US International Trade Court Denies Companies' Bid To Block Trump's Tariffs

US International Trade Court Denies Companies' Bid To Block Trump's Tariffs

(emphasis ours),

The U.S. International Trade Court on April 22 denied a request by five U.S. small businesses to block President Donald Trump’s decision to impose tariffs on nearly all countries.

?itok=9OjMhXUy

?itok=9OjMhXUy

Liberty Justice Center filed the https://libertyjusticecenter.org/pressrelease/liberty-justice-center-seeks-a-temporary-restraining-order-in-lawsuit-challenging-liberation-day-tariffs/

on April 18 on behalf of the five owner-operated businesses that rely on imports, seeking a temporary restraining order to block the tariffs, which they alleged were unlawful.

In a brief two-page https://storage.courtlistener.com/recap/gov.uscourts.cit.17080/gov.uscourts.cit.17080.13.0.pdf

, the court’s three-judge panel declined to issue a restraining order on the grounds that the plaintiffs had not shown they would face irreparable harm if the tariffs were implemented.

The order states that a hearing on all then-pending motions related to the legal challenge is scheduled for May 13.

The Epoch Times reached out to the Liberty Justice Center and the White House for comment but received no response by publication time.

Trump announced a minimum 10 percent tariff on nearly all countries on April 2, along with steeper levies on about 60 nations identified as the “worst offenders” in trade imbalances with the United States, as part of an effort to curb unfair trade practices.

The Trump administration subsequently granted a 90-day pause to most countries to allow for negotiations, except for China, which faced tariffs of up to https://www.whitehouse.gov/fact-sheets/2025/04/fact-sheet-president-donald-j-trump-ensures-national-security-and-economic-resilience-through-section-232-actions-on-processed-critical-minerals-and-derivative-products/

“as a result of its retaliatory actions.”

In an April 18 courthttps://libertyjusticecenter.org/wp-content/uploads/010-VOS-Selections-Filed-Motion-for-TRO-PI.pdf

, the plaintiffs argued that the tariffs would harm their “reputation and goodwill to customers” by forcing them to raise prices, as their businesses rely on importing products from multiple countries.

One of the plaintiffs, MicroKits, an educational electronic kits maker, said that it may have to pause operations “in about seven weeks” once it runs out of parts, which it normally imports from China.

Other plaintiffs include alcohol company VOS Selections, sportfishing e-commerce business FishUSA, pipe maker Genova Pipe, and cycling apparel brand Terry Precision Cycling.

“These tariffs are devastating small businesses,” Jeff Schwab, a Liberty Justice Center lawyer representing the plaintiffs, said in a https://libertyjusticecenter.org/pressrelease/liberty-justice-center-seeks-a-temporary-restraining-order-in-lawsuit-challenging-liberation-day-tariffs/

. “We are asking the court to act swiftly to declare these tariffs unlawful and protect these businesses from further harm.”

Trump invoked the International Emergency Economic Powers Act (IEEPA), which allows the president to regulate international transactions in response to “an unusual and extraordinary threat” to national security, in introducing the tariffs.

The plaintiffs argued that the Trump administration’s justification for invoking the law does not meet the requirement of constituting an emergency or an extraordinary threat.

“In reality, Congress has not delegated any such power. IEEPA does not authorize the President to impose unilateral worldwide tariffs on any country he chooses at any rate he chooses,” they stated.

The lawsuit argued that the requirement for presidential action outlined in the IEEPA is not satisfied, as the United States’ trade deficit in goods with other countries does not constitute an emergency; this deficit has persisted for decades without resulting in economic harm, it said.

A key aim of Trump’s tariff policy is to reset global trade and encourage foreign governments to negotiate bilateral agreements that are more fair to the United States. Despite dozens of countries seeking bilateral deals with the United States, China had refused to negotiate and instead raised its tariffs on American goods to 125 percent.

In an April 2 executive order, Trump https://www.whitehouse.gov/presidential-actions/2025/04/regulating-imports-with-a-reciprocal-tariff-to-rectify-trade-practices-that-contribute-to-large-and-persistent-annual-united-states-goods-trade-deficits/

that the tariffs are necessary to bolster national security with regard to supply chains, noting that U.S. trading partners have engaged in “economic policies that suppress domestic wages and consumption, as indicated by large and persistent annual U.S. goods trade deficits.”

“Large and persistent annual U.S. goods trade deficits have led to the hollowing out of our manufacturing base; inhibited our ability to scale advanced domestic manufacturing capacity; undermined critical supply chains; and rendered our defense-industrial base dependent on foreign adversaries,” he stated.

Tom Ozimek contributed to this report.

https://cms.zerohedge.com/users/tyler-durden

Wed, 04/23/2025 - 14:25

Wildfire Scorches 8,500 Acres In New Jersey, Shuts Down Stretch Of Garden State Parkway

Wildfire Scorches 8,500 Acres In New Jersey, Shuts Down Stretch Of Garden State Parkway

A fast-moving wildfire in southern New Jersey has scorched more than 8,500 acres (3,440 hectares) of dense forest as of Tuesday night and was just 10% contained, according to the New Jersey Forest Fire Service. The wildfire has forced the closure of an 11-mile stretch of the Garden State Parkway and prompted the evacuation of thousands.

WILDFIRE UPDATE: Jones Road Wildfire - Ocean & Lacey Townships, Ocean County

New Jersey Forest Fire Service remains on scene of a wildfire burning in Ocean & Lacey Townships, Ocean County.

SIZE & CONTAINMENT

🔥 8,500 acres

🔥 10% contained https://t.co/6rN2Ku9e5N

— New Jersey Forest Fire Service (@njdepforestfire) https://twitter.com/njdepforestfire/status/1914873438793355709?ref_src=twsrc%5Etfw

More than 1,300 structures are threatened by the menacing wildfire raging across Ocean and Lacey Townships, about 90 miles south of New York City.

?itok=dabEzBdj

?itok=dabEzBdj

Dramatic footage of the wildfire has been posted on X:

A drive down the Garden State Parkway at 2:30 AM, as the Jones Road wildfire rages on in Ocean County, NJ.

The Garden State Parkway and Route 9 are now open in both directions.

The fire continues to burn thousands of acres, and threaten over 1,300 structures. https://t.co/K6Xqw9nVGf

— The Lakewood Scoop (@LakewoodScoop) https://twitter.com/LakewoodScoop/status/1914997603806101919?ref_src=twsrc%5Etfw

BREAKING: The Garden State Parkway has been closed in both directions from Exit 80 South to Exit 63 due an ongoing wildfire which began in Barnegat Township, New Jersey.

The fire has so far burned hundreds of acres and is 0% contained. Mandatory evacuations have been issued.… https://t.co/wlTqcB942U

— Shlomo Schorr (@OneJerseySchorr) https://twitter.com/OneJerseySchorr/status/1914787383608037642?ref_src=twsrc%5Etfw

Terrifying scenes in NJ as wildfire spreads https://t.co/iETSFTjH5y

— Breaking911 (@Breaking911) https://twitter.com/Breaking911/status/1914845516694716686?ref_src=twsrc%5Etfw

Large enough to see from space.

A wildfire ignites and rapidly grows in size in New Jersey. https://t.co/gHyL3jLabr

— CIRA (@CIRA_CSU) https://twitter.com/CIRA_CSU/status/1914805427105079793?ref_src=twsrc%5Etfw

Bloomberg cited satellite imagery data showing the wildfire is near the defunct Oyster Creek nuclear power plant, which was decommissioned in 2018.

Forest fires have been battering New Jersey and New York over the last year because of regional drought conditions.

According to U.S. Drought Monitor data, southern New Jersey has been plagued by a moderate drought.

?itok=GTUn7977

?itok=GTUn7977

Fire risks across South Jersey remain high on Wednesday.

https://cms.zerohedge.com/users/tyler-durden

Wed, 04/23/2025 - 14:05

Solid 5Y Auction Stops Through Despite Another Sharp Drop In Foreign Demand

Solid 5Y Auction Stops Through Despite Another Sharp Drop In Foreign Demand

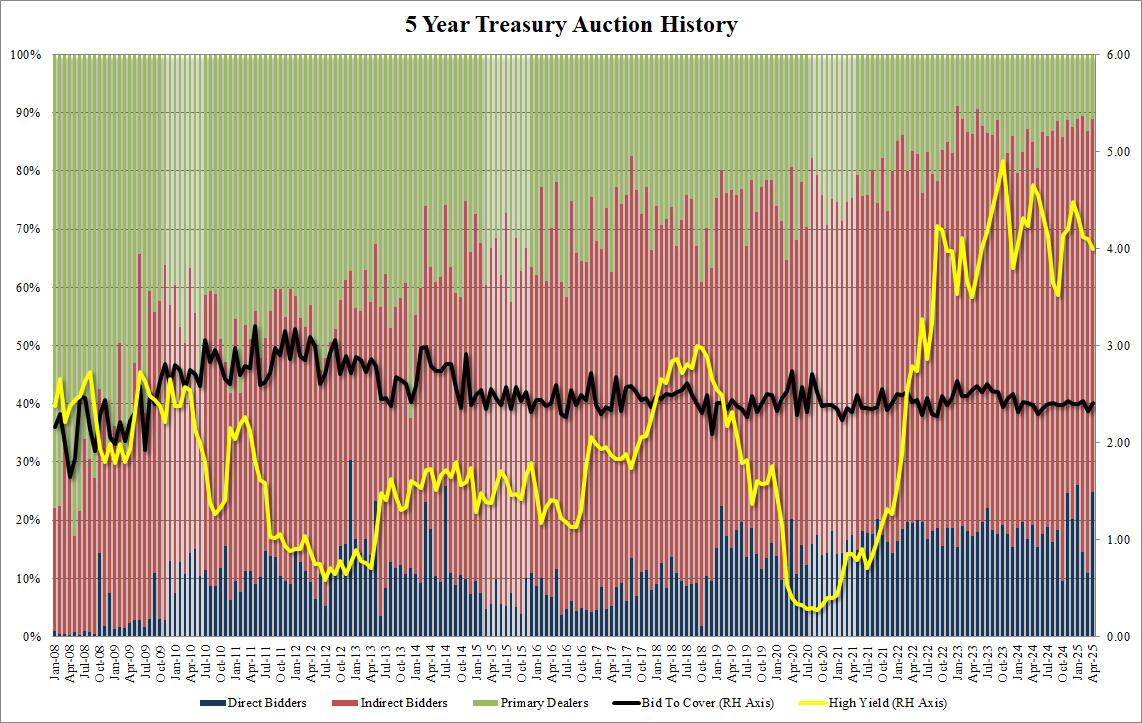

After yesterday's ugly 2Y auction saw a major drop in foreign demand, markets were worried that not only would today's sale of $70bn in 5Y paper be poor received, especially after the brutal whiplash which has seen 10Y yields tumble 10bps then spike right back up, but worse, foreign demand would be even scarcer. In the end, it wasn't quite so bad.

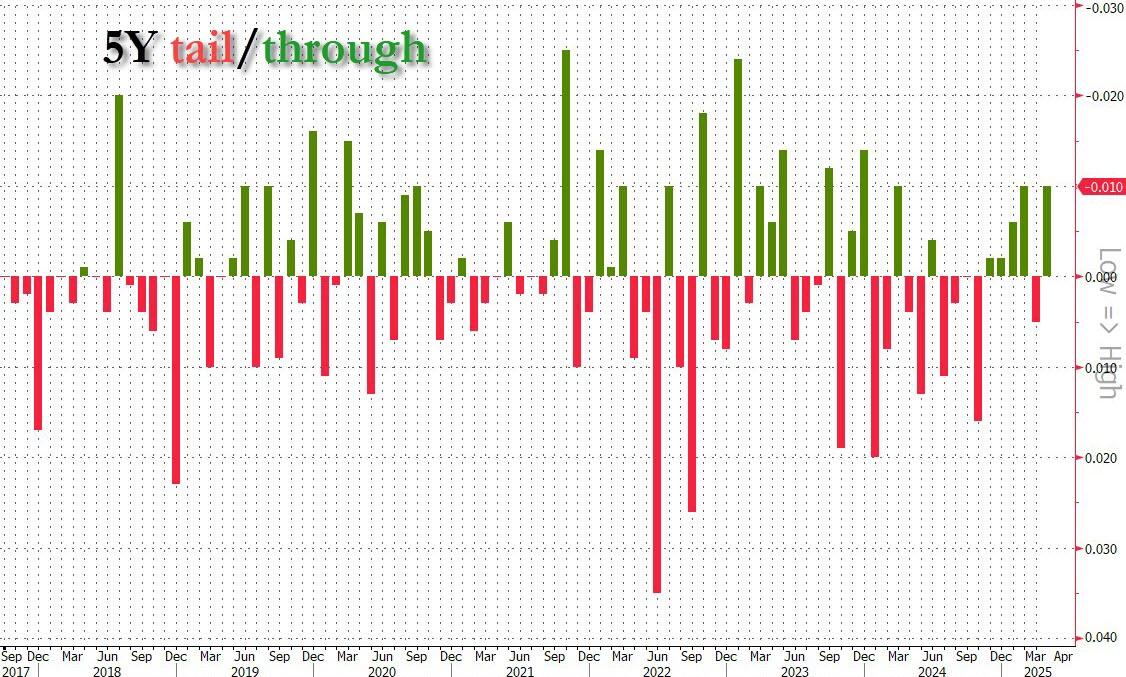

Starting at the top, the auction priced at a high yield of 3.995%, the first sub 4.0% 5Y auction since Sept (and thus, the first sub 4.00% coupon, specifically today's coupon was 3.875%), down from 4.10% last month, but the auction also stopped through the 4.005% When Issued by 1.0bp, the 5th stop through in the past 6 auctions.

?itok=d158soXK

?itok=d158soXK

The bid to cover was solid at 2.41, above last month's 2.33, and right on top of the 2.39 six-auction average.

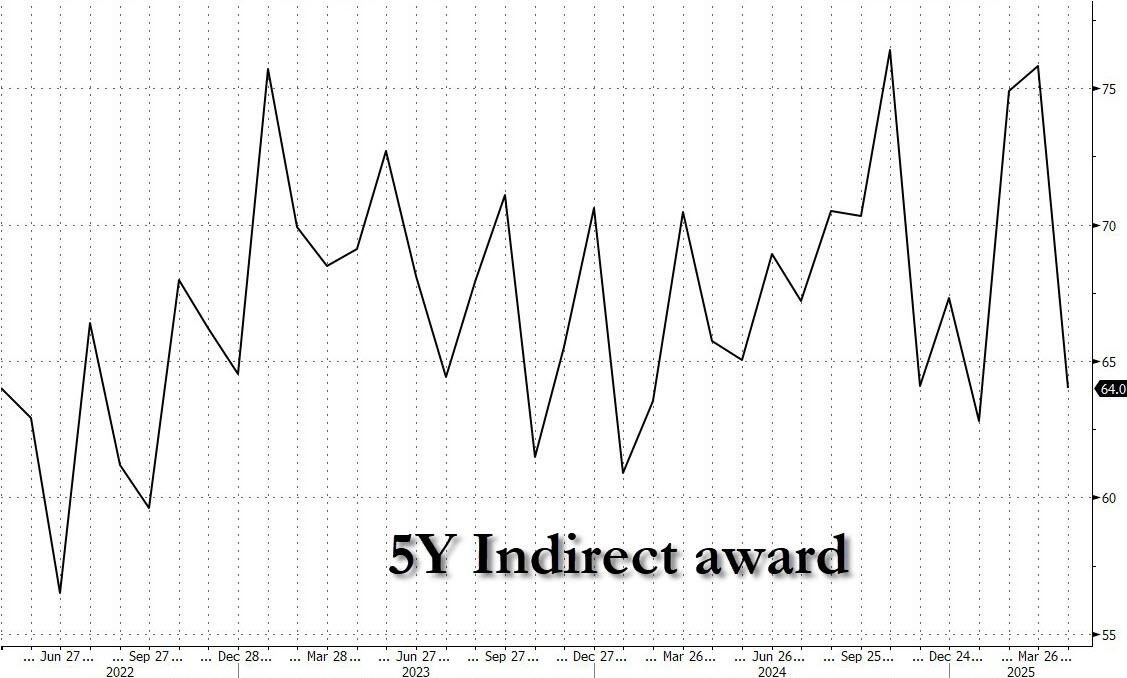

Like yesterday, it's the internals that were most interesting, but unlike yesterday, we did not see a painful tumble in the Indirect award as foreign bidders pulled out. Which is not to say there was a lot of them: the Indirect takedown dropped from 75.8% in March, one of the highest on record, to just 64.0%, low, but not outlandishly so, and in fact January's 62.8% was lower. So while foreigners were skittish, it wasn't as bad as yesterday.

?itok=xVagGzEK

?itok=xVagGzEK

And with Indirects sliding, Directs naturally jumped, from 11.0% to 24.8%, the highest since January, and one of the highest on record. The offset, Dealers, took down just 11.1%, down from 13.2% in March and one of the lowest on record.

?itok=3wRwNy7B

?itok=3wRwNy7B

Overall, this was a solid auction, and while indirects slumped, the drop was more modest than yesterday's jarring crash to a 2 year low. Still the market reaction showed some indigestion, and 10Y yield were last seen at 4.37% after dropping as low as 4.25% earlier.

https://cms.zerohedge.com/users/tyler-durden

Wed, 04/23/2025 - 13:28

"West Coast On Tipping Point": Los Angeles Port Set For Steep Drop In Traffic

"West Coast On Tipping Point": Los Angeles Port Set For Steep Drop In Traffic

The Trump administration is likely monitoring sliding scheduled import volumes at the Port of Los Angeles—the largest container port in the Western Hemisphere—amid President Trump's overnight remarks hinting at a https://www.zerohedge.com/market-recaps/futures-surge-after-trump-tones-down-rhetoric-china-powell

. The president's comments to ease trade tensions with Beijing come as scheduled import volumes at the LA Port indicate possible inbound trade disruptions on the horizon.

According to https://volumes.portoptimizer.com/

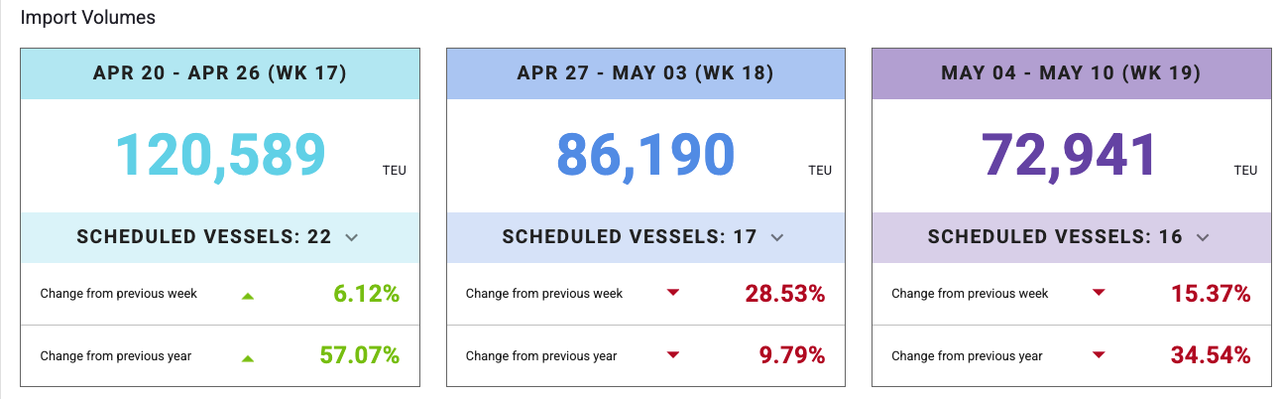

, a tracking system for vessel operators, scheduled import volumes for the LA Port for the week ending May 3 show a 38.53% week-over-week plunge. Year-over-year, the data shows a 9.79% decrease. For the week ending May 10, scheduled import volumes continued to slow, with a year-over-year change down around 35%.

?itok=u83_IlhU

?itok=u83_IlhU

We've closely monitored the fallout from the 145% tariffs on Chinese goods entering the U.S. for weeks, as trade disruptions ripple from China to the U.S. Now, it appears those disruptions are about to reach American West Coast ports.

Let's review what's transpired:

https://www.zerohedge.com/markets/amazon-cancels-orders-walmart-pulls-forecast-tariffs-take-hold

https://www.zerohedge.com/markets/chinese-sellers-amazon-panic-after-trumps-tariff-bazooka

https://www.zerohedge.com/markets/chinese-plastics-factories-face-mass-closure-us-ethane-disappears

"We are at a tipping point on the West Coast," Ken Adamo, chief of analytics at DAT Freight & Analytics, told https://www.cnbc.com/2025/04/22/busiest-us-ports-see-big-drop-in-chinese-freight-vessel-traffic.html

, adding, "Looking at how many truck loads are available versus trucks, we've seen a precipitous drop, over 700,000 loads have evaporated nationally in the past week compared to two weeks prior."

Falling scheduled import volumes at the LA Port coincide with a rise in canceled sailings.

More color from CNBC:

The vessel drop coincides with a rise in canceled sailings from ocean carriers on Pacific routes that include ports of Long Beach, Los Angeles, Oakland, and Seattle, according to an alert from Worldwide Logistics informing clients of blank sailings.

The Gemini alliance between Maersk and Hapag Lloyd has a cancellation rate of 24.39%; followed by the Ocean Alliance, comprising CMA CGM, Cosco Shipping, Evergreen, and OOCL, at 18%; and the Premier Alliance, comprising Ocean Network Express, Hyundai Merchant Marine, and Yang Ming Marine Transport, at 15%. MSC and ZIM currently have a 10% rate of canceled sailings.

Ocean carriers are trying to balance the pullback in orders resulting from the tariffs and the escalation of tensions in the trade war. CNBC recently reported a total of 80 blank, or canceled, sailings out of China as demand plummets and carriers suspend or adjust transpacific services.

Trump's possible de-escalation of the trade war also came after the IMF reported on Tuesday that tariffs had prompted it to slash https://www.zerohedge.com/markets/imf-slashes-global-gdp-forecasts-warns-trade-war-fallout-china-us

.

Probably what compelled the sudden shift from the top.

Another week or two of this, and you get empty shelves in the US. Actual COVID-style physical shortages. https://t.co/5m8v5KEvFK

— Gregory Brew (@gbrew24) https://twitter.com/gbrew24/status/1915048268314394854?ref_src=twsrc%5Etfw

. . .

https://cms.zerohedge.com/users/tyler-durden

Wed, 04/23/2025 - 13:25

https://www.zerohedge.com/economics/west-coast-tipping-point-los-angeles-port-set-steep-drop-traffic

If You Believe The Trump Pivot Story, "Clearly You Enjoy Fairy Tales"

If You Believe The Trump Pivot Story, "Clearly You Enjoy Fairy Tales"

By Michael Every of Rabobank

And They All Lived Happily Ever After(?)

Once again, an awful lot just happened, even by 2025 standards, and while some might be away with the faeries as a result, I still things as very Grimm.

As Tuesday saw the Wall Street Journal warn that the US Dow was heading for its worst April since the 1929 Great Depression, which fits the present zeitgeist, in Washington D.C. we got a flurry of developments:

President Trump said he doesn’t intend to fire Fed Chair Powell - which he can’t anyway. And he may not even want to if he could as it’s useful to have a scapegoat for anything that goes wrong. Markets loved the prospect of going back to a world where they can savagely criticize, and lean against, central bankers but elected officials can’t; let’s see if they proceed to price for the Fed cutting rates ahead in exactly the manner Trump was talking about.

Elon Musk floated that he’s about to step back from DOGE from next month, only spending time wielding a chainsaw a few days a week.

of US CEA Head Miran which claims there are no White House plans for capital controls (that he knows of).

The State Department is going to get a big shake-up to slim it down.

At Health and Human Services, RFK, Jr. is to ban artificial food dyes, also stating: “Sugar is poison, and Americans need to know that it is poisoning us.”

US Treasury Secretary Bessent side-briefed an investment bank that the trade stand-off with China is “unsustainable” --it’s a de facto embargo now after all-- and a deal would be struck soon, even if it will take 2-3 years for things to normalise. This saw stocks rip higher before the public heard about it --“Main Street not Wall Street”, right?-- though Bessent apparently also said much depended on China, not the US, moving.

The White House added a trade deal with China is going well, and Trump said the final tariff won’t be as high as 145% “because China will have to make a deal.” To a 60% tariff, once unthinkable but now looking reasonable by comparison? To voluntary export restraint?

The US said it’s received 18 trade proposals and has meetings with 34 others this week - all of whom will be told to deal less with China.

’ port fees now in place are so high they also decouple the US from Chinese-built vessels, with Chinese-cranes, containers, and chassis next in line. It’s full steam ahead for the trade war on that front.

Meanwhile, China asked South Korea not to export goods to US defense firms that contain its rare earths, and Vietnam and Korea clamped down on transshipment of Chinese goods to the US, showing sides are being taken. Expect more of that ahead.

’-- just not the ones prepared to match US offers of removing all regulatory barriers to trade-- as “Even the EU’s most protectionist countries are realizing that they need new friends to trade with as their oldest ally goes rogue.”

’. So, Europe will be importing a lot more then? Because nobody wants to replace exporting to the US with importing from the EU. In which case, Europe ‘replacing the US’ globally means taking on all its key weaknesses, such as trade deficits, with few of its strengths, such as energy, tech, and defence muscle.

In geopolitics, Russia proposed to freeze the invasion of Ukraine along current lines as part of a peace deal. Europe remains concerned that could lead to further concessions from the US would weaken Ukraine going forwards, and Kyiv has already rejected ceding Crimea to Russia. Is there really a happy ending there?

US and Israeli military preparations for a strike on Iran continue, as President Trump says he and Israeli PM Netanyahu are “on the same side of every issue.” Yet US-Iran nuclear talks are advancing quickly, with the two sides already exchanging drafts according to once source – and as Israel sees its outgoing equivalent of the FBI leaves an affidavit that the PM wanted him to spy on protestors and swear loyalty to him over the legal system. Some would argue that the last time the Middle East saw a happy ending was in ‘The Tales of the Arabian Nights’.

And sounding like one itself, the now suddenly ex-head of the WEF and his wife -- whom all the Liberal World Order’s great and good liked to hobnob with -- are under investigation for financial and ethical misconduct involving ATMs, private in-room massages at hotels, and luxury travel. I’m shocked that an organization as democratic, transparent, and accountable as the WEF, and which charges nearly $50 for a hotdog, might allegedly have seen misuse of funds like that. Some will be equally sure the next WEF head will Build Back Better.

So, where do we sit now? With stocks higher, key bond yields lower, DXY trending higher if off yesterday’s peak, and gold sharply lower if trying to rebuild momentum in early Asian trading.

But if you think that just because Trump said he isn’t going to fire Powell in an era in which the independence of central banks is going to be called into question by the demands of realpolitik; or because he said something nice about China and tariffs for the nth time as the world starts to divide along geopolitical lines; or because nuclear-armed Russia and nearly-nuclear-armed Iran are about to live happily ever after with the neighbours they have sworn to destroy,… well, clearly you enjoy fairy tales.

Sadly, we still have to achieve a new global security, financial, economic, and trading architecture to replace the old US-centric one that didn’t work well enough not to collapse. That will take us 1,001 nights, at least!

https://cms.zerohedge.com/users/tyler-durden

Wed, 04/23/2025 - 13:05

https://www.zerohedge.com/markets/if-you-believe-trump-pivot-story-clearly-you-enjoy-fairy-tales

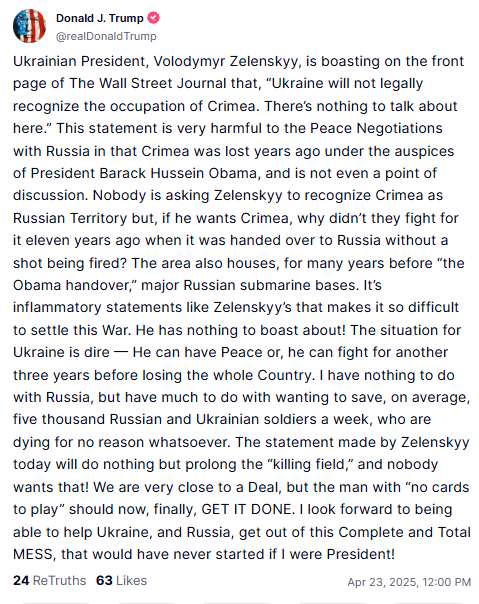

Round Two! Trump Excoriates Zelensky For Rejecting Crimea Proposal For Peace

Round Two! Trump Excoriates Zelensky For Rejecting Crimea Proposal For Peace

Trump vs. Zelensky Round Two? Tensions initially looked to have cooled after the Zelensky-Vance-Trump February 28 verbal blow-up and showdown at the Oval Office (see clip below), but the spat is heating up once again, and is fast getting personal.

President Trump has slammed President Zelensky in a Wednesday post on Truth Social, saying of the Ukrainian leader, "if he wants Crimea, why didn’t they fight for it eleven years ago when it was handed over to Russia without a shot being fired"... and "He can have Peace or, he can fight for another three years before losing the whole Country."

The fiery denunciation appears in direct response to Zelensky the day prior rejecting Washington demands that Ukraine be ready to formally recognize Russian sovereignty over Crimea. Trump continued, "It's inflammatory statements like Zelenskyy’s that makes it so difficult to settle this War. He has nothing to boast about!"

?itok=egy1UU6H

?itok=egy1UU6H

The White House has this week been making it clear that the United States is ready to walk away from the peace process if it doesn't have willing partners. All of this pressure seems aimed squarely at Kiev, given also Vice President Vance's Wednesday remarks while in India.

"We’ve issued a very explicit proposal to both the Russians and the Ukrainians, and it’s time for them to either say yes or for the United States to walk away from this process," Vance told the press pool while on the trip. "The only way to really stop the killing is for the armies to both put down their weapons, to freeze this thing and to get on with the business of actually building a better Russia and a better Ukraine." Freezing the war now would certainly give Russian forces a huge advantage, given the immense territory in the East they now hold.

Trump in the fresh social media post further demanded that now is the time to "GET IT DONE" - referring to achieving a lasting settlement. And he coupled this with another swipe at Zelensky, saying the man has "no cards to play" - which has been a US admin theme going back to February.

"I look forward to being able to help Ukraine, and Russia, get out of this Complete and Total MESS, that would have never started if I were President!" - Trump concluded in the post.

Trump is clearly not happy in the wake of Zelensky's Tuesday remarks wherein he asserted that Ukraine will not legally recognize Russia's occupation of Crimea under any circumstances,

"There is nothing to talk about. This violates our Constitution. This is our territory, the territory of the people of Ukraine," Zelensky https://www.youtube.com/watch?v=xnLsfFwkiaE

.

But Trump is now calling this out as essentially BS - saying that no, this is the very thing in question that must be talked about if the war is to end. On a practical level, Russia is never going to give up Crimea regardless, given it has long been the historic home of the Russian Navy's Black Sea fleet, and has an overwhelming Russian-speaking population.

This was "Round One"...

.https://twitter.com/VP?ref_src=twsrc%5Etfw

— Rapid Response 47 (@RapidResponse47) https://twitter.com/RapidResponse47/status/1895527936939487722?ref_src=twsrc%5Etfw

Will Zelensky respond to this latest dressing down by Trump? His PR handlers are likely urging him not to. The last time this happened in the wake of Zelensky's visit to the White House, the US cut off weapons supplies and intelligence-sharing to Kiev for several days. But this spat and sparring could blow up further yet. Zelensky expressed hope that he could meet with Trump while in Rome for the Pope's funeral on Saturday, but this is now looking less likely.

https://cms.zerohedge.com/users/tyler-durden

Wed, 04/23/2025 - 12:50

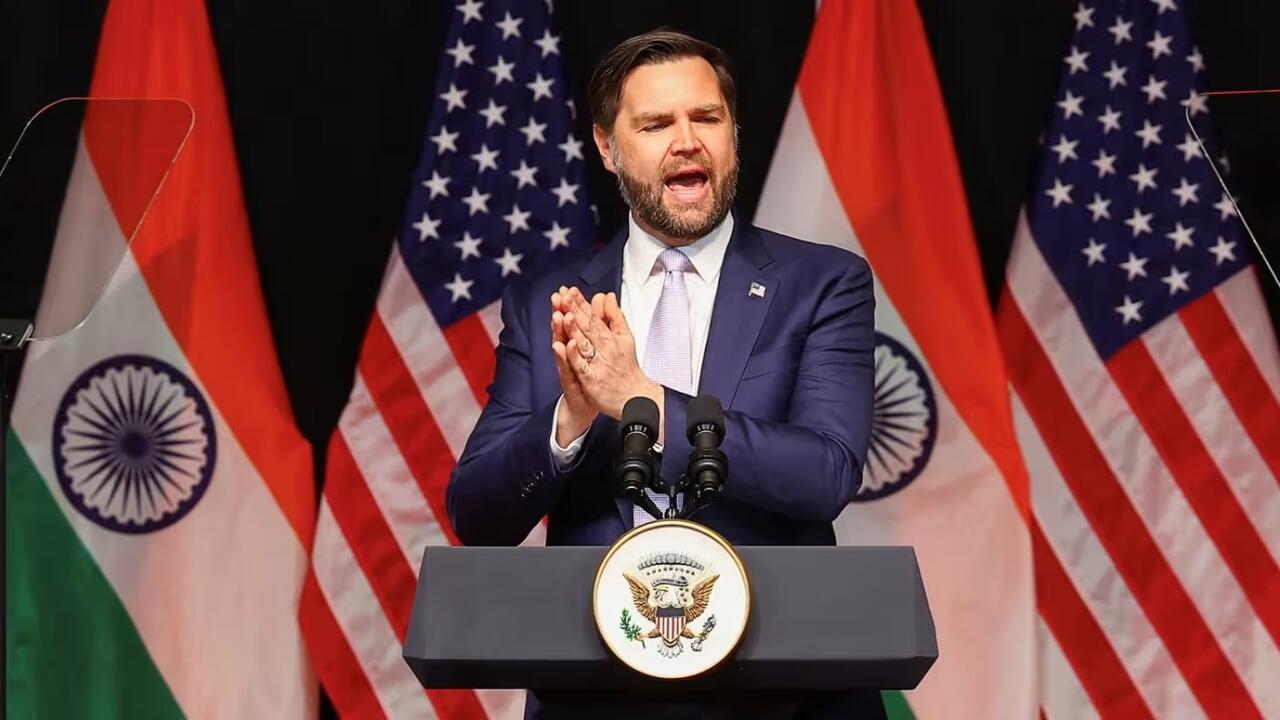

Vance Ramps Up Pressure On Ukraine With Peace Plan That 'Sharply Favors Russia'

Vance Ramps Up Pressure On Ukraine With Peace Plan That 'Sharply Favors Russia'

Vice President JD Vance while traveling in India on Wednesday issued some new and provocative remarks on the prospect of Ukraine peace, and Washington's demands related to ending the war.

The NY Times headlined is coverage of Vance's new remarks by somewhat disparagingly https://www.nytimes.com/2025/04/23/world/europe/ukraine-cease-fire-talks-london.html

"Plan for Ukraine That Sharply Favors Russia" — given that it calls for 'freezing' the front lines, which would leave Russian forces in control of the majority of the Donbass region in Eastern Ukraine.

The Vice President reiterated to reporters that the United States would "walk away" from engaging in a peace process if both Ukraine and Russia refused to accept the American terms. The NY Times concludes, "But President Volodymyr Zelensky of Ukraine was clearly the target."

?itok=a0RE9TYb

?itok=a0RE9TYb

"We’ve issued a very explicit proposal to both the Russians and the Ukrainians, and it’s time for them to either say yes or for the United States to walk away from this process," Vance told the press pool. "The only way to really stop the killing is for the armies to both put down their weapons, to freeze this thing and to get on with the business of actually building a better Russia and a better Ukraine."

Here is the brief list of basics that Washington is demanding for its outline of peace:

—a "freeze" of territorial lines in the three-plus year war

—no path to NATO membership for Ukraine

—formal recognition of Russia holding Crimea

But it was only yesterday that Ukraine's President Zelensky said he has rejected the possibility of ceding over Crimea, after the Trump administration reportedly offered this 'gift' to Putin of US recognition of Russian sovereignty over the strategic peninsula which has long been home to the Russian navy's Black Sea fleet.

According to Ukrainian https://kyivindependent.com/zelensky-rules-out-recognizing-crimea-as-russian-warns-against-legitimizing-putins-game/

:

Ukraine will not legally recognize Russia's occupation of Crimea under any circumstances, President Volodymyr Zelensky said during a briefing in Kyiv on April 22.

"There is nothing to talk about. This violates our Constitution. This is our territory, the territory of the people of Ukraine," Zelensky https://www.youtube.com/watch?v=xnLsfFwkiaE

.

Zelensky added, "As soon as talks about Crimea and our sovereign territories begin, the talks enter the format that Russia wants - prolonging the war - because it will not be possible to agree on everything quickly."

Kiev has also recently accused Moscow of using negotiations as a smokescreen, also coming off the 30-hour Easter truce, which saw both sides accuse the other of many violations.

Commenting further of Vance's fresh remarks, the https://www.nytimes.com/2025/04/23/world/europe/ukraine-cease-fire-talks-london.html

writes, "It was the first time a U.S. official had publicly laid out a cease-fire deal in such stark terms and the comments appeared designed to increase pressure on Ukraine, which has long refused to accept Russia’s claims on its lands, particularly in Crimea."

Ukraine is meanwhile telling its Western backers that it is "ready to negotiate, but not to surrender." According to fresh words of Ukraine’s vice PM Yulia Svyrydenko, "There will be no agreement that hands Russia the stronger foundations it needs to regroup and return with greater violence. A full ceasefire—on land, in the air, and at sea—is the necessary first step. If Russia opts for a limited pause, Ukraine will respond in kind."

JD Vance threatens to abandon Russia, Ukraine peace negotiations with Trump’s ‘final offer’ on the table https://t.co/AmTiuQMyHt

— New York Post (@nypost) https://twitter.com/nypost/status/1915052057754570814?ref_src=twsrc%5Etfw

Something like this was just tried as part of the 30-hour Easter ceasefire, with apparent limited success. But Svyrydenko also hit back at Washington, https://x.com/ChristopherJM/status/1915016930932502776

:

—Open to negotiations, but not surrender

—No deal to allow Russia to regroup for future aggression

—Full ceasefire (land, air, sea) required as first step

—No “frozen conflict” masked as peace

—No Ukraine recognition of Crimea as Russian

—If no NATO membership, must get strong, binding security guarantees

The reality remains that if Zelensky can't so much as admit that Crimea will be permanently in Russia's hands, with no hope of Kiev ever getting it back, the prospect of a peace settlement happening anytime soon seems very remote. Moscow has made clear it will never give Crimea over to Ukraine, after the 2014 referendum, and most Western officials recognize this as a reality as well.

This is why the White House is willing to let go of Ukrainian claims on Crimea as well, given it is a realistic first step and major, pragmatic concession toward potentially ending the conflict.

https://cms.zerohedge.com/users/tyler-durden

Wed, 04/23/2025 - 12:20

https://www.zerohedge.com/geopolitical/vance-ramps-pressure-ukraine-peace-plan-sharply-favors-russia

High-Level Ukraine Peace Talks Scrapped After Rubio, Witkoff Pull Out Last Minute

High-Level Ukraine Peace Talks Scrapped After Rubio, Witkoff Pull Out Last Minute

US Secretary of State Marco Rubio was expected to lead a high-level American delegation for more Ukraine peace consultations among allies in London on Wednesday. But in the latest sign that White House patience is wearing thin, the American delegation became a no-show.

"European diplomats pulled the plug on high-level talks set for Wednesday about ending Russia’s war in Ukraine after top US diplomats abruptly canceled plans to attend," https://www.washingtonpost.com/world/2025/04/23/ukraine-war-london-peace-talks-rubio/

reports.

?itok=8PDlN4P5

?itok=8PDlN4P5

Now there will only be lower-level talks, and a planned foreign minister's meeting has been scrapped due to Rubio's absence. All this highlights the clear rift between Washington and European partners, which has seen the US side push the idea of offering Russia recognition of its sovereignty over Crimea.

Ukraine has instead wanted to "discuss a complete ceasefire first and everything else later" - according to an official quoted in The Washington Post.

British Foreign Secretary David Lammy was supposed to host his peers, but will now merely "drop in" during lower level talks, according to the report. "The foreign minister-level meeting isn’t happening," an unnamed diplomat told the Post.

"We’re hopeful as per the Rubio tweet that a meeting in London can happen soon, but without Witkoff, the secretary of state, the French and German foreign ministers, there’s no reason for the foreign secretary to chair," the diplomat said.

According to more travel details from https://www.washingtonpost.com/world/2025/04/23/ukraine-war-london-peace-talks-rubio/

:

U.S. Secretary of State Marco Rubio had been scheduled to fly to London on Tuesday night but canceled those plans midday. Steve Witkoff, a special envoy and close ally of President Donald Trump central to White House efforts to broker an end to the war, also dropped out. He will head to Moscow this week, according to the Russians.

Likely these optics of Witkoff going to Moscow instead of London will be seen by Kiev as further evidence it is losing its number one ally and supplier of weapons and intelligence.

And Vice President JD Vance while on a planned trip to India Wednesday reiterated the White House stance, saying "We’ve issued a very explicit proposal to both the Russians and the Ukrainians, and it’s time for them to either say yes or for the United States to walk away from this process."

He continued in the remarks to reporters while visiting the Taj Mahal, "We’re going to see if the Europeans, the Russians and the Ukrainians are ultimately able to get this thing over the finish line."

Rubio and Witkoff will not be attending the London talks with Ukraine and European leaders. Kellogg will attend.

Yesterday Zelensky appeared to reject the Crimea recognition part of Kellogg's plan.

Kellogg's plan is going down in flames, and he will take the L. Rubio and… https://t.co/kXd4LgMjlt

— Alex Christoforou (@AXChristoforou) https://twitter.com/AXChristoforou/status/1914939158922989636?ref_src=twsrc%5Etfw

The suggestion is that both sides would have to give up territories they control, and make mutual compromises, but still it's clear that Russia is in the driver's seat on the battlefield - having just this week also regained nearly all of Kursk territory, leaving Zelensky with no leverage there.

Ukraine has said it's open to negotiations "but not to surrender". President Putin has meanwhile in a surprise move reportedly offered to https://www.zerohedge.com/geopolitical/putin-offers-freeze-ukraine-invasion-along-current-front-line-report

- or freeze it in place - for the sake of achieving peace; however, he would likely want major concessions from the West in return, starting with international recognition of Crimea as under Russia. And any 'freeze' of current lines leaves Russia in control of most of the Donbass region.

https://cms.zerohedge.com/users/tyler-durden

Wed, 04/23/2025 - 11:45

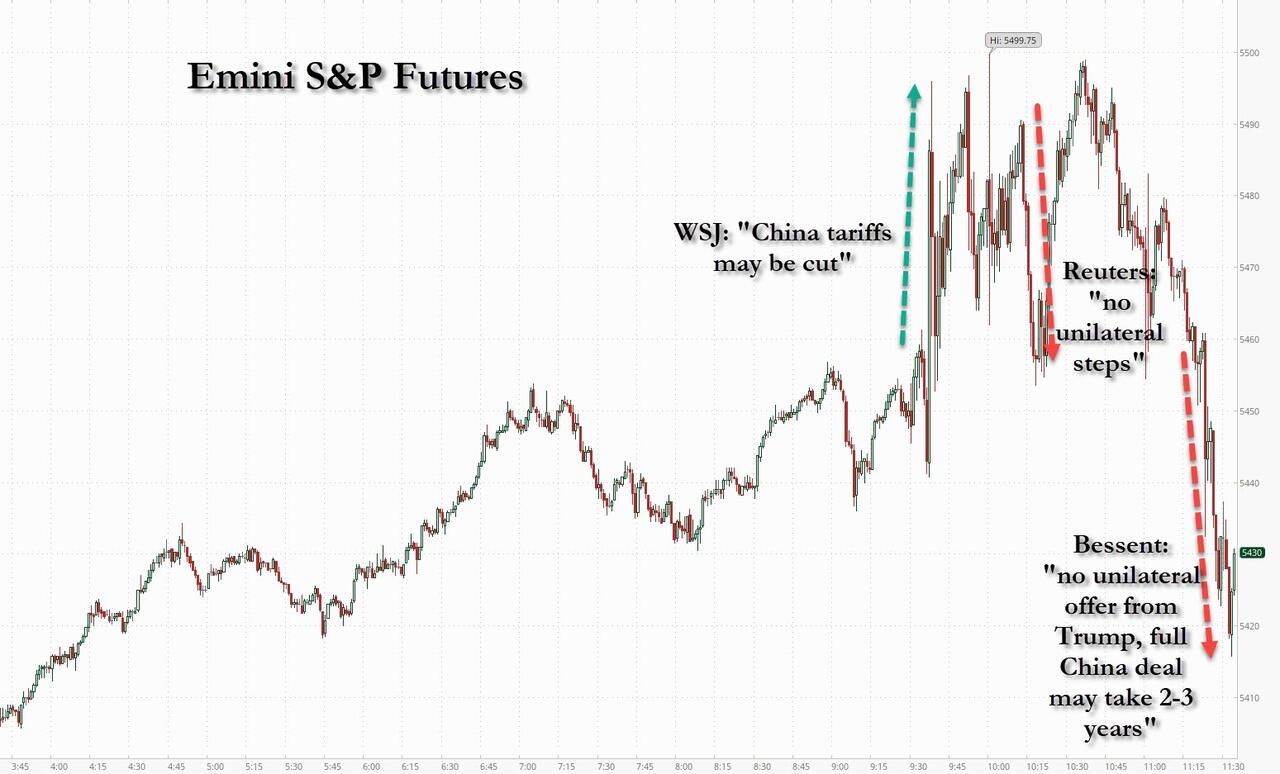

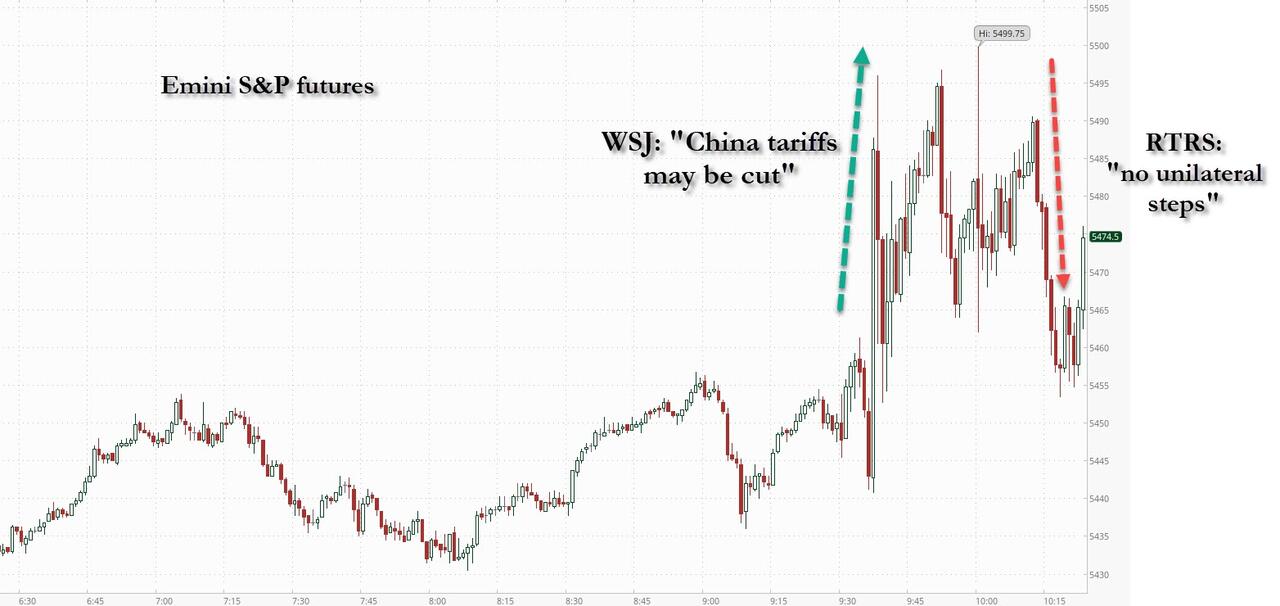

Stocks Slide After Bessent Confirms "No Unilateral Offer" From Trump To Cut China Tariffs

Stocks Slide After Bessent Confirms "No Unilateral Offer" From Trump To Cut China Tariffs

Update (11:30am ET): Much of the day's gains were erased moments ago, when in a follow up report seeking to undo the early post-WSJ exuberance, Reuters reported that Bessent said "no unilateral offer from Trump" to cut China tariffs (suggesting that Trump was hardly capitulating), and that a full China trade deal could take 2 to 3 years. In other words, all Reuters did was echo what was reported yesterday, but the algos had already forgotten it, and unleashed sell programs.

Some more details from the Reuters report:

Both US and China are waiting to speak to the other both sides see current tariff situation is unsustainable.

Declines to comment on WSJ story on lowering tariffs on China, but would not be surprised if they went down in a mutual way.

China situation needs to be de-escalated for trade talks to proceed. US-China tariffs will likely have to come down for trade negotiations to talk, rates are unsustainable.

Does not have time frame for start of China talks and will have to take place at lower levels than Trump and Xi.

Tariff negotiations will not be an continued process at all.

US-Japan trade talks do not have specific currency targets and expects Japan to honor G7 agreements on FX.

The result was an immediate resumption slam of risk, with spoos sliding almost 100 points from session highs of 5500 high at 1030am ET, and back to opening levels.

?itok=ubAJ8dzB

?itok=ubAJ8dzB

Meanwhile, the US 10y yield is now down just 6.5bp at 4.33% after touching 4.25% earlier. EURUSD is seeing little reaction to the latest Bessent headline, trading down 0.4%.

* * *

Update (10:15am ET): Just minutes after the WSJ report (below) sparked another boost to stocks shortly after the close, Reuters has poured cold water on risk sentiment reporting that any tariff cuts would only take place pending talks with Beijing and would not be unilateral but in conjunction with China talks:

WHITE HOUSE WOULD LOOK AT LOWERING TARIFFS ON CHINESE IMPORTS PENDING TALKS WITH BEIJING

ANY STEPS WOULD BE IN CONJUNCTION WITH CHINA TALKS, NOT UNILATERAL -SOURCE

Following the Reuters note, stocks promptly reversed the earlier gains on the much more cheerful WSJ report which sounded as if Trump was willing to capitulate.

?itok=IdUzVYjz

?itok=IdUzVYjz

Earlier:

Stocks are spiking higher, and extending premarket gains, after the https://www.wsj.com/politics/policy/white-house-considers-slashing-china-tariffs-to-de-escalate-trade-war-6f875d69?mod=hp_lead_pos1

that the Trump administration is considering slashing its steep tariffs on Chinese imports - in some cases by more than half -in a bid to de-escalate tensions with Beijing that have roiled global trade and investment, according to people familiar with the matter.

According to the report, China tariffs were likely to come down to between roughly 50% and 65%, about half of their current levels. The administration is also considering a tiered approach similar to the one proposed by the House committee on China late last year: 35% levies for items the U.S. deems not a threat to national security, and at least 100% for items deemed as strategic to America’s interest. The bill proposed phasing in those levies over five years.

In retrospect, the WSJ report said nothing new - and appears to be an attempt to merely stay in the newsflow - after Trump said Tuesday he was willing to cut tariffs on Chinese goods, saying the 145% tariffs he imposed on China during his second term would come down. “But it won’t be zero,” he said. The announcement sent stocks surging afterhours.

On Wednesday, China signaled it was open to trade talks with the U.S., though Beijing warned it wouldn’t negotiate under continued threats from the White House. In China’s policymaking circles, Trump’s comments Tuesday were viewed as a sign of him folding, the WSJ reported citing people who consult with Chinese officials said.

The expressions of openness to a deal from both sides represent a shift from much of the past month, as the world’s two largest economies exchanged reciprocal tariff increases and testy words, helping push stock markets around the world to their worst weeks in many years.

President Trump hasn’t made a final determination, the people said, adding that the discussions remain fluid and several options are on the table.

Separately, and at almost the exact same time, the https://www.wsj.com/economy/trump-jerome-powell-fed-e8f8f98b?mod=hp_lead_pos2

in on the other key topic du jour, namely the "explanation" why Trump decided not to fire Jerome Powell - as Trump also revealed he would not do yesterday. According to the WSJ, the White House had engaged lawyers to see how Chair Powell could be removed from office. However, Treasury Secretary Bessent and Commerce Secretary Lutnick are said to have stepped in and raised concerns about the market implications of such a move. Some more details:

As Trump’s criticism of the Fed chair ramped up over the last week, White House lawyers privately reviewed legal options for attempting to remove Powell, including whether they could do so for “cause,” according to people familiar with the matter. The laws that created the Federal Reserve say Fed governors can only be removed before their term ends for cause, which courts have generally interpreted to mean malfeasance or impropriety. Finding a pretext for dismissing Powell would have edged the White House closer to a dramatic escalation with the central bank.

Those discussions came to a halt early this week when Trump told his senior aides that he wouldn’t try to oust Powell. His decision came after interventions from Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick, who warned Trump that such a move could trigger far-reaching market chaos and a messy legal fight, the people said. Lutnick also told the president that efforts to fire the Fed chair likely wouldn’t lead to any practical change on interest rates because other members of the Fed’s board would likely approach monetary policy similarly to Powell, one of the people said.

While there was nothing actually new in the WSJ reports, they validated the good news that had pushed stocks up sharply higher overnight, and the result was further gains this morning which sent the S&P up more than 3% and fast approaching the first key CTA buy trigger around 5460.

?itok=D7SGV3Ob

?itok=D7SGV3Ob

https://cms.zerohedge.com/users/tyler-durden

Wed, 04/23/2025 - 11:42

Oklo In Talks To Supply Energy To OpenAI, Prompting Sam Altman To Step Down

Oklo In Talks To Supply Energy To OpenAI, Prompting Sam Altman To Step Down

OpenAI CEO Sam Altman has stepped down as chair of nuclear start-up Oklo to avoid a conflict of interest ahead of potential energy supply talks between the two companies, https://www.ft.com/content/a511bae0-d19f-4ebd-9520-69d3f89d8556

.

Altman, an early investor in Oklo since 2015, will be replaced immediately by CEO and co-founder Jacob DeWitte.

Oklo’s leadership team remains robust. CEO Jacob DeWitte, with a background in nuclear engineering, and COO Caroline Cochran, a longtime advocate for nuclear innovation, co-founded the company.

The board includes Daniel Poneman, former U.S. Deputy Secretary of Energy; Michael Thompson, a finance and tech investor; retired Lt. Gen. John Jansen, offering military and leadership insight; and Michael Klein, with deep governance and financial experience.

The move comes as AI firms scramble to secure low-carbon, high-output energy sources to power next-generation models. OpenAI’s energy demands are expected to soar, especially with the launch of its $500 billion Stargate data center project in partnership with SoftBank.

The https://www.ft.com/content/a511bae0-d19f-4ebd-9520-69d3f89d8556

says that while Oklo has yet to secure regulatory approval or formal partnerships, a deal with OpenAI would mark another step in the growing trend of direct agreements between tech firms and small modular reactor (SMR) developers.

?itok=P4q_uZRG

?itok=P4q_uZRG

SMRs—advanced nuclear plants under 300 megawatts—are drawing rising interest, with companies like Amazon, Microsoft, and Rolls-Royce backing the sector. Since early 2024, developers including Oklo, X-energy, and Newcleo have raised over $1.5 billion. Oklo has been one of our favorite names at Zero Hedge to watch.

Altman, also a major investor in nuclear fusion company Helion, has faced scrutiny over his many ventures. His complex financial ties were cited during his brief ouster from OpenAI’s board in 2023. After reinstating him, the company pledged to tighten its conflict-of-interest policies.

“Fission is an essential solution for meeting the growing energy demands of artificial intelligence. As Oklo explores strategic partnerships to deploy clean energy at scale, particularly to enable the deployment of AI, I believe now is the right time for me to step down,” Altman said.

At the same time, https://spectrum.ieee.org/small-modular-reactor-united-states

, the U.S. Department of Energy is offering $900 million to help small modular reactors (SMRs) move from blueprint to build. Originally launched in October 2024, the program was revised last month to match President Trump’s energy agenda—removing community benefit requirements and giving equal weight to technical and commercial factors.

Applications are due April 23. The funding targets advanced Generation III+ reactors that use light water as coolant and low-enriched uranium fuel. Each design must generate 50–350 megawatts, emphasize factory-based construction, and aim for deployment in the 2030s with enhanced safety and efficiency.

Despite heavy global investment, no SMR project has broken ground in the U.S., with many stalled or canceled. Canada and China are further along, but still lack operational models.

The DOE’s streamlined program demands near-term deployment plans, putting SMRs to a long-awaited test: can they finally break out of the prototype phase?

https://cms.zerohedge.com/users/tyler-durden

Wed, 04/23/2025 - 11:10

https://www.zerohedge.com/markets/oklo-talks-supply-energy-openai-prompting-sam-altman-step-down

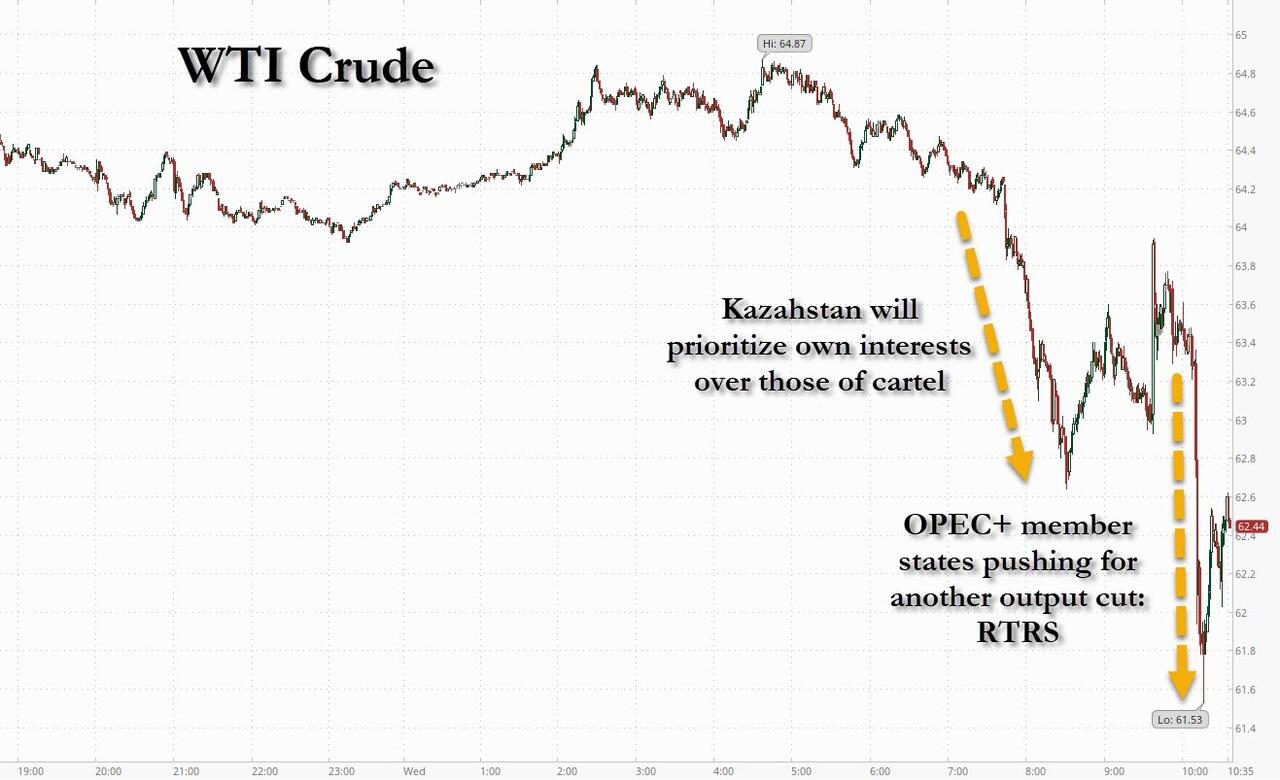

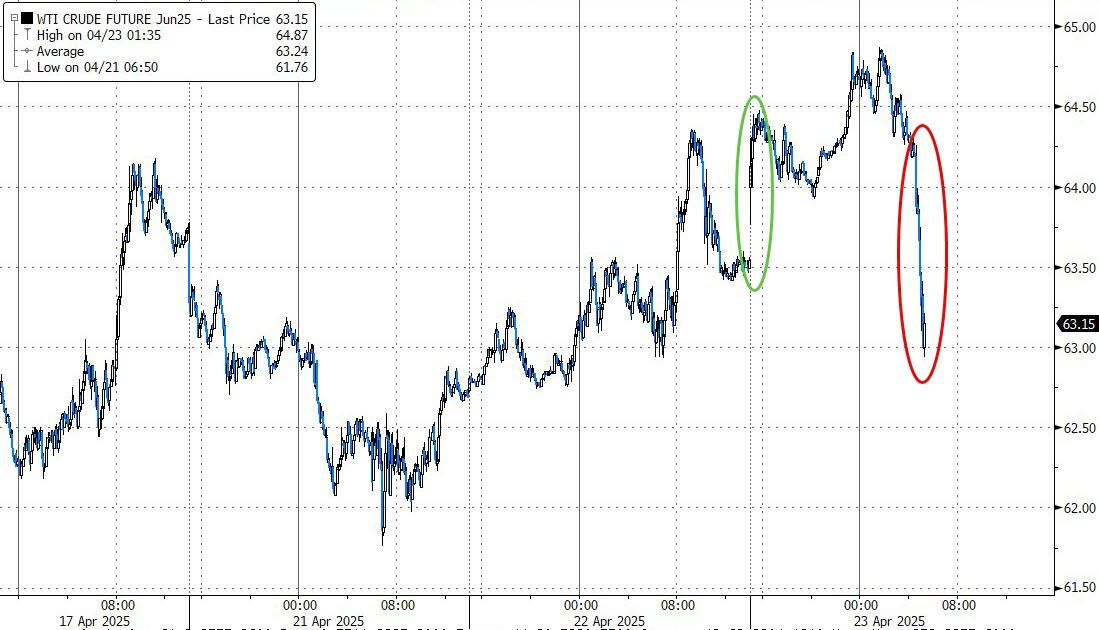

WTI Prices Tumble As Official Crude Inventory Data Disappoints, Production Remains Near Record Highs

WTI Prices Tumble As Official Crude Inventory Data Disappoints, Production Remains Near Record Highs

Overnight gains on the heels of across the board inventory draws reported by API (and some optimism on easing China tensions) have been dashed this morning after https://www.zerohedge.com/energy/oil-prices-drop-kazakh-chaos-threatens-opec-alliance

But for now, all eyes are on the official data...

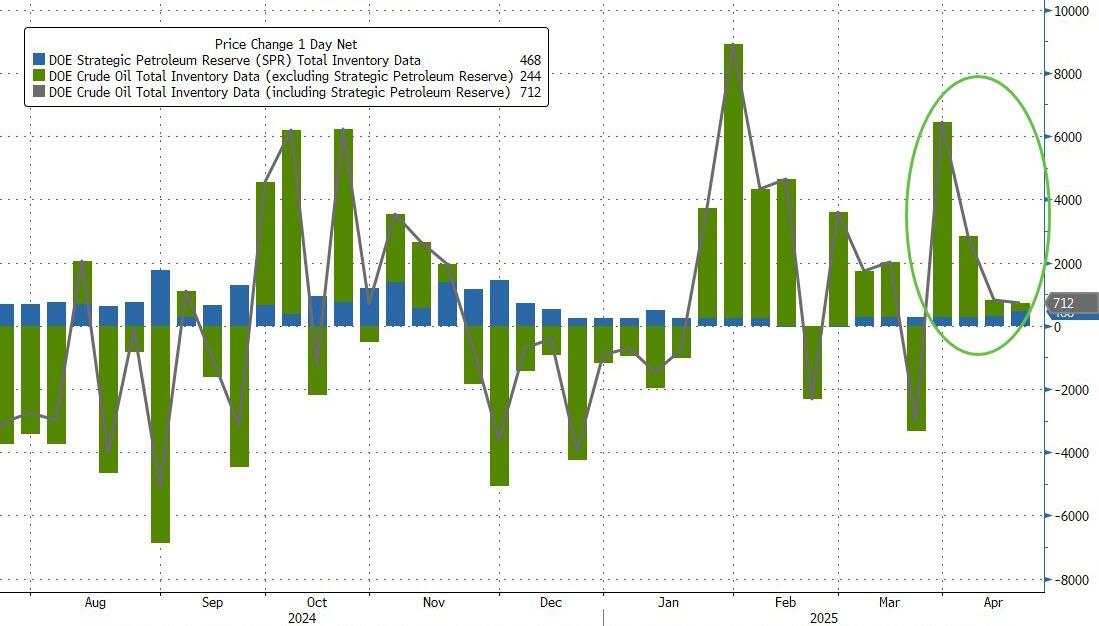

API

Crude: -4.57mm

Cushing: -354k

Gasoline: -2.18mm

Distillate: -1.64mm

DOE

Crude: +244k

Cushing: -86k

Gasoline: -4.476mm

Distillate: -2.35mm

The official data was considerably worse than API's with DOE reporting a small crude build vs API's big draw. Products did see major drawdowns...

?itok=AW_I224l

?itok=AW_I224l

Source: Bloomberg

Imports of Canadian crude oil fell for the third consecutive week to 3.3 million barrels a day. The decline is partly explained by the weeklong outage of the Keystone pipeline, the conduit that delivers supplies from the oil sands to US refineries. The drop-off weighed on overall crude imports into the US.

Gasoline imports climbed to the highest since August as we gear up for summer driving season.

Total US crude stocks rose for the fourth week helped by the addition of 468k barrels to the SPR...

?itok=G1Q5KS4B

?itok=G1Q5KS4B

Source: Bloomberg

US Crude production remains near record highs...

?itok=RFZ_fQOp

?itok=RFZ_fQOp

Source: Bloomberg

WTI prices are tumbling following the OPEC comments...

?itok=_rNda9R8

?itok=_rNda9R8

Earlier this month the Organization of the Petroleum Exporting Countries and its allies unexpectedly announced plans to hike output at three times the pace previously expected in May. That move was designed to keep perennial overproducers like Kazakhstan in line with their targets, and Saudi Arabia’s energy minister said at the time the hike would be just an “aperitif” if those countries didn’t improve their performance.

“The comment about ‘own interest’ is new to me,” said Arne Lohmann Rasmussen, chief analyst at A/S Global Risk Management.

“It underlines that OPEC+ has some tough quarters ahead with the global economy/demand under pressure from the trade-war. Certainly not bullish for oil.”

The comments raise fresh concerns about whether OPEC+ will continue to press ahead with a faster-than-expected pace of output hikes in the coming months. That could add supplies to a market that has been relatively strong in the short-term, but that analysts widely expect to be oversupplied later this year.

https://cms.zerohedge.com/users/tyler-durden

Wed, 04/23/2025 - 10:47

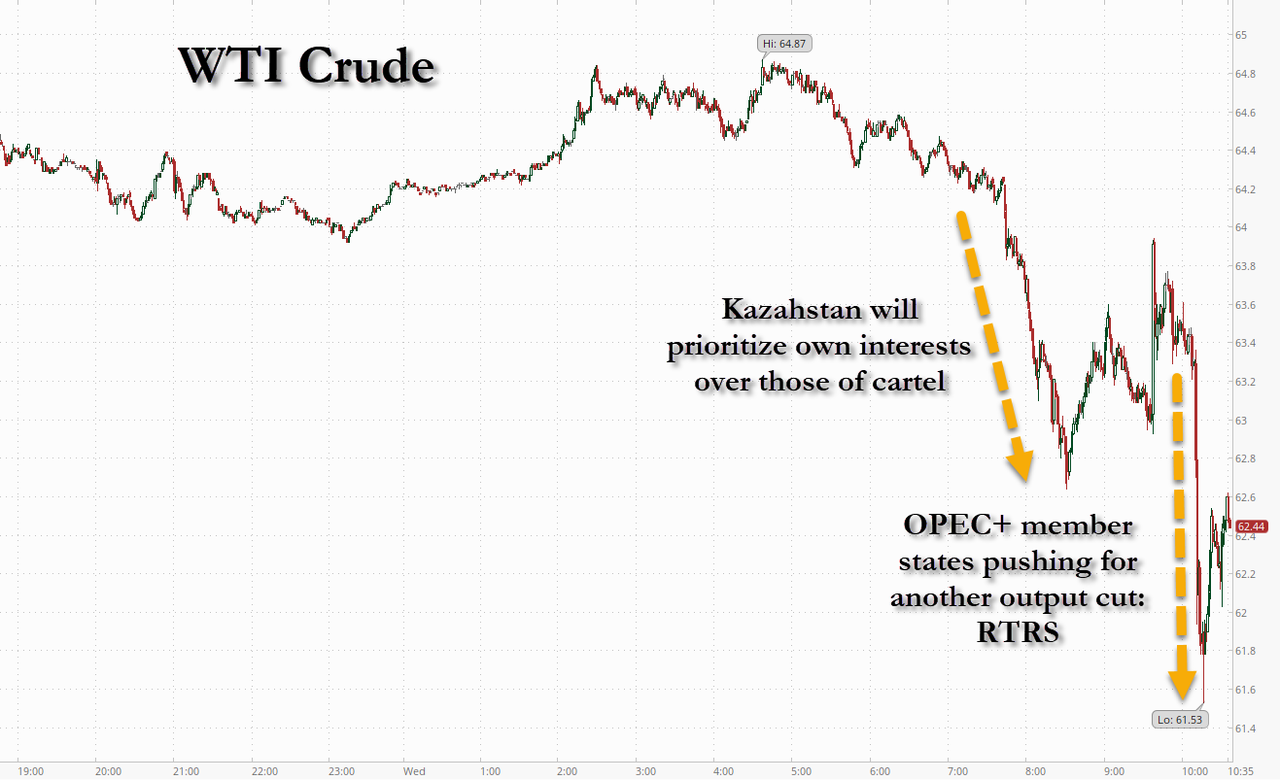

Oil Prices Drop As Kazakh Chaos Threatens OPEC Alliance

Oil Prices Drop As Kazakh Chaos Threatens OPEC Alliance

Update 10:33 am ET: What was already an ugly day for oil on the back of the Kazakhstan comments that it would effectively not adhere to OPEC+ quotas, turned even uglier after Reuters came out with another oil hit piece, reporting that "some" OPEC+ member countries are pushing for another output increase. The report said its OPEC sources said there were calls for that to be tabled at the May 5 meeting and enacted in June.

Why OPEC+ would agree to flooding the world with oil at a time when most major countries are already teetering on recession, and a flood of production could send oil crashing and spark budget crises across OPEC+ nations, was unclear. What was clear is that whoever commissioned the Reuters report, was short oil, as WTI dumped as low as $61.53 from a session high just shy of $65.

?itok=_KeJdDEr

?itok=_KeJdDEr

* * *

Oil turned lower after Kazakhstan said it will prioritize national interests over those of the OPEC+ alliance, a move that risks fueling further tensions within the cartel.

Overnight saw prices rally after bigger than expected inventory drawdowns reported by API in the US, but that was all erased this morning as Kazakhstan’s newly appointed energy minister Erlan Akkenzhenov said the country is not able to reduce production at its three largest projects as they are controlled by international oil majors, Reuters reported.

He said the country will prioritize its national interests over commitments to the OPEC+ alliance.

?itok=aU7HPNiI

?itok=aU7HPNiI

The move lower shows just how overly sensitive financial markets have become in recent months. Kazakhstan has been 'over-producing' for years with OPEC unable to control them... but suddenly it's an issue?

https://cms.zerohedge.com/users/tyler-durden

Wed, 04/23/2025 - 10:32

https://www.zerohedge.com/energy/oil-prices-drop-kazakh-chaos-threatens-opec-alliance

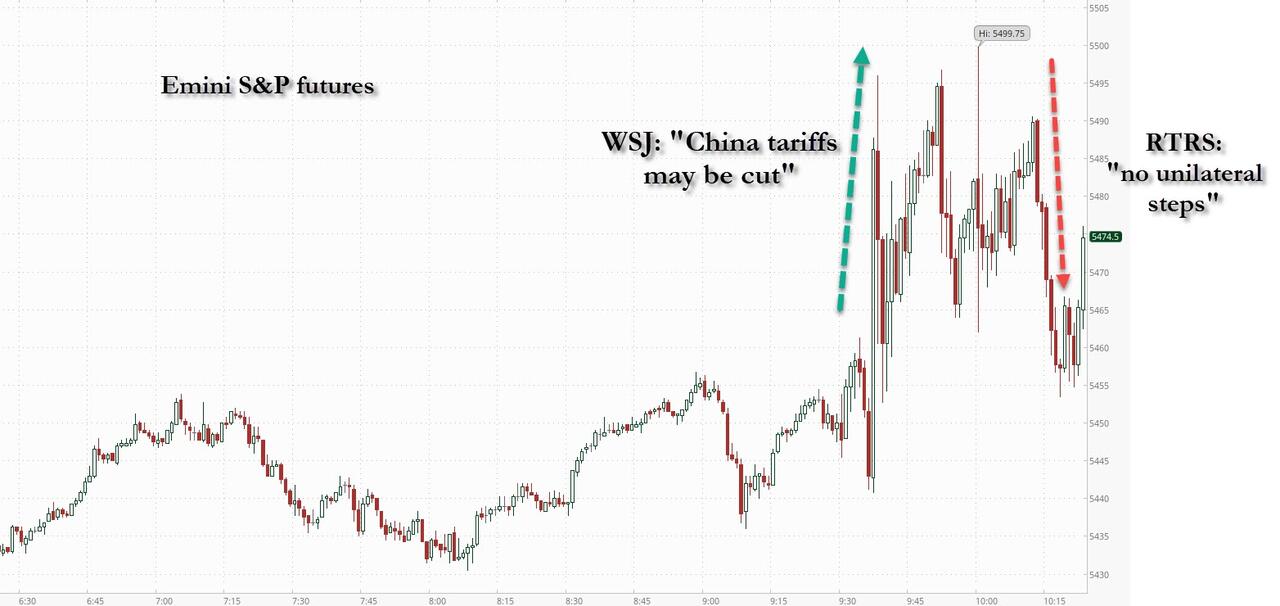

Reuters Pours Cold Water On WSJ Tariff Report, Says Any De-Escalation Steps Would Not Be Unilateral

Reuters Pours Cold Water On WSJ Tariff Report, Says Any De-Escalation Steps Would Not Be Unilateral

Update 10:15am ET: Just minutes after the WSJ report (below) sparked another boost to stocks shortly after the close, Reuters has poured cold water on risk sentiment reporting that any tariff cuts would only take place pending talks with Beijing and would not be unilateral but in conjunction with China talks:

WHITE HOUSE WOULD LOOK AT LOWERING TARIFFS ON CHINESE IMPORTS PENDING TALKS WITH BEIJING

ANY STEPS WOULD BE IN CONJUNCTION WITH CHINA TALKS, NOT UNILATERAL -SOURCE

Following the Reuters note, stocks promptly reversed the earlier gains on the much more cheerful WSJ report which sounded as if Trump was willing to capitulate.

?itok=IdUzVYjz

?itok=IdUzVYjz

Earlier:

Stocks are spiking higher, and extending premarket gains, after the https://www.wsj.com/politics/policy/white-house-considers-slashing-china-tariffs-to-de-escalate-trade-war-6f875d69?mod=hp_lead_pos1

that the Trump administration is considering slashing its steep tariffs on Chinese imports - in some cases by more than half -in a bid to de-escalate tensions with Beijing that have roiled global trade and investment, according to people familiar with the matter.

According to the report, China tariffs were likely to come down to between roughly 50% and 65%, about half of their current levels. The administration is also considering a tiered approach similar to the one proposed by the House committee on China late last year: 35% levies for items the U.S. deems not a threat to national security, and at least 100% for items deemed as strategic to America’s interest. The bill proposed phasing in those levies over five years.

In retrospect, the WSJ report said nothing new - and appears to be an attempt to merely stay in the newsflow - after Trump said Tuesday he was willing to cut tariffs on Chinese goods, saying the 145% tariffs he imposed on China during his second term would come down. “But it won’t be zero,” he said. The announcement sent stocks surging afterhours.

On Wednesday, China signaled it was open to trade talks with the U.S., though Beijing warned it wouldn’t negotiate under continued threats from the White House. In China’s policymaking circles, Trump’s comments Tuesday were viewed as a sign of him folding, the WSJ reported citing people who consult with Chinese officials said.

The expressions of openness to a deal from both sides represent a shift from much of the past month, as the world’s two largest economies exchanged reciprocal tariff increases and testy words, helping push stock markets around the world to their worst weeks in many years.

President Trump hasn’t made a final determination, the people said, adding that the discussions remain fluid and several options are on the table.

Separately, and at almost the exact same time, the https://www.wsj.com/economy/trump-jerome-powell-fed-e8f8f98b?mod=hp_lead_pos2

in on the other key topic du jour, namely the "explanation" why Trump decided not to fire Jerome Powell - as Trump also revealed he would not do yesterday. According to the WSJ, the White House had engaged lawyers to see how Chair Powell could be removed from office. However, Treasury Secretary Bessent and Commerce Secretary Lutnick are said to have stepped in and raised concerns about the market implications of such a move. Some more details:

As Trump’s criticism of the Fed chair ramped up over the last week, White House lawyers privately reviewed legal options for attempting to remove Powell, including whether they could do so for “cause,” according to people familiar with the matter. The laws that created the Federal Reserve say Fed governors can only be removed before their term ends for cause, which courts have generally interpreted to mean malfeasance or impropriety. Finding a pretext for dismissing Powell would have edged the White House closer to a dramatic escalation with the central bank.

Those discussions came to a halt early this week when Trump told his senior aides that he wouldn’t try to oust Powell. His decision came after interventions from Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick, who warned Trump that such a move could trigger far-reaching market chaos and a messy legal fight, the people said. Lutnick also told the president that efforts to fire the Fed chair likely wouldn’t lead to any practical change on interest rates because other members of the Fed’s board would likely approach monetary policy similarly to Powell, one of the people said.

While there was nothing actually new in the WSJ reports, they validated the good news that had pushed stocks up sharply higher overnight, and the result was further gains this morning which sent the S&P up more than 3% and fast approaching the first key CTA buy trigger around 5460.

?itok=D7SGV3Ob

?itok=D7SGV3Ob

https://cms.zerohedge.com/users/tyler-durden

Wed, 04/23/2025 - 10:30

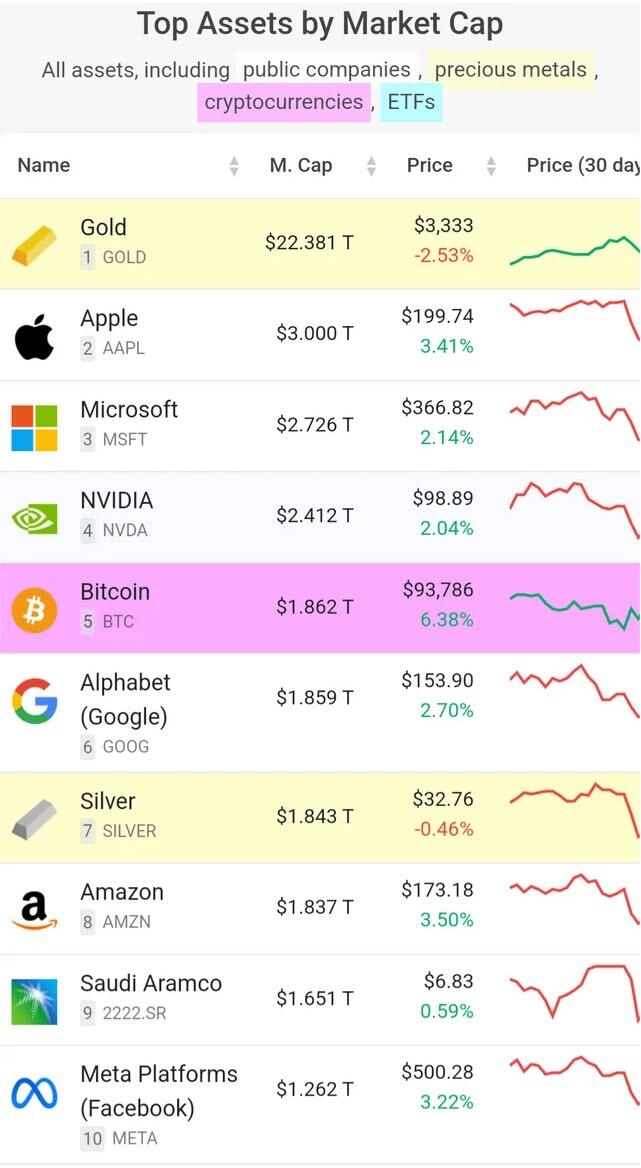

Sudden Massive ETF Inflows Push Bitcoin Above Google As World's 5th Largest Asset

Sudden Massive ETF Inflows Push Bitcoin Above Google As World's 5th Largest Asset

Investments in Bitcoin exchange-traded funds (ETFs) rebounded to levels last seen in January, signaling a recovery in investor sentiment from concerns about global trade tariff escalations.

US spot Bitcoin ETFs had over $912 million worth of cumulative net inflows on April 22, marking their highest daily investment in more than three months since Jan. 21...

?itok=5Th7Ye4P

?itok=5Th7Ye4P

This helped lift the price of bitcoin above $94,000...

?itok=MefQPzI5

?itok=MefQPzI5

“Macro factors like a weakening dollar and rising gold correlation” may reinforce Bitcoin’s appeal as a hedge against economic volatility, Ryan Lee, chief analyst at Bitget Research, told https://cointelegraph.com/news/bitcoin-etfs-912m-dramatic-sentiment-boost

.

And lifted the crypto currency above Google as the world's fifth largest asset...

?itok=UO1UFesH

?itok=UO1UFesH

Crypto and traditional stock markets are “walking a tightrope between political drama and economic reality,” with Bitcoin staging a significant rebound thanks to “strong ETF inflows, institutional acquisitions, and a weakening US dollar,” according to Nexo dispatch analyst Iliya Kalchev:

“Bitcoin’s strength amid dollar weakness, record gold prices, and renewed institutional buying reflects a market recalibrating what safety looks like.”

“The conversation has clearly shifted. Bitcoin is no longer trading in the shadows of tech — it’s becoming a lens through which macro uncertainty is priced,” he added.

Nansen CEO Alex Svanevik also praised Bitcoin’s resilience, noting that the maturing asset has https://cointelegraph.com/news/bitcoin-decouples-from-stocks-gains-safe-haven-status

— more gold” in the past two weeks, increasingly acting as a safe haven asset against economic turmoil, though concerns over economic recession may limit its price trajectory.

?itok=aBIY7Rca

?itok=aBIY7Rca

On April 21, BitMEX co-founder Arthur Hayes predicted that this might be the “last chance” to https://cointelegraph.com/news/bitcoin-rally-may-follow-us-treasury-buybacks

, as the incoming US Treasury buybacks may signal the next significant catalyst for Bitcoin price.

https://cms.zerohedge.com/users/tyler-durden

Wed, 04/23/2025 - 10:25

Stocks Spike To Session Highs On WSJ Report White House Looking To Slash China Tariffs

Stocks Spike To Session Highs On WSJ Report White House Looking To Slash China Tariffs

Stocks are spiking higher, and extending premarket gains, after the https://www.wsj.com/politics/policy/white-house-considers-slashing-china-tariffs-to-de-escalate-trade-war-6f875d69?mod=hp_lead_pos1

that the Trump administration is considering slashing its steep tariffs on Chinese imports - in some cases by more than half -in a bid to de-escalate tensions with Beijing that have roiled global trade and investment, according to people familiar with the matter.

According to the report, China tariffs were likely to come down to between roughly 50% and 65%, about half of their current levels. The administration is also considering a tiered approach similar to the one proposed by the House committee on China late last year: 35% levies for items the U.S. deems not a threat to national security, and at least 100% for items deemed as strategic to America’s interest. The bill proposed phasing in those levies over five years.

In retrospect, the WSJ report said nothing new - and appears to be an attempt to merely stay in the newsflow - after Trump said Tuesday he was willing to cut tariffs on Chinese goods, saying the 145% tariffs he imposed on China during his second term would come down. “But it won’t be zero,” he said. The announcement sent stocks surging afterhours.

On Wednesday, China signaled it was open to trade talks with the U.S., though Beijing warned it wouldn’t negotiate under continued threats from the White House. In China’s policymaking circles, Trump’s comments Tuesday were viewed as a sign of him folding, the WSJ reported citing people who consult with Chinese officials said.

The expressions of openness to a deal from both sides represent a shift from much of the past month, as the world’s two largest economies exchanged reciprocal tariff increases and testy words, helping push stock markets around the world to their worst weeks in many years.

President Trump hasn’t made a final determination, the people said, adding that the discussions remain fluid and several options are on the table.

Separately, and at almost the exact same time, the https://www.wsj.com/economy/trump-jerome-powell-fed-e8f8f98b?mod=hp_lead_pos2

in on the other key topic du jour, namely the "explanation" why Trump decided not to fire Jerome Powell - as Trump also revealed he would not do yesterday. According to the WSJ, the White House had engaged lawyers to see how Chair Powell could be removed from office. However, Treasury Secretary Bessent and Commerce Secretary Lutnick are said to have stepped in and raised concerns about the market implications of such a move. Some more details:

As Trump’s criticism of the Fed chair ramped up over the last week, White House lawyers privately reviewed legal options for attempting to remove Powell, including whether they could do so for “cause,” according to people familiar with the matter. The laws that created the Federal Reserve say Fed governors can only be removed before their term ends for cause, which courts have generally interpreted to mean malfeasance or impropriety. Finding a pretext for dismissing Powell would have edged the White House closer to a dramatic escalation with the central bank.

Those discussions came to a halt early this week when Trump told his senior aides that he wouldn’t try to oust Powell. His decision came after interventions from Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick, who warned Trump that such a move could trigger far-reaching market chaos and a messy legal fight, the people said. Lutnick also told the president that efforts to fire the Fed chair likely wouldn’t lead to any practical change on interest rates because other members of the Fed’s board would likely approach monetary policy similarly to Powell, one of the people said.

While there was nothing actually new in the WSJ reports, they validated the good news that had pushed stocks up sharply higher overnight, and the result was further gains this morning which sent the S&P up more than 3% and fast approaching the first key CTA buy trigger around 5460.

?itok=D7SGV3Ob

?itok=D7SGV3Ob

https://cms.zerohedge.com/users/tyler-durden

Wed, 04/23/2025 - 10:11

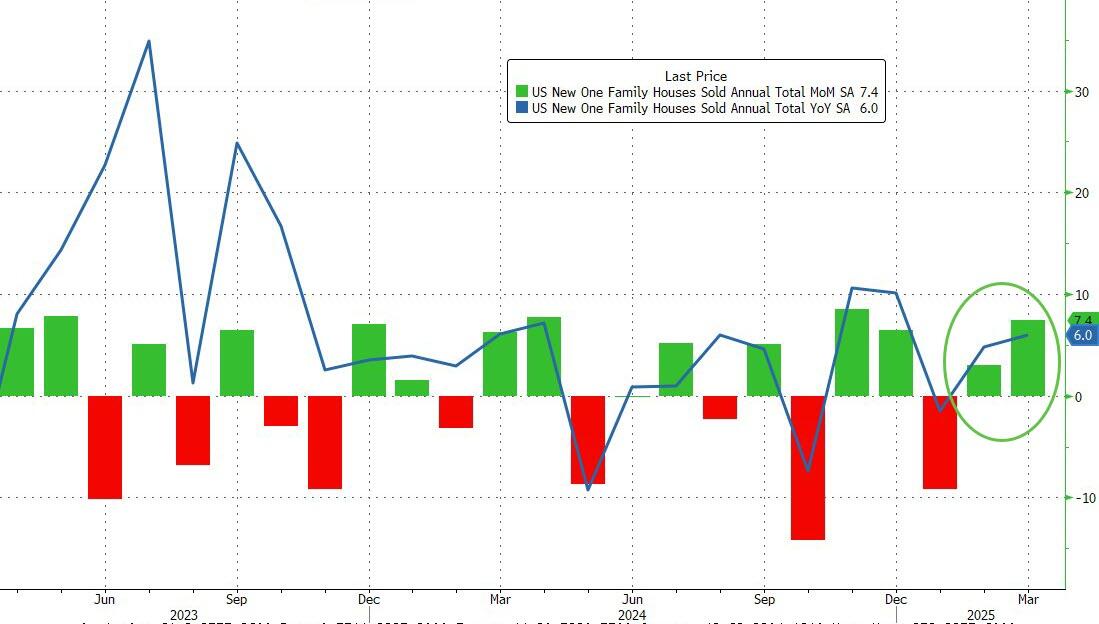

US New Home Sales Surged In March As Mortgage Rates Tumbled, But...

US New Home Sales Surged In March As Mortgage Rates Tumbled, But...

New home sales soared 7.4% MoM in March (dramatically better than the +1.3% MoM expected), lifting sales up 6.0% YoY...

?itok=M-nnuVwZ

?itok=M-nnuVwZ

But...

While new home sales soared amid the tumbling mortgage rates, April has seen rates surge back up to 7.00%, suggesting this sudden sales spike will be short-lived...

?itok=NoLNqd9w

?itok=NoLNqd9w

And if confirmation was needed, the more timely 'mortgage applications' data shows a major plunge in the last two weeks...

?itok=f9_2EIcW

?itok=f9_2EIcW

...and if you're hoping for lower rates to keep the American Dream alive, that will likely come at the cost of a recessionary environment...

?itok=IvVVnyFn

?itok=IvVVnyFn

...not exactly a great background for homebuyers, whose sentiment already languishes at record lows...

https://cms.zerohedge.com/users/tyler-durden

Wed, 04/23/2025 - 10:10

https://www.zerohedge.com/personal-finance/us-new-home-sales-surged-march-mortgage-rates-tumbled

"After Shorts Are Squeezed, Will Markets Turn Lower Again"

"After Shorts Are Squeezed, Will Markets Turn Lower Again"

By Peter Tchir of Academy Securities

If We Could Turn Back Time

I think this is the second time I’ve used a Cher song in the T-report (must be a guilty pleasure of mine). I also think that some of my colleagues at Academy have some firsthand knowledge of the filming of the video. In any case, as headline after headline hit last night, this is the song that kept popping into my head.

If we could turn back time?

If we went back a few weeks ago and had announced:

10% tariffs on every nation (as “reciprocal”) with 90 days to negotiate deals.

All USMCA compliant goods exempted.

A variety of important tech exempted.

Something harsh, but manageable in the interim, with China.

Complete faith in the independence of the Fed.

How bearish would I have been?

Would recession still be on the table? Possibly, but the “capital R” recession would have seemed unlikely and Depression would not have been something I would have contemplated putting in writing.

Would 20% to 30% down on stocks been my call? Definitely not.

But we didn’t!

Do These Pants Make Me Look Bad?

I think in all human history, the only “correct” answer to this question is NO! The real answer might be yes, but that has rarely helped any relationship. Even, avoiding the question by saying that the pants bring out the color of your eyes, tends to be taken for a no.

This administration has spent the better part of the past month telling every country that they look awful in their outfits! That whatever they had on, was just hideous.

Now, in the car ride to the event, we’ve decided that maybe the outfit wasn’t that bad?

Bessent speaks at 10:00 am today. It seems likely that he might bring up some things the Treasury can do to help the bond market (there is chatter about announcing an operation twist to help support the long end of the yield curve).

We can continue to rally on the back of this new “softer” approach from the administration. Some of the people in the admin seemed to have disappeared from the talk show circuit. There is clearly some “repositioning” of policy.

Maybe as we wrote about this weekend, in https://academysecurities.com/macro-strategy-insights/dealpalooza/?asmac=46bf7cf3-09a8-4c37-8aeb-5cece66499f2

, the admin will back off and make some deals (even if they aren’t particularly effective). More importantly, maybe the admin will pivot to Domestic Production for National Security.

That pivot would be welcome and maybe the self-imposed de-escalation in tariffs is a step in that direction?

I find it difficult to see how this backtracking will help “win” big concessions in trade deals. To me, it confirms, that we over-reached, over-estimated our relative strength and have had to backtrack. That isn’t great for the U.S. negotiating position, at least not for those countries who already felt that the U.S. had miscalculated. Recent actions will only confirm that opinion for those countries.

But maybe it let’s us pivot to something more domestic in nature. Something that isn’t a zero-sum game.

That would be positive and I could embrace this rally further.

It seems plausible to expect more positive headlines today, especially from Bessent.

But, the reality is, I think the U.S. is in a far weaker position globally today, than it was a month or two ago. We, unfortunately, cannot go back in time, and the things that have been said or done, cannot be unsaid (they can be undone, but that isn’t the same).

Had we just started here a month or so ago, markets would be in better shape, and many friendships wouldn’t have been tested the way they were. But we aren’t.

So, I’ll move to cautiously optimistic that the worst is behind us on the policy front.

I’m not sure the damage of what has been done and what is still on the table (I think there are still tariffs in place), has been priced into equities after these recent bounces. The bond market may also have to shift to thinking about deficits again, as those concerns may reach “headline” status again, if everything else calms down.

I do feel bad that I no longer can claim to have any idea of what tariffs are in place, on what, with who, but I suspect some of those in charge of enforcing the policy no longer do either, as it has been “evolving” so rapidly.

Good luck, enjoy the respite, it is okay to be optimistic, but there is some risk that after the shorts are squeezed and reality sinks in, markets turn lower again.

https://cms.zerohedge.com/users/tyler-durden

Wed, 04/23/2025 - 10:05

https://www.zerohedge.com/markets/after-shorts-are-squeezed-will-markets-turn-lower-again

'America First Does Not Mean America Alone': Bessent Discuses Tariffs, Global Financial System

'America First Does Not Mean America Alone': Bessent Discuses Tariffs, Global Financial System

Days after Scott Bessent dazzled JP Morgan with closed-door comments (aka not Main Street) that the tariff standoff with China is unsustainable, the US Treasury Secretary is set to deliver comments on Wednesday at the IIF Global Outlook Forum regarding the state of the global financial system as the Trump administration seeks to tamp down rhetoric over China.

?itok=rVy_tCqf

According to a copy of Bessent's prepared remarks, he is set to tell the IIF that "America First does not mean America Alone," and that the International Monetary Fund must prioritize economic and financial sustainability. He is calling for IMF and World Bank reforms after "mission creep," and will say that the Trump administration wants to work with them.

"Going forward, the Trump Administration will leverage U.S. leadership and influence at these institutions and push them to accomplish their important mandates," Bessent said, adding "The United States will also demand that the management and staff of these institutions be accountable for demonstrating real progress."

According to a report by the https://www.wsj.com/politics/policy/white-house-considers-slashing-china-tariffs-to-de-escalate-trade-war-6f875d69

minutes before Bessent's speech, the Trump administration "is considering slashing its steep tariffs on Chinese imports—in some cases by more than half—in a bid to de-escalate tensions with Beijing."

President Trump hasn’t made a final determination, the people said, adding that the discussions remain fluid and several options are on the table.

One senior White House official said the China tariffs were likely to come down to between roughly 50% and 65%. The administration is also considering a tiered approach similar to the one proposed by the House committee on China late last year: 35% levies for items the U.S. deems not a threat to national security, and at least 100% for items deemed as strategic to America’s interest, some of the people said. The bill proposed phasing in those levies over five years. -WSJ

Watch Treasury Secretary Bessent speak live here (due to start at 1000ET):

Bessent's comments also come after President Donald Trump softened his tone on the unfolding trade war between the world's two largest economies - to which China's foreign ministry spokesman, Guo Jiakun replied "our doors are wide open."

According to Tuesday comments by Trump, "very high" tariffs on Chinese imports will "come down substantially, but it won't be zero."

"I think we're going to live together very happily and ideally work together, so I think it's going to work out very well," Trump told reporters at the White House.

Trump notably excluded China from a pause on "reciprocal" tariffs that were extended to other trading partners in order to allow them time to negotiate - blaming China's retaliatory actions for its exclusion.

The China tariffs include a 125% reciprocal tariff on top of Trump's original 20% tariff related to the fentanyl trade. Combined with pre-existing Section 301 tariffs, some Chinese goods face levies as high as 245%.

Bessent's full comments below:

Thank you for that kind introduction. It’s an honor to be here.

In the final months of World War II, Western leaders convened the greatest economic minds of their generation. Their task? To build a new financial system.

At a quiet resort high up in the mountains of New Hampshire, they laid the foundation for Pax Americana.

The architects of Bretton Woods recognized that a global economy required global coordination. To encourage that coordination, they created the IMF and the World Bank.

These twin institutions were born after a period of intense geopolitical and economic volatility. The purpose of the IMF and the World Bank was to better align national interests with international order, thereby bringing stability to an unstable world.

In short, their purpose was to restore and preserve balance.

This remains the purpose of the Bretton Woods institutions. Yet everywhere we look across the international economic system today, we see imbalance.

The good news: it doesn’t have to be this way. My goal this morning is to outline a blueprint to restore equilibrium to the global financial system and the institutions designed to uphold it.

I have spent the bulk of my career from the outside looking in on financial policy circles. Now I am on the inside looking out. And I am eager to work with each of you to restore order to the international system. To achieve this, however, we must first reconnect the IMF and World Bank with their founding missions.

The IMF and World Bank have enduring value. But mission creep has knocked these institutions off course. We must enact key reforms to ensure the Bretton Woods institutions are serving their stakeholders—not the other way around.

Bringing balance back to global finance will require clear-eyed leadership from the IMF and World Bank. This morning, I will explain how they can provide that leadership to build safer, stronger, and more prosperous economies all around the world. I wish to invite my international counterparts to join us in working toward these goals.

On this point, I wish to be clear: America First does not mean America alone. To the contrary, it is a call for deeper collaboration and mutual respect among trade partners.

Far from stepping back, America First seeks to expand U.S. leadership in international institutions like the IMF and World Bank. By embracing a stronger leadership role, America First seeks to restore fairness to the international economic system.

Global Imbalances and Trade

Nowhere is the imbalance I mentioned earlier more obvious than in the world of trade. That’s why the United States is taking action now to rebalance global commerce.

For decades, successive administrations relied on faulty assumptions that our trading partners would implement policies that would drive a balanced global economy. Instead, we face the stark reality of large and persistent U.S. deficits as a result of an unfair trading system.

Intentional policy choices by other countries have hollowed out America’s manufacturing sector and undermined our critical supply chains, putting our national and economic security at risk. President Trump has taken strong action to address these imbalances and the negative impacts they have on Americans.

This status quo of large and persistent imbalances is not sustainable. It is not sustainable for the United States, and ultimately, it is not sustainable for other economies.

Now I know “sustainability” is a popular term around here. But I’m not talking about climate change or carbon footprints. I’m talking about economic and financial sustainability—the kind of sustainability that raises standards of living and keeps markets afloat. International financial institutions must be singularly focused on upholding this kind of sustainability if they are to succeed in their missions.

In response to President Trump’s tariff announcements, more than 100 countries have approached us wanting to help rebalance global trade. These countries have responded openly and positively to the President’s actions to create a more balanced international system. We are engaged in meaningful discussions and look forward to talking with others.

China, in particular, is in need of a rebalancing. Recent data shows the Chinese economy tilting even further away from consumption toward manufacturing. China’s economic system, with growth driven by manufacturing exports, will continue to create even more serious imbalances with its trading partners if the status quo is allowed to continue.

China’s current economic model is built on exporting its way out of its economic troubles. It’s an unsustainable model that is not only harming China but the entire world.

China needs to change. The country knows it needs to change. Everyone knows it needs to change. And we want to help it change—because we need rebalancing too.

China can start by moving its economy away from export overcapacity, and toward supporting its own consumers and domestic demand. Such a shift would help with the global rebalancing that the world desperately needs.

Of course, trade is not the only factor in broader global economic imbalances. The persistent over-reliance on the United States for demand is resulting in an evermore unbalanced global economy.

Some countries’ policies encourage excess saving, which holds back private sector-led growth. Others keep wages artificially depressed, which also suppresses growth. These practices contribute to global dependence on U.S. demand to spur growth. They also lead to a global economy that is weaker and more vulnerable than it should be.

In Europe, former ECB President Mario Draghi has identified several sources of stagnation—and he has outlined several recommendations to get the economy back on the right track. European countries would do well to take his recommendations to heart.

Europe has already taken some long overdue initial steps that I applaud. These steps create a new source of global demand, and also involve Europe stepping up on the security front. I believe global economic relationships should come to reflect security partnerships.

Security partners are more likely to have compatible economies structured for mutually beneficial trade. If the United States continues offering security guarantees and open markets, then our allies must step up with stronger commitments to shared defense. The initial actions from Europe on increased fiscal and defense spending are proof that the Trump Administration’s policies are working.

U.S. Leadership at the IMF and World Bank

The Trump Administration and U.S. Treasury are committed to maintaining and expanding U.S. economic leadership in the world. This is especially true at the international financial institutions.

The IMF and World Bank serve critical roles in the international system. And the Trump Administration is eager to work with them—so long as they can stay true to their missions.

But under the status quo, they are falling short.

The Bretton Woods institutions must step back from their sprawling and unfocused agendas, which have stifled their ability to deliver on their core mandates.

Going forward, the Trump Administration will leverage U.S. leadership and influence at these institutions and push them to accomplish their important mandates. The United States will also demand that the management and staff of these institutions be accountable for demonstrating real progress. I invite all of you to join us in working to refocus these institutions on their core missions. It is in our collective interest to do so.

IMF

First, we must make the IMF the IMF again.

The IMF’s mission is to promote international monetary cooperation, facilitate the balanced growth of international trade, encourage economic growth, and discourage harmful policies like competitive exchange rate depreciation. These are crucially important functions to support the U.S. and global economies.

Instead, the IMF has suffered from mission creep. The IMF was once unwavering in its mission of promoting global monetary cooperation and financial stability. Now it devotes disproportionate time and resources to work on climate change, gender, and social issues.

These issues are not the IMF’s mission. And the IMF’s focus in these areas is crowding out its work on critical macroeconomic issues.