on weakening the US Dollar be the only deal offered? That would be very Luke 12:48 for US allies.

Just in case the penny hasn’t yet dropped, there is little distinction between economics and geopolitics in the current environment. The Trump Administration is aggressively deploying trade and financial policy to achieve foreign policy goals in similar fashion to what China has been doing for years. This is economic statecraft, make no mistake.

To highlight the new Cold War dynamic at play, Volodymyr Zelenskyy overnight said that Ukrainian forces had captured two Chinese soldiers fighting alongside Russian troops in Eastern Ukraine, and that he had information that “significantly more Chinese citizens” were serving in Russian military units. This follows earlier news that North Korean soldiers have been embedded alongside Russian forces in Kursk. Zelenskyy’s claim has not been independently verified, and it is not yet clear whether the Chinese soldiers were volunteers or fighting at the behest of the Chinese government, but Zelenskyy has directed his Foreign Minister to contact Beijing demanding answers.

https://cms.zerohedge.com/users/tyler-durden

Wed, 04/09/2025 - 13:05

https://www.zerohedge.com/markets/could-trump-cut-china-out-dollar-system

The Media's Piss Stain Starts To Dry

The Media's Piss Stain Starts To Dry

Submitted by https://quoththeraven.substack.com/p/the-medias-piss-stain-starts-to-dry

Over the last few days, I’ve been part of an extraordinarily small contingency of people https://quoththeraven.substack.com/p/the-inevitable-just-sooner

over President Trump’s new tariff plan or the ensuing stock market pullback.

A couple of days ago, I https://quoththeraven.substack.com/p/the-inevitable-just-sooner

that the media shrieking hysterically about how the world was ending as a result of this trade policy was nothing more than a visceral reaction to what was happening in the stock market. It had to be. With just hours having passed since the implementation of Trump’s tariff policy, there was no real way to judge its success based on the merits.

Said another way, these things take time.

In an https://quoththeraven.substack.com/p/the-inevitable-just-sooner

, I criticized Wharton PhD Jeremy Siegel—whose actual title is probably some bullshit with the word “emeritus” next to it—for coming out and declaring Trump’s tariff policy to be the worst policy decision in 95 years.

My https://quoththeraven.substack.com/p/the-inevitable-just-sooner

wasn’t that he was wrong—only that it was too soon to make such a declaration.

Siegel was on CNBC again Monday this week. He started his interview by alluding to the idea that the Federal Reserve has room to cut interest rates—similar to the way he https://quoththeraven.substack.com/p/the-inevitable-just-sooner

for an emergency rate cut back in August of last year. As the interview progressed, the stock market started to spike upwards on what we now know was a discredited headline about a 90-day pause in tariffs—and on live television, within the course of the five-minute interview window, Siegel had changed his tone, backing off his rhetoric and calling the now-debunked headline “terrific.”

?itok=4ai7bcq4" width="500"/>"Holy sh*t! We're all gonna die!"

It was proof positive that everybody—even supposedly well-adjusted, intellectual, seasoned economists—reacts first to the stock market and asks questions later.

I https://quoththeraven.substack.com/p/the-inevitable-just-sooner

the same when the Wall Street Journal editorial board came out just three days after the implementation of Trump’s tariff policy and declared Xi Jinping as the “emerging winner” of this policy decision. Whether the policy works or not is one thing. But declaring winners after just three days just doesn’t make sense to me.

Today, we are witnessing the opposite: the market opened the day green, and the VIX is lower because—even though we have uncertainty about the future of these trade deals—at least the market knows that the giant shock of announcing the tariff to begin with has now passed. Everybody has been able to regain some semblance of footing, everybody knows where we stand now with other countries, and market direction going forward will be more of a prolonged response to how negotiations with other countries go.

With China being the obvious main holdout, it appears as though negotiations with crucial countries—like Japan, for instance—are already moving forward.

And so now that people in the financial media and “analysts”—who appear to get their pulse on sentiment from reading nothing but social media—are officially done pissing themselves, and the market has at least temporarily found some sort of point to bounce off of (even if it continues to eventually move lower again) their respective piss stains can start to dry, and we can move past the large shock of discomfort into the still uncomfortable, but less shocking, choppy waters of trade negotiation.

President Trump was right during his interview a day or two ago when he told reporters that sometimes you have to “take the medicine.” It is this outlook on big change being digested by markets that will help them find a bottom faster and get everybody on the same page of where we stand now—without worrying whether or not our end of the negotiating table is going to capitulate or make terrible concessions, which could actually wind up being counterproductive.

And whether or not you believe Trump’s policy is working, you have to give him credit for having the spine to stand by it. I know we have very short memories, but the fever pitch of people—media, citizens, friends, business leaders, analysts, and advisors even—who must have been begging on Thursday and Friday of last week to reverse course had no effect on an unwavering President Trump.

If you’re going to “throw a grenade in the room and then walk away” as a way of setting policy, you have to be 100% behind your decision—and for better or for worse, there’s no doubt Trump has dug in. As I shttps://quoththeraven.substack.com/p/fearless

, I don’t know why Trump is fearless, or what drives it, but I think it’s an asset.

People on financial media this morning are bright-eyed and bushy-tailed, congratulating each other for having the fortitude to endure such tumultuous volatility. Markets are green! Flowers are blooming! The worst is over!

And these are, of course, also insane proclamations. There’s still going to be a significant amount of volatility ahead, and to suggest that the market has bottomed here is, https://quoththeraven.substack.com/p/trading-the-shit-show-april-2025?utm_source=publication-search

, foolish. When the market is going up over long periods of time, it goes both down and up over shorter periods of time. When the market goes down over long periods of time, it makes lower lows and lower highs, going both up and down over shorter periods of time.

Doing something like proclaiming the Fed should raise or lower rates based on what the stock market is doing in one session is an extraordinarily irresponsible and dangerous way to set policy. Essentially, the entire global economy—representing $100 trillion in assets or more—hangs in the balance of what the Federal Reserve decides to do with interest rates. To watch an “economist” on live television change their tune and cavalierly throw out interest rate cuts and hikes in different directions over the course of a five-minute interview is insane.

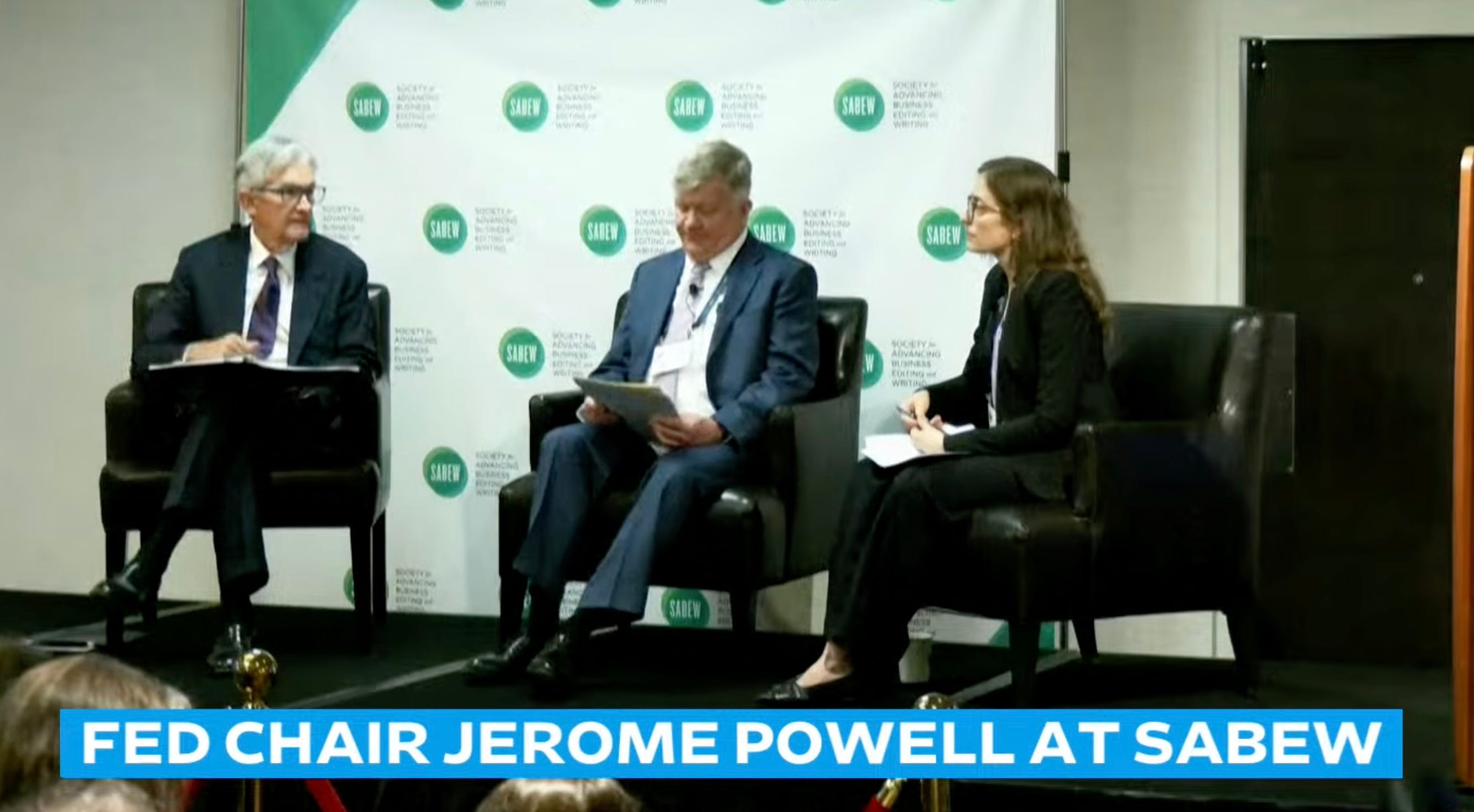

But I guess that is only to be expected from financial media who can’t help but make the story of the day whatever the market is doing that particular day. Real market veterans know: one day, one week, or one month of pattern does not make. And I’ll give Jerome Powell credit: watching his https://www.youtube.com/watch?v=rmm1OZBSarI

, I thought he spoke about the market’s reaction and the Feds ensuing plans with a steady hand.

Going forward, if there’s one thing to be adamant about, in my opinion, it’s continuing to ignore reactionary responses to every individual headline that pops up about negotiations. To me, it harkens back to how people were watching and trading the number of COVID deaths as they occurred, minute by minute, in real time.

Looking back now, it’s easier to paint with much broader strokes: you should’ve bought stocks on the crash in March 2020 and sold them recently when the Shiller price-to-earnings ratio nearly hit 40x. It wasn’t so easy to discern that on a minute-by-minute basis in 2020, however.

As the days, weeks and months pass by, order and trends will emerge from this tariff fiasco. This is why I don’t bother arguing about the formula the Trump administration used to implement the tariffs, nor do I argue about specifics. The point of the policy was to recalibrate our standing in the world of trade and that’s what it’s doing. We’ve made the message crystal clear, and we have postured accordingly. Already, nations are coming to the table to try and work through the problem. Trump himself said it right yesterday, proclaiming something to the effect of: “If this is done right, it will only have to be done once.”

As I’ve been saying, regardless of how trade negotiations go, I still believe the stock market to be overvalued based on historical averages. But this doesn’t mean that there aren’t bargains out there in individual names and sectors. When undergoing such a massive macroeconomic shift, capital is going to move, valuations are going to change, and the market is going to look different on the other side of this policy negotiation than it did before.

Taking a longer view, I think cooler heads are going to prevail, and by the end of summer, things will have calmed down significantly. So as for me, I’m going to keep my cool head. The hysterical media was acting last week like it was a guarantee this trade war was going to last 100 years. It’s been four or five days, and we’ve already got people at the negotiating table.

I’ll look for value if the market moves lower or higher from here. As I said before the tariff war even began, I believe the market could still fall 30 or 40% from here easily—towards the historical P/E average near around 16x earnings. And once the deals start getting consummated, then I will start to judge the effectiveness of the negotiating tactic that the President is employing.

I judge effectiveness by how and when these new policies will be implemented and whether or not they are a net positive for the country after the fact. So for me, the answers are still yet to come. But for the lot of individuals who use the stock market as their mood ring for the day, at least they have a day today to let that piss stain from last week dry up a little bit.

QTR’s Disclaimer: Please read my full legal disclaimer https://quoththeraven.substack.com/about

with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Wed, 04/09/2025 - 07:20

https://www.zerohedge.com/markets/medias-piss-stain-starts-dry

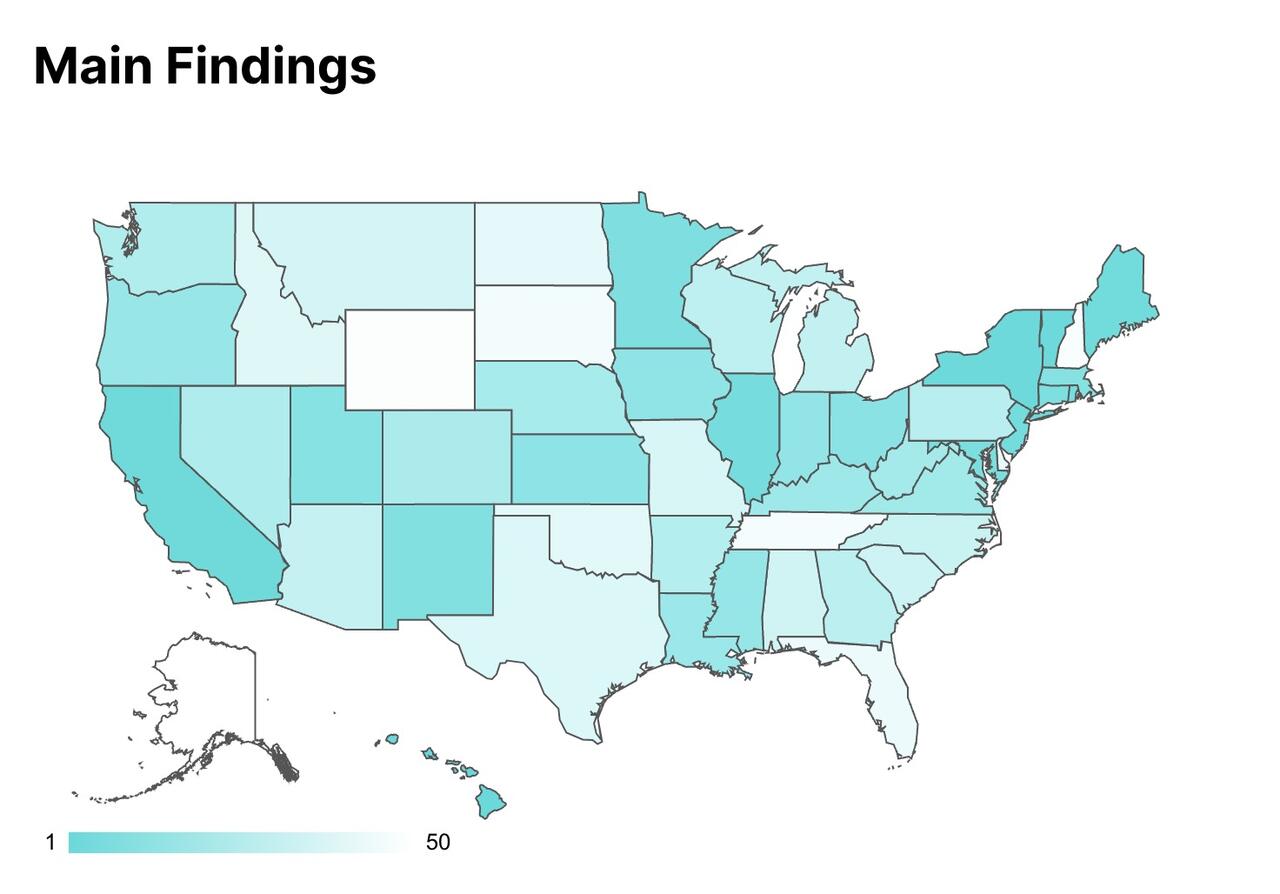

These Are The U.S. States With The Most Criminals Still At Large

These Are The U.S. States With The Most Criminals Still At Large

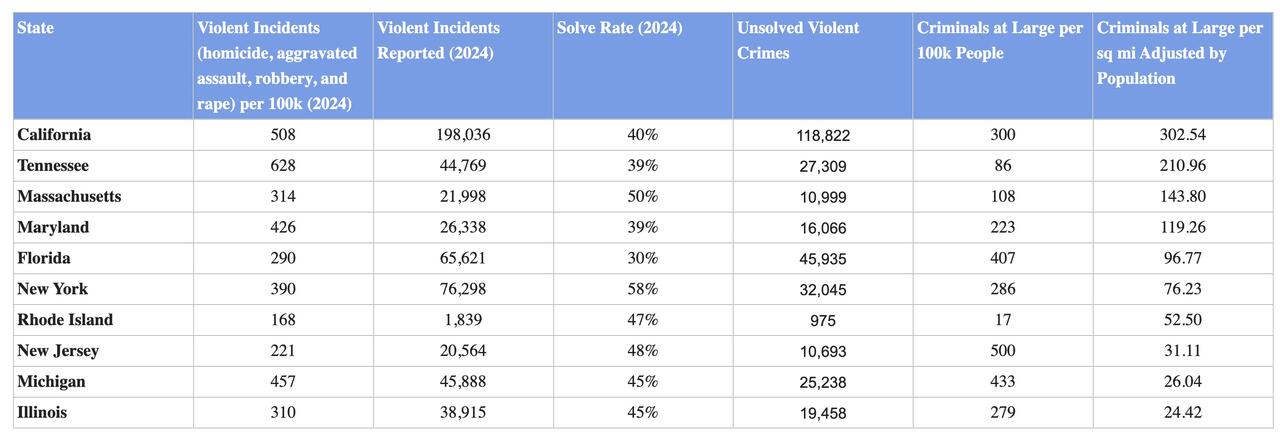

A study by Spartacus Law Firm ranked U.S. states by the number of criminals still at large, factoring in violent crime rates, solve rates, population, and land area. The final metric—criminals at large per square mile adjusted for population—put California at the top due to its high rate of unsolved violent crimes.

California leads U.S. states in criminals still at large, with 303 per square mile when adjusted for population. The state reported 198,000 violent incidents—60% unsolved—leaving nearly 119,000 offenders unaccounted for.

Tennessee ranks second with 211 per square mile, driven by the highest violent crime rate nationally (628 per 100K people) and a low 39% solve rate, according to https://spartacuslawfirm.com/

.

Massachusetts takes third at 144 per square mile. Despite a 50% clearance rate and fewer incidents, its small size boosts offender density.

Maryland places fourth with 119, mirroring Tennessee’s 39% solve rate but with fewer incidents and a higher population density.

Florida is fifth at 97 per square mile, hampered by the lowest clearance rate (30%) among the top ten, resulting in nearly 46,000 unsolved cases.

?itok=tCmu7ztR

?itok=tCmu7ztR

New York comes sixth with 76. Though it boasts the highest solve rate (58%) of the group, its large population drives high total incidents.

The https://spartacuslawfirm.com/

says that Rhode Island is seventh at 53, with the lowest crime rate and total incidents, but a modest solve rate of 47%.

New Jersey ranks eighth with 31, a slightly better solve rate than Rhode Island’s, but a much higher volume of unsolved crimes.

Michigan places ninth at 26, with a high crime rate and low solve rate, totaling over 25,000 unsolved cases.

Illinois rounds out the list at tenth with 24 per square mile, similar to Michigan in solve rate and crime volume, with around 19,500 cases unresolved.

"The concentration of violent criminals at large in urban centers reveals a complex interplay between criminal justice resources, population density, and geographic constraints. This geographic lens shifts the conversation from comparing solve rates to considering how unresolved crimes create "hot zones" of impunity," Chandon Alexander, CEO of Spartacus Law Firm, commented on the study.

He continued: "Law enforcement agencies might benefit from targeted resource allocation based on these density metrics rather than raw crime statistics. The stark differences between states with similar solve rates but vastly different criminal concentrations suggests that traditional policing approaches may need regional customization, particularly in states where criminals benefit from proximity to jurisdictional boundaries or transportation networks that facilitate mobility after committing violent acts.”

The full study data can be found https://docs.google.com/spreadsheets/u/0/d/e/2PACX-1vThFfwa1XGZUc5dJFuBctlAEZBRqWLl3kslAcKnMlr_w4TAJf1JQFReR15skSliZrSi4ryPRjnx6A_P/pubhtml?urp=gmail_link&pli=1

.

https://cms.zerohedge.com/users/tyler-durden

Wed, 04/09/2025 - 06:55

https://www.zerohedge.com/markets/these-are-us-states-most-criminals-still-large

US Space Chief Warns Congress Of China's Space Capabilities In Potential Indo–Pacific War

US Space Chief Warns Congress Of China's Space Capabilities In Potential Indo–Pacific War

China’s ambitions in space pose a “powerful destabilizing force” to the U.S. economy and national security, according to Gen. Chance Saltzman, chief of space operations for the U.S. Space Force.

“Space has become a warfighting domain,” Saltzman told the U.S.-China Economic and Security Review Commission, a bipartisan congressional panel, in a https://www.theepochtimes.com/epochtv/live-now-uscc-holds-hearing-on-chinas-ambitions-in-space-5835817

on April 3.

“Over the last two decades, our competitors, China in particular, have invested heavily in counter space threats, kinetic and non-kinetic weapons that can deny, degrade, or destroy our satellites,” Saltzman warned.

The hearing took place as tensions have mounted between China and the United States regarding trade policies and tariffs. Saltzman’s testimony sheds light on the challenges that the U.S. military could face over a potential conflict in the western Pacific, including Taiwan.

?itok=Y6q7qE7k

?itok=Y6q7qE7k

Saltzman explained that China has been able to advance its space capabilities quickly because it has a “Western Pacific mindset,” pooling all its resources and advancing all capabilities in that region. In contrast, the United States has more global concerns, according to the Space Force commander.

“The modern battlefield has to account for the space domain,“ he said.

”If we can’t continue to protect our use of the domain and we can’t deny an adversary, it’s going to be tough to meet military objectives in any of the other domains.”

In his written https://www.uscc.gov/sites/default/files/2025-04/Chance_Saltzman_Testimony.pdf

, Saltzman explained that the Chinese regime’s military, the People’s Liberation Army (PLA), has set out military objectives for the space domain.

“Intelligence suggests the PLA likely sees counterspace operations as a means to deter and counter U.S. military intervention in a regional conflict,” Saltzman wrote.

The general said China’s space weapons include ground-to-space missiles and ground-based lasers, the latter of which can “disrupt, degrade, or damage satellite sensors.”

“By the mid-to-late 2020s, we expect them to deploy systems high enough in power that they can physically damage satellite structures,” his testimony reads.

Currently, China’s military exercises “regularly incorporate radio frequency jammers” against space-based communications, radars, and navigation systems, according to Saltzman.

“Intelligence suggests the PLA may be developing jammers to target a greater range of frequencies, including U.S. military protected extremely-high-frequency (EHF) systems,” he said.

In 2022, China https://www.theepochtimes.com/us/china-russia-conceal-military-capabilities-of-satellites-posing-threat-to-us-report-5575709

a satellite equipped with a robotic arm to tow a defunct Chinese navigation satellite to a graveyard orbit. Saltzman said such a robot-armed satellite was an example of how satellites can have both civilian and military applications and that it is “not a science fiction” that China can use such technology to “capture enemy satellites.”

China is also practicing “dogfighting in space,” Saltzman said, saying his service has seen Chinese experimental satellites conducting “unusual, large, and rapid maneuvers” in geostationary orbit in recent years. Based on the observation, Saltzman said Beijing “is resolved to contest [U.S.] spacepower through combat operations.”

“China’s advancement in space technology, their stated desire to dominate, and Beijing’s disregard for international norms for the responsible use of space make them an incredible danger to U.S. prosperity and security,” he said.

“China’s determination to deny U.S. spacepower in the Indo–Pacific could not only degrade of [sic] our military space-based capability, but it would threaten the satellites of our allies and commercial partners as well.”

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/08/2025 - 23:25

These Are The U.S. States With The Highest And Lowest Tax Burdens

These Are The U.S. States With The Highest And Lowest Tax Burdens

A new study looked at the highest and lowest tax burdens, per state, in the U.S.

To rank states by tax burden, WalletHub analyzed all 50 based on three factors: property taxes, income taxes, and sales/excise taxes — each measured as a share of personal income — and combined them for an overall score.

Hawaii tops the nation in total tax burden, with residents surrendering nearly 14% of their income to state and local taxes, according to the https://wallethub.com/edu/states-with-highest-lowest-tax-burden/20494

. This includes 4.2% for income taxes, 2.6% for property taxes, and a hefty 7.2% for sales and excise taxes.

?itok=Js3qw2Kc

?itok=Js3qw2Kc

At the opposite end, Alaska has the lightest tax load. With no state income tax, and modest property and sales tax burdens of 3.5% and 1.5% respectively, Alaskans pay just 4.9% of their income in total.

Wyoming and New Hampshire follow closely behind, with total tax burdens of 5.79% and 5.94%, respectively. Wyoming similarly benefits from having no income tax, while New Hampshire, despite its steep property taxes — the second highest in the nation — offsets this with extremely low sales taxes and no general sales tax at all.

Other low-burden states include Tennessee, South Dakota, and Florida, all of which also forgo a state income tax. Tennessee residents pay only 6.38% of their income in total taxes, while South Dakotans and Floridians pay slightly more at 6.46% and 6.49%, respectively. Delaware also ranks low at 6.52%, due in large part to its minimal sales tax burden — the second lowest in the country.

These states reflect a broader trend: the lowest-taxed states often avoid personal income taxes altogether and keep consumption-based taxes in check, making them attractive destinations for taxpayers seeking to maximize their earnings.

When it comes to income taxes alone, New York leads with the highest burden, taking 5.8% of residents’ income.

Vermont ranks highest for property taxes, collecting 5% of personal income. In contrast, Alabama offers the lowest property tax burden, claiming only 1.4%.

?itok=Yo56l_Di

?itok=Yo56l_Di

For sales and excise taxes, Hawaii again leads, with residents paying 7.2% of their income annually. New Hampshire sits at the other extreme, with no general sales tax and minimal excise taxes, amounting to less than 1% of income.

The https://wallethub.com/edu/states-with-highest-lowest-tax-burden/20494

says red states have a lower tax burden than blue states, on average.

Analyst Chip Lupo commented: “It’s easy to be dismayed at tax time when you see just how much of your income you lose. Living in a state with a low tax burden can alleviate some of that stress. Some states charge no income tax or no sales tax, although all states have some form of property taxes and excise taxes.”

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/08/2025 - 23:00

https://www.zerohedge.com/markets/these-are-us-states-highest-and-lowest-tax-burdens

The Gold Standard Is Back - Stablecoins Need To Rethink What 'Backing' Really Means

The Gold Standard Is Back - Stablecoins Need To Rethink What 'Backing' Really Means

https://cointelegraph.com/news/the-gold-standard-is-back

Stablecoins were heralded as a breakthrough in the cryptocurrency space as a way to marry the lightning-fast, borderless nature of digital assets with the stability of traditional currencies. They achieve this by pegging their value to reserves like fiat currencies or commodities. Stablecoins are engineered to maintain a fixed exchange rate, typically one-to-one, with the underlying asset.

?itok=4JdiBgsf

?itok=4JdiBgsf

What does “stability” mean? At its core, stability demands three pillars:

Reliable collateral: The tangible assets that back the token.

Transparency: The ability for anyone to independently verify reserves.

Consistent peg maintenance: Robust safeguards against depegging, where a stablecoin’s market value strays from its fixed ratio with the underlying asset.

Without these foundational elements, stablecoins are little more than speculative instruments masquerading as safe harbors. In 2022 alone, billions in valuehttps://cointelegraph.com/news/bitcoin-crypto-sentiment-tracker-levels-decline-celsius-terra-3ac

, meaning their market prices diverged significantly from their intended 1:1 ratio with an underlying asset — prompting an unsettling question: Can digital assets ever be genuinely stable without demonstrable and independently audited backing?

The need for reliable asset-backed models

Recent market events have exposed severe fundamental weaknesses in privately issued stablecoins. These tokens often rely on opaque mechanisms, inadequate audit practices or collateral that investors cannot independently verify.

These shortcomings repeatedly led to sudden “depegging” events, such as the collapse of Iron Finance’s TITAN token in 2021. The overleveraged algorithmic system https://cointelegraph.com/news/iron-finance-bank-run-stings-investors-a-lesson-for-all-stablecoins

, wiping out billions in liquidity.

https://cointelegraph.com/news/why-did-terra-luna-and-ust-crash-find-out-on-the-market-report

also highlighted a similar vulnerability, with the stablecoin’s value disintegrating quickly, intensifying doubts about algorithmic models lacking transparent reserves.

Meanwhile, partially collateralized and so-called “fully audited” stablecoins have faced scrutiny for inconsistent disclosure practices. Even well-known issuers must constantly prove their reserves are sufficient and legitimate.

These issues primarily stem from insufficient oversight and ambiguous collateral management practices by private issuers. Investors typically have limited means to independently verify reserves, fueling persistent doubts about whether the stated backing genuinely exists or whether tokens are properly collateralized.

Only models with tangible asset support and verifiably documented reserves can genuinely deliver the stability that digital assets promise. Through transparent frameworks, we can rebuild trust and usher in a new era of reliable digital finance. These events underscore a universal truth: True stability is forged through auditable oversight and verifiable reserves, not hollow branding.

Gold is a timeless anchor

Gold has served as humanity’s ultimate store of value for millennia, preserving wealth through wars, economic collapses and pandemics. Its scarcity, intrinsic worth and universal acceptance have made it a refuge when institutions falter — evidenced by its 25% surge during the 2020 market crash as investors fled volatile assets.

Gold’s value transcends borders and ideologies, resting on tangible scarcity rather than hollow promises. For example, while the US dollar has lost 96.8% of its purchasing power since 1913, gold has consistently preserved and even grown its purchasing power. This track record positions it as an ideal anchor for digital assets seeking stability in a volatile crypto landscape.

Critics of gold might point to its storage and custodial costs, along with the logistical challenges of physically moving bullion. Modern vaulting solutions and robust insurance measures have, however, largely mitigated these concerns, particularly when combined with blockchain-based audit mechanisms.

Gold-backed stablecoins capitalize on this timeless reliability, pairing physical gold’s enduring value with blockchain’s efficiency. By linking digital tokens directly to physical gold, they sidestep the speculative risks of cryptocurrencies and the inflationary pitfalls of government-issued money.

Blockchain-enabled gold tokenization

Blockchain technology removes the traditional obstacles to gold ownership by enabling fractional digital ownership and global trading without intermediaries.

Physical gold stored in regulated vaults is digitized into tokens, each representing a precise fraction of the underlying asset. Every transaction is immutably recorded on a decentralized ledger, enabling investors to continuously check reserves in real time through automated smart contracts.

This system overcomes gold’s historic limitations, including illiquidity and high storage costs, while eliminating the opacity of traditional reserve management. Merging gold’s tangible security with blockchain’s immutable record-keeping, the system also engineers trust directly into the architecture.

This approach creates a stablecoin model unlike any other, where verifiable backing is the system’s backbone, not merely promised on paper.

Creating stablecoins that truly deliver stability

Gold-backed stablecoins merge blockchain’s inherent accountability with gold’s stability, establishing a new class of digital assets resistant to volatility. Anchoring digital tokens to gold’s intrinsic value, this model sidesteps the volatility of speculative cryptocurrencies and the inflationary risks of government-issued currencies.

The result is a stablecoin engineered for trust, where stability isn’t promised by code or institutions — it’s bolstered by tangible scarcity and blockchain’s unyielding transparency.

Trust as a cornerstone

The primary challenge facing stablecoins is establishing user trust. This trust can’t be built solely on a company’s reputation. It must be earned through independently verifiable collateral, real-time audits and clear regulatory oversight.

Innovative hybrid models showcase this approach effectively. The government strictly regulates and audits the gold reserves in a hybrid model to maintain verifiable 1:1 backing. The private entities handle token issuance, trading and compliance processes, carefully separating state verification of collateral from private management of operational functions.

This public-private partnership ensures rigorous oversight without creating a central bank digital currency. As they divide responsibilities, the model establishes a system where the government guarantees authenticity and collateral integrity while private enterprises handle operational efficiency, ensuring a balanced and decentralized yet trustworthy environment.

Toward a more trustworthy digital financial ecosystem

Genuine stability in digital finance emerges not from marketing slogans but from transparent mechanisms and verifiable collateral.

The future of digital finance lies in combining blockchain’s revolutionary transparency with the historically proven stability of gold, especially under government auditing and privately managed structures. As more asset-backed solutions emerge, institutions, regulators and everyday users will adopt stablecoins that transparently deliver on their stability promises.

This evolution marks a pivotal shift. Investors will no longer accept vague assurances. Investors demand concrete stability. Gold-backed stablecoins, blending ancient reliability with blockchain innovation, will lead the next generation of digital financial instruments, ensuring stablecoins fulfill their original promise — stability without compromise.

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/08/2025 - 13:40

"Tariff War Just Begun": Beijing's Counter-Tariff Options Against Trump Leaked By Bloggers

"Tariff War Just Begun": Beijing's Counter-Tariff Options Against Trump Leaked By Bloggers

On Monday, President Trump https://www.zerohedge.com/markets/futures-surge-europe-says-ready-negotiate-us

" of the trade war. Two top Chinese bloggers leaked some of those potential countermeasures on Tuesday.

A flurry of headlines overnight helped stabilize Asian equity markets. According to Goldman analyst Shubham Ghosh, some of those headlines included, "Consumption boost, leadership onshore willing to front-load stimulus, PBOC vowing sufficient funding, all adding up."

"Onshore A-shs had a much better price action where the start was slow and it gradually picked up momentum towards the close – National team support speculated as notably combined turnover of the ETFs favoured by them hit a massive 92 bn Yuan," Ghosh told clients.

We detailed overnight the commerce ministry's threat to take "https://www.zerohedge.com/market-recaps/stocks-bonds-gold-dumped-us-dollar-liquidity-fears-grow

" to defend its "rights and interests" should Trump fire off another round of tariffs. One key line from the ministry should keep traders up at night:

"China will never accept this. If the U.S. insists on going its own way, China will fight it to the end."

?itok=s2kvMi7L

?itok=s2kvMi7L

In addition to the commerce ministry's comments, two top Chinese bloggers have potentially leaked Beijing's next moves, which could target everything from U.S. poultry and agricultural goods to Hollywood films—and even include a suspension of China-U.S. cooperation on fentanyl-related issues.

noted that Liu Hong, a senior editor at Chinese media outlet Xinhuanet, and Chairman Rabbit, the social media handle for Ren Yi, the Harvard University-educated grandson of former Guangdong party chief Ren Zhongyi, released an identical set of countermeasures that Beijing has mulled over to counter Trump.

Hong operates the account Niutanqin, which listed the potential countermeasures:

We have also received some latest news on specific countermeasures against US tariffs . China has prepared at least six major measures.

1. Significantly increase tariffs on U.S. agricultural products such as soybeans and sorghum.

Sources said that in view of the recent bullying behavior of the United States, China is considering significantly increasing tariffs on U.S. agricultural products such as soybeans and sorghum.

2. Prohibit the import of U.S. poultry meat into China.

Sources pointed out that in view of the frequent outbreaks of avian influenza in the United States, relevant parties strongly recommended that China ban the import of American poultry to ensure the food safety of the Chinese people.

3. Suspend China-US cooperation on fentanyl.

It was revealed that the Chinese government is considering stopping its fentanyl cooperation with the U.S. due to the U.S.'s threat to impose another 50% tariff. The reason is simple: the U.S. has completely ignored China's humanitarian assistance, not only does it not understand China's sincerity and goodwill, but it has also smeared, blamed and shifted the blame, which has seriously damaged the foundation of China-US fentanyl cooperation.

4. Countermeasures in the services trade sector.

The source also revealed that this includes restricting U.S. companies from participating in procurement and restricting business cooperation such as legal consulting. The U.S. has a long-term trade surplus in services with China, and the so-called "reciprocal tariffs" of the U.S. government will undoubtedly bring serious crisis to the U.S. service exports, which currently have a huge trade surplus.

5. Ban the import of American films.

According to relevant experts, in view of the U.S. threat to escalate tariffs on China , relevant departments are studying reducing or even banning the import of American films.

6. Investigate the benefits that U.S. companies have gained from intellectual property in China.

According to sources, in view of the huge monopoly profits obtained by relevant U.S. companies in China, relevant departments are studying to investigate the above situation.

"After all, China today is no longer the China of 100 years ago, 40 years ago, or four years ago. We have experienced too many ups and downs. We know clearly that we still face many challenges and difficulties, but we believe that we are on the right side of history," the Niutanqin account said.

Niutanqin warned: "If you mess around, you will have to pay for it. The storm brought to the United States by the tariff war has just begun."

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/08/2025 - 07:20

"Outlook Negative From Here": Goldman Finds Frontloading Party Is Over

"Outlook Negative From Here": Goldman Finds Frontloading Party Is Over

Over the past year, U.S. importers have been frontloading shipments—ranging from e-commerce goods and small appliances to soft goods and replacement parts—across Transpacific trade lanes in anticipation of President Trump's tariff threats.

With Trump's "Liberation Day" tariff blitz passed and the potential for even more tariffs ahead, signs are emerging that cargo flows across Transpacific routes are slowing. In fact, Goldman Sachs now expects the freight volume outlook could turn negative from here.

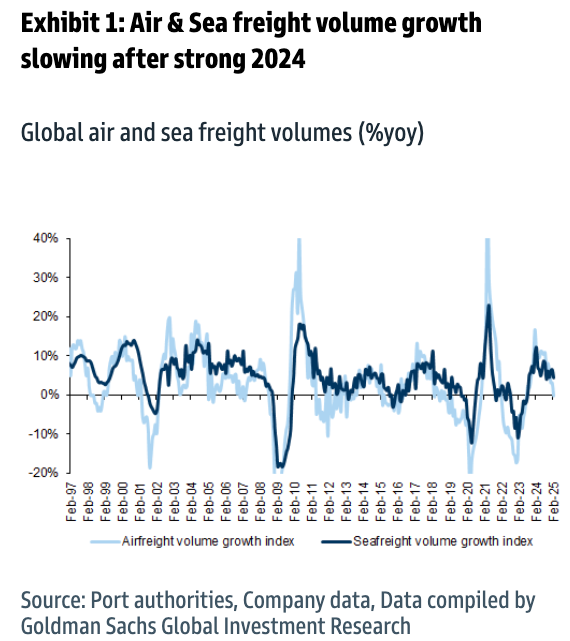

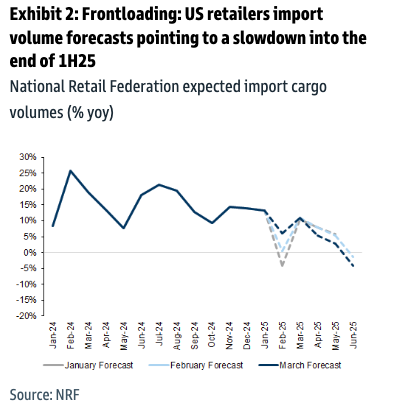

Goldman's Patrick Creuset, Theodora Beadle, and others told clients Monday that first-quarter freight volumes remained solid. However, they noted this was primarily because of frontloading goods ahead of tariffs, and now, because of the deepening trade war, "the volume outlook is clearly negative from here."

?itok=tl2sZ_97

?itok=tl2sZ_97

Creuset provided more color about the inflection point for the Transpacific tradelane:

Q1 freight volume data remained fairly strong, with Ocean volumes up c.5% on our readings for Jan/Feb, and China port volumes up 10%yoy, while air cargo is up low single digits following a strong Q4 peak. However, we believe a lot of this reflects frontloading of U.S. imports as we have highlighted in prior editions.

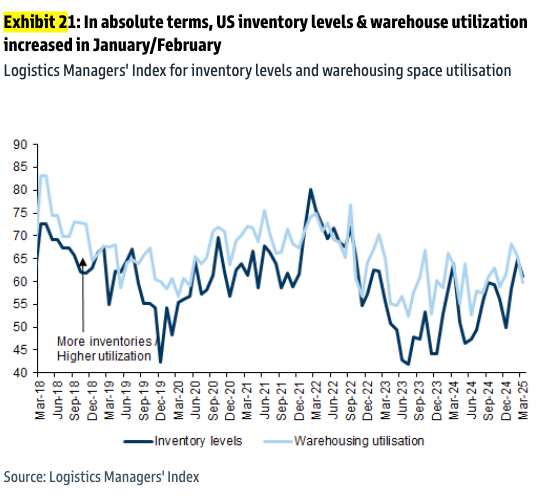

As U.S. tariff increases are set to take effect in April (and potential retaliation from trade partners) the volume outlook is clearly negative from here, in particular on the Transpacific tradelane. Prior to the latest tariff announcements, U.S. retailers were expecting a mid-single digit yoy import decline by June Exhibit 2 following the recent re-stocking Exhibit 21.

Exhibit 2

?itok=DCzfH05p

?itok=DCzfH05p

Exhibit 21

?itok=dwXSh9kk

?itok=dwXSh9kk

The analysts then asked question of how severe the slowdown will be—and what it could mean for freight rates:

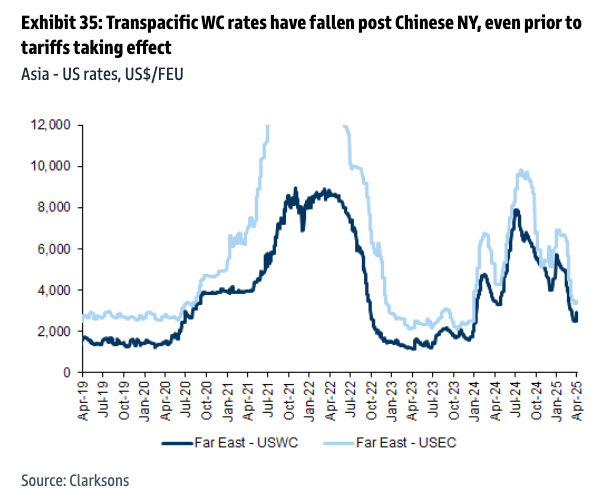

We believe the most likely scenario for ocean freight markets is a decline in Transpacific volumes driving further rate declines from still elevated levels Exhibit 35; this in turn will lead carriers to reduce capacity and hand back charters.

?itok=rhVPotHp

?itok=rhVPotHp

Key questions are:

the magnitude of the volume decline

the pace and magnitude of capacity cuts - there is a lot of headroom to cut, at least 5% of global capacity in our view Exhibit 43 but will depend on competitive dynamics amid the new alliance structure

?itok=EjDFPTLA

?itok=EjDFPTLA

whether vessels taken out of the Transpac are idled and scrapped, or cascaded into North-South trades (depressing rates there), and

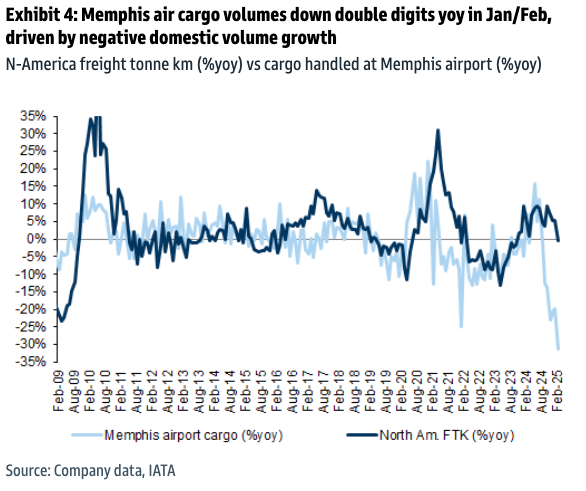

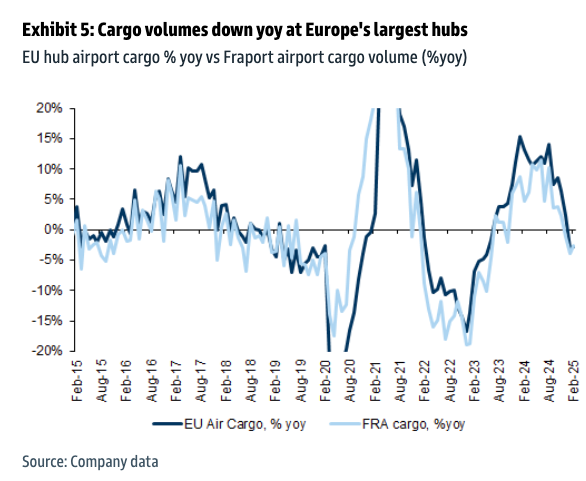

the extent of negative demand spillovers to RoW from weaker U.S. trade and growth. The impact from overcapacity in ocean will also be deflationary on air cargo, where slowing volume growth predates the latest tariff measures Exhibit 5.

?itok=EkfpSb5D

?itok=EkfpSb5D

The slowdown on Transpacific tradelanes also comes as Goldman's chief economist Jan Hatzius downshifted his U.S. economic growth forecast in a note titled "US Daily: Countdown to Recession."

Here are the highlights of Hatzius' note:

We are lowering our 2025 Q4/Q4 GDP growth forecast to 0.5% and raising our 12-month recession probability from 35% to 45% following a sharp tightening in financial conditions, foreign consumer boycotts, and a continued spike in policy uncertainty that is likely to depress capital spending by more than we had previously assumed. This baseline forecast still rests on our standing assumption that the effective U.S. tariff rate will rise by 15pp in total, which would now require a large reduction in the tariffs scheduled to take effect on April 9.

If most of the April 9 tariffs do take effect, then the effective tariff rate will rise by an estimated 20pp once those increases and likely sectoral tariffs take effect, even allowing for some country-specific agreements at a later date. If so, we expect to change our forecast to a recession.

In our current non-recession baseline, we expect the Fed to deliver a package of three consecutive 25bp insurance cuts starting in June (vs. July previously), lowering the funds rate to 3.5-3.75%. In a recession scenario, we would instead expect the Fed to cut by around 200bp over the next year. Our probability-weighted Fed forecast now implies 130bp of rate cuts this year (up from 105bp previously, reflecting the increase in our probability of recession), similar to market pricing as of Friday's close.

Making matters worse, President Turmp on Monday threatened to "impose ADDITIONAL Tariffs on China of 50%" unless Beijing withdraws a 34% retaliatory duty on U.S. goods (read full note: https://www.zerohedge.com/markets/futures-surge-europe-says-ready-negotiate-us

).

"If China does not withdraw its 34% increase above their already long term trading abuses by tomorrow, April 8th, 2025, the United States will impose ADDITIONAL Tariffs on China of 50%, effective April 9th," Trump posted on social media.

?itok=D2g-J_eM

?itok=D2g-J_eM

The president also said "all talks with China concerning their requested meetings with us will be terminated!"

"Negotiations with other countries, which have also requested meetings, will begin taking place immediately," he added

Additionally, Trump said that all talks with China will be terminated.

The takeaway: Frontloading by importers is subsiding and can exert deflationary pressure on the shipping industry. It also suggests broader growth drag and heightened recession risk. The question remains if Trump can solve trade disputes with top trading partners in a timely fashion.

https://cms.zerohedge.com/users/tyler-durden

Tue, 04/08/2025 - 06:55

https://www.zerohedge.com/markets/outlook-negative-here-goldman-finds-frontloading-party-over

The Great Globalists Invasion: These Titans Have Only One Goal - The Domination Of The Human Race Via Dictatorship

The Great Globalists Invasion: These Titans Have Only One Goal - The Domination Of The Human Race Via Dictatorship

https://madgewaggy.blogspot.com/2025/04/the-great-globalists-invasion-these.html

Half the developed world is walking blithely towards authoritarianism. Seeking change, citizens are voting against their best interests and allowing iconic democratic institutions to corrode.

?itok=FMsKL-vQ

?itok=FMsKL-vQ

There is still room for redemption, but hope is not a strategy. To prevent the rise of fascism, people need to use the very rights that are at risk. The right to free speech, the right to assembly. The right to vote. In theory, the right to bear arms is also meant to prevent the rise of tyranny. Unfortunately, a significant portion of society is too busy watching Netflix or worshiping false gods to prevent democracy’s demise.

As we saw in France over the past few months, we can use these rights to our benefit. Whether or not we choose to do so is to be determined. Sadly, once the threshold into authoritarianism is crossed redemption is no-longer a winning strategy.

It’s too early to know what the future holds, but in the following article I attempt to show what daily life in a dictatorship is like and how best to survive.

“Every day in the Gestapo, I saw how people had been broken by terror. I experienced myself how one was crunched by this machine. That is what was so monstrous about it. One was no longer human.”

– Victor Klemperer from his diaries “I Will Bear Witness: A Diary of the Nazi Years”

Life Under Authoritarian Rule

Authoritarian governments rule by fear. Broad top-down and grassroots surveillance is key to keeping the population on edge.

North Korea’s surveillance state is among the most extreme in the world. The regime employs a vast network of informants, and even private conversations are not safe from scrutiny. Citizens are required to attend weekly self-criticism sessions, where they must confess any perceived disloyalty. This constant surveillance ensures that any opposition – along with the dissenter’s entire family – is quickly identified and neutralized. The fear of imprisonment, torture, or execution is ever-present, as even minor infractions can lead to severe punishment.

In Nazi Germany, the secret police created a culture of fear by encouraging citizens to report any suspicious activities, even those of their friends and family. This tactic effectively turned people against each other and ensured a high level of compliance with the regime’s policies. As one German citizen recounted, “We lived in fear of being denounced by our neighbors, friends, even our own children.”

“We had all grown used to living in a state of permanent fear, and that was why we were always so short of time. Fear is the most time-consuming activity there is.”

– Nadezhda Mandelstam from “Hope Against Hope”

?itok=cd31-X2F

?itok=cd31-X2F

A key ingredient to creating fear is actual or perceived alienation. For authoritarian regimes, the alienation pre-planted using social means (with the threat of physical isolation). Alienation is manufactured by a combination of relentless censorship and propaganda, leaving dissenters to believe they are alone. For this reason, media control is essential to maintaining a dictatorship.

The Soviet Union, for example, tightly controlled the flow of information through state-run media outlets. Independent journalism was virtually nonexistent, and the government disseminated propaganda to shape public perception. Independent journalists and writers who dared to challenge the official narrative faced imprisonment or worse. The Soviet regime’s propaganda glorified the state and its leaders while demonizing perceived enemies. A Soviet citizen described the omnipresence of propaganda: “Everywhere we looked, we saw the state’s version of reality. There was no escape from it.”

Similarly, China’s Great Firewall restricts access to information from outside the country, ensuring that the population is exposed only to state-approved narratives. Social media platforms are closely monitored, and any content deemed subversive is swiftly removed. The Chinese Communist Party (CCP) employs sophisticated algorithms to censor dissent and promote its propaganda, creating a controlled information environment. This pervasive censorship stifles dissent and prevents the spread of alternative viewpoints.

Propaganda is a powerful tool for shaping public perception and maintaining control.

Nazi Germany’s Joseph Goebbels famously stated:

“If you tell a lie big enough and keep repeating it, people will eventually come to believe it. The lie can be maintained only for such time as the State can shield the people from the political, economic and/or military consequences of the lie. It thus becomes vitally important for the State to use all of its powers to repress dissent, for the truth is the mortal enemy of the lie, and thus by extension, the truth is the greatest enemy of the State.”