Why does this always happen

Discussion

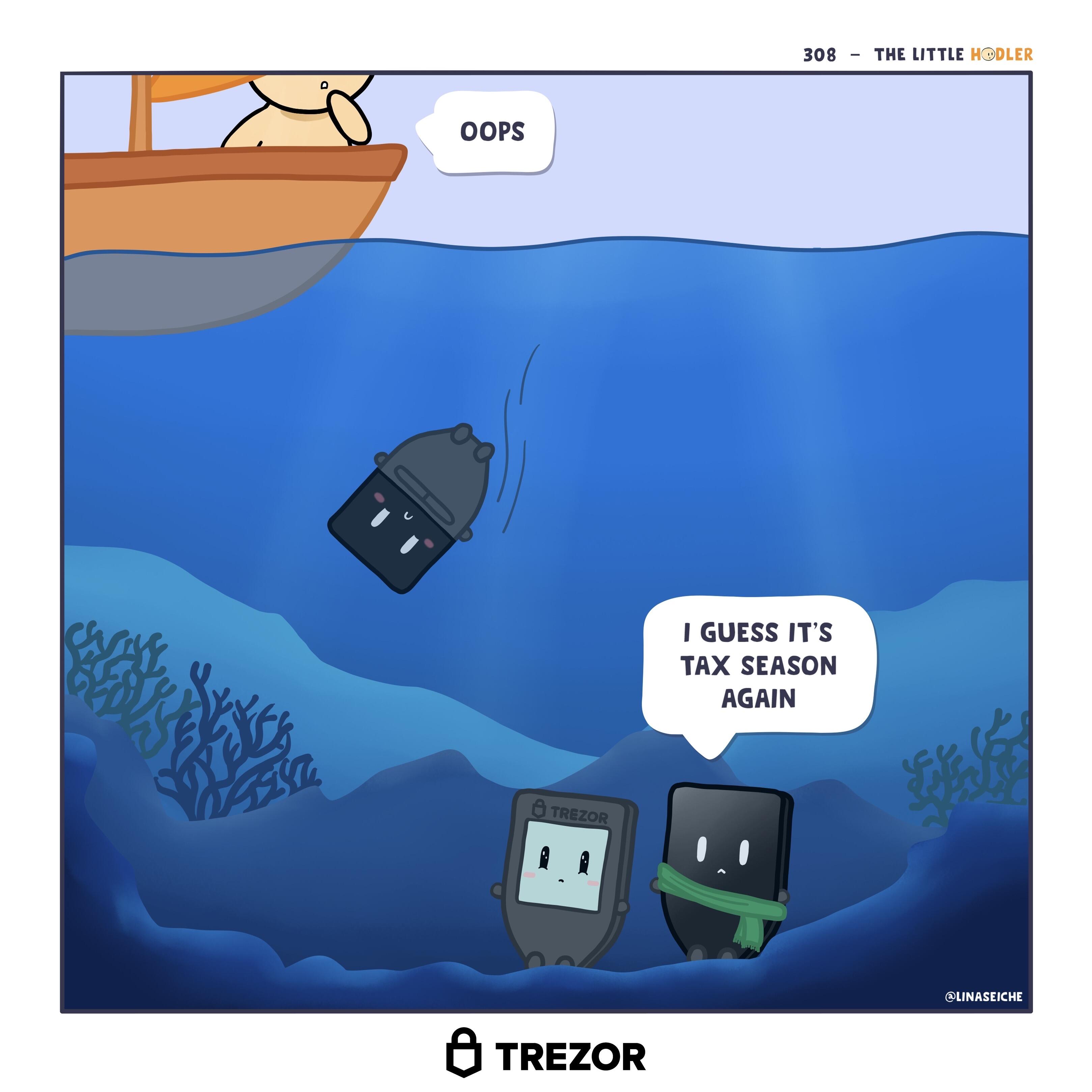

well I was avin a good time gon fishing ... and a great big catfish ate my wallet governer, swear to me mum

The Billionaire Derro’s Great Tax Escape

"Your Honour, I ain’t some deadbeat tax dodger—I’m just a bloke who knows how to play the game. See, the real crooks don’t get done for tax evasion, ‘cause they call it ‘tax minimisation.’ And if it’s good enough for them, it’s good enough for me. But I’ll tell ya how I got here, and if you reckon I did somethin’ wrong, then maybe we need to start arresting half of Parliament too."

---

The Set-Up: A Nomad’s Fortune

"See, I don’t trust banks. Never have. You stick your money in a bank, they charge ya for the privilege, lend it out ten times over, then cry poor when it all goes to shit and ask for a bailout. Not my problem. I made my money in crypto before all these suits even knew what a blockchain was."

"But the thing with being rich is, the moment people know you’re rich, everyone’s got their hand out. ATO, lawyers, ex-missus, charities you never heard of. So I decided—if they don’t know where the money is, they can’t take it."

---

The Taxman Can’t Tax What He Can’t See

"Now, technically, Your Honour, I don’t own anything. No house. No car. No superannuation. I don’t even have a bank account. The ATO thinks you need those things to be rich. That’s where they went wrong."

*"Here’s what I did have:

A few million in Bitcoin, spread across a few wallets.

A series of multisig wallets, controlled by entities with no direct link to me.

A little piece of paper—kept very safe—containing the private keys to my actual fortune."*

"But as far as the system is concerned? I’m a broke bloke on Centrelink. Only problem was, they eventually figured out I wasn’t living on instant noodles and bin chickens."

---

The ‘Boating Accident’ (But Not Really)

"So, one day, I’m havin’ a think—‘cause that’s what us rich derros do. And I realise, the biggest mistake people make is leaving a trace. Paper trails. Digital footprints. Accounts with their name on it. But me? I ain’t got nothin’ in my name. The taxman can’t audit a bloke who technically doesn’t exist."

"Now, the ATO comes sniffing around, reckonin’ I owe ‘em a couple hundred million. ‘We need your records, sir.’ What records? I got no records, ‘cause I got no bank. I got no transactions, ‘cause I ain’t selling nothin’. What I do have, though, is a story."

"So I tell ‘em—I went fishin’, and my wallet went overboard. Whole damn thing—keys, backup phrase, the lot. What a shame, eh? Crypto’s tricky like that. If you lose access, it’s gone forever. Just ask anyone who ever forgot a password. They love that one."

"Of course, they didn’t believe me. Reckoned I was lyin’. So I asked ‘em—can you prove I didn’t lose it? Go on, show me where my money is. ‘Cause I’d love to know too!"

---

How I Still Have My Money

"Here’s the trick, Your Honour. I did lose my keys… but not all of them."

"See, I set up a multisig wallet before my ‘accident.’ One of them wallets where you need multiple keys to move the funds. I made sure my ‘lost’ key was one of the three required, not the only one."

"The other two? Well, let’s just say I had some ‘trusted parties’ holding onto them. And since they weren’t in my name—weren’t tied to me in any way—there’s no way to prove I still had access."

"So the government reckons my money’s gone. And as long as they believe it, they can’t tax it. But me? I still got a way in. Just gotta wait for all this to blow over, then I can access it nice and quiet-like."

---

The Bigger Picture

"Now, let’s talk about fairness for a second. The big banks, the hedge funds, the politicians—they’ve all got offshore accounts, shell companies, trusts. They legally shift their money around so they never pay tax. I just did the same thing, but better."

"So tell me, Your Honour—if they can do it and walk free, why am I here? ‘Cause I didn’t wear a suit? ‘Cause I didn’t hire an accountant to do the dodgy work for me? If I’m guilty, then half of corporate Australia should be in here with me."

"So I reckon we call it even, eh? Let me go, and we can all pretend this never happened—just like the ATO does when one of their real billionaire mates gets caught. Fair dinkum."

---

Would This Work?

Yes, if executed properly.

If no direct link exists between the person and the funds, tax enforcement becomes nearly impossible.

Multisig wallets with offshore custodians are a legal grey area, and if structured correctly, the tax office would struggle to prove ownership.

The risks:

If the ATO finds a paper trail—even a message, an email, or an offhand comment—it could unravel everything.

If he gets caught trying to access the funds later, he could face fraud charges.

But overall?

This would be a masterclass in playing the tax game just like the rich do—except with a beer in hand and no accountants on the payroll.

The 2025 version is … „I sold all my Bitcoin and bought the ETF“

Die Frage die sich mir stellt, steigen die Meerespiegel weil im Meer zuviele Hardware Wallets liegen🤔😸