They pay mining fees, so I don't mind if it's art, coinjoin, ransomware payment or consolidating utxo's.

According to my node, it's a valid Bitcoin transaction.

It's not a test either. To test Bitcoin, use testnet.

Bit2me empezó vendiendo BTC a través de halcash sin pedir ni un dato. Incluso pidieron financiarse a través de una extinta plataforma de crowdlending mediante BTC.

Ahora no son capaces de nombrar a Bisq, Peach o HodlHodl y le ponen pegas a tener Bitcoin sin KYC.

https://www.youtube.com/live/ndVsKAx2kVg?feature=shared&t=2472

Prefiero que exista Bit2me a que la única opción sea Coinbase, pero si de verdad defiendes la autocustodia y la privacidad, una incentivo que se me ocurre es cobrar por guardar los depósitos de tus usuarios. Y que aunque la ley no te obligue, demuestres que tienes sus fondos y no estás operando bajo reserva fraccionaria.

Bit2me empezó vendiendo BTC a través de halcash sin pedir ni un dato. Incluso pidieron financiarse a través de una extinta plataforma de crowdlending mediante BTC.

Ahora no son capaces de nombrar a Bisq, Peach o HodlHodl y le ponen pegas a tener Bitcoin sin KYC.

https://www.youtube.com/live/ndVsKAx2kVg?feature=shared&t=2472

Endeudáos y, si os portáis bien, os perdonaremos la deuda periódicamente (os la recompraremos, haciendo que baje el coste).

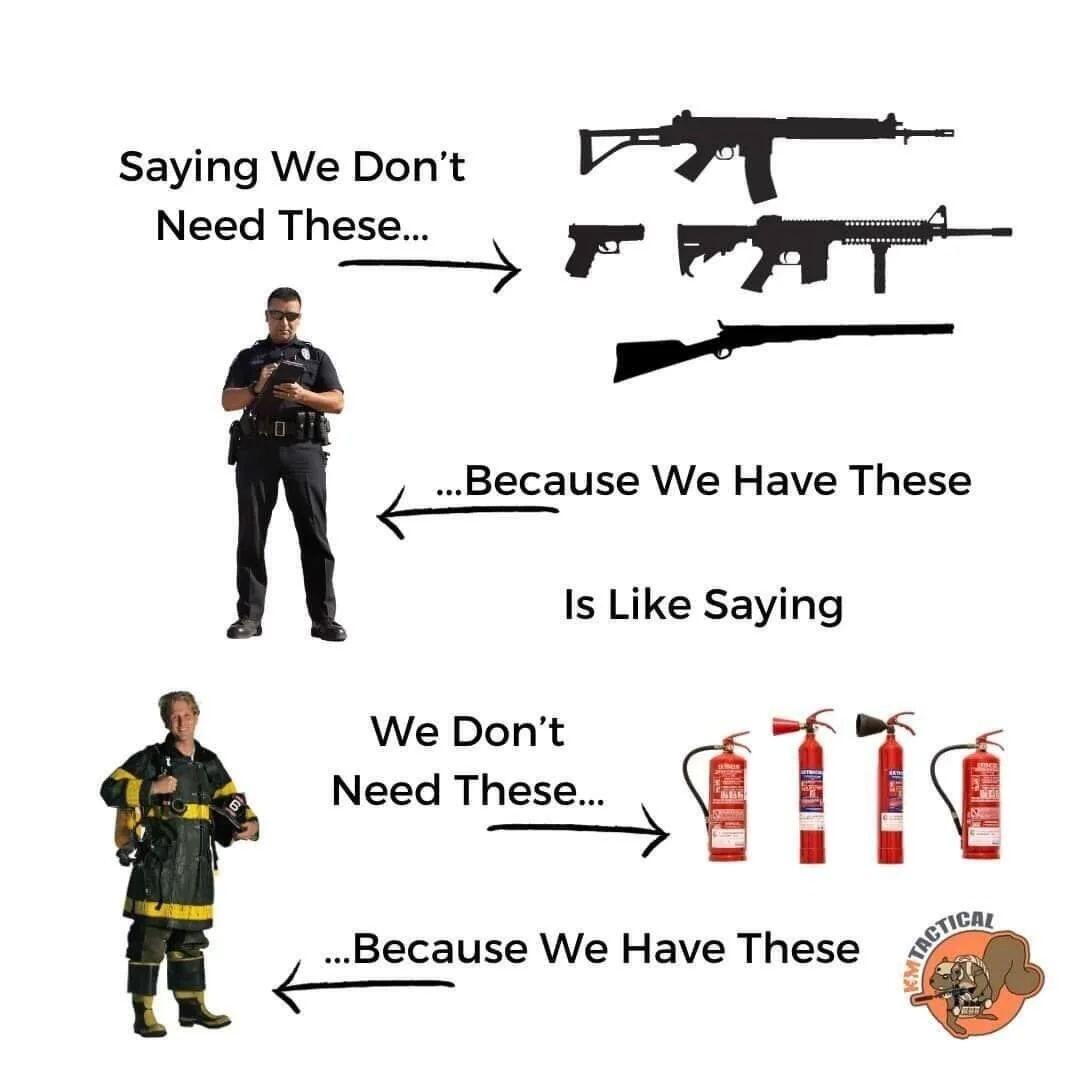

The difference is firefighters don't usually start fire, so you don't need to protect from them, while police attacks you quite often.

Una cosa es decir que Bitcoin y las altcoins no son lo mismo (tampoco todas las alts son lo mismo).

Otra cosa es aplaudir el intervencionismo estadounidense.

No en vano, la prueba de trabajo se inventó para eliminar spam. No eliminaremos el spam, pero al menos tendrá un precio. #zapvertising

Creo que Bitcoin ha llegado justo a tiempo, pero no tanto para combatir la impresión infinita ded fiat, sino para combatir un ejército de bots capaces de escribir mejor que yo.

Las tasas de minería detienen su fase alcista y forman un hombro cabeza hombro.

Si rompe la resistencia podrían seguir subiendo, aunque también podrían quedar igual o bajar.

Más consejos de no inversión en mi canal.

It gets easier to explain, indeed. As it's not small, they will pay more attention to it.

Recuerda como empezó esto.

Decían que las CBDC's no tendrían lugar, luego que podrían llegar a darse solo entre Bancos, ahora dicen que NO van a sustituir al efectivo y que NO tienen como objetivo el control. ¿Te lo crees?

En 2019, cuando Meta empezó a explorar la posibilidad de crear una CBDC global, China ya llevaba tiempo en ello, y llevaba ventaja. Escribí en ese entonces este artículo, porque desde ese momento se visualizaba el camino a seguir (control versus descentralización, CBDC vs #Bitcoin):

https://dinerosinreglas.com/mundo-cashless

Ahora nos dicen que las CBDC's PODRÍAN sustituir al efectivo, pero ni siquiera entre ellos se ponen de acuerdo para ocultar el verdadero objetivo:

Cuídate, estudia, pero sobre todo prepárate para lo que se viene, la intención de acabar con el efectivo es clara, y por ende, el control de todo lo que aún no están controlando esta al llegar, esta a la vuelta de la esquina!

#Bitcoin

Facebook estudió la posibilidad de crear una DC (moneda digital).

La gracia estaba en que no era obligatorio usarla.

Los esbirros de los CB (Central Banks) le dieron palos por todos lados porque con el monopolio del dinero no se juega.

Given that halvings are a known and sure fact, it should not have any impact on the price, but they seem to have.

Is it because economic actors are not as rational as supposed, and they live on paycheck to paycheck basis instead?

Lo mismo es bueno que no les dejaran protestar, entonces lo único que podrían hacer es conseguir BTC y ahí sí que harían daño.