Bullard Backs 100bps In 2025 Rate Cuts In Hopes Of Replacing Powell

Bullard Backs 100bps In 2025 Rate Cuts In Hopes Of Replacing Powell

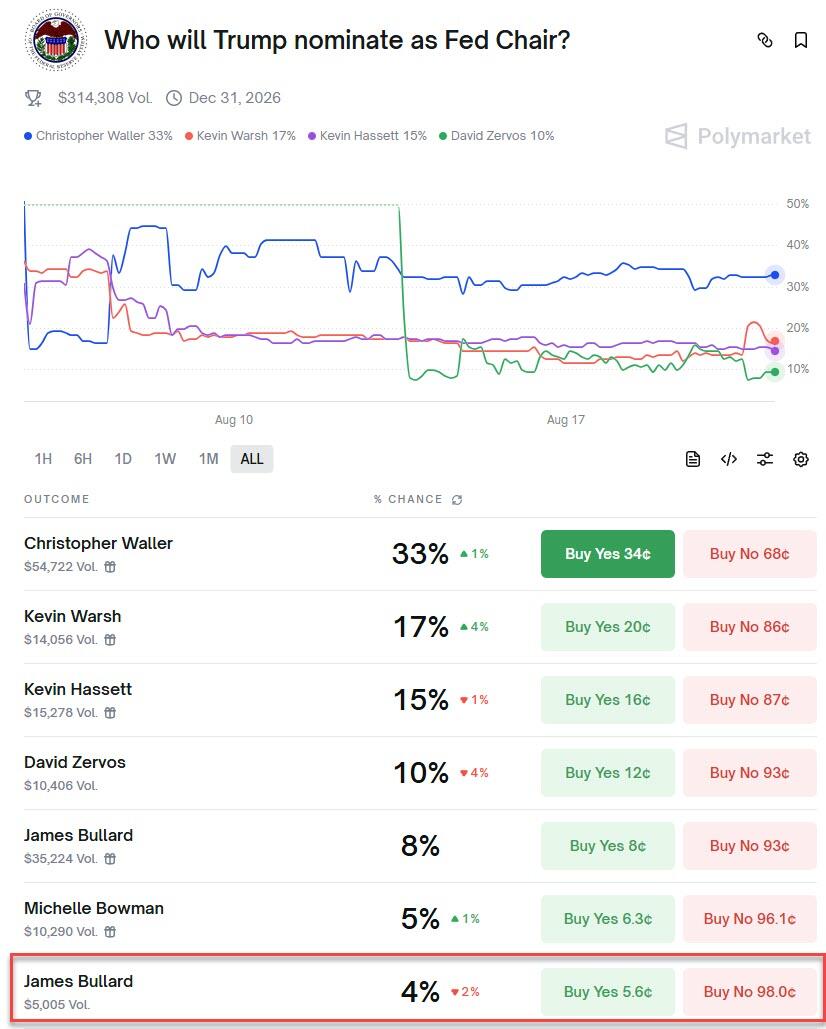

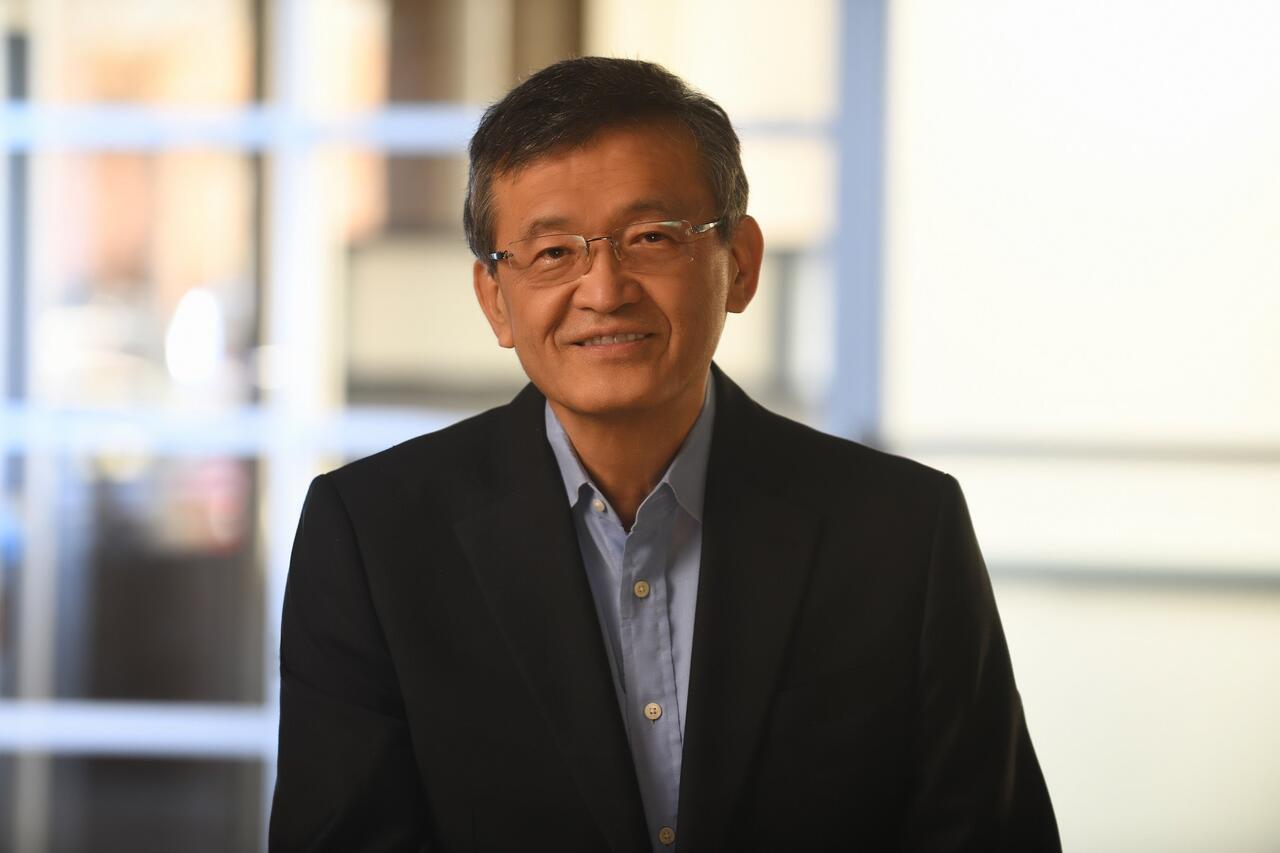

With candidates hoping to replace Jerome Powell coming up with increasingly dovish - not to mention - plans on how to attract Trump's attention and jump in the lead earlier this morning, former St. Louis Fed president James Bullard, who has emerged a long-shot contender for the next US central bank chief, called for a percentage point of interest-rate cuts this year, with scope to do more in 2026.

“Rates are a little bit high right now, and I think we can get down about 100 basis points going into 2026 — I think that’ll start with a rate reduction here at the September meeting, and probably be followed up later this year,” Bullard said on Fox Business Thursday.

Bullard, now dean of Purdue University’s business school, said he’d been in contact with Treasury Secretary Scott Bessent about his candidacy for Fed chair, and is aiming to set up an interview with him, “probably” after Labor Day — which falls on Sept. 1.

As for further rate cuts next year, Bullard said it will depend on how data come in. He also cited the need to protect the reserve status of the dollar.

Unfortunately for Bullard, he remains dead last in the https://polymarket.com/event/who-will-trump-nominate-as-fed-chair?tid=1755783705885

, and he will have to either push for NIRP or, even better, Yield Curve Control if he hopes to have any real chance of getting Trump to notice him.

?itok=K5_37uQE

?itok=K5_37uQE

https://cms.zerohedge.com/users/tyler-durden

Thu, 08/21/2025 - 09:47

https://www.zerohedge.com/markets/bullard-backs-100bps-2025-rate-cut-hopes-replacing-powell

US, EU Release Details Of Trade Deal

US, EU Release Details Of Trade Deal

The US and European Union finally laid out the details of their recently announced trade deal which reduces tariffs on European automobiles while opening the door to new potential discounts for steel and aluminum.

The joint statement issued this morning represents an advancement of the preliminary deal announced a month ago, and includes specific benchmarks for the EU to secure its promised sectoral tariff discounts on cars, pharmaceuticals and semiconductors, as well as new commitments for addressing the bloc’s digital services regulations.

Trump had repeatedly praised the sweeping US-EU trade framework, extolling it as “a big deal” in a Monday White House meeting with foreign leaders including European Commission President Ursula von der Leyen.

The development underscores the nature of trade talks under Trump, with some initial, broad pronouncements of deals giving way to weeks or more of work to hammer out detailed agreements. Many of them are also tied to sweeping policy changes that could take time to materialize.

For example, Trump already imposed a flat 15% rate on most European goods, half the 30% he’d previously threatened. But the US promise to extend that lower levy to autos and auto parts now hinges on the EU formally introducing a legislative proposal to eliminate a host of its own tariffs on US industrial goods and provide “preferential market access” for some US seafood and agricultural products.

Below we summarize the highlights from the deal:

US to levy 15% tariff on most EU imports, including autos, pharmaceuticals, semiconductor chips and lumber.

US and EU to consider steps to ensure secure supply chains, including tariff rate-quota solutions.

US and EU commit to address ‘unjustified digital trade barriers,’ with EU agreeing not to adopt network usage fees.

US and EU to consider cooperation on ring-fencing domestic steel and aluminum markets from overcapacity.

US and EU to negotiate rules of origin to ensure the trade agreement benefits predominantly both partners.

EU companies to invest an additional USD 600bln across US strategic sectors through 2028.

EU intends to procure USD 750bln in US LNG, oil and nuclear energy products, plus at least USD 40bln of US AI chips.

From September 1, US to apply only MFN tariffs on EU aircraft and parts, generic pharmaceuticals, ingredients, chemical precursors and unavailable natural resources.

US will lower tariffs on autos and auto parts when EU introduces legislation to enact tariff reductions.

EU intends to eliminate tariffs on all US industrial goods and provide preferential market access for US seafood and agricultural goods.

Senior US official expects tariff relief for EU automakers to come in 'hopefully weeks.*

US and EU release joint statement locking in details of trade deal reached last month.

Tariffs:

15% on most goods (vs 30% threatened)

15% on Autos (prev. 25%)

15% on Pharma + Chips

US will retain a 50% tariff on EU steel and aluminium

Zero-for-zero tariffs have been agreed for some agricultural products, aircraft component parts, and certain chemical

No final agreement has been reached yet on tariffs for spirits

Aircraft exports are temporarily exempt from tariffs pending the outcome of a US investigation

EU Investments

EU will invest USD 600bln in the US, including in military equipment

EU will purchase USD 750bln worth of US energy, mainly LNG

As Bloomberg reports, the statement outlines choreographed action on both sides of the Atlantic, with the US codifying reduced auto tariffs once the EU “formally introduces the necessary legislative proposal to enact” its own promised tariff reductions. The discounted 15% tariffs on European auto imports, lower than a 27.5% Trump previously imposed on them, would be effective from the start of the same month that legislation is advanced.

They could be in place within weeks, said a senior Trump administration official who briefed reporters on the initiative. The shift has been anxiously anticipated by some EU member states, particularly Germany, which exported $34.9 billion of new cars and auto parts to the US in 2024.

The legislative trigger is designed to help ensure the EU delivers on its promised tariff reductions — and ensure the 27-nation bloc has sufficient pressure to obtain the political mandate needed to make the changes, the administration official said.

Meanwhile, the US is committing to apply lower most-favored-nation tariffs to a slew of other European products — including aircraft and aircraft parts, generic pharmaceuticals and their ingredients and some natural resources such as cork. The US is also renewing its commitment to cap sectoral tariffs on European pharmaceutical products, semiconductors and lumber at 15%.

It’s also opening the prospect for discounted rates on some steel, aluminum and derivative products under a quota system. That’s a shift from the White House’s stated plans in July, when the Trump administration insisted those metal tariffs would remain at 50%, helping to lower trade deficits with the EU and bring revenue to US coffers.

On steel and aluminum, the EU and US now assert they “intend to consider the possibility to cooperate on ring-fencing their respective domestic markets from overcapacity, while ensuring secure supply chains between each other,” according to the joint statement.

As discussed here before, the document raises major questions about how the EU might fulfill its promise to invest $600 billion in the US or purchase some $750 billion in US energy resources, including liquefied natural gas, oil and nuclear power products. through 2028.

Private sector investments by European companies would be expected across strategic sectors in the US, including pharmaceuticals, semiconductors and advanced manufacturing, the senior administration official said. Meanwhile, the EU plans to substantially increase procurement of military and defense equipment from the US, according to the statement, and intends to buy at least $40 billion worth of US artificial intelligence chips.

According to the joint statement, the EU intends to provide preferential market access for seafood and non-sensitive agricultural goods imported from the US, including tree nuts, certain dairy products, fresh and processed fruits and vegetables, processed foods, planting seeds, soybean oil, and pork and bison meat.

In recent weeks, deliberations over the EU’s digital services regulations and potential relief for some goods — including wine and spirits - were seen prolonging talks. The EU didn’t secure lower rates for alcohol in the joint statement.

But the US and EU are pledging to address some of what the statement calls “unjustified digital trade barriers,” with the bloc confirming that it will “not adopt or maintain network usage fees.”

The EU has committed to work toward providing more “flexibilities” in its levy on carbon-intensive imports set to kick in next year, the statement said, and it will seek to ensure its corporate sustainability due diligence and reporting requirements don’t pose “undue restrictions on transatlantic trade.”

Potential changes could include eased compliance requirements for small- and medium-sized businesses, according to the statement.

https://cms.zerohedge.com/users/tyler-durden

Thu, 08/21/2025 - 09:30

https://www.zerohedge.com/economics/us-eu-release-details-trade-deal

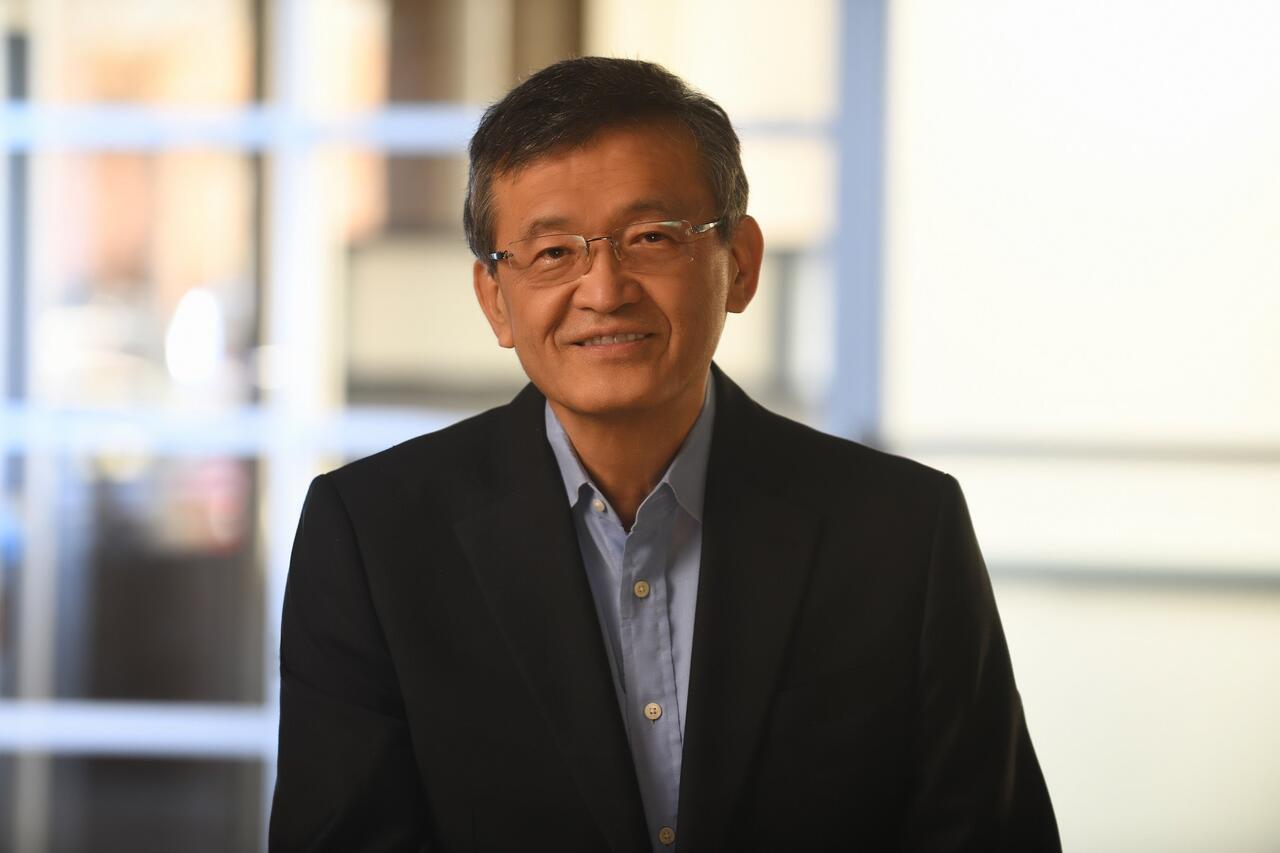

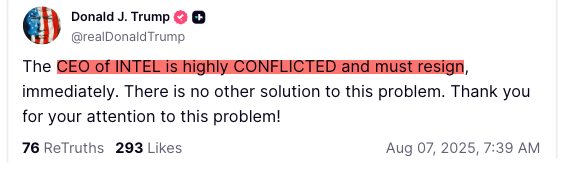

Robbed, Punched, And Pistol-Whipped - A White House Reporter's Account Of Crime In DC

Robbed, Punched, And Pistol-Whipped - A White House Reporter's Account Of Crime In DC

(emphasis ours),

Commentary

The latest move by the White House to crack down on crime in Washington prompted me to reflect on a harrowing https://www.theepochtimes.com/us/reporter-for-epoch-times-sister-media-robbed-at-gunpoint-in-dc-5018803

from my own life - the morning I was robbed at gunpoint just steps from my apartment.

?itok=KrsKa_Ju

?itok=KrsKa_Ju

It was 8:30 a.m. on a Saturday in January 2022. I had just left my building near The Wharf in Southwest D.C. when a man in a black ski mask appeared out of nowhere, pointed a https://www.theepochtimes.com/us/reporter-for-epoch-times-sister-media-robbed-at-gunpoint-in-dc-5018803

, and demanded my phone.

“Give me your phone,” he barked as he snatched it from my jacket pocket.

Then, with cold precision, he ordered me to hand over my wallet, laptop, and phone password.

Before fear even set in, instinct kicked in—not to protect my belongings, but to protect the sensitive information I carried. As a White House reporter for NTD Television, the sister outlet of The Epoch Times, I felt an overwhelming duty to safeguard my sources, colleagues, and loved ones.

“I can’t,” I said. “Don’t do this.”

He struck me across the face with the butt of his handgun.

My cheek went numb and flushed red.

“Help! Help!” I screamed as he ran off. A neighbor called the police. Later, an officer told me the assailant had fled into an apartment just a block away. They believed they knew who he was—but I never heard from them again.

I stayed surprisingly composed during the attack, but once I got back inside, the fear set in. He could have shot me. I could have died—just as my career was beginning. My parents and now-husband were hundreds of miles away.

I grew up in New York City and considered myself street-smart. Crime statistics had always been just numbers. I walked the streets of Queens and Manhattan alone, day or night. That Saturday morning shattered that confidence.

It’s been more than two years. Since then, I’ve never walked the streets of D.C. alone at night. I Uber home every day—even though my office is within walking distance. I’m on high alert after dark, whether I’m working or just meeting friends. Fear lives around every corner.

I didn’t tell my grandparents what happened until a year later—I was afraid it would devastate them and convince them I should leave D.C. entirely. Truthfully, I still love this city. But the scar of that morning lingers.

So when friends ask, “Is D.C. safe?” I don’t just share the stats. I share what happened to me.

Officially, the Metropolitan Police Department says violent crime is down 35 percent from its 2023 peak, and city leaders say we’re near a 30-year low. But lived experience tells a different story.

Last year alone, D.C. reported 29,348 crimes, including:

3,469 violent offenses

1,026 assaults with a dangerous weapon

2,113 robberies

That’s thousands of families like mine, who have endured the trauma and aftermath of violence.

Some experts say not all crimes are even reported. Others point to claims that police leadership under-reported data to make the numbers look better. One thing, however, is hard to manipulate: the homicide rate.

In 2024, D.C.’s homicide rate was 27.3 per 100,000 residents—the fourth-highest in the country, and more than double the rate from just a decade ago.

So far in 2025, there have been more than 100 homicides.

Among the victims:

Three-year-old Honesty Cheadle, shot while sitting in a car with her family after Fourth of July fireworks.

21-year-old Capitol Hill intern Eric Tarpinian-Jachym, killed while walking through Northwest D.C. one evening.

And just hours after President Trump declared a public safety emergency on August 12, a 33-year-old man was shot and killed in Logan Circle—less than a mile from the White House.

These are not just numbers. Each one is a person. A life cut short. A family changed forever.

As national debate swirls around crime in the capital and whether National Guard troops should patrol its streets, I hope we remember the human cost behind every statistic.

I’m expecting my first child at the end of this year. And we’ve decided we won’t stay in D.C.—not until both the numbers and the stories prove the city has truly changed.

As a new mom, I want my son to grow up in a place where he can walk freely, play safely, and live without fear. I think most parents want the same.

And I hope—someday—we can live that vision here in our nation’s capital: a clean, beautiful, and truly shining city on a hill once again.

https://cms.zerohedge.com/users/tyler-durden

Thu, 08/21/2025 - 09:15

Initial Claims Unexpectedly Jump As Continuing Claims Surge To Four-Year Highs On Deep Tri-State Misery

Initial Claims Unexpectedly Jump As Continuing Claims Surge To Four-Year Highs On Deep Tri-State Misery

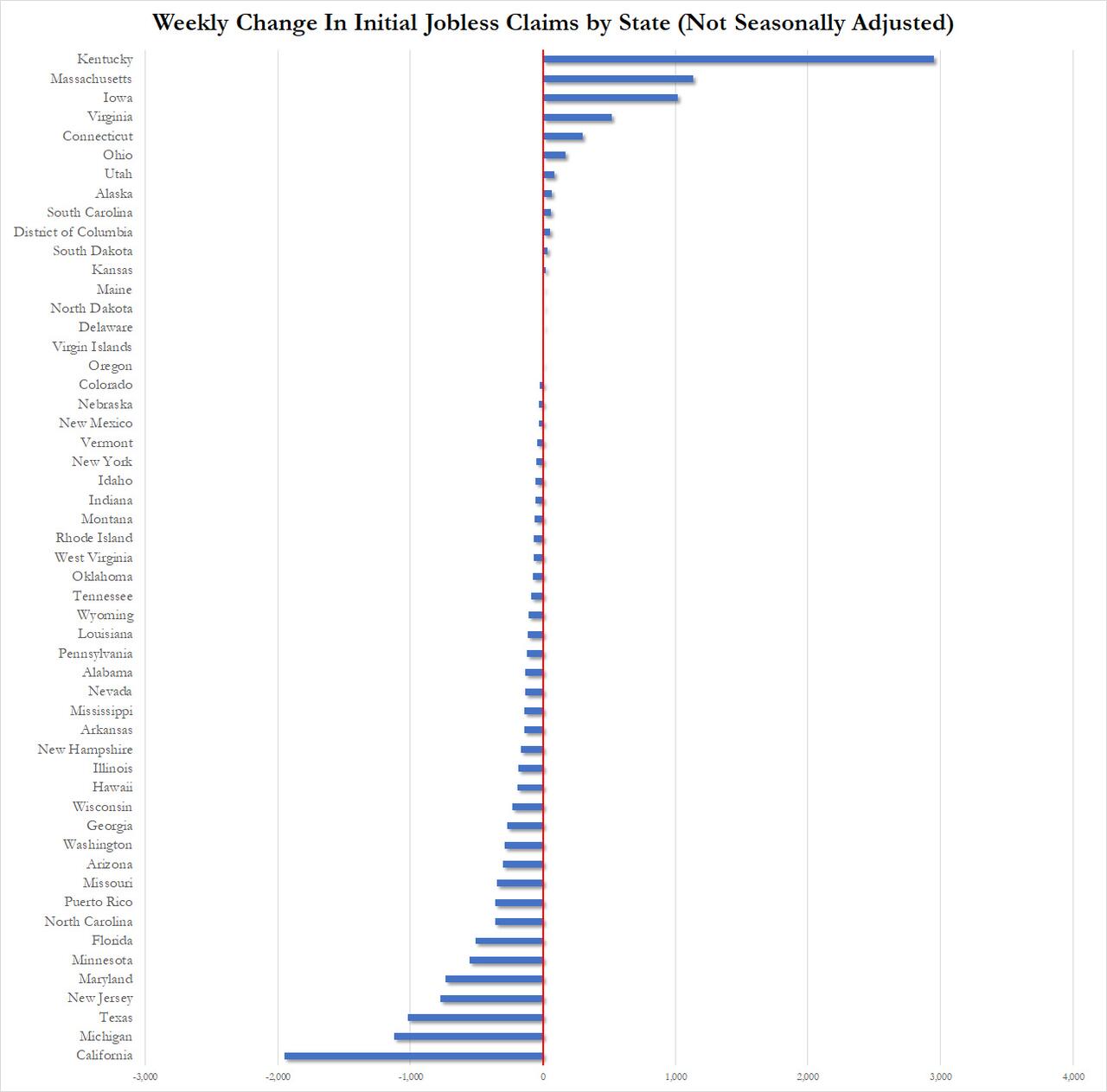

One week after initial claims printed at the same level (224k) where they were at in Nov 2021 (with non-seasonally adjusted claims hovering near record lows), moments ago the BLS reported that claims jumped in the last week, rising by 11k to 235K, the highest since June 20. Curiously the jump in seasonally adjusted claims took place even as unadjusted claims dipped to 2025 lows.

?itok=Ci7kSDBM

?itok=Ci7kSDBM

A breakdown of initial claims by state does not show any dramatic outliers: Kentucky saw the biggest increase in initial claims, up almost 2K, while claims in California dropped by 1,948.

?itok=6ImiN1oI

?itok=6ImiN1oI

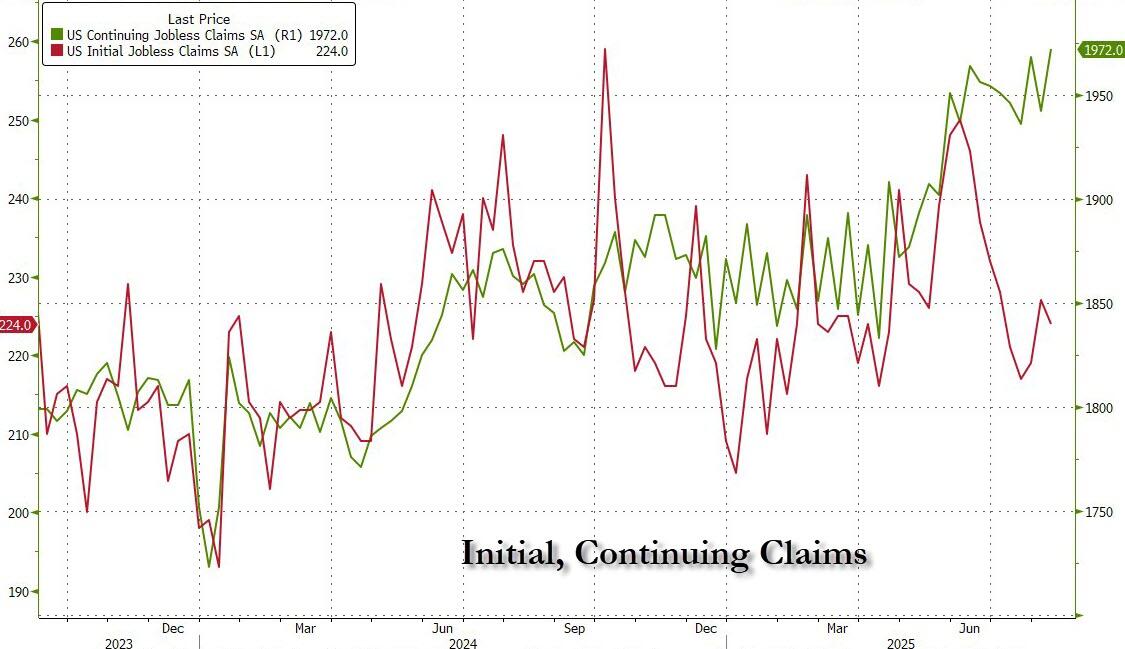

Meanwhile, the relentless rise in continuing jobless claims continues, and in the latest week rose to 1.972 million, up from 1942 million, and above the 1.960 million expected; it was also the highest print since the covid crash.

?itok=OctUH4_r

?itok=OctUH4_r

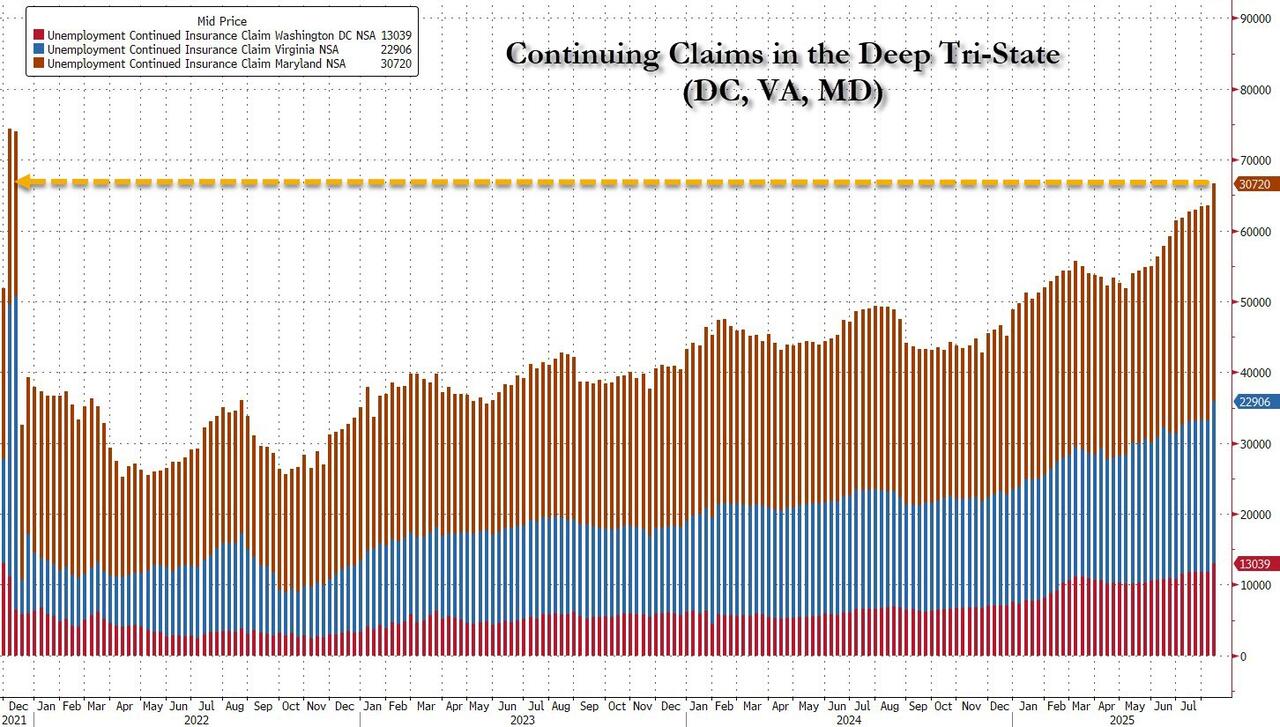

The silver lining (if that's what one would call it) is the continuing jobless claims across the Deep TriState keep rising...

?itok=h2KD6_9p

?itok=h2KD6_9p

Must may be gone, but DOGE is still taking deep state coup-plotter scalps.

https://cms.zerohedge.com/users/tyler-durden

Thu, 08/21/2025 - 08:51

"Too Expensive And Risky": Bed Bath & Beyond Explains Why It Won’t Operate Stores In "Overregulated" California

"Too Expensive And Risky": Bed Bath & Beyond Explains Why It Won’t Operate Stores In "Overregulated" California

The chairman of the resurrected home goods chain Bed Bath & Beyond announced on Aug. 20 that the company would not open or operate retail stores in California, calling it overregulated, expensive, and risky.

“This decision isn’t about politics—it’s about reality,” company head Marcus Lemonis said in a social media https://x.com/marcuslemonis/status/1958162142651470232?s=61

.

“California has created one of the most overregulated, expensive, and risky environments for businesses in America. It’s a system that makes it harder to employ people, harder to keep doors open, and harder to deliver value to customers.”

Lemonis—the executive chairman of Beyond, Inc., which owns Bed Bath & Beyond—claimed that the state’s regulations result in higher taxes, fees, and wages that many businesses can’t sustain. The regulations strangle growth, he said.

?itok=cCnJpGly

?itok=cCnJpGly

California Gov. Gavin Newsom’s office did not express concern about the retailer’s announcement in a response following the company’s announcement.

“After their bankruptcy and closure of every store, like most Americans, we thought Bed, Bath & Beyond no longer existed,” Newsom’s spokesperson, Tara Gallegos, told The Epoch Times in an email.

“We wish them well in their efforts to become relevant again as they try to open a 2nd [sic] store.”

Bed Bath & Beyond, founded in 1971, expanded to become a U.S. retail icon of home goods, experiencing significant growth.

In 2023, the company filed for https://www.theepochtimes.com/business/bed-bath-beyond-lives-online-overstock-com-buys-rights-to-bankrupt-retailer-and-changes-name-5364592

, closing hundreds of stores after years of dismal sales and several attempts to turn the struggling business around. The company was purchased by online retailer Overstock.com and transitioned to an online-only presence.

Bed Bath & Beyond closed all 41 of its California stores, along with all other U.S. locations, in July 2023.

The retailer’s parent company, The Brand House Collective, https://www.prnewswire.com/news-releases/iconic-bed-bath--beyond-brand-returns-to-stores-with-first-bed-bath--beyond-home-in-nashville-302514528.html

a grand opening of its first Bed Bath & Beyond Home store in Nashville set for Aug. 8. The company’s shareholders approved the move in July.

“We’re proud to reintroduce one of retail’s most iconic names with the launch of Bed Bath & Beyond Home, beautifully reimagined for how families gather at home today,” Amy Sullivan, CEO of The Brand House Collective, said in a statement on July 28.

“This isn’t just a store, it’s a fresh start for a brand that means something special to so many families.”

The store also brought back its popular Beth Bath & Beyond coupons as it celebrated the grand opening.

Bed Bath & Beyond is investing in an alternative California strategy, according to Lemonis.

The company will offer 24 hour to 48 hour delivery to customers, and in many cases will deliver on the same day of purchase.

?itok=m7cIZCHF

?itok=m7cIZCHF

A Bed Bath & Beyond store in Los Angeles on April 10, 2013. The company closed its 41 California outlets in 2023. Kevork Djansezian/Getty Images

Californians can continue to get products directly through the company’s website “on our terms, and with their best interest at heart,” but without the extra costs imposed by California’s taxes and regulations, according to Lemonis.

“We’re taking a stand because it’s time for common sense,” he said.

“Businesses deserve the chance to succeed. Employees deserve jobs that last. And customers deserve fair prices. California’s system delivers the opposite.”

https://cms.zerohedge.com/users/tyler-durden

Thu, 08/21/2025 - 08:45

Futures Slide For Fifth Day As Jackson Hole Jitters Rise

Futures Slide For Fifth Day As Jackson Hole Jitters Rise

US equity futures dropped, extending the recent selloff into its fifth day, as traders stayed guarded ahead of the Federal Reserve’s gathering at Jackson Hole. As of 8:00am, S&P 500 futures fell 0.2%, while Nasdaq 100 futures were flat after a two-day selloff that erased 2% off the index. In premarket trading, Nvidia rose 0.8% while most Magnificent Seven peers posted losses. Retail giant Walmart brought Q2 earnings season to an unofficial close after reporting an EPS miss (68c vs exp. 74c) and even though it lifted guidance (now expects net sales to rise 3.75% to 4.75% this year, versus previous forecast of a 3% to 4%) that wasn't enough for the market, however, and the stock dropped in premarket trading. European stocks dropped 0.3%, erasing an earlier gain, and snapping a three-day winning streak. US treasuries fell, pushing the yield on the 10-year higher to 4.31%. The dollar strengthened and reversed all of yesterday's losses while Brent crude rose to the highest in two weeks even as the rest of the commodity complex was mixed. It's a busy economic calendar: we get weekly jobless claims and August Philadelphia Fed business outlook (8:30am), S&P Global US PMIs (9:45am) and July leading index and existing home sales (10am). The Fed speaker slate includes Atlanta Fed President Bostic at 7:30am, the last central bank official slated to speak before Chair Powell’s discourse at Jackson Hole Friday

?itok=2YuU8mUT

?itok=2YuU8mUT

In premarket trading, Mag 7 stocks are mostly lower (Nvidia +0.8%, Tesla unchanged, Microsoft -0.1%, Alphabet -0.2%, Amazon -0.3%, Meta -0.3%, Apple -0.5%). Here are some other notable premarket movers:

Aegon ADRs (AEG) are up 5% after the Dutch insurance company posted better-than-expected results and said it planned to increase its share buyback. Management said the company may redomicile to the US, a move that Morgan Stanley said would “make sense.”

Boeing Co. (BA) gains 1.5% as the company is heading closer toward finalizing a deal with China to sell as many as 500 aircraft, according to people familiar with the matter.

Canadian Solar (CSIQ) falls 11% after forecasting third-quarter revenue below analyst expectations.

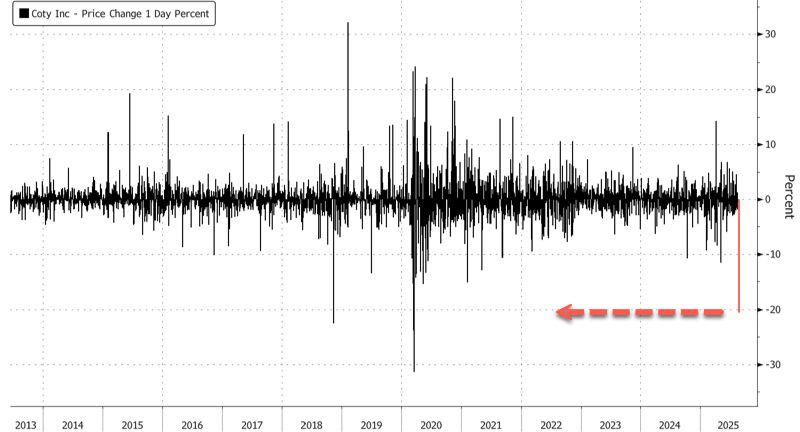

Coty (COTY) falls 20% after the personal care products company forecast steep sales declines and reported a wider-than-expected loss for the fourth quarter.

Dayforce (DAY) rises 1.4% after entering into a definitive agreement with Thoma Bravo to become a privately held company in an all-cash transaction with an enterprise value of $12.3 billion.

Hewlett Packard Enterprise (HPE) gains 3.1% after being raised to overweight from equal-weight at Morgan Stanley as analysts note that recently-closed Juniper deal will be an earnings upside.

SharkNinja (SN) trades lower by 2% as holders affiliated with Chairperson CJ Xuning Wang offer 5 million shares in the household-appliance maker via JPMorgan, BofA Securities.

Two Harbors Investment (TWO) falls 3% after the mortgage REIT resolved litigation with Pine River via a one-time $375m cash settlement and cut its quarterly dividend to 34c a share.

Walmart (WMT) slips 2.4% after the world’s largest retailer posted second quarter profit that disappointed.

In corporate news, FanDuel, the online gambling division of Flutter Entertainment, is teaming up with CME Group, the largest US derivatives exchange, to offer bets on stocks, commodity prices and even inflation. Google introduced a new slate of consumer gadgets, including several smartphones, a watch and new wireless earbuds, all meant to show off the company’s latest advances in artificial intelligence. Musk‘s Starlink service is said to be in conversation with Emirates and other Middle Eastern airlines, with winning business in the region potentially marking a watershed moment in Starlink’s global competition.

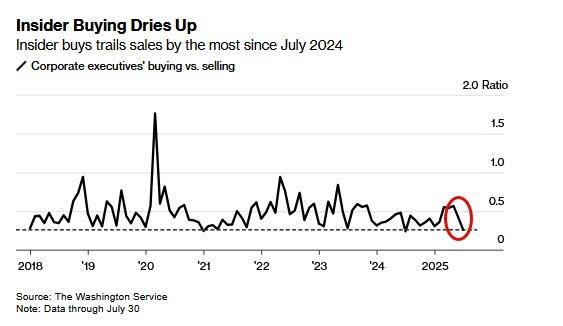

This week has seen pressure on momentum names (read tech stocks) particularly the largest names, amid worries that their sharp rally since April has moved too far, too fast. Traders are also cautious as the Jackson Hole symposium kicks off later today, with investors awaiting Fed Chair Jerome Powell’s speech at 10am ET Friday for guidance on the path for interest rates. Despite the pullback in stocks this week, the VIX hasn’t really budged, and Goldman said it’s time to buy the dip in momentum stocks (and the overall market according to JPMorgan).

The market’s direction today will also be shaped by PMIs, home sales data and Walmart earnings (which missed but boosted its revenue forecast). For the euro area, the Composite Purchasing Managers’ Index compiled by S&P Global grew at the quickest pace in 15 months as manufacturing exited a three-year downturn.

“What we are currently seeing is profit-taking and a natural flight to quality ahead of Jerome Powell’s speech in Jackson Hole,” said John Plassard, head of investment strategy at Cité Gestion. But “let’s not beat around the bush: this is not the end of tech, and even less so for stocks linked to artificial intelligence.”

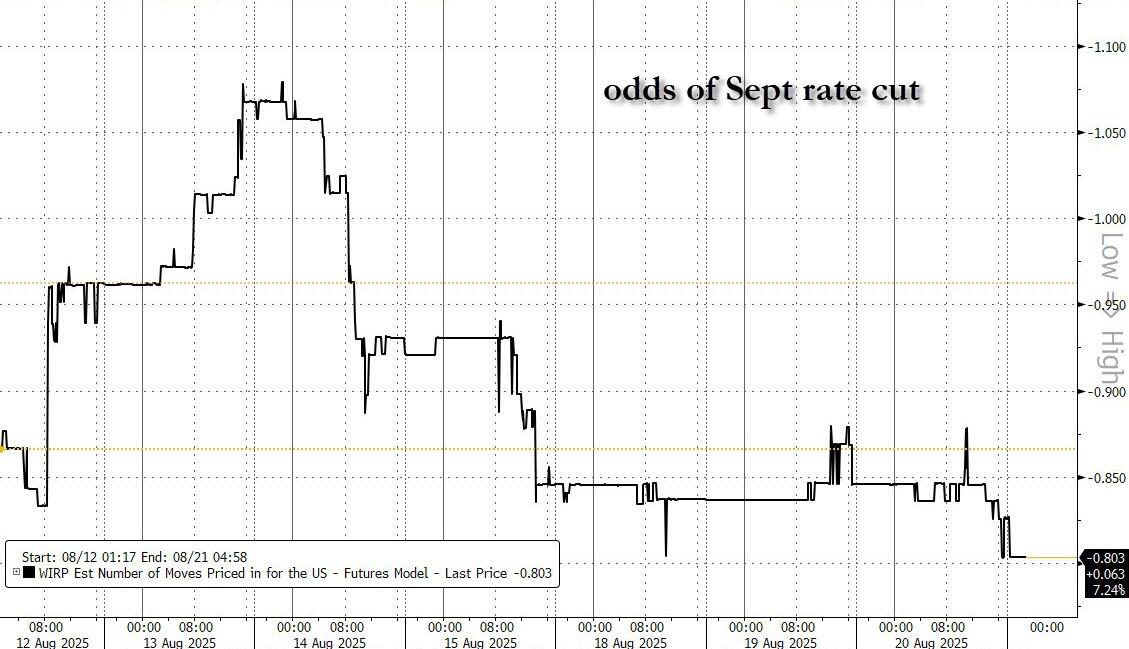

Swaps are currently pricing in 80% chance of a Fed quarter-point cut in September, and at least three more over the next year, some strategists warned that the market may be too optimistic about the pace and depth of easing.

?itok=Yh1Woggu

?itok=Yh1Woggu

“All it’s going to take is a bit of stickiness in inflation and actually a labor market print which shows it’s not falling off a cliff for the market to say, ‘hang on,’” Karen Ward, chief market strategist for EMEA at JPMorgan Asset Management, told Bloomberg TV.

In his latest effort to stack the Fed board, Trump and his allies are demanding Fed Governor Lisa Cook resign over alleged owner-occupancy fraud. For her part, Cook signaled her intention to remain at the central bank.

Yesterday, the latest FOMC Minutes for the July 29-30 meeting showed most officials viewed inflation risks as outweighing labor-market concerns, with tariffs fueling a growing divide within the rate-setting committee, though the discussions came before subsequent dramatic dire revisions to jobs data.

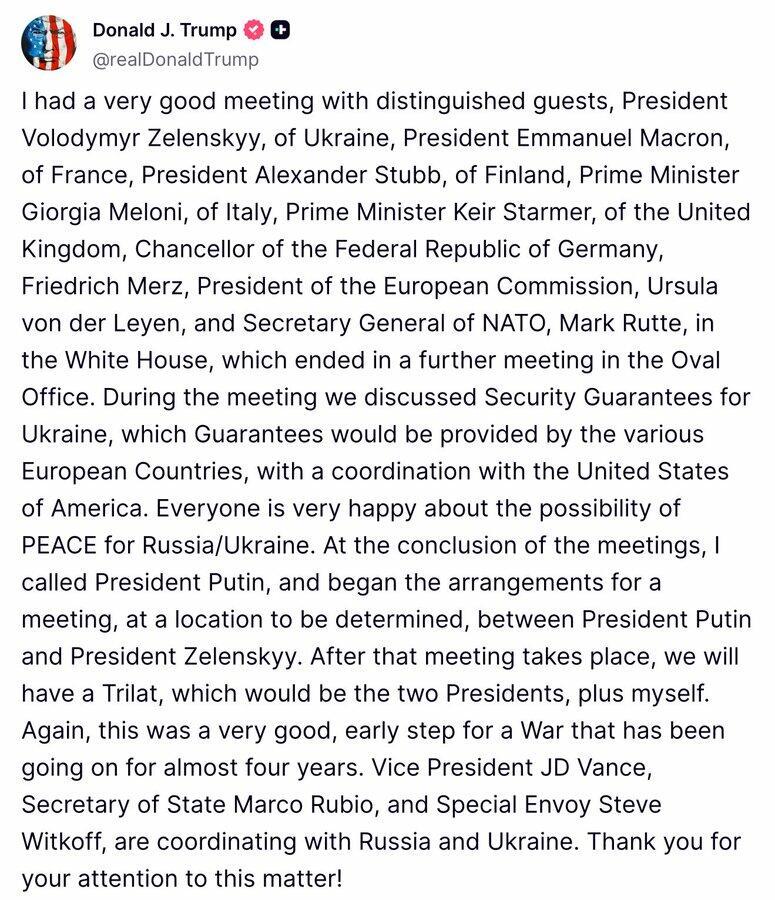

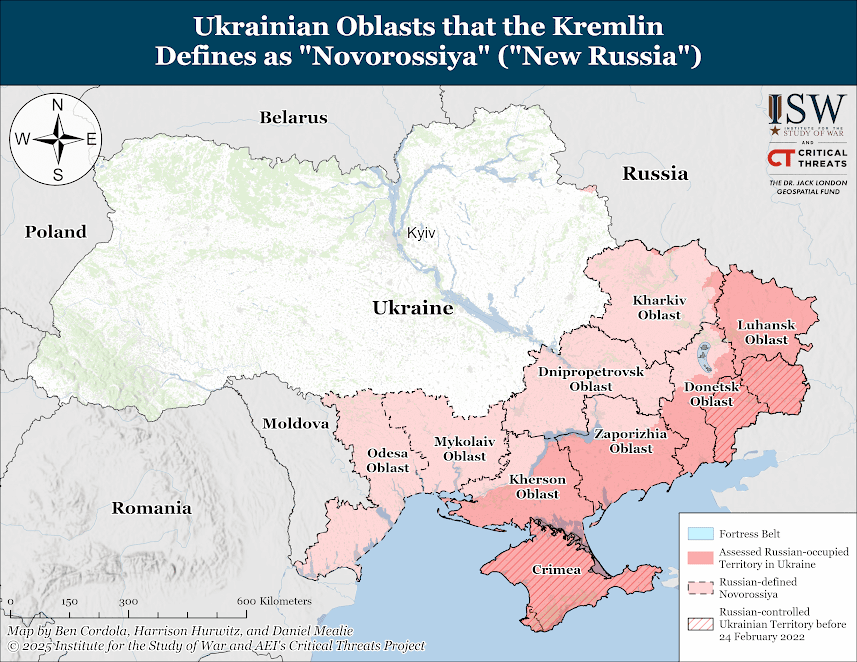

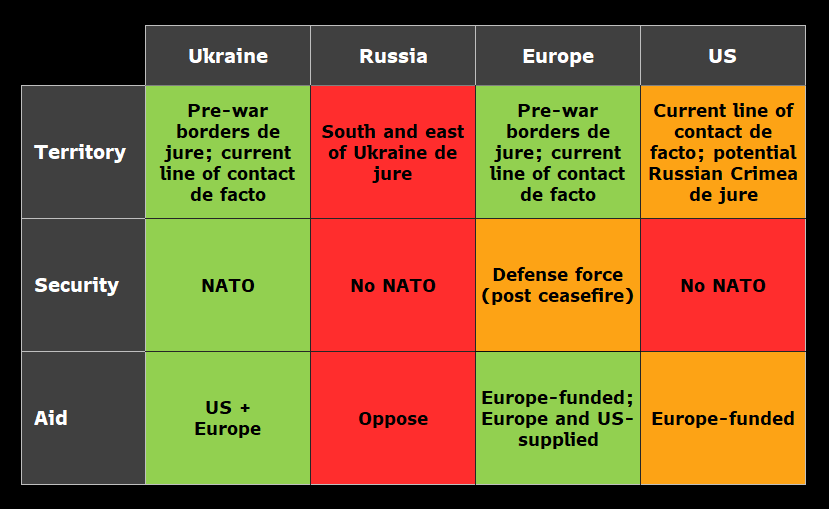

On the geopolitical front, US Vice President JD Vance said negotiations over ending Russia’s war in Ukraine are focused on security guarantees for Ukraine and territory Russia wants to control — including Ukrainian territory that Russia isn’t occupying — as the US tries to broker a peace deal between the two nations. Brent crude rose 0.8%.

The Stoxx 600 falls 0.2% with media, consumer product and chemical shares leading declines. Nordics represented several of the region’s biggest movers, with hearing-aid maker GN Store Nord surging 19% after reporting earnings, while Norwegian oil firm Aker BP jumped after a large oil find in the North Sea. UK retailer WH Smith plunged after signaling North American profit will be much weaker than previously hoped. Here are the biggest movers Thursday:

Aegon shares jump as much as 7.4%, reaching a 10-year high, after the Dutch insurance company posted better-than-expected results and said it planned to increase its share buyback

GN Store Nord gains as much as 19% after the Danish hearing aid and audio equipment firm’s 2Q earnings beat estimates across the board. Analysts see a strong showing following weaker reports from European peers

Aker BP shares rise as much as 4.6% after the Norwegian industrial investment company announced a “significant oil discovery” as it completed the Omega Alfa exploration campaign in the Norwegian North Sea

ALK-Abello gains as much as 5.9%, the most since May, after the Danish allergy drugmaker reported 2Q earnings. Analysts say that while the report holds few surprises after the company pre-released figures, they reassured

Salmar gains as much as 6.1%, the most since April, after the Norwegian salmon firm reported its latest earnings, which DNB Carnegie described as in line, with “positive” cost and volume guidance for the rest of the year

DNO gains as much as 11%, the most since 2023, after the Norwegian oil company reported its latest earnings and hiked its dividend per share by around 20%. DNB Carnegie expects the raised payouts to support the shares

Renishaw shares rise as much as 8.9% to the highest since February after the precision measuring equipment maker indicated its adjusted pretax profit for the full year will be at the high end of the guidance range

WH Smith shares plummet as much as 38%, the biggest drop on record, after the retailer warned headline trading profit from North America will be significantly lower than previously hoped

CTS Eventim shares slide as much as 20%, the most since 2007, after the events firm reported 2Q Ebitda well below estimates. The firm cited “intense and persistent cost pressures” for live events and headwinds in other divisions

Novonesis falls as much as 7.8% after the Danish biotechnology group reported earnings. Analysts say a profitability miss and merely reiterated margin guidance disappointed, and will lead to slight consensus cuts

European stocks in the beauty and personal care sector fell after US company Coty reported a wider adjusted loss per share in 4Q than analysts expected, while forecasting steep sales declines will continue

Sensirion falls as much as 8.2% after both Berenberg and Research Partners downgraded the semiconductor device manufacturer to hold from buy following its first-half earnings

UK housebuilders are under pressure on Thursday as London builders are taking longer to start home constructions after receiving permits, with a slump in demand threatening to derail the government’s plan to build 1.5m homes

Kojamo declines as much as 5.9% following its second-quarter results, with JPMorgan retaining its underweight rating and a cautious stance on the real estate company

Earlier in the session, Asian stocks traded in a tight range, as a rebound in some tech stocks was offset by declines in Japan. The MSCI Asia Pacific Index fell 0.2%, with Japan’s Daiichi Sankyo among the top drags after a series of block trades at a discount. Hon Hai and TSMC were among the biggest boosts for the gauge. Shares hit a record high in Australia, while those in South Korea and Taiwan also advanced. Investors are awaiting cues from the Jackson Hole symposium, where Federal Reserve Chair Jerome Powell is expected to speak on Friday. Nvidia’s results next week will be another key test, with expectations for improving global tech earnings having bolstered sentiment. Equities also traded higher in mainland China, Vietnam and New Zealand on Thursday. MSCI equity gauges for every nation in the region are trading above their 200-day moving averages for the first time since 2021, according to Sentimentrader.com.

In FX, the euro and pound both edge higher against the greenback after the better-than-expected PMI data. The Norwegian krone is the best-performing G-10 currency, rising 0.5% after Norway’s GDP grew more than forecast in the second quarter.

In rates, treasuries are under pressure in early US trading amid steeper losses for most European bond markets sparked by stronger-than-anticipated August preliminary PMI gauges. US yields are higher by 1bp-2bp, the 10-year by about 1.8bp at 4.31%, vs increases of 3bp-4bp for UK and most euro-zone counterparts. US session features 30-year TIPS reopening auction at 1pm New York time. Week’s major focal point is Fed Chair Powell’s Jackson Hole speech on Friday. UK gilts are leading declines in European government bonds after the UK private sector expanded at the strongest pace in 12 months. UK 10-year yields rise 3 bps to 4.70%. German 10-year borrowing costs add 2 bps to 2.73% after the euro area’s private sector grew at the quickest pace in 15 months.

Looking at today's calendar, US economic data calendar includes weekly jobless claims and August Philadelphia Fed business outlook (8:30am), August preliminary S&P Global US PMIs (9:45am) and July leading index and existing home sales (10am). Fed speaker slate includes Atlanta Fed President Bostic at 7:30am, the last central bank official slated to speak before Chair Powell’s discourse at Jackson Hole Friday

Market Snapshot

S&P 500 mini -0.1%

Nasdaq 100 mini little changed

Russell 2000 mini -0.3%

Stoxx Europe 600 -0.2%

DAX -0.1%

CAC 40 -0.5%

10-year Treasury yield +1 basis point at 4.3%

VIX +0.2 points at 15.93

Bloomberg Dollar Index little changed at 1207.17

euro little changed at $1.1658

WTI crude +1% at $63.35/barrel

Top Overnight News

Fed reserve governor Lisa Cook has defied calls from Trump to resign, saying she has “no intention of being bullied to step down” after FHFA Director Bill Pulte posted he was making a criminal referral based on a mortgage application from four years ago: FT

The Texas House approved a new congressional map that may add up to five GOP seats in the 2026 midterms. In California, the state’s top court declined to halt Governor Gavin Newsom’s own redistricting plan, which he’s pursuing to offset the moves in Texas and elsewhere. BBG

Meta Platforms has frozen hiring in its artificial-intelligence division after spending months scooping up 50-plus AI researchers and engineers. WSJ

South Korea will unveil an additional $150 billion in US investment from private firms during Lee Jae Myung’s summit with Trump, local media said. BBG

The euro area’s private sector expanded at the quickest pace in 15 months, PMI data showed, adding to evidence of the region’s resilience. Manufacturing ended a three-year downturn despite higher US levies. UK composite PMI also rose more than expected. BBG

China is aggressively trying to persuade domestic tech firms to avoid buying Nvidia chips following “insulting” remarks from Commerce Sec Lutnick. FT

Japan’s 20-year yields hit their highest since 1999 amid fiscal concerns and fading demand from key investors. Yields on 30-year notes approached a new high. BBG

India’s flash PMIs for Aug are strong, including manufacturing (59.8, up from 59.1 in Jul) and especially services (65.6, a big jump from 60.5 in Jul). S&P

Russia warned on Wednesday that it should effectively hold veto power over any action to assist Ukraine after a peace deal is reached, rendering planned Western security guarantees for Kyiv moot and delivering a setback to negotiations championed by President Trump. Russia’s Lavrov also played down likelihood of a summit between Russia/Ukraine leaders happening soon. WSJ

Trade/Tariffs

China’s Commerce Minister talked with Kazakhstan’s Trade Minister and said China is ready to work with Kazakhstan to promote the upgrading of bilateral trade, while China is ready to strengthen cooperation in emerging fields and accelerate the cultivation of new trade formats.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed, albeit with a mildly positive bias as the region attempted to shrug off the lacklustre lead from Wall St, where sentiment was dampened amid continued tech weakness and hawkish-leaning FOMC Minutes. ASX 200 outperformed amid a slew of earnings releases and breached the 9,000 level for the first time in history. Nikkei 225 was dragged lower by weakness in pharmaceuticals and automakers, with the latter not helped by reports that Japanese automakers are passing some of the expense of US tariffs through to American car buyers, which is a change from their strategy of absorbing the impact. Hang Seng and Shanghai Comp were mixed with the Hong Kong benchmark led lower by underperformance in tech stocks including Baidu and Xiaomi, despite both recently reporting a jump in profits, while the mainland remained propped up following the PBoC's liquidity efforts.

Top Asian News

Asian petrochemicals shares rise as China is set to launch a sweeping overhaul of its petrochemicals and oil refining sector to phase out smaller facilities and target outdated operations for upgrades.

Chinese biomedical shares rise after Premier Li Qiang toured company sites and emphasized the need to increase scientific and technological backing as well as policy support for the sector.

Chinese crypto-linked stocks rally after a report that the government is considering a plan for expanded yuan use and stablecoins.

Sonic Healthcare shares slide as much as 10%, the most since May 2024, after the Australian diagnostics and pathology firm reported net income for the full year that missed the average analyst estimate.

South Korea’s Financial Services Commission urges financial firms to provide necessary support in the course of the nation’s petrochemical industry restructuring, according to a statement from the financial regulator.

European bourses (STOXX 600 -0.2%) are trading with little in the way of a clear bias. Geopolitical tensions resurfaced early doors after Ukraine's Air Force stated that Russia used 574 drones and 40 missiles in an overnight attack. Focus also on EZ PMIs which saw the saw the composite move further into expansionary territory. European equity sectors show a mostly negative tilt with stock-specific updates relatively light. Energy names sit at the top of the leaderboard amid upside in underlying crude prices. To the downside, Media names lag with Wolters Kluwer (-2.2%) a notable underperformer in the sector following a PT reduction at Morgan Stanley.

Top European News

The euro area’s private sector expanded at the quickest pace in 15 months, PMI data showed, adding to evidence of the region’s resilience. Manufacturing ended a three-year downturn despite higher US levies. UK composite PMI also rose more than expected.

FX

Steady trade for DXY after a session yesterday, which was dominated by newsflow surrounding the Fed. US rates markets endured a steepening of the curve, led by the front-end amid reporting that President Trump could fire Fed Governor Cook amid alleged mortgage fraud. Thereafter, attention pivoted to the account of the July policy announcement, which was viewed with a hawkish lens. DXY sits towards the mid-point of Wednesday's 98.07-44 range.

EUR saw some pressure early doors after comments from Ukraine's Air Force that Russia used 574 drones and 40 missiles in an overnight attack. This has helped reinforce the message that despite a more encouraging direction of travel for peace talks, the reality on the ground remains tense between Russia and Ukraine. Some of the pessimism was faded following flash PMI metrics from across the Eurozone with a solid report from France kickstarting the recovery and followed by a mostly positive German release. The EZ-wide print saw the composite move further into expansionary territory. EUR/USD sits just above its 50DMA at 1.1645.

JPY is fractionally weaker vs. the USD after a session of gains on Wednesday, which were in part driven by a refocus on interest-rate differentials as the front-end of the US curve was dragged lower by the possibility of Fed Governor Cook being removed from her position. Overnight, there was little follow-through seen from mixed flash Japanese PMI metrics for August, which saw the manufacturing metric tick higher from its prior (but remain sub-50) and services fall from its previous (but remain above 50). USD/JPY sits within Wednesday's 146.87-147.81.

GBP is the marginal outperformer across the majors following a better-than-expected outturn for flash August services and composite PMIs, which rose further into expansionary territory. Cable has picked up from its 1.3436 session low with a current session peak at 1.3476.

Antipodeans are both are a touch softer vs. the USD with NZD unable to launch much of a recovery from Wednesday's RBNZ-induced losses and AUD failing to garner any support from upticks in flash PMI metrics for August. AUD/USD is at its lowest level since June 23rd with focus on a test of the 0.64 mark and the 200DMA @ 0.6386.

Fixed Income

USTs began the European session around the unchanged mark, with price action fairly tentative in a continuation of the lacklustre trade seen overnight. As the European morning kicked off, trade has largely been dictated by Bunds, which have had a number of regional PMIs to digest (more in Bunds below). US paper currently trades lower by a handful of ticks, in a 111-24 to 111-29 range, currently contained within the prior day's confines. Looking ahead, weekly initial jobless claims and US PMIs alongside Fed speak from Bostic and Schmid.

Bund Sept’25 started the European session around the unchanged mark and then slipped on both the French and then German PMI metrics, which overall highlighted the ongoing strength in the Manufacturing sector, whilst Services was a little more subdued. The EZ wide figure confirmed the strong Manufacturing / slightly softer Services picture, with the former surprisingly climbing into expansionary territory. In terms of the commentary, it highlighted that “U.S. trade policy is leaving its mark. Foreign orders in the eurozone manufacturing sector have declined for the second month in a row”.

Gilts traded subdued throughout the European morning, taking leads from the hotter-than-expected PMI metrics in Europe. Into the region’s own figures, UK paper traded lower by around 15 ticks. Thereafter, on the region’s own PMI metrics, Gilts fell from 90.99 to 90.91 before trimming half of the move; currently trading in a 90.82 to 91.22 range. Unlike in Europe, the upside in Composite was thanks to strength in the Services sector whilst Manufacturing was subdued. It is worth highlighting that the accompanying release was fairly downbeat; “Payroll numbers also continue to be cut at an aggressive rate”; “the demand environment remains both uneven and fragile”.

France sells EUR 10.499bln vs exp. EUR 8.5-10.5bln 2.40% 2028, 2.50% 2030, and 2.70% 2031 OAT.

Commodities

Modestly positive trade in the crude complex in what has been a quiet session thus far, but with eyes remaining on geopolitics amid a couple of notable updates. WTI resides in a USD 62.78-63.40/bbl range while Brent sits in a USD 66.88-67.49/bbl parameter.

Softer trade across precious metals, albeit modest in spot gold and silver, with newsflow on the lighter side and with the metals largely moving in tandem with the dollar. Price action this morning sees the precious metals complex subdued, with spot gold on either side of its 50 DMA (~3,348.10/oz) in a USD 3,334.28.56-3,352.30/oz range.

Subdued price action across the base metals complex - in fitting with the broader market mood as traders look ahead to the Jackson Hole Symposium. 3M LME copper prices reside in a USD 9,689.45-9,739.40/t range.

Geopolitics: Middle East

UN Secretary General Guterres called for an immediate ceasefire in Gaza to avoid massive death and destruction in Gaza City, while he called for Israel to reverse its decision to expand the illegal settlement expansion in the West Bank.

Geopolitics: UKRAINE

Ukraine's Air Force said Russia used 574 drones and 40 missiles in an overnight attack.

Moscow to host first nuclear summit on September 25", according to Al Arabiya.

Ukraine President Zelensky said Kyiv wants to have an understanding of security guarantees within 7-10 days, followed by bilateral and trilateral leaders meetings. If Russia is not ready for a bilateral leaders meeting, Ukraine and Europe want to see strong US reaction. ‘Flamingo’ missile is Ukraine’s most successful missile, mass production expected by early next year. Ukrainian proposal for US drone deal entails production worth USD 50bln over five years. Ten million drones expected to be produced yearly as part of the deal. China not included in security guarantees because China did not help after the Russian invasion. On Budapest as venue for peace talks: “For now, this is challenging.”Ukraine will not legally recognise Russia's occupation of its territories. There is no signal that Moscow is prepared to end the war and have substantial conversations. Ukraine has tested a new long-range missile.

Ukrainian President Zelenksy's Chief of Staff warned against repeating mistakes of the 1994 Budapest memorandum on security guarantees and said Ukraine's allies have started active work on the military aspect of security guarantees, while a contingency plan is being developed with partners in case Russia extends the war or violates agreements from leaders' meetings.

US VP Vance said on Fox News that Europeans are going to have to take the lion’s share of the burden in security. It was separately reported that a Pentagon top policy official told a small group of allies Tuesday night that the US plans to play a minimal role in any Ukraine security guarantees, according to POLITICO citing Defense Undersecretary for Policy Colby.

Turkish defence ministry source said ceasefire between Russia and Ukraine needed before discussing peacekeeping mission framework, via Reuters citing sources.

Russia attacked a key Ukrainian gas compressor station vital for storage operations, according to Reuters sources.

Ukraine military said it hit a Russian oil refinery, drone warehouse and fuel base overnight.

Geopolitics: Other

North Korea has a heavily fortified, covert military base that could house its newest long-range ballistic missiles, which are potentially capable of striking the US mainland, according to a new report cited by the WSJ.

US Event Calendar

8:30 am: Aug 16 Initial Jobless Claims, est. 225.33k, prior 224k

8:30 am: Aug 9 Continuing Claims, est. 1960k, prior 1953k

8:30 am: Aug Philadelphia Fed Business Outlook, est. 6.5, prior 15.9

9:45 am: Aug P S&P Global U.S. Manufacturing PMI, est. 49.7, prior 49.8

9:45 am: Aug P S&P Global U.S. Services PMI, est. 54.2, prior 55.7

9:45 am: Aug P S&P Global U.S. Composite PMI, est. 53.5, prior 55.1

10:00 am: Jul Leading Index, est. -0.1%, prior -0.3%

10:00 am: Jul Existing Home Sales, est. 3.92m, prior 3.93m

10:00 am: Jul Existing Home Sales MoM, est. -0.25%, prior -2.7%

DB's Jim Reid concludes the overnight wrap

While the headline market moves were fairly muted over the past 24 hours, investors had to navigate a couple of major narratives. One was renewed concerns over Fed independence as President Trump suggested that Fed Governor Cook should resign, which pushed gold (+0.98%) to its best day since the weak July payrolls report on August 1. The other was continued pressure on tech stocks as the Mag-7 (-1.11%) posted consecutive declines of more than 1% for the first time since the post-Liberation Day sell-off in early April. This sent the S&P 500 (-0.24%) lower for a fourth session running even as the index recovered most of its -1% intra-day decline.

The topic of the US administration’s influence over the Fed came back into the headlines as Trump posted that Fed Governor “Cook must resign, now!!!”. His post followed news that Federal Housing Finance Agency (FHFA) Director Bill Pulte had written a criminal investigation referral letter to Attorney General Pam Bondi alleging that Governor Lisa Cook may have committed mortgage fraud. Pulte has been one of the staunchest Fed critics within the administration, earlier calling for an investigation into Chair Powell over the Fed’s building renovations. Yesterday Pulte claimed that the allegations give Trump “cause to fire” Governor Cook. Later in the day, Cook said in a statement that she had “no intention of being bullied to step down from my position”.

Governor Cook was nominated to the Federal Reserve Board by Joe Biden in 2022 and our US economists see her as leaning slightly towards to dovish end within the FOMC. Were Governor Cook to resign or be fired, that would create another opening for Trump to fill on the seven-person Board. With Stephen Miran nominated to take the seat recently vacated by Governor Kugler and two Fed Governors – Bowman and Waller – dissenting to vote for a rate cut at the July meeting, this would increase the prospects of a dovish majority emerging on the Board, especially if Chair Powell relinquishes his seat next year. That said, if concerns over threats to Fed independence increase, Powell could choose to serve out the rest of his board term (which ends in 2028) even after his term as Chair ends next May.

The news was a reminder of the lingering concerns over future Fed independence and risks of fiscal dominance, though the extent of the market reaction was fairly modest. The most sustained reaction was in gold (+0.98%) as mentioned at the top. The dollar index fell by a couple of tenths following the news but was back to little changed (-0.05%) by the close. Front-end yields fell by 3-4bps, but that move came amid a broader risk-off mood early in the session and also reversed later on.

By the close, 10yr Treasury yields were -1.5bps lower at 4.29% but 2yr yields were unchanged at 3.75%. This curve flattening was also supported by hawkish-leaning minutes of the July FOMC meeting. These showed that most of the FOMC “judged the upside risk to inflation” as greater than the “downside risk to employment”, with several participants noting the “risk of longer-term inflation expectations becoming unanchored”. That said, the minutes did suggest easing would be warranted “if labor market conditions were to weaken materially", and given the weak jobs report that followed the July decision, the relative focus on employment versus inflation risks will likely have shifted since. So, while pricing of September rate cut inched down yesterday to its lowest since the August 1 jobs report, a 25bp cut was still 83% priced.

US equities saw an even larger round trip, with a rout for tech stocks early in session leaving the S&P 500 more than -1% down intra-day but recovering to -0.24% by the close. The NASDAQ fell -0.67%, having been almost -2% down early on, while the Mag-7 slid by -1.11% after a -1.67% drop on Tuesday. The last time the Mag-7 saw consecutive declines of more than 1% was during the post-Liberation Day collapse in early April. The tech sell-off may have been exacerbated by reporting of an MIT study claiming that 95% of enterprises adopting AI saw no measurable increase in profits. Here at DB research, we remain optimistic on the productivity impact of AI but the report is a reminder that successful integration of new technologies takes time and that it’s still uncertain who will be the biggest end beneficiaries of the AI wave. Outside of tech, US equities had a decent day, with most of the S&P 500 sectors advancing, led by energy (+0.86%) which benefited as Brent crude prices rose +1.60% to $66.84/bbl.

Turning to Europe, we saw the latest rate decision from Sweden’s Riksbank, which kept rates on hold at 2.00% as expected while continuing to signal “some probability of a further interest rate cut this year”. Market pricing of another rate cut by year-end inched down to 88% from 91% the day before. We also heard from ECB President Lagarde, who said that “Recent trade deals have alleviated, but certainly not eliminated, global uncertainty” and noted that the euro area economy was likely to see slower growth this quarter. So that was arguably a bit more dovish in tone than her press conference last month, though Lagarde gave away little on the policy outlook.

Expectations of ECB easing ticked up on the day, with 21bps of cuts now priced by next June, the highest this has been in almost two weeks. In turn, European government bonds rallied with 10yr bund yields falling -3.2bps to 2.72%, and OAT (-2.2bps) and BTP (-3.0bps) yields similarly moving lower. Bunds were also supported by Germany’s PPI inflation print (-1.5% yoy vs -1.4% expected) falling to a 13-month low in July. Meanwhile, the euro area final headline CPI for July came in line with the flash reading at 2.0%.

Over in the UK, gilts yields saw a larger rally, with 10yr yields down -6.8bps to 4.67%. This came despite July CPI coming in slightly stronger than expected at +3.8% yoy for both headline and core inflation (vs +3.7% expected), which marked the highest headline reading since January 2024. A saving grace noted by our UK economist Sanjay Raja is that with the volatile transport and travel services components driving the upside, most core services metrics ticked down on the month (see Sanjay’s reaction here). Money markets moved to price in more BoE easing for early 2026 following the release, with the amount of cuts priced by next June rising +5.5bps to 38bps.

The repricing in UK rates helped the FTSE 100 outperform (+1.01%). The Stoxx 600 rose +0.24% but continental indices were more subdued, with the CAC (+0.06%) posting a marginal gain but the DAX (-0.69%) and FTSE MIB (-0.36%) losing ground.

Overnight, sentiment has turned risk-on again in most Asian equity markets. The KOSPI is up +0.73%, while the S&P/ASX 200 (+0.90%) is leading the way after a strong flash PMI print. Australia's composite PMI rose from 53.8 to 54.9 and the manufacturing index reached a 35-month high of 52.9. Chinese stocks are on also the rise, with the CSI (+0.72%) and the Shanghai Composite (+0.33%) higher though the Hang Seng (-0.10%) is lagging. Meanwhile, US equity futures on the S&P 500 and NASDAQ 100 are little changed after yesterday’s decline.

The one Asian market defying the regional positive trend is Japan, with the Nikkei down -0.58%. That comes despite Japan’s composite PMI rising to a 6-month high of 51.9 in the August flash reading (up from 51.6 in July), as stabilization in manufacturing (49.9 vs 48.9 in July) has offset slowing services growth (52.7 vs 53.6 in July). However, long-end JGB yields are inching higher to new multi-decade highs ahead of the July inflation print tomorrow morning, with the 30yr yield up +0.7bps to 3.18%, a new all-time high since this tenor was introduced in 1999.

To the day ahead, the main highlight will be the August flash PMI prints in Europe and the US. Other data releases include the August Philadelphia Fed business outlook, July existing home sales and weekly jobless claims in the US as well as August Eurozone consumer confidence. Earnings include Walmart, Intuit, and Workday. The Fed’s Bostic is due to speak, while the Kansas City Fed’s Jackson Hole symposium begins this evening with the main events on Friday and Saturday.

https://cms.zerohedge.com/users/tyler-durden

Thu, 08/21/2025 - 08:07

https://www.zerohedge.com/markets/futures-slide-fifth-day-jackson-hole-jitters-rise

Coty Tanks As Fragile Turnaround Delayed On Perfume Sales Slump

Coty Tanks As Fragile Turnaround Delayed On Perfume Sales Slump

Coty shares crashed in premarket trading after the beauty giant warned of a deeper sales slump this quarter and posted a steeper-than-expected loss for the fourth quarter.

The beauty company, which develops, manufactures, markets, and distributes cosmetics, fragrances, and skincare products, warned that like-for-like sales, which measure revenue from existing business units, will fall between 6% and 8% this current quarter, exceeding the Bloomberg consensus estimate of a 2.6% decline.

?itok=X5vBLqT4

?itok=X5vBLqT4

For quarter four, Coty beat on revenue but missed on earnings, pressured by margin compression and weaker U.S. consumer beauty sales.

Here's an earnings snapshot of the previous quarter:

Earnings: Adjusted loss per share 5c, wider than last year's 3c loss and well below the 1.4c profit expected (Bloomberg consensus).

Revenue: Net revenue $1.25B, down 8.1% y/y but slightly above the $1.21B estimate.

Americas: $511.2M (-12% y/y, vs. $515M est.)

EMEA: $574.2M (-4% y/y, vs. $569M est.)

APAC: $167M (-8.4% y/y, but well ahead of $134.6M est.)

Prestige: $760.6M (-5.3% y/y, above $717.8M est.)

Consumer Beauty: $491.8M (-12% y/y, in line with $496M est.)

Margins & Profitability: Gross margin 62.3% (vs. 64.2% y/y, 63.1% est.); Adjusted EBITDA $126.7M (-23% y/y, vs. $130.8M est.).

Sales Trends: Like-for-like sales fell 9%, the sharpest drop in over four years.

Coty's latest comes amid a five-year turnaround effort. There are reports that the company may unload assets - potentially selling its luxury portfolio to Interparfums and ending mass-market names like Covergirl, Rimmel, Adidas, and Nautica in a separate deal, according to Women's Wear Daily.

Softness is expected to continue into the second quarter ending in December, with Coty forecasting sales declines of around 5%, versus the Bloomberg Consensus estimate of flat performance.

"A return to sales and profit growth at Coty is delayed until fiscal 2H26 at best," Bloomberg Intelligence analyst Deborah Aitken wrote in a note, adding that the beauty maker's "forecast of a sales drop in 1H26 "is not without risk to a recovery in 2H, though is aided by new launches, price hikes to offset tariffs and an easier year-ago comparison partially."

JPMorgan analyst Andrea Teixeira wrote in a note, "Investors will continue to treat COTY shares as a 'show me the money' story given the lack of visibility and more discretionary nature of fragrances amid a more challenging consumer demand backdrop." Teixeira has a "Neutral" rating on the stock.

Even though the bar was very low for Coty following the year-to-date underperformance, "results were worse than expected," Citi analyst Filippo Falorni said. He cut the stock from "Buy" to "Neutral" and downshifted his 12-month price target to $4.25 from $6.50.

Shares are down 21% in premarket trading. If losses hold into the cash session, it would mark the steepest daily decline since the early Covid period.

?itok=OcapZFkp

?itok=OcapZFkp

Rollercoaster ride.

?itok=VsNu9vpI

?itok=VsNu9vpI

. . .

https://cms.zerohedge.com/users/tyler-durden

Thu, 08/21/2025 - 07:45

https://www.zerohedge.com/markets/coty-tanks-fragile-turnaround-delayed-perfume-sales-slump

Interviews To Replace Fed Chair To Start After Labor Day, Bessent Says

Interviews To Replace Fed Chair To Start After Labor Day, Bessent Says

Potential candidate interviews for the post of the new Federal Reserve chairman will be happening soon, Treasury Secretary Scott Bessent said in an Aug. 19 https://www.cnbc.com/2025/08/19/bessent-says-interviews-for-incredible-group-of-potential-fed-chairs-will-start-after-labor-day.html

with CNBC.

“In terms of the interview process, we’ve announced 11 very strong candidates,“ Bessent said, without providing any more details on the list.

”I’m going to be meeting with them probably right before [and] right after Labor Day, and to start bringing down the list to present to President [Donald] Trump.”

This year, Labor Day falls on Sept. 1.

“It’s an incredible group,“ Bessent said.

”It’s people who are at the Fed now, have been at the Fed, and private sector. So I’m looking forward to meeting all of them with a very open mind.”

The Fed chairman is https://www.brookings.edu/articles/who-has-to-leave-the-federal-reserve-next-2/

by the president for a four-year term and must be confirmed by the Senate.

?itok=W4BXqE2I

?itok=W4BXqE2I

The term of the current Fed chairman, Jerome Powell, is set to https://www.theepochtimes.com/us/feds-powell-to-take-center-stage-for-final-time-at-jackson-hole-retreat-5902683

in May 2026.

Talking about the Fed’s high interest rates, Bessent said the central bank is seeing “some distributional aspects to the higher rates,” especially in housing and lower-income households with high credit card debt.

On one hand, there is a boom in capital expenditure, while on the other hand, households and home building are struggling, he said.

“If we keep constraining home building, then what kind of inflation does that create one or two years out?“ he said.

”So, you know, a cut here could facilitate a boom or a pickup in home building, which will keep prices down one, two years down the road.”

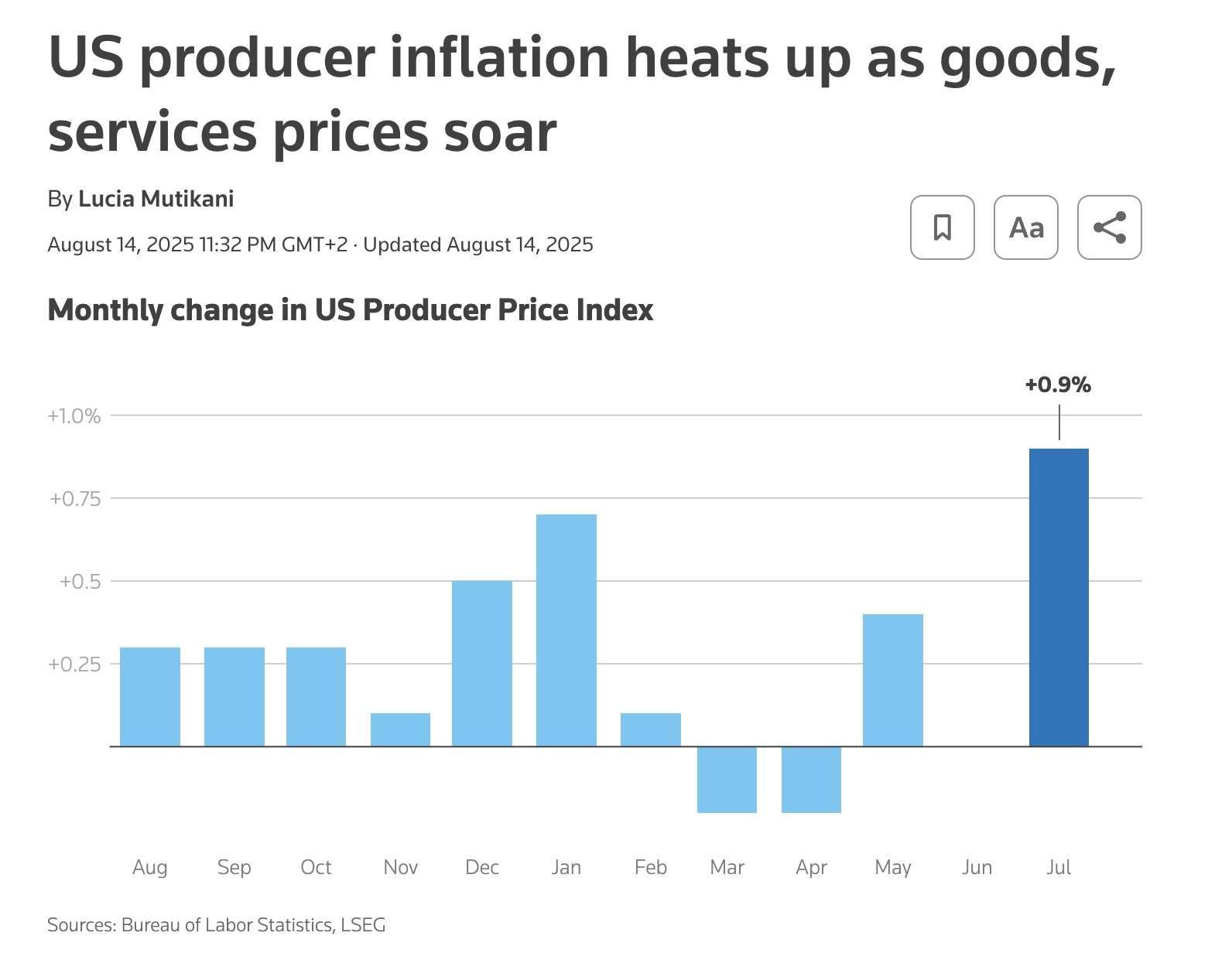

Bessent was asked whether the producer price index (PPI) inflation number for July, published last week, suggests that it is the right time to cut 50 points or at least 25 points from the Fed’s interest rate.

PPI measures prices paid by businesses for goods and services. In July, the https://www.theepochtimes.com/us/us-wholesale-inflation-unexpectedly-rises-0-9-percent-in-july-5901178

months.

Bessent dismissed the PPI increase, highlighting the fact that since Trump first came to office, there have been five “very tame” PPI figures. He said a major component of July’s PPI number was investment services, “which just means the market went up a lot.”

Bessent’s comments about interviewing Fed chairman candidates come amid rumors about multiple https://www.theepochtimes.com/business/who-will-succeed-fed-chair-jerome-powell-here-are-the-top-contenders-5890403

that could take over as Powell’s successor, including former Fed board member Kevin Warsh, current Fed board member Christopher Waller, and National Economic Council Director Kevin Hassett.

Trump has been at odds with Powell over the issue of rate cuts. The president has https://www.theepochtimes.com/business/fed-likely-to-make-2-interest-rate-cuts-before-end-of-year-investment-expert-says-5903047

for lowering interest rates to bring down borrowing costs and trigger growth.

However, Powell has maintained that rates will only be cut once the central bank is convinced that inflation will not rise because of Washington’s tariff policies.

In July, Bessent https://www.theepochtimes.com/us/trump-starts-process-to-replace-fed-chair-wont-oust-powell-early-bessent-says-5887663

the formal process for selecting a new Fed chairman was underway and clarified that Trump has no intention to remove Powell before the end of his term in May despite differences in opinion.

On July 25, Trump said he may appoint a new Fed chairman based on the candidate’s https://www.theepochtimes.com/us/trump-says-he-will-only-appoint-fed-chair-who-wants-to-cut-interest-rates-5879639

to lower rates.

Rate Cut Issue

Since December 2024, the Fed has kept interest rates unchanged in a range of 4.25 percent to 4.5 percent for five consecutive meetings.

There are three more policy meetings scheduled for the central bank in 2025: one from Sept. 16 to Sept. 17 and one each in October and December.

After the July meeting, Powell cited inflation as a cause for concern, arguing that the effects of tariffs on inflation “remain to be seen.”

“We see our current policy stance as appropriate to guard against inflation risks,” he said.

However, Waller and Fed Vice Chair for Supervision Michelle Bowman had dissented from the decision to keep rates unchanged at the July meeting.

The one-off increases in price level should be “looked through,” Waller said, arguing that the current monetary policy was more restrictive than necessary.

In an Aug. 12 https://think.ing.com/articles/limited-tariff-impact-allows-the-fed-to-cut-us-rates-in-september/

, ING Bank stated that while the cost of many goods will end up rising in time because of tariffs, it does not “see inflation pressures persisting.”

Between 2021 and 2022, inflation jumped to 9 percent. At the time, oil prices tripled, home prices and rents surged, and the job market remained “red hot” amid soaring wages, the bank stated. All of these factors contributed to rising inflation.

“Today, these are all disinflationary influences, with cooling housing rents in particular set to help offset the effect of tariffs over the coming quarters,” ING Bank stated.

“With the jobs market not looking as solid as it did earlier in the year and consensus [gross domestic product] growth forecasts having been cut from 2.5 percent at the beginning of this year down to 1.5 percent we believe the Fed will cut the policy rate in September and follow up with additional 25 [basis point] cuts in October and December.”

https://cms.zerohedge.com/users/tyler-durden

Thu, 08/21/2025 - 07:20

https://www.zerohedge.com/political/interviews-replace-fed-chair-start-after-labor-day-bessent-says

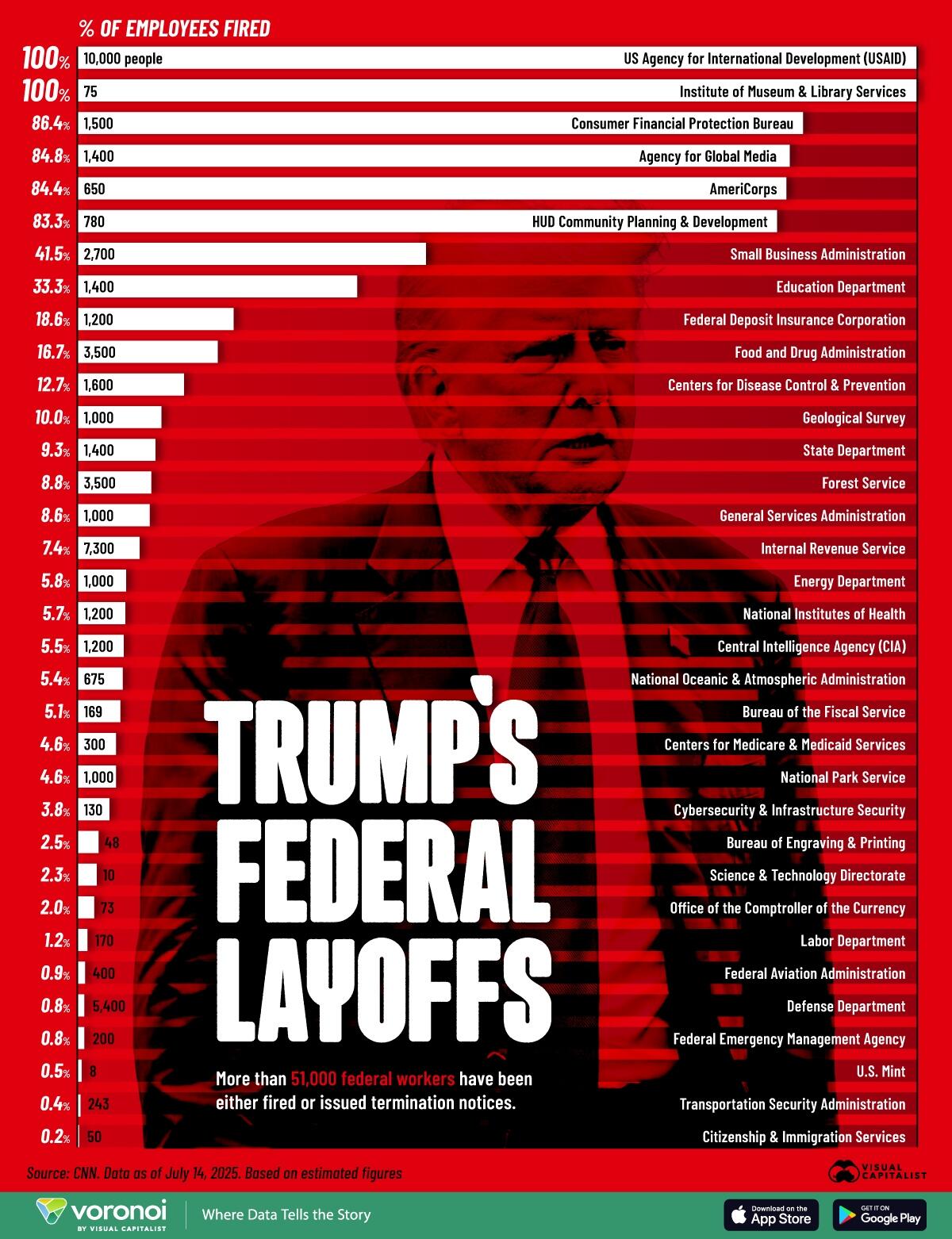

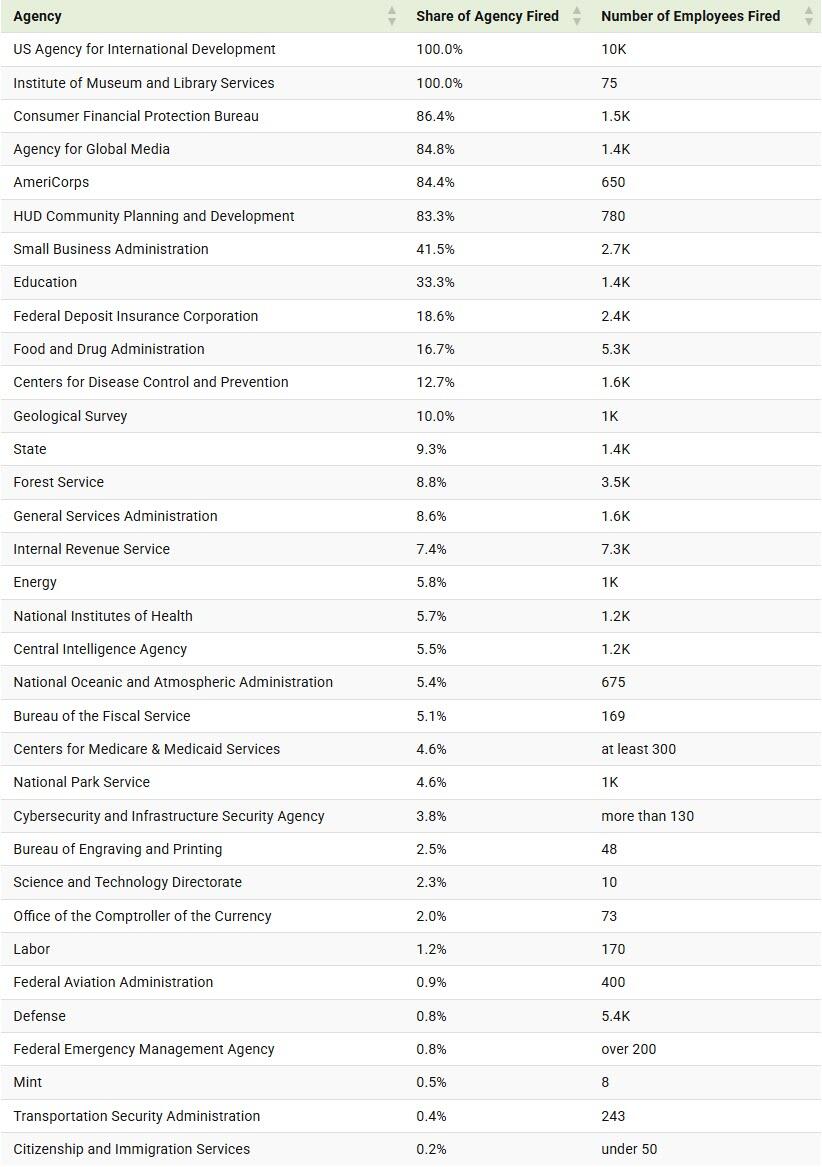

Visualizing Federal Layoffs Under Trump

Visualizing Federal Layoffs Under Trump

Does cutting government headcount make it work more effectively?

From firing inspectors-general, to mass layoffs in the Department of Education, the federal workforce is being scaled back.

So far, the Supreme Court has ruled in favor of 12 of these terminations, while scores of workers are leaving voluntarily.

This graphic, https://www.visualcapitalist.com/federal-layoffs-under-trump

.

?itok=r8mse-D1

?itok=r8mse-D1

Ranked: Federal Layoffs by Agency in 2025

In the table below, we show more than 51,000 federal job cuts as of July 14, 2025:

?itok=MUlpj1_c

?itok=MUlpj1_c

So far, 34 agencies or sub-agencies have made job cuts either through layoffs or notices of termination.

As a result, Washington D.C. is home to the highest number of layoffs in the country in 2025, with six agencies seeing at least 80% of their workforce eliminated.

Most notably, USAID’s closure resulted in about 10,000 layoffs, with 83% of its programs being shut down.

Meanwhile, the Small Business Administration cut about 42% of its workforce, equal to approximately 2,700 employees.

Even more staggeringly, the Consumer Financial Protection Bureau (CFPB) cut 86.4% of its staff.

For perspective, the federal headcount stood at about three million employees in early 2025, with 50% working in the sector for more than 10 years.

Overall, the U.S. ranks 11th out of 80 countries by share of government workers per capita, based on 2023 figures.

https://cms.zerohedge.com/users/tyler-durden

Thu, 08/21/2025 - 06:55

https://www.zerohedge.com/political/visualizing-federal-layoffs-under-trump

Alcohol Consumption In The U.S. Falls To Record Low

Alcohol Consumption In The U.S. Falls To Record Low

A new Gallup poll shows only 54 percent of U.S. adults now drink alcohol — the lowest level in the survey’s 90-year history. Those who do drink also report consuming less, https://www.nytimes.com/2025/08/13/well/us-alcohol-drinking-low-poll.html?campaign_id=190&emc=edit_ufn_20250816&instance_id=160663&nl=from-the-times®i_id=110941733&segment_id=204026&user_id=eb3b115abed24cacb59032280aed3dee

.

Drinking had remained at or above 60 percent for decades but dropped to 58 percent in 2024 before hitting this year’s record low. Gallup also found, for the first time, that most Americans believe even one to two drinks a day harm health.

“A decade or two ago, there was this perception that a glass of red wine with dinner every night might actually help you live longer,” said Dr. Scott Hadland of Mass General for Children. “It does seem now like it’s taking hold,” added Columbia epidemiologist Katherine Keyes, referring to shifting views of alcohol’s harms.

that the health risks are well-documented: alcohol-related deaths more than doubled between 1999 and 2020, and research links even small amounts of drinking to DNA damage and cancer. Former surgeon general Vivek Murthy has called for cigarette-style warning labels on alcohol.

?itok=TwLSfmrs

?itok=TwLSfmrs

Middle-aged adults, who saw a spike in alcohol-related illness during the pandemic, reported the sharpest drop: just 56 percent said they drank, down from 70 percent in 2024. “That suggests the message is sinking in across the board, not just with young people,” said Johns Hopkins professor Johannes Thrul.

Only half of adults aged 18 to 34 reported drinking, steady from 2024 but down from 59 percent in 2023. Researchers attribute younger abstinence to more education on alcohol harms, pandemic-era social changes, and shifting culture. Thrul noted many are choosing cannabis instead, while “mindful drinking” and “sober curious” movements grow online alongside a booming nonalcoholic beverage market.

Polls are imperfect — alcohol use is often underreported — but other national surveys show the same trend. “Certainly a welcome sign for those of us in this area who have been trying to shift the messaging around alcohol use for a long time,” Keyes said.

https://cms.zerohedge.com/users/tyler-durden

Thu, 08/21/2025 - 05:45

https://www.zerohedge.com/markets/alcohol-consumption-us-falls-record-low

The Germans Are Invading Poland (This Time With Real Estate Investment Capital)

The Germans Are Invading Poland (This Time With Real Estate Investment Capital)

Polish media outlets and some citizens are lamenting German real estate investors who are swooping into the Polish city of Wrocław and buying up 1,486 apartments, after an agreement was signed on Aug. 16 of this year. However, Wrocław is only one city, and across the country, these same German investors are buying up 5,300 parents in total, for which the Germans will pay €564 million.

?itok=xwZGJ0Jf

?itok=xwZGJ0Jf

In Wrocław, the major investment involves numerous buildings on Horbaczewskiego, Jaworska, Zakładowa, and Grabiszyńska Streets.

Not everyone is happy about the deal.

“Germans are buying nearly 1,500 apartments in Wrocław. They will take over entire apartment blocks, along with their residents. And this is just the beginning of Western companies entering our real estate market. European companies have many times greater capital, so they will easily outbid Polish companies. Either we introduce appropriate taxation for this type of business, or in a dozen or so years we’ll wake up with our hand in the pot. Once again,” wrote political activist Adam Czarnecki on X.

Niemcy kupują prawie 1500 mieszkań we Wrocławiu. Przejmą całe bloki razem z ich mieszkańcami. A to dopiero początek wchodzenia zachodnich firm na nasz rynek nieruchomości - europejskie spółki dysponują wielokrotnie większym kapitałem, więc bez problemu przelicytują polskie.… https://t.co/omf6AM0BG8

The case concerns buildings constructed by companies associated with the developer Echo Investment, which house apartments for rent under the Resi4Rent brand. On Aug. 16, a preliminary agreement was signed for the sale of all shares in 18 property management companies across the country.

The purchase was made by developer Vantage Development, which in turn is owned by the German investment fund TAG Beteiligungs und Immobilienverwaltungs GmbHz.

The Polish newspaper https://wpolityce.pl/kraj/738126-niemiecki-kapital-ma-przejac-53-tys-mieszkan-w-polsce

wrote the “Germans are rubbing their hands.”

In Germany itself, investors have bought up substantial amounts of property in major cities like Hamburg, Berlin and Munich, helping drive up prices for locals. The role of foreign capital flowing into Western countries remains a point of contention. In some nations like New Zealand, a ban on foreign real estate investors was enacted to help tame real estate prices and ensure locals have a chance to afford apartments and homes in their own country.

As for Poland, it is increasingly a popular destination for foreign capital. In Germany, top news papers have run headlines such as “https://unternehmen.focus.de/david-rydz.html

The deal in Wrocław still needs approval

The outlet for writes, “As for Wrocław itself, the TuWrocław.com website reports that the buildings in question are at Zakładowa 24 (302 apartments); Jaworska 6-8 (681 apartments); Horbaczewskiego 16 (301 apartments); and Grabiszyńska 91 (202 apartments).”

The transaction still needs to be approved by the Polish Office of Competition and Consumer Protection, but could be finalized by mid-December 2025.

The acquisition of residential buildings by German-based Vantage Development and Robyg, which is owned by the same company, is not the only investment in Wrocław. The company is also invested in Port Popowice.

The issue of investors buying up property in major European cities is not only an issue involving Germans, however, Poles may be especially sensitive to German investors due to the historical conflicts between the two countries.

https://cms.zerohedge.com/users/tyler-durden

Thu, 08/21/2025 - 05:00

Switzerland Says It Won't Arrest Putin If He Enters For Peace Summit

Switzerland Says It Won't Arrest Putin If He Enters For Peace Summit

Switzerland would offer diplomatic immunity to Russian President Vladimir Putin if he were to travel there for potential peace negotiations with Ukraine, Swiss Foreign Minister Ignazio Cassis announced Tuesday.

"We have always expressed our willingness, but of course it depends on the major powers' willingness to engage," Cassis stated, after Monday's White House announcements playing up a meeting between Putin and Zelensky soon.

?itok=rlKwc04e

?itok=rlKwc04e

But the Kremlin itself hasn't confirmed there will actually be such a meeting anytime time soon, with FM Lavrov on Wednesday signaling this could also happen in the future when each side was ready for a finalized peace deal.

The White House seems to be too out front on its 'confirmed' declarations, which aren't confirmed from the Moscow side at all. Trump seems to be pressing hard for a major diplomatic 'win' - but without all the sides being fully on board just yet.

French President Emmanuel Macron suggested Tuesday that Geneva could serve as the location for such talks, while also Italian Foreign Minister Antonio Tajani agreed in calling the Swiss city "a suitable venue."

Of course, Putin has had an International Criminal Court arrest warrant hanging over him since 2023 over alleged war crimes related to the invasion of Ukraine.

This is a similar case with Netanyahu - as both leaders have seen their travel somewhat restricted as a slew of European countries might move to arrest them. Netanyahu and Putin have been having to avoid most travel to basically anywhere in the West.

Putin had earlier in the war refrained from attending a BRICS summit in South Africa due to the ICC warrant. South Africa was feeling pressure from the ICC at the time over the possible trip.

Switzerland's FM Cassis has explained that his government reviewed the legal implications and concluded that due to its unique status and Geneva's role as the European hub for the United Nations, it has the ability to host a summit which would be for the sake of peace and not move on the arrest warrant.

https://cms.zerohedge.com/users/tyler-durden

Thu, 08/21/2025 - 04:15

Watch: Man Arrested In UK For Saying "We Love Bacon"

Watch: Man Arrested In UK For Saying "We Love Bacon"

https://modernity.news/2025/08/20/watch-man-arrested-in-uk-for-saying-we-love-bacon/

A British man has been arrested for saying “we love bacon” while protesting the building of a proposed giant mosque.

?itok=pAxElemA

?itok=pAxElemA

https://www.telegraph.co.uk/news/2025/08/20/defend-right-to-offend-muslims-bacon/

that the protest occurred at the site of planned super mosque in the Lake District, which is populated by an almost 100% white population.

The report further notes that the 23-year-old man, was not otherwise being disruptive, causing any damage or being in any way violent.

Muslims are building a Mosque in Dalton, on the edge of the Lake District. On the 16th Aug a man at a protest said "we want bacon."

He was arrested under Section 5 of the Public Order Act 1986, suspected of a racially aggravated public order offence. https://t.co/iAcWiXfM3c

— David Atherton (@DaveAtherton20) https://twitter.com/DaveAtherton20/status/1958090017651167500?ref_src=twsrc%5Etfw

The arresting police officer claims that the grounds for the detainment were “racial abuse.”

A young man was arrested in the UK for saying he loves bacon, which is offensive to Muslims.🤦🏻♂️ https://t.co/akwhpIQxm7

— Don Keith (@RealDonKeith) https://twitter.com/RealDonKeith/status/1957855273948721152?ref_src=twsrc%5Etfw

Telegraph writer Isabel Oakeshott notes:

Of course Muslims don’t eat pork. As a result, they cannot share this particular delight with the rest of us. However, despite a steady rise in our own Muslim population, the UK remains a Christian country. Supposedly, we also enjoy free speech. Why then did the unfortunate father find himself frogmarched away from the protest by two police officers?

Saying ‘We love bacon’ is simply a truism. We British do love it, and there is nothing wrong with saying so.

As for remarks about bacon near a religious site or in the company of Muslims, they hardly constitute public disorder, still less ‘racial abuse,’ as the officer who arrested him can be heard suggesting.

The South Lakes Islamic Centre, often referred to as the Kendal mosque due to its proximity to the town of Kendal in Cumbria, is a £2.5 million facility under construction in Dalton-in-Furness on the edge of the Lake District.

Why is the beautiful and unspoiled Lake District getting a super mosque? https://t.co/sEtt3kAD4o

— Darren Grimes (@darrengrimes_) https://twitter.com/darrengrimes_/status/1901764276303626603?ref_src=twsrc%5Etfw

Construction began in March 2025, with reports indicating that the structure is now nearing completion despite challenges like suppliers refusing to provide materials amid public backlash.

Let's stop dressing this up as "just a place of worship." The construction of a £2.5 million mosque on the edge of the Lake District isn't about serving a scattered community of 100 families – it's about staking territory. This is not necessity – it's a statement of permanence… https://t.co/09pHyEXtWS

— Jim Chimirie 🇬🇧🎗 (@JChimirie66677) https://twitter.com/JChimirie66677/status/1907014349983449572?ref_src=twsrc%5Etfw

Opposition to the project has been vocal, with groups staging protests at the site since last month. Critics cite concerns over increased noise, traffic, and cultural impact in a rural area, but a core argument revolves around the region’s demographics: the Lake District and surrounding Cumbria have a Muslim population of approximately 0.4%, or around 2,000 people across the county, raising questions about the necessity of what some dub a “mega mosque” in such a sparsely populated Muslim area.

The Lake District in England is on of the most beautiful areas of The Country.

Muslims represent less than 0.5% of the local Community.

So please ask yourself people – why the f*** are they constructing a Super Mosque there? https://t.co/kq14lVE1dy

— Concerned Citizen (@BGatesIsaPyscho) https://twitter.com/BGatesIsaPyscho/status/1948838373936038143?ref_src=twsrc%5Etfw

Detractors suggest it’s disproportionate, especially with nearby facilities like mosques in Carlisle, Penrith, and Whitehaven, and speculate it could signal plans for larger-scale housing or migration to the area.

Here https://twitter.com/PatrickChristys?ref_src=twsrc%5Etfw