Amazon Reverses 7% After Hours Plunge Despite Cloud Miss, Ugly Guidance

Amazon Reverses 7% After Hours Plunge Despite Cloud Miss, Ugly Guidance

Ahead of Amazon's earnings, UBS said that the online retailer is the "cleanest Mag7 name to own", although in retrospect it may also be the cleanest Ma7 name to sell, which is what is taking place after hours when the stock tumbled after it missed on Q4 cloud revenue and also guided well below estimates.

First, here is a big picture of what the company reported for the just concluded 4th quarter:

EPS $1.86 vs. $1.43 q/q, beating estimates of $1.50

Net sales $187.79 billion, +10% y/y, beating estimates of $187.32 billion

Online stores net sales $75.56 billion, +7.1% y/y, beating estimates of $74.71 billion

Physical Stores net sales $5.58 billion, +8.3% y/y, beating estimates of $5.4 billion

Subscription Services net sales $11.51 billion, +9.7% y/y, missing estimates of $11.58 billion

Subscription services net sales excluding F/X +10% vs. +13% y/y, estimate +10.3%

North America net sales $115.59 billion, +9.5% y/y, beating estimates of $114.27 billion

International net sales $43.42 billion, +7.9% y/y, beating estimates of $44.13 billion

Third-Party Seller Services net sales $47.49 billion, +9% y/y, missing estimates of $48.02 billion

Third-party seller services net sales excluding F/X +9% vs. +19% y/y, estimate +10.2%

So far so good (with some exceptions). But what caught the market's attention first was Amazon's AWS revenue, which came in just below estimates:

AWS net sales $28.79 billion, +19% y/y, estimate $28.82 billion

Amazon Web Services net sales excluding F/X +19% vs. +13% y/y, estimate +19%

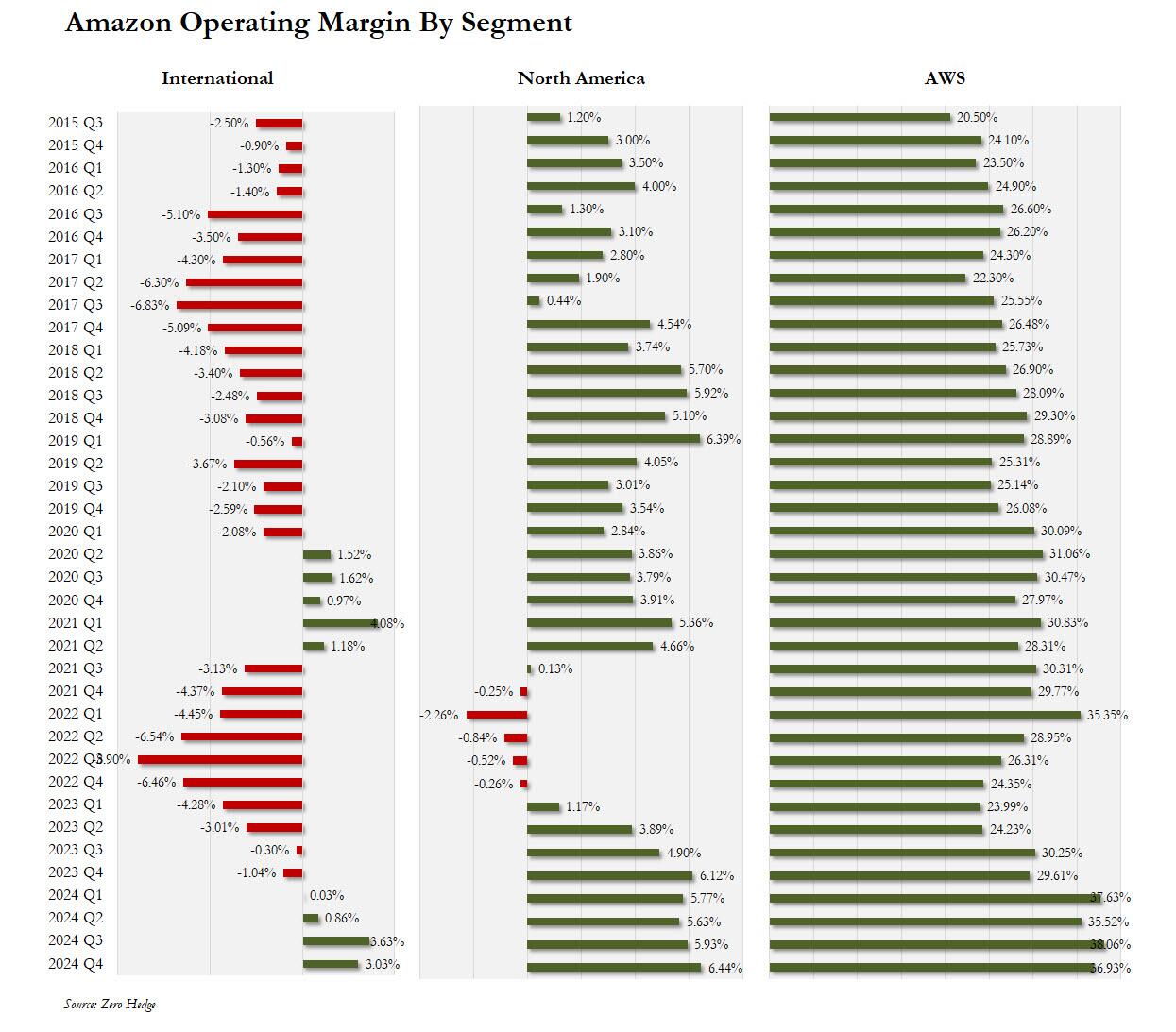

Turning to operating results, here the results were uniformly solid:

AWS operating profit 36.9%, down from 38.1% but beating estimates of 34.7%

Operating income $21.20 billion, +61% y/y, beating estimate $18.84 billion

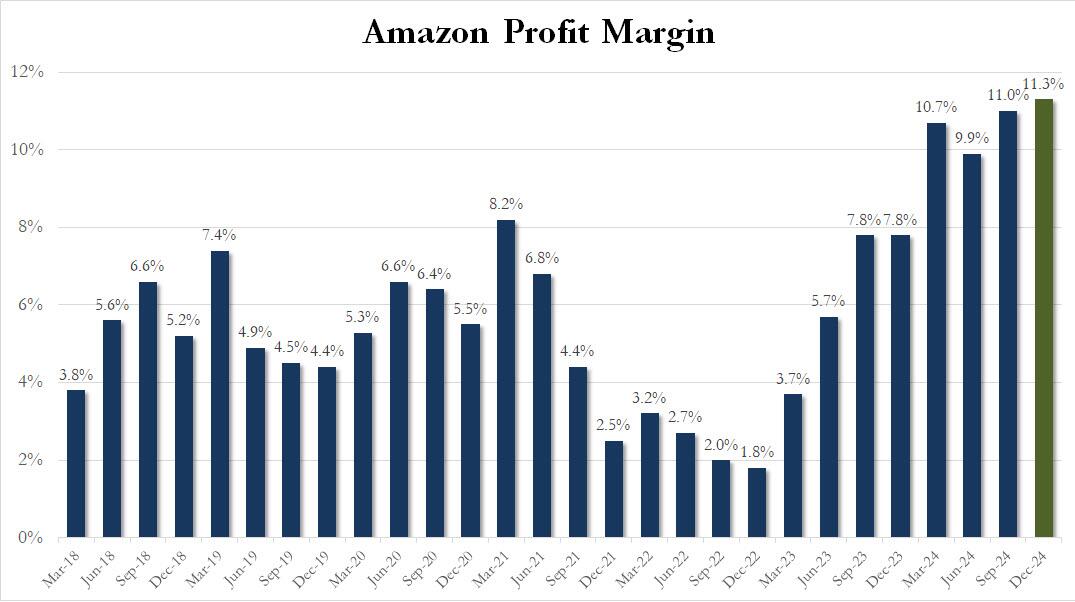

Operating margin 11.3% vs. 7.8% y/y, beating estimate 10.1%

North America operating margin +8% vs. +6.1% y/y, beating estimate +6.48%

International operating margin 3% vs. -1% y/y, missing estimate 3.08%

As for fulfillment expenses, these came in slightly below estimates, while the seller unit mix was slightly higher than expected:

Fulfillment expense $27.96 billion, +7.2% y/y, estimate $28.45 billion

Seller unit mix 62% vs. 61% y/y, estimate 60.2%

Of the above, the most notable highlight - as per our preview - was AWS which grew revenue by 19% for a second consecutive quarter to $28.79BN, which however was just below the sellside estimate of $28.82BN. So maybe a little weakness here similar to Microsoft.

?itok=mTjQEyU8

?itok=mTjQEyU8

Still, if revenue growth for AWS was a bit light, the 36.9% margin likely offset it, beating estimates of 34.7%, but below last quarter's print of 38.1%. Elsewhere, North American profit rose to $25 billion, resulting in a profit of 6.44%, the highest since at least 2015 (although one wonders how much higher this number can rise). Meanwhile, international margins dipped to 3.03% from 3.63%.

?itok=T9gcHEoq

?itok=T9gcHEoq

As a result of the jump in North American profits, Amazon's consolidated operating margin rebounded strongly, and after dipping modestly in Q2 from the previous record, rose to a new all time high of 11.3% in Q4.

?itok=kGzuwilr

?itok=kGzuwilr

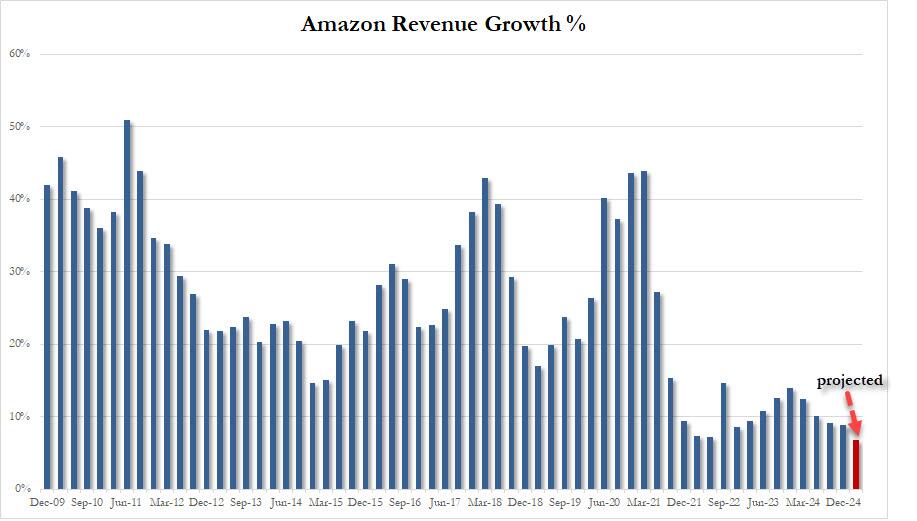

However, while the above data was mixed to modestly solid, it was the company's guidance that led to an after hours drop in the stock; that's because the company projected profit and revenue in the current quarter both of which came in below Wall Street expectations:

Sees net sales $151.0 billion to $155.5 billion, below the estimate of $158.64 billion

Sees operating income $14.0 billion to $18.0 billion, below the estimate $18.24 billion

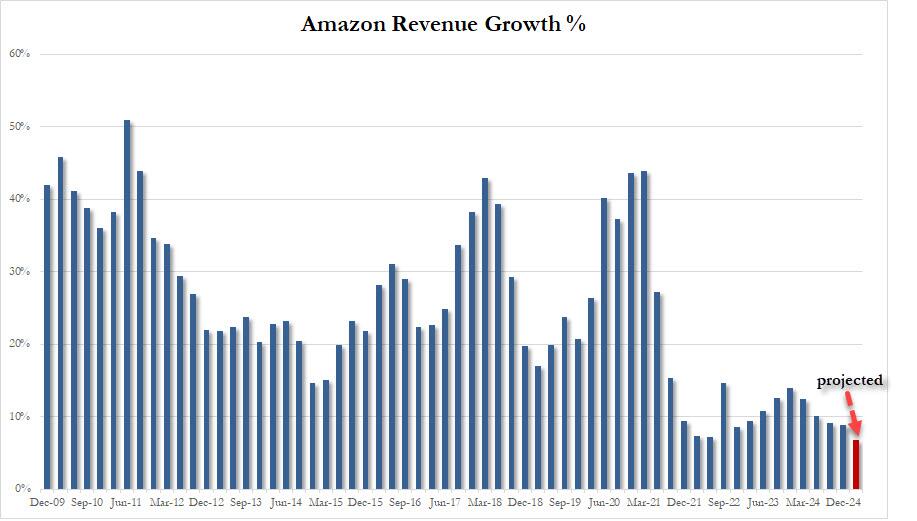

If accurate, that would mean Q4 revenue will grow at the slowest pace since the global financial crisis.

?itok=ROnC6lXE

?itok=ROnC6lXE

And while any other day the cloud miss and ugly guidance would have been enough to send the stock tumbling - as it did for a bit, sliding as much as 7% after hours, the unprecedented retail BTFD kneejerk reaction has taken the stock after hours and remarkable pushed it back flat on the session as the market plumbs new levels of stupidity.

?itok=hiQ49-by

https://cms.zerohedge.com/users/tyler-durden

Thu, 02/06/2025 - 16:38