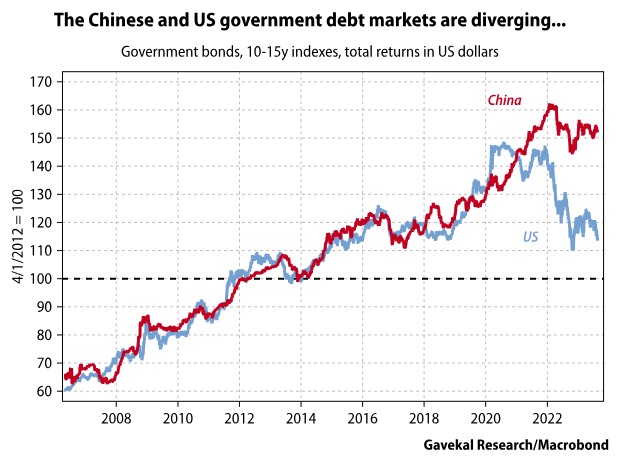

> This brings me to what should be the big story of the summer: the meltdown in US treasuries. Here is the biggest market in the world, the bedrock of the global financial system, falling by close to double digits in a month. And perhaps most amazing, this meltdown is occurring on limited news. There have been no Federal Reserve policy changes, no hawkish speeches from Jerome Powell. Basically, long-dated US treasuries just fell -9% on no news.

> This should be the news. Instead, the news is all about China’s financial meltdown."

https://research.gavekal.com/article/making-sense-of-the-china-meltdown-story/