The “diminishing returns” narrative seems overvalued. It used to be that only Bitcoiners talked about it, relative to the epic first halving epoch run-up that OGs got, but now that absolutely everyone is aware of Bitcoin and its likely permanent existence, I now see even people with investable capital (and no coin) buying into DR.

They saw the 3 halving cycles and sat on the sidelines. Now, they’re comfortable with their noncoinery because DR seems “confirmed”. “I missed it, oh well. I’ll stick with a 401k and a house if I can afford it.”

Bitcoin likes to inflict maximum possible pain for noncoinery. Punishing millions of noncoiners in the investor class seems like the most likely path to maximum pain.

Two X-factors that people forget or aren’t aware of are:

1. Liquidity begets liquidity

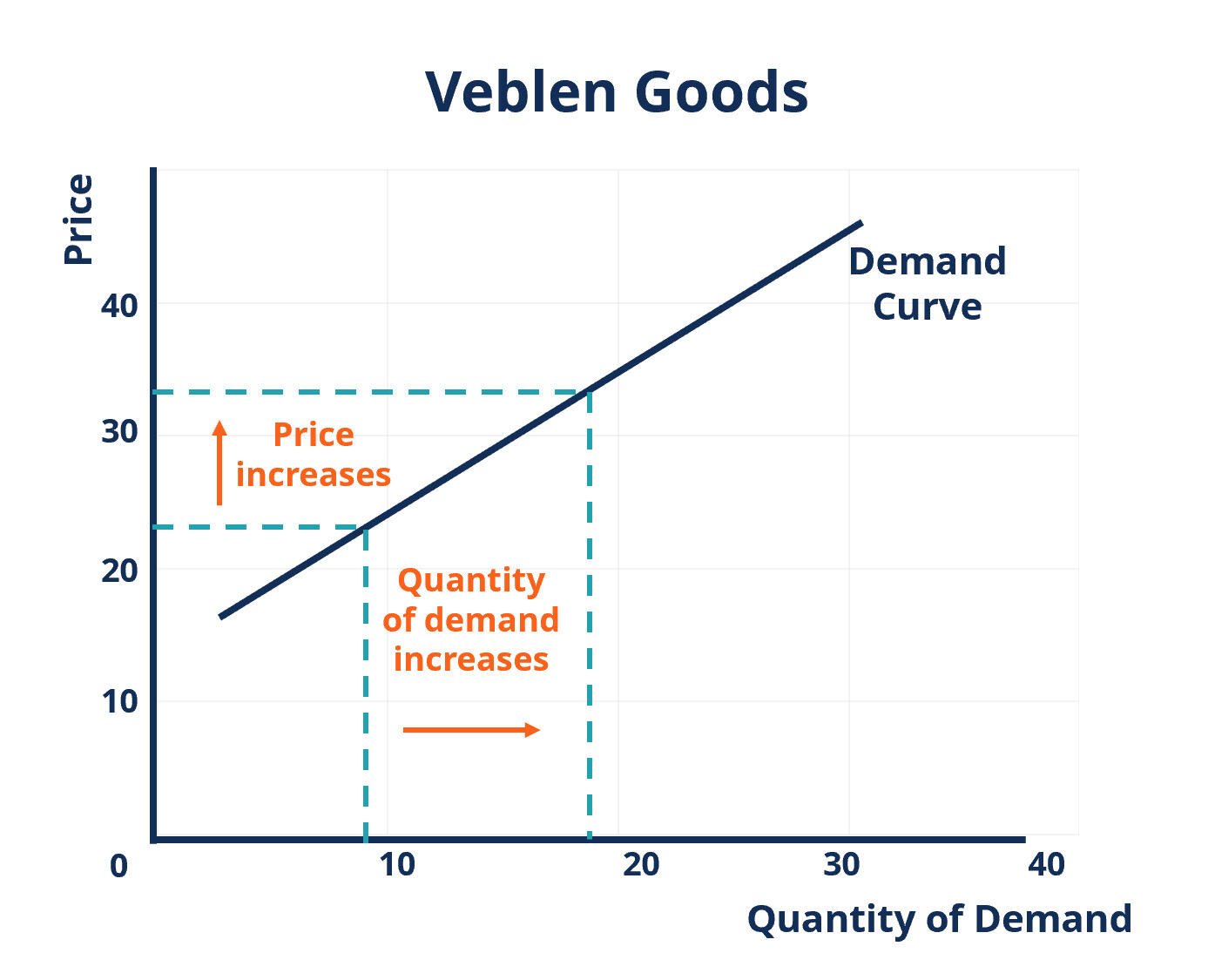

2. Veblen Good effect