Something to take on WhatsApp

Nice

Really nice

Love this angle

Plus the network affects huge potentially

Sometimes I do try and WhatsApp and the phone number is not on the network

With Nostr, this might never happen, if it scales

Quickly compared a investment from today to 2020

It was measured in aud$

“Oh, we’re kind of in line with back then”

I said to my wife

But then… boom. What about real inflation?

Oops

Just about the most important thing any investor can look at

In purchasing power it’s down

For sure

Regardless of what government metric tells you otherwise

Once again, I was tripped up by how counter intuitive inflation actually is

Prices going up does not mean value is increasing

It’s in fact the denominator falling

Most people have no idea…

I make more money posting on primal than I do on X

Something tell me that will become truer over time

It’s very clearly the future shopfront of the world

A fair space for people to build from

Interestingly the traction thus far is driven by zealot like early users

I love that social side of it so much

So true

nostr:note14a2j20vpyqd6z8fj83p3nut3v2kl0m6hw0qhl0fa68mhrtvcpmnsutjxcq

Hence this is a fascinating place as entrepreneurs

First beach walk with Alfie completed

So good to get out the house

💪🏻

Remember: no one knows the future price & timeline of Bitcoin

Precisely what I was thinking

Point is you control your data, and only release where and when necessary

This wasn’t possible properly pre-Nostr I don’t believe, as you always had to trust someone else…

Fun fact of the day:

There have been 31,000 human languages, most of which are dead, with circa 6000 in existence today

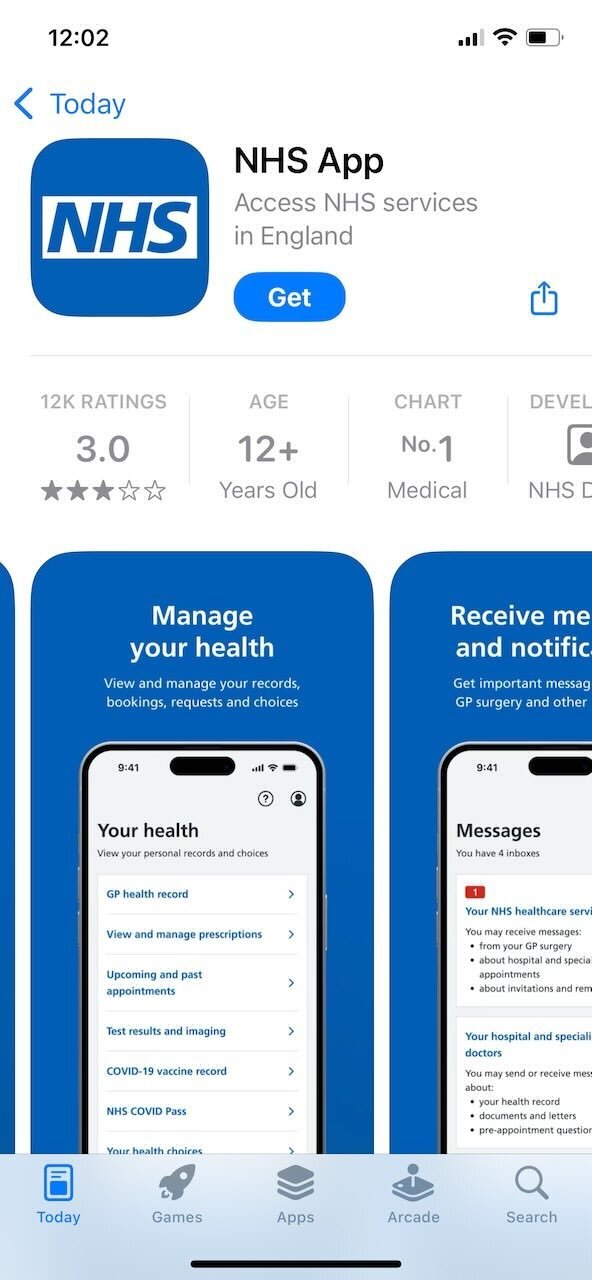

This is an Australian Government issued infant medical record book

Having had a home birth we’re still asked to update it

Mostly it’s been useful to track weight readings

Got me thinking…

Imagine one’s health records digitalised, in your control, distributed when you chose, & to whom you chose

It would be so powerful

Nostr can do this. Right nostr:npub1hqaz3dlyuhfqhktqchawke39l92jj9nt30dsgh2zvd9z7dv3j3gqpkt56s ?

I would pay for this service

For sure. Will share

How does Nostr affect debt markets?

I’ve heard product ideas for Nostr related health & insurance products recently

Better digital identity, & user controlled data, surely revolutionise risk calculation

I’d rather lend money to someone in my social network who I trust more

But then if BTC is the cost of capital, how do you calc a reasonable interest rate?

#asknostr

After owning Bitcoin, all I really want is a family home

But I don’t want to sell any Bitcoin, so I need to find another way

Which leads me to using BTC as collateral somehow

I am not confident it will work

Going to do some deep research

If I figure it out, others will want the same thing

Sums up nicely how I was feeling this morning

Justifying one’s decision making is hard sometimes…

nostr:note1hv60n0kulxkknzdleqj5eyq8uysgrujjwj47vj9uund7x73y7y2q2zmgkv

The sell is very clear as well: never get cancelled

Better property rights means better capital creation potential

I think this insight is the thing that’s got me most bullish lately