#meme #memestr #nostrmeme

#meme #memestr #nostrmeme

Discussion

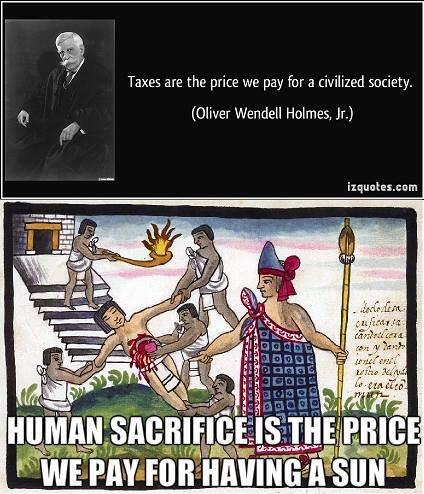

Sorry for this copy/paste from ChatGPT but that guy had no concept of the taxation we endure now.

———

During Oliver Wendell Holmes Jr.'s time on the Supreme Court (1902-1932), the tax rates and overall economic situation were quite different from today. The United States did not have a federal income tax until the ratification of the 16th Amendment in 1913. Before that, the federal government relied mainly on tariffs and excise taxes for revenue.

After the introduction of the income tax, the rates were initially much lower than they are today, with the highest marginal rate reaching 7% for incomes over $500,000 ($11.8 million in 2024 dollars). Over time, especially during World War I and World War II, tax rates increased significantly to finance war efforts and government programs. However, it's essential to note that tax rates varied widely throughout this period based on economic conditions and government policy.

During Holmes's tenure on the Supreme Court, the United States experienced significant economic and social changes, including the Industrial Revolution, the Progressive Era, World War I, and the Great Depression. These events shaped the country's economic landscape and influenced tax policies and rates. However, it's crucial to research specific years or periods to get a more accurate picture of tax rates and economic conditions during Holmes's time on the bench.