Burrito Now, Pay Later: DoorDash - Klarna Deal Feeds US Debt Addiction

Burrito Now, Pay Later: DoorDash - Klarna Deal Feeds US Debt Addiction

We've reported on many indications of a faltering US economy being propped up by debt, but our latest entry is particularly emphatic: DoorDash has inked a deal with Klarna that will let cash-strapped consumers pay for restaurant food, groceries and other delivery orders in four equal, interest-free installments, or "https://about.doordash.com/en-us/news/doordash-partners-with-klarna

, such as a date that aligns with their paycheck schedules."

Buy Now, Pay Later (BNPL) arrangements have surged in recent years. However, what began as a reasonable accommodation for large purchases like appliances and furniture has now metastasized to a point where Americans can finance Friday-night-pizza impulse-buys.

?itok=07Z3uhut

?itok=07Z3uhut

Klarna derives more than 60% of its revenue from fees paid by merchants who offer the financing option to their customers, with those fees potentially ranging from https://www.cnn.com/2025/03/21/business/doordash-klarna-buy-now-pay-later-partnership/index.html

of the purchase price. With some merchants, Klarna and other BNPL-facilitators also earn interest on long-term credit plans stretching out to upwards of 36 months.

However, Klarna also has a chance to earn money from consumers who take the interest-free, four-equal-installments plan -- in the form of https://www.tekrevol.com/blogs/how-does-the-klarna-app-make-money-app/

, up to 25% of the purchase price. For the financially disorganized or imminently insolvent, the interest-free option could prove to be a siren song that leaves their cash flow dashed against the metaphoric rocks of unexpectedly expensive burritos and Kung Pao chicken.

what do you mean you have $11k in "doordash debt" https://t.co/pu1h8GqdZg

— adam 🇺🇸 (@personofswag) https://twitter.com/personofswag/status/1902815645777138081?ref_src=twsrc%5Etfw

Even for those who make timely payments, the interest-free option can have a destructive effect over time, by encouraging consumers to commit to spending more money than they would in the absence of the appealing, "interest-free" enticement. Indeed, that's one of the essential attractions for DoorDash and other merchants who choose to partner with the likes of Klarna:

According to research from https://www.rbccm.com/en/insights/tech-and-innovation/episode/2021-outlook-massive-shift-in-e-commerce-spend

“The problem is these things start having a very pervasive and very negative influence on people who can’t afford it,” Anish Nagpal, an University of Melbourne marketing professor who studies behavioral decision-making, told the https://www.washingtonpost.com/business/2025/03/21/doordash-klarna-buy-now-pay-later/

. “They just want something now, and they go into this spiral of debt and always trying to chase up and meet the payment requirement.”

In 20 years democrats will be campaigning on DoorDash loan forgiveness

— Dr. Richard Harambe (@Richard_Harambe) https://twitter.com/Richard_Harambe/status/1903177359211032679?ref_src=twsrc%5Etfw

Naturally, Klarna Chief Commercial Officer David Sykes https://about.doordash.com/en-us/news/doordash-partners-with-klarna

on things:

“Our partnership with DoorDash marks an important milestone in Klarna’s expansion into everyday spending categories. By offering smarter, more flexible payment solutions for groceries, takeout, and retail essentials, we’re making convenience even more accessible for millions of Americans.”

We must ask: Is it ever "smarter" to finance a sandwich?

News of the DealDash BNPL arrangement comes against a backdrop of steadily rising consumer debt and signs that Americans are increasingly unable to keep up with their obligations. The New York Fed's latest https://www.newyorkfed.org/newsevents/news/research/2025/20250213

found that total household debt increased by $93 billion in 2024's fourth quarter, pushing the total over $18 trillion. Warning lights are flashing:

The share of subprime auto borrowers at least 60 days past due hit 6.56% in January, https://www.zerohedge.com/markets/bidenomics-hangover-worsens-subprime-auto-loan-delinquencies-hit-record-high-january

in 1994.

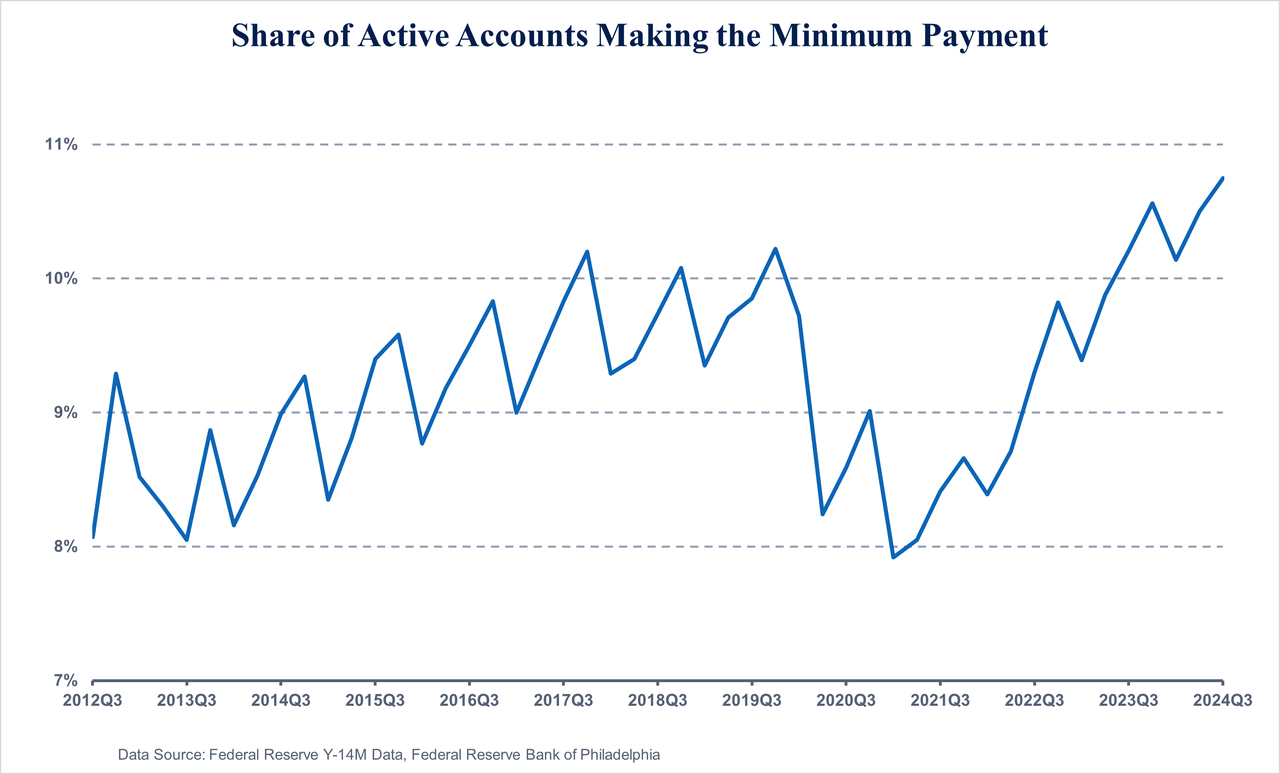

The percentage of credit card holders making only the minimum payment hit 10.75% in Q4 2024, https://www.cnbc.com/2025/01/22/minimum-payments-on-credit-cards-hit-record-level-as-delinquencies-also-rise.html

in a Philly Fed data series that goes back to 2012.

?itok=PljBGgyl

?itok=PljBGgyl

The share of 30-day-delinquent credit-card balances hit 3.52%, https://www.cnbc.com/2025/01/22/minimum-payments-on-credit-cards-hit-record-level-as-delinquencies-also-rise.html

reached in Q2 2021.

After the Doordash-Klarna news broke, social media memesters had an absolute field day:

So then they securitized all the DoorDash loans and sliced them into tranches to sell off to the banks

Rating agencies were slapping AAA on Chick-fil-A orders for credit scores under 500 who didn’t leave a tip https://t.co/sa3YKIqLhw

— Max Gagliardi (@max_gagliardi) https://twitter.com/max_gagliardi/status/1902943104602189935?ref_src=twsrc%5Etfw

John, the name of the company is DoorDash. Through a partnership with Klarna, they’ve just unlocked interest-free structured liquidity for high-frequency sustenance transactions. You can finance a carne asada burrito over 4 easy payments, or even defer the charge until payday. https://t.co/VUFounWDTq

— Adam Singer (@AdamSinger) https://twitter.com/AdamSinger/status/1902805429224448438?ref_src=twsrc%5Etfw

how i walk up to my doordash driver after tipping $0 on the 18 McGriddles i just financed https://t.co/u4ZyZSN0gZ

— Frosty ❄ (@I_Frosty_) https://twitter.com/I_Frosty_/status/1902876406410858550?ref_src=twsrc%5Etfw

"so you financed a $5.29 McChicken on DoorDash but still remain bullish on the economy?" https://t.co/c57aVqbVC0

— Boring_Business (@BoringBiz_) https://twitter.com/BoringBiz_/status/1902928107847213172?ref_src=twsrc%5Etfw

“They’re called DoorDash Default Swaps.” https://t.co/rX5ZDGfIEa

— Multifamily Madness (@MultifamilyMad) https://twitter.com/MultifamilyMad/status/1903197245589082480?ref_src=twsrc%5Etfw

“So we take these DoorDash loans, combine them, and create a whole new instrument where investors can bet on whether borrowers will pay off their Taco Bell Crunch Wrap Supreme within 12 months” https://t.co/cwU484agrg

— Dr. Parik Patel, BA, CFA, ACCA Esq. (@ParikPatelCFA) https://twitter.com/ParikPatelCFA/status/1902843222977867835?ref_src=twsrc%5Etfw

DoorDash debt collection outside your door because you missed a Chipotle payment https://t.co/pJdr2frU5u

— Archer, Leader of the Gorgonites (@RollxTidexTee) https://twitter.com/RollxTidexTee/status/1902752117779042700?ref_src=twsrc%5Etfw

the year is 2038 and you owe $50,000 of burrito debt to doordash but you can pay it all off by living in mr beasts minivan for 80 days

— Zack Voell (@zackvoell) https://twitter.com/zackvoell/status/1902922945351069795?ref_src=twsrc%5Etfw

You are telling me these loans are backed by consumers who ordered burritos on DoorDash? https://t.co/hU76On8Y5N

— Boring_Business (@BoringBiz_) https://twitter.com/BoringBiz_/status/1903067850522186039?ref_src=twsrc%5Etfw

Me tipping the DoorDash driver $150 cuz it's on Klarna's tab https://t.co/oo05X2sHWM

— Phella (@iamphella) https://twitter.com/iamphella/status/1902775668057776161?ref_src=twsrc%5Etfw

The delivery guy watching me sign a 6-year financing deal for my double cheeseburger https://t.co/03KtqAylj0

— piet (@piet_dev) https://twitter.com/piet_dev/status/1903099122149724626?ref_src=twsrc%5Etfw

"What do you mean your orders? We're talking about one DoorDash order, aren't we?"

"I had three. A burger from Five Guys, fries from McDonalds, and a 20 ounce Slurpee from 7/11." https://t.co/kuDJj6NazJ

— the prince with a thousand enemies ♂️ (@jaketropolis) https://twitter.com/jaketropolis/status/1902810109736259772?ref_src=twsrc%5Etfw

"Alright, so DoorDash makes money whenever any of you orders food instead of cooking. But the problem is, some of you are so broke, you can’t even afford that. You don’t have $15 for a burrito. Which, obviously, means you should just not get the burrito, right?" https://t.co/PCUfJVSJuZ

— Poe's Law, Esq: Poe's Lawyer (@dyingscribe) https://twitter.com/dyingscribe/status/1902893397037191336?ref_src=twsrc%5Etfw

Excited to announce that I closed on a $31.38 transaction to secure a burrito and side of chips

20-year senior fixed rate financing was provided by Klarna

DoorDash provided delivery of the asset

Congratulations to all involved https://t.co/u0DPMHlS8K

— Chase Passive Income (@chasedownleads) https://twitter.com/chasedownleads/status/1902785526186307734?ref_src=twsrc%5Etfw

https://cms.zerohedge.com/users/tyler-durden

Sat, 03/22/2025 - 15:45

https://www.zerohedge.com/markets/burrito-now-pay-later-doordash-klarna-deal-feeds-us-debt-addiction